The IR emitters and receivers market is the business sector that involves infrared (IR) technology. IR emitters and receivers are essential in home electronics, industrial automation, and security systems, as they provide non-contact sensing, biometric authentication, and motion sensing. As consumer demand for smart home tech, automotive safety features, and IoT-enabled infrared products increases, the industry will likely continue to expand through at least the next 10 years.

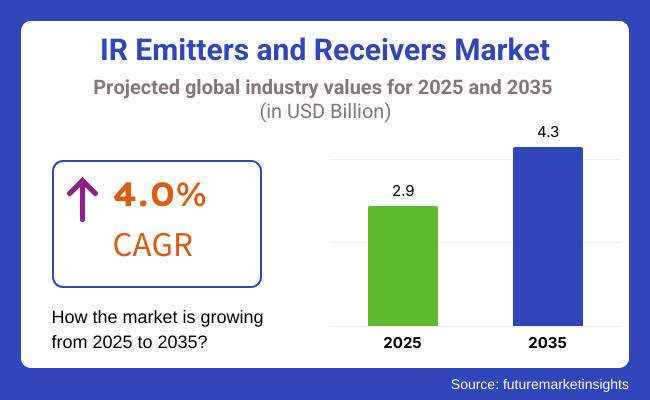

The industry is projected to grow USD 2.9 billion in 2025 and USD 4.3 billion in 2035, with a constant CAGR of 4.0% throughout the forecast period. The growing adoption of IR technology in applications, including smart home automation, auto sensors, and medical diagnosis, is a key factor driving the industry's growth.

IR sensors are widely used in remote controls and proximity sensors and are a component of facial recognition devices due to their outstanding reliability, power consumption, and accuracy. The use of miniaturized IR components in IoT-based applications further supports the growth of infrared sensing technology.

Key technologies such as AI-driven vision systems, the enhanced performance of thermal imaging, and gesture recognition solutions are being evaluated collectively. Gaining traction of infrared-based night-vision cameras, security surveillance systems, and industrial monitoring systems is rising as industries focus on automation & real-time data analysis. In addition, increasing demand for automotive safety systems such as adaptive cruise control, lane departure warning, and collision avoidance systems further pushes the IR transmitter and receiver industry.

The dominant industry share in North America and Europe is attributed to significant investment in industrial automation, automotive technology, and complex security solutions. On the other hand, the Asia-Pacific industry is expected to expand significantly, owing to the growing demand for consumer electronics manufacturing, smart city development, and the increasing requirement for energy-efficient IR sensing technologies.

Advancements in low-power IR sensing technologies, AI-enhanced infrared communication, and high-performance thermal imaging systems are advancing end-users across various industries to develop new products based on the industry globally.

As industries shift towards adopting infrared technology for automation, security, and smart systems, cost-effective and scalable IR solutions will continue to find investments, paving the way for the future of sensing and communications technologies for multiple industries to come.

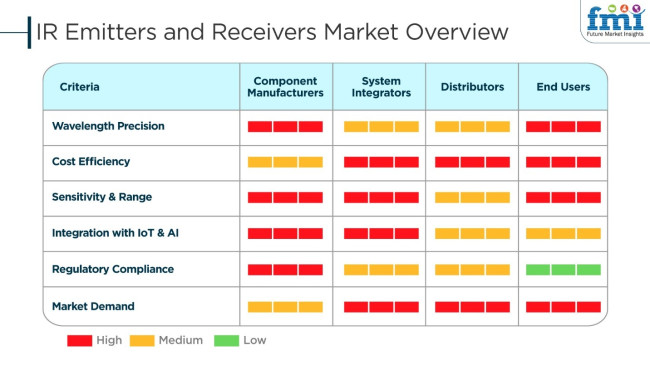

The IR Emitters and Receivers Market is registering remarkable growth, primarily due to the burgeoning use in automotive sensors, consumer electronics, industrial automation, and healthcare. Component makers are committed to improving wavelength precision, sensitivity, and power efficiency, which results in infrared (IR) communication, sensing, and imaging solutions with high performance.

System integrators bring together the development of the Internet of Things (IoT) and Artificial Intelligence (AI) technologies with the focus on automation, security, and smart home applications. Distributors are more about cost efficiency and industry demand, which is the reason for the provisioning of a stable supply chain in the different industries.

End users strive for compact and practical IR equipment, which means they need reliable, high-sensitivity IR solutions with extended range and minimal interference that will help make their decisions. New drivers include tiny IR components, IR sensing powered by AI, and high-speed optical communication technologies, making it possible for the automotive LiDAR, gesture recognition, and biometric authentication to be the main drivers of the industry.

| Company | Osram Opto Semiconductors |

|---|---|

| Contract/Development Details | Osram secured a multi-year contract with a leading automotive manufacturer to supply high-performance IR emitters and receivers for advanced driver-assistance systems (ADAS) and in-cabin monitoring. |

| Date | March 15, 2024 |

| Contract Value (USD Million) | Approximately USD 60 - USD 70 |

| Estimated Renewal Period | 4 years |

| Company | Vishay Intertechnology |

|---|---|

| Contract/Development Details | Vishay entered into an agreement with a global consumer electronics company to provide infrared components for proximity sensing and facial recognition technology in smart devices. |

| Date | July 22, 2024 |

| Contract Value (USD Million) | Approximately USD 50 - USD 60 |

| Estimated Renewal Period | 5 years |

| Company | Everlight Electronics |

|---|---|

| Contract/Development Details | Everlight expanded its IR emitter and receiver portfolio through a strategic partnership with a major industrial automation firm, focusing on optical sensing solutions for robotics and smart manufacturing. |

| Date | October 10, 2024 |

| Contract Value (USD Million) | Approximately USD 40 - USD 50 |

| Estimated Renewal Period | 4 years |

| Company | Excelitas Technologies |

|---|---|

| Contract/Development Details | Excelitas announced a collaboration with a top-tier healthcare technology provider to develop infrared-based medical sensors for non-contact temperature measurement and biometric authentication. |

| Date | January 5, 2025 |

| Contract Value (USD Million) | Approximately USD 30 - USD 40 |

| Estimated Renewal Period | 3 years |

Between 2020 and 2024, the industry experienced steady growth, driven by rising demand in consumer electronics, industrial automation, and security applications. Infrared (IR) technology became essential in remote sensing, biometric authentication, and touchless interfaces, particularly in smartphones and smart home devices.

The automotive industry also played a role in industry growth, incorporating IR sensors for driver monitoring and advanced driver assistance systems (ADAS). Also, growing use in medical diagnostics, including non-contact temperature measurement, further drove industry growth.

Between 2025 and 2035, the trends of miniaturization, efficiency, and AI-based infrared applications will define industry development. Unrelenting expansion of IoT and smart infrastructure will drive demand for IR components in automation, surveillance, and predictive maintenance.

In the auto-tech space, IR night vision and in-cabin monitoring will get more sophisticated. Furthermore, increasing expenditure on defense and aerospace applications will keep driving innovation in high-performance IR sensing and imaging solutions, thus ensuring further industry growth.

Comparative Market Shift Analysis (2020 to 2024 vs. 2025 to 2035)

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Governments introduced stricter regulations on IR-based biometric authentication and surveillance to ensure data privacy and security. | AI-driven compliance frameworks mandate advanced encryption and secure data transmission for IR-based authentication, medical imaging, and surveillance applications. |

| IR technology gained wider use in remote controls, facial recognition, and proximity sensors for smartphones and smart home appliances. | AI-based IR sensors facilitate sophisticated gesture control, contactless user interfaces, and effortless integration into AR/VR devices for immersive experiences. |

| Producers incorporated IR emitters and receivers into automation systems for object detection, temperature sensing, and safety compliance. | The IR-based night vision cameras and driver monitoring systems in automobiles are used for reducing accidents. |

| AI-enabled infrared sensors will facilitate fully autonomous vehicle perception systems at improved navigation in low-light conditions, pedestrian detection, and driver fatigue monitoring. | In fact, IR sensors played a key role in non-contact thermometers and pulse oximeters during the COVID-19 pandemic. |

| AI with IR imaging enhances early disease diagnosis and personalized treatments and redefines the future of telemedicine and wearable health technologies through remote patient monitoring. | Such usage includes perimeter protection, motion detection, and access control based on facial recognition, which would at least have been used by governments and private companies. |

| Long-range AI-based IR surveillance systems facilitate autonomous threat detection, real-time behavior analysis, and predictive security analytics. | Small, low-power IR emitters and receivers were built by companies to maximize battery life in mobile and IoT devices. |

| Hyper-realistic virtual interactions will be promoted by the AI-enhanced IR tracking further paving the path to the metaverse, digital avatars, and real-time motion synchronization. | AI-based infrared sensors have improved real-time analytics, which finds application in robotics, smart homes as well as industrial safety. |

IR emitters and receivers market mainly suffers from technological obsolescence, supply chain disruptions, and compliance with the regulatory initiatives is the critical risk areas of the mentioned industry. The most significant technological issue is fast pacing obsolescence because the trend requires more efficient, power-saving, and miniaturized products. The companies that don't engage in R and D and innovation are going to suffer from the lost industry relevance.

The other possible risk comes from supply chain vulnerabilities. The situation is more pronounced because of a heavy reliance on semiconductor components and rare materials. Geopolitical tensions, trade limitations, or silicon's and gallium arsenide (GaAs) shortages can perpetrate disruptions that lead to price fluctuations and production delays. Therefore, covering these risks is achievable by implementing multiple sources of supply strategies.

Concerning the risks, rules, policies, and especially safety, electromagnetic interference (EMI) regulations, and environmental sustainability see big issues. Compliance with RoHS (Restriction of Hazardous Substances) and WEEE (Waste Electrical and Electronic Equipment) directives is required in many regions, and noncompliance can trigger legal penalties or industry disadvantages.

The already stiffened competition from existing companies and low-cost producers especially from China, Taiwan, and South Korea is the main reason for reductions in profit margin. The production of goods must bear the mark of high quality, flexibility, and low environmental impact.

Thermal design solution based on vapor chambers benefits gaming laptops, data centers, and high-power LEDs. These vapor chambers, in contrast with conventional heat pipes, distribute the heat evenly, allowing for fewer thermal hotspots and enabling a higher system reliability.

Using vapor chamber technology for superior thermal performance and lifestyle in their top PC coolers for gaming and HEDT processors, Cooler Master is yet another example. Furthermore, the company designs vapor chamber solutions for 5G base stations to provide ideal thermal control of high-speed communication equipment.

With the increasing demand for miniature and high-performance cooling technologies, vapor chambers are increasingly being adopted in industries that require high heat flux rejection, such as aerospace and automotive electronics.

Variable conductance heat pipes (VCHPs), which can dynamically adjust their heat transport capability in response to ambient conditions, facilitate a thermally controlled environment. Such technology is broadly used in spacecraft, satellites, and military-grade electronics, and temperature changes can interfere with the performance of the systems.

NASA employs VCHPs on space missions to achieve thermal balance over a large range of environmental conditions. Likewise, Advanced Cooling Technologies (ACT) manufactures custom VCHP influx solutions providing avionics and defense applications with stable operation despite varying thermal environments.

Tired of traditional rectifiers and looking for cleaner power, sectors demand abler cooling systems. Variable conductance heat pipes emerge extensively for high precision approaches, providing excellent temperature management and higher energy effectiveness.

Thermal design solution based on vapor chambers benefits gaming laptops, data centers, and high-power LEDs. These vapor chambers, in contrast with conventional heat pipes, distribute the heat evenly, allowing for fewer thermal hotspots and enabling a higher system reliability.

Using vapor chamber technology for superior thermal performance and lifestyle in their top PC coolers for gaming and HEDT processors, Cooler Master is yet another example. Furthermore, the company designs vapor chamber solutions for 5G base stations to provide ideal thermal control of high-speed communication equipment.

With the increasing demand for miniature and high-performance cooling technologies, vapor chambers are increasingly being adopted in industries that require high heat flux rejection, such as aerospace and automotive electronics.

Variable conductance heat pipes (VCHPs), which can dynamically adjust their heat transport capability in response to ambient conditions, facilitate a thermally controlled environment. Such technology is broadly used in spacecraft, satellites, and military-grade electronics, and temperature changes can interfere with the performance of the systems.

NASA employs VCHPs on space missions to achieve thermal balance over a large range of environmental conditions. Likewise, Advanced Cooling Technologies (ACT) manufactures custom VCHP influx solutions providing avionics and defense applications with stable operation despite varying thermal environments.

Tired of traditional rectifiers and looking for cleaner power, sectors demand abler cooling systems. Variable conductance heat pipes emerge extensively for high precision approaches, providing excellent temperature management and higher energy effectiveness.

| Countries | CAGR (2025 to 2035) |

|---|---|

| USA | 8.5% |

| China | 9.0% |

| Germany | 7.8% |

| Japan | 8.2% |

| India | 9.3% |

| Australia | 7.6% |

The USA IR receivers and emitters industry develops quickly as industries adopt infrared technology in consumer electronics, automotive, healthcare, and defense systems. The rising use of IR-based sensors in thermal imaging, proximity sensing, and remote control fuels the industry. The USA private sector and government spent over USD 12 billion on infrared technology R&D 2024.

The automotive industry has IR sensors integrated into advanced driver-assistance technology (ADAS) and autonomous vehicles for increased security and better navigation in harsh weather. IR diagnostic instruments in the healthcare industry, from non-touch thermometers to imaging equipment, are in greater demand.

The home automation industry has also become more robust, with IR sensors providing energy-efficient lighting, temperature adjustment, and security systems. FMI believes the United States IR receivers and emitters industry will expand at 8.5% CAGR throughout research.

Growth Drivers in the USA

| Key Drivers | Detail |

|---|---|

| Consumer Electronics Growth | Growth in the use of IR sensors in smartphones, wearables, and home automation. |

| Automotive Night Vision & ADAS | Growth in the use of IR sensors in driver-assist and autonomous vehicles. |

| Defense & Medical Applications | Investments in surveillance led by IR, thermal imaging, and medical diagnosis. |

China's IR emitter and receiver industry grows as sectors adopt infrared technology in intelligent electronics, industrial automation, and security. China, the global capital of consumer electronics manufacturing, witnesses a growing demand for IR components in wearables, cameras, and smartphones. In 2024, the government invested USD 15 billion in optoelectronic and infrared sensor technologies to increase the nation's industry share abroad.

Government focus on intelligent surveillance systems and smart cities driven by AI is boosting IR-based security solutions. Affordable IR thermal sensor technology is also spearheaded by China, which envisions additional uses in industrial safety systems, fire alarms, and the medical field. FMI opines that China's Industry will grow at 9.0% CAGR during the forecast period.

Growth Drivers in China

| Key Drivers | Details |

|---|---|

| Government Support to IR Technology | IR technology is enabled through smart surveillance and smart policy efforts. |

| More Consumer Electronics Industry | More smartphone and camera production with IR functionality. |

| Improvements in Infrared Thermal Imaging | Affordable IR sensors for industrial and security uses. |

Germany's industry is driven by its sophisticated industrial sector, rising automotive application, and growing investment in infrared-based security solutions. German auto manufacturers utilize IR sensors in ADAS and night vision for enhanced driver safety and autonomous vehicle operation.

IR motion sensors and safety monitoring supplement industrial automation to achieve maximum manufacturing efficiency. Further, Germany's emphasis on energy-efficient optoelectronics is the basis of innovation in high-performance IR receivers and emitters. Intelligent security solutions such as IR-based surveillance systems and biometric identification accelerate industry expansion.

Growth Drivers in Germany

| Key Drivers | Details |

|---|---|

| Strong Automotive Industry Take-up | IR sensor application to night vision and driver assistance systems. |

| Industrial Automation Growth | Worldwide adoption of IR-based factory motion sensing. |

| Growth of Intelligent Security Systems | IR receivers supplement surveillance and biometric products. |

Japan has increased due to Japanese leadership in healthcare, robotics, and smart electronics. Infrared sensors offer accurate temperature sensing, non-contact medical diagnosis, and home automation. Japanese companies focus on developing small and low-power IR devices, enhancing sensor performance and power usage.

Robotics applications utilize infrared sensing technology, particularly in service and industrial robots, that must possess sufficient perception of the environment. The medical industry relies increasingly on IR sensors in early disease detection and patient monitoring, which justifies using infrared imaging applications. FMI is of the opinion that Japan's IR receivers and emitters industry will maintain an 8.2% CAGR during the forecast period.

Growth Drivers in Japan

| Key Drivers | Details |

|---|---|

| Integration of IR Sensors into Robotics | Japan is the world leader in robot vision systems based on IR technology. |

| Healthcare & Medical Diagnostics Growth | Growing use of IR in non-invasive temperature measurement. |

| Growing Penetration of Smart Home | Increasing use of IR sensors in automation and security. |

India's receivers and emitters of IR are growing rapidly because the country is moving towards smart cities, digitalization, and security systems that rely on infrared. The government's 'Digital India' is driving the masses towards using IR-based surveillance networks and automation in public spaces.

Consumer electronics mass production increases with IR sensors' use in mobile, TV, and home appliances. IR thermal sensing is also used in industrial pre-emptive maintenance, industries, and energy field guard monitoring. During the research period, FMI discovered that the India Industry will increase by 9.3% CAGR.

Growth Drivers in India

| Key Drivers | Detail |

|---|---|

| Piloting Security & Surveillance Need | More use of IR cameras and urban expansion. |

| Increase in Consumer Electronics | Increase in production of IR-mobile phones and home appliances. |

| Uses of Thermal Imaging in Industry | Uses of IR sensors in prediction maintenance and safety. |

The Australian industry grows increasingly as industries adopt infrared technology for defense, environmental monitoring, and renewable energy uses. The defense industry invests in infrared-guided surveillance systems for national security infrastructure improvement.

IR sensors are essential in monitoring solar and thermal energy systems for improved performance and efficiency in renewable energy systems. Environmental agencies also use IR thermal cameras for fire detection, wildlife conservation, and tracking ecosystems.

Growth Drivers in Australia

| Key Drivers | Details |

|---|---|

| Defense Expenditure on Infrared Technology | Penetration of security and surveillance-related applications guided by IR. |

| Renewable Energy Sector Development | Increased use of IR sensors in solar and thermal power plants. |

| Environmental & Wildlife Monitoring | Adopting IR cameras for ecosystem preservation and preventing fires. |

The Industry is experiencing an exponentially rising growth rate as the technology itself is embraced across consumer electronics, automotive safety, industrial automation, and healthcare applications. Growth in demand for advanced sensing technologies, touchless interfaces, and biometric authentication solutions- the key applications for IR emitters/receivers-has been driving growth for the industry.

Major players are focusing on miniaturization, power efficiency, and AI-based IR sensing solutions for these important applications: facial recognition, proximity sensing, and optical communication. The companies are also exploring investment opportunities in next-generation materials such as quantum dots and VCSEL (Vertical-Cavity Surface-Emitting Laser) technology for higher sensitivity and better signal processing.

The competitive landscape is shaped by strategic mergers, acquisitions, and partnerships for the expansion of technological expertise and industry reach. The pressing need for regulatory energy efficiency and compliance with eye safety will further strengthen some of these industry standards as a key differentiator. However, firms engaged in innovating high-speed IR transmission, thermal imaging, and precision sensing will have better chances of reaping the rewards in this transitioning industry.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Vishay Intertechnology | 20-25% |

| Osram Opto Semiconductors | 15-20% |

| Everlight Electronics | 10-15% |

| Rohm Semiconductor | 8-12% |

| Lite-On Technology | 5-10% |

| Kingbright Company | 4-8% |

| Other Companies (combined) | 30-38% |

| Company Name | Key Offerings/Activities |

|---|---|

| Vishay Intertechnology | High-efficiency IR emitters and receivers for industrial and automotive applications. |

| Osram Opto Semiconductors | Infrared LED technology for biometric security, optical communication, and automotive safety. |

| Everlight Electronics | Cost-effective IR sensing solutions for consumer electronics and smart home applications. |

| Rohm Semiconductor | Miniaturized IR components optimized for wearable devices and IoT applications. |

| Lite-On Technology | IR solutions for remote control systems, industrial automation, and proximity sensing. |

| Kingbright Company | High-power IR LEDs for security surveillance and medical imaging applications. |

Key Company Insights

Vishay Intertechnology (20-25%)

Vishay leads the industry in IR emitters and receivers, offering one of the widest selections of efficient infrared components. The company concentrates on automotive safety systems, industrial automation, and optical communications applications, assuring reliability and improved performance.

Osram Opto Semiconductors (15-20%)

Osram uses state-of-the-art infrared LED solutions for biometric authentication, optical communication, and automotive driver assistance systems. Investment in AI-enabled IR sensing further strengthens its competitive positioning.

Everlight Electronics (10-15%)

Everlight develops low-cost IR sensor solutions for consumer electronics, smart home automation, and touchless control systems. The company also invests in continuously improving the efficiency and performance of its IR offerings.

Rohm Semiconductor (8-12%)

Rohm Semiconductor develops low-profile infrared components made for wearables and IoT. Its ultra-low-power IR sensing solutions target designs for energy-efficient compact devices.

Lite-On Technology (5-10%)

Lite-On supplies IR to remote control systems, industrial automation, and proximity sensing. Due to the high reliability of its IR LEDs, Lite-On is favored in many sectors.

Kingbright Company (4-8%)

Kingbright manufactures high-power infrared LEDs that are applicable to security surveillance, medical imaging, and machine vision. Kingbright is also expanding into next-generation IR sensor technologies.

Other Key Players (30-38% Combined)

The market is segmented by type into vapor chamber, variable conductance, diode, thermosyphon, and others.

By end use, the market serves multiple industries, including consumer electronics, automotive, construction, transportation & logistics, chemical, aerospace, healthcare, military & defense, and other sectors.

Region-wise, the market spans North America, Latin America, Europe, Asia Pacific, and the Middle East & Africa.

The industry is slated to reach USD 2.9 billion in 2025.

The industry is predicted to reach USD 4.3 billion by 2035.

The key companies in the industry include Excelitas Technologies Corporation, FLIR Systems, Inc., Hamamatsu Photonics KK, Honeywell Process Solutions (HPS), Murata Manufacturing Co., Ltd, Orange Pi, OSRAM Opto Semiconductors GmbH, Texas Instruments, Inc., VTech Opto Technology Co., Ltd, and Vishay Intertechnology, Inc.

India, slated to grow at 9.3% CAGR during the forecast period, is poised for the fastest growth.

Vapor chambers are being widely used.

Table 1: Global Market Value (US$ million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Units) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ million) Forecast by Type, 2018 to 2033

Table 4: Global Market Volume (Units) Forecast by Type, 2018 to 2033

Table 5: Global Market Value (US$ million) Forecast by End-Use, 2018 to 2033

Table 6: Global Market Volume (Units) Forecast by End-Use, 2018 to 2033

Table 7: North America Market Value (US$ million) Forecast by Country, 2018 to 2033

Table 8: North America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 9: North America Market Value (US$ million) Forecast by Type, 2018 to 2033

Table 10: North America Market Volume (Units) Forecast by Type, 2018 to 2033

Table 11: North America Market Value (US$ million) Forecast by End-Use, 2018 to 2033

Table 12: North America Market Volume (Units) Forecast by End-Use, 2018 to 2033

Table 13: Latin America Market Value (US$ million) Forecast by Country, 2018 to 2033

Table 14: Latin America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 15: Latin America Market Value (US$ million) Forecast by Type, 2018 to 2033

Table 16: Latin America Market Volume (Units) Forecast by Type, 2018 to 2033

Table 17: Latin America Market Value (US$ million) Forecast by End-Use, 2018 to 2033

Table 18: Latin America Market Volume (Units) Forecast by End-Use, 2018 to 2033

Table 19: Western Europe Market Value (US$ million) Forecast by Country, 2018 to 2033

Table 20: Western Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 21: Western Europe Market Value (US$ million) Forecast by Type, 2018 to 2033

Table 22: Western Europe Market Volume (Units) Forecast by Type, 2018 to 2033

Table 23: Western Europe Market Value (US$ million) Forecast by End-Use, 2018 to 2033

Table 24: Western Europe Market Volume (Units) Forecast by End-Use, 2018 to 2033

Table 25: Eastern Europe Market Value (US$ million) Forecast by Country, 2018 to 2033

Table 26: Eastern Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 27: Eastern Europe Market Value (US$ million) Forecast by Type, 2018 to 2033

Table 28: Eastern Europe Market Volume (Units) Forecast by Type, 2018 to 2033

Table 29: Eastern Europe Market Value (US$ million) Forecast by End-Use, 2018 to 2033

Table 30: Eastern Europe Market Volume (Units) Forecast by End-Use, 2018 to 2033

Table 31: South Asia and Pacific Market Value (US$ million) Forecast by Country, 2018 to 2033

Table 32: South Asia and Pacific Market Volume (Units) Forecast by Country, 2018 to 2033

Table 33: South Asia and Pacific Market Value (US$ million) Forecast by Type, 2018 to 2033

Table 34: South Asia and Pacific Market Volume (Units) Forecast by Type, 2018 to 2033

Table 35: South Asia and Pacific Market Value (US$ million) Forecast by End-Use, 2018 to 2033

Table 36: South Asia and Pacific Market Volume (Units) Forecast by End-Use, 2018 to 2033

Table 37: East Asia Market Value (US$ million) Forecast by Country, 2018 to 2033

Table 38: East Asia Market Volume (Units) Forecast by Country, 2018 to 2033

Table 39: East Asia Market Value (US$ million) Forecast by Type, 2018 to 2033

Table 40: East Asia Market Volume (Units) Forecast by Type, 2018 to 2033

Table 41: East Asia Market Value (US$ million) Forecast by End-Use, 2018 to 2033

Table 42: East Asia Market Volume (Units) Forecast by End-Use, 2018 to 2033

Table 43: Middle East and Africa Market Value (US$ million) Forecast by Country, 2018 to 2033

Table 44: Middle East and Africa Market Volume (Units) Forecast by Country, 2018 to 2033

Table 45: Middle East and Africa Market Value (US$ million) Forecast by Type, 2018 to 2033

Table 46: Middle East and Africa Market Volume (Units) Forecast by Type, 2018 to 2033

Table 47: Middle East and Africa Market Value (US$ million) Forecast by End-Use, 2018 to 2033

Table 48: Middle East and Africa Market Volume (Units) Forecast by End-Use, 2018 to 2033

Figure 1: Global Market Value (US$ million) by Type, 202 to 2033

Figure 2: Global Market Value (US$ million) by End-Use, 202 to 2033

Figure 3: Global Market Value (US$ million) by Region, 202 to 2033

Figure 4: Global Market Value (US$ million) Analysis by Region, 2018 to 2033

Figure 5: Global Market Volume (Units) Analysis by Region, 2018 to 2033

Figure 6: Global Market Value Share (%) and BPS Analysis by Region, 202 to 2033

Figure 7: Global Market Y-o-Y Growth (%) Projections by Region, 202 to 2033

Figure 8: Global Market Value (US$ million) Analysis by Type, 2018 to 2033

Figure 9: Global Market Volume (Units) Analysis by Type, 2018 to 2033

Figure 10: Global Market Value Share (%) and BPS Analysis by Type, 202 to 2033

Figure 11: Global Market Y-o-Y Growth (%) Projections by Type, 202 to 2033

Figure 12: Global Market Value (US$ million) Analysis by End-Use, 2018 to 2033

Figure 13: Global Market Volume (Units) Analysis by End-Use, 2018 to 2033

Figure 14: Global Market Value Share (%) and BPS Analysis by End-Use, 202 to 2033

Figure 15: Global Market Y-o-Y Growth (%) Projections by End-Use, 202 to 2033

Figure 16: Global Market Attractiveness by Type, 202 to 2033

Figure 17: Global Market Attractiveness by End-Use, 202 to 2033

Figure 18: Global Market Attractiveness by Region, 202 to 2033

Figure 19: North America Market Value (US$ million) by Type, 202 to 2033

Figure 20: North America Market Value (US$ million) by End-Use, 202 to 2033

Figure 21: North America Market Value (US$ million) by Country, 202 to 2033

Figure 22: North America Market Value (US$ million) Analysis by Country, 2018 to 2033

Figure 23: North America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 24: North America Market Value Share (%) and BPS Analysis by Country, 202 to 2033

Figure 25: North America Market Y-o-Y Growth (%) Projections by Country, 202 to 2033

Figure 26: North America Market Value (US$ million) Analysis by Type, 2018 to 2033

Figure 27: North America Market Volume (Units) Analysis by Type, 2018 to 2033

Figure 28: North America Market Value Share (%) and BPS Analysis by Type, 202 to 2033

Figure 29: North America Market Y-o-Y Growth (%) Projections by Type, 202 to 2033

Figure 30: North America Market Value (US$ million) Analysis by End-Use, 2018 to 2033

Figure 31: North America Market Volume (Units) Analysis by End-Use, 2018 to 2033

Figure 32: North America Market Value Share (%) and BPS Analysis by End-Use, 202 to 2033

Figure 33: North America Market Y-o-Y Growth (%) Projections by End-Use, 202 to 2033

Figure 34: North America Market Attractiveness by Type, 202 to 2033

Figure 35: North America Market Attractiveness by End-Use, 202 to 2033

Figure 36: North America Market Attractiveness by Country, 202 to 2033

Figure 37: Latin America Market Value (US$ million) by Type, 202 to 2033

Figure 38: Latin America Market Value (US$ million) by End-Use, 202 to 2033

Figure 39: Latin America Market Value (US$ million) by Country, 202 to 2033

Figure 40: Latin America Market Value (US$ million) Analysis by Country, 2018 to 2033

Figure 41: Latin America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 42: Latin America Market Value Share (%) and BPS Analysis by Country, 202 to 2033

Figure 43: Latin America Market Y-o-Y Growth (%) Projections by Country, 202 to 2033

Figure 44: Latin America Market Value (US$ million) Analysis by Type, 2018 to 2033

Figure 45: Latin America Market Volume (Units) Analysis by Type, 2018 to 2033

Figure 46: Latin America Market Value Share (%) and BPS Analysis by Type, 202 to 2033

Figure 47: Latin America Market Y-o-Y Growth (%) Projections by Type, 202 to 2033

Figure 48: Latin America Market Value (US$ million) Analysis by End-Use, 2018 to 2033

Figure 49: Latin America Market Volume (Units) Analysis by End-Use, 2018 to 2033

Figure 50: Latin America Market Value Share (%) and BPS Analysis by End-Use, 202 to 2033

Figure 51: Latin America Market Y-o-Y Growth (%) Projections by End-Use, 202 to 2033

Figure 52: Latin America Market Attractiveness by Type, 202 to 2033

Figure 53: Latin America Market Attractiveness by End-Use, 202 to 2033

Figure 54: Latin America Market Attractiveness by Country, 202 to 2033

Figure 55: Western Europe Market Value (US$ million) by Type, 202 to 2033

Figure 56: Western Europe Market Value (US$ million) by End-Use, 202 to 2033

Figure 57: Western Europe Market Value (US$ million) by Country, 202 to 2033

Figure 58: Western Europe Market Value (US$ million) Analysis by Country, 2018 to 2033

Figure 59: Western Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 60: Western Europe Market Value Share (%) and BPS Analysis by Country, 202 to 2033

Figure 61: Western Europe Market Y-o-Y Growth (%) Projections by Country, 202 to 2033

Figure 62: Western Europe Market Value (US$ million) Analysis by Type, 2018 to 2033

Figure 63: Western Europe Market Volume (Units) Analysis by Type, 2018 to 2033

Figure 64: Western Europe Market Value Share (%) and BPS Analysis by Type, 202 to 2033

Figure 65: Western Europe Market Y-o-Y Growth (%) Projections by Type, 202 to 2033

Figure 66: Western Europe Market Value (US$ million) Analysis by End-Use, 2018 to 2033

Figure 67: Western Europe Market Volume (Units) Analysis by End-Use, 2018 to 2033

Figure 68: Western Europe Market Value Share (%) and BPS Analysis by End-Use, 202 to 2033

Figure 69: Western Europe Market Y-o-Y Growth (%) Projections by End-Use, 202 to 2033

Figure 70: Western Europe Market Attractiveness by Type, 202 to 2033

Figure 71: Western Europe Market Attractiveness by End-Use, 202 to 2033

Figure 72: Western Europe Market Attractiveness by Country, 202 to 2033

Figure 73: Eastern Europe Market Value (US$ million) by Type, 202 to 2033

Figure 74: Eastern Europe Market Value (US$ million) by End-Use, 202 to 2033

Figure 75: Eastern Europe Market Value (US$ million) by Country, 202 to 2033

Figure 76: Eastern Europe Market Value (US$ million) Analysis by Country, 2018 to 2033

Figure 77: Eastern Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 78: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 202 to 2033

Figure 79: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 202 to 2033

Figure 80: Eastern Europe Market Value (US$ million) Analysis by Type, 2018 to 2033

Figure 81: Eastern Europe Market Volume (Units) Analysis by Type, 2018 to 2033

Figure 82: Eastern Europe Market Value Share (%) and BPS Analysis by Type, 202 to 2033

Figure 83: Eastern Europe Market Y-o-Y Growth (%) Projections by Type, 202 to 2033

Figure 84: Eastern Europe Market Value (US$ million) Analysis by End-Use, 2018 to 2033

Figure 85: Eastern Europe Market Volume (Units) Analysis by End-Use, 2018 to 2033

Figure 86: Eastern Europe Market Value Share (%) and BPS Analysis by End-Use, 202 to 2033

Figure 87: Eastern Europe Market Y-o-Y Growth (%) Projections by End-Use, 202 to 2033

Figure 88: Eastern Europe Market Attractiveness by Type, 202 to 2033

Figure 89: Eastern Europe Market Attractiveness by End-Use, 202 to 2033

Figure 90: Eastern Europe Market Attractiveness by Country, 202 to 2033

Figure 91: South Asia and Pacific Market Value (US$ million) by Type, 202 to 2033

Figure 92: South Asia and Pacific Market Value (US$ million) by End-Use, 202 to 2033

Figure 93: South Asia and Pacific Market Value (US$ million) by Country, 202 to 2033

Figure 94: South Asia and Pacific Market Value (US$ million) Analysis by Country, 2018 to 2033

Figure 95: South Asia and Pacific Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 96: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 202 to 2033

Figure 97: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 202 to 2033

Figure 98: South Asia and Pacific Market Value (US$ million) Analysis by Type, 2018 to 2033

Figure 99: South Asia and Pacific Market Volume (Units) Analysis by Type, 2018 to 2033

Figure 100: South Asia and Pacific Market Value Share (%) and BPS Analysis by Type, 202 to 2033

Figure 101: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Type, 202 to 2033

Figure 102: South Asia and Pacific Market Value (US$ million) Analysis by End-Use, 2018 to 2033

Figure 103: South Asia and Pacific Market Volume (Units) Analysis by End-Use, 2018 to 2033

Figure 104: South Asia and Pacific Market Value Share (%) and BPS Analysis by End-Use, 202 to 2033

Figure 105: South Asia and Pacific Market Y-o-Y Growth (%) Projections by End-Use, 202 to 2033

Figure 106: South Asia and Pacific Market Attractiveness by Type, 202 to 2033

Figure 107: South Asia and Pacific Market Attractiveness by End-Use, 202 to 2033

Figure 108: South Asia and Pacific Market Attractiveness by Country, 202 to 2033

Figure 109: East Asia Market Value (US$ million) by Type, 202 to 2033

Figure 110: East Asia Market Value (US$ million) by End-Use, 202 to 2033

Figure 111: East Asia Market Value (US$ million) by Country, 202 to 2033

Figure 112: East Asia Market Value (US$ million) Analysis by Country, 2018 to 2033

Figure 113: East Asia Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 114: East Asia Market Value Share (%) and BPS Analysis by Country, 202 to 2033

Figure 115: East Asia Market Y-o-Y Growth (%) Projections by Country, 202 to 2033

Figure 116: East Asia Market Value (US$ million) Analysis by Type, 2018 to 2033

Figure 117: East Asia Market Volume (Units) Analysis by Type, 2018 to 2033

Figure 118: East Asia Market Value Share (%) and BPS Analysis by Type, 202 to 2033

Figure 119: East Asia Market Y-o-Y Growth (%) Projections by Type, 202 to 2033

Figure 120: East Asia Market Value (US$ million) Analysis by End-Use, 2018 to 2033

Figure 121: East Asia Market Volume (Units) Analysis by End-Use, 2018 to 2033

Figure 122: East Asia Market Value Share (%) and BPS Analysis by End-Use, 202 to 2033

Figure 123: East Asia Market Y-o-Y Growth (%) Projections by End-Use, 202 to 2033

Figure 124: East Asia Market Attractiveness by Type, 202 to 2033

Figure 125: East Asia Market Attractiveness by End-Use, 202 to 2033

Figure 126: East Asia Market Attractiveness by Country, 202 to 2033

Figure 127: Middle East and Africa Market Value (US$ million) by Type, 202 to 2033

Figure 128: Middle East and Africa Market Value (US$ million) by End-Use, 202 to 2033

Figure 129: Middle East and Africa Market Value (US$ million) by Country, 202 to 2033

Figure 130: Middle East and Africa Market Value (US$ million) Analysis by Country, 2018 to 2033

Figure 131: Middle East and Africa Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 132: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 202 to 2033

Figure 133: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 202 to 2033

Figure 134: Middle East and Africa Market Value (US$ million) Analysis by Type, 2018 to 2033

Figure 135: Middle East and Africa Market Volume (Units) Analysis by Type, 2018 to 2033

Figure 136: Middle East and Africa Market Value Share (%) and BPS Analysis by Type, 202 to 2033

Figure 137: Middle East and Africa Market Y-o-Y Growth (%) Projections by Type, 202 to 2033

Figure 138: Middle East and Africa Market Value (US$ million) Analysis by End-Use, 2018 to 2033

Figure 139: Middle East and Africa Market Volume (Units) Analysis by End-Use, 2018 to 2033

Figure 140: Middle East and Africa Market Value Share (%) and BPS Analysis by End-Use, 202 to 2033

Figure 141: Middle East and Africa Market Y-o-Y Growth (%) Projections by End-Use, 202 to 2033

Figure 142: Middle East and Africa Market Attractiveness by Type, 202 to 2033

Figure 143: Middle East and Africa Market Attractiveness by End-Use, 202 to 2033

Figure 144: Middle East and Africa Market Attractiveness by Country, 202 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Iris Recognition Market Size and Share Forecast Outlook 2025 to 2035

Irrigation Syringe Market Size and Share Forecast Outlook 2025 to 2035

IR Corrected Lenses Market Size and Share Forecast Outlook 2025 to 2035

Iridium Spark Plug Market Size and Share Forecast Outlook 2025 to 2035

Iron Phosphate Market Size and Share Forecast Outlook 2025 to 2035

Ironing Table Market Size and Share Forecast Outlook 2025 to 2035

Iron Powder Market - Trends & Forecast 2025 to 2035

Iron Oxide Market Report - Growth, Demand & Forecast 2025 to 2035

IR Spectroscopy Market Analysis - Growth & Forecast 2025 to 2035

Iron Ore Pellets Market Growth - Trends & Forecast 2025 to 2035

Irradiation Apparatus Market Trends – Growth & Industry Outlook 2024-2034

Irrigation testing kit Market

Irrigation Liners Market

Iron and Steel Casting Market Size and Share Forecast Outlook 2025 to 2035

Wireless Refrigerant Charging Scale Market Size and Share Forecast Outlook 2025 to 2035

Wireless Hydrometer Market Size and Share Forecast Outlook 2025 to 2035

Air Caster Skids System Market Size and Share Forecast Outlook 2025 to 2035

Direct Fast Dyes Market Size and Share Forecast Outlook 2025 to 2035

Direct Thermal Printing Film Market Size and Share Forecast Outlook 2025 to 2035

Tire Marking Machine Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA