The inspection and inventory labels market is expected to grow rapidly with increased demand from logistics, manufacturing, and retail businesses for exact, reliable, and high-speed labeling solutions. Compliance, traceability, and operational efficiency have led to the adoption of advance and automated labeling technologies like RFID-enabled smart labels and environment-friendly materials for labels.

Manufacturers are able to innovate in thermal transfer, tamper-evident, and color-coded labeling technologies to keep abreast of industry needs. Besides this, pressures of "green" or greenish labeling promoted recyclable as well as bio-degradable material of labels due to global needs in sustainability criteria.

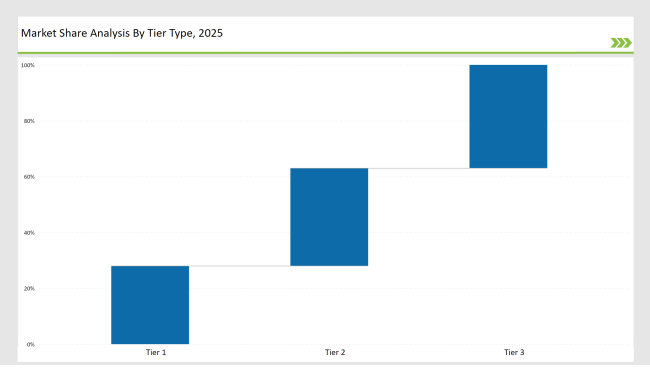

Tier-1 companies Avery Dennison, Zebra Technologies, 3M lead with 28% market share with their excellent performance in the domain of RFID, high-duration labels, as well as driven compliance solutions. Brady Corporation, Sato Holdings, and Honeywell International are among the

Tier 2 players that account for 35% of the industry and offer mid-sized businesses affordable, adaptable solutions. With a quarter of the market,

Tier 3 is made up of regional and specialty manufacturing companies that specialize in high-speed, environmentally friendly labeling solutions. These companies place a strong emphasis on tamper-proof security labeling methods, sophisticated thermal printing, and localized production.

Explore FMI!

Book a free demo

Global Market Share by Key Players (2025)

| Category | Market Share % |

|---|---|

| Top 3 (Avery Dennison, Zebra Technologies, 3M) | 14% |

| Rest of Top 5 (Brady Corporation, Sato Holdings) | 8% |

| Next 5 of Top 10 (Honeywell International, TSC Auto ID, Brother Industries, Seiko Epson, Weber Packaging) | 6% |

The inspection and inventory labels market caters to industries requiring high-precision, durable, and compliance-driven labeling solutions. Businesses are increasingly investing in automation and smart tracking to enhance operational efficiency and reduce errors.

Manufacturers are optimizing efficiency, security, and sustainability in labeling solutions.

The industry is rapidly evolving through automation, sustainability, and compliance-focused innovation. Companies are leveraging AI-driven quality control, robotic-assisted label printing, and cloud-based inventory management integration. Sustainable innovations, including biodegradable labels and eco-friendly adhesives, are reshaping the industry’s footprint.

Year-on-Year Leaders

Labeling technology suppliers should emphasize automation, sustainability, and precision engineering to meet increasing regulatory and industry demands.

| Tier Type | Example of Key Players |

| Tier 1 | Avery Dennison, Zebra Technologies, 3M |

| Tier 2 | Brady Corporation, Sato Holdings |

| Tier 3 | Honeywell International, TSC Auto ID, Brother Industries, Seiko Epson, Weber Packaging |

| Manufacturer | Latest Developments |

| Avery Dennison | Launched RFID-enabled biodegradable labels in March 2024. |

| Zebra Technologies | Developed AI-powered thermal printers for inventory automation in April 2024. |

| 3M | Expanded tamper-proof labeling solutions in June 2024. |

| Brady Corporation | Strengthened its industrial-grade labeling portfolio in July 2024. |

| Sato Holdings | Innovated sustainable adhesives for eco-friendly labels in August 2024. |

| Honeywell International | Released high-speed label printers for warehousing in May 2024. |

| TSC Auto ID | Focused on cloud-integrated inventory tracking labels in September 2024. |

| Seiko Epson | Advanced in precision thermal printing for industrial use in October 2024. |

The competitive landscape in the inspection and inventory labels market is evolving as key players focus on automation, sustainability, and high-precision engineering to maintain strong market positions.

The industry will continue adopting AI-driven defect detection, cloud-integrated tracking systems, and fully recyclable label materials. Smart labeling features such as digital authentication, anti-counterfeiting elements, and automated serialization will improve regulatory compliance and operational efficiency. The demand for personalized, on-demand label printing will rise, driven by e-commerce and global supply chain expansions.

Leading players include Avery Dennison, Zebra Technologies, 3M, Brady Corporation, Sato Holdings, and Honeywell International.

The top 3 players have a significant influence on the global market, driven by their technological innovations and broad industry reach.

The market shows medium concentration, with top players holding a dominant position.

Nitrogen Flushing Machine Market Analysis by Automatic and Semi-Automatic Through 2035

Pan Liner Market Analysis by Polyethylene (PE), Nylon, Polypropylene, Polyester, Polytetrafluoroethylene (PTFE) and Biodegradable Plastics Through 2035

Perfume Filling Machine Market Analysis by Automatic Perfume Filling Machines and Manual Perfume Filling Machines Through 2035

Molded Pulp Packaging Machines Market Analysis - Growth & Forecast 2025 to 2035

Packaging Tensioner Market Analysis - Growth & Forecast 2025 to 2035

Packaging Films Market Analysis by Product Type, Material Type and End Use Through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.