Expectations for the robot devices industrial market to grow significantly from 2025 to 2035 - due to the growing need for automation technologies in manufacturing, increasing labour costs and demand for high-precision production processes. Examples of industries where industrial robots are often used are automotive, electronics, metals & machinery, plastics & chemicals, food & beverage for operations like welding, material handling, assembly and painting.

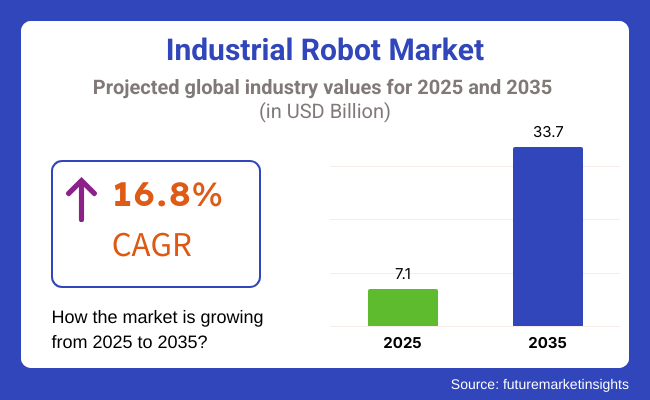

The market size is projected to grow from USD 7.1 Billion Enriching growth in Industrial Robots Driven by Industrial Automation Demand Several factors, such as improved sensors technologies, artificial-intelligence (AI)-based control systems and cloud-based monitoring systems, contribute in enhancing productivity and efficiency in industries. Demand is also fuelled by the move from traditional production lines to smart factories as manufacturers work to hone throughput, product quality and operational flexibilities, Robinson said.

Increasing industrialization and high demand for maintaining stringent regulatory requirements for how safe an environment is, is pushing industries towards collaborative robots (cobots), which can operate in the cache of humans without compromising their safety. Widely believed to be the future of robotics, collaborative robots, or cobots, are becoming a solution for small- and medium-sized enterprises (SMEs) due to their small form factor, low cost, and ease of programming.

Open architecture controllers and modular robotics systems are emerging to bring about a new frontier for custom robotic solutions to solve industry-specific problems. With fewer investments getting on board with Industry 4.0, the industrial robot market will keep on generating opportunities for global makers.

Explore FMI!

Book a free demo

The North America's industrial robot market is driven with established players, research and development in various sectors and adoption of automated manufacturing processes as North America has keen interest to enhance efficiencies with Automation.

The railway segment of this region increased its demand according to the size of a vast automotive sector in the region, as the automotive sector being the largest users of the industrial robots in the region, where systems are required for assembly and welding applications.

In addition, retail demand for e-commerce has continued to grow, resulting in significant demand for picking and packing robots across distribution centres-the existing and upcoming warehouses need more automated picking and packing robots.

From robots to drones, companies across the world are pouring in money to fulfil growing demands with robotic solutions that perform tasks more efficiently than manual labour. Neither only strict government regulation around workplace safety that necessitates minimization of human exposure to dangerous environments has encouraged the proliferation of these advanced robotic systems.

We see that collaborative robots are growing increasingly popular in North America, especially in SMEs where space and safety are a main concern. Moreover, the robotics sector is experiencing growth in machine learning technology, enabling robots to function in a more open and flexible way. These trends will position North America as one of the top regions for industrial robot innovation and deployment over the next 10 years.

Europe's industrial robot market is primarily led by its thriving automotive and electronics industries across established countries such as Germany, Italy, France, and the UK Automakers from Germany is constantly investing in robotics technologies to bring improvements & efficiency to production lines and add precision.

Beyond the automotive sector, the pharmaceutical and healthcare industries in Europe are incorporating robotic solutions for processes like packaging, medical device assembly and laboratory automation. There exists a demand for robots that can handle fragile components, be able to perform tasks in sterile environments, etc.

The adoption of Industrial robots is also driven by some regulatory frameworks such as the EU Machinery Directive and also the ISO safety standards for collaborative robots in Europe. These regulations foster the implementation of straightforward, dependable, and efficient robotic systems that boost productivity without compromising safety.

The continued development of digital twins and virtual commissioning tools also aids European manufacturers in the robotics integration process. This enables companies to spend less time setting up systems and making mistakes, ultimately leading to an increase in the efficiency of the entire process, all while testing robot performance before setting any wheels in motion.

The largest sector for industrial robots is the Asia-Pacific region, which is also the fastest growing Industrial robot largely due to the rapid increase in manufacturing in China, Japan, South Korea and India. China, for its part, is the world leader in industrial robot installations, fuelled by strong demand from automotive, electronics, and consumer goods sectors.

Japan, long home to some of the world’s largest manufacturers of robots, continues to push innovation into areas like humanoid robotics, precision assembly and sophisticated welding systems. Equally important are developing easy to program, maintain and integrate robots into existing production lines.

Another key player is South Korea, where the emphasis is on deploying industrial robots to improve productivity in semiconductor manufacturing and flat panel displays. Also, government initiatives for the promotion of smart factories are adding to the demand for industrial robotics in the country.

Although India's industrial robot market currently constitutes a small segment, the automotive and electronics industries are rapidly developing in the country and having a positive impact on the development of India's industrial robots, coupled with government incentives for mass production through "Make in India". With the increase in labour costs and the need for quality improvement, Indian manufacturers will be adopting more robotic solutions to remain competitive.

The industrial robot market of the Asia-Pacific region holds a lion's share and is estimated to remain so throughout the forecast period, supported by the rising investments in research & development, the emergence of novel technologies, and favourable policies from various governments.

Challenge

High Initial Investment and Integration Complexities

High Initial Investment, Integration Complexities, and Requirement for Highly Specialized Maintenance are the challenges faced by the Industrial Robot Market. Industrial robots are prevalent in manufacturing, logistics and automotive sectors, but deploying those needs heavy infrastructure changes and skilled labour.

Furthermore, the pace of automation technology development means companies need to keep upgrading technology to leverage its capabilities, which small enterprises may struggle to manage in the long run. The likes of large enterprises could leverage economies of scale that a small enterprise couldn't.

To overcome these challenges, manufacturers will need to adopt modular robot designs, plug-and-play automation solutions, and capabilities for artificial intelligence (AI) driven self-learning: all of these factors reduce setup complexity and operational costs. Partnerships with tech providers to create programming and predictive maintenance tools that are easy to use will also help increase take-up.

Opportunity

Smart Manufacturing & AI-Powered Robotics Growth

Share Application of smart manufacturing and AI robotics are a key factor in growth of Industrial Robot Market. As companies in nearly every sector transition to more automated solutions to increase efficiency, accuracy, and scale. Real-time decision-making, predictive maintenance, and adaptive operations facilitated between them by AI-driven robotics will further reduce downtime and optimize production.

Moreover, the technology behind collaborative robots (cobots) is also improving workplace safety and productivity through seamless human-machine collaboration. With the surge of digital transformation of industries, those manufacturers adopting AI-enabled robotic solutions has cloud-based connectivity and real-time analytics powered by IVAs will be at the forefront of the evolution.

Global Industrial Robot Market had significant growth between 2020 and 2024 due to the rising automation in manufacturing, supply chain optimization, and strong demand for higher productivity. Everything from automotive, electronics to e-commerce industries integrated robotic solutions for smooth operation and less dependence on manual labour.

Meanwhile, in some industries, adoption was hampered by high implementation costs, job displacement concerns, and technical integration difficulties. Companies took action to fix these issues by increasing robotic flexibility, devising cost-effective automation solutions, and enhancing training programs for human-robot partnership.

Between 2025 to 2035, the market will see transformative changes due to advances in AI, autonomous robotics, and human-robot collaboration. Digital Twins, Edge Computing, Machine Vision: The New Era of Industrial Automation. Robotics-as-a-Service (Raas) will reduce barriers for small and mid-sized enterprises, allowing automated solutions to become more widespread.

The sustainable robotic manufacturing using energy-efficient components and recyclable materials will be in line with global environmental policies. Organizations that embrace intelligent automation, real-time adaptability, and seamless cloud integration will be the leaders in the next phase of industrial evolution.

Market Shifts: A Comparative Analysis (2020 to 2024 vs. 2025 to 2035)

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | New safety and compliance standards emerging for automation |

| Technological Advancements | Increasing demand for collaborative robots & machine vision |

| Industry Adoption | Increased use in automotive, electronics, and logistics |

| Supply Chain and Sourcing | Dependence on traditional semiconductor components |

| Market Competition | Existing robotics producers are overwhelming |

| Market Growth Drivers | Growing demand for automation, efficiency, and cost-cutting |

| Sustainability and Energy Efficiency | Limited focus on energy-efficient robotic solutions |

| Integration of Real-Time Analytics | Gradual implementation of sensor-based monitoring |

| Advancements in Robotics-as-a-Service (RaaS) | Limited accessibility for small enterprises |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | More strict policies promote energy-efficient and AI-driven robotic systems |

| Technological Advancements | Ubiquitous deployment of AI-enabled autonomous robotics, digital twins and predictive maintenance. |

| Industry Adoption | The latest new focus is expanding into precision manufacturing, pharmaceuticals, and smart factories. |

| Supply Chain and Sourcing | Shift towards sustainable materials and decentralized robotic production hubs. |

| Market Competition | Emergence of AI-powered robotics start-ups providing economical, scalable automation solutions. |

| Market Growth Drivers | Increased investments AI, human-robot collaboration, and digital manufacturing ecosystems. |

| Sustainability and Energy Efficiency | Widespread adoption of low-energy robotics, recyclable parts, and green automation. |

| Integration of Real-Time Analytics | AI-driven predictive analytics, real-time performance tracking, and cloud-based automation controls. |

| Advancements in Robotics-as-a-Service (RaaS) | Increased affordability and accessibility of subscription-based robotic solutions for diverse industries. |

While rapid adoption of automation fuels substantial growth in industrial robotics across automotive, aerospace, and logistics in America, challenges still remain. Tesla, Ford and GM leading automotive automation through multifaceted robotic arms skilfully welding and inspecting.

Meanwhile, e-commerce and shrewd warehouses stimulate demand for autonomous mobilizers navigating expansive premises and collaborative robots working willingly with people. Additionally, the administration motivates advances through tax relief for computerized production and "brainy factories."

However, as AI enhances robotics, issues surface regarding occupational disruption and retraining displaced employees. With proceeding technological progress and increasing adoption of industrial automation, the USA industrial robot industry undoubtedly expands dramatically. Nonetheless, policymakers must address potential societal impacts to ensure benefits are widely shared.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 17.1% |

The burgeoning British industrial robotics sector is flourishing due to the astonishing need for automation across manufacturing, logistics, and healthcare. The UK's concentrated effort to cultivate smart factories and digital transformation has inspired various industries to embrace robotic automation. The objectives of expertise and cost reduction are well-understood.

Automotive giants Jaguar Land Rover and Rolls-Royce have incorporated robotic welding, painting, and materials handling systems to exponentially accelerate output productivity. Simultaneously, the exponential rise of warehouse automation within e-commerce has fuelled the necessity for autonomous robots in order fulfilment centres.

Meanwhile, the logistics sector has borne witness to a proliferation of self-governing robots transporting goods within distribution centres and warehouses. Some shuttle freight over long distances while others focus their skills in more confined areas.

With governmental initiatives championing industrial automation and sustained investment in AI-enabled robotics, the exponentially expanding UK industrial robot market is primed for robust growth going ahead. The nation is committed to aiding British companies adopting cutting-edge robotic technology through funding opportunities as well as intensive research and development initiatives.

Though scepticism lingers regarding how strategies can truly future-proof industries against global competition in the long run, it is hoped that this approach will help reinforce the country's manufacturing foundation.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 15.9% |

The European Union industrial robot market has experienced dramatic expansion in recent years, driven powerfully by a strong push towards widespread factory automation throughout the area. Countries like Germany, vibrant with automotive production and mechanical manufacturing at the leading edge of heightened automation levels, along with France and Italy, have clearly emerged as pioneers in robotic adoption.

The bloc's persistent focus on accomplishing sustainability and transitioning towards practices in manufacturing that demand significantly less energy has nudged numerous industries towards incorporating smart, AI-powered robots. In addition, the growing recognition of collaborative robots or "cobots" within small and medium-sized enterprises across the

EU has aided spreading robotic adoption beyond large-scale industrial settings to smaller firms as well. With continued and ambitious investment in developing intelligent manufacturing abilities coupled with robust policy support for automation across all EU member states, experienced analysts predict that the regional industrial robotics market will keep a steady, upward development trajectory in the coming years as sustainability and productivity increase.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 16.6% |

The ever-burgeoning Japanese commercial robot market is primarily propelled by massive demand from the automotive, electronics, and microchip enterprises. As a global authority in robotic technology, Japanese corporations like Fanuc, Yaskawa, and Kawasaki dominate the worldwide panorama for industrial robots.

A major motivation behind escalating adoption of mechanization remedies and collaborative robots in manufacturing functions is Japan's maturing populace and work limitations. Additionally, the nation's strategic investments in man-made knowledge-integrated robotic platforms for exacting assembly and quality confirmation processes are catalysing market progress.

With continuous advancement in high-precision and intelligent robot design, the potential for sizable growth in the Japanese industrial robot sector stays considerable. The ground-breaking work in robotics by top businesses will back really sizeable market expansion and react to the necessity for automation substitutes to cope with human resource restrictions over the long term.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 16.9% |

South Korea's industrial robot sector has witnessed explosive development, catalysed by towering automation levels in electronics, semiconductors, and vehicles. South Korea has the highest robot density in manufacturing globally, with powerhouses like Samsung and Hyundai pouring considerably into AI-guided robotic automation.

The flourishing of clever factories and 5G-enabled industrial automation is further stimulating requirement for thoughtful robotic structures. Moreover, administration projects under the Korean New Deal are advancing the acceptance of collaborative robots and next-generation AI-powered automation answers.

With ongoing technological progression in industrial robotics and ballooning financial backing in digital transformation, experts anticipate South Korea's industrial robot market will see significant growth and development, as smart devices and automated solutions increasingly manage precision operations and streamline production.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 16.8% |

The robot controllers segment of which represents roughly during 30% to 40% of the global industrial robot market, additionally highlights a funky matter of analysis, as diverse production sectors are ready in line with the state-of-the-art robotic automation solutions with a consider smarting up errors, amplifying productivity and reducing the cost of operational runtime.

Automation systems play a crucial role in enhancing efficiency and productivity throughout key processes, including assembly lines, material handling, and quality control, which is witnessing widespread adoption in automotive, electronics, metal fabrication, and pharmaceutical industries. Due to high degrees of motion freedom, better payload capacity, and control precision, articulated robots have become one of the most popular robotic solutions available in the industries.

With joints similar to a human arm, the articulated robot can make various movements, resulting in more flexibility for complex operations such as parts assembly or material handling than traditional fixed automation. High speed articulated robotic arms were adopted due to the requirement on efficiency, cost reduction, and quality consistency by automakers expected to be driving growth owing to the increasing demand for articulated robots for welding, painting and assembly automation in automotive manufacturing. In automotive plants for example, articulated robots tend to improve production speed by 30% leading to better throughput and less downtime.

The market dynamics have been bolstered by the growth of articulated robots in heavy-duty applications (high-payload robotic arms for metal manufacturing, forging, and heavy component assembly), resulting in increased demand in industrial machinery and construction equipment production.

With the added integration of AI-powered vision systems, real-time object recognition and adaptive motion control, adoption soared, as did precision and decreased material waste on high-speed manufacturing lines.

This has fuelled the market growth with the present-day collaborative articulated robots endowed with human-machine interaction capabilities and force-sensing technology, ensuring an enhanced adoption rate within mixed-production environments.

The increase of six-axis and seven-axis articulated robots with more adaptability for complex part handling has intensified the market expansion due to its superiority in different multi-functional production lines.

Articulated robots, while offering flexibility, precision, and automation efficiency, also face challenges, including high initial costs, complex programming requirements, and the need for regular maintenance. However, recent innovations in AI-driven robot learning, modular robotic arm designs and energy-efficient motion control systems are making these machines more adaptable, affordable, and energy-efficient over the long term, which will continue to drive growth in the articulated robot market.

The SCARA (Selective Compliance Assembly Robot Arm) robots have seen good market adoption, especially in electronics assembly, pharmaceuticals, and food packaging, as manufacturers look for high-speed, repeatable, and cost-effective robotic automation to handle precision assembly and handling tasks. Dissimilar articulated robots, SCARA robots work on a compact horizontal plane, allowing for swifter and more accurate installation in tight workspace circumstances.

The increasing deployment of SCARA robots in electronics manufacturing development entails high-speed pick and place automation for circuit board assembly, a trend that has enabled adoption of precision-driven robotic systems by manufacturers of electronic components, due to the need for increased efficiency and defect reduction. Also, SCARA robots complete product assembly tasks in up to 40% less time compared to traditional assembly lines, allowing for faster lead times and more products to be assembled and delivered in a given timeframe.

This combination of need and opportunity has caused SCARA robots to expand their use within the pharmaceutical and medical device assembly, with cleanroom-compatible designs and precision-controlled handling allowing for greater adoption of SCARA robots in sterile production environments.

Moreover, the incorporation of AI-powered motion optimization with automated speed adjustment and precision grip control has also contributed to the adoption of robotic collocation in high-accuracy small-parts assembly.

Compact and lightweight SCARA robots with a plug-and-play mechanism for the integration of modular production lines are developed to drive market growth, enabling greater adoption in space-constrained industrial environments.

The rapid adoption of SCARA robots in fast-moving consumer goods (FMCG) industries from packaging to sorting and labelling has reinforced the expansion of the market for SCARA robots through ensuring better throughput in higher-volume production applications.

While SCARA robots are faster, more accurate, and generally cheaper, their design leads to limited movement range and motion in one direction, less flexibility for payload and tasks that require multi-directional movement. But integrating new advancements in AI and adaptive control, high-speed vision, and flexible gripping are making SCARA robotic automation more usable, efficient, and scalable keeping SCARA robotic automation on the rise.

Two key market drivers are the automotive and electrical & electronics sectors, with industries responding to the need to automate production processes, improve quality control, and meet rising industrial production against a backdrop of steady growth in high-precision industrial robot deployments.

With automation being a game-changer to the carmakers, automotive industry finds itself on the top consuming segment in industrial robotics leading to vehicle assembly, welding, painting and more to-be-perform better with robotic automation. But robotic automation provides quality as well as cycle time reduction and manufacturing defect elimination over manual labour.

The global demand for industrial robots for welding and assembly applications, including six-axis articulated robots to handle complex geometries, has led to the adoption of high-speed robotic systems as automotive companies increase production volume with a global footprint, focusing more on scalability and safety. According to studies, robotic welding improves joint consistency up to 90% providing greater durability and reducing rework costs.

Growth in the adoption of collaborative robots (cobots) in automotive production, with AI-powered human-robot collaboration facilitating mixed-line manufacturing, has ambushed demand in the market, offering more adaptability and enhanced worker protection.

Widespread adoption of technology such as AI-powered quality inspection, which uses vision-guided robotic arms to identify defects and even adjust the assembly process in real-time, on top of existing technologies thus better ensuring consistency in production of vehicles.

Market growth is aimed at the development of robotic painting and coating systems, to citified multi-paint systems that manage high levels of concentration, as high-precision spraying technology enables uniform surface finishing, which, in particularly, has targeted industrialization in automotive body connected body integrated painting applications, supporting the high adoption of robotic systems in through the aforementioned processes.

The integration of robotic automation in electric vehicle (EV) production, such as automation for battery assembly and precise wiring, coupled with considerations for better market expansion ensured integration with scalability as EV production increases.

While robotic automation in the automotive sector does offer advantages in terms of production efficiency, quality control, and scalability, there are still challenges to its adoption including high upfront costs, complex integration processes, and cybersecurity risks for connected robotic systems.

In contrast, new innovations in AI self-learning robots, cloud-based robotic process optimization and digital twin simulation technology are leading to improvements in cost-efficiency, adaptability and operational intelligence that will prevent the market for robotic automation in automobile manufacturing from shrinking any time soon.

The electrical & electronics vertical witnessed strong market adoption, predominantly in semiconductor fabrication, consumer electronics assembly, and printed circuit board (PCB) fabrication wherein companies increasingly deploy high-precision robotic automation to manipulate delicate electronic components. Robotic automation differs from traditional assembly lines as it provides micro-scale precision and reduction of material waste and better yield rates.

Recommended SCARA and delta robots such as those found in the semiconductor assembly of robotic pick-and-place automation, which has been undergoing widespread adoption due to increasing throughput and accuracy demands from electronics manufacturers, are quickly being adopted into common robotic precision systems.

Market demand has been further reinforced with the deployment of robotic automation for consumer electronics manufacturing, including AI-powered robotic arms for smartphone assembly and chip packaging, creating the need for deeper adoption across high-volume production environments.

This has been further bolstered with robotic soldering and micro-welding systems, which offers high precision robotic accuracy when working on sensitive circuit board connections, improving overall manufacturing reliability.

These systems can inspect the products during the production process, using AI to detect defects and ensure quality in real-time, allowing for more consistent production and further driving market growth.

Although robotic automation offers benefits like miniaturization, precision, and yield optimization, there are challenges in terms of capital investment, programming complexity, and limited adaptability to design changes. But next-gen flexibility in robotic integration, AI-based real-time adaptive control and high-speed vision-based robotics are enhancing scalability, efficiency, and long-term cost savings, and ensuring that robotic automation in electronics manufacturing will not slow down anytime soon.

The industrial robot market is also growing due to the increasing demand for automation, precision manufacturing, and AI-powered robotic systems in the automotive, electronics, healthcare, and logistics sectors. To ensure efficiency, flexibility, and productivity, companies are working on collaborative robots known as cobots AI-powered vision systems, and high-speed robotic automation.

It features worldwide robotics manufacturers and specialized automation solutions-companies that advance technology for robotic arms, automated mobile robots AMRs, artificial intelligence (AI) fueled industrial automation.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| FANUC Corporation | 15-20% |

| ABB Ltd. | 12-16% |

| Yaskawa Electric Corporation | 10-14% |

| KUKA AG (Midea Group) | 8-12% |

| Mitsubishi Electric Corporation | 5-9% |

| Other Companies (combined) | 40-50% |

| Company Name | Key Offerings/Activities |

|---|---|

| FANUC Corporation | Develops high-speed robotic arms, AI-integrated automation solutions, and cloud-connected industrial robots. |

| ABB Ltd. | Specializes in collaborative robots (cobots), robotic welding systems, and vision-guided automation. |

| Yaskawa Electric Corporation | Manufactures precision robotic arms for assembly, material handling, and smart factory automation. |

| KUKA AG (Midea Group) | Provides AI-powered industrial robots for automotive, aerospace, and smart manufacturing applications. |

| Mitsubishi Electric Corporation | Offers compact, high-speed robotic solutions for electronics, food processing, and factory automation. |

Key Company Insights

FANUC Corporation (15-20%)

FANUC, a forerunner in the industrial robot space, specializes in designing speed-optimized, intelligent robotic automation systems for precision manufacturing.

ABB Ltd. (12-16%)

ABB offers cobots and intelligent robotic automation that includes vision systems and smart factory connectivity.

Yaskawa Electric Corporation (10-14%)

Yaskawa Industrial & Robotics Solutions: High-Precision Motion Control & Material Handling Solutions.

KUKA AG (Midea Group) (8-12%)

They develop automation systems and robotic arms integrated with AI to ensure that they integrate seamlessly into workflows in an industrial environment.

Mitsubishi Electric Corporation (5-9%)

Mitsubishi produces compact and high speed robots, and fuses intelligence with AI robot automation for smart manufacturing.

Other Key Players (40-50% Combined)

Several industrial automation and robotics companies contribute to next-generation robotic technology, AI-driven factory automation, and precision robotic control. These include:

The overall market size for Industrial Robot Market was USD 7.1 Billion In 2025.

The Industrial Robot Market expected to reach USD 33.7 Billion In 2035.

The demand for industrial robots will be driven by factors such as advancements in automation technology, the need for improved operational efficiency, labour cost reduction, and the rising adoption of robots in industries like automotive, electronics, and manufacturing for precision and safety.

The top 5 countries which drives the development of Industrial Robot Market are USA, UK, Europe Union, Japan and South Korea.

Articulated and SCARA Robots Drive Market Growth to command significant share over the assessment period.

Glass Door Merchandisers Market Growth - Trends & Forecast 2025 to 2035

Hydrostatic Testing Market - Trends & Forecast 2025 to 2035

Retail Printers Market Growth - Trends & Forecast 2025 to 2035

Rubber Extruder Market Growth - Trends & Forecast 2025 to 2035

Factory Automation And Industrial Controls Market Growth - Trends & Forecast 2025 to 2035

Extrusion Equipment Market Growth - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.