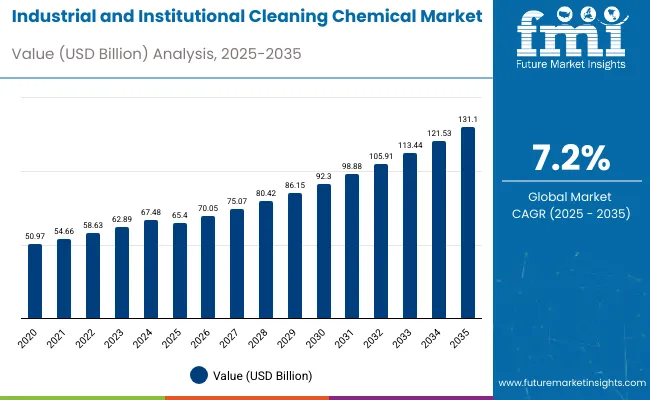

The industrial and institutional cleaning chemical market is projected to expand steadily from USD 65.4 billion in 2025 to USD 131.1 billion by 2035, advancing at a CAGR of 7.2%. This growth is driven by increasing hygiene awareness, stricter regulations, and expanding applications across healthcare, food processing, and industrial sectors.

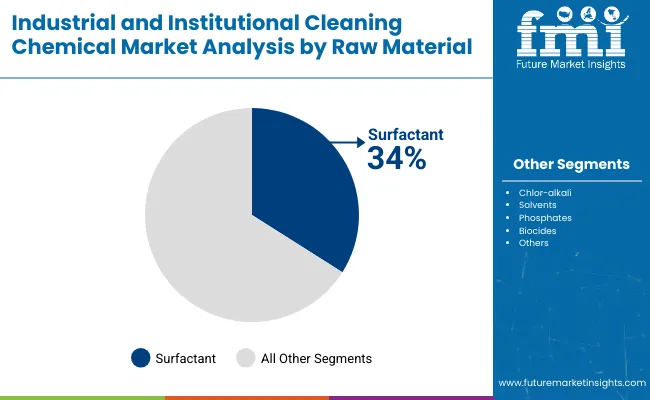

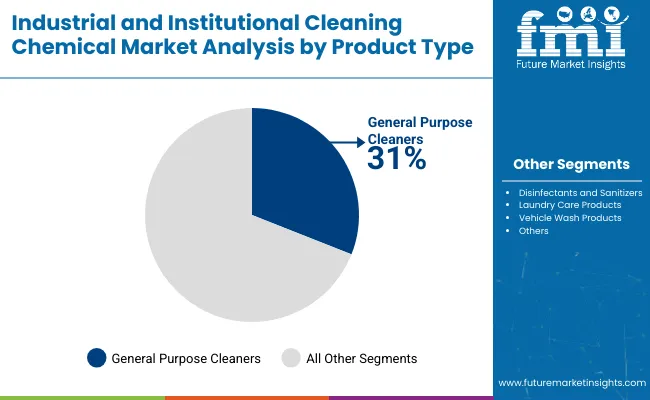

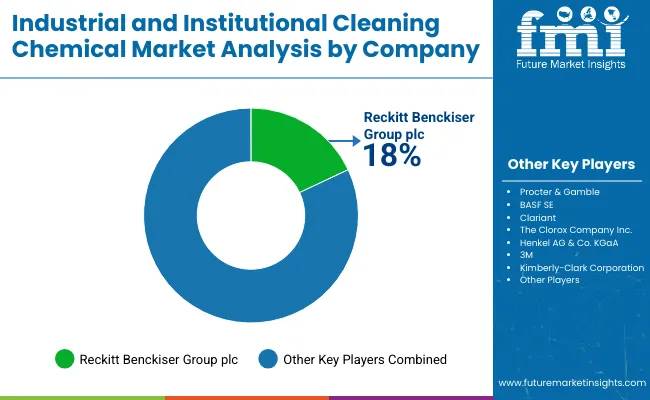

Key segments such as surfactants and general-purpose cleaners dominate the market, while leading companies like Reckitt Benckiser Group plc and Procter & Gamble bolster their positions through innovation and capacity expansion.

By 2030, the market is forecasted to reach around USD 92.7 billion, showing a steady climb across the first half of the period. The absolute dollar growth between 2025 and 2035 is expected to be about USD 65.7 billion, indicating measured but reliable expansion. Growth is considered somewhat back-loaded as increased demand for eco-friendly and technologically advanced cleaning solutions in healthcare, food processing, and commercial sectors is anticipated to drive stronger market penetration in the latter half of the timeline.

Key companies such as Procter & Gamble, Reckitt Benckiser Group plc, BASF SE, Henkel AG & Co. KGaA, and Croda International are consolidating their positions by scaling production capacities and investing in innovative cleaning technologies. Their development pipelines emphasize eco-friendly formulations, advanced disinfectants, and multifunctional cleaning solutions aimed at industrial, healthcare, and foodservice sectors. Market performance is closely linked to regulatory compliance, environmental standards, and quality assurance, which will continue to influence competitive dynamics across global regions.

The market holds a significant share across various sectors, with commercial applications dominate with over 68% market share in 2024. Industrial and manufacturing uses account for the remaining share, but their demand is also rising due to stricter hygiene regulations. The market is expanding through innovations in eco-friendly cleaning products, advanced disinfectants, and automated cleaning technologies, impacting hygiene standards globally and reinforcing the positions of key players like Procter & Gamble, Reckitt Benckiser Group plc, and BASF SE.

The market is transforming with advancements in eco-friendly formulations and technological innovations that enhance cleaning efficacy and safety. Producers are expanding their product portfolios to include biodegradable, plant-based, and multifunctional cleaning agents, supported by growing demand from healthcare, food processing, and commercial sectors.

Commercial building operations encounter service coordination challenges as cleaning chemical programs require coordination between janitorial service providers, building occupant scheduling, and indoor air quality management while managing product selection, application training, and performance monitoring. Facility management teams coordinate with tenant representatives to establish cleaning schedules while working with service contractors about product standardization and quality verification procedures.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 65.4 billion |

| Market Forecast Value (2035) | USD 131.1 billion |

| CAGR (2025 to 2035) | 7.2% |

The industrial and institutional cleaning chemical market is growing due to increased awareness of hygiene and stringent health and safety regulations globally. The COVID-19 pandemic has heightened demand for effective cleaning and disinfectant products across healthcare, food processing, hospitality, and manufacturing sectors. Furthermore, advances in eco-friendly and biodegradable formulations, coupled with technological innovations like automated cleaning systems, are making cleaning processes safer and more efficient.

Strong regulatory frameworks and rising demand for sustainable cleaning solutions are driving manufacturers to innovate and expand product portfolios. The market growth is also supported by expanding applications in emerging economies, where urbanization and industrialization increase the need for cleanliness and sanitation. Leading companies are investing in research and development to offer multifunctional cleaning agents that meet evolving consumer and institutional standards. Additionally, collaborations with end-users and focus on product quality and environmental compliance are reshaping industry dynamics, promising robust market expansion from 2025 to 2035.

The market is segmented by raw material, product type, end use verticals, and region. By raw material, the market is divided into chlor-alkali (caustic soda, soda ash, and chlorine), surfactant (non-ionic, anionic, cationic, and amphoteric), solvents (alcohols, hydrocarbons, chlorinated, ethers, and others such as chelants, rheology modifiers, opacifiers, dispersants, ketones, esters), phosphates, biocides, and others. Based on product type, the market is categorized into general purpose cleaners, disinfectants and sanitizers, laundry care products, vehicle wash products, and others (specialty cleaners and warewashing products).

In terms of end use verticals, the market is bifurcated into commercial (food services, retail, healthcare, laundry care, institutional buildings, and others such as education, hospitality); manufacturing (food & beverage processing, metal manufacturing & fabrication, electronic components, and others such as automotive, chemical industries. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia and Pacific, and Middle East & Africa.

The leading share of segments in the market in 2025 is dominated by surfactants, capturing 34% of the market.Surfactants, which include non-ionic, anionic, cationic, and amphoteric types, function by reducing surface tension, enabling effective removal of dirt, oils, and contaminants. Anionic surfactants, widely used in detergents and cleaning products, are prized for their strong foaming and cleansing properties. Non-ionic surfactants excel in oil emulsification without leaving residues, making them crucial in fabric care and hard surface cleaners.

The growth in this segment is driven by rising demand for eco-friendly, bio-based surfactants and innovations targeting reduced environmental impact. Additionally, surfactants are essential in industrial cleaning due to their efficacy in low-foam formulations, critical for automated cleaning systems in food, pharmaceutical, and manufacturing sectors. The increasing urbanization, hygiene awareness, and regulatory push towards sustainability further propel the surfactants segment, with Asia Pacific as a dominant regional market.

General purpose cleaners hold the largest market share in the market in 2025, accounting for 31% of the total share. These cleaners are widely used because of their versatility and effectiveness in cleaning a broad spectrum of surfaces in various environments, including commercial buildings, healthcare facilities, educational institutions, and food processing units. Their multipurpose nature enables them to cater to diverse cleaning needs, from floors and walls to glass and countertops.

Innovations in eco-friendly and biodegradable formulations are also increasing their popularity. The high demand for general purpose cleaners is driven by growing awareness of hygiene standards and stringent regulations that necessitate regular and thorough cleaning. Moreover, their cost-effectiveness and ease of use make them a preferred choice across industries, supporting steady market growth and ensuring they remain the dominant segment within the market.

The market is expected to experience significant growth from 2025 to 2035, driven primarily by increasing awareness of hygiene and the rising demand for safer, eco-friendly cleaning products. Rising concerns about health and sanitation, especially in healthcare and food processing sectors, have pushed institutions to adopt advanced cleaning chemistries that offer both efficacy and reduced environmental impact. Innovation in formulation technologies such as enzyme-based, low-foam, and biodegradable chemicals is broadening market opportunities, enabling manufacturers to cater to evolving institutional needs and regulatory requirements.

Rising Institutional and Regulatory Focus Fuels Industrial and Institutional Cleaning Chemical Market Growth

The growing emphasis on stringent hygiene standards and regulatory compliance across healthcare, food processing, and commercial sectors has been a key driver of growth in the Industrial and Institutional Cleaning Chemical Market. In recent years, heightened sanitation protocols and infection control measures have pushed institutions globally to adopt advanced cleaning formulations that ensure safety and efficacy. By 2025, organizations are expected to increasingly utilize cleaning chemicals with proven antimicrobial and biodegradable properties, aligning with evolving regulatory requirements and environmental sustainability goals.

Innovation in Formulation and Technology Enhances Market Expansion Opportunities

In parallel, manufacturers are integrating advanced technologies such as enzyme-based and low-foam chemicals with automated dosing systems to optimize cleaning performance and reduce chemical waste. These innovations improve operational efficiency, reduce environmental impact, and enhance compliance with health and safety standards. By 2025, the adoption of sustainable cleaning formulations and smart dispensing technologies is anticipated to be a core element of institutional cleaning strategies, giving market leaders with superior product portfolios and delivery systems a significant competitive advantage.

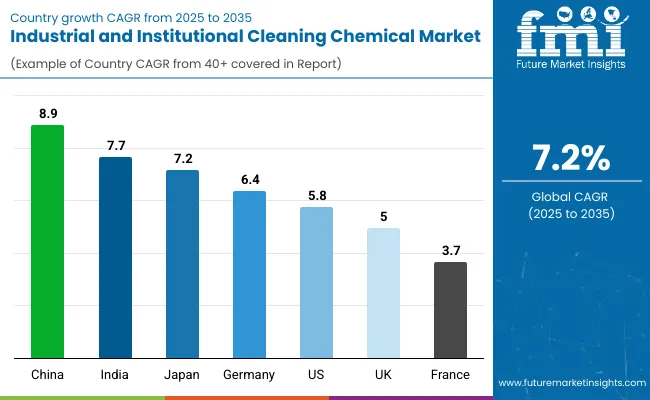

| Countries | CAGR (%) |

|---|---|

| China | 8.9 |

| India | 7.7 |

| Japan | 7.2 |

| Germany | 6.4 |

| USA | 5.8 |

| UK | 5.0 |

| France | 3.7 |

The market shows varying growth rates across key countries. China leads with the highest CAGR of 8.9%, driven by rapid industrialization, expanding urban infrastructure, and strong government initiatives promoting sanitation and sustainable practices. India follows with a CAGR of 7.7%, supported by urban growth, sanitation campaigns, and rising demand in healthcare and hospitality sectors. Japan experiences a CAGR of 7.2%, propelled by stringent regulations, high healthcare standards, and innovations in biodegradable cleaning formulations.

Germany exhibits a steady CAGR of 6.4%, underpinned by its advanced industrial base, strict environmental policies, and emphasis on green chemistry. The U.S. market grows at 5.8% CAGR, fueled by rigorous hygiene standards, sustainable product adoption, and automated system integration. The U.K. sees 5% CAGR growth, supported by institutional investments and regulatory pressures for eco-friendly products. France, with a more moderate 3.7% CAGR, focuses on regulatory compliance, green formulations, and sustainable manufacturing.

The report covers an in-depth analysis of 40+ countries; seven top-performing OECD countries are highlighted below.

Revenue from industrial and institutional cleaning chemicals in Chinais expanding rapidly with a CAGR of 8.9%, driven by industrial growth and expanding urban infrastructure. Government initiatives focusing on sanitation and environmental sustainability are promoting the use of eco-friendly cleaning chemicals. The healthcare and food processing sectors notably contribute to demand with strict hygiene requirements

. Local manufacturers are investing heavily in enzyme- and solvent-based formulations to meet regulatory and consumer needs. Increasing public awareness and government subsidies support sustainable production practices. Policies targeting carbon neutrality further encourage green product development. The focus on research and innovation is strengthening China’s role as a global leader in this market.

Demand for industrial and institutional cleaning chemicals in India is growing at a CAGR of 7.7%, fueled by rapid urbanization and rising sanitation awareness. Government sanitation campaigns and increasing regulations in healthcare and educational institutions are key growth drivers. The hospitality sector also contributes to rising demand for specialized cleaning products.

Manufacturers are developing cost-effective and eco-friendly formulations to meet the needs of emerging markets. Growing commercial infrastructure and expanding institutional cleaning services support strong market growth. Online distribution channels aid product availability even in remote areas. Rising consumer concern over hygiene standards promotes adoption of advanced cleaning solutions.

Revenue from industrial and institutional cleaning chemicals in Germany demonstrates a CAGR of 6.4%, driven by its advanced industrial base and strict environmental regulations. The automotive and manufacturing industries are significant end-users demanding sustainable cleaning agents. The country emphasizes research into green chemistry and biodegradable products, aligning with European environmental standards.

Industrial sectors prioritize reducing chemical emissions and waste through better production methods. Strict regulatory frameworks foster innovation in formulation and compliance. Germany’s healthcare and hospitality markets complement steady demand in institutional cleaning. Increased awareness of environmental impact leads manufacturers to adopt sustainable sourcing and production strategies.

Revenue from industrial and institutional cleaning chemicalsin Japan is growing at a CAGR of 7.2%, supported by stringent regulations and high healthcare standards. Demand is rising for biodegradable and enzyme-based cleaning formulations that comply with environmental policies. Automated cleaning technologies integrated with dosing systems enhance efficiency in sectors like food processing and pharmaceuticals.

Companies prioritize innovation to meet sustainability goals and regulatory compliance. Institutional segments, especially post-pandemic, enforce heightened hygiene standards. Japan’s research institutions and manufacturers lead innovation in eco-friendly, high-performance cleaning products, driving market growth. Growing public health awareness fuels ongoing demand for advanced sanitation solutions.

Demand for industrial and institutional cleaning chemicals in the USA market grows at a CAGR of 5.8%, led by strict hygiene regulations in healthcare, foodservice, and educational sectors. Rising demand for sustainable formulations drives innovation. Adoption of automated cleaning systems reduces chemical waste and improves cleaning efficiency.

Leading manufacturers invest in product development emphasizing bio-based and non-toxic ingredients. Strict infection control practices post-pandemic increase demand for disinfectants and sanitizers. The commercial cleaning industry’s growth further propels market expansion, supported by partnerships and digital distribution methods. Corporate social responsibility initiatives stimulate market focus on green cleaning technologies.

Demand for industrial and institutional cleaning chemicals in the UK is rising at a CAGR of 5%, bolstered by institutional investments in hygiene and stringent chemical regulations. Both public institutions and private enterprises increase adoption of eco-friendly cleaning products to meet legal requirements.

The food processing and healthcare sectors, in particular, uphold strict sanitation standards. The commercial cleaning service industry expands to accommodate growing hygiene awareness post-pandemic. Manufacturer collaborations with cleaning service providers optimize application and product delivery. Rising regulatory pressure encourages innovation in sustainable and efficient cleaning products. The UK's focus on environmental responsibility shapes future market trends.

Revenue from industrial and institutional cleaning chemicals in France is projected to grow at a CAGR of 3.7%, driven by rigorous chemical safety laws and a focus on environmental sustainability. The healthcare and hospitality industries generate strong demand for cleaning chemicals that meet hygiene and eco-friendly standards.

Research emphasizes biodegradable products and green formulations as customers seek safer, sustainable options. Government campaigns reinforce public health awareness and sanitation practices. Waste minimization regulations compel manufacturers toward cleaner production techniques. Though growth is moderate, France’s adherence to strict quality and environmental standards positions it as a key player in Europe’s cleaning chemicals market. The balance of regulatory compliance and innovation maintains steady expansion.

The industrial and institutional cleaning chemicals market is moderately consolidated, with major multinational corporations leading through product innovation, global manufacturing capacity, and strong distribution networks. Key players such as Procter & Gamble, BASF SE, Henkel AG & Co. KGaA, Reckitt Benckiser Group plc, and Ecolab Inc. dominate the market by offering comprehensive cleaning and hygiene solutions tailored for healthcare, food processing, hospitality, and commercial sectors. Their broad product portfolios emphasize efficacy, safety, and sustainability, supported by robust R&D pipelines and strong brand recognition.

Dow Inc., Clariant AG, and Croda International strengthen the market landscape through innovative surfactants, solvents, and specialty cleaning formulations, focusing on cost-efficient manufacturing and supply chain optimization to ensure reliability and price competitiveness. Solvay SA and 3M Company contribute through advanced chemical technologies, including disinfectants, surface cleaners, and industrial degreasers designed for high performance and regulatory compliance.

Regional manufacturers, particularly in Asia-Pacific and Latin America, are expanding by offering localized, eco-friendly formulations and adapting to regional environmental and safety regulations. Barriers to entry remain moderate, shaped by stringent chemical safety standards, sustainability requirements, and technological know-how in formulation chemistry.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 65.4 Billion |

| Raw Material | Chlor -alkali (Caustic Soda, Soda Ash, Chlorine), Surfactants (Non-ionic, Anionic, Cationic, Amphoteric), Solvents (Alcohols, Hydrocarbons, Chlorinated, Ethers, Others), Phosphates, Biocides, Others (Chelants , Rheology Modifiers, Opacifiers , Dispersants, Ketones, Esters) |

| Product Type | General Purpose Cleaners, Disinfectants and Sanitizers, Laundry Care Products, Vehicle Wash Products, Others (Specialty Cleaners, Warewashing Products) |

| End Use Verticals | Commercial (Food Services, Retail, Healthcare, Laundry Care, Institutional Buildings, Others include offices, hotels, lodging, educational institutions, recreational areas, and public institutions such as courts and government buildings). Manufacturing (Food & Beverage Processing, Metal Manufacturing & Fabrication, Electronic Components, Others include textiles, pulp and paper industry, petrochemical industry, automotive manufacturing, and other specialized industrial processes). |

| Regions Covered | North America, Latin America, Asia Pacific, Western Europe, Eastern Europe, Middle East & Africa |

| Countries Covered | United States, China, India, Japan, Germany, United Kingdom, France, Brazil, Canada, South Korea, Mexico, Australia, and 40+ other countries |

| Key Companies Profiled |

Procter & Gamble, BASF SE, Henkel AG & Co. KGaA, Reckitt Benckiser Group plc, Croda International, Ecolab Inc., Clariant AG, 3M Company, Solvay SA, Dow Inc |

| Additional Attributes | Dollar sales by product type and raw materials , i ncreasing demand for eco-friendly and biodegradable products, g rowth in automated cleaning systems, i nnovations in enzyme-based and low-foam technologies, r ising regulatory compliance, e xpanding use of sustainable sourcing and formulation standard s |

In terms of raw material, the industry is divided into chlor-alkali, surfactant, solvents, phosphates, biocides, and others. The chlor-alkali segment is further divided into sub segments, as caustic soda, soda ash, and chlorine. The surfactant segment is divided as non-ionic, anionic, cationic, and amphoteric. The solvents segments consists of five sub-segments as alcohols, hydrocarbons, chlorinated, ethers, and others.

In terms of product grade, the industry is divided into general purpose cleaners, disinfectants and sanitizers, laundry care products, vehicle wash products, and others.

In terms of End Use Verticals, the industry is divided into commercial and manufacturing. Commercial segment is further divided into food services, retail, healthcare, laundry care, institutional buildings and others. The manufacturing segment is divided into food and beverage processing, metal manufacturing and fabrication, electronic components and others.

Key countries of North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia Pacific, and Middle East and Africa (MEA) have been covered in the report.

The global industrial and institutional cleaning chemical market is estimated to be valued at USD 65.4 billion in 2025.

The market size for industrial and institutional cleaning chemical is projected to reach USD 131.1 billion by 2035.

The industrial and institutional cleaning chemical market is expected to grow at a CAGR of 7.2% between 2025 and 2035.

The surfactants segment is projected to lead the industrial and institutional cleaning chemical market with a 34% market share in 2025.

In terms of product type, general purpose cleaners are expected to command a 31% share in the industrial and institutional cleaning chemical market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Industrial Precision Oven Market Size and Share Forecast Outlook 2025 to 2035

Industrial Water Chiller for PCB Market Size and Share Forecast Outlook 2025 to 2035

Industrial & Commercial HVLS Fans Market Size and Share Forecast Outlook 2025 to 2035

Industrial Robot Controller Market Size and Share Forecast Outlook 2025 to 2035

Industrial Wired Routers Market Size and Share Forecast Outlook 2025 to 2035

Industrial Evaporative Condensers Market Size and Share Forecast Outlook 2025 to 2035

Industrial Energy Management System Market Size and Share Forecast Outlook 2025 to 2035

Industrial Insulation Market Size and Share Forecast Outlook 2025 to 2035

Industrial Safety Gloves Market Size and Share Forecast Outlook 2025 to 2035

Industrial Cleaner Market Size and Share Forecast Outlook 2025 to 2035

Industrial Dust Treatment System Market Size and Share Forecast Outlook 2025 to 2035

Industrial Vertical Washing Tower Market Size and Share Forecast Outlook 2025 to 2035

Industrial Pepper Market Size and Share Forecast Outlook 2025 to 2035

Industrial Electronics Packaging Market Forecast and Outlook 2025 to 2035

Industrial Absorbent Market Forecast and Outlook 2025 to 2035

Industrial Furnace Industry Analysis in Europe Forecast and Outlook 2025 to 2035

Industrial Denox System Market Size and Share Forecast Outlook 2025 to 2035

Industrial Electronic Pressure Switch Market Size and Share Forecast Outlook 2025 to 2035

Industrial WiFi Module Market Size and Share Forecast Outlook 2025 to 2035

Industrial Security System Market Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA