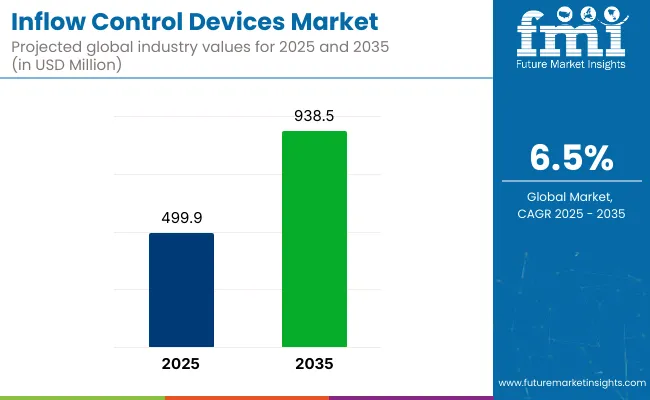

The inflow control devices market is valued at USD 499.9 million in 2025 and is expected to reach USD 938.5 million by 2035, reflecting a CAGR of 6.5%. Growth is being driven by rising demand for optimized reservoir performance, increasing adoption in mature and unconventional fields, and the shift towards smart, automated solutions that integrate AI-based monitoring. The deployment of inflow control devices in offshore and shale gas fields is expected to remain strong due to their ability to improve hydrocarbon recovery and reduce water or gas breakthroughs.

| Metric | Value |

|---|---|

| Estimated Size (2025) | USD 499.9 million |

| Projected Value (2035) | USD 938.5 million |

| CAGR (2025 to 2035) | 6.5% |

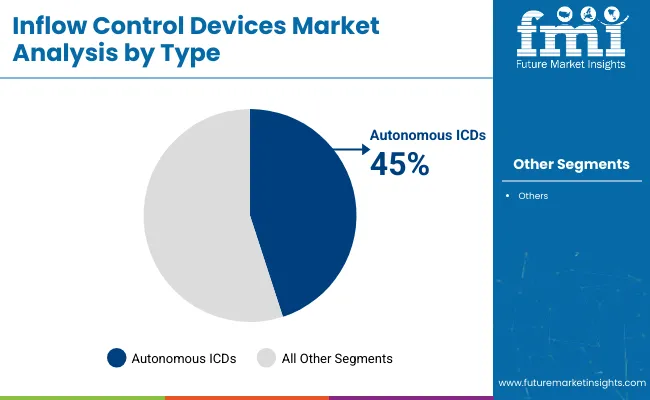

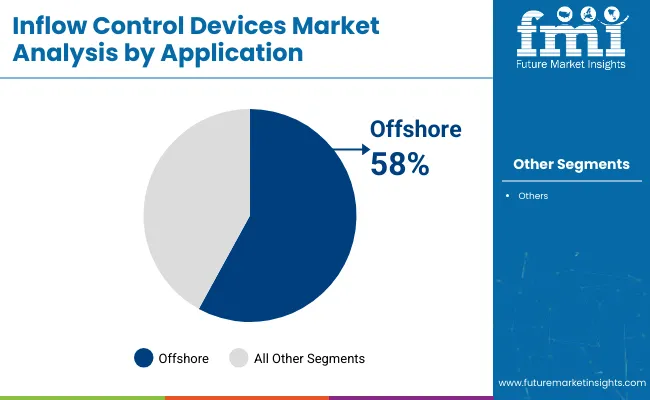

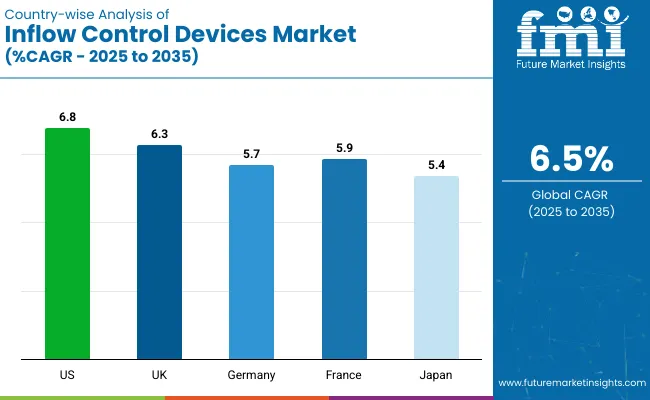

North America is anticipated to hold the largest share, primarily driven by shale gas and deepwater projects in the USA, expanding rapidly at a significant CAGR of 6.8%. In contrast, countries such as the UK and France are projected to witness rapid growth at CAGRs of around 6.3% and 5.9%. Autonomous inflow control devices by type segment account for 45% of the market share, while by application, the offshore segment holds a prominent market share of 58% in 2025.

Among companies, Schlumberger is expected to retain a leading market share due to its strong portfolio in autonomous ICDs and widespread regional presence, especially in the Middle East. In contrast, smaller regional companies in Asia-Pacific are likely to face challenges due to higher installation costs and limited technological expertise, while European manufacturers are aligning with strict sustainability regulations to achieve success through hybrid and eco-friendly solutions. Competition is further intensifying as local players attempt to capture niche markets with budget-friendly alternatives.

Inflow control devices (ICDs) hold an estimated 18% to 22% share within the well completion equipment market, primarily due to their role in optimizing production and extending well life. Within the broader downhole tools market, ICDs account for around 12% to 15%, reflecting their specialized but essential function.

In the oilfield equipment market, ICDs contribute a modest 4% to 6%, as this category includes a wide range of drilling and surface equipment. In the flow control equipment segment, ICDs make up approximately 10%, and in the enhanced oil recovery (EOR) market, their share is about 5%, supporting zonal isolation and flow balancing.

The inflow control devices market has been segmented into type, application, and region. By type,it includes autonomous (AICD), passive (PICD), and active (AICD). By application,it is segmented into onshore and offshore.Byregion,it covers North America, Latin America, Western Europe, Eastern Europe, South Asia and Pacific, East Asia, Middle East and Africa.

Autonomous inflow control devices (AICDs) are expected to remain the leading segment, accounting for around 45% share in 2025. Their ability to self-regulate fluid inflow rates without external intervention has driven adoption in complex reservoirs where permeability varies significantly. Passive ICDs are likely to see moderate growth due to their cost-effectiveness in mature fields, while active ICDs with real-time adjustments are gaining ground, albeit from a lower base, due to high costs and complex installation requirements.

Offshore applications are expected to maintain the largest share, accounting for 58% of the market in 2025. Offshore reservoirs often present heterogeneous permeability and fluctuating pressure conditions, necessitating advanced inflow control solutions to maximize hydrocarbon recovery while minimizing unwanted water or gas ingress. Onshore application growth is steady due to cost-effective deployment in aging fields. However, technological innovations continue to prioritize offshore deployment for maximizing well productivity and extending asset lifespan.

Recent Trends in the Inflow Control Devices Market

Challenges in the Inflow Control Devices Market

The USA leads the inflow control devices (ICDs) market with a projected CAGR of 6.8% (2025 to 2035), driven by shale gas expansion, deepwater projects, and AI adoption. The UK follows at 6.3%, focusing on extending North Sea well life and aligning with its Net Zero Strategy.

Germany (5.7%) leverages engineering innovation and export strength, while France (5.9%) invests in offshore and African E&P projects, aligned with EU emission goals. Japan, with a 5.4% CAGR, emphasizes overseas deployments in the Middle East and Southeast Asia, supported by digitalization and sustainability regulations. Across all regions, smart and AI-enabled ICDs are key growth drivers.

The report covers in-depth analysis of 40+ countries; five top-performing OECD countries are highlighted below.

The inflow control devices demand in the USA is projected to grow at a CAGR of 6.8% from 2025 to 2035. Growth is being driven by strong upstream investments in shale gas and deepwater projects alongside strict environmental policies targeting methane emission reductions. Adoption of AI-enabled autonomous ICDs is strengthening operational efficiency and maximizing hydrocarbon recovery across major basins such as the Permian and the Gulf of Mexico.

The revenue from inflow control devices in the UK. is anticipated to expand at a CAGR of 6.3% between 2025 and 2035. The emphasis remains on maximizing production from mature North Sea fields through the adoption of smart ICDs. Sustainability commitments under the Net Zero Strategy are supporting investments in energy-efficient reservoir management, while offshore operators prioritize hybrid and AI-enabled inflow control technologies to extend well lifespans.

The inflow control devices sales in Germany are expected to register a CAGR of 5.7% from 2025 to 2035. Though domestic oil production is limited, German engineering expertise drives technological innovation in ICD design, including automation and predictive maintenance systems. Companies focus on exports and global E&P operations, contributing to advanced, durable, and sustainability-compliant ICD solutions for international markets.

The inflow control devices market in France is projected to grow steadily with a CAGR of 5.9% from 2025 to 2035. French multinationals are investing in sustainable oil and gas technologies, deploying advanced ICDs in offshore and international E&P projects. Alignment with EU emission targets is driving adoption, while technological partnerships in Africa and the Middle East enhance France’s role in responsible reservoir management.

The revenue from the inflow control devices in Japanis forecasted to expand at a CAGR of 5.4% between 2025 and 2035. Limited domestic production has shifted focus to overseas oilfield investments, primarily in the Middle East and Southeast Asia. Japanese energy companies are prioritizing energy efficiency and adopting smart ICDs with automated control to optimize extraction while complying with stringent sustainability-focused regulations.

The inflow control devices market is moderately consolidated, with major global players accounting for a substantial share while regional and niche technology providers cater to specific project needs. Companies such as Schlumberger, Halliburton, Baker Hughes, Weatherford, and Tendeka are competing intensely by expanding autonomous ICD portfolios, integrating AI-driven monitoring, and offering digital twin solutions for reservoir optimization. Pricing competitiveness is maintained through leasing models, while innovation remains focused on smart flow control systems and corrosion-resistant materials.

Company strategies center on developing advanced autonomous ICDs to reduce intervention needs, expanding into emerging markets with cost-effective models, and forging partnerships with national oil companies for localization. For instance, Schlumberger and Halliburton are focusing on AI-enabled smart ICDs for Middle Eastern offshore fields, whereas Baker Hughes is investing in predictive maintenance capabilities. Weatherford is emphasizing 3D-printed ICD technologies for unconventional reservoirs to lower production costs and deployment timeframes.

Recent Inflow Control Devices Industry News

| Report Attributes | Details |

|---|---|

| Current Total Market Size (2025) | USD 499.9 million |

| Projected Market Size (2035) | USD 938.5 million |

| CAGR (2025 to 2035) | 6.5% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Market Analysis Parameters | Revenue in USD millions /Volume in Units |

| By Type | Autonomous (AICD), Passive (PICD), Active (AICD) |

| By Application | Onshore, Offshore |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, South Asia , Pacific, East Asia, Middle East and Africa |

| Countries Covered | United States, United Kingdom, Germany, France, Japan, China, South Korea, Brazil, UAE, Saudi Arabia |

| Key Players | Schlumberger Limited, Halliburton Company, Baker Hughes Company, Weatherford International Plc, Tendeka , RGL Reservoir Management, National Oilwell Varco, Omega Completion Technology Ltd., Welltec A/S, Interwell Norway AS |

| Additional Attributes | Dollar sales by value, market share analysis by region, country-wise analysis, and company recent developments |

By type, the industry is segmented into autonomous (AICD), passive (PICD), and active (AICD).

In terms of application, the industry is segmented into onshore and offshore.

The industry is segmented by region into North America, Latin America, Western Europe, South Asia & Pacific, East Asia, Middle East, and Africa.

The market size is valued at USD 499.9 million in 2025.

The market is forecasted to reach USD 938.5 million by 2035, reflecting a CAGR of 6.5%.

Autonomous inflow control devices are expected to lead the market with a 45% share in 2025.

Offshore applications are expected to hold a 58% share of the market in 2025.

The USA is anticipated to be the fastest-growing market with a CAGR of 6.8% from 2025 to 2035.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Inflow Pressure Screen Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Controllable Shunt Reactor for UHV Market Size and Share Forecast Outlook 2025 to 2035

Control Room Solution Market Size and Share Forecast Outlook 2025 to 2035

Control Knobs for Panel Potentiometer Market Size and Share Forecast Outlook 2025 to 2035

Controlled-Release Drug Delivery Technology Market Size and Share Forecast Outlook 2025 to 2035

Controlled Environment Agriculture (CEA) Market Size and Share Forecast Outlook 2025 to 2035

Control Cable Market Size and Share Forecast Outlook 2025 to 2035

Control Towers Market Size and Share Forecast Outlook 2025 to 2035

Controlled & Slow Release Fertilizers Market 2025-2035

Controlled Intelligent Packaging Market

Biocontrol Solutions Market Size and Share Forecast Outlook 2025 to 2035

Biocontrol Agents Market Size and Share Forecast Outlook 2025 to 2035

Oil Control Shampoo Market Size and Share Forecast Outlook 2025 to 2035

LED Control Unit Market Size and Share Forecast Outlook 2025 to 2035

Sun Control Films Market Size and Share Forecast Outlook 2025 to 2035

CNC Controller Market Size and Share Forecast Outlook 2025 to 2035

PID Controller Market Size and Share Forecast Outlook 2025 to 2035

Market Share Breakdown of Sun Control Films Manufacturers

PLC Controlled Packing Machine Market Trends – Forecast 2024-2034

Seat Control Module (SCM) Market Forecast and Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA