Between the years 2025 and 2035, the industrial robotics market is going to experience a booming growth owing it to the automation in various industries such as manufacturing, automobile, electronics, food & beverages and pharma.

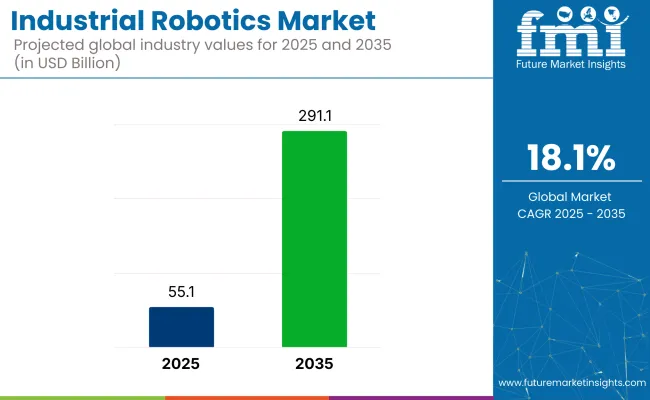

With a market valuation of USD 55.1 Billion by 2025, we expect the company to grow to USD 291.1 Billion by 2035 with a compound annual growth rate of 18.1%. Advanced robotics in production lines is helping companies scale up productivity and quality consistency while bringing down operational expenses.

The growing market trend of collaborative robots (cobots) which are robots that are able to cooperate with a human in a shared workspace. Cobots were designed to perform routine tasks for accuracy and to be a safe working partner. Also, the advent of artificial intelligence (AI) and machine learning (ML) algorithms are improving how industrial robots work too. AI-based decision making and predictive maintenance help businesses achieve better efficiency, less downtime and an increase in the lifespan of their robotic installations.

Another Significant Driver of the Market is Increased Demand for Flexible and Customized Robot Solutions as the manufacturing trend changes, companies are looking to employ robots that are reusable or able to be reprogrammed for different processes. Such flexibility enables manufacturers to respond quickly to changing production requirements, which leads to improved competitiveness and flexibility overall

The industrial robotics industry still has a stable growth trend, with the upstream sensor and the robot software are the most critical. Government-imposed Industry practices, investments in smart factories and digitalization will still drive the industry growth.

The articulated robots and the collaborative robots segments comprise a major percentage of the industrial robots market, with the industries relying more and more on autonomous high-precision robotic systems for work safety, efficiency, and productivity achievement. The robots are central to facilitating end-to-end industrial automation, increasing process precision, and improving scalability in applications from assembly to material handling, welding, and packaging

Articulated robots are among the most flexible robot solutions with high flexibility, multi-axis mobility, and high speed employed in manufacturing and process operations. Increased range of motion and flexibility define articulated robots compared to traditional rigid automation systems, making them capable of performing effective operation of intricate movements like welding, painting, and material handling.

Increasing demand for accuracy in the electrical, automotive, and metalworking industries has necessitated articulated robots to satisfy the desire of firms to have robotic functionality that delivers highest accuracy, repetitiveness, and production rates. Evidence indicates that articulated robots have the impact of minimizing cycle times, avoiding defects, and reducing the cost of operation, all leading to increased levels of mass production efficiency

Articulated robots on high-speed manufacturing lines, for example, multi-joint robot arms with sensors and AI-powered process optimization, have increased market demand as companies utilize real-time data analysis, predictive maintenance, and robotic assistance for automation in workflow efficiency.

The convergence of AI and machine learning in articulated robotic systems has further increased process automation, enabling robots to learn from changing production conditions, optimize motion paths, and self-correct for errors, providing greater productivity.

High-payload articulated robots, with better torque control, increased load capacity, and improved kinematic accuracy, have optimized heavy-duty material handling operations, with untroubled integration in warehousing, logistics, and assembly lines.

Utilization of articulated robots to high-precision manufacturing, such as the manufacture of medical devices, semiconductors, and the assembly of aerospace components, has propelled market growth, with robot-aided operations providing higher quality output, reduced tolerances, and reduced human errors.

While it performs well at high speeds, articulated robotics is burdened with the problems of high capital investment needs, complex programming requirements, and compatibility problems with older industrial machines. However, advances in no-code robotic programming, robotic path planning using artificial intelligence, and modular articulated robotic systems are making cost-effectiveness, ease of use, and ease of deployment better, and this will continue to drive articulated robot market growth.

Cobots have been widely used in the electronics, food and beverage, and SME industries as businesses increasingly utilize human-robot collaboration to attain optimal productivity, ensure safe work conditions, and low-cost automation. While industrial robots have inherent dangers associated with their application, cobots feature superior safety controls, force-limiting movement, and adaptive learning during runtime to support collaborative operations by humans and machines within shared spaces.

Growing demand for flexible, easy-to-program automation in labor-intensive industries has driven the application of cobots since companies seek scalable and cost-efficient alternatives to conventional robotic automation. Studies have demonstrated that collaborative robots maximize the flexibility of production, increase ergonomic protection, and reduce operation bottle necks to ensure greater efficiency for assembly, packaging, and material handling tasks.

The intersection of real-time process analytics and artificial intelligence-based vision systems in collaborative robots has driven market demand because cobots employ machine learning algorithms to improve on tasks, precision of motion, and learning from unstructured settings.

Increased application in healthcare, pharma, and lab automation sectors has also accelerated market expansion as robot-supported solutions repeatable work such as handling samples, dispensing drugs, and diagnostic analysis more precisely with enhanced process consistency.

Design development of compact, plug-and-play cobot products with simplified programming interfaces, mobility platform integration, and enhanced human-machine interface has increased the deployment ease to benefit SMEs and non-automotive sectors.

The adoption of cobots in logistics, e-commerce, and warehouse automation has fortified demand in the market, as order fulfillment, packing, and sortation systems with robotics assistance enhance supply chain effectiveness and reduce human labor dependency.

In spite of its flexibility automation strengths, cobots are threatened by limitations of payload capacity, speed, and adaptation to emerging safety regulations. Yet, latest breakthroughs in AI-based motion control, state-of-the-art force-feedback sensors, and automated robotic programming make cobot responsiveness, safety measures, and marketplace intrusion more achievable, assuring continued growth for collaborative robots within smart manufacturing industries.

The assembly/disassembly and welding segments are two of the principal market drivers, as businesses increasingly use robotic automation to boost manufacturing efficiency, improve product consistency, and maintain operational scalability.

The assembly and disassembly part has become one of the biggest uses of industrial robots, with producers more and more adopting robotic systems to optimize manufacturing processes, increase product quality, and lower labor dependence. As opposed to traditional assembly lines, assembly assisted by robots promises higher speed, accuracy, and consistency, maximizing manufacturing efficiency and eliminating defects.

The growing need for automation in car, electronics, and consumer goods production has spurred uptake of robotic assembly systems since robots facilitate accurate component handling, screwdriving, part fitting, and sub-assembly tasks with fewer errors. Research shows that robotic-assisted assembly has the effect of substantially enhancing takt time, increasing throughput, and providing increased manufacturing agility to accommodate just-in-time production models.

The inclusion of vision-guided robotic systems in assembly lines has fortified market demand, with AI-based vision analytics improving object recognition, allowing autonomous part placement, and facilitating adaptive process execution.

The creation of reconfigurable work cells, self-learning features, and process improvement through artificial intelligence has maximized production flexibility to enable quicker responsiveness to design alterations and customized production.

The use of robotics in electronics manufacturing, such as PCB assembly, semiconductor production, and smartphone assembly, has solidified market growth as robotic micro-assembly provides ultra-high precision, reduced defect rates, and improved product reliability.

Although robotic assembly excels in high-speed automation, it is weak in the field of high system integration costs, complex programming requirements, and skilled worker training requirements. Recent advances in AI-based robotic programming, 5G-enabled real-time connectivity, and next-generation robotic dexterity enhancements are, however, increasing assembly efficiency, scalability, and ease of use, foreshadowing greater market expansion for robotic assembly applications.

The welding business has experienced good market acceptance among automotive, aerospace, and metal fabrication sectors based on growing usage of robotic welding systems by manufacturers to improve joint quality, cut labor expenses, and improve the safety of employees. Robotic welding provides more consistent bead placement, less spatter, and better penetration control than manual welding processes, which enable maximum weld strength and life.

More use of high-precision automated welding machinery in heavy-duty equipment and structural production has provoked adoption of robot welding systems since companies need to produce standard, error-free welds to maximize product integrity and reduce post-processing adjustment.. Studies indicate that robotic welding reduces rework, enhances metallurgical properties, and offers quicker cycle times, enabling high-volume production efficiency.

The synergy between real-time seam tracking and AI adaptive welding control within robotic welding systems has spurred market demand as AI-driven analytics improve torch location, arc length, and heat input precision to achieve improved weld integrity.

Increasing uptake of collaborative robot welding systems that include real-time force feedback, intelligent path planning, and hybrid welding has also helped drive the market, since cobot-based welding enables flexible automation, human-robot collaboration, and enhanced safety in applications involving high weld content.

While it enjoys the benefits of computerized manufacturing, robotic welding is limited by factors like gargantuan capital investment, maintenance complexity, and inconsistency in material compositions. Nevertheless, the latest advancements in laser-assisted robotic welding, artificial intelligence -driven weld defect inspection, and next-generation autonomous welding technologies are enhancing process efficiency, quality control, and cost savings, making robotic welding applications continue to grow in the market.

Another factor that is in favour of North America is the manufacturing base of industries and the high adoption of automation technologies. For example, robots are used heavily in United States industries like automotive, electronics, and aerospace to produce vehicles and manned space vehicles at production rates and quality levels that human workers would be unable to achieve.

The adoption of AI and IoT solutions over robotic systems has further consolidated the region's revenue share in the global market. There is also massive progress being made in the field of robotics adoption in Canada, with a surge in investments into advanced manufacturing facilities. Thailand’s commitment to innovation and support for Industry 4.0 are new opportunities for robotics firms to gain a foothold.

Moreover, the introduction of stringent safety regulations and quality standards is pushing manufacturers towards utilizing robotic solutions that offer consistent performance and minimize workplace hazards. North America is projected to experience steady growth in the industrial robotics market throughout the forecast period, driven by significant focus on technology development, workforce training, and research partnerships.

A key market boosted with well-established automotive industry and broad network of industrial equipment manufactures. Germany, Italy and France are leading in the adoption of robotic technologies, automating production processes with increased output and high product quality. In order to meet the goals outlined by the European Union regarding digitalization and sustainable production methods, energy-efficient robotic systems have been developed and implemented.

These systems not only help with the reduction of energy usage and sustainability goals, but also environmental compliance goals. In addition, its focus on pushing innovation from R&D has produced novel robotic solutions to complex manufacturing challenges.

Moreover, as the European e-commerce industry grows, it has created a demand for robotic technology in the warehouse and logistics market. Pick-and-place robots, automated material handling systems, and autonomous mobile robots (AMRs) lead the charge in optimizing supply chains and meeting the growing demands of online shoppers.

However, with continuous investments in raw materials of smart manufacturing, along with the proliferation of AI-powered robots, Europe is predicted to emerge as a leading player in industrial robotics market in the next 10 years.

The industrial robotics market is also witnessing its strongest growth in Asia-Pacific driven by rapid industrialization, growing manufacturing hubs and a robust electronics industry. China, Japan and South Korea are among the world leaders in robotic automation, with a large share of global robot installations.

China's effort to transform its manufacturing industry with plans has spurred the adoption of industrial robots in manufacturing plants. Demand is increasing for collaborative robots and artificial intelligence-enabled robotic solutions in the country, allowing manufacturers to improve productivity, lower labour expenses, and remain competitive globally.

Japan is also at the forefront of mastering robotic assembly, emphasizing precise engineering and technological prowess. While excitement in earlier iterations was inspired by futuristic British robotics companies, the most innovative Japanese robotics companies are paving the way for the future of smarter and hyper flexible next-generation robotics that can complete complex tasks in multiple industries.

The South Koreans after all, they are famous for high-tech manufacturing and electronics - are investing in robotics R&D, too. South Korean manufacturers can not only keep their world-leading status in global tech supply chains but also enhance their productivity through using high-end robotic systems.

Asia-Pacific is set to lead the industrial robotics market during the forecast period, owing to strong government support, expanding investments in research and development (R&D), and rising demand for technological automation.

Challenges

Steep Upfront Costs: Industrial robots, particularly premium ones with vision and AI, come with high upfront costs. SMEs might find it difficult to bear the initial cost despite long-term cost savings.

Technical Sophistication: Integration of robot systems in existing production lines typically requires special expertise, translating into training expense and possible delays in installation.

Workforce Adjustment: Industrial robot introduction may create workforce displacement concerns, calling for retraining programs to allow employees to transition to new positions involving supervising and maintaining robot systems.

Opportunities

Development of Collaborative Robots: Cobot development allowing safe interaction with human workers is creating new uses in sectors that were based on manual work.

Automation for Intelligent Solutions: The advent of AI & ML based technology is enabling robots to be adaptive, intelligent & high performing, leading the path toward intelligent automation solutions for manufacturers.

Rising applications: Rising applications in non-industrial segments including healthcare, agriculture and logistics provide significant growth potential to the market players.

Industrial robotics witnessed considerable growth between 2020 and 2024 due to increase in demand for automation, precision and efficiency in various sectors including but not limited to automotive, electronics, healthcare and manufacturing.

So, these robots became ubiquitous as businesses embodying on decrease on human factor, accelerate productivity or reliability on production relied on collaborative robots (cobots), autonomous mobile robots (AMRs), and AI-driven robotic systems. The industry 4.0 concept encouraged investments in smart factories, where robotics, IoT, and AI-based automation work hand in hand on the production line.

Policies were introduced across governments to financially incentivize the adoption of automation and robotics. The market was mainly led by China, Japan, Germany, and the North America, heavily investing in AI-powered robotics, Sensor technology, and Robotic Process Automation (RPA). Firms concentrated on minimizing downtime, optimizing supply chains, and incorporating real-time analytics, all with industrial robots being a pivotal aspect of such production efficiency.

Machine vision, real-time AI processing, and cloud robotics have also progressed, allowing robots to assemble and maintain components in complex, dynamic environments through predictive planning and adaptive learning. Cobots, operational alongside human beings, became popular in SMEs, as we saw the birth of accessible automation based on AI. On the other hand, the combination of 3D printing in robotic manufacturing also made it possible for companies to develop lighter, bespoke robotic items, enhancing design flexibility.

The market wasn't all artificial intelligence and unicorns, however; it struggled with high costs of initial investment, cybersecurity risks and shortages of technical skills. Many industries battled automating legacy systems with robotics, leading to automation events being held off. These new frontiers in industrial robotics were also presenting challenges as automation technologies can be complex, requiring a high investment, whether in R&D or the hardware to automate a process.

With this comprehensive digital integration, by 2035 the industrial robotics market will run audit ways fitted with autonomous, self-optimizing systems, optimizing production/network performance and enhancing interactivity using collaborative robots, enabling real time human collaboration, predictive maintenance, and complex decision-making. AI-driven Swarm Robotics: AI-driven swarm robotics will coordinate groups of robots in areas such as manufacturing, logistics, and warehouse automation, helping to improve efficiency and reduce downtime.

Holographic interfaces and AR-enabled robotic control will introduce advanced human-robot interaction methods, streamlining robotic operations through intuitive touch. The fusion of AI, robotics, and decentralized intelligence will redefine industries, paving the way for a future where automation, adaptability, and precision are the bedrock of industrial progress.

From 2025 to 2035, there will be a revolution in the industrial robotics market powered by AI-based autonomous robotics combined with quantum computing for robotic decision-making, and high-rate human-robot collaboration. Hyper-intelligent robots with real-time learning will emerge, fundamentally transforming manufacturing, logistics and even service industries into fully autonomous, self-optimizing production ecosystems.

When combined with AI, cognitive robots will enhance productivity by teaching robots to learn from experience, recognize complex patterns and make instantaneous decisions without human interference. One step closer is quantum computing, which will allow robots to analyse big data in real time, determining the best decisions based on what they are manufacturing.

Bone also talked about brain-computer interfaces (BCI), which will enable humans to control robotic systems directly - a huge opportunity for teleoperations in dangerous sectors like the nuclear industry, deep-sea sectors and also space manufacturing.

Soft robotics, bio-inspired robotics, and self-repairing robotic systems will become more common, allowing for improved flexibility, adaptability, and longevity. Maintenance costs will be alleviated significantly thanks to robots made of biodegradable and self-repairing materials. Incorporating nanosensors into robotic arms to enable manipulation at the nanoscale will revolutionize sectors like semiconductor fabrication, medical research and construction of micro-mechanisms.

The next leap in industrial automation will be driven by cloud robotics and decentralized AI models, enabling robots to tap into communal knowledge; work across a global ecosystem; and update their capabilities in a cloud-based system. The advent of Edge AI processing will make possible real-time responsiveness, without worrying about latency problems that could create complications in critical applications. As companies scale automation, we will see the rise of robot-as-a-service (RaaS) business models that will enable industries to lease, upgrade and optimize their robotic deployments without capital investment up front.

High level of cybersecurity will become mandatory as AI drones will become critical to national infrastructure. Governments deploy block chain-based robotic identity management, quantum encryption for industry networks, and AI threat detection to deliver secure, tampered-proof robotic systems. autonomous mobile robots autonomous mobile robots dominating smart warehouses the smart warehouses of the future will be dominated by the likes of self-learning logistics management, AI-empowered inventory tracking, and predictive demand forecasting.

At the preview stage of Factory Robotics 2035, the world of productive industry will be built around self-aware robots, AI-powered swarm robotics, and fully autonomous smart factories, with lower operating costs, fewer human errors, and higher efficiency. Industries transitional matrix would be so shifting, ultimately human-robot symbiosis, AI-enabled cognition, and cloud-based robotic cognitive computing to orchestrate with technology.

Market Shifts: A Comparative Analysis 2020 to 2024 vs. 2025 to 2035

| Market Shift | 2020 to 2024 |

|---|---|

| Regulatory Landscape | Governments encouraged robotic adoption with grants, automation policies, and safety regulations. |

| Technological Advancements | Companies adopted machine vision, cloud robotics, and AI-driven automation. |

| Industry Applications | They were used in automotive, electronics, healthcare, and logistics through industrial robots. |

| Adoption of Smart Equipment | Cobots, AMRs, and AI-powered robotic assistants integrated into companies. |

| Sustainability & Cost Efficiency | Firms focused on reducing production waste, improving efficiency, and integrating 3D printing in robotics. |

| Data Analytics & Predictive Modelling | Improved efficiency by AI-driven predictive maintenance, real-time error detection and robotic process automation (RPA). |

| Production & Supply Chain Dynamics | Market faced disruptions due to COVID-19, semiconductor shortages, and labour constraints. |

| Market Growth Drivers | Growth was fuelled by automation demand, cost reduction strategies, and improved robotic intelligence. |

| Market Shift | 2025 to 2035 |

|---|---|

| Regulatory Landscape | Regulations will focus on AI ethics, cybersecurity compliance, and robotic workforce integration policies. |

| Technological Advancements | Quantum-enhanced robotics, edge AI processing, and real-time adaptive decision-making will dominate automation. |

| Industry Applications | Robotics: Autonomous Smart factories, self-repair robots, and human-robot collaborative workforces |

| Adoption of Smart Equipment | Rise of self-aware robots robotic exoskeletons decentralized AI-enabled manufacturing |

| Sustainability & Cost Efficiency | Biodegradable robots, AI-powered energy optimization, and fully automated zero-waste production systems. |

| Data Analytics & Predictive Modelling | Adoption of self-learning AI, digital twin-based robotic optimization, and predictive quantum computing for robotic cognition. |

| Production & Supply Chain Dynamics | Block chain-powered robotic supply chains, decentralized AI automation hubs, and self-learning robotic inventory management will optimize efficiency. |

| Market Growth Drivers | Expansion will be driven by fully autonomous smart factories, AI-embedded collaborative robots, and decentralized, self-optimizing production networks. |

The USA industrial robotics market is growing at a quick pace, boosted by the evolution of AI-driven automation, surging application in logistics & healthcare, and smart manufacturing initiatives with government support.

The USA is witnessing mass deployment of industrial robots in the metal fabrication, electronics, and automotive sectors. With manufacturers worried about cost savings, precision, and productivity, AI-based automation solutions and collaborative robots (cobots) are in great demand. Tesla, General Motors, and Ford are spending on robotic arms, automated assembly lines, and machine vision systems to improve manufacturing efficiency.

Apart from that, the e-commerce and logistics revolution has propelled the use of robots in fulfillment centers and warehouses. Walmart, Amazon, and FedEx are introducing AI-based robotic systems for automated delivery, packing, and sorting operations. Autonomous mobile robots (AMRs) and robotic process automation (RPA) development is also revolutionizing the logistics sector.

The USA healthcare sector is also beginning to adopt surgical robots, robot-assisted diagnostic tools, and laboratory robots. As telemedicine expands and the hospitals keep making investments in robot-assisted procedures, hospitals are making investments in accurate robotic systems for minimally invasive surgeries.

With heavy investment in AI-robotics, increasing penetration into logistics & healthcare, and moves by the government towards industrial automation, the United States industrial robot market is geared to see a strong growth pace.

| Country | CAGR (2025 to 2035) |

|---|---|

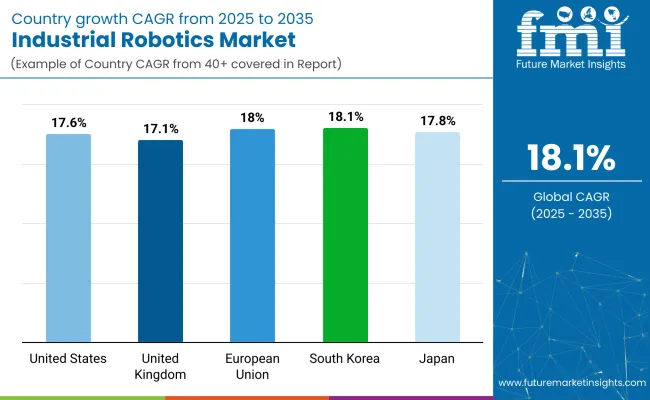

| USA | 17.6% |

The UK industrial robotics market is experiencing consistent growth due to technological innovation in AI-powered automation, manufacturing & logistics adoption growth, and healthcare & agriculture demand growth.

UK government's Made Smarter program and Industry efforts are driving automation in manufacturing, leading to more utilization of robotic arms, automated assembly lines, and precision robots in the automotive, electronics, and aerospace industries. Rolls-Royce, BAE Systems, and Jaguar Land Rover are applying robotics to precision machining, quality checking, and welding activities.

The UK's thriving e-commerce sector is also driving the demand for robotic warehouse automation. Though Ocado and Tesco have invested in sortation houses, robotic pickers, and AI-driven fulfillment centers, the logistics sector is also experiencing a robot revolution.

Apart from this, the healthcare industry is also seeing increasing robotic surgery and automated lab processing equipment. Robotic agriculture is also making inroads with improvements in robotic harvesters, autonomous drones, and crop monitoring through artificial intelligence.

With strong industrial automation initiatives, increased investment in logistics robots, and growing applications in healthcare & agriculture, the UK industrial robotics market will experience steady growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 17.1% |

The UK industrial robotics market is experiencing consistent growth due to technological innovation in AI-powered automation, manufacturing & logistics adoption growth, and healthcare & agriculture demand growth.

UK government's Made Smarter program and Industry 4.0 efforts are driving automation in manufacturing, leading to more utilization of robotic arms, automated assembly lines, and precision robots in the automotive, electronics, and aerospace industries. Rolls-Royce, BAE Systems, and Jaguar Land Rover are applying robotics to precision machining, quality checking, and welding activities.

The UK's thriving e-commerce sector is also driving the demand for robotic warehouse automation. Though Ocado and Tesco have invested in sortation houses, robotic pickers, and AI-driven fulfillment centers, the logistics sector is also experiencing a robot revolution.

Apart from this, the healthcare industry is also seeing increasing robotic surgery and automated lab processing equipment. Robotic agriculture is also making inroads with improvements in robotic harvesters, autonomous drones, and crop monitoring through artificial intelligence.

With strong industrial automation initiatives, increased investment in logistics robots, and growing applications in healthcare & agriculture, the UK industrial robotics market will experience steady growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 18.0% |

Japan's industrial robotics industry is among the most advanced globally, with backing from robotics technology, government policies, and growing use in manufacturing, health care, and logistics.

The country is also toured by world-class robotics firms like FANUC, Yaskawa, and Kawasaki Robotics targeting the development of even more sophisticated AI-driven robotic solutions for machine tending, assembly lines, and accurate automation. The electronics and automotive industry is the major investment driver with the likes of Toyota, Honda, and Sony making investments in cutting-edge robotic manufacturing equipment.

In addition, there are also rising demands for the application of robots in medical services and elderly services. With an increasing number of aging citizens in Japan, robotically assisted surgery systems, rehabilitation robots, and intelligent devices for nurse assistants are increasingly utilized.

The warehousing and logistics are increasingly being automated with organizations using autonomous mobile robots (AMRs) and artificial intelligence-powered sorting units to optimize supply chains.

As AI robots continue to make strides, intelligent automation receives growing investment, and demand for precision manufacturing grows stronger, the market for Japanese industrial robots is anticipated to increase profoundly.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 17.8% |

The South Korean industrial robot market is expanding exponentially with investments in smart factories, through-the-roof demand in the semiconductor manufacturing process, and increasing applications in the logistics & retail automation segments.

South Korea's Smart Factory Program is also propelling the adoption of AI robots in automotive, electronics, and machinery production. Automakers such as Samsung, Hyundai, and LG Electronics are investing in robot manufacturing lines, AI-based automation, and IoT-supported robot systems for increased manufacturing efficiency.

Samsung and SK Hynix dominate the chipmaking sector, which is the largest buyer of precision robots, and robot arms and automated wafer handlers are a critical component in manufacturing the chips.

Moreover, the growth of e-commerce and automation of logistics has fueled investment in robotic warehouse systems, autonomous delivery robots, and AI-based order fulfillment hubs. Coupang and Naver are incorporating robotic automation in intelligent warehouses and last-mile delivery solutions.

With ongoing investments in intelligent factories, growing adoption of robotics in the logistics & semiconductor sectors, and robust government incentives for AI-enabled automation, South Korean industrial robotics market is predicted to witness a strong growth rate.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 18.1% |

Advances in AI-driven robotics and integration of industry are fueling the growth of industrial robotics market. Companies have emphasized cobots and AI driven robotic arms, and AGVs to improve precision, efficiency, and workplace safety. The market is composed of worldwide robotics producers and specialized automation solution providers in robotic welding industrial automation, material handling industrial and smart factory automation.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Fanuc Corporation | 15-20% |

| ABB Ltd. | 12-16% |

| Yaskawa Electric Corporation | 10-14% |

| KUKA AG (Midea Group) | 8-12% |

| Mitsubishi Electric Corporation | 5-9% |

| Other Companies (combined) | 40-50% |

| Company Name | Key Offerings/Activities |

|---|---|

| Fanuc Corporation | Develops AI-powered robotic arms, autonomous manufacturing robots, and smart industrial automation solutions. |

| ABB Ltd. | Specializes in collaborative robots (cobots), robotic welding, and AI-enhanced industrial automation for smart factories. |

| Yaskawa Electric Corporation | Manufactures high-precision motion control systems, robotic palletizing solutions, and AI-driven industrial robotics. |

| KUKA AG (Midea Group) | Provides autonomous material handling robots, human-robot collaboration systems, and factory automation platforms. |

| Mitsubishi Electric Corporation | Offers robotic assembly solutions, SCARA robots, and AI-integrated factory automation technologies. |

Key Company Insights

Fanuc Corporation (15-20%)

Fanuc dominates the industrial robotics space with high-speed, AI-powered robotic automation systems for manufacturing, automotive, and electronics sectors. The company integrates real-time machine learning for optimizing processes.

ABB Ltd. (12-16%)

ABB is a global leader in cobots and industrial robotic automation with expertise in human-robot collaboration, intelligent robotic welding, and artificial intelligence-powered process automation.

Yaskawa Electric Corporation (10-14%)

Yaskawa designs precision motion control systems and robotic automation for assembly lines, improving energy efficiency and accuracy in industrial robots.

KUKA AG (Midea Group) (8-12%)

KUKA offers intelligent robotics solutions for the logistics, automotive, and healthcare sectors with a focus on AI-based human-robot collaboration.

Mitsubishi Electric Corporation (5-9%)

Mitsubishi Electric provides SCARA and articulated robots with AI and IoT integration for smart factory automation and predictive maintenance.

Several automation and robotics manufacturers contribute to next-generation robotic control, smart AI automation, and IoT-integrated robotic operations. These include:

The total industrial robotics market size was USD 55.1 Billion in 2025.

Industrial Robotics Market to Touch USD 291.1 Billion Mark in 2035.

The motivation for automation in manufacturing, a rise in labour cost, advancement of AI and IoT integration and the need for higher productivity, accuracy and efficiency in industries such as automotive, electronics and healthcare will lead to growth of the industrial robotics market.

USA, UK, Europe Union, Japan and South Korea are the top 5 countries are driving the development of Industrial Robotics Market.

The segment holds a persuasive Pie throughout the course of the assessment period driven by Articulated Robots and Collaborative Robots.

Explore Similar Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA