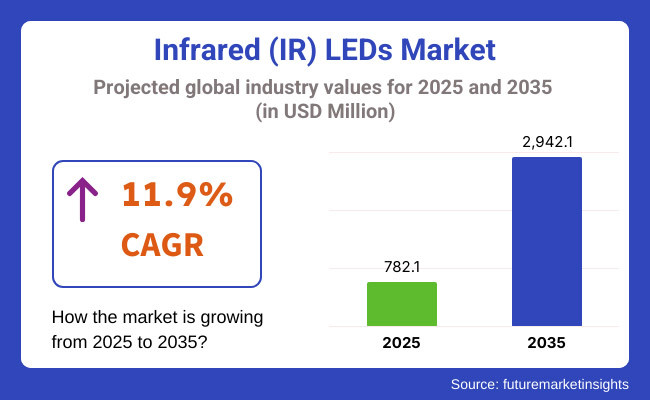

The Global Infrared (IR) LEDs market is projected to grow significantly, from USD 782.1 million in 2025 to USD 2,942.1 million by 2035 an it is reflecting a strong CAGR of 11.9%.

Rising demand in sectors such as telecommunications, automotive, retail, healthcare, and consumer electronics, is driving up demand for the Infrared (IR) LEDs market. The rising adoption of IR LEDs across end-use verticals, such as security and surveillance systems, biometric authentication, and CCTV cameras would further propel growth.

Regulatory standards are high in many industries, such as automotive and healthcare, where reliable IR LED solutions are paramount. IR LEDs are being integrated with medical imaging, driver monitoring systems, and various safety applications to comply with requirements and improve operational efficiency.

Growing demand for digital transformation and development in consumer electronics is driving the growth of IR LEDs. IR LED technology is being integrated into devices with features like facial recognition, gesture control, and proximity sensors to boost user experience and functionality, specifically in low-light conditions.

These sensors are being widely used in industrial automation, retail sector for applications including but not limited to object detection, barcode scanning and motion tracking. IR LEDs are now an integral part of the automotive industry and are widely used for night vision assist and advanced driver-assistance systems (ADAS).

With little to no costs and great acceptance of IR LEDs in surveillance systems, improved automotive safety and presence of key IR LED manufacturers in the countries of North America drive the growth of the IR LEDs market in North America. At the same time, nations such as India and South Korea are being propelled by the adoption rate of IR LED technologies as part of smart city developments and electronics manufacturing expansion.

| Company | Osram Opto Semiconductors |

|---|---|

| Contract/Development Details | Awarded a contract by a major automotive manufacturer to supply IR LEDs for advanced driver-assistance systems (ADAS), enhancing vehicle safety features such as night vision and driver monitoring. |

| Date | March 2024 |

| Contract Value (USD Million) | Approximately USD 30 |

| Renewal Period | 4 years |

| Company | Everlight Electronics |

|---|---|

| Contract/Development Details | Partnered with a consumer electronics company to integrate IR LEDs into smart home devices, enabling functionalities like remote control and motion detection.. |

| Date | September 2024 |

| Contract Value (USD Million) | Approximately USD 20 |

| Renewal Period | 3 years |

Rising adoption in security and surveillance systems for biometric authentication and CCTV cameras

Infrared (IR) LEDs are becoming an integral part of security and surveillance systems owing to their capabilities to produce clear photographes in starlight and in absence of light. Mosques across Cairo previously have held nightly Quran recitals following the Taraweeh prayers in Ramadan. .

Increasing implementation of IR-based biometric systems: Governments worldwide are adopting stringent security protocols in endpoints, mainly like airports, public transportation hubs, and border control facilities, which increase the deployment of IR-based biometric systems. CCTV cameras with IR LED perfectly fit to be very useful as the day and night surveillance system in the public and private areas.

In 2024, several countries initiated a national security program to modernize their surveillance system with sophisticated biometric tools. Over five hundred fifty thousand IR enabled facial recognition cameras were deployed in urban centers to enhance security as part of this initiative. Meanwhile, the government also announced plans to invest USD 2 billion in AI-powered surveillance systems using IR LEDs for the real-time monitoring and detection of threats.

With the improved performance of IR LED-based technologies, law enforcement agencies have witnessed a 30% increase in accuracy of facial recognition systems, which makes it an important instrument for helping national security and stopping crime.

Integration of IR LEDs in smart home devices for enhanced automation and security

The growing number of smart home technology adoption has also accelerated the growth of IR LED integration into multiple home automation and security products. IR LEDs are essential in motion sensing sensors, smart doorbells, and smart lighting systems, providing increased security and convenience for homeowners.

Smart cameras with IR LEDs make live monitoring possible, even in complete darkness, adding another layer of protection against intruders. Voice-controlled assistants and home automation hubs also use IR technology when controlling infrared-enabled devices like televisions, air conditioners, and smart appliances.

Governments are actively pushing smart city projects such as increased interest in smart security for neighborhoods. A national housing program in a leading economy installed over 1 million smart surveillance cameras based on IR LED in newly developed housing areas in 2023.

It also introduced subsidies for homeowners adopting smart security systems, resulting in a 40% rise in IR-powered home automation devices in a year. IR LEDs are essential for creating interconnected, secure, and automated households, which is in line with the government's 2030 target of achieving an 80% adoption rate of smart homes across urban areas.

Growing consumer preference for contactless technology increasing IR LED applications

In recent years, the demand for contactless technology has increased, primarily due to the role that IR LEDs play in facilitating touchless interactions across industries. IR light-emitting diodes (LEDs) are an essential part of modern life. IR technology has positively impacted the development of touchless systems and technologies in retail stores, public transportation systems, and healthcare facilities. As more consumer electronics products like laptops, gaming consoles, and interactive kiosks adopt gesture recognition systems using IR LEDs, users will experience greater convenience.

Now, governments worldwide are allowing touchless infrastructures in public spaces to mitigate the spread of infectious diseases. Contactless ticketing systems powered by IR LEDs were installed in 200 subway stations by a major metropolitan transit authority, leading to a 60% increase in contactless transactions within six months.

The new policy also introduced touchless access control systems in all government offices, with around 500,000 IR LED-enabled terminals estimated to be installed by end of 2025. These initiatives represent a growing trend toward a contactless economy, with IR LED technology playing a central role in facilitating safer and more efficient interactions across various industries.

High-power IR LEDs require significant energy, limiting their use in battery-operated devices

Infrared (IR) LEDs are essential in many applications, such as night vision, biometric detection, and gesture recognition. One of the core issues with high-power IR LEDs is their high-energy consumption, which makes them ineffective for battery-powered devices.

High-power IR LEDs, unlike conventional LEDs, need an extensive amount of electrical energy to produce brightness while delivering unmatched performance. This higher draw on power can quickly deplete batteries, rendering them less effective for portable and battery-powered applications like wireless security cameras, wearable health records monitors, and remote sensing instruments.

IR LEDs are extremely energy-consuming, therefore consuming the battery of the equipment, which requires frequent charging or replacement. This limitation becomes even more important in applications where it is required to run continuously, for example, devices like surveillance systems and medical monitor tools, which needs consistent performance.

Moreover, it limits the effectiveness of battery-operated consumer electronics such as smart remote controls and augmented reality (AR) devices as IR LEDs consume an inordinate amount of power. To achieve this, as battery technology continues to improve, the power requirements of high-power IR LEDs will need to be balanced with greater operational time for the device, while still delivering high efficiency without compromising performance in portable applications.

| Market Shift | 2020 to 2024 |

|---|---|

| Regulatory Landscape | Safety regulations for IR LED usage in biometric and surveillance applications increased. |

| Growth in Consumer Electronics | Increased adoption in facial recognition, AR/VR, and security cameras. |

| Technological Advancements | Miniaturization and power efficiency improvements enhanced performance. |

| Medical & Automotive Integration | IR LEDs were increasingly used in medical diagnostics and driver monitoring systems. |

| Market Growth Drivers | Rising demand for biometric authentication and surveillance solutions. |

| Market Shift | 2025 to 2035 |

|---|---|

| Regulatory Landscape | AI-powered compliance tracking ensures IR LED safety and efficiency in emerging applications. |

| Growth in Consumer Electronics | AI-driven IR imaging enables advanced night vision and gesture recognition systems. |

| Technological Advancements | Quantum dot technology revolutionizes IR LED efficiency and spectral accuracy. |

| Medical & Automotive Integration | AI-powered health monitoring and autonomous vehicle navigation rely on real-time IR sensing. |

| Market Growth Drivers | AI-enhanced IR LEDs redefine human-machine interactions and environmental sensing. |

The section highlights the CAGRs of countries experiencing growth in the Infrared (IR) LEDs market, along with the latest advancements contributing to overall market development. Based on current estimates China, India and USA are expected to see steady growth during the forecast period.

| Countries | CAGR from 2025 to 2035 |

|---|---|

| India | 14.8% |

| China | 13.6% |

| Germany | 8.2% |

| Japan | 11.0% |

| United States | 10.2% |

The retail sector of India is moving through a digital age, and in this age, automation has become a widely used tool to improve not just efficiency but also overall customer experience as well. India’s smart retail landscape is gaining traction with automated checkouts, systems that do away with a traditional billing counter.

IR LEDs lie at the heart of these solutions, providing non-contact barcode scanning, secure payment facial recognition, and gesture control. The growing need for self-checkout kiosks and smart payment solutions to handle the traffic for retailers is thus driving up the requirement for IR LED in authentication and scanning technologies.

The Indian government is promoting digital retail initiatives through a range of programs like, Digital India, as digital retail is expected to help integrate smart technologies into retail operations. In a recent announcement by the government, India’s digital payments have reached over 3 Trillion USD in annual transactions, suggesting that automated solutions are increasingly being adopted.

The move toward cashless transactions and biometric authentication in payment systems stimulates the broader use of IR LED-based facial and fingerprint recognition in retail for all transactions. IR LED applications will be significantly expanded with smart checkout solutions in cities such as Mumbai, Delhi and Bengaluru as retailers increasingly adopt smart checkout solutions to increase efficiency while reducing human dependence on retail transaction solutions.

IR LED-powered facial recognition technology has been widely adopted by financial institutions and government agencies in the United States. Fintechs have started using IR LEDs in their biometric authentication to securely log in to banking apps, ATMs, and even confirm a digital transaction. Facial recognition even in low light IR LEDs have helped in improving the recognition rates even in low-light conditions making them an integral part of security protocols used in financial services.

Similarly, the security and public safety efforts of USA government agencies have also expanded the utilization of IR LED-based surveillance and identification systems for border security and law enforcement.

The USA government recently announced a USD 1.2 billion investment in AI-driven security technologies, including biometric authentication systems enhanced by IR LEDs. Also, a 40 percent increase in the adoption of IR-based biometric security at airports and border checkpoints has been reported by the Department of Homeland Security.

As concerns about identity fraud and cybersecurity threats continue to grow, federal agencies and financial institutions are adopting authentication solutions powered by IR LEDs. Massive facial recognition projects have been initiated by cities, like New York and Los Angeles, leading to greater demand for high-performance IR LEDs in public and private security systems.

In China, where facial recognition technology has been widely adopted for public surveillance, law enforcement and urban security management, the Utility Model patent system has been used to protect such tech.

IR LEDs are integral to these systems, enabling enhanced image capture in low-light and nighttime conditions, thereby facilitating accurate facial recognition for security monitoring. In big cities like Beijing, Shanghai, and Shenzhen, China has implemented its smart city initiatives, which have resulted in a wide deployment of IR LED-based surveillance networks.

The Chinese government, there are now more than 600 million surveillance cameras in operation throughout the country, most of which use IR LEDs to see at night. Also, facial recognition databases have been added by China’s public security agencies, through the inclusion of AI-based IR LED technology, aimed at increasing the capability to identify people in crowds.

After the government made significant investments in artificial intelligence and software-powered smart surveillance, deployments of facial recognition cameras in transportation hubs, airports and critical infrastructure surged 35% year-over-year. As China updates its national security framework, the adoption of high-performance IR LEDs in facial recognition and surveillance applications is expected to increase dramatically.

The section provides detailed insights into key segments of the Infrared (IR) LEDs market. The Component category includes IR LED Chip and IR LED Package. Industry such as Telecommunication, Automotive, Retail, Healthcare, Consumer Electronics and Others. Addressable IR LED Chip segment is growing quickly. The Commercial hold largest market share in Infrared (IR) LEDs.

The growing demand for IR LED chips will propel the overall Infrared LED market as the application of these chips is gradually expanding to include facial recognition, biometric authentication, security surveillance. Many IR LED chips are efficient and precise in dim scenarios where other sensing and lighting mechanisms may fail, which places them at the heart of next-gen security systems, smart home devices, and industrial automation.

The growth of consumer electronics, particularly smartphones and wearable devices, have also contributed to the increasing demand for IR LED chips as these devices incorporate features such as proximity sensing and facial recognition to enhance user experience.

From the perspective of IR LED chips, governments across the globe have become increasingly aware of the need to enhance security and surveillance facilities. A smart surveillance systems utilizing advanced IR LED-based facial recognition technology also made headlines recently with a national security initiative announcing a USD 500 million investment for upgrades.

Furthermore, several regulatory bodies have developed novel rules that aid in the implementation of IR LED chips in medical devices for noninvasive health monitoring, such as pulse oximeters and infrared thermometers. The ongoing concentration towards automation and security the IT infrastructure along with emerging technology is predicted to foster the prospects of IR LED chips, thus dominating the Infrared LED market in the future.

| Segment | CAGR (2025 to 2035) |

|---|---|

| IR LED Chip (Component) | 13.9% |

The consumer electronics have a dominant share in IR LEDs application segment owing to continuous adoption in smartphones, smart TVs, gaming consoles, and augmented reality (AR) devices. Also IR LEDs are widely used for proximity sensors, remote controls, and biometric authentication in portable or mobile devices, which are ubiquitous components of consumer electronics. The growing need for advanced IR LED technologies in various applications such as facial recognition, eye-tracking systems, and virtual reality (VR) has also emphasized their usage in a wide range of consumer sectors.

Government programs that encourage digital transformation and the adoption of smart devices have also driven the growth of IR LED use in consumer electronics. With over 80% of new smartphones produced having adopted IR LED facial recognition, this new technology is becoming the standard. CUSTOMER DEMAND: The hands-free, gesture control of smart home devices is hot right now -- IR LED integrations in home automation systems are up 40% With organized electronics producers innovating and consolidating their IR LED arrangements for upgraded end-client insight, the customer hardware section is projected to hold the biggest piece of the overall industry, making a continued development for the Infrared LED market.

| Segment | Value Share (2025) |

|---|---|

| Consumer Electronics (Industry) | 22.1% |

The Infrared (IR) LED industry is experiencing significant demand driven by the growing need for security surveillance, automotive applications, healthcare monitoring, and industrial automation. The market is characterized by intense competition among key players, which are primarily focused on technological development, energy efficiency, and compactness of IR LED components. While leading players compete by enhancing innovation, leveraging distribution, and forging partnerships, nascent participants assist with cost-effective solutions.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Osram Opto Semiconductors | 22-27% |

| Nichia Corporation | 15-20% |

| Everlight Electronics | 12-17% |

| Luminus Devices, Inc. | 8-12% |

| EPILEDS Technologies, Inc. | 6-10% |

| Other Companies (combined) | 28-38% |

| Company Name | Key Offerings/Activities |

|---|---|

| Osram Opto Semiconductors | Develops high-efficiency IR LEDs for automotive, industrial automation, and biometric security. Invests in miniaturized and high-power IR solutions. |

| Nichia Corporation | Focuses on energy-efficient IR LEDs for medical imaging, night vision, and facial recognition. Advances in deep infrared technology enhance market presence. |

| Everlight Electronics | Supplies cost-effective and high-reliability IR LEDs for security cameras, smart home applications, and industrial sensors. Expands production capacity globally. |

| Luminus Devices, Inc. | Specializes in high-performance IR LEDs for defense, automotive sensing, and medical applications. Innovates in compact, high-power IR illumination. |

| EPILEDS Technologies, Inc. | Produces infrared LED chips for industrial automation, surveillance, and optical communication. Focuses on deep infrared wavelengths for niche applications. |

Strategic Outlook

Osram Opto Semiconductors (22-27%)

Osram is a leader in the IR LED market for automotive, security, and industrial applications with advanced innovations. For night vision, biometric authentication, and LiDAR systems, its high-power IR LED solutions are suitable. The company incrementally improves efficiency and miniaturization making its IR LEDs coveted technology in emerging applications such as autonomous vehicles and smart city infrastructure.

Nichia Corporation (15-20%)

Nichia Corporation is the market leader in energy-efficient IR LED technology. The company specializes in use cases such as facial recognition, medical imaging, and industrial automation. Advancements in deep infrared technology and narrow-spectrum emitters make Nichia highly competitive in high-precision sensing and detection applications.

Everlight Electronics (12-17%)

Everlight Electronics is a leading supplier of low-cost IR LED solutions for surveillance, smart home objects, IoT connected security systems, and other applications. Emerging demand for IR LEDs in emerging markets is met by the company's investment in more automation and high-volume production. Affordability and reliability: the keys to consumer electronics sector expansion for Everlight.

Luminus Devices, Inc. (8-12%)

Luminus Devices provides high-performance IR LED solutions for defense, automotive, and medical applications. The company specializes in high-power illumination solutions that push the boundaries of night vision, military-grade surveillance, and autonomous vehicle sensing. Luminus is broadening its relationships with OEMS to accelerate the implementation of infrared technology for premium applications.

EPILEDS Technologies, Inc. (6-10%)

EPILED Technologies specializes in red, blue, and green infrared LED chips targeted for industrial automation, industrial grade surveillance, and optical communication and invention. The company focuses on deep infrared wavelengths for specific applications in gas detection and thermal imaging. Niche Industrial Markets Strengthened by EPILEDS' Expertise in High-Wavelength IR LEDs.

Other Key Players (28-38% Combined)

The report covers a number of companies within this segment including Excelitas Technologies, High Power Lighting Corp., Kingbright Electronic Co, Vishay Intertechnology, Inc., and Lite-On Technology Corporation. Most of these companies develop tailored IR LED products for varied applications such as automotive safety, industrial sensing, and smart lighting. This facilitates continued market growth and innovation as IR LED applications expand.

In terms of Product, the segment is divided into IR LED Chip and IR LED Package.

In terms of Industry, the segment is segregated into Telecommunication, Automotive, Retail, Healthcare, Consumer Electronics and Others.

A regional analysis has been carried out in key countries of North America, Latin America, East Asia, South Asia & Pacific, Western Europe, Eastern Europe and Middle East and Africa (MEA), and Europe.

The Global Infrared (IR) LEDs industry is projected to witness CAGR of 11.9% between 2025 and 2035.

The Global Infrared (IR) LEDs industry stood at USD 782.1 million in 2025.

The Global Infrared (IR) LEDs industry is anticipated to reach USD 2,942.1 million by 2035 end.

South Asia & Pacific is set to record the highest CAGR of 13.2% in the assessment period.

The key players operating in the Global Infrared (IR) LEDs Industry Osram Opto Semiconductors, Nichia Corporation, Everlight Electronics, Luminus Devices, Inc., EPILEDS Technologies, Inc., Excelitas Technologies, High Power Lighting Corp., Kingbright Electronic Co., Ltd., Vishay Intertechnology, Inc., Lite-On Technology Corporation.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Infrared Heating Pad Market Size and Share Forecast Outlook 2025 to 2035

Infrared Thermography Market Size and Share Forecast Outlook 2025 to 2035

Infrared Thermometer Market Growth – Trends & Forecast 2025 to 2035

Infrared Search and Track (IRST) Systems Market Analysis - Growth & Forecast 2025 to 2035

Infrared Sensors Market Analysis – Growth & Trends 2025 to 2035

Infrared Imaging Market

Mid-infrared Lasers Market Analysis - Growth & Trends 2025 to 2035

Near Infrared Absorbing Material Market Growth – Trends & Forecast 2024-2034

Global Near Infrared Imaging Market Analysis – Size, Trends & Forecast 2024-2034

Passive Infrared Sensor Market Size and Share Forecast Outlook 2025 to 2035

Long Wave Infrared Supercontinuum Laser Market Forecast and Outlook 2025 to 2035

Shortwave Infrared (SWIR) Market Size and Share Forecast Outlook 2025 to 2035

Medical Far Infrared Therapy Device Market Size and Share Forecast Outlook 2025 to 2035

Automotives Infrared Cores Market Size and Share Forecast Outlook 2025 to 2035

Non-Dispersive Infrared (NDIR) Market Growth - Forecast 2025 to 2035

Non-Dispersive Infrared Sensing Market

Military Electro-Optics Infrared (EO/IR) Systems Market Report – Growth & Trends 2025 to 2035

Orthopedic Bone Defect Repair Materials Market Size and Share Forecast Outlook 2025 to 2035

Short Circuit Isolator Market Size and Share Forecast Outlook 2025 to 2035

Fire Resistant Apron Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA