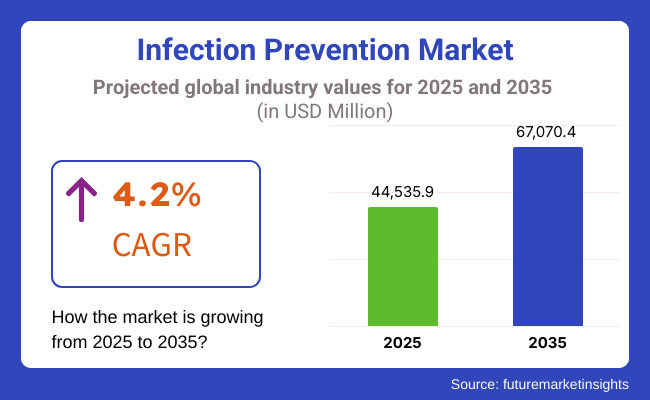

Global infection prevention sales reached approximately USD 44,535.9 million at the end of 2025. Forecasts suggest the market will achieve a 4.2% compound annual growth rate (CAGR) and exceed USD 67,070.4 million in value by 2035.

The infection prevention business is set to take off as more and more healthcare facilities recognize the need to control infections, particularly against the background of rising healthcare-associated infections (HAIs) and antibiotic-resistant pathogens. Hospitals, clinics, laboratories, and long-term care facilities focus on infection control measures not only for the protection of patients but also to comply with tighter regulations.

Simultaneously, technology is changing the face of the industry- with AI-based infection monitoring, antimicrobial treatments, and robot disinfection units being rolled out by companies as tools to enhance infection control and productivity.

The use of disenfection robots is being adopted by supermalls and business hotels in the Middle East and Europe where they are cleaning public as well as guest areas. And there's a growing trend toward green, non-toxic disinfectants as sustainability becomes the focus.

It's not limited to healthcare-hospitality, food processing, and consumer goods industries are implementing infection prevention methods too. With all this changing, infection control is not longer a medical concern-it's a top priority for many different industries to ensure the safety of people.

On the side of the raised awareness, technology, and healthcare-associated infections (HAIs) in the last three decades, the development of the infection prevention market was a revolution. With the arrival of disinfection, issues of antibiotic resistance and newly emerging diseases laid the ground for the development of infection control within the world of healthcare professionals.

By the end of the 2000s, regulators were increasing the rate of inspection, demanding newer sterilization technology developments, such as automated disinfection, UV-C light disinfection, and antimicrobial coating. Worldwide health crises like SARS, H1N1, and COVID-19 also further heightened the need for PPE, hand sanitizer products, and infection control.

Despite prohibitive prices and compliance challenges, these developments presented a mechanism for further market expansion.

Explore FMI!

Book a free demo

Increasingly, the North American infection prevention market will be propelled by an extremely high incidence of HAIs within ever so modern healthcare facilities that promote solid infection control protocols, supported by government incentives willing to back infection control endeavors.

Within hospitals, there is a wide acceptance of improved infection prevention practices, while newer sterilization techniques are enthusiastically accepted by all. MDRO-associated hospital-acquired infections are compelling hospitals now into higher levels of disinfection and infection prevention measures.

The study and investment into research and development have spurred companies into launching newer technologies such as touchless disinfection systems, AI-based hygiene monitoring systems, and self-sanitizing surfaces. Besides, the demand for personal protective equipment (PPE) is increasing in sectors outside the clinic, such as workplaces and schools.

The market growth is further fueled by these two factors. On the other hand, due to higher costs and stringent regulations, small healthcare facilities find routine application very difficult.

As for infection prevention, it is going to have steady growth in Europe because patient safety will concern the authorities that regulate their activities and hospitals will expand and develop their infection control programs; it will also come into play that there will be increasing demand upon sterilization products.

The Americans spend on new technologies of disinfection; they institute research on antimicrobial resistance for purposes of infection control. The three European countries of Germany, France, and the UK currently have investments on new technologies.

There is also an understanding by the European Centre for Disease Prevention and Control (ECDC) concerning the rules of infection control, whereby hospitals with healthcare facilities must comply with standards of hygiene. Opening a new FDI with European legislation concerning the minimization of environmental impacts results into a rising demand for sustainable and green disinfectants.

Advances in sterilization techniques like plasma-based disinfection and nanotechnology-based antimicrobial coatings gain popularity while installing digital monitoring systems for enhanced hygiene compliance and results in infection prevention.

Notwithstanding, the disparity in the health care policies and budget constraint in public health facilities pose challenges. In some regions, smaller health care providers do not receive the necessary financial allocations to pave the way for access to state-of-the-art infection prevention technologies.

Of all regions of the world, the fastest growth in terms of the market for infection prevention will be that of the Asia-Pacific region as improvements are taking place in the healthcare infrastructure combined with greater awareness for infection control and the escalating rate of hospital-acquired infections.

Greater need for PPE, disinfectants, and sterilization instruments is attracted into nations such as China, India, and Japan by government-stimulated health programs. The increase in medical centers at a high rate has also contributed to an increased demand for infection-prevention products.

The epidemics of diseases such as tuberculosis, influenza, and COVID-19 have significantly contributed to the need for hospital hygienic treatment and sterilization procedures. Foreign investment in health facilities as well as expansion of the medical tourism sector in countries such as Thailand and Malaysia fuel demand for infection control products.

However, such challenges like poor rural access to healthcare, price consciousness, and varying regulatory policies will hinder market penetration. Growth in the region shall also be due to the heightened consumer awareness for hygiene but much of it is primarily associated with the rising uptake of home-used infection prevention products.

Addressing Healthcare Disparities and Infection Control Gaps

Impoverished nations are inclined not to curtail infections due to weak health infrastructures. Shortage of finances, under-staffed and poorly equipped hospitals, and poorly trained medical staff have compromised practitioners' ability to enforce effective infection control measures.

A majority of the health facilities are poorly equipped with sterilization facilities and personal protective equipment (PPE) and effective cleaning substances, further weakening the danger caused by healthcare-acquired infections (HAI).

Moreover, variance in infection control policies between nations and health care institutions creates pockets of infection prevention gaps. Government and health care organizations cannot collectively develop universally agreed guidelines, consequently preventing infection control standardization across the world.

These variations introduce inconsistencies in cleanliness, disinfection, and the management of antimicrobial resistance and thus dilute the other miscellaneous infection prevention endeavors.

The stakeholders must invest in health care infrastructure, regulatory policy harmonization, and provision of large-scale training programs for doctors to overcome the challenges. Infection control can be ensured all over the world by ensuring concerted efforts towards effective and consistent preventive measures in all health care facilities.

Emerging Infection Prevention Market Opportunities

High-growth demand is mainly attributed to growing infection prevention priorities in healthcare environments. New innovative technologies like UV sterilization, infection prevention robots, and smart monitoring systems are further likely to boost infection control efficiency. Growth in home healthcare services and telemedicine are likely to raise the demand for infection prevention products in non-hospital settings.

Increased governmental support for infection control programs along with public awareness initiatives add even more to market growth. An environmentally friendly move toward disinfectant products causes manufacturers to pursue the manufacture of biodegradable PPE and sustainable sterilization products.

Hospitals and public facilities are jumping onto the bandwagon of AI-enabled hygiene monitoring solutions that enhance better compliance with infection control and lower HAIs. All of these innovations and trends in the market share reveal the increasing involvement of infection prevention interventions in clinical and non-clinical settings.

Innovations Transforming Infection Prevention

Healthcare facilities take infection control technology to the next level with automated disinfection systems, antimicrobial coatings, and green prevention solutions. Nothing could be more efficient, given that human error is circumvented, hygiene protocols really enforced, and patient safety enhanced, than robotic disinfection units and AI-based sterilization technologies.

Clinics and hospitals are currently implementing antimicrobial coatings on high-touch surfaces, furniture, as well as medical equipment in a bid to prevent the transmission of microbes. The coatings incorporate silver nanoparticles and other antimicrobial agents that provide extended bacteria- and virus-free protection, thereby improving infection control measures.

Companies fight environmental issues through green infection prevention products. Companies are developing green disinfectants, biodegradable protech gears, and reusable sterilization approaches that are really effective in infection control while minimizing ecological footprints.

All these developments, together, create cleaner environments for the healthcare industry, hence offering safer areas for patients and doctors.

Expansion of Personal Protective Equipment (PPE) Beyond Healthcare

It is not, however, limited to food processing and hospitality industries; public transport companies are also increasing the volume of personal protective equipment (PPE) in their environment for the purpose of supporting the market growth. It is the COVID impact, which has heightened awareness for hygiene at the workplace which has led organizations to institutionalize PPE as a regular practice towards safety.

Masks, gloves, and protective shields are now compulsory within offices, retail stores, and public transport systems to minimize the risk exposure of infections. Hygiene standards by which regulatory agencies are strengthening will hasten the use of PPE. As industries lay more emphasis on health and safety, PPE goes on to be required to ensure public safety and cleanliness standards at all levels of non-healthcare environments.

The main reason for the growth in the infection prevention market is the COVID-19 pandemic, making a wake-up call on hygiene and strict infection control practices in hospitals; this increased demand for personal protective equipment (PPE), disinfectants, and sterilization materials, as well as antimicrobial coatings, for hospitals and companies alike.

Presently, there have also been advances in UV disinfection technology and nanotechnology-based antimicrobial products. It has been a challenge for the producers nevertheless, with disrupted supply chains and price fluctuations in raw materials.

Antimicrobial innovations will continue, with the positive development of artificial intelligence in surveillance systems for infections while continuing high infection prevention activities at the hospitality and food processing industries. These will characterize the infection prevention market from 2025 to 2035.

Stricter regulation will compel companies to resort to sustainable disinfectant-based products, while increasing AMR stimuli will prompt the research of new classes of biocides and novel ways of infection control. Simultaneously, increased investments in healthcare in emerging markets will make the entry further easy.

Comparison Table

| Category | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Regulators authorized PPE and disinfectants on an emergency basis because of COVID-19. |

| Technological Advancements | Businesses developed UV disinfection, antimicrobial coatings, and nanotechnology applications. |

| Consumer Demand | Healthcare facilities and public places increased PPE, hand sanitizers, and surface disinfectant purchases. |

| Market Growth Drivers | The pandemic, increasing HAIs (hospital-acquired infections), and worldwide hygiene consciousness fueled market expansion. |

| Sustainability | Firms ranked effectiveness above the environment, providing limited green products. |

| Supply Chain Dynamics | Disruptions in the supply chain limited PPE and disinfectants. |

| Category | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Authorities will impose stricter regulations on antimicrobial resistance and environmentally friendly disinfection products. |

| Technological Advancements | Manufacturers will create AI-powered infection surveillance, intelligent sterilization, and biodegradable antimicrobial solutions. |

| Consumer Demand | Consumers will prefer long-term antimicrobial solutions and automated infection control systems. |

| Market Growth Drivers | Infection prevention will spread beyond the healthcare sector into consumer products, hospitality, and food processing. |

| Sustainability | The sector will focus on biodegradable, non-toxic, and sustainable infection prevention products. |

| Supply Chain Dynamics | Firms will improve supply chains through local production and tactical alliances. |

Market Outlook

The battle against hospital-acquired infections (HAIs) and the need to comply with stringent regulatory requirements have created a vigorously thriving USA infection prevention market. The Centers for Disease Control and Prevention (CDC) stated that on any given day, 1 in 31 patients in a hospital will develop an HAI, emphasizing the importance of infection control.

Unfortunately, efficiency in infection prevention will be determined by the growing pool of elderly persons more vulnerable to these infections. The giants of the industry continue funding different R&D developments, including antimicrobial coatings against infection and robotized disinfection systems.

Nevertheless, issues like product prices and regulatory concerns, as well as variations in infection control practices among healthcare facilities, may limit market growth.

Market Growth Factors

Market Forecast

| Year | CAGR (2025 to 2035) |

|---|---|

| 2025 to 2035 | 3.3% |

Market Outlook

Germany's infection control industry is continually growing, driven by stringent regulation, stringent health standards, and established public health programs. With one of the top healthcare systems in Europe, Germany has set in place strict infection control practices for hospitals, outpatient facilities, and long-term care centers.

On top of this, national guidelines on hygiene management have been made compulsory with regular updates and audits for preventing cross-contamination Nevertheless, the costliness of new technologies for infection control and the need for employee specialized training are hindrances to instant adoption.

Market Growth Factors

Market Forecast

| Year | CAGR (2025 to 2035) |

|---|---|

| 2025 to 2035 | 3.1% |

Market Outlook

China's infection control market is coming rapidly into the light because of unprecedented large-scale reforms in the health sector, gigantic investments in healthcare facilities, and increased emphasis on disease control. The country has already seen major public health crises, such as hospital-acquired infections and respiratory infections, that forced the government to institute stronger infection control strategies.

The National Health Commission (NHC) has put in place effective disinfection practices, hand washing campaigns, and improved sterilization processes for medical equipment. Increasing speed of urbanization and a growing hospital network drives demand for infection prevention facilities both in public and private healthcare facilities.

Meanwhile, local and foreign companies are developing new offerings tailored to hospitals, labs, and outpatient facilities. However, differences in healthcare infrastructure in urban and rural areas and the high cost of imported advanced technology for infection control may inhibit widespread implementation.

Market Growth Factors

Market Forecast

| Year | CAGR (2025 to 2035) |

|---|---|

| 2025 to 2035 | 5.5% |

Market Outlook

The infection prevention market in India is growing rapidly with the awareness created due to infectious diseases, strong government health programs, and higher investments in hospitals.

The factors leading to HAIs used to be congestion in the hospital and poor sanitation, but the Swachh Bharat Abhiyan (Clean India Mission) and National Infection Control Guidelines are among the many government initiatives that will assist hospitals in improving their hygiene as well as infection control strategies.

As such, there is a surge in usage of solutions such as UV sterilizers, antimicrobial coatings, and hand sanitizers at hospitals and public places. Increased sophistication in infection control solutions is sought after due to the development of medical tourism and growing numbers of private hospitals. In contrast, rural healthcare facilities face challenges in terms of lacking resources and insufficient staff training.

Market Growth Factors

Market Forecast

| Year | CAGR (2025 to 2035) |

|---|---|

| 2025 to 2035 | 5.8% |

Market Outlook

In Brazil, the infection prevention market is witnessing growth due to increased healthcare expenditures, the government's disease control initiatives, and rising hospital-acquired infection rates. National health programs and hospital accreditation standards emphasizing infection control have been instated by the government.

The country's huge urban population and an increasing need for high-standard healthcare services have attracted further investments in sterilization devices, personal protective equipment (PPE), and antimicrobial coatings. However, contrasting inequalities in health access in rural versus urban settings and persisting economic uncertainties could hinder market growth.

Market Growth Factors

Market Forecast

| Year | CAGR (2025 to 2035) |

|---|---|

| 2025 to 2035 | 3.5% |

Infection Prevention Market Segment Outlook

Sterilization Equipment: Dominating the Market with High Demand for Infection Control

Essentially, sterilization technology is highlighted as an important infection control measure, with health facilities today abiding by high standards of hygiene. Low-temperature sterilization, heat sterilization, radiation sterilization, and liquid sterilization are some of the established sterilization technologies that aid hospitals, clinics, and the pharmaceutical industry in keeping medical instruments and environments sterile.

The growing incidence of hospital-acquired infections (HAIs) and the increase in surgical procedures worldwide necessitated the urgent need for more sterilization products. That is, the regulatory scene is getting stringent, and the clinical automation of sterilization technology is forcing the market.

Emerging technologies in low-temperature sterilization processes, such as hydrogen peroxide plasma and ethylene oxide sterilization, are now on the spotlight because they can effectively sterilize heat-sensitive surgical instruments.

Surface Disinfectants: Expanding Adoption in Healthcare and Non-Healthcare Settings

As many have become aware that cleanliness is essential to stop the transmission of diseases, especially surface disinfectants are in great demand worldwide. More and more, hospitals, clinics, laboratories, and even public places are employing surface disinfectants in their endeavor to control infections.

The COVID-19 outbreak, however, ushered in an era for aggressor disinfectants and formulations using strong alcohol, quaternary ammonium compound, and hydrogen peroxide-based ingredients. Also, more recently, much more attention has been directed at greener and non-toxic disinfectants with the growing emphasis on sustainability.

Surface disinfectants would therefore continue to be most critical in infection prevention practice owing to the adoption spurred by hospital infection control efforts and regulatory clearances.

Hospitals & Clinics: Primary Consumers of Infection Prevention Solutions

Hospitals and clinics account for the bulk of infection control, thus being the greatest consumers of sterilization products, which include disinfectants, hand sanitizers, and all types of protective equipment. The patient safety priorities that prevail in these establishments call for compliance with high standards of cleanliness to avert HAIs and furnish a clean environment for interventions.

Along with an increasing number of procedures and expanding healthcare infrastructure, particularly in emerging markets, infection prevention solutions are also gaining in demand. New technologies in sterilization and disinfection will further entrench hospitals and clinics at the top of the market.

Pharmaceutical Companies: Ensuring Sterile Manufacturing Environments

A sterilized environment is a must and cannot be compromised for pharmaceutical purposes. Companies invest heavily in sterilization machines, disinfectants, and other contamination-control products to meet stringent regulatory standards and to also guarantee the safety of their products. With an increase in biopharmaceuticals and vaccine production, the prevention of infections becomes even more vital. Vapor-phase hydrogen peroxide and UV-C light sterilization are increasingly being recognized as being more effective in the removal of contaminants. The environment related to infection prevention will continue to witness growth when companies establish stricter hygiene and infection control practices.

The rise in concern and focus among healthcare organizations and providers regarding hospital-acquired infections (HAIs) has translated the market into a burgeoning opportunity in infection prevention. Government regulations on specific requirements are stricter, and firms are driving sterilization and disinfection technology in line with such demands.

Major companies are aggressively adding to their portfolios, innovating infection prevention solutions, and strategizing alliances to reinforce their own market positions. With both traditional healthcare organizations and new participants holistically investing in research-based infection-prevention technologies, intense competition prevails in the market.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Reckitt Benckiser | 6.3% |

| Steris | 2.1% |

| 3M Company | 2.1% |

| Haylard Health | 1.6% |

| Other Companies (combined) | 87.9% |

| Company Name | Key Offerings/Activities |

|---|---|

| 3M Company | Provides a wide range of sterilization, disinfection, and PPE solutions. |

| STERIS Corporation | Specializes in surgical sterilization, infection prevention, and endoscope reprocessing. |

| Ecolab Inc. | Develops advanced antimicrobial coatings and healthcare sanitation products. |

| Cantel Medical (Sotera Health) | Focuses on high-level disinfection and infection control systems for medical devices. |

Key Company Insights

3M Company

The chief role of this company is within infection prevention, and its offerings include a complete portfolio of sterilization and personal protective equipment (PPE) solutions. 3M invests in research and development to make its products safer and more effective, protecting patients as well as healthcare providers.

STERIS Corporation

STERIS is renown for its stunning performance in sterilization and surgical infection prevention. The company has launched strategic acquisitions and remains innovative in order to diversify its portfolio, aiding hospitals and healthcare facilities in achieving maximum levels of infection control.

Ecolab, Inc.

Providing healthcare sanitation by advanced antimicrobial technology is Ecolab. Ecolab is an eco-friendly company that develops environmental-friendly disinfecting technologies that hospitals and medical centers can use to maintain strict sanitation levels without increasing environmental footprint.

Cantel Medical (Sotera Health)

The focus of Cantel Medical is infection prevention specific to medical devices but primarily in areas such as endoscope reprocessing and high-level disinfection. Through an ongoing expansion of its portfolio with innovative technologies, the company helps healthcare providers provide more care that is safer for the patient.

Several other companies contribute significantly to the infection prevention market by offering specialized disinfection and sterilization solutions. Notable players include:

The overall market size for Infection Prevention Market was USD 44,535.9 million in 2025.

The Infection Prevention Market is expected to reach USD 67,070.4 million in 2035.

Growing Preference for Infection Prevention Products has significantly increased the demand for Infection Prevention Market.

The top key players that drives the development of Infection Prevention Market are Reckitt Benckiser, Steris, 3M Company, Haylard Health and Belimed AG

Consumables is is expected to command significant share over the assessment period.

The Prurigo Nodularis (PN) Treatment Market is segmented by product, and end user from 2025 to 2035

Warm Autoimmune Hemolytic Anemia (WAIHA) Treatment Market Analysis by Drug Class, Distribution Channel, and Region through 2035

Atrophic Vaginitis Treatment Market Analysis And Forecast by Diagnosis, Treatment, Therapy Type, Distribution Channel, and Region through 2035

Adrenal Crisis Management Market Analysis and Forecast, By Diagnosis Method, Treatment Method, Distribution Channel, and Region, through 2035

Birch Allergy Treatment Market Analysis by Drug Class, Route of Administration, Distribution Channel and Region: Forecast from 2025 to 2035

Cancer Vaccines Market Analysis by Technology, Treatment Method, Application and Region from 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.