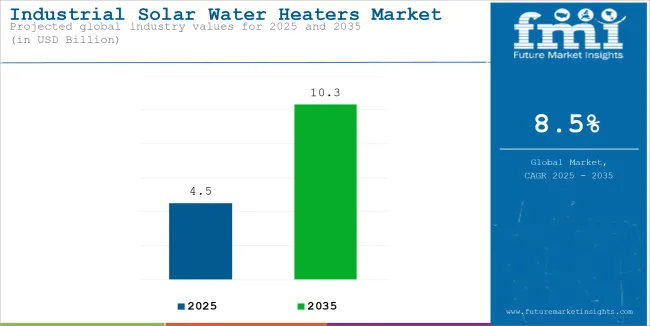

The global industrial solar water heaters market will account for USD 4.5 billion in 2025. It is anticipated to grow at a CAGR of 8.5% during the assessment period and reach a value of USD 10.3 billion by 2035.

| Attributes | Description |

|---|---|

| Estimated Global Industrial Solar Water Heaters Market Size (2025E) | USD 4.5 Billion |

| Projected Global Industrial Solar Water Heaters Market Value (2035F) | USD 10.3 Billion |

| Value-based CAGR (2025 to 2035) | 8.5% |

Industrial solar water heaters utilize the sun’s free energy to provide hot water for a wide range of industrial applications, from manufacturing to hospitality and healthcare. With increasing awareness about environmental impact, industries are turning to solar energy solutions to lower costs and promote sustainable operations. The global market for industrial solar water heaters is on an upward trajectory, with growth driven by a combination of environmental policies, technological advancements, and rising energy costs.

Rising Energy Costs

The soaring price of conventional energy sources, such as natural gas, electricity, and fossil fuels, triggers the interest of industries towards more cost-effective options, including solar water heating systems. This is due to growing environmental awareness. With the increasing need for businesses to reduce their carbon footprint and become more sustainable, solar water heaters are an attractive solution because they use clean and renewable energy.

Additionally, Industries increasingly seek energy independence, and a solar water heater is an alternative that is immune to volatile fossil fuel markets and geopolitical uncertainties.

This matrix shows the high-impact opportunities driving growth in the market, such as technological innovation and government support, while also addressing the key challenges, such as high initial costs and intermittency concerns. The installation process can be expensive to begin with, which may prevent small to medium-sized businesses from taking the step.

| Opportunities | Challenges |

|---|---|

| High Impact | Low Impact |

| Technological Advancements: Improved efficiency, energy storage solutions, and hybrid systems will drive growth. | High Initial Investment: The upfront capital cost for installation can still be a barrier, especially for small to medium-sized businesses. |

| Government Support and Policies: Incentives, subsidies, and renewable energy mandates will accelerate adoption globally. | Intermittency of Solar Energy: Variability in solar energy availability can create challenges for industries that require consistent heat. |

| Emerging Markets: Growth in developing economies (e.g., Asia-Pacific, Africa, Latin America) will create significant demand. | Market Fragmentation: A fragmented market with many small players may make it difficult to establish standardized, global solutions. |

| Integration with Smart Technologies: IoT, energy management systems, and data analytics will optimize performance, efficiency, and cost savings. | Regulatory Barriers and Standards: Varying global standards and certifications can complicate international trade and market access. |

Blockchain for Energy Trading

In the industrial solar water heater market, several technological trends are shaping the development and uptake of solar thermal systems. These trends aim to improve efficiency, reduce costs, and expand the capabilities of solar water heaters for industrial applications.

Additionally, in the wake of an increasing move of industries to decentralized energy solutions, blockchain is seen as a mode to manage and trade excess energy produced by solar water heaters. Businesses can now sell back or share with the rest of local energy producers all that excess energy going back into the grid or sharing it throughout the industrial network to optimize use.

Cost-Reduction Innovations

Industry manufacturers are doing their best through cost-cutting measures to make industrial solar water heaters within the reach of the common population. Advanced processes such as 3D printing, automated production lines, etc. are being used nowadays to reduce their production costs for the benefit of the consumer and the environment.

Enhanced Durability and Longevity

Developments in corrosion-resistant materials for the collector, pipe, and tank have significantly improved the durability and dependability of solar water heaters. Such materials as stainless steel, titanium, and specific coatings minimize the likelihood of rusting and corrosion even under highly aggressive industrial exposure conditions.

Moreover, self-cleaning technologies are integrated into more advanced solar collectors to minimize their maintenance needs.

| Attributes | Details |

|---|---|

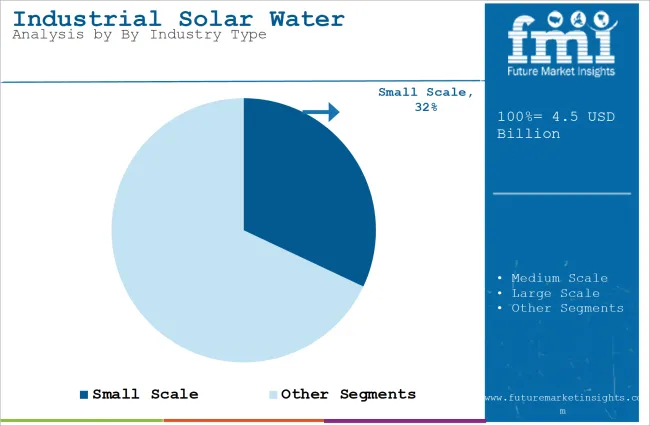

| Top Industry Type | Large-scale market |

| Market Share in 2025 | 32.5% |

Based on industry type, the market is divided into small-scale, medium-scale, and large-scale. The large-scale segment is expected to account for a 32.5% share in 2025. The major share of the industrial SWH market is taken up by large-scale industries requiring large quantities of hot water, such as food processing, textile manufacturing, chemical processing, pharmaceuticals, and breweries. These sectors have high thermal energy demands and use solar water heating systems to cut down on energy costs.

| Attributes | Details |

|---|---|

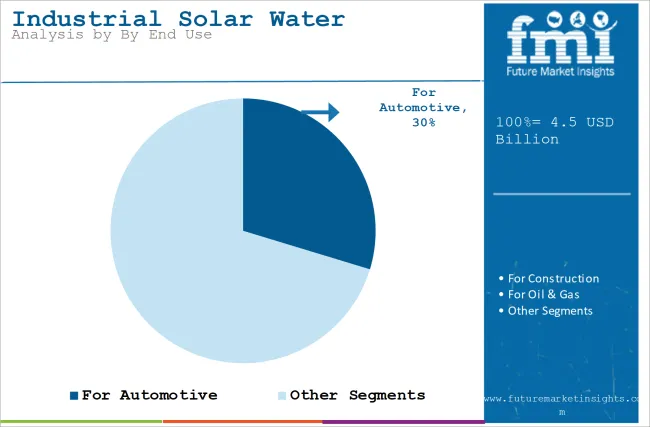

| Top End-use | Oil & Gas Market |

| Market Share in 2025 | 30.8% |

Based on end-use, the market is divided into automotive, construction, oil & gas, paints & coatings, and others. The oil & gas segment is expected to account for a 30.8% share in 2025. The oil & gas industry is highly energy-intensive, and increasing focus on enhancing energy efficiency and reducing operational costs.

Solar water heaters are cost-effective and environmentally friendly solutions for heating water in industrial processes, worker facilities, and other applications. Lots of oil and gas companies embrace renewable energy sources as part of their corporate sustainability goals, mainly in areas that have high solar irradiance.

| Attributes | Details |

|---|---|

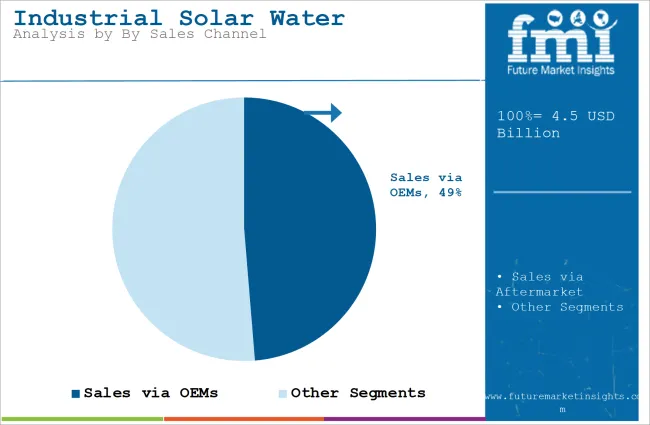

| Top Sales-Channels | Sales via Aftermarket |

| Market Share in 2025 | 51.3% |

Based on sales channels, the market is divided into Sales via OEM and sales via Aftermarket. The sales via the aftermarket segment are expected to account for a 30.8% share in 2025. Aftermarket components for industrial solar water heaters include solar collectors, storage tanks, pumps, heat exchangers, and control systems. Maintenance services and repairs are also essential to maintain the systems in optimal working condition.

Additionally, aftermarket sales also include modifications and improvements made to existing systems, such as energizing storage units or incorporating control systems to regulate the performance of solar water heaters. An older system requires upgrading with enhanced collectors or an improved storage possibility as the generation of solar power improves.

Those companies usually favor such upgrading through which they obtain energy at lower costs. Increasing in focus on sustainability and renewable energy standards might make businesses want to keep their solar water heaters in good condition, thus boosting the demand for aftermarkets.

India's industrial solar heaters market is poised to grow at a CAGR of 13.2% from 2025 to 2035. India is one of the fastest-growing markets for solar technology, considering the governmental push toward renewable energy uptake and increasing demand for energy-saving solutions and plenty of sunlight.

China is expanding to grow at a CAGR of 5.9% from 2025 to 2035. China is the country that leads the world in adopting solar energy, including both solar photovoltaics and solar thermal systems. China invests greatly in industrial-scale solar water heating applications since it has an industrial size and a high energy demand.

China, as the largest producer of solar water heaters, has an extremely competitive domestic market. In recent years, it has emerged as one of the most important export countries of solar thermal products.

The UK is expanding to grow at a CAGR of 7.9% from 2025 to 2035. The UK industrial solar water heater market is on a steady growth path, backed by the long-term focus of the country towards reducing carbon emissions, meeting the renewable energy target, and being in line with energy efficiency regulations. Hospitality, manufacturing, and commercial buildings are major sectors adopting solar thermal solutions.

The cost-saving and sustainability advantages of solar water heaters are now increasingly recognized across these sectors. The UK government provides feed-in tariffs and more incentives to companies utilizing renewable energy, which boosts the growth of the market.

France is expanding to grow at a CAGR of 8.9% from 2025 to 2035. France is increasingly adopting solar thermal technology, focusing on meeting EU renewable energy targets. The industrial sectors of agriculture, pharmaceuticals, and food processing are the main adopters of solar water heating systems. France has been implementing subsidies and tax incentives for businesses in the installation of solar technologies, this has spurred both residential and industrial demand.

Germany

Germany has been the pioneer in adopting solar energy. The country highly utilizes solar thermal systems in the renewable energy transition. In industrial applications, the focus is mainly on integrating solar water heating systems in manufacturing, food processing, and hotels. Energy efficiency regulations and the thrust on Energiewende the transition to renewable energy keep demand for solar thermal technologies open in Germany.

The USA is expanding to grow at a CAGR of 6.8% from 2025 to 2035. The USA industrial solar water heater market is growing, mainly in commercial and industrial applications. States such as California, Texas, and Hawaii are seeing increased uptake due to strong solar irradiance and government incentives. The USA market is driven by the need to improve energy efficiency goals and encourage industries to wean off the conventional fossil fuels being used for heating purposes.

Additionally, incentive programs at the federal and state levels are continuing to increase renewable energy use, in the USA, investment tax credits for example, have increased industrial solar water heater uptake in the market.

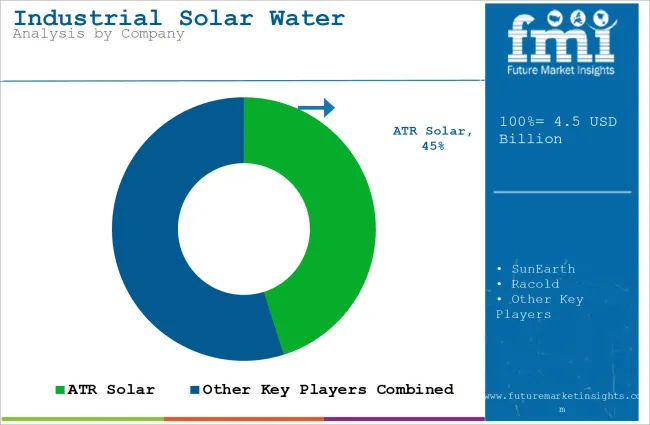

The competitive landscape of the industrial solar water heater market is highly dominated by global players, regional manufacturers, and new entrants. The competitive nature of this industry is, therefore, marked by competition between the product's efficiency, cost-effectiveness, technological innovation, customer service, and ability to meet the specific needs of industrial clients.

| Global Market Focus | Regional Market Focus |

|---|---|

| Premium Product Offering | ATR Solar: Known for high-quality, efficient solar thermal systems for both residential and industrial use. They focus on high-end solutions that deliver superior performance and durability, particularly in North America. |

| Cost-effective Product Offering | Racold: Primarily focused on delivering affordable and reliable solar water heating solutions, Racold is a leading player in emerging markets like India and Latin America, offering a balance between cost and efficiency for industrial customers. |

| Premium Product Offering | Alternate Energy Technologies LLC: Focuses on designing and delivering solar thermal systems for commercial and industrial markets in North America. They provide premium-quality systems with advanced features for high-performance applications. |

Strategic Initiatives

The following strategies are being adopted by companies in the industrial solar water heater market to either maintain or increase their market share:

Partnerships and collaborations: Strategies of forming strategic partnerships with construction companies, energy providers, and government agencies to expand their reach and deliver integrated solutions.

Expansion into Emerging Markets: Companies are increasingly targeting markets that have growing industrial sectors such as India, Africa, and Latin America where the need for energy-efficient solutions is increasing.

Product Innovation: Hybrid systems, the integration of smart technology, and enhanced energy storage in a product that will cater to the varied needs of industrial consumers.

The industry has witnessed the emergence of several innovative startups with differentiated growth strategies.

For example, Solarex is a Turkish startup that develops high-performance industrial solar thermal systems. It provides large-scale industrial installations, which include solar water heating systems for factories, hotels, and commercial buildings. This company is mainly focused on optimizing the efficiency of solar collectors as well as incorporating solar water heating systems with other forms of renewable energy, including solar photovoltaics.

Solar Reserve (USA): Solar Reserve provides solar thermal technology with storage capabilities that focus on big industrial applications. The thermal energy storage technology is useful for storing heat for later usage, thereby producing continuous hot water even in times when the sun is not there.

GreenMax Technology (India): GreenMax Technology is an Indian startup focusing on providing solar water heating solutions suited to local industries. It provides customized solar thermal systems for large industrial processes such as textile production and food processing.

In terms of industry type, the market is segmented into small-scale, medium-scale, and large-scale.

In terms of end-users, the market is segmented into automotive, construction, oil & gas, paints & coatings, and others.

In terms of sales channels, the market is segmented into Sales via OEM and sales via Aftermarket.

In terms of region, the market is segmented into North America, Europe, Asia Pacific, and Middle-East and Africa.

The market is predicted to reach USD 4.5 billion by 2025.

The market is predicted to reach USD 10.3 billion by 2035.

The prominent companies in the industrial solar water heaters market include Greentek India Pvt. Ltd., Chandrlok International, Alternate Energy Technologies LLC., and others.

India is likely to create lucrative opportunities for the industrial solar water heaters market.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2016 to 2032

Table 2: Global Market Volume (Units) Forecast by Region, 2016 to 2032

Table 3: Global Market Value (US$ Million) Forecast by Industry Type, 2016 to 2032

Table 4: Global Market Volume (Units) Forecast by Industry Type, 2016 to 2032

Table 5: Global Market Value (US$ Million) Forecast by Sales Channel, 2016 to 2032

Table 6: Global Market Volume (Units) Forecast by Sales Channel, 2016 to 2032

Table 7: Global Market Value (US$ Million) Forecast by End Use, 2016 to 2032

Table 8: Global Market Volume (Units) Forecast by End Use, 2016 to 2032

Table 9: North America Market Value (US$ Million) Forecast by Country, 2016 to 2032

Table 10: North America Market Volume (Units) Forecast by Country, 2016 to 2032

Table 11: North America Market Value (US$ Million) Forecast by Industry Type, 2016 to 2032

Table 12: North America Market Volume (Units) Forecast by Industry Type, 2016 to 2032

Table 13: North America Market Value (US$ Million) Forecast by Sales Channel, 2016 to 2032

Table 14: North America Market Volume (Units) Forecast by Sales Channel, 2016 to 2032

Table 15: North America Market Value (US$ Million) Forecast by End Use, 2016 to 2032

Table 16: North America Market Volume (Units) Forecast by End Use, 2016 to 2032

Table 17: Latin America Market Value (US$ Million) Forecast by Country, 2016 to 2032

Table 18: Latin America Market Volume (Units) Forecast by Country, 2016 to 2032

Table 19: Latin America Market Value (US$ Million) Forecast by Industry Type, 2016 to 2032

Table 20: Latin America Market Volume (Units) Forecast by Industry Type, 2016 to 2032

Table 21: Latin America Market Value (US$ Million) Forecast by Sales Channel, 2016 to 2032

Table 22: Latin America Market Volume (Units) Forecast by Sales Channel, 2016 to 2032

Table 23: Latin America Market Value (US$ Million) Forecast by End Use, 2016 to 2032

Table 24: Latin America Market Volume (Units) Forecast by End Use, 2016 to 2032

Table 25: Europe Market Value (US$ Million) Forecast by Country, 2016 to 2032

Table 26: Europe Market Volume (Units) Forecast by Country, 2016 to 2032

Table 27: Europe Market Value (US$ Million) Forecast by Industry Type, 2016 to 2032

Table 28: Europe Market Volume (Units) Forecast by Industry Type, 2016 to 2032

Table 29: Europe Market Value (US$ Million) Forecast by Sales Channel, 2016 to 2032

Table 30: Europe Market Volume (Units) Forecast by Sales Channel, 2016 to 2032

Table 31: Europe Market Value (US$ Million) Forecast by End Use, 2016 to 2032

Table 32: Europe Market Volume (Units) Forecast by End Use, 2016 to 2032

Table 33: Asia Pacific Market Value (US$ Million) Forecast by Country, 2016 to 2032

Table 34: Asia Pacific Market Volume (Units) Forecast by Country, 2016 to 2032

Table 35: Asia Pacific Market Value (US$ Million) Forecast by Industry Type, 2016 to 2032

Table 36: Asia Pacific Market Volume (Units) Forecast by Industry Type, 2016 to 2032

Table 37: Asia Pacific Market Value (US$ Million) Forecast by Sales Channel, 2016 to 2032

Table 38: Asia Pacific Market Volume (Units) Forecast by Sales Channel, 2016 to 2032

Table 39: Asia Pacific Market Value (US$ Million) Forecast by End Use, 2016 to 2032

Table 40: Asia Pacific Market Volume (Units) Forecast by End Use, 2016 to 2032

Table 41: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2016 to 2032

Table 42: Middle East and Africa Market Volume (Units) Forecast by Country, 2016 to 2032

Table 43: Middle East and Africa Market Value (US$ Million) Forecast by Industry Type, 2016 to 2032

Table 44: Middle East and Africa Market Volume (Units) Forecast by Industry Type, 2016 to 2032

Table 45: Middle East and Africa Market Value (US$ Million) Forecast by Sales Channel, 2016 to 2032

Table 46: Middle East and Africa Market Volume (Units) Forecast by Sales Channel, 2016 to 2032

Table 47: Middle East and Africa Market Value (US$ Million) Forecast by End Use, 2016 to 2032

Table 48: Middle East and Africa Market Volume (Units) Forecast by End Use, 2016 to 2032

Figure 1: Global Market Value (US$ Million) by Industry Type, 2022 to 2032

Figure 2: Global Market Value (US$ Million) by Sales Channel, 2022 to 2032

Figure 3: Global Market Value (US$ Million) by End Use, 2022 to 2032

Figure 4: Global Market Value (US$ Million) by Region, 2022 to 2032

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2016 to 2032

Figure 6: Global Market Volume (Units) Analysis by Region, 2016 to 2032

Figure 7: Global Market Value Share (%) and BPS Analysis by Region, 2022 to 2032

Figure 8: Global Market Y-o-Y Growth (%) Projections by Region, 2022 to 2032

Figure 9: Global Market Value (US$ Million) Analysis by Industry Type, 2016 to 2032

Figure 10: Global Market Volume (Units) Analysis by Industry Type, 2016 to 2032

Figure 11: Global Market Value Share (%) and BPS Analysis by Industry Type, 2022 to 2032

Figure 12: Global Market Y-o-Y Growth (%) Projections by Industry Type, 2022 to 2032

Figure 13: Global Market Value (US$ Million) Analysis by Sales Channel, 2016 to 2032

Figure 14: Global Market Volume (Units) Analysis by Sales Channel, 2016 to 2032

Figure 15: Global Market Value Share (%) and BPS Analysis by Sales Channel, 2022 to 2032

Figure 16: Global Market Y-o-Y Growth (%) Projections by Sales Channel, 2022 to 2032

Figure 17: Global Market Value (US$ Million) Analysis by End Use, 2016 to 2032

Figure 18: Global Market Volume (Units) Analysis by End Use, 2016 to 2032

Figure 19: Global Market Value Share (%) and BPS Analysis by End Use, 2022 to 2032

Figure 20: Global Market Y-o-Y Growth (%) Projections by End Use, 2022 to 2032

Figure 21: Global Market Attractiveness by Industry Type, 2022 to 2032

Figure 22: Global Market Attractiveness by Sales Channel, 2022 to 2032

Figure 23: Global Market Attractiveness by End Use, 2022 to 2032

Figure 24: Global Market Attractiveness by Region, 2022 to 2032

Figure 25: North America Market Value (US$ Million) by Industry Type, 2022 to 2032

Figure 26: North America Market Value (US$ Million) by Sales Channel, 2022 to 2032

Figure 27: North America Market Value (US$ Million) by End Use, 2022 to 2032

Figure 28: North America Market Value (US$ Million) by Country, 2022 to 2032

Figure 29: North America Market Value (US$ Million) Analysis by Country, 2016 to 2032

Figure 30: North America Market Volume (Units) Analysis by Country, 2016 to 2032

Figure 31: North America Market Value Share (%) and BPS Analysis by Country, 2022 to 2032

Figure 32: North America Market Y-o-Y Growth (%) Projections by Country, 2022 to 2032

Figure 33: North America Market Value (US$ Million) Analysis by Industry Type, 2016 to 2032

Figure 34: North America Market Volume (Units) Analysis by Industry Type, 2016 to 2032

Figure 35: North America Market Value Share (%) and BPS Analysis by Industry Type, 2022 to 2032

Figure 36: North America Market Y-o-Y Growth (%) Projections by Industry Type, 2022 to 2032

Figure 37: North America Market Value (US$ Million) Analysis by Sales Channel, 2016 to 2032

Figure 38: North America Market Volume (Units) Analysis by Sales Channel, 2016 to 2032

Figure 39: North America Market Value Share (%) and BPS Analysis by Sales Channel, 2022 to 2032

Figure 40: North America Market Y-o-Y Growth (%) Projections by Sales Channel, 2022 to 2032

Figure 41: North America Market Value (US$ Million) Analysis by End Use, 2016 to 2032

Figure 42: North America Market Volume (Units) Analysis by End Use, 2016 to 2032

Figure 43: North America Market Value Share (%) and BPS Analysis by End Use, 2022 to 2032

Figure 44: North America Market Y-o-Y Growth (%) Projections by End Use, 2022 to 2032

Figure 45: North America Market Attractiveness by Industry Type, 2022 to 2032

Figure 46: North America Market Attractiveness by Sales Channel, 2022 to 2032

Figure 47: North America Market Attractiveness by End Use, 2022 to 2032

Figure 48: North America Market Attractiveness by Country, 2022 to 2032

Figure 49: Latin America Market Value (US$ Million) by Industry Type, 2022 to 2032

Figure 50: Latin America Market Value (US$ Million) by Sales Channel, 2022 to 2032

Figure 51: Latin America Market Value (US$ Million) by End Use, 2022 to 2032

Figure 52: Latin America Market Value (US$ Million) by Country, 2022 to 2032

Figure 53: Latin America Market Value (US$ Million) Analysis by Country, 2016 to 2032

Figure 54: Latin America Market Volume (Units) Analysis by Country, 2016 to 2032

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Country, 2022 to 2032

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Country, 2022 to 2032

Figure 57: Latin America Market Value (US$ Million) Analysis by Industry Type, 2016 to 2032

Figure 58: Latin America Market Volume (Units) Analysis by Industry Type, 2016 to 2032

Figure 59: Latin America Market Value Share (%) and BPS Analysis by Industry Type, 2022 to 2032

Figure 60: Latin America Market Y-o-Y Growth (%) Projections by Industry Type, 2022 to 2032

Figure 61: Latin America Market Value (US$ Million) Analysis by Sales Channel, 2016 to 2032

Figure 62: Latin America Market Volume (Units) Analysis by Sales Channel, 2016 to 2032

Figure 63: Latin America Market Value Share (%) and BPS Analysis by Sales Channel, 2022 to 2032

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by Sales Channel, 2022 to 2032

Figure 65: Latin America Market Value (US$ Million) Analysis by End Use, 2016 to 2032

Figure 66: Latin America Market Volume (Units) Analysis by End Use, 2016 to 2032

Figure 67: Latin America Market Value Share (%) and BPS Analysis by End Use, 2022 to 2032

Figure 68: Latin America Market Y-o-Y Growth (%) Projections by End Use, 2022 to 2032

Figure 69: Latin America Market Attractiveness by Industry Type, 2022 to 2032

Figure 70: Latin America Market Attractiveness by Sales Channel, 2022 to 2032

Figure 71: Latin America Market Attractiveness by End Use, 2022 to 2032

Figure 72: Latin America Market Attractiveness by Country, 2022 to 2032

Figure 73: Europe Market Value (US$ Million) by Industry Type, 2022 to 2032

Figure 74: Europe Market Value (US$ Million) by Sales Channel, 2022 to 2032

Figure 75: Europe Market Value (US$ Million) by End Use, 2022 to 2032

Figure 76: Europe Market Value (US$ Million) by Country, 2022 to 2032

Figure 77: Europe Market Value (US$ Million) Analysis by Country, 2016 to 2032

Figure 78: Europe Market Volume (Units) Analysis by Country, 2016 to 2032

Figure 79: Europe Market Value Share (%) and BPS Analysis by Country, 2022 to 2032

Figure 80: Europe Market Y-o-Y Growth (%) Projections by Country, 2022 to 2032

Figure 81: Europe Market Value (US$ Million) Analysis by Industry Type, 2016 to 2032

Figure 82: Europe Market Volume (Units) Analysis by Industry Type, 2016 to 2032

Figure 83: Europe Market Value Share (%) and BPS Analysis by Industry Type, 2022 to 2032

Figure 84: Europe Market Y-o-Y Growth (%) Projections by Industry Type, 2022 to 2032

Figure 85: Europe Market Value (US$ Million) Analysis by Sales Channel, 2016 to 2032

Figure 86: Europe Market Volume (Units) Analysis by Sales Channel, 2016 to 2032

Figure 87: Europe Market Value Share (%) and BPS Analysis by Sales Channel, 2022 to 2032

Figure 88: Europe Market Y-o-Y Growth (%) Projections by Sales Channel, 2022 to 2032

Figure 89: Europe Market Value (US$ Million) Analysis by End Use, 2016 to 2032

Figure 90: Europe Market Volume (Units) Analysis by End Use, 2016 to 2032

Figure 91: Europe Market Value Share (%) and BPS Analysis by End Use, 2022 to 2032

Figure 92: Europe Market Y-o-Y Growth (%) Projections by End Use, 2022 to 2032

Figure 93: Europe Market Attractiveness by Industry Type, 2022 to 2032

Figure 94: Europe Market Attractiveness by Sales Channel, 2022 to 2032

Figure 95: Europe Market Attractiveness by End Use, 2022 to 2032

Figure 96: Europe Market Attractiveness by Country, 2022 to 2032

Figure 97: Asia Pacific Market Value (US$ Million) by Industry Type, 2022 to 2032

Figure 98: Asia Pacific Market Value (US$ Million) by Sales Channel, 2022 to 2032

Figure 99: Asia Pacific Market Value (US$ Million) by End Use, 2022 to 2032

Figure 100: Asia Pacific Market Value (US$ Million) by Country, 2022 to 2032

Figure 101: Asia Pacific Market Value (US$ Million) Analysis by Country, 2016 to 2032

Figure 102: Asia Pacific Market Volume (Units) Analysis by Country, 2016 to 2032

Figure 103: Asia Pacific Market Value Share (%) and BPS Analysis by Country, 2022 to 2032

Figure 104: Asia Pacific Market Y-o-Y Growth (%) Projections by Country, 2022 to 2032

Figure 105: Asia Pacific Market Value (US$ Million) Analysis by Industry Type, 2016 to 2032

Figure 106: Asia Pacific Market Volume (Units) Analysis by Industry Type, 2016 to 2032

Figure 107: Asia Pacific Market Value Share (%) and BPS Analysis by Industry Type, 2022 to 2032

Figure 108: Asia Pacific Market Y-o-Y Growth (%) Projections by Industry Type, 2022 to 2032

Figure 109: Asia Pacific Market Value (US$ Million) Analysis by Sales Channel, 2016 to 2032

Figure 110: Asia Pacific Market Volume (Units) Analysis by Sales Channel, 2016 to 2032

Figure 111: Asia Pacific Market Value Share (%) and BPS Analysis by Sales Channel, 2022 to 2032

Figure 112: Asia Pacific Market Y-o-Y Growth (%) Projections by Sales Channel, 2022 to 2032

Figure 113: Asia Pacific Market Value (US$ Million) Analysis by End Use, 2016 to 2032

Figure 114: Asia Pacific Market Volume (Units) Analysis by End Use, 2016 to 2032

Figure 115: Asia Pacific Market Value Share (%) and BPS Analysis by End Use, 2022 to 2032

Figure 116: Asia Pacific Market Y-o-Y Growth (%) Projections by End Use, 2022 to 2032

Figure 117: Asia Pacific Market Attractiveness by Industry Type, 2022 to 2032

Figure 118: Asia Pacific Market Attractiveness by Sales Channel, 2022 to 2032

Figure 119: Asia Pacific Market Attractiveness by End Use, 2022 to 2032

Figure 120: Asia Pacific Market Attractiveness by Country, 2022 to 2032

Figure 121: Middle East and Africa Market Value (US$ Million) by Industry Type, 2022 to 2032

Figure 122: Middle East and Africa Market Value (US$ Million) by Sales Channel, 2022 to 2032

Figure 123: Middle East and Africa Market Value (US$ Million) by End Use, 2022 to 2032

Figure 124: Middle East and Africa Market Value (US$ Million) by Country, 2022 to 2032

Figure 125: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2016 to 2032

Figure 126: Middle East and Africa Market Volume (Units) Analysis by Country, 2016 to 2032

Figure 127: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2022 to 2032

Figure 128: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2022 to 2032

Figure 129: Middle East and Africa Market Value (US$ Million) Analysis by Industry Type, 2016 to 2032

Figure 130: Middle East and Africa Market Volume (Units) Analysis by Industry Type, 2016 to 2032

Figure 131: Middle East and Africa Market Value Share (%) and BPS Analysis by Industry Type, 2022 to 2032

Figure 132: Middle East and Africa Market Y-o-Y Growth (%) Projections by Industry Type, 2022 to 2032

Figure 133: Middle East and Africa Market Value (US$ Million) Analysis by Sales Channel, 2016 to 2032

Figure 134: Middle East and Africa Market Volume (Units) Analysis by Sales Channel, 2016 to 2032

Figure 135: Middle East and Africa Market Value Share (%) and BPS Analysis by Sales Channel, 2022 to 2032

Figure 136: Middle East and Africa Market Y-o-Y Growth (%) Projections by Sales Channel, 2022 to 2032

Figure 137: Middle East and Africa Market Value (US$ Million) Analysis by End Use, 2016 to 2032

Figure 138: Middle East and Africa Market Volume (Units) Analysis by End Use, 2016 to 2032

Figure 139: Middle East and Africa Market Value Share (%) and BPS Analysis by End Use, 2022 to 2032

Figure 140: Middle East and Africa Market Y-o-Y Growth (%) Projections by End Use, 2022 to 2032

Figure 141: Middle East and Africa Market Attractiveness by Industry Type, 2022 to 2032

Figure 142: Middle East and Africa Market Attractiveness by Sales Channel, 2022 to 2032

Figure 143: Middle East and Africa Market Attractiveness by End Use, 2022 to 2032

Figure 144: Middle East and Africa Market Attractiveness by Country, 2022 to 2032

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Industrial Bench Scale Market Size and Share Forecast Outlook 2025 to 2035

Industrial Low Profile Floor Scale Market Size and Share Forecast Outlook 2025 to 2035

Industrial Sand Mill Market Size and Share Forecast Outlook 2025 to 2035

Industrial Control Network Modules Market Size and Share Forecast Outlook 2025 to 2035

Industrial Precision Oven Market Size and Share Forecast Outlook 2025 to 2035

Industrial & Commercial HVLS Fans Market Size and Share Forecast Outlook 2025 to 2035

Industrial Robot Controller Market Size and Share Forecast Outlook 2025 to 2035

Industrial Wired Routers Market Size and Share Forecast Outlook 2025 to 2035

Industrial Evaporative Condensers Market Size and Share Forecast Outlook 2025 to 2035

Industrial Energy Management System Market Size and Share Forecast Outlook 2025 to 2035

Industrial Insulation Market Size and Share Forecast Outlook 2025 to 2035

Industrial Safety Gloves Market Size and Share Forecast Outlook 2025 to 2035

Industrial Cleaner Market Size and Share Forecast Outlook 2025 to 2035

Industrial Dust Treatment System Market Size and Share Forecast Outlook 2025 to 2035

Industrial Vertical Washing Tower Market Size and Share Forecast Outlook 2025 to 2035

Industrial Pepper Market Size and Share Forecast Outlook 2025 to 2035

Industrial Electronics Packaging Market Forecast and Outlook 2025 to 2035

Industrial Absorbent Market Forecast and Outlook 2025 to 2035

Industrial Furnace Industry Analysis in Europe Forecast and Outlook 2025 to 2035

Industrial Denox System Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA