The demand for industrial oil is projected to experience steady growth in the global sector, as numerous industries including energy generation, manufacturing, and automotive rely on industrial oil due to its various applications. The market is valued at around USD 70,441.2 million in 2025, and with a CAGR of 3.5%, it could reach around USD 99,364.2 million by 2035.

These factors, including growing technological advancements in oil refining, rising investments in renewable energy, and increasing demand for efficient lubrication of machinery to minimize wear and tear, are likely to boost the sector's growth over the next few years. In addition, increasing environmental regulations are forcing the products of bio-based industrial oils, which are also influencing the industrial trends.

In 2024, the industrial oil industry experienced sharp fluctuations influenced by price volatility, supply realignments, and changing patterns of demand. Crude oil prices hit a high in early 2024 but declined in the second half due to softening global demand and rising production.

Industries, especially manufacturing and transportation, had mixed growth, with some areas slowing down because of economic uncertainties and increased use of alternative energy sources. Geopolitical tensions and shifting trade policies also impacted oil supply chains, causing price volatility.

The industrial oil industry will stabilize with moderate growth. Demand for oil is expected to increase as industrial activity increases, particularly in developing economies. But the increasing pressure for renewable energy and technological advancements in energy-efficient systems could limit excessive growth in demand.

AI-based energy management systems and better refining processes are expected to make oil usage more efficient. Geopolitics and trade talks will continue to shape pricing and supply patterns. Although there remain challenges, 2025 should see a more balanced industry underpinned by solid industrial demand and continued technological progress.

Metrics Table

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 70,441.2 million |

| Industry Size (2035F) | USD 99,364.2 million |

| CAGR (2025 to 2035) | 3.5% |

Explore FMI!

Book a free demo

This report is based on the consensus of the survey of various stakeholders in the industrial oil market, which includes manufacturers, suppliers, distributors, retailers, microparticle, and end-user segments from various industries. The intention was to gain insights on the evolving challenges and opportunities shaping the sector.

Respondents cited the growing influence of sustainability and environmental regulations on product formulations and sourcing strategies. The general consensus among industry leaders was that we require more bio-based and alternative synthetic oils that can enable us to reduce our environmental footprint without sacrificing performance.

Rapid industrialization, particularly in emerging economies, is driving the demand for industrial oil, the survey also stated. Stakeholders identified growing applications in energy generation, heavy machinery, and automotive manufacturing as driving growth. However, they cited supply chain disruptions and crude oil price volatility as concerns that impact production and pricing strategies.

Interviews with experts elucidate technological advancements in refining processes and additive formulations that prolong oil life and efficiency. In manufacturing and power generation, innovations in lubrication technology, combined with digital monitoring systems, are driving operational efficiency, participants said. Regulatory compliance and the transition to greener alternatives were also identified as important long-term industry sustainability drivers.

Respondents indicated they were confident about the future of the market despite adversity with citing strategic research and development investments. Companies are emphasizing the expansion of production capacity and the development of tailored solutions to address the needs of different industries. The findings in the survey demonstrate a general high commitment towards innovation, sustainability, and flexibility in the evolving industrial oil market.

| Countries/Regions | Key Regulations & Policies |

|---|---|

| United States | Environmental Protection Agency (EPA) regulations on lubricant disposal, Renewable Fuel Standard (RFS), and ASTM standards for industrial oils. |

| European Union | REACH (Registration, Evaluation, Authorization, and Restriction of Chemicals) regulations, Euro 7 emission standards, and circular economy policies for industrial lubricants. |

| China | "Made in China 2025" policies promoting advanced lubricant technologies, National Environmental Protection Standards, and restrictions on high-emission oils. |

| India | Bureau of Indian Standards (BIS) for lubricant quality, Petroleum & Explosives Safety Organization (PESO) guidelines, and focus on biodegradable lubricants. |

| Japan | Japan Industrial Standards (JIS) for lubricants, Ministry of Economy, Trade and Industry (METI) directives on energy-efficient industrial oils. |

| Brazil | National Agency of Petroleum, Natural Gas, and Biofuels (ANP) guidelines on industrial oil composition and environmental impact. |

| Gulf Cooperation Council (GCC) | GCC Standardization Organization (GSO) regulations on lubricant specifications and environmental compliance for industrial applications. |

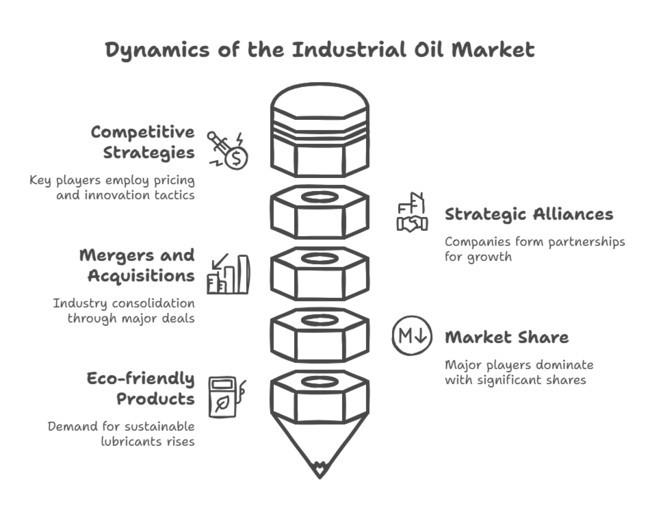

The industrial oil market is characterized by both aggressive pricing strategies from key players and innovations that are transforming the sector, as well as strategic partnerships and global expansion to keep up with demand. Price competition is still a significant consideration, with a proliferation of manufacturers in certain areas.

Attributing this, segment players are progressively differentiating themselves by investing in R&D collaborations to develop high performing, energy-saving and sustainable industrial oils. The demand for eco-friendly lubricants has resulted in bio-based and synthetic lubricants that meet stringent regulatory requirements, and consumers are also promoting such sustainable alternatives in India and worldwide.

Leading global players are pursuing strategic alliances with raw material providers, end users and research institutes to promote growth. They can also prepare to venture into developing sectors through partnerships. Companies are also strategizing around mergers and acquisitions to expand their industry reach, optimize the supply chain and enhance production.

As a result, manufacturers have begun providing predictive maintenance and even more advanced predictive services based on oil condition using digitalization and smart monitoring solutions embedded in their oil with the applications industrial oil. These include longer contracts with key players in the automotive, energy and manufacturing sectors, ensuring they remain relevant and profitable.

Indian Oil Corporation (IOC) has shown solid performance, achieving a 43% market share in India's petroleum products sector in the fiscal year 2025. This dominance is due to its extensive refining capacity, fuel retail network, and strategic expansions.

However, in the global industrial oil market, its share is significantly smaller compared to major international players like ExxonMobil and Shell. The rise comes due to its strategic initiatives like the addition of nearly 1,800 outlets through its expanding petrol pump network, a 14 per cent growth in volume sales of fuel and a highest-ever pipeline expansion for the fiscal, 2025 to 2035 period.

Though we do not have concrete segment share data for other industrial oil players, it can be reasonably noted that firms such as IOC are adopting diversified measures in order to increase their segment share. It is expected that as the sector continues to evolve, more of the competition will follow with similar approaches to protect industry share and gain a larger stake.

In 2024 and early 2025, mergers and acquisitions in the industrial oil sector increased. In October, ExxonMobil announced a deal to acquire Pioneer Natural Resources for USD 59.5 billion in an all-stock transaction to bolster its shale oil assets.

A few days later, Chevron announced it would take over Hess Corporation in a USD 53 billion all-stock deal (total enterprise value of USD 60 billion), improving its exploration and production arms. Occidental Petroleum took a page from the consolidation playbook too, acquiring Permian oil and gas producer Crown Rock for about USD 12 billion, including debt, bolstering its position in the lucrative Permian Basin.

In March 2025, Honeywell International Inc. acquired Sundyne LLC for USD 2.2 billion to bolster its Energy and Sustainability (ESS) business. Sundyne, based in Arvada, Colorado, makes high-engineered pumps and compressors that serve petrochemical, liquefied-natural-gas (LNG) and renewable fuel sector. This acquisition aligns with Honeywell's effort to expand its energy security solutions and comes on the heels of several such portfolio transformation deals.

Market Share Analysis

ExxonMobil Corporation

Shell plc

TotalEnergies SE

Chevron Corporation

BP plc (Castrol Industrial)

Fuchs Petrolub SE

Idemitsu Kosan Co., Ltd.

SK Lubricants

Sinopec Corp

Phillips 66 (Phillips 66 Lubricants)

The industrial oil industry can be segmented based on application, including hydraulic oils, metalworking fluids, gear oils, and process oils. For instance, hydraulic oils account for a significant share owing to the necessity in industrial equipment, construction, and automotive sectors.

Process oils, on the other hand, are rapidly gaining ground, particularly in the chemical industry and in polymers, where these oils are essential for producing rubber, plastics and coatings. Precision, high-performance, and customized oils are in demand as industries seek improved manufacturing efficiency and equipment longevity.

Industrial oils can be grouped into mineral, synthetic and bio-based oils. Mineral oils, which are inexpensive and readily available, still command a strong industry share. The Process Oil segment, under the By Oil Type category, holds the largest industry share at 31.2%, reflecting its dominant usage across industries and is estimated to witness a growth rate of 2.1% CAGR over the coming decade.

On the other hand, industries looking for high-performance lubricants require synthetic oils that have better thermal stability, longer service life, and improved efficiency. These are especially growing in aerospace, automotive, and heavy machinery sectors. Moreover, the sustainability trend and more stringent environmental regulations have resulted in the growing attention towards bio-based oils, which are derived from renewable raw materials and therefore are considered environmentally friendly alternatives.

Manufacturing is the largest industrial oil consumer, including lubrication, cooling, and production. Other sectors that make substantive use of industrial lubricants include the automotive and transportation sectors that employ those products for vehicle maintenance and performance enhancement.

But the energy business, specifically renewable energy such as wind and solar, is quickly becoming a growing customer for the specialized oils and greases, pushed by the world’s move toward clean energy. Moreover, the increasing adoption of advanced lubricants across industries like mining, textiles and food processing is anticipated to further drive the demand for these lubricants to enhance machinery performance and reduce operational costs.

Most oils for industry are crude oil based, and given the existing refining infrastructure and context, crude oil is still the dominant source. The leading segment holds a 67.6% share, highlighting its dominance in the industrial oil industry. With increasing awareness with respect to the environment, bio-based oils have seen remarkable growth.

Derived from vegetable oils and animal fats, these oils are increasingly embraced by industries seeking to lower their carbon emissions and meet stringent sustainability regulations. Oil derived from biomass is increasingly used in industrial applications, including lubricants and process oils, while ongoing research into bio-oil components is expected to drive wider industry adoption in the coming years.

The USA industry for industrial oil continued to be robust, as demand from manufacturing, automotive and energy sectors grew. The United States holds a 20.4% industry share, driven by strong industrial demand and sustainability initiatives. The country experienced considerable consolidation, and the major oil companies were building out their infrastructure through mergers and acquisitions.

Sustainability regulations drove industrial oils towards biodegradable options, as governments have mandated the reduction of carbon emissions and pollutants. Lower Import Dependency through Investment in Domestic Oil Production and Refining Tech new domestic oil production and refining tech investments, which sustained the supply chain and reduced dependency on import. The USA industrial oil industry is expected to grow at a steady pace in the forthcoming years, due to the integration of industrial automation and sustainability initiatives.

The industrial oil landscape in the UK was reshaped as renewable energy investments surged and environmental regulations. The United Kingdom's industrial oil industry is growing at a 2.6% CAGR, driven by sustainability efforts and advanced manufacturing. The demand for traditional industrial oils remained healthy, but we saw a clear shift to more sustainable and synthetic solutions.

British companies in automotive, aerospace and heavy machinery centre on high-performance lubricants and hydraulic fluids to improve efficiency and achieve EU and domestic environmental standards. The restructuring of supply chains due to Brexit-related trade adjustments caused companies to look for new partners in and outside Europe.

Digitalization also permeated the industrial sector, where AI-enabled maintenance solutions had augmented the efficiency of sectors like manufacturing. The government policies to reach net-zero emissions make the industry move towards low-carbon, sustainable products. Thus, the future of UK industrial oil lies within gradual shifts in sustainability and technological advancements.

France's industrial oil industry has been shaped by the country's strong push toward sustainability and technological innovation. Tighter government regulations and EU-wide policies mandating carbon neutrality spurred industries to use biodegradable and low-emission industrial oil. The automotive and aerospace industries, major players in the industry, sought to improve fuel efficiency and reduce environmental impact through investment in high-performance lubricants.

Manufacturing industries in France also focused on energy-efficient production processes, which spurred the demand for specialty industrial oils that reduce machine wear and tear and waste. Moreover, the focus on research and development in France led to innovations in oil formulations, including synthetic and bio-based options.

The French industrial oil industry is likely to gradually change towards greener alternatives, coupled with steady demand in conventional sectors owing to strong government push for sustainable industrial solutions and on-going technological advancements.

Given its solid manufacturing, automotive, and engineering sectors, was good for Germany's industrial oil industry and holds a 6.8% industry share, driven by strong industrial demand and sustainability initiatives. Plus, the focus on industrial processes is paying off for the country as industrial machine using high-end lubricants and hydraulic fluids that are improving productivity and longevity have seen increased demand.

In the face of the German government’s policies of energy efficiency and emission reduction, industries adopted synthetic and biodegradable oils, also in the light of wider EU goals. Maintained a mixed growth trend in the automotive and industrial sectors due to high disposable income and strong investments into the predictive maintenance and industrial automation that optimize oil consumption and help reduce the downtime in manufacturing plants.

Geopolitical factors from the global supply chain forced companies to diversify the sourcing strategies, bringing stability to the industrial oil sector. In the field of technology, Germany remains at the forefront of engineering and industrial progress, and also acts in the area of oil as one of the most developed industries which is predicted to grow in a more innovative and eco-friendly way.

Companies continued to seek efficiency and sustainability, and demand for both high-quality lubricants and specialized industrial oils remained stable. Biodegradable and synthetic industrial oils gradually replaced traditional options due to Italy's regulatory environment, which was compatible with the directive of the EU regarding emission reduction and promotion of alternatives that are friendly to the environment.

Expansion of the renewable energy sector in the country has also driven a transition towards sustainable solutions in the means of production. Italian firms worked to modernize their manufacturing using automation and machine-digital monitoring and optimizing their oil and their site to save running costs.

The industrial oil industry in the country is anticipated to grow in a steady manner, facilitated by advancements in technology, meeting regulatory standards of compliance, and the continued movement towards sustainability in industrial scopes.

The industrial oil demand in South Korea was supported primarily by the country advanced manufacturing sector which encompasses the automotive, shipbuilding, and electronics industries. With a high emphasis on innovation, the country witnessed high demand for industrial oils that improves efficiency and decreases maintenance cost, thus driving growth for the segment.

Government action emphasizing sustainability and carbon neutrality encouraged companies to use greener lubricants and hydraulic fluids. Smart manufacturing technologies, e.g. IoT-based monitoring and AI-driven predictive maintenance, were essential to optimize industrial oil use.

South Korea also increased its refining and processing capabilities, lessening its reliance on imports and ensuring a stable supply chain. The high-tech industrial landscape of the country will drive continued evolution of the industrial oil industry around sustainability, automation, and advanced formulations.

The Japanese industrial oil industry is behind precision engineering and high-tech industries. The top automotive and robotics industries in the country needed specialized lubricants and hydraulic fluids that enable superior performance in adverse conditions. The Japan holds a 6.2% industry share, driven by strong industrial demand and sustainability initiatives.

Japan’s focus on reducing industrial emissions has contributed to increased investment in synthetic and biodegradable industrial oils. Petroleum production is more automated now than at any time in history, aided by AI, which makes it entirely possible to avoid wasting anything, even oil. In response to government regulatory favouritism towards sustainable industry practices, developer's oil formulations transitioned towards lower-emission energy solutions.

Japan’s Industrial Oil Industry may not be the biggest in the world, but it is among the most sustainable, owing to technological adoption, regulatory compliance, and the growing need for high-quality and sustainable industrial solutions.

China has the largest industrial oil industry in the world, driven by accelerating industrialization, strong infrastructure, and a growing manufacturing sector. The China industrial oil industry is growing at a 4.1% CAGR, driven by sustainability efforts and advanced manufacturing. The demand for industrial oils in the country also grew, along with major investments in high-performance lubricants used in machines, automotive and heavy industries.

Increase in adoption of synthetic & bio-based industrial oils due to stricter government regulations on emissions & sustainability. Beijing also redoubled efforts to strengthen domestic refining capacity, to ensure supply chain stability. And the emergence of smart manufacturing and automation further optimized oil per industry. China’s industrial oil industry is anticipated to experience steady growth alongside continuing industrial expansion and regulatory reforms, with increased focus on efficiency and sustainability.

The Australian and New Zealand industrial oil industry was largely influenced by mining, agriculture, and transportation. Industrial oils demand was stable, with a focus on sustainability and regulatory compliance. Stricter emission policies and a waste management framework introduced by the Australian government means that industries now prefer eco-friendly lubricants which holds a 0.5% industry share.

New Zealand’s industrial sector has not been left behind, adopting sustainable alternatives and reinforcing its commitment to environmental preservation. By that time, automation was set to take off in either mining or agriculture, optimizing oil usage further in both areas and thus improving efficiency and lowering costs.

As Australia and New Zealand's industrial oil industry gets built up with infrastructure and sustainable options, the country is projected to embrace innovation and environmental friendliness when it comes to oil solutions.

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Moderate growth due to COVID-19 impact and supply chain disruptions in early 2020. Recovery started in 2022 with increased industrial activity. | Stronger growth expected due to rising automation, renewable energy expansion, and bio-based oil adoption. |

| Recovery in manufacturing, increasing demand from automotive and power sectors, rising synthetic oil use. | Sustainability trends, bio-based oil innovations, stricter regulations on emissions, and continued industrial expansion. |

| Industrial engine oils dominated due to high demand in automotive and machinery sectors. | Process oils and bio-based oils expected to see higher demand as industries shift to eco-friendly solutions. |

| Mineral and synthetic oils were widely used due to cost-effectiveness. | Bio-based oils expected to grow rapidly with sustainability initiatives. |

| Automotive and manufacturing led the industry, while power generation saw steady growth. | Power generation, construction, and renewable energy sectors expected to drive demand. |

| Asia-Pacific dominated due to industrialization, while North America and Europe saw steady demand. | Asia-Pacific remains dominant in the overall industrial oil sector, but Europe and North America are experiencing faster adoption rates of bio-based oils relative to their existing industry sizes. |

| Stricter regulations on emissions encouraged cleaner industrial oils but adoption was slow. | Governments worldwide enforcing stringent environmental policies, accelerating bio-based oil use. |

| Growth in synthetic oils and expansion of the electric vehicle sector. | Bio-based oil innovations, industrial automation, and increased adoption in renewable energy sectors. |

Global macroeconomic factors such as GDP growth, trade policy, supply chain disruptions, energy transition policy lead to an inextricable linkage between the industrial oil market. The industrial oils are consumed are also closely related to industrial production and infrastructure construction, especially in the developing countries like India, China, and southeast Asia. A surge in industrial lubricants and process oil consumption can be attributed to rising manufacturing in these economies as they expand further.

This segment is also affected by the ongoing energy transition. To this end, governments around the world are encouraging the use of renewable energy and sustainable industrial practices, pushing companies to develop bio-based and synthetic alternatives. Yet industrial oils are still the most demanded by some heavy machinery, automotive and power plant types.

Moreover, changing geopolitical circumstances and trade policies disrupt oil supplies, resulting in price fluctuations. Brent crude oil prices have a direct impact on the industrial oil production costs. Inflationary pressures, along with currency fluctuations, determine procurement strategies for industrial firms, and this in turn impacts the overall industry growth.

However, the industrial oil segment is expected to experience steady growth through the implementation of technological advancements, industrial automation, and major global infrastructure projects..

The transition from petrochemical-based to bio-based or other sustainable oils is one of the major contributors of growth in the industrial oil industry. As governments and industries demand reduced carbon emissions and environmentally friendly alternatives, businesses that invest in renewable and biodegradable lubricants will create a competitive advantage. This trend is especially notable in regions with stringent environmental regulations, like Europe and North America.

The Asia-Pacific region is projected to have the highest growth rate during the forecast period, due to the rapid industrialization in China, India, and Southeast Asia. A high demand for industrial oils exists as a result of rising manufacturing action, infrastructure growth, and a booming automotive sector.

In this case, companies targeting the local industrys need to explore setting up local production plants and distribution partnerships to cut down on costs and enhance supply chain efficiencies. Industries like aerospace, power generation and precision machining need specialized lubricants capable of operating in extreme conditions.

Industrial oil manufacturers must research and develop sustainable and high-performance lubricants to remain competitive. Increased industry position and regulatory compliance will be derived from investment in environmentally conscious formulations, and gaining industry certifications. Expanding their regional reach in fast-growing regions such as Asia-Pacific is another area where companies need to invest.

Building more local production, logistics, and after-sales services is essential to achieve industry share. In areas where sustainability is more concerned, it would be all about advertising bio-based alternatives and customer education for the benefits.

Digital transformation trend means that manufacturers can research and produce smart lubrication solutions linked to IoT platforms. Add conditioning monitoring and predictive maintenance services to industrial oils (new business model, new applications, new revenues, higher loyalty).

Finally, companies must expand their product portfolios to address the changing demands of industrial applications." Businesses can capitalize on future industrial trends and improve profitability by concentrating on higher margin segments including synthetic oils, process oils, and specialty lubricants.

Industrial oil is widely used in manufacturing, automotive, energy, mining, and heavy machinery sectors for lubrication, cooling, and operational efficiency.

Growing industrialization, increasing automation, demand for high-performance lubricants, and sustainability trends are key factors driving growth.

Companies are focusing on bio-based and environmentally friendly lubricants, reducing carbon footprints, and enhancing recycling and re-refining technologies.

Asia-Pacific, particularly China and India, is seeing rapid growth due to expanding manufacturing and infrastructure development. North America and Europe are also advancing in synthetic and bio-based oils.

Major companies include ExxonMobil, Shell, TotalEnergies, Chevron, BP (Castrol), Fuchs Petrolub, Idemitsu Kosan, SK Lubricants, Sinopec, and Phillips 66.

Mineral, Synthetic and Semi-Synthetic, Bio-based

Process Oil, Hydraulic Oils, Industry Engine Oils, Gear Oils, Metal Working Fluids, Turbine and Circulating Oils, Refrigerating Oils, Compressor Oils

Crude Oil, Soybean, Rapeseed, Sunflower, Palm, Others

Energy Generation, Oil & Gas, Manufacturing, Automotive, Heavy Engineering Equipment

North America, Latin America, Europe, East Asia, SAPeI (South Asia Pacific excl. India), The Middle East & Africa, India

Anti-seize Compounds Market Size & Growth 2025 to 2035

Industrial Pipe Insulation Market Trends 2025 to 2035

Phosphate Conversion Coatings Market 2025 to 2035

Colloidal Silica Market Demand & Trends 2025 to 2035

Technical Coil Coatings Market Growth 2025 to 2035

Perfluoropolyether (PFPE) Market Size & Trends 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.