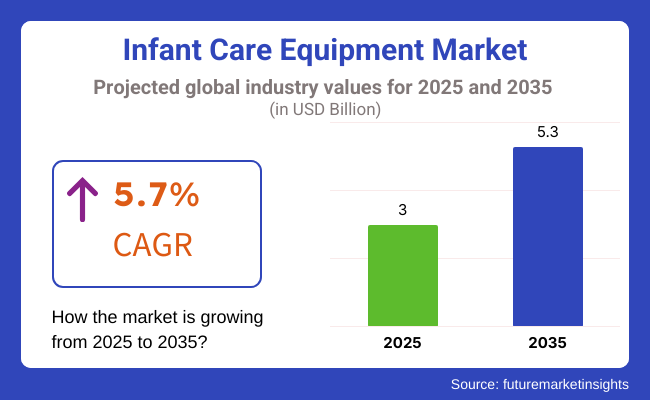

The infant care equipment market is valued at USD 3.0 billion in 2025, with estimates reaching as high as USD 5.3 billion in 2035, and is expected to expand at a compound annual growth rate (CAGR) of 5.7% during the forecast period.

Between 2025 and 2035, the infant care equipment market would experience phenomenal market growth. This is attributed to increased awareness of infant health, enhanced neonatal technology, and an increase in the healthcare budget.

Specialized machinery like thermoregulation machinery, phototherapy machinery, and monitoring machinery will be in greater demand because of the increase in preterm deliveries and complications in neonatal health.

Technology has advanced to the point where these machines are portable and easy to use, hence making it easier and better to provide care for infants. Further improvements in healthcare infrastructure in developing economies now bring many clinics and hospitals within reach of acquiring such high-end baby care equipment.

While some challenges still persist, such as equipment cost, strict regulations, and the need for specialist training, they are unlikely to stop overall market growth. After all, with time, the demand for better neonatal care and outcomes is sure going to boom high in the coming decade.

For the last five years, the Infant Care Equipment Market received a constant growth push which was driven by a combination of higher birth rates in developing countries, stronger parent education, and the improvement in technology used in neonatal care.

Between 2019 and 2020, the market was affected because the COVID-19 pandemic resulted in the interruptions in the supply chain and the short-run declines in demands for the products, especially in retail markets. Nevertheless, the hospital-grade neonatal products such as incubators, respiratory care devices and phototherapy units were adopted more than before as a result of the rising concerns about the premature births and neonatal complications.

Last year, the market showed a clear sign of recovery as soon as the economies opened up, and baby care products spending of the consumers soared up. Parents' interest in infection prevention and safety awareness surged the demand for sophisticated baby monitors, UV sterilizers, and smart wearable devices for infants.

The groundbreaking baby monitors equipped with IoT technology and the AI-based sleep tracking system picked up the pace. From 2022 through 2023, there was a very positive change toward green and eco-friendly baby care products, with the most popular brands introducing BPA-free feeding bottles and baby diapers that can be broken down safely, and plants based skincare products.

Explore FMI!

Book a free demo

The region that is considered to occupy the largest share in the Infant Care Equipment Market during the forecast period is North America owing to such factors as having a very extensive and robust healthcare infrastructure, technological development as well as technology adoption in advanced neonatal care, and huge investments geared toward research and development. The preterm births are quite high in the United States, and thus the interest in newer ways of improving neonatal care-in developments and discoveries-is enormous.

The area has well-didactic organizations and the culture of patient-centered care resulting in usage of the most sophisticated infant care equipment. More hospitals and healthcare providers turning up to invest in latest kinds of electronics increases a subsequent demand for sophisticated medical devices that can facilitate better neonatal care.

A region with high expenditure on healthcare naturally makes it easy for well-resourced healthcare facilities to adapt modern equipment potentially improving newborn outcomes. Some of the challenges hindering the market include restrictive regulations that delay the introduction of new devices and expensive development; they may limit growth, but the general demand for improvement in neonatal care solutions guarantees growth in the market.

Advanced neonatal care has gained prominence lately, and so has the demand for the infant and baby care equipment directed toward better outcomes for babies. Germany, France, and the UK lead the charge into healthcare innovations, with a growing number of firms investing in novel baby care technologies.

To improve the care of newborns, the hospitals in these countries are adopting advanced monitoring and therapeutic technologies. The well-established healthcare infrastructures in Europe and the continuous focus on patient care improvement are adding fuel to the demand.

However, economic uncertainty and regulations that differ from country to country could pose challenges that will pressurize the rate of new technology adoption across the region. Despite any such possible hindrances, Europe is still evolving with innovation and remains determined to push the advancement of neonatal care.

The most substantial growth regarding Infant Care Equipment Market is expected to be in the Asia-pacific region, with all these factors accounting for the improvement in healthcare infrastructure, health expenditure, and increasing awareness regarding neonatal care.

Besides, Asia-Pacific is seeing a greater number of preterm births and neonatal disorders due to lifestyle changes and aging population through better healthcare accessibility and increasing disposable income in countries such as China, India, and Japan. Some of these specialized products like thermoregulation machines, phototherapy devices, and monitoring systems have been demanded to enhance care for neonates.

At this regional level, the medical devices market is allowing sophisticated devices to be procured, and the investment of many companies into these technologies is pushing the market further upward.

The challenge is the poor awareness about modern medical technologies in rural communities and government regulations that may hamper the scaling of new-age equipment. Nevertheless, despite the hurdles, the Asia-Pacific market is poised for massive growth owing to the burgeoning healthcare infrastructure and increasing awareness regarding neonatal care options.

The equipment market for infant care has a couple of significant roadblocks that would impede its growth in the future. An important one of these is how tightly regulated are the approval and release of newly developed infant care devices.

Regulating the release and approval is necessary to verify the safety and efficacy of a product, yet it also is very time consuming and involves an extensive amount of testing and paperwork, which discourages bringing fresh products to practitioners.

Another major bane is the extremely exorbitant cost of capital for developing radical neonatal care technologies. Coming up with new technologies, testing, and production may be way beyond the small firms or start-ups ability. Such unreasonably high cost would eventually restrict competition and make it more complex for innovative ideas to penetrate the market.

Finally, these sophisticated modern devices require specialized training and expertise for effective usage. Unfortunately, there remains a dearth of personnel trained and qualified in using the high technology gadgets, which adds hurdles while trying to adopt the technologies in hospitals and clinics.

To counter these issues, the industry needs to put in place continuous training programs and ensure thorough clinical trials and well-coordinated efforts between the regulatory agencies and companies. Collectively, we will be able to streamline approval processes, fund safety initiatives, and ultimately drive innovation to expand the market.

Meeting the Rising Demand for Specialized Care in the Infant and Baby Equipment Market

The infant and young toddler care devices relating industry has great promise in the face of challenges in the growth potential sector. As the healthcare industry becomes more patient-centric, there is more demand for equipment that can improve clinical outcomes and at the same time keep in mind the comfort and care of the newborn and family.

An element of individualized care gives scope to product development for innovative designs to meet some distinct needs of infants, especially neonatally inclined.

These technologies empower health personnel to pick out complications early enough so that interventions may render more effective, thus reducing risk to vulnerable infants. The rise in the numbers of preterm births across the globe correlates with an increasing need for care equipment like incubators and ventilators.

Collaborative efforts between medical device manufacturers and the healthcare community could also augment advancement within the industry. Such a partnership would develop exciting new technological advances that could be brought to market much faster, making this state-of-the-art infant care technology available to a greater number of hospitals and clinics. Working together in this way can make a huge difference in neonatal care and give hope for improved outcomes and brighter futures for newborns all over the world.

Empowering Infant Care: The Role of Technology in Shaping Baby Equipment

Early stages in the rapidly changing Infant Care Equipment Market owe their momentum to the new technologies, which stress more on individualizing care. One of the finest opportunities might be the new generation of portable, hand-held monitoring devices. Such devices monitor vital signs continuously, thereby relieving stress in newborns, eventually improving outcomes.

Modern phototherapy machines are equipped with sophisticated features and ensure that they are effective in managing neonatal jaundice without many side effects. With this option, the infant receives the needed treatment but reduces collateral damage. Thermoregulation devices to ensure an optimal level of body temperature are crucial determinants of survival rates.

Another global breakthrough is engaging telemedicine functions on the infant care devices. This allows the possibility for the physicians and caregivers to monitor and consult the health of the baby from afar, thus extending the scope of care and making it more convenient to families. The technologies are not only improving the equipment but also creating avenues for better and more effective care for babies across the globe.

From Wearables to Eco-Friendly Solutions: The Future of Infant and Baby Care Equipment

An emergent trend across the baby products and infant care equipment segments is to implement wearable monitoring devices. Easy to use, these devices in real-time monitor vital signs and notify caregivers at the earliest sign of health complications. Physicians have embraced such devices to observe neonates continuously and non-invasively, thus enhancing outcomes for the babies.

Another trend gaining traction is the design of eco-friendly and sustainable baby care equipment, as consumers and health care organizations develop an attunement to green issues. There is also increasing interest in personalized neonatal care, with the design of equipment to suit the needs of each particular infant.

Besides this, embedding sophisticated data analytics in infant care devices provides healthcare professionals with insights that aid them in making better-informed decisions that ultimately nurture better care. It is boosting not only the innovations in their equipment but the care delivered to the newborns.

The years 2020 to 2024 saw steady growth in the infant and baby care devices sector, as some regions experienced increasing birth rates, heightened parental awareness toward neonatal health, and advancements in neonatal medical equipment technologies. As levels of neonatal care ranking such as incubators, phototherapy units, infant warmers, and monitoring systems grew, so too did the demand for such devices.

Concurrently, innovation in smart infant care products such as AI-enhanced baby monitoring and wearable infant health tracking technologies made parenting easy for most households. Nonetheless, exorbitant prices of newer neonatal treatment equipment, lengthy regulations, and variations in medical infrastructure meant certain areas were incapable of accessing them.

Focusing on 2025 to 2035, exciting new developments such as AI-assisted monitoring equipment, intelligent neonatal care devices, and growth of non-invasive medical devices will define the market. Higher standards of safety and quality of baby care machines, prioritizing safety above everything, will become expected.

Expanded availability of neonatal care and telemedicine in-home services will result in rising demand for smart, connected baby care devices for parental monitoring in home settings. Strategies to be more sustainable will drive the innovation of green materials and energy-efficient technologies. Added to that, advances in manufacturing processes and diversified sourcing will contribute to making the supply chain more robust.

Comparison Table

| Category | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | The FDA and CE approved neonatal care devices with stricter safety standards for baby care products. |

| Technological Advancements | AI-powered baby monitors, wearable health trackers, and advanced neonatal incubators gained popularity. |

| Consumer Demand | Parents became more aware of neonatal health, leading to greater adoption of smart baby care products. |

| Market Growth Drivers | Increasing birth rates in select regions and improvements in neonatal intensive care units (NICUs) fueled growth. |

| Sustainability | The market took initial steps toward eco-friendly baby care products, while disposable medical consumables remained high. |

| Supply Chain Dynamics | Global supply chains supported the provision of medical-grade infant care equipment, though shortages occasionally occurred. |

| Category | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Regulators will enforce stricter standards for smart baby monitors, AI-driven health trackers, and sustainable infant care products. |

| Technological Advancements | AI-driven neonatal monitoring, smart cribs, and non-invasive diagnostic tools for infant health assessment will emerge. |

| Consumer Demand | Families will demand more home-based neonatal care solutions and telehealth-integrated infant monitoring systems. |

| Market Growth Drivers | Digital health solutions, better healthcare access in emerging markets, and a focus on early disease detection will drive market expansion. |

| Sustainability | The industry will shift towards biodegradable materials, sustainable baby care equipment, and energy-efficient neonatal devices. |

| Supply Chain Dynamics | Manufacturers will localize production, diversify suppliers, and enhance automation in production to improve supply chain resilience. |

Market Outlook

Within the USA, Infant Care Equipment Market has been consistently increasing. This is because people are becoming more aware of neonatal well-being and the increased uptake of innovative medical technologies.

Devices such as thermoregulation products, phototherapy units, and monitoring devices are in demand because healthcare institutions continue to advance infant care. But the prohibitive prices of these cutting-edge technologies and stringent regulation demands might pose some impediments as the market keeps expanding.

Market Growth Factors

Market Forecast

| Year | CAGR (2025 to 2035) |

|---|---|

| 2025 to 2035 | 2.9% |

Market Outlook

The German health system is strong and focused on attracting medical innovations, thus benefiting the market for infant and baby care equipment. Increasing incidences of neonatal ailments and the care quality in neonatal units are perpetuating demand for sophisticated equipment. Additionally, increased government support for health programs is impelling growth. High costs and strict regulations, however, may impede growth.

Market Growth Factors

Market Forecast

| Year | CAGR (2025 to 2035) |

|---|---|

| 2025 to 2035 | 2.3% |

Market Outlook

At such a rapid pace, China is advancing with growth trends in its Infant Care Equipment Market from strong economic growth and rising investment in healthcare. As the government focuses more on child and maternal health, it is further driving the penetration of use of high-tech equipment. Disparities in healthcare access between rural and urban regions, coupled with low awareness, could retard some of this growth.

Market Growth Factors

Market Forecast

| Year | CAGR (2025 to 2035) |

|---|---|

| 2025 to 2035 | 4.5% |

Market Outlook

The Indian market for infant care equipment will expand considerably. There is a high birth rate in India along with increasing health awareness, driving demand for high-tech infant care equipment. Improvement in maternal and child health has been the concern of the government, which also contributes to its expansion. Resource constraints in rural regions and varied healthcare quality there could hinder general growth.

Market Growth Factors

Market Forecast

| Year | CAGR (2025 to 2035) |

|---|---|

| 2025 to 2035 | 5.5% |

Market Outlook

The Infant Care Equipment Market in Brazil is expanding due to better healthcare infrastructure and an increased emphasis on child and maternal well-being. Increased demand for sophisticated care equipment comes with an increase in the number of neonatal ailments. Both public and private healthcare facilities are part of the market. Economic divides and variations in healthcare accessibility at a regional level could hinder growth.

Market Growth Factors

Market Forecast

| Year | CAGR (2025 to 2035) |

|---|---|

| 2025 to 2035 | 3.2% |

Incubators for Neonates: The Role in the Care of Newborns

Incubators are extremely important for infant care as they provide an empathetic environment for premature and low-birth-weight babies to grow. These machines successfully maintain the critical physiological parameters of temperature, humidity, and oxygen that are very necessary for survival. Furthermore, as the number of preterm infants or neonates with respiratory problems becomes higher, the demand for updated incubators with monitoring and ventilation assistance will grow.

Today's highly modernized technologies in incubators continue to make the devices highly secured and efficient; features now are closed-loop temperature control, easy touch screen interface, and remote montoring ability by means of internet technology. In fact, this sector is soaring demand, mainly due to the growth of such units around the world, most especially in developing countries.

Phototherapy Equipment: Changing the Game of Neonatal Jaundice Treatment

Among the other phototherapy devices-is the main focus of attention when it comes to treating the disease for neonatal jaundice, which is very much common among newborns. High bilirubin levels lead to jaundice, and LED phototherapy units can replace the conventional CFL system since they are more energy-efficient and can last longer while emitting less heat. Hence safe for fragile babies.

To facilitate even more jaundice treatment outside the hospital, parents, and caregivers can access additional home use or portable phototherapy units. There is a greater emphasis on minimally invasive treatment options and further advanced technologies with fiber optics, all contributing to exceedingly faster growth for the marketathan has ever before.

Hospitals: The Heart of Neonatal Care

These are the places where infant care comes complete. Every premature or medically complicated infant needs to be admitted into or kept in a specialized NICU. Sophisticated monitoring equipment, dedicated medical staff, etc., make the best out of these newborns with respiratory difficulty or congenital problems live longer or at least extend their lifespan.

As governments invest heavily in maternal and child healthcare and increase the birth rates of emerging economies, the demand on hospitals is only going to grow. They are also bringing into hospitals the latest technology like AI-enabled monitors and telemedicine, taking much more responsible hands to so much better quality and efficiency in care.

Pediatric and Neonatal Clinics: Shaping the Future of Infant Health

Pediatric and newborn clinics are now an essential part of baby care, providing neonatal services specifically for babies and their families. Clinics now have more preventative functions, such as providing vaccinations, developmental check-ups, and early screenings for disease, thereby decreasing the rate of hospital usage.

Families welcome this transition toward more accessible family-oriented care with increased access to pediatric subspecialists and handheld monitoring devices. Electronic health records and AI-assisted diagnostics are also transforming how clinics deliver care, allowing it to be easier for parents and healthcare providers to monitor a baby's health in real-time.

High and high in that area, infant and baby care equipment development has run very successfully as there is an increase in neonatal care awareness, more births, and newer technologies for baby care.

The populace's demands over this device segment are growing, leading these players to innovate, gain their own approvals, and build a global footprint to remain competitive. More competition with growing investments being poured into the market by many consumer and healthcare giants, as these brands snoop around looking for the next big thing in baby care.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Philips Healthcare | 20-25% |

| GE Healthcare | 15-18% |

| Medtronic plc | 12-15% |

| Drägerwerk AG & Co. KGaA | 8-10% |

| Other Companies (combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| Philips Healthcare | They will provide advanced neonatal incubators, warmers, and monitoring networks. |

| GE Healthcare | They provide neonatal-intended care solutions such as respiratory and phototherapy devices. |

| Medtronic plc | High-precision infant monitoring and respiratory support solutions. |

| Drägerwerk AG & Co. KGaA | Neonatal ventilation and incubator technologies designed to improve care. |

Key Company Insights

Philips Healthcare (20-25%)

A leader in neonatal care, Phillips Healthcare is into high-tech incubators, warmers, and monitoring systems that aid in newborn care. Their innovation and research focus is therefore critical in product development for better infant care.

GE Healthcare (15-18%)

GE is committed to the neonatal welfare cause with its ultra-modern respiratory and phototherapy equipment, contributing prominently toward the survival of newborns under critical care.

Medtronic plc (12-15%)

Medtronic is a leader in the field of infant care, recognized globally for its advanced respiratory support and monitoring technologies, critical to the successful practice of neonatal care.

Drägerwerk AG & Co. KGaA (8-10%)

Drägerwerk is well known for its neonatal ventilation and incubator products, aimed at providing maximum care and comfort to premature children.

Other Notable Players (30-40% Total)

Apart from these incumbents, there are a few more companies that are making a significant presence in the market with specialized and value-for-money solutions. Significant contributors include:

As the need for infant care equipment increases, these firms are concentrating on technology, regulatory requirements, and increasing their footprint to enhance neonatal care and increase infant survival rates.

The overall market size for Infant Care Equipment Market is expected to be USD 3.0 billion in 2025.

The Infant Care Equipment Market is expected to reach USD 5.3 billion in 2035.

The market in Japan is expected to grow at a CAGR of 3.4% during the forecasted period.

The top key players that drives the development of Infant Care Equipment Market are Philips Healthcare, GE Healthcare, Medtronic plc, Drägerwerk AG & Co. KGaA, Atom Medical Corporation and Natus Medical Incorporated.

Thermoregulation devices by product is expected to command significant share over the assessment period.

Thermoregulation Devices (Radiant Warmers, Neonatal Incubators, Neonatal Cooling Systems), Phototherapy Equipment (LED Phototherapy Unit, CFL Phototherapy Unit, Phototherapy Eye Mask) , Monitoring Systems (Neonatal Ventilation, Brain Monitoring, Blood Gas Monitoring System), Hearing Screening, Vision Screening.

Hospitals, Pediatric and Neonatal Clinics, Nursing Homes.

North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, Middle East & Africa.

Anti-hyperglycemic Agents Market: Growth, Trends, and Assessment for 2025 to 2035

At Home Heart Health Testing Market Analysis - Size & Industry Trends 2025 to 2035

Eyelid Scrub Market Analysis & Forecast by Product, Application and Region 2025 to 2035

Protein Diagnostics Market Share, Size and Forecast 2025 to 2035

CGRP Inhibitors Market Trends - Growth, Demand & Forecast 2025 to 2035

Indolent Systemic Mastocytosis treatment Market Insights: Size, Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.