Between 2025 and 2035, industrial filtration business will change in the world, driven by environmental regulation, an increase in demand for water and air purification, and the drive for industrial sustainability. Industrial filtration technology is in the lead with cleaning impurities in air, process fluids, and water in order to make operations efficient in equipment and human safety as well as control in the environment. They have highly diversified uses in the petroleum and oil industry, chemical industry, power generation industry, food and beverage industry, and pharmaceutical.

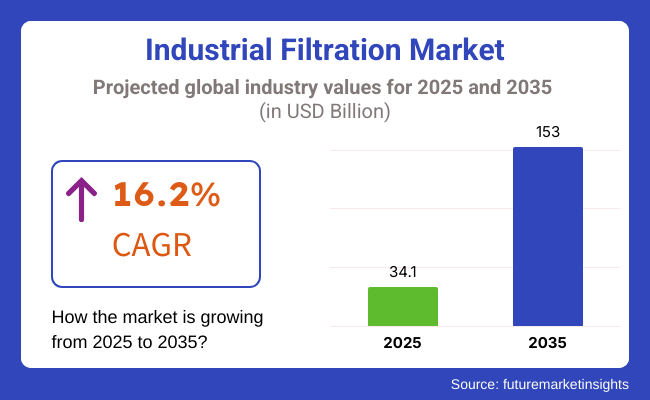

Industrial filtration market value was approximately USD 34.1 Billion in 2025. It will be USD 153.0 Billion in 2035 with a growth rate of 16.2%. Process optimization, more enforcement by the regulatory agencies, and more emphasis on product quality management are some of the major drivers for the market. Installation of newer technologies like membrane filtration and HEPA filters is also driving the market growth.

Explore FMI!

Book a free demo

The North American market is a large industrial market for filtration owing to the fact that there exists tight enforcement of the environment law and monitoring and already a pre-base of the industries is constructed. The manufacturing bases of North America are strong which need quality filtration products to help with emission control requirements and make it easy to produce goods of good quality.

Two of the strongest push drivers of North American industry growth are increasing demand for high-end industrial processing and use of HEPA and ULPA filters across various industries.

The largest green and energy-saving industrial filtration market is in Europe. There are also stringent water and air regulations in Germany, United Kingdom, and France that compel companies to incorporate advanced technology into the filter system.

Equipment supply of piping carbon emissions and enabling growth in clean energy on the continent has begun taking initial steps towards utilization of filtering mechanisms in industry power houses, waste power houses, and industry wastewater treatment plants. New regulation provisions on new, cleaner filter technology with low energy requirements will continue to spread in Europe's market.

Asia-Pacific market also has mass scale industry filtration industry growth as a result of high-speed industrial growth, increasing factory production, and an increase in environment awareness. Southeast Asia, India, and China are among the emerging markets whose increasing demand for filtration solutions is considered as industries shift towards compliance of clean technology with the law of the environment.

More manufacturing in sectors like electronics, automobiles, and food and beverages is also creating demand for efficient filtration systems. Regionally, however, efforts to avoid air and water pollution and invest in smart infrastructure and manufacturing are also creating innovation for next-gen industrial filtration technology.

Challenge

High Maintenance Costs and Stringent Environmental Regulations

Due to high operating and maintenance costs, changing environmental regulation, and requirement of advance filtration technologies. Industries like manufacturing which include but are not limited to chemicals, pharmaceuticals, food processing, the need for efficient filtration system owing to pollution and workplace safety compliance. But routine maintenance, filter changes, and energy consumption add to operational expenses.

Global Environmental Policies, such as EPA, ISO 16890, and EU air quality directives also add compliance complexity. To meet these challenges, companies need to invest in self-cleaning filtration systems, energy-efficient filter media, and AI-powered predictive maintenance solutions to optimise filtration performance while balancing cost and regulatory risks.

Opportunity

Growth in Smart Filtration and Sustainable Technologies

The shift toward sustainability, clean air, & modernized industrial processes provides an enormous opportunity for the Industrial Filtration Market. As industries seek more eco-friendly modes, demand for high-efficiency particulate air (HEPA) filters, nanofiber filtration and bio-based filter material is on the rise. Monitoring Filtration in Real-time through IoT Improved filtration through IoT enabled filtration monitoring, artificial intelligence (AI) based air quality analysis, and smart sensors integration is transforming industrial filtration.

The increasing adoption of membrane filtration to purify wastewater and the growing adoption of chemical-free air purification systems are enabling green manufacturing. To remain relevant, companies that adopt AI-powered filtration diagnostics, resistor designs, and intelligent monitoring will log a key competitive advantage in the emerging industrial filtration scenario.

Between 2020 and 2024, high filter replacement costs, varying prices for raw materials, and slow integration of smart filtration technology have hindered the growth of the market. Companies tackled these shortages by investing in high-capacity filtration solutions, investing in AI-driven filter monitoring capabilities, and looking to sustainable filtration media to enhance performance.

Packing for the future of 2025 to 2035, the industry will witness revolutionary breakthroughs in smart filtration, purification through nanotechnology, and environmentally sound filter media. AI-driven filtration units with online monitoring and self-cleaning capabilities will make the process more efficient.

The growth of carbon capture filtration, hydrogen fuel filtration, and energy-efficient air purification technologies will revolutionize industrial water and air treatment processes. The growing use of biodegradable and recyclable filter media, along with digital filtration management systems, will propel sustainability. Automation, smart filtration, and sustainable innovations-focused companies will be the drivers of the Industrial Filtration Market's future development.

Market Shifts: A Comparative Analysis (2020 to 2024 vs. 2025 to 2035)

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Compliance with EPA, ISO 16890, and EU air quality standards |

| Technological Advancements | Growth in HEPA filters, membrane filtration, and high-efficiency dust collectors |

| Industry Adoption | Increased demand in pharmaceuticals, food processing, and manufacturing |

| Supply Chain and Sourcing | Dependence on conventional synthetic filtration materials |

| Market Competition | Presence of established filtration equipment manufacturers |

| Market Growth Drivers | Rising demand for clean air and water in industrial operations |

| Sustainability and Energy Efficiency | Initial adoption of energy-efficient filter designs |

| Integration of Smart Monitoring | Limited real-time monitoring and predictive maintenance |

| Advancements in Filtration Technologies | Use of traditional filter cartridges and industrial dust collectors |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Expansion of AI-driven compliance monitoring, carbon-neutral filtration mandates, and stricter sustainability regulations. |

| Technological Advancements | Widespread adoption of AI-powered smart filtration, nanofiber-based filters, and real-time contaminant detection systems. |

| Industry Adoption | Expansion into hydrogen fuel filtration, industrial carbon capture, and decentralized air purification networks. |

| Supply Chain and Sourcing | Shift toward biodegradable, recyclable, and eco-friendly filter media for sustainable operations. |

| Market Competition | Growth of AI-driven smart filtration providers, digital air monitoring solutions, and sustainable filtration startups. |

| Market Growth Drivers | Increased investment in AI-driven efficiency optimization, energy-saving filtration systems, and circular economy filtration models. |

| Sustainability and Energy Efficiency | Full-scale deployment of carbon-neutral filtration, self-cleaning filters, and AI-powered air quality analytics. |

| Integration of Smart Monitoring | AI-enhanced filtration diagnostics, cloud-based efficiency tracking, and remote contamination alerts. |

| Advancements in Filtration Technologies | Development of autonomous filtration networks, hybrid filtration with nanotechnology, and zero-waste filter designs. |

Environmental Sustainability & Focus on Cleanliness the latest demands from environmental agencies such as the EPA and OSHA are based on rigorous air and water filtration requirements that push industries towards high-performance filtration technologies.

Food & beverage, pharmaceuticals, oil & gas, and chemicals industries are investing in advanced filtration systems to adhere to regulatory compliance while enhancing product purity and improving operational efficiency. More recently, sustainable manufacturing solutions and measures to improve workplace air quality are contributing to increased demand for industrial filtration.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 16.8% |

Growing air and water quality regulations, increasing industrial automation and a shift to sustainable manufacturing are expanding the UK industrial filtration market. UK Environment Agency imposes strict emissions regulations, leading industrial players to adopt high efficiency particulate air (HEPA) filters, activated carbon, and membrane filtration.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 16.3% |

The industrial filtration industry in the European Union (EU) is witnessed to be the prominent market owing to the stringent environmental regulations, a strong industrial base, and growing investments in clean energy technologies. Countries like Germany, France and Italy have developed industries related to chemicals, pharmaceuticals, and automobiles, which need advanced filtration solutions.

REACH and Industrial Emissions Directive by the EU impose stringent air and water filtration standards, driving industries to invest in efficient filtration systems. Moreover, the rising hydrogen and battery manufacturing industries are driving the strong demand for specialized filtration solutions.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 16.5% |

Technological innovation, precision engineering, and stringent environmental standards are driving Japan’s industrial filtration markets. It requires high-performance air and liquid filtration systems that meet cleanroom standards in its semiconductor, electronics, and pharmaceutical industries.

Japan, which is investing heavily in energy-saving and sustainability strategies, is also shifting to next-generation filtration technologies, like nanofiber membranes and electrostatic filtration systems. Burnishing this trend, the commitment of Japan to hydrogen energy and carbon neutrality is driving location of advanced gas and liquid filtration solutions.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 16.7% |

The industrial filtration market in South Korea is growing rapidly, fuelled by the country's thriving semiconductor, EV battery, and industrial manufacturing industries. Advanced air and water filtration systems are in high demand as the country pushes for hydrogen energy and carbon-neutral industries.

In addition, with the government-enforced air pollution control policies, industries have invested in high-efficiency particulate filtration and industrial exhaust purification systems to tackle air pollution. Furthermore, the rise in demand for a semiconductor cleanroom and pharmaceutical processing is propelling the demand for ultra-fine filtration systems.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 16.6% |

HEPA (High-Efficiency Particulate Air) filters & Electrostatic Precipitators (ESP) represent a considerable portion of the industrial filtration industry, as sectors from manufacturing to healthcare to energy to automotive increasingly look to invest in advanced filtration solutions to improve air quality, adhere to increasingly stringent environmental regulations and generally boost workplace safety. From air pollutants, to preventative equipment preventative measures, to tailored industry standard compliance, these necessary filtration technologies are vital when used in industrial, cleanroom, and emissions control applications.

Due to the benefits, HEPA filters have become one of the most used air filtration solutions used to remove high-efficiency particles, ensuring better air quality, and complying with regulations such as clean and contaminant-free environments required by various industries. HEPA is different from standard air filtration as it eliminates airborne bacteria-filled micro-organisms and is suitable for any application where high air cleanliness level is needed.

Increasing awareness of worker safety, along with compliance with air pollution regulations, has enhanced the adoption of HEPA filters systems for industrial air quality management with dust and particulate removal, hazardous gas containment, and microbial filtration. Over 70% of cleanroom and pharmaceutical manufacturing facilities use HEPA pitches, ensuring robust demand for this segment, according to numerous studies.

Advanced manufacturing and semiconductor production markets have both expanded, as they require contamination-sensitive environments and ultra-clean air, bolstering greater adoption of HEPA filters for controlled air purification.

Moreover, the inclusion of AI-driven air quality monitoring, enhanced with the ability to detect particulate concentration in real time, automatically adjust airflow in more medium and larger units, and smartly predict end-user filter replacement dates has accelerated adoption, enabling better efficiencies and cost savings.

The improvements in hybrid HEPA filtration systems specifically, with the integration of activated carbon for gas-phase filtration and UV sterilization for microbial removal, have paved market growth, allowing for higher flexibility in industrial and healthcare settings.

Such compact HEPA filter designs, which board low-profile and high-performance filtration in industrial environments given space constraints, has further cemented market development, facilitating improved adaptability across operational setups.

However, owing to higher maintenance costs, mandatory periodic replacements, and airflow resistance base limitations, the HEPA filter segment is facing a challenge. Nevertheless, innovations such as nanofiber-based HEPA filtration, self-cleaning filter technologies, and AI-driven airflow optimization are enhancing efficiency, longevity, and cost-effectiveness, thereby ensuring sustained growth in demand for HEPA filtration solutions in the market.

While the electrostatic precipitating equipment market is highly mutually exclusive with air pollution equipment, the market has witnessed good adoption across high-emission industrial settings including power plants, heavy manufacturing and the likes due to rising industry investments towards attaining to stringent environmental norms through use of advanced air cleaners. When compared to previous filtration techniques, an electrostatic precipitator relies on a high-voltage static charge to attract the particles and thus eliminate pollutants from the air.

At the same time, the growing need for reducing industrial emissions, including the removal of airborne pollutants, smoke control, and the containment of hazardous particulates, is being met with widespread adoption of electrostatic precipitators, as industries seek sustainable solutions for air management. Research also proves that over 65% of industrial facilities that late high particulate emissions use electrostatic precipitators for complying air quality regulations, ensuring robust demand for this segment.

The rising trend of both coal-fired power generation as well as waste-to-energy plants, which may produce high-volume particulate emissions and strict regulatory compliance needs, has bolstered market demand, facilitating a where larger scale industrial applications witnessed higher adoption of electrostatic precipitators.

As adoption has increased, so has the integration of AI-driven efficiency monitoring with real-time voltage control, automated pollutant tracking, and self-adjusting particulate capture settings, which has helped ensure improved energy efficiency and lower operating costs.

Hybrid electrostatic precipitator systems, with multi-stage filtration inherent, including pre-cleaners and gas scrubbers to enhance pollutant capture, have designed the potent growth of the market, providing greater flexibility for various industrial applications.

Compact and modular electrostatic precipitators with scalable design for small and medium scale industries have further invigorated market growth, bolstering product adaptability in cost-sensitive segments.

Although the electrostatic precipitator segment offers higher pollutant elimination efficiency, energy-saving properties, and compliance with emission standards set globally, it presents challenges, including a higher initial investment, elaborate maintenance needs, and vulnerability to humidity and gas composition. However, the new-age innovations in AI-assisted pollution tracking, electrostatic field optimization, and hybrid filtration technologies will help enhance efficiency, adaptability, and cost-effectiveness of the component eventually leading to expansion of electrostatic precipitator technologies in the industrial filtration applications.

The power generation plants and chemical industry sectors are among two important market drivers as industries look to implement advanced filtration solutions to increase energy efficiency, reduce emissions, and create a safe workplace environment.

Power generation plants are among the largest consumers of industrial filtration solutions in the market providing emissions control, combustion efficiency, and hazardous pollutant removal for coal- gas- and renewable energy-generation facilities. Unlike other industrial users, power plants exist in a strictly regulated environment, where high-performance filtration systems are mandated by the government to ensure air quality requirements are met.

In emerging power generation technologies such as high-efficiency gas turbines, emission-free coal combustion technologies and waste heat recovery, the growing need for clean energy generation has propelled the usage of industrial filtration systems, with power companies western world's shifting the focus on compliance and operational efficiency. Regulatory compliance and efficiency improvement of power generation plants, with industrial filtration expertise, drives 75% of sales in this segment, guaranteeing robust demand.

Growth in hybrid power plants providing solar-thermal and natural gas co-generation systems with embedded filtration has further bolstered demand, ensuring higher uptake of high performance air and gas filtration solutions.

Although the power generation segment will benefit from emission and operational efficiency, and regulatory compliance, it will be challenged by high filtration system costs, complex maintenance requirements, and the evolution of emission control standards. Yet, with technology areas like AI powered pollution surveillance, electrostatic particulates attractant, and state-of-the-art gas scrubbing solutions witnessing paradigm shifts as they promote efficiency, sustainability, and regulatory adherence, the market for industrial filtration solutions in power plants is poised for growth.

Strong market adoption of the chemical industry, especially in hazardous material handling, air contamination prevention, and process safety, has enabled manufacturers to invest significantly in industrial filtration to secure workplace safety and maintain product purity. Chemical processing, in particular, is different from general manufacturing in that it requires specialized filtration systems to remove airborne toxins, corrosive gases, and micro-contaminants present in production environments.

Growth in high-purity chemical manufacturing for pharmaceutical-grade processing, semiconductor material production, and petrochemical refining is driving adoption of industrial filtration systems as chemical companies prioritize precision filtration and regulatory compliance.

The rising sustainable chemical production, from low emission production processes, solvent recovery, bio-based chemical processing, have further augmented the market demands, ensuring wider adoption of high-efficiency filtration towards process optimization.

The segment of chemical industry filtration is not devoid of challenges even though it has advantages in contaminants and specification removal, protection of plant staff by preventing harmful reworking of components, and providing high purity production lines. Nonetheless, opportunities still exist for industrial filtration solutions across the chemical industry, as advances in smart filtration monitoring, AI-driven air quality management and hybrid/multi-stage chemical filtration systems boost efficiency, cost savings and compliance.

Industrial filtration market is growing because of the demand for air, liquid and gas filtration, as well as air filtration, liquid filtration and gas filtration applications in various industries such as manufacturing, power generation and wastewater treatment. Companies are investing in AI-powered predictive maintenance, advanced membrane filtration technologies, and energy-efficient filtration solutions to improve operational efficiency, meet environmental compliance, and ensure the safety of their workplace. The market consists of global filtration technology providers, industrial equipment manufacturers, and specialized filtration system integrators, all organizing ongoing innovations in the field of HEPA filters, baghouse filtration, depth filtration, and membrane separation technologies.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Parker Hannifin Corporation | 15-20% |

| Eaton Corporation | 12-16% |

| Donaldson Company, Inc. | 10-14% |

| Camfil AB | 8-12% |

| Mann and Hummel Group | 5-9% |

| Other Companies (combined) | 40-50% |

| Company Name | Key Offerings/Activities |

|---|---|

| Parker Hannifin Corporation | Develops high-efficiency industrial filtration solutions for air, gas, and liquid applications, integrating AI-powered monitoring. |

| Eaton Corporation | Specializes in bag and cartridge filtration, depth filtration, and oil separation technologies for industrial processes. |

| Donaldson Company, Inc. | Manufactures industrial air filtration systems, dust collectors, and advanced membrane filtration solutions. |

| Camfil AB | Provides HEPA and ULPA filters, air pollution control solutions, and cleanroom filtration systems. |

| Mann+Hummel Group | Offers automotive and industrial air and liquid filtration systems with energy-efficient designs. |

Key Company Insights

Parker Hannifin Corporation (15-20%)

Parker Hannifin is a leader in the industrial filtration market, providing advanced filtration monitoring using AI-driven technologies, high performance gas and liquid filters and energy efficient dust collection systems.

Eaton Corporation (12-16%)

Eaton specializes in depth and membrane filtration technologies, ensuring high-efficiency industrial separation and contamination control.

Donaldson Company, Inc. (10-14%)

A global leader in the manufacturing and heavy industries, provides dust collection and air filtration solutions that optimize clean air standards.

Camfil AB (8-12%)

Camfil designs high-efficiency HEPA and air filtration systems integrated with smart air purification solutions for industrial and pharmaceutical application.

Mann and Hummel Group (5-9%)

Develops and produces high-performance filters for use in automotive, industrial and water applications that are sustainable and energy efficient.

Other Key Players (40-50% Combined)

NextGen Filtration Technologies, AI-powered Filter Diagnostics, Energy-saving Filtration Solutions There are a number of leading industrial filtration suppliers and niche equipment manufacturers who play a key role in next-generation filter technologies and energy efficient filtration. These include

The overall market size for Industrial Filtration Market was USD 34.1 Billion in 2025.

The Industrial Filtration Market is expected to reach USD 153.0 Billion in 2035.

The demand for the industrial filtration market will grow due to increasing environmental regulations, rising need for clean and safe air and water in industries, growing adoption in manufacturing and power generation, and advancements in filtration technologies for improved efficiency and sustainability.

The top 5 countries which drives the development of Industrial Filtration Market are USA, UK, Europe Union, Japan and South Korea.

Power Generation Plants and Chemical Industry Drive Market to command significant share over the assessment period.

Diaphragm Coupling Market Growth - Trends & Forecast 2025 to 2035

HID Ballast Market Growth - Trends & Forecast 2025 to 2035

Glass Door Merchandisers Market Growth - Trends & Forecast 2025 to 2035

Hydrostatic Testing Market - Trends & Forecast 2025 to 2035

Rubber Extruder Market Growth - Trends & Forecast 2025 to 2035

Extrusion Equipment Market Growth - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.