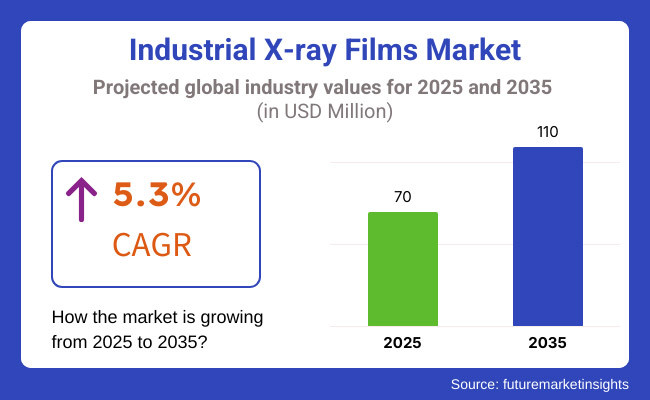

The Global Industrial X-ray films industry's size is poised to reach USD 70 million in 2025. Demand for industrial X-ray films will likely top USD 110 million by 2035, with an expected CAGR of approximately 5.3% over the next decade.

The industry is projected to make steady growth during this forecast period. This growth will be driven by the advancements in non-destructive testing (NDT) techniques and rising demand for high-quality X-ray films across various sectors such as aerospace, automotive and manufacturing. In addition to this, the adoption of digital radiography and emerging technologies in developing economies will also contribute significantly to the market’s development during this period.

The growth of the industrial X-ray films sector is attributed to factors such as rising demand for non-destructive testing (NDT) in aerospace, automotive, and manufacturing industries, advancements in digital radiography, and stringent quality standards.

The industry has also been witnessing several restraints, including high-cost setups, environmental disposal concerns, and competition with other NDT technologies. The key trends in the sector have shown a rise in automated inspection systems, preventive maintenance, and quality control focus expansion in emerging economies and the integration of advanced imaging techniques.

Explore FMI!

Book a free demo

During the period between 2020 to 2024, the Industrial films industry has witnessed a significant expansion in digital radiography. There has been a surge in demand for NDT in various industries, with a keen focus on quality control and defect detection. However, the market also faced challenges, including high setup costs and environmental concerns regarding film disposal.

In the forecast period 2025 to 2035, the industry will comprise advanced imaging techniques, more acceptance of automated inspection systems, and expansion in emerging economies. With a focus on preventive maintenance and quality control, technological innovations are anticipated to drive the growth of market collaborations.

| Key Drivers | Restraints |

|---|---|

| The industrial X-ray films industry is driven by the increasing demand for non-destructive testing (NDT) in industries such as aerospace, automotive, and manufacturing. NDT ensures the quality and integrity of components without causing damage. | High initial setup costs for X-ray film inspection systems can be a barrier for some companies, especially small and medium-sized enterprises. |

| Advancements in digital radiography are enhancing the quality, sensitivity, and durability of industrial X-ray films, making them more efficient and effective. These technological improvements are driving industry growth. | Environmental concerns related to the disposal of X-ray films pose challenges, as they contain chemicals that can be harmful if not properly managed. Proper disposal and recycling measures are needed. |

| Stringent regulatory standards for product quality and safety are driving the need for reliable inspection technologies, including X-ray radiography. Compliance with these standards is essential for industry players. | Competition from alternative NDT technologies, such as ultrasonic testing and magnetic particle inspection, is also a restraint. These technologies offer different advantages and are gaining traction in various industries. |

| The expansion of industries in emerging economies is leading to higher demand for industrial X-ray films as these countries adopt advanced testing methods. Industrial growth in these regions presents opportunities for sectors expansion. | The complexity of operating and maintaining advanced X-ray film systems requires specialised training and expertise, which can be a barrier for some companies. Ensuring skilled personnel are available is crucial. |

| The increasing emphasis on preventive maintenance and quality control in manufacturing processes requires regular inspections using X-ray films. This focus on preventive measures supports sectors growth. | Adhering to stringent regulatory standards can be challenging and costly for companies, impacting the adoption of X-ray films. Regulatory compliance requires significant investments in time and resources. |

Key Drivers

| Driver | Impact |

|---|---|

| Increasing demand for non-destructive testing (NDT) | High |

| Advancements in digital radiography | High |

| Stringent regulatory standards | Medium |

| Expansion in emerging economies | High |

| Focus on preventive maintenance and quality control | High |

Key Restraints

| Restraint | Impact |

|---|---|

| High initial setup costs | Medium |

| Environmental concerns related to disposal | High |

| Competition from alternative NDT technologies | Medium |

| Technological complexity | Medium |

| Regulatory compliance costs | Medium |

The oil and gas industry will remain a major end-user of industrial X-ray films in the upcoming decade. The growth of the market will be led by the use of non-destructive testing (NDT) technology to keep the integrity of pipelines, storage tanks, and other critical infrastructure. One of the critical aspects of ensuring safety and operational efficiency will be the use of advanced imaging techniques to detect defects and prevent failures.

Industrial X-ray films would also be on the rise in the automotive industry. As automobile parts become more intricate and the demand for diligence rises, X-ray films will be crucial for application in weld inspection, identification of internal defects, and critical part testing. X-ray inspection will also benefit from the emphasis on lightweight materials and advanced manufacturing techniques.

Various sectors in aerospace and defence will remain dependent upon industrial X-ray films for NDT. X-ray films enable precise and independent detection of aircraft, spacecraft, and defence equipment.

Innovative X-ray technology will be adopted with increasing use, propelled by safety and quality.

The growth of the industrial X-ray films market will also be driven by other industries, such as manufacturing and construction. Industries demand consistent inspections to keep quality to avoid failures. These factors will augment the growth of the market in these regions, especially regarding the adoption of automated inspection systems and the several applications of advanced imaging techniques.

The USA Industrial X-ray Films market grow steadily in 2025 Factors such as a rise in demand from user industries like aerospace, automotive, and construction will help to lead in the market space. Improvements in non-destructive testing (NDT) and quality control will raise demand.

The industry growth is projected to be driven by regulatory requirements regarding safety and compliance and by technological improvements in imaging systems. Industry leaders will keep pushing the envelope on film quality and durability to meet the needs of different sectors. Despite the transition towards digital radiography, the growing utilisation of X-ray films in production facilities and laboratories is expected to drive growth. Sales of industrial X-ray films in USA expected to reach USD 21.6 million in 2035.

The growth of the industrial X-ray Films market in Canada will remain stable in 2025 and is mainly driven by NDT applications related to Oil & gas, Mining, and manufacturing. The demand for X-ray films used to inspect the material for possible faults will increase as Canada’s industries are undergoing quality and safety standards. In addition, the market will be driven by the oil sands and pipeline sectors. The trend is toward digital imaging in some industries, and this is likely to slightly impact the use of classic X-ray film.

The UK Industrial X-ray Films industry is likely to grow at a moderate CAGR by 2025. Demand for industrial X-ray films will remain driven by the aerospace, automotive, and construction industries, all of which have a significant bearing on the manufacturing sector in the country. Progress in materials and X-ray technology would ensure film stays relevant as digital X-ray systems grow in popularity.

The strict safety regulations enforced by the UK, especially in the oil and gas sectors, will keep the demand for high-quality X-ray films emerging. Sales of industrial X-ray films is expected in the United Kingdom (UK) is USD 4.1 million.

The Industrial X-ray Films industry is projected to have steady growth in the French economy, with growth driven by the robust manufacturing sector and enormous investments in infrastructure and energy in 2025. X-ray films will mostly be used by the aerospace and automotive industries to check quality and compliance with safety standards.

The country’s energy sector, particularly nuclear and oil, will continue to demand high-resolution X-ray films for material inspections. Despite a gradual shift towards digital radiography, the traditional film market will continue to thrive as traditional film imaging systems.

In 2025, Germany is predicted to have a strong hold over the industrial X-ray film industry owing to the presence of major automotive, aerospace, and machinery manufacturers. Demand for X-ray film will be driven by the need for precision engineering and safety standards in industries such as automotive and industrial machinery in Germany, which is a global manufacturing hub. However, digital X-ray systems are expected to gain more popularity, which may result in a decrease in market share for traditional X-ray films.

South Korea Industrial X-ray Films industry is expected to grow steadily during the forecast year. Electronics, Automotive, and Shipbuilding industries are expected to create significant demand in the country. Its manufacturing technology prowess will ensure that the X-ray films will still be used for non-destructive testing in quality control processes.

The government support for infrastructure projects and policy-led safety standards across sectors such as construction and energy will propel the economy The demand for high-quality material testing requirements in critical sectors will continue to contribute to the demand, though traditional X-ray films may compete with digital solutions. Sales in industrial X-ray films in South Korea is expected to reach USD 4.8 million.

Demand for Industrial X-ray Films from electronics, automotive, and heavy machinery industries is expected to push Japan through 2025 at a stable rate. With the country's emphasis on manufacturing precision and innovative technology, there will be widespread use of X-ray films for the NDT application.

Japan’s ageing infrastructure, focus on safety and quality assurance, would provide steady demand in the construction and energy sectors. Although digital X-ray technologies will become increasingly widespread, conventional X-ray films will continue to play an essential role in high-accuracy inspections, particularly for sectors where stringent safety standards and material integrity are paramount.

The growth forecast of the Industrial X-ray Films industry in China highlights the trends and developments in various industries, including automotive, construction, and energy, which will propel the demand and growth of the industry by 2025. South Korea’s changing manufacturing industry and quality assurance in its heavy industries will ensure continued demand for X-ray films. In addition, the increased emphasis by China on safety standards and environmental regulations will help fuel industry growth.

This could change in the future, as one of the latest trends in the development and increasing demand for digital X-rays may reduce the use of X-ray films; however, they will still be important in high-precision testing and in industries where high levels of inspection detail are required. Sales in industrial X-ray films in China is expected to reach 16.8 million.

The Industrial X-ray Films sector in India is expected to witness moderate growth in 2025 on account of growing manufacturing, construction and energy sectors across the country. With an emphasis on infrastructure development and industrial safety, X-ray films for quality control and material testing will remain in high demand throughout India. Non-destructive testing will also be driven by rapid industrialisation in the automotive, aerospace and power sectors in the country.

The Industrial X-ray Films sector is highly consolidated, and the Tier 1 players capture around 90% share in the market. These players have a very strong presence in the sector owing to their innovative technologies, strong brand presence, and well-established distribution channels.

The consolidation means they benefit from economies of scale so they can maintain cost efficiencies while continuing to provide high-quality products and services. Consequently, the sector is less fragmented, with smaller players finding it hard to enter or challenge the dominance of the incumbents.

Some developments in the industry in 2024 Key players such as GE Inspection Technologies, Fujifilm Holdings, and Carestream Health are driving innovations, particularly in areas like digital radiography solutions and hybrid imaging systems. GE Inspection Technologies has unwrapped upgraded film products that are said to enhance image quality, reduce the cost of ownership and increase durability for non-destructive testing (NDT).

Fujifilm has expanded its manufacturing footprint globally for industrial X-ray films to serve growing demand in emerging markets. Another breakthrough made by Carestream Health included the latest film-based solutions for the aviation and automobile industries. The most recent developments reinforce investments in technology and production capabilities, cementing the status of the Tier 1 players.

Industrial X-ray films are used for non-destructive testing (NDT) to detect internal defects and ensure the quality of components.

Industries such as aerospace, automotive, oil & gas, and manufacturing primarily use industrial X-ray films.

The demand is driven by advancements in digital radiography, increased quality control standards, and the need for NDT in various sectors.

Challenges include high setup costs, environmental disposal concerns, and competition from other NDT technologies.

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.