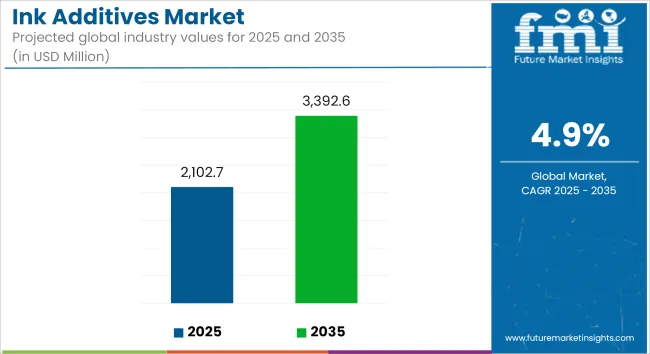

The global ink additives market is projected to expand from USD 2,102.7 million in 2025 to USD 3,392.6 million by 2035, registering a CAGR of 4.9% over the forecast period. Demand growth is being supported by increased consumption in packaging, commercial printing, and textile sectors, along with a transition to high-performance and eco-compatible ink formulations.

Ink additives are being incorporated to optimize ink properties such as flow, adhesion, pigment dispersion, anti-foaming behavior, and drying time. These additives are being utilized across various printing technologies including flexographic, gravure, digital, offset, and screen printing. Their application is being seen in sectors such as flexible packaging, publishing, product labeling, and textile decoration, where performance requirements vary significantly by substrate and end-use environment.

Water-based, UV-curable, and bio-based inks are witnessing rising adoption. This shift is increasing the demand for ink additives that support viscosity stability, substrate wetting, and resistance to scratching or smudging. Compliance with low-VOC (Volatile Organic Compound) emission standards is being enforced across regions, prompting reformulation efforts to align with regulatory expectations while preserving print quality.

Manufacturers are developing next-generation dispersants, wetting agents, and defoamers to address the performance needs of high-speed and multi-substrate presses. Additives with low odor profiles are being introduced for sensitive applications such as food packaging and pharmaceutical labeling. Anti-misting agents and high-solids formulations are being used to enhance press productivity by reducing drying times and minimizing ink loss.

Raw material pricing volatility, particularly for specialty surfactants and resins, continues to challenge procurement strategies. R&D is being directed toward biodegradable and recyclable additive solutions that can improve lifecycle management of printed materials.

Print service providers are adopting additive technologies that can accommodate faster run speeds, tighter registration accuracy, and diverse substrate compatibility. These evolving needs are reinforcing the role of ink additives in pressroom efficiency and print durability.

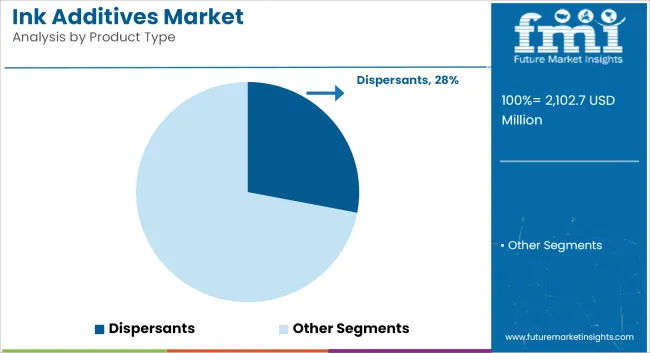

Dispersants are estimated to account for approximately 28% of the global ink additives market share in 2025 and are projected to grow at a CAGR of 5.0% through 2035. These additives help achieve uniform pigment distribution, prevent agglomeration, and improve color strength and stability. Their effectiveness directly impacts print quality, particularly in high-speed commercial and packaging printing processes.

Dispersants are widely used in both water-based and solvent-based formulations and are gaining traction in UV-curable systems. Manufacturers are focusing on next-generation dispersants that offer improved compatibility with bio-based resins and low-VOC profiles, driven by increasing demand for sustainable and regulatory-compliant printing solutions.

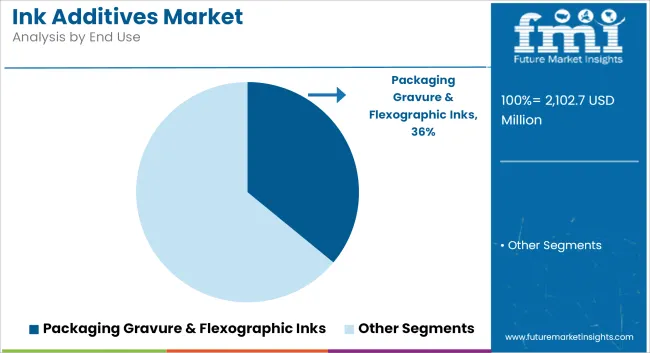

The packaging gravure and flexographic segment is projected to hold approximately 36% of the global ink additives market share in 2025 and is expected to grow at a CAGR of 5.1% through 2035. Ink additives in this segment are used to enhance print adhesion, control viscosity, accelerate drying, and reduce foam during high-speed press operations.

With expanding e-commerce, retail branding, and demand for shelf-ready packaging, gravure and flexo printing technologies remain central to high-volume packaging production. Additives tailored for food-safe, odor-free, and recyclable inks are gaining importance, especially in regulated markets such as the EU and North America. As converters move toward sustainable and functional packaging, the demand for high-performance ink additives continues to grow in the flexographic and gravure space.

Regulatory Pressure, Cost Sensitivity, and Ink Compatibility

Formulation complexity increases significantly for inks due to compliance requirements for inks for food and pharma packaging in numerous environmental and health regulations. High volatility of raw materials especially compound with specialty chemicals and synthetic dispersing agents affects the price stability. Furthermore, compatibility with a myriad of ink and substrate types, particularly with digital and hybrid presses, still poses a technical problem.

Bio-Based Additives, Digital Printing Growth, and Smart Packaging

Bio-based and compostable additives, non-toxic rheology modifiers, and sustainable defoamers for next-generation printing applications present opportunities. Inkjet printing in textiles and packaging, and digital printing driving low-viscosity, fast-curing and anti-bleed additives across various applications as well. The rise of smart packaging and printing conductive ink presents opportunities for functional ink additives within electronics and IoT-enabled labeling.

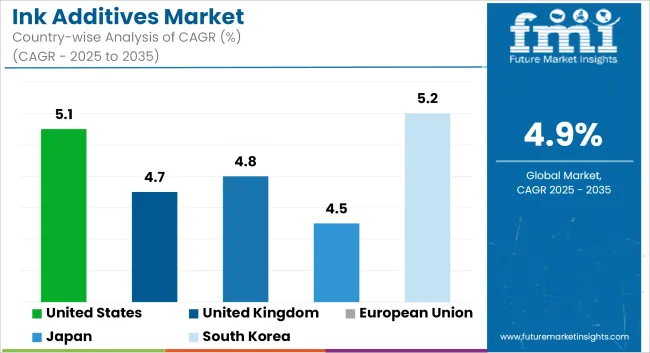

Due to the revival of packaging, labeling, and specialty printing applications, the USA ink additives market is experiencing a steady rise. Additives that improve print quality, drying time, and surface adhesion are in demand across flexographic, gravure, and digital printing technologies.

The transition to water-based and UV-curable inks is leading inroads for low-VOC, sustainable additive solutions. USA manufacturers are further looking at anti-foaming agents, dispersants, and rheology modifiers designed for high-speed printing and e-commerce packaging lines.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 5.1% |

Ink additives market in UK is cheering and casting itself with the increase demand for eco-friendly packaged in addition to custom printed consumer goods with pressure from regulators to cut solvent-based emissions, the use of bio-based additives in water-based ink systems is on the rise.

High demand for performance enhancing compounds like slip agents, wetting agents, and anti-misting compounds is driven by increasing short-run digital printing in sectors like personal care, food, and beverage. Domestic suppliers are also innovating in pigment dispersion stability and substrate flexibility.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 4.7% |

Germany, Italy, and the Netherlands are dominating the EU ink additives market, as they are backed by strong infrastructure for industrial printing and regulations focused on environmental sustainability. Corrugated packaging, sustainable labeling, and textile printing drive growth.

