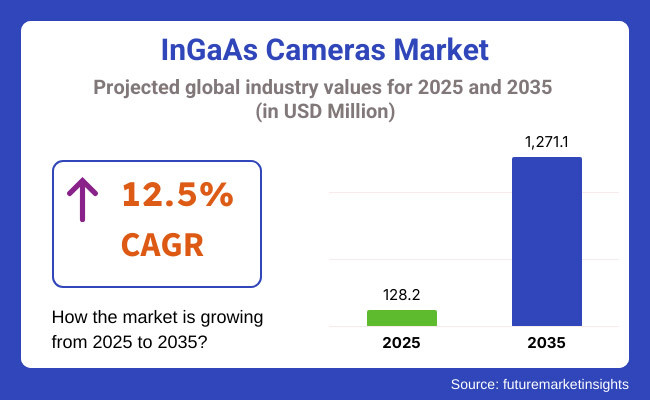

The global InGaAs Cameras market is projected to grow significantly, from USD 128.2 million in 2025 to USD 1,271.1 million by 2035 an it is reflecting a strong CAGR of 12.5%.

Rising demand for InGaAs Cameras in healthcare, industrial, aerospace and defense sectors are driving InGaAs Cameras Market. These devices aim to provide enterprise-level imaging capabilities, especially in low-light and near-infrared (NIR) environments, so are critical for applications like surveillance, medical diagnostics, and industrial inspection.

The InGaAs camera can effectively monitor industries such as semiconductors, pharmaceuticals and manufacturing, which require strict quality control and inspection. The one is governments' specific regulations and defense policies on surveillance and security applications, which are driving the demand for high-sensitivity imaging solutions.

The growing demand for high-resolution InGaAs cameras with real-time monitoring functions as automation and AI-based inspection systems take root. In addition, improvements in cooled and uncooled camera technologies are enhancing imaging quality, lowering cost and broadening the market.

The North America is leading the market, owing to high investments in defense and aerospace and industrial automation. Strong technological advances and major industry players focusing on research and development also work in the region's favor. As well as strict surveillance and security regulations further increase adoption.

North America is anticipated to hold the largest share of the InGaAs camera market, followed by Europe and Asia-Pacific, with rapid growth in the region, especially in China and Japan, driven by increased implementation of InGaAs cameras in semiconductor inspection and medical imaging. With the continuous modernization of industries and the gradual integration of advanced imaging technology, the demand for InGaAs Camera will continue to increase and the market will be expanding steadily across the globe.

| Company | Sensors Unlimited (Collins Aerospace) |

|---|---|

| Contract/Development Details | Secured a contract with a defense agency to provide InGaAs cameras for surveillance and reconnaissance applications, leveraging their capability to operate in low-light conditions. |

| Date | May 2024 |

| Contract Value (USD Million) | Approximately USD 40 |

| Renewal Period | 5 years |

| Company | Xenics NV |

|---|---|

| Contract/Development Details | Partnered with a semiconductor manufacturer to deploy InGaAs cameras for wafer inspection processes, aiming to detect defects at the microscopic level and improve yield rates. |

| Date | November 2024 |

| Contract Value (USD Million) | Approximately USD 25 |

| Renewal Period | 4 years |

Increasing adoption in quality control and semiconductor inspection for precise monitoring

They are particularly useful in detecting defects in wafers, circuit boards, and microelectronics by their exceptional near-infrared (NIR) detection capabilities, contributing to their growing demand for example in semiconductor inspection and quality control. Microlithography has become an indispensable component as manufacturers chase down ever-smaller, ever-more complex chip designs.

These tools assist with non-destructive testing (NDT) by detecting airborne particulates, fractures, and material inconsistencies not detectable by standard optical sensors. Further, InGaAs sensors are being integrated into automated optical inspection (AOI) systems to enhance the manufacturing mechanism and yield rate.

Under the CHIPS and Science Act, the USA Department of Commerce recently launched an initiative to invest USD 50 billion in domestic semiconductor production. This increases the demand for new advanced inspection and metrology tools, including InGaAs cameras, and equipment required to ensure quality control in new chip fabrication plants. The EU has also introduced a USD 43 billion semiconductor support package aimed at strengthening supply chain resilience and improving manufacturing standards.

As the global semiconductor industry surges towards a projected USD 1 trillion valuation by 2030, semiconductor manufacturing will rely heavily on high-precision imaging technologies like InGaAs cameras to facilitate high-yield production and defect-free chips.

Growing use of InGaAs cameras in hyperspectral imaging for scientific research

To collect data across different spectral bands, especially in the short-wave infrared (SWIR) (900nm-1700nm) range, InGaAs cameras are transforming hyperspectral imaging. This is significant for applications like environmental monitoring, biomedical imaging, and materials analysis, which require spectra for full information since standard optical cameras are unable to provide that level of detail.

In hyperspectral imaging, the InGaAs sensors enable accurate identification of chemical composition, which is critical in monitoring chemical contaminants in water, vegetative health assessment, mineral deposit mapping, etc. They can also function in low-light conditions, which is particularly useful for deep-space observations and astronomical explorations.

NASA and ESA have been increasing their investment on hyperspectral satellite programs to bring next-generation earth observation systems with InGaAs-based hyperspectral sensors. For example, NASA’s Surface Biology and Geology (SBG) mission, that would be launched in the coming years, may cost more than USD 600 million for advanced imaging technology, including SWIR-capable sensors.

In addition, Indian Space Research Organisation (ISRO) has reported plans for hyperspectral imaging satellites to observe climate change and soil degradation, which will likely stimulate demand for high-performing InGaAs cameras. The hyperspectral imaging market for InGaAs cameras is expected to grow in the long term owing to presence of government investments in scientific imaging technologies across the globe.

Expansion in consumer electronics and optical communication for high-speed data transfer

The need API gateways as API monetization technologies, for secure, scalable and efficient API management. These gateways serve as intermediaries between API providers and consumers, implementing security measures such as authentication, rate limiting, and traffic management.

As more industries embrace APIs, more organizations are pairing up API gateways to safeguard their digital assets against digital attacks whilst enhancing performance. API gateways can also be integrated in multi- and hybrid cloud environments for unified API management across different platforms.

Cybersecurity in Public Sector Digital Services: API Gateway based Solutions In 2023, government cloud providers required API gateways for all national e-governance portals. This regulation impacted more than 1,000 public-facing APIs, which reduced the unauthorized access attempts by 40% in six months. Such initiatives emphasize the critical importance of API gateways in protecting sensitive data and ensuring continuous service delivery.

Low awareness and adoption in emerging markets hinder growth

The low level of awareness and uptake in developing economies. Such cameras are mostly deployed for professional use in high-end industrial and defense and scientific applications, limiting exposure to the wider audience.

Even in the context of smart sensors, many industries in developing regions are still unaware of the quality security and hyperspectral imaging benefits that InGaAs cameras can offer. In contrast to visible-light cameras, which are so widely known and used that the benefits of InGaAs sensors may not be as well understood in areas that do not provide a low-cost alternative.

Due to the budget limitations of emerging economies, the businesses often value low-cost imaging solutions and are unwilling to spend on high-performance InGaAs technology. Since most InGaAs components are developed by firms in North America, Europe, and Japan, access is limited due to the absence of local manufacturers and suppliers.

| Market Shift | 2020 to 2024 |

|---|---|

| Regulatory Landscape | Export regulations and military-grade security standards influenced market growth. |

| Industrial & Scientific Applications | Expansion into semiconductor inspection, spectroscopy, and defense imaging. |

| Sensor & Sensitivity Enhancements | Improved pixel sensitivity enabled better low-light imaging. |

| Miniaturization & Portability | Development of compact, handheld InGaAs cameras for portable applications. |

| Market Growth Drivers | Increasing adoption in precision imaging and non-visible spectrum analysis. |

| Market Shift | 2025 to 2035 |

|---|---|

| Regulatory Landscape | AI-driven global compliance frameworks ensure secure deployment of InGaAs technology. |

| Industrial & Scientific Applications | AI-powered spectral imaging enhances precision in scientific and industrial applications. |

| Sensor & Sensitivity Enhancements | Quantum-enhanced sensors push InGaAs camera capabilities to near-infrared spectroscopy. |

| Miniaturization & Portability | AI-powered autonomous imaging systems enable real-time chemical and biological detection. |

| Market Growth Drivers | AI-driven spectral analytics redefine applications in security, healthcare, and environmental monitoring. |

The section highlights the CAGRs of countries experiencing growth in the InGaAs Cameras market, along with the latest advancements contributing to overall market development. Based on current estimates China, India and USA are expected to see steady growth during the forecast period.

| Countries | CAGR from 2025 to 2035 |

|---|---|

| India | 14.8% |

| China | 13.9% |

| Germany | 8.7% |

| Japan | 12.5% |

| United States | 10.4% |

The China Chip industry and government policy and huge amounts of money flowing into homegrown chip making. To be less dependent on overseas semiconductor suppliers, the country plans to produce more locally, and this has led to a growing demand for more sophisticated inspection and imaging technologies like InGaAs cameras.

They are essential for functions such as wafer inspection, defect detection, and process monitoring, maintaining the high precision needed for semiconductor fabrication. As if China is ramping up production of 5nm and below chips, InGaAs cameras are more and more being used in fab plants to evaluate yield rate, as well as to identify micro level defects that visible-light cameras can't recognize.

The Chinese government has provided over USD 150 billion in backing via its National Integrated Circuit Industry Investment Fund, helping domestic chipmakers ramp up production and implement advanced quality control frameworks. As new semiconductor fabs are being built, so is the demand for high-resolution imaging systems.

Also recent policies are tax incentives and grants which promote the research of semiconductor imaging technologies leading to an increased adoption of InGaAs sensors. With the continuation of the Made in China 2025 initiative, there is a need for more high-performance inspection tools to develop China’s semiconductor ecosystem, which will ensure continuous demand for InGaAs-based imaging solutions in the QC application.

India's industrial automation growth has been exponential & more and more end users have started investing in quality control & predictive maintenance based on advanced imaging system. With Indian manufacturers upgrading production lines, the need for high-precision inspection systems such as InGaAs cameras is increasing.

Traditional visible-light cameras are blind to the hidden defects (and even temperature or moisture content) that can be observed by InGaAs imaging, a fact that makes automated quality checks made possible by InGaAs cameras critical in industries as diverse as pharmaceuticals, textiles, and electronics manufacturing.

As India transitions to Industry 4.0, real-time machine vision systems integrated with InGaAs sensors are being implemented to monitor product quality and to proactively detect faults in the production process.

Initiatives like Production-Linked Incentive (PLI) Scheme from the Indian government with USD 26 billion allocated to boost electronics and manufacturing sectors will provide further impetus for the adoption of high-tech imaging solutions. Moreover, smart manufacturing programme of India is intended to digitalise and automate traditional industries, increasing the demand for InGaAs-based inspection technologies.

The United States is leading the wave of AI imaging and automation, with sectors implementing smart vision for robotics, automation, and machine learning. They are also becoming indispensable in machine vision driven by AI as they accurately identify objects, analyze defects, and differentiate materials found in industries such as aeronautics, electronics and autonomous manufacturing.

Applications for AI-powered InGaAs imaging include low-light, high-temperature or infrared-sensitive environments where traditional cameras cannot perform. With the USA turning more towards production lines integrated with AI, the presence of InGaAs cameras for automated quality control and predictive maintenance is growing.

US Government Funding USD 4 billion for AI-Driven Manufacturing Boosting Automation and Vision Intelligence. The CHIPS and Science Act (2022)-locating USD 52 billion to support the production of semiconductors-is projected to increase demand for high-performance imaging solutions in precision manufacturing, as well.

NIST is also drafting standards around AI-based imaging, meaning they will continue to push for further adoption of InGaAs sensors in automated applications. Additionally, as AI and robotics are forecast to generate more than USD 1 trillion in economic impact by 2030, thus the USA will experience substantial growth in InGaAs-based imaging for machine vision, autonomous systems as well as next-gen industrial applications.

The section contains information about the leading segments in the industry. By Technology, the Cooled Camera segment is estimated to grow quickly from the period 2025 to 2035. Additionally, by Scanning Type, Line Scan Camera segment hold dominant share in 2025.

| Technology | CAGR (2025 to 2035) |

|---|---|

| Cooled Camera | 14.0% |

InGaAs cameras, cooled, growing rapidly due to superior low-light, high temperature, scientific performance compared to uncooled products. Cooled cameras, unlike uncooled models, use either thermoelectric cooling (TEC) or cryogenic cooling to minimize noise in the sensor that leads to higher sensitivity and improves overall clarity.

These features make them crucial for astronomy, spectroscopy, defense imaging and semiconductor inspection. This demand for accurate thermal imaging in defence and industrial sectors has accelerated adoption. InGaAs cooled cameras also have extraordinary usage in hyperspectral imaging; the detection of subtle spectral shifts - that is central to hyperspectral remote sensing applications in environmental and chemical monitoring - are specifically conducted using InGaAs cooled detectors.

Funding for infrared imaging technologies is on the rise by governments around the world. To develop advanced infrared imaging solutions such as cooled InGaAs cameras for surveillance and reconnaissance purposes, the United States Department of Defense (DoD) has invested around USD 500 million in the year 2023. Likewise, China’s National Defense Technology Plan is encouraging investment towards thermal imaging solutions which is driving the adoption of cooled InGaAs sensors.

| Scanning Type | Value Share (2025) |

|---|---|

| Line Scan Camera | 59.2% |

The line scan camera is dominated by line scan InGaAs cameras, due primarily to their widespread deployment in high-speed industrial inspection (or quality control), semiconductor manufacture and hyperspectral imaging. These cameras allow one line of the image to be captured at a time and is used more for fast-paced production lines that require high-res imaging.

Line scan InGaAs cameras are increasingly being used within the electronics, food, and pharmaceutical industries to identify surface defects, contamination, and quality inconsistencies. Furthermore, these cameras are extensively used in solar panel inspection and printed circuit board (PCB) analysis, where precise imaging is required to detect microscopic tolerance defects.

Line scan imaging solutions are witnessing implementation across multiple sectors, being driven by government initiatives. High-speed inspection cameras are being thrived by China government’s USD 80 billion within semiconductor independence initiative.

In line with this, in the rest of the world, the United States has recently announced that the National Science Foundation (NSF) is increasing investment in machine vision and AI imaging to the tune of 40%, which is also accelerating line scan InGaAs camera adoption for automation and robotics applications.

Applications across several sectors including defense, industrial inspection, biomedical imaging, and scientific research requiring shortwave infrared (SWIR) imaging, have been contributing to the growing Indium Gallium Arsenide (InGaAs) camera market. Competitive Landscape.

There are several factors that have impacted the landscape of the polymerase chain reaction (PCR) market, mainly, demand for further sensitivity, resolution and integration. The market players are established companies, and they integrate technology, collaborations, and solutions to industry-specific challenges.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Hamamatsu Photonics K.K. | 22-27% |

| Sensors Unlimited (Collins Aerospace) | 18-22% |

| Xenics | 12-17% |

| Teledyne FLIR | 10-15% |

| Allied Vision Technologies GmbH | 7-10% |

| Other Companies (combined) | 25-35% |

| Company Name | Key Offerings/Activities |

|---|---|

| Hamamatsu Photonics K.K. | Provides high-performance SWIR cameras for scientific research, industrial inspection, and medical applications. Focuses on ultra-sensitive detectors with advanced cooling technologies. |

| Sensors Unlimited (Collins Aerospace) | Specializes in defense and aerospace SWIR imaging solutions. Offers ruggedized cameras for military, security, and remote sensing applications. |

| Xenics | Develops advanced SWIR imaging solutions for industrial automation, quality inspection, and thermography. Expanding machine vision integration. |

| Teledyne FLIR | Manufactures compact, high-resolution SWIR cameras with real-time image processing. Targets defense, industrial, and medical imaging markets. |

| Allied Vision Technologies GmbH | Provides cost-effective, industrial-grade InGaAs cameras with high sensitivity and adaptability for various imaging applications. |

Strategic Outlook

Hamamatsu Photonics K.K. (22-27%)

Hamamatsu is the market leader in InGaAs cameras, providing unrivaled imaging solutions for both scientific and industrial markets. The company innovates continuously and develops ultra-sensitive detection technology for semiconductor inspection, biomedical imaging, and spectroscopy. With emphasis on higher-level cooling and sensor enhancement, it retains leadership in the enhanced imaging segments.

Sensors Unlimited (Collins Aerospace) (18-22%)

Sensors Unlimited has a strong focus on defense, aerospace and security applications. The company specializes in ruggedized SWIR cameras capable of operating in extreme environments, such as military surveillance, night vision, reverse sensing and so on. Its collaborative affiliation with Collins Aerospace gives it an advantage over aerospace and tactical imaging solutions.

Xenics (12-17%)

Xenics as a growing leader in the field of SWIR imaging, especially for industrial and scientific applications. The company adds to its high-performance SWIR sensors, and machine vision solutions portfolio. Focusing on applications related to automation, quality control, and thermography, Xenics is establishing its position in the industrial imaging market.

Teledyne FLIR (10-15%)

Teledyne FLIR is known for its expertise in thermal imaging, but it is also now pursuing SWIR capabilities. Its cameras combine real-time image processing with AI-augmented analytics servicing defense, industrial inspection and medical imaging markets. This continued investment in miniaturization and AI-based analytics make it a strong contender in the industry.

Allied Vision Technologies GmbH (7-10%)

Wild M, New SWIR Cameras from Allied Vision Set New Standards For Low-Cost and High-Performance Industrial and Research SWIR Cameras. Although these JBT segment forensics typically target obstinate InGaAs camera customers, the company's dual-sensor technology is postured for innovations in both larger applications and smaller segment needs, and to meet cost-performance targets and pricing points for cost-sensitive, reliable InGaAs camera customers.

Other Key Players (25-35% Combined)

Other remaining players, such as New Imaging Technologies (NIT), Princeton Infrared Technologies, Raptor Photonics, Leonardo DRS, and Photon etc. are helping the market grow through innovative products. These are niche players in high-speed imaging, hyperspectral analysis and low-light detection. They are critical to market growth given their role in driving technological advancement while expanding SWIR applications.

In terms of Technology, the segment is segregated into APLI Monetization Platform and Services.

In terms of Scanning Type, the segment is segregated into Small & Medium Enterprise and Large Enterprise.

In terms of Industry, it is distributed into BFSI, IT & Telecom, Manufacturing, Travel & Hospitality, Healthcare, Energy & Utilities and Others.

A regional analysis has been carried out in key countries of North America, Latin America, East Asia, South Asia & Pacific, Western Europe, Eastern Europe and Middle East and Africa (MEA), and Europe.

The Global InGaAs Cameras industry is projected to witness CAGR of 12.5% between 2025 and 2035.

The Global InGaAs Cameras industry stood at USD 128.2 million in 2025.

The Global InGaAs Cameras industry is anticipated to reach USD 1,271.1 million by 2035 end.

South Asia & Pacific is set to record the highest CAGR of 13.7% in the assessment period.

The key players operating in the Global InGaAs Cameras Industry Hamamatsu Photonics K.K., Sensors Unlimited (a division of Collins Aerospace), Xenics, Teledyne FLIR, Allied Vision Technologies GmbH, New Imaging Technologies (NIT), Princeton Infrared Technologies, Inc., Raptor Photonics Ltd., Leonardo DRS, Photon.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

InGaAs Image Sensors Market

Network Cameras and Video Analytics Market Analysis – Trends & Forecast 2025 to 2035

Security Cameras (IR Illuminator) Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Cameras Market Size and Share Forecast Outlook 2025 to 2035

Light Field Cameras Market Size and Share Forecast Outlook 2025 to 2035

Mobile Gamma Cameras Market Growth - Industry Trends & Forecast 2025 to 2035

Time Of Flight Cameras Market Size and Share Forecast Outlook 2025 to 2035

Embedded Smart Cameras Market Growth – Trends & Forecast 2023-2033

Wireless Surgical Cameras Market Size and Share Forecast Outlook 2025 to 2035

Half-frame Oblique Cameras Market Size and Share Forecast Outlook 2025 to 2035

Full-frame Oblique Cameras Market Size and Share Forecast Outlook 2025 to 2035

Medium Format Film Cameras Market Size and Share Forecast Outlook 2025 to 2035

Night Vision Surveillance Cameras Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA