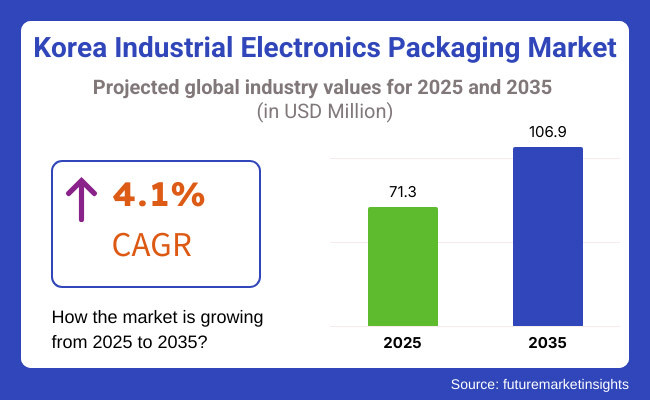

The Korea industrial electronics packaging market is estimated to account for USD 71.3 million in 2025. It is anticipated to grow at a CAGR of 4.1% during the assessment period and reach a value of USD 106.9 million by 2035.

Industry Outlook

The Korean industrial electronics packaging industry is expected to experience steady growth, spurred on by technological progress and government policies favoring the packaging sector. As Korea's dominance in the electronics and semiconductor manufacturing industries continues, packaging solutions will adapt to drive growth in demand for high-performing and environmentally friendly materials.

Technologies for green and intelligent packaging are predicted to be major trends throughout the decade. Moreover, the development of automation and Industry 4.0 will continue to drive innovation in industrial packaging methods to make them more durable and efficient. Industrial electronics packaging demand is likely to be robust as Korea establishes itself as a world leader in electronics production.

Explore FMI!

Book a free demo

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Demand was primarily driven by increased production of industrial electronics, the rise of semiconductor packaging, and the influence of global electronics manufacturers like Samsung and LG. | Growth will be fueled by automation, Industry 4.0, AI-driven packaging solutions, and eco-friendly materials. Sustainability initiatives will gain momentum. |

| Traditional packaging materials and methods dominated, with a gradual shift toward miniaturization and high-performance packaging. Smart packaging adoption remained low. | Advanced materials such as nanotechnology-based packaging, anti-static solutions, and smart packaging with sensors will become more widespread. |

| The Korean government introduced initiatives to support domestic manufacturing and industrial growth, especially in the semiconductor and electronics sectors. However, sustainability policies were in early stages. | The government is expected to impose stricter environmental regulations, promoting the use of recyclable and biodegradable packaging materials. Support for R&D in packaging innovation will increase. |

| The industry faced challenges such as supply chain disruptions due to COVID-19, raw material shortages, and fluctuating demand for industrial electronics. | Future challenges will include regulatory compliance, the need for cost-effective sustainable packaging, and rising global competition in the electronics packaging market. |

| Dominated by large conglomerates like Samsung, LG, and SK Hynix, along with packaging firms focusing on industrial electronics. Mergers and acquisitions were limited. | The industry will see increased competition with new startups and global companies entering the market. Collaborations and acquisitions are expected to rise. |

| Limited focus on sustainable packaging. The industry primarily used plastic and traditional materials, with minimal emphasis on eco-friendly alternatives. | A significant shift toward sustainable packaging, including biodegradable and recyclable materials. Companies will invest in reducing carbon footprints. |

| Automation was slowly being integrated into packaging, but manual processes were still prevalent in many areas. | AI and robotics will play a crucial role in optimizing packaging efficiency, reducing waste, and enhancing protective features. Smart packaging will become mainstream. |

| The market experienced steady growth, with foundational advancements in packaging technology. The demand remained strong, supported by Korea’s industrial and technological dominance. | The industry is poised for transformative growth, with a focus on innovation, sustainability, and efficiency. Korea will continue to be a key player in global industrial electronics packaging. |

Growing Demand for Green Packaging

Korean consumers are increasingly demanding sustainable and eco-friendly industrial electronics packaging. Companies are reacting by using recyclable, biodegradable, and reusable packaging. Companies now concentrate on minimizing carbon footprints, adopting greener production processes, and phasing out single-use plastics. Public policies and business commitments towards sustainability also drive demand, compelling additional businesses towards sustainable packaging solutions.

Growing Preference for Intelligent and Smart Packaging

Korean businesses and consumers must possess intelligent packaging that improves product protection, traceability, and customer experience. Firms employ RFID tags, QR codes, and IoT sensors to improve logistics efficiency and authenticate product authenticity. Industrial electronics producers utilize intelligent packaging to track environmental conditions, avoid damage, and give real-time information about the handling of the product. This is in line with the trend towards digital supply chain management in Korea.

Growing Demand for Miniaturization and Personalization

With industrial electronics getting more compact and sophisticated, customers demand special-purpose packaging solutions that can hold special product sizes and functionalities. Today, packaging is designed with special protective features to protect delicate electronic parts from shock, vibration, and moisture. Miniaturization further ensures less waste packaging and optimal storage and transport efficiency.

On the basis of material type, the market is segmented into plastic and paper & paperboard. Plastic continues to be the preferred product in Korea's industrial electronic packaging industry because of its stronger protective properties, durability, and lower costs.

Companies commonly employ plastic packaging as it possesses very good moisture barrier qualities, crash resistance, as well as static prevention capabilities that all of the sensitive electronic parts' delicate requirements would require. Plastic packaging is weightless, so this automatically slashes shipping cost while maximizing the logistics efficiency.

Plastic substances are highly efficient, such as polyethylene (PE), polypropylene (PP), and polyvinyl chloride (PVC), which are able to protect effectively against weather elements like moisture and temperature variation and hence become a perfect choice in industrial electronics.

On the basis of packaging form, the industry is segmented into rigid and flexible. The industrial electronics packaging market in Korea is heavier on rigid packaging due to its superior protection, ruggedness, and structural integrity. Industrial electronics such as semiconductors, circuit boards, and other sensitive components require top-level protection from physical shock, humidity, electrostatic discharge (ESD), and temperature fluctuation.

Rigid packaging materials like plastic clamshells, molded fiber trays, corrugated boxes, and hard cases provide the strength necessary to prevent damage during transit and storage. With Korea being the world leader in high-tech manufacturing, rigid packaging remains the optimum selection to shield expensive and sensitive electronics.

Based on product type, the market is divided into industrial automation equipment & others, industrial controls, power electronics, process control equipment, and testing & measuring equipment. Power electronics packaging is the largest applied segment in Korea's industrial electronics packaging market because the country is leading in semiconductor, energy, and high-tech manufacturing industries.

Power electronics such as converters, inverters, power modules, and battery management systems need special packaging solutions to maintain thermal management, electromagnetic shielding, and mechanical protection. Being the market leader in electric vehicles (EVs), clean energy, and high-k semiconductor manufacturing in Korea, powerful power electronics packaging is a continuous need.

Market concentration in the industrial electronics packaging market in Korea remains high as large players and specialized firms take up the industry. Leaders of the market demand include Samsung, LG, and SK Hynix. Key players like industrial requirements are provided by experienced packaging suppliers, supplying high-performance material and protective technology to maintain the strong electronics production base in Korea.

Large firms and specialized packaging firms maintain competitive leadership through innovation and government-sponsored initiatives. Investments in environment-friendly resources, automation, and intelligent packaging enhance their market leadership. While newcomers conquer specialty markets, incumbents reign at the top by embracing state-of-the-art protective solutions specific for Korea's fast-changing industrial electronics market.

The industry has entry barriers in terms of high-quality requirements, technological know-how, and economies of scale. Efficient players utilize advanced R&D, collaborations, and computerized production to ensure cost leadership and efficiency. Consolidation of the industry places Korea in a leadership role among global industrial electronics packaging solutions.

Korea's industrial electronics packaging sector remains highly competitive, with market leaders and specialty companies leading the way in innovation. Market leaders employ cutting-edge materials, automation, and sustainability to maintain their position. Domestic and international companies compete aggressively, pushing high-performing packaging solutions that protect industrial electronics from environmental, mechanical, and electrostatic stress.

Large electronics manufacturers such as Samsung and LG drive demand, dictating packaging industry trends. Their supply chains need precision-engineered protective packaging to ensure product safety during transportation and storage. Packaging suppliers develop customized solutions, including anti-static coatings, thermal management materials, and impact-resistant designs to meet the evolving needs of Korea's high-tech manufacturing sector.

New entrants must deal with demanding industry standards, technological competence, and financial limitations. Incumbents maintain market dominance through strategic investments in smart packaging, recyclable products, and artificial intelligence-based logistics integration. Collaboration between electronics companies and packaging companies fosters continuous research and development that maintains Korea at the forefront of industrial packaging innovation.

Sustainability is increasingly becoming a determining competitive force, influencing packaging innovation. Companies are turning their focus to biodegradable, reusable, and lightweight packaging materials in order to respond to green legislation and business sustainability goals. Companies that become cost-effective while being eco-friendly are at an advantage, as companies prioritize sustainable packaging because of regulation and consumer forces.

Technological change continues to fuel market forces as digitalization and automation enhance efficiency. Industry 4.0 solutions integrate AI-based quality checking, robotics, and real-time monitoring systems within packaging production. Industry 4.0 solution adopters realize a competitive edge by improving the accuracy of packages, reducing wastage, and optimizing supply chain processes for Korea's fast-changing industrial electronics industry.

Major Developments

The market is anticipated to reach USD 71.3 million in 2025.

The market is predicted to reach a size of USD 106.9 million by 2035.

Prominent players include Delphon Industries LLC, Summit Container Corporation, Protective Packaging Corporation, Dou Yee Enterprises (S) Pte Ltd., Dordan Manufacturing Company Inc., and others.

With respect to material type, the market is classified into plastic and paper & paperboard.

In terms of packaging type, the market is segmented into flexible and rigid.

In terms of product type, the market is divided into industrial automation equipment & others, industrial controls, power electronics, process control equipment, and testing & measuring equipment.

In terms of province, the market is segmented into South Gyeongsang, North Jeolla, South Jeolla, Jeju, and Rest of Korea.

EPE Liner Market Analysis – Size, Growth & Demand 2025 to 2035

Electron High Barrier Packaging Film Market Growth - Forecast 2025 to 2035

Envelope Market Insights – Growth & Trends Forecast 2025 to 2035

Envelope Sealing Machines Market Trends - Growth & Forecast 2025 to 2035

GHS Label Market Analysis by Material, Product Type, Printing Technology and End Use Through 2035

Packaging Testing Equipment Market Analysis & Growth 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.