EU manufacturers are although working on multipurpose additives which provide color fastness, low migration, and conjugality with biodegradable inks. There is also growing demand for additives in energy-curable ink technologies, which are used in high-speed commercial and offset printing.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union | 4.8% |

Japan’s ink additives market is slowly increasing as innovation in high-precision printing in electronics, packaging, and specialty applications continues. In low-energy UV printing, Japanese companies are concentrating on additives that enhance ink flow, substrate adhesion, and anti-scratch performance.

Additives for smart packaging, RFID printing, and thermochromic inks are also in growing demand. Japanese researchers are also working on making formulations that are wind and food safe to comply with accuracy demand for safety and sustainability.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 4.5% |

Ink additives market in South Koreais growing owing to the increase in printed electronics, digital textile printing and functional packaging market. The country’s developed manufacturing ecosystem is creating needs for high-performance dispersants, defoamers, and drying agents to enable ultrafine resolution and effective fast-drying capabilities.

As a result, sustainable printing initiatives are driving further adoption of water-based systems that utilize low-impact additives. Korean manufacturers are investigating adding these nano-additives into printed circuit boards and wearable devices to make them more conductive, and more flexible and durable.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 5.2% |

Industry players are strategically investing in specialized solutions aimed at improving print quality, performance, and sustainability. There is a growing emphasis on multifunctional additives that enhance flow, wetting, defoaming, and surface slip, tailored for energy-curable inks and UV/EB curing systems. These innovations are essential to meet the evolving demands of modern printing technologies, including offset, flexographic, and digital printing, while ensuring enhanced efficiency and eco-friendly outcomes. This shift reflects the industry’s focus on adapting to technological advancements and sustainability goals, positioning companies to stay competitive in a rapidly changing market.

The overall market size for the ink additives market was USD 2,102.7 million in 2025.

The ink additives market is expected to reach USD 3,392.6 million in 2035.

The demand for ink additives will be driven by increasing demand for high-performance printing in packaging, publication, and commercial printing, growing adoption of eco-friendly and low-VOC ink formulations, rising use of digital and UV-curable inks, and innovations in dispersants, de-foamers, and slip agents.

The top 5 countries driving the development of the ink additives market are the USA, China, Germany, Japan, and India.

The dispersants segment is expected to command a significant share over the assessment period.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Inkjet Printers Market Size and Share Forecast Outlook 2025 to 2035

Ink Abrasion Resistance Tester Market Size and Share Forecast Outlook 2025 to 2035

Ink Resin Market Size and Share Forecast Outlook 2025 to 2035

Ink Cartridge Printer Market Size and Share Forecast Outlook 2025 to 2035

Ink-Cartridge Market Size and Share Forecast Outlook 2025 to 2035

Inkjet Printer Market in Korea – Growth & Demand Forecast through 2035

Ink Receptive Coatings Market Trend Analysis Based on Inks, Applications, and Region 2025 to 2035

Inkjet Coders Market Growth - Trends & Outlook 2025 to 2035

Key Players & Market Share in the Inkjet Printers Industry

Inkjet Paper Market Trends & Industry Growth Forecast 2024-2034

Inkjet Label Market Trends & Industry Growth Forecast 2024-2034

Ink Tank Printer Market

Ginkgo Biloba Extract Market Size and Share Forecast Outlook 2025 to 2035

Sinker Type EDM Market Size and Share Forecast Outlook 2025 to 2035

Sinker Drill Market Size and Share Forecast Outlook 2025 to 2035

Sink Bowls Market Size and Share Forecast Outlook 2025 to 2035

Painkillers Market Size and Share Forecast Outlook 2025 to 2035

Trinket Box Market Size and Share Forecast Outlook 2025 to 2035

Drinkable Yogurt Market Size and Share Forecast Outlook 2025 to 2035

Drinking Fountain Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA