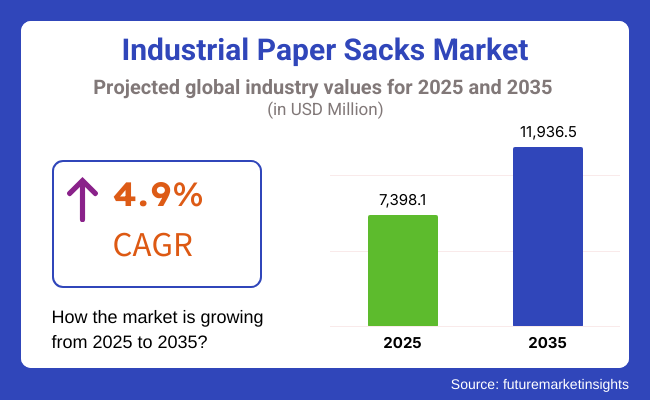

The market for industrial paper sacks is estimated to generate a market size of USD 7,398.1 million in 2025 and would increase to USD 11,936.5 million by 2035. It is expected to increase its sales at a CAGR of 4.9% over the forecast period 2025 to 2035. Revenue generated from industrial paper sacks in 2024 was USD 7,099.9 million.

The food industry has been the biggest investor of the industrial paper sack market. It has gained momentum recently because rising demand that requires sustainable, long-lasting, & food-safe packaging. Paper sacks are widely used for packing flour, sugar, grains, rice, coffee, powdered dairy products among many other dry food ingredients that require longer storage.

The increase in demand for eco-friendly packaging has resulted in increased usage of paper sacks by food manufacturers with the rise in biodegradable and recyclable materials instead of plastic use and environmental policies and regulations. This is further supported by government policies enforcing plastic bans and sustainability programs.

Cement packaging holds the highest market share of industrial paper sacks, being stronger and more durable as well as resistant to moisture. It is a high volume product whose packaging and transportation should be safe and dust-proof so that its contents do not get damaged.

Due to their ecological nature, ease of movement, and ability to bear heavy loads, industrial paper sacks are very common. In addition, with increasing demand for sustainable and efficient packaging solutions in the construction sector, the adoption of paper sacks for cement packaging also increases.

The industrial paper sacks market will expand with lucrative opportunities during the forecast period, as it is estimated to provide an incremental opportunity of USD 4836.6 million and will increase 1.6 times the current value by 2035.

Explore FMI!

Book a free demo

The below table presents the expected CAGR for the Industrial Paper Sacks Market over several semi-annual periods spanning from 2024 to 2034.

| Particular | Value CAGR |

|---|---|

| H1 | 5.4% (2024 to 2034) |

| H2 | 4.4% (2024 to 2034) |

| H1 | 5.6% (2025 to 2035) |

| H2 | 4.2% (2025 to 2035) |

In the first half (H1) of the decade from 2024 to 2034, the business is predicted to surge at a CAGR of 5.4%, followed by a slightly higher growth rate of 4.4% in the second half (H2) of the same decade. Moving into the subsequent period, from H1 2025 to H2 2035, the CAGR is projected to decrease slightly to 5.6% in the first half and remain relatively moderate at 4.2% in the second half. In the first half (H1) the market witnessed a decrease of 20 BPS while in the second half (H2), the market witnessed an increase of 20 BPS.

Growing need for sustainable and biodegradable packaging.

As industrial awareness and environmental concerns are becoming the need of the hour and the government restrictions on plastics use, industrial paper sacks are gradually becoming the alternative. Most of the food, agriculture, and chemical industries opt for biodegradable and recyclable packaging as a measure of plastic waste prevention.

Paper sacks from renewable raw materials can act as a support for the renewal of global goals of sustainability. Companies are investing in innovative paper-based packaging that offers strength, durability, and moisture resistance, driving demand further.

Expansion of the Construction and Cement Industry

Rising construction activities globally, especially in emerging economies, are driving industrial paper sacks' demand. Secure and durable packaging solutions are in demand for cement, gypsum, and other building materials, where multi-wallpaper sacks are chosen due to strength and resistance against rough handling. Infrastructure projects, coupled with rising urbanization, are further enhancing market growth due to the fact that paper sacks offer an efficient and cost-effective packaging solution for bulk materials.

Environmental Regulations and Raw Material Costs

Despite being an eco-friendly alternative, industrial paper sacks have its production challenges in terms of environmental regulations and the volatility of raw material prices. Since the reliance is on wood pulp, there is a question of deforestation and too much water usage; sustainability requirements tend to be more demanding.

This raises the cost of production, which makes it tough for the manufacturer to maintain a favorable price, hence decreasing market growth. In addition, supply chain disturbances and higher energy prices have resulted in decreasing profitability.

| Key Investment Area | Why It’s Critical for Future Growth |

|---|---|

| Sustainability & Recycling Innovations | The only hope for the sustenance of goal and consumer's expectation is making an investment on recyclable, biodegradable, and compostable paper sack solutions when plastic usage is on the decline from global regulations. |

| Strength & Durability Enhancements | Industrial paper sacks are needing high-performance coatings, multi-layer construction, and moisture-resistant treatments for the strength to carry cement, chemicals, and agricultural products. |

| Barrier Coating & Protection Technologies | Barrier Coating & Protection Technologies |

| Barrier Coating & Protection Technologies | Barrier Coating & Protection Technologies |

| Customization & Branding Innovation | Companies are also investing in the high-quality print and custom design for branding. Paper sacks, therefore, serve as a marketing tool for many industries, especially food, agriculture, and construction. |

The global industrial paper sacks market achieved a CAGR of 4.2% in the historical period of 2020 to 2024. Overall, the industrial paper sacks market performed well since it grew positively and reached USD 7,099.9 million in 2024 from USD 6,022.6 million in 2020.

Industrial paper sack market would continue to grow steadily during the forecast period from 2020 to 2024, with most growth coming from increasing demand in the construction and agriculture industries. The surge in infrastructure development required durable and environment-friendly packaging materials for cement, chemicals, and minerals.

Alongside these factors, the increased pressure of environmental regulations forces manufacturers to adopt high-strength recyclable paper sacks. Innovations related to moisture-resistant coatings and multi-layered sack designs further supported market growth.

| Market Aspect | 2019 to 2024 (Past Trends) |

|---|---|

| Market Growth | Moderate growth driven by increasing use in construction, agriculture, and chemicals. |

| Material Trends | Use of multi-ply kraft paper with plastic liners for enhanced strength and moisture resistance. |

| Regulatory Environment | Regulations promoting recyclable packaging and phasing out single-use plastics. |

| Consumer Demand | Strong preference for cost-effective, durable, and high-capacity sacks. |

| Technological Advancements | Development of water-resistant and reinforced paper sack designs for heavy-duty applications. |

| Sustainability Efforts | Gradual shift towards recyclable and FSC-certified paper materials. |

| Market Aspect | 2025 to 2035 (Future Projections) |

|---|---|

| Market Growth | Continued expansion with rising demand for eco-friendly and biodegradable packaging solutions. |

| Material Trends | Greater adoption of fully biodegradable, compostable, and plastic-free industrial paper sacks. |

| Regulatory Environment | Stricter policies banning plastic-based packaging and mandating sustainable alternatives. |

| Consumer Demand | Growing demand for lightweight, biodegradable, and high-performance paper sacks. |

| Technological Advancements | Advancements in barrier coatings, tear-resistant materials, and digital printing for branding. |

| Sustainability Efforts | Significant investment in completely compostable and bio-based paper sack solutions. |

Strong growth in the industrial paper sack market is expected to be seen due to increasing adoption of eco-friendly and biodegradable, plastic-free packaging in construction, agriculture, chemicals, and food industries. Increasing environmental regulations banning plastic packaging will force the businesses to opt for recyclable Kraft paper sacks with high-strength reinforcement and moisture-resistant coating.

More importantly, advanced water-resistant and high-barrier coating technologies will further expand the usage of the paper sack in moisture-sensitive industries. Sustainability-led investment and consumer demand for affordable packaging, which is compostable, will form the core basis of market direction through 2025 to 2035.

Tier 1 companies comprise market leaders capturing significant market share in global market. These market leaders are characterized by high production capacity and a wide product portfolio. These market leaders are distinguished by their extensive expertise in manufacturing across multiple packaging formats and a broad geographical reach, underpinned by a robust consumer base.

They provide a wide range of series including recycling and manufacturing utilizing the latest technology and meeting the regulatory standards providing the highest quality. Prominent companies within tier 1 include Mondi Group, Smurfit Kappa, WestRock, Holmen Group, and JK Paper.

Tier 2 companies include mid-size players having presence in specific regions and highly influencing the local market. These are characterized by a strong presence overseas and strong market knowledge. These market players have good technology and ensure regulatory compliance but may not have advanced technology and wide global reach. Prominent companies in tier 2 include BillerudKorsnäs, International Paper, Segezha Group, Gascogne Sack, Klabin S.A., Nordic Paper, LC Packaging, SimPac.

Tier 3 includes the majority of small-scale companies operating at the local presence and serving niche markets. These companies are notably oriented towards fulfilling local market demands and are consequently classified within the tier 3 share segment.

They are small-scale players and have limited geographical reach. Tier 3, within this context, is recognized as an unorganized market, denoting a sector characterized by a lack of extensive structure and formalization when compared to organized competitors.

| Region | 2019 to 2024 (Past Trends) |

|---|---|

| Global | Rising demand for biodegradable paper sacks as alternatives to plastic across construction, food, and chemicals industries. |

| North America | Growth in multi-wall paper sacks for industrial packaging due to increasing environmental concerns. |

| Asia Pacific (APAC) | Rapid industrialization in China and India has boosted demand for durable paper sacks in cement and agriculture sectors. |

| South Asia | Expansion of food and grain packaging using kraft paper sacks due to cost-effectiveness and biodegradability. |

| Middle East & Africa | Growing cement, agriculture, and chemicals industries drive demand for industrial paper sacks. |

| Latin America | Paper sacks have gained popularity in agriculture, cement, and food industries due to eco-friendly advantages. |

| Europe | EU's single-use plastic bans have accelerated demand for sustainable paper sacks in various industries. |

| Region | 2025 to 2035 (Future Projections) |

|---|---|

| Global | Higher investments in moisture-resistant, reinforced, and compostable paper sacks to support sustainability. |

| North America | Stricter government regulations on plastic bags drive stronger adoption of recycled and reusable paper sacks. |

| Asia Pacific (APAC) | Increasing shift toward recyclable and FSC-certified paper sacks due to government sustainability mandates. |

| South Asia | Focus on high-barrier, lightweight, and reinforced paper sack solutions to replace plastic-based alternatives. |

| Middle East & Africa | Adoption of moisture-resistant and biodegradable paper sacks for better storage and environmental compliance. |

| Latin America | Government initiatives for banning plastic sacks will drive the transition toward recyclable paper-based alternatives. |

| Europe | Strong circular economy policies push companies to invest in high-strength, fully biodegradable paper sacks. |

The section below covers the future forecast for the industrial paper sacks market in terms of countries. Information on key countries in several parts of the globe, including North America, Latin America, East Asia, South Asia and Pacific, Western Europe, Eastern Europe and MEA is provided. USA is expected to account for a CAGR of 3.9% through 2035. In Europe, Spain is projected to witness a CAGR of 4.5% by 2035.

| Countries | Value CAGR (2025 to 2035) |

|---|---|

| USA | 3.9% |

| Germany | 3.6% |

| China | 5.8% |

| UK | 3.4% |

| Spain | 4.5% |

| India | 6.0% |

| Canada | 3.6% |

Due to the rapid development of e-commerce in the United States, an increasing demand of durable and tamper-proof industrial paper sack packaging is being placed. With so much bulk produce, construction goods, and more agricultural products reaching businesses and consumer directly, strength, tear-resistant, and protections against transport requirements are placed during packaging.

Industrial paper sacks containing cement, fertilizers, and even food products demand moisture-resistant coatings, reinforced layers, and higher strength to resist handling as well as long-distance shipping. Sustainability is another challenge.

Companies are trying to produce biodegradable and recyclable paper sacks that can meet consumer preferences and regulatory pressures. With an increase in the use of e-commerce, there is a need for strong, tamper-proof, and eco-friendly paper sack solutions, thereby influencing innovations in material strength and design.

This market is fueled mainly by Germany's booming construction sector, since the cement, gypsum, and other building materials it uses are high in demand due to durable, eco-friendly packaging solutions. Because of environmental laws in the European Union, demand for biodegradable and recyclable paper sacks has picked up pace.

The construction material storage and transport will get protected by strength, moisture protection, and dust prevention from industrial paper sacks. The multi-wall paper sacks also exhibit increased barrier properties as the Germans emphasize infrastructure with sustainable materials, thus resulting in an increasing demand for it. Reducing plastic waste, thus, will lead to increasing demand for industrial paper sacks; this makes the use of such a product even more preferable to pack construction products.

The section contains information about the leading segments in the industry. In terms of material, kraft paper is are estimated to account for a share of 69.4% by 2035. By sack type, pasted valve sacks is projected to dominate by holding a share above 46.5% by the end 2035.

| Material | Market Share (2025) |

|---|---|

| Kraft Paper | 69.4% |

The most widely used industrial paper sack material is Kraft paper since it boasts a higher tensile strength, tear resistance, and eco-friendliness that enables the paper to be very strong. The use of kraft paper ensures the durability of heavy-duty products such as cement, chemicals, and agricultural goods.

In addition, kraft paper is highly breathable, which minimizes moisture retention and prevents spoilage of the product. Its biodegradable and recyclable characteristics are in tune with the latest sustainability trends, and it is more in demand among the manufacturers who would want to keep abreast of environmental regulations. The demand for sustainable and sturdier packaging solutions continues to propel the usage of kraft paper in various industrial applications.

| Sack Type | Market Share (2025) |

|---|---|

| Pasted Valve Sacks | 46.5% |

These valve sacks have gained wide acceptance for industrial packaging, with advantages such as great strength, fast filling, and tight sealing of the sacks. Valve sacks are designed for high-speed filling to reduce spillage and ensure more efficiency in production. Durable by multiple layers of paper, these valve sacks can be used to pack cement, chemicals, or agricultural products without the risk of moisture, contamination, or external damage.

This further improves the efficiency of handling with quick and dust-free filling capabilities, which is why it has become the popular choice for the transportation and storage of bulk material. Pasted valve sacks have remained at the top in the industrial paper sack market as the demand for safe, environment-friendly, and inexpensive packaging is growing.

Industrial paper sack manufacturers are investing in high-strength, multi-layered, and sustainable packaging solutions for construction and agriculture industries. Companies are expanding through strategic partnerships, acquisitions, and collaborations with local brands to enhance production capacity and geographical reach.

Key Developments in Industrial Paper Sacks Market

Vendor Insights in Industrial Paper Sacks Market

| Manufacturer | Vendor Insights |

|---|---|

| BillerudKorsnäs | A key player in sustainable paper sack packaging, focusing on high-strength, and biodegradable, and recyclable paper solutions for industrial use. |

| Segezha Group | Specializes in multi-wall kraft paper sacks for cement, food, and agricultural industries, prioritizing durability and moisture resistance. |

| Smurfit Kappa Group | Offers innovative, eco-friendly industrial paper sacks with customized barrier coatings and lightweight designs to replace plastic alternatives. |

| WestRock Company | Provides high-performance paper sack solutions with a focus on sustainability, food safety, and extended shelf life for dry bulk products. |

| Mondi Group | A global leader in recyclable and compostable industrial paper sacks, integrating high-barrier technology for enhanced product protection. |

The Industrial Paper Sacks Market is projected to witness CAGR of 4.9% between 2025 and 2035.

The Industrial Paper Sacks Market stood at USD 7,099.9 million in 2024.

Global industrial paper sacks industry is anticipated to reach USD 11,936.5 million by 2035 end.

East Asia is set to record a CAGR of 5.2% in assessment period.

The key players operating in the industrial paper sacks market include Mondi Group, Smurfit Kappa, WestRock, Holmen Group, and JK Paper.

In terms of sack type, the industry is segmented into sewn open mouth sacks, pasted valve sacks, pasted open mouth sacks, self-opening satchel (SOS) sacks, and multi-wall paper sacks.

In terms of material type, the industry is segmented into kraft paper, coated paper, and laminated paper.

In terms of capacity, the industry is segmented into up to 5 Kg, 5 Kg to 25 Kg, 25 Kg to 50 Kg, and above 50 Kg.

In terms of end-use industry, the industry is segmented into building & construction, food & beverages, chemicals, agriculture, pharmaceuticals, and mining & minerals.

Key regions covered include North America, Latin America, Western Europe, Eastern Europe, South Asia & Pacific, East Asia, and the Middle East & Africa.

BOPP Film Market Analysis by Thickness, Packaging Format, and End-use Industry Through 2025 to 2035

Waterproof Packaging Market Trends - Demand & Industry Forecast 2025 to 2035

Thermochromic Labels Market Insights - Innovations & Growth 2025 to 2035

Topical Drugs Packaging Market Growth & Forecast 2025 to 2035

Vinyl Extrusion Equipment Market Insights - Growth & Forecast 2025 to 2035

Treatment Pumps Market Insights Growth & Demand Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.