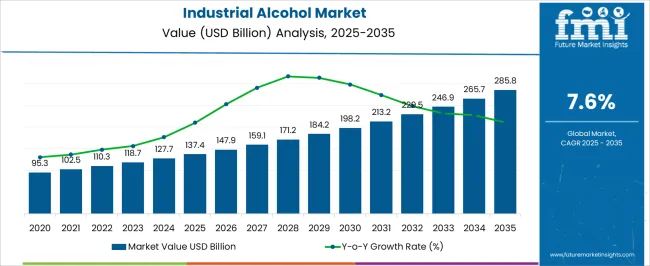

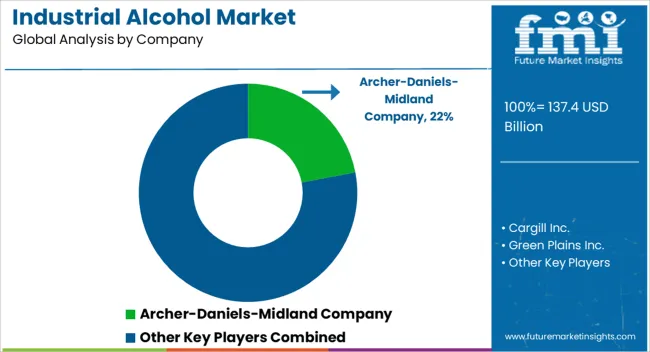

The Industrial Alcohol Market is estimated to be valued at USD 137.4 billion in 2025 and is projected to reach USD 285.8 billion by 2035, registering a compound annual growth rate (CAGR) of 7.6% over the forecast period.

| Metric | Value |

|---|---|

| Industrial Alcohol Market Estimated Value in (2025 E) | USD 137.4 billion |

| Industrial Alcohol Market Forecast Value in (2035 F) | USD 285.8 billion |

| Forecast CAGR (2025 to 2035) | 7.6% |

The industrial alcohol market is expanding steadily, supported by rising demand for bio-based chemicals, growth in the fuel blending sector, and increasing industrial applications in pharmaceuticals, personal care, and energy. Regulatory mandates encouraging the use of renewable feedstocks and emission reduction strategies are accelerating the shift from synthetic to bio-derived alcohols.

Technological advancements in fermentation, distillation, and dehydration processes have improved yield efficiency and feedstock flexibility. Supply chain developments and vertical integration by key players have also contributed to cost optimization and regional market penetration.

The rising adoption of alcohol-based disinfectants and sanitizers has expanded consumption patterns across both industrial and institutional settings. Looking ahead, the market is expected to benefit from increased ethanol blending programs, global renewable energy targets, and the proliferation of sustainable raw material sourcing across end-use verticals.

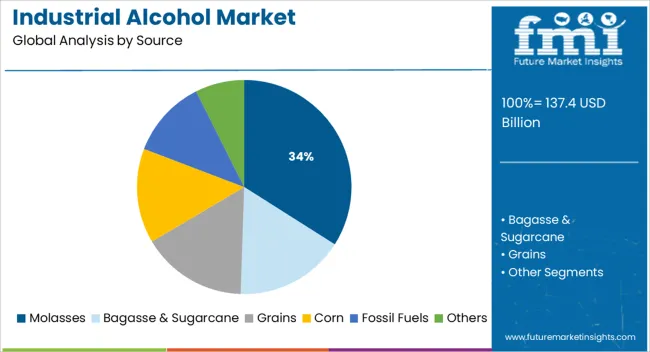

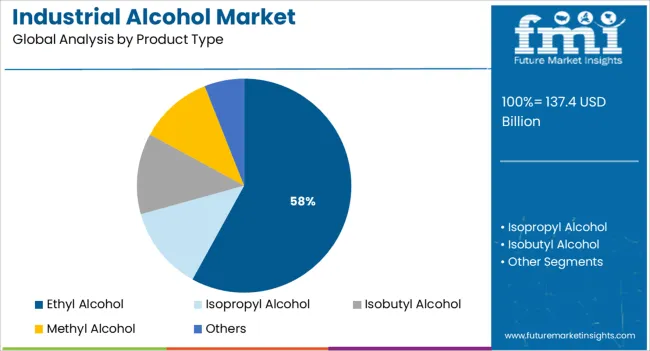

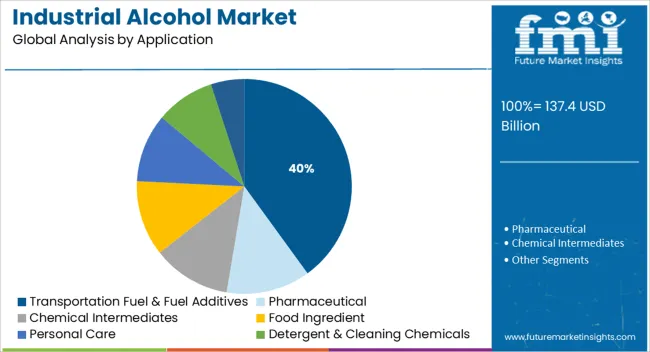

The market is segmented by Source, Product Type, Application, and Processing Method and region. By Source, the market is divided into Molasses, Bagasse & Sugarcane, Grains, Corn, Fossil Fuels, and Others. In terms of Product Type, the market is classified into Ethyl Alcohol, Isopropyl Alcohol, Isobutyl Alcohol, Methyl Alcohol, and Others. Based on Application, the market is segmented into Transportation Fuel & Fuel Additives, Pharmaceutical, Chemical Intermediates, Food Ingredient, Personal Care, Detergent & Cleaning Chemicals, and Others. By Processing Method, the market is divided into Fermentation and Synthetic. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Molasses is projected to account for 34.0% of the total industrial alcohol market revenue by 2025, positioning it as the leading source segment. This dominance has been supported by its widespread availability, cost-effectiveness, and high fermentable sugar content, which makes it an ideal substrate for ethanol production.

The use of molasses in alcohol production aligns with circular economy practices, particularly in sugar-producing regions where it serves as a key byproduct. Governments in emerging economies have promoted its utilization through ethanol blending mandates, further boosting its demand.

Additionally, molasses-based production requires relatively lower capital investment compared to grain or synthetic alternatives, supporting its continued dominance among mid-scale and decentralized producers. With supply chain stability and domestic feedstock security becoming a policy priority, molasses remains a dependable source for industrial alcohol output.

Ethyl alcohol is expected to hold a 58.0% share of the industrial alcohol market in 2025, making it the most widely used product type. Its versatility across fuel, pharmaceutical, and chemical industries has made it a cornerstone of industrial alcohol consumption.

The segment’s growth is attributed to rising bioethanol blending programs, increased pharmaceutical formulations, and its extensive application in industrial solvents and disinfectants. Ethyl alcohol’s compatibility with a wide range of feedstocks, including sugarcane, corn, and lignocellulosic biomass, supports its scalability across both developed and developing markets.

Enhanced regulatory clarity around fuel-grade ethanol standards and growing public-private partnerships in bio-refinery projects have further reinforced its market dominance. Its eco-friendly profile and established supply chains continue to make ethyl alcohol the preferred product type in the global industrial value chain.

Transportation fuel and fuel additives are projected to contribute 40.0% of the total industrial alcohol market revenue by 2025, making it the leading application segment. This leadership is driven by the global push toward cleaner fuels and reduced dependence on fossil energy sources.

Ethanol’s role as an oxygenate in gasoline has been reinforced through national mandates, especially in economies aiming to reduce vehicular emissions and improve air quality. The use of industrial alcohol as a renewable blending component has expanded significantly due to carbon reduction commitments under climate accords.

Advances in second-generation ethanol technologies and feedstock diversification have improved yield efficiencies, strengthening supply chains for fuel applications. As countries escalate their biofuel blending targets, the transportation sector continues to be the primary growth driver for industrial alcohol consumption.

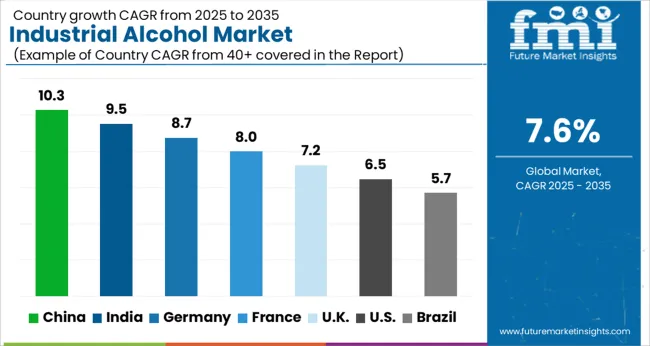

China and India Market to Benefit from Rising Industrial Alcohol Prices by Government Agencies. India has even launched its policies for alternative alcohol fuel, such as ethanol. China is dominating the East Asia industrial alcohol market and currently holds a share of more than 32.5%. This has pushed the sales of industrial alcohol in Asian markets.

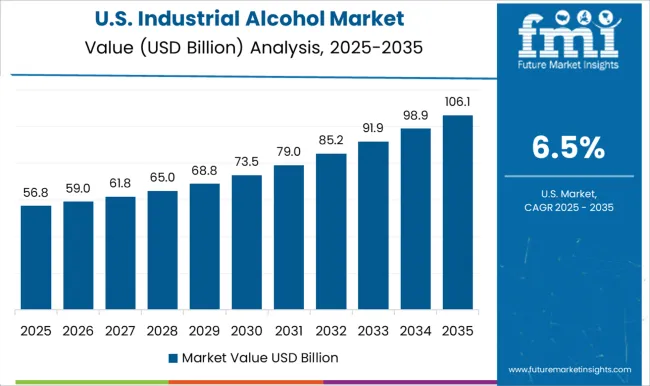

The US holds more than 75.7% of the North American industrial alcohol market share, which is predicted to increase at a CAGR of around 4.2% over the forecast period. In 2024, the US held the highest share of the industrial alcohol market in North America, finds FMI.

To expand the market space of a certain company, brands focus on building a bridge between multiple industries so that the supply chain can be enhanced and developed. In large applications, few end users are worth mentioning as they fuel the higher sale of industrial alcohol.

In medical applications in multiple medicine wings, alcohol cannot be set apart from the medical industry. From its application in the pharmaceutical sector to its benefits against anxiety and depression, industrial alcohol has become an important part of the sector. Its use in homeopathy is remarkable and the world has known it.

Beverage & Industrial Use

Apart from being an important part of the food and beverage industry, it keeps on getting used in industries such as hardware, fashion, and chemistry projects. It gives special shine and life to fashion products while it works like a catalyst and main compound In multiple chemical reactions.

Renewable Ethanol in Beverages and Industries

The new renewable ethanol experiment has been successful with multi-industries tests. Mainly formed through sugarcane, alcohol is renewable and has environmental benefits. It has been used in some industries as an alternative and has shown impressive results. Governments around the world now focus on promoting alternative fuels that involve ethanol.

Denatured alcohol is used in alcohol burners and camping stoves as a solvent and fuel. A variety of denaturing and additive methods are used in the manufacturing of denatured alcohol, which is further utilized in a wide range of applications, particularly in the industrial sector.

The most commonly used conventional additive is 10% methanol and methyl alcohol and hence it is called methylated spirits. Some of the other important additives include isopropyl alcohol, methyl ethyl ketone, acetone, and methyl isobutyl ketone.

In the USA, denatured alcohol mixtures with a higher percentage of methanol are sold. In contrast to the biochemistry denaturation method, ethanol molecules remain intact and are not chemically altered during the denaturation process.

The rapid expansion of the E15 and flex-fuel infrastructure is expected to be largely pushed by the USA Department of Agriculture’s (USDA) Higher Blends Infrastructure Incentive Program (HBIIP), which provides fuel retailers with various resources to enable true fuel choice.

Spurred by the aforementioned factors, the global industrial alcohol market is expected to showcase a CAGR of 7.6% from 2025 to 2035, as compared to the 6.2% CAGR exhibited from 2020 to 2024.

Denatured Ethanol Manufacturers to Use Industrial Alcohol

The US holds more than 75.7% of the share in the North American industrial alcohol market, which is predicted to increase at a CAGR of around 4.2% over the forecast period. In 2024, the USA held the highest share of the industrial alcohol market in North America, finds FMI.

Biogenic carbon dioxide, which is one of the industry's essential co-products that typically go unnoticed, received a lot of attention in 2024. A quarter of the USA ethanol plants capture CO2 and use it for various applications, right from beverage carbonation and wastewater treatment to meat processing and dry ice production.

With full potential, ethanol plants capture 3 to 3.5 million tons of CO2 per year, accounting for roughly 40% of the national supply. Ongoing development of innovative technologies for the production of ethanol is expected to push growth in the USA

Leather Companies in the UK are Using Industrial Denatured Alcohol, Fueling Sales

According to FMI, the UK is estimated to hold more than 17.2% of the share in the Europe industrial alcohol market in 2025. It is expected to grow at a CAGR of around 5.3% in the forecast period.

Denatured alcohol serves a variety of functions for both small-scale applications and industrial applications in a wide range of end-use industries. As long as it has not been dyed, denatured alcohol is considered to be an ideal choice for use on leather products to kill mildew.

To avoid surface damage, it must be mixed equally with water for leather applications. Denatured alcohol as a cleaning agent can be used to remove dirt, paint, and debris from surface coatings. It also works well as a solvent for removing adhesives, oils, lubricants, and grime from a wide range of surfaces.

Excess adhesive or existing wax coatings on finished products such as furniture can be easily removed with a rag containing denatured alcohol. The rapid expansion of the industrial cleaners market in the UK is expected to create new growth opportunities for industrial alcohol manufacturers.

China and India Market to Benefit from Rising Industrial Alcohol Prices by Government Agencies

China is dominating the East Asia industrial alcohol market and is currently holding a share of more than 32.5%. It is expected to grow at a CAGR of around 6.3% in the forecast period. In South Asia, on the other hand, the Indian alcohol market is anticipated to remain at the forefront through 2035.

Rising crude oil prices are set to open new growth opportunities for biofuel manufacturers in both countries. The Indian government is planning to surge ethanol production in the next decade.

The government has also increased its federal interest assistance scheme to facilitate new distillery capacity projects for manufacturing 127.7 million tons of ethanol annually. It has raised the prices of ethanol from December 2024 to November 2024.

Industrial Alcohol Manufacturers to Utilize Corn as a Source

Based on the source, the corn segment is set to dominate the global industrial alcohol market by holding more than 30.2% of its share in 2025. It is expected to grow at a CAGR of around 4.2% over the forecast period, says FMI.

Ongoing development of the ethanol industry worldwide is expected to boost the production of distillers' grains and corn gluten meal. These are likely to be utilized as feedstock for biodiesel production or animal feed.

For instance, according to the Renewable Fuels Association (RFA), in 2024, ethanol producers in the US generated 33.1 million metric tons (MMT) of distillers grains, and gluten meal.

These bio-products are valuable protein-rich substitutes for corn, soybean meal, and other ingredients used to feed dairy cows, chickens, pigs, fish, turkeys, and other animals around the globe. These factors are likely to bolster the corn segment in the upcoming decade.

Preference for Ethyl Alcohol among Denatured Ethanol Manufacturers to Drive Growth

By product type, the ethyl alcohol segment is expected to dominate the global industrial alcohol market and hold more than 31.2% of the share in 2025, finds FMI. It is expected to grow at a CAGR of around 3.9% over the forecast period.

Ethyl alcohol is a renewable fuel that can be blended with gasoline and has high octane content. Ethanol produced from various sources, including corn, potatoes, wheat, barley, sugar crops, and grain sorghum has the same chemical properties and is available in numerous forms.

The US is considered to be a global leader in terms of corn-based ethanol production. Furthermore, increasing the production of sugar in Brazil and several countries in the Asia Pacific, including India and Indonesia is likely to drive the segment.

Besides, the fermentation ability of sugar molasses makes them suitable for ethanol production. Sugarcane and its derivatives are the world's second-largest feedstock for ethanol production, followed by corn. Over the forecast period, Brazil is expected to be the largest producer of sugarcane-based ethanol.

Transportation Fuel Producers to Adopt Industrial Denatured Alcohol

Based on application, the transportation fuel and fuel additives segment is expected to dominate the industrial alcohol market by holding more than 26.7% of the share in 2025. As per FMI, it is expected to grow at a CAGR of around 4.3% over the forecast period.

Growth is mainly attributed to the ongoing expansion of the automotive industry across the globe. Demand for gasoline-powered vehicles has increased significantly in Europe and the Asia Pacific, which would also drive the segment.

The use of bioethanol in existing gasoline vehicles would benefit the environment as it generates fewer toxic elements than other fossil fuels such as fossil fuel-based gasoline and diesel. Besides, bioethanol can extend an engine's lifespan. Owing to increasing sales of flexible fuel vehicles, bioethanol manufacturers are expected to surge their products worldwide.

The global industrial alcohol market is highly fragmented due to the presence of various mid-sized and small competitors. Mergers and acquisitions, product innovations, and capacity expansions are some of the key strategies adopted by major players.

For instance

| Attribute | Details |

|---|---|

| Estimated Market Size (2025) | USD 137.4 billion |

| Projected Market Valuation (2035) | USD 285.8 billion |

| Value-based CAGR (2025 to 2035) | 7.6% |

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2024 |

| Market Analysis | Value (USD Billion) and Volume (MT) |

| Key Regions Covered | North America; Latin America; Europe; East Asia; South Asia; Oceania; and the Middle East & Africa |

| Key Countries Covered | United States of America, Canada, Brazil, Mexico, Chile, Peru, Argentina, Germany, Italy, France, United Kingdom, Spain, BENELUX, Nordic, Russia, Poland, China, Japan, South Korea, India, Thailand, Indonesia, Malaysia, Singapore, Australia, New Zealand, GCC Countries, Turkey, South Africa, North Africa, and Central Africa |

| Key Segments Covered | Source, Product Type, Application, Processing Method, and Region |

| Key Companies Profiled | Cargill Inc.; Archer-Daniels-Midland Company; Green Plains Inc.; Grain Millers Inc.; Willmar Group; MGP Ingredients, Inc.; Cristalco; Royal Dutch Shell Plc; Raizen Energia; GREENFIELD SPECIALTY ALCOHOLS |

| Report Coverage | Market forecast, company share analysis, competition intelligence, Drivers, Restraints, Opportunities and Threats analysis, market dynamics and challenges, and strategic growth initiatives |

The global industrial alcohol market is estimated to be valued at USD 137.4 billion in 2025.

The market size for the industrial alcohol market is projected to reach USD 285.8 billion by 2035.

The industrial alcohol market is expected to grow at a 7.6% CAGR between 2025 and 2035.

The key product types in industrial alcohol market are molasses, bagasse & sugarcane, grains, corn, fossil fuels and others.

In terms of product type, ethyl alcohol segment to command 58.0% share in the industrial alcohol market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Industrial Grade Electrochemical CO Sensor Market Size and Share Forecast Outlook 2025 to 2035

Industrial Bench Scale Market Size and Share Forecast Outlook 2025 to 2035

Industrial Low Profile Floor Scale Market Size and Share Forecast Outlook 2025 to 2035

Industrial Sand Mill Market Size and Share Forecast Outlook 2025 to 2035

Industrial Control Network Modules Market Size and Share Forecast Outlook 2025 to 2035

Industrial Precision Oven Market Size and Share Forecast Outlook 2025 to 2035

Industrial Water Chiller for PCB Market Size and Share Forecast Outlook 2025 to 2035

Industrial & Commercial HVLS Fans Market Size and Share Forecast Outlook 2025 to 2035

Industrial Robot Controller Market Size and Share Forecast Outlook 2025 to 2035

Industrial Wired Routers Market Size and Share Forecast Outlook 2025 to 2035

Industrial Evaporative Condensers Market Size and Share Forecast Outlook 2025 to 2035

Industrial Energy Management System Market Size and Share Forecast Outlook 2025 to 2035

Industrial Insulation Market Size and Share Forecast Outlook 2025 to 2035

Industrial Safety Gloves Market Size and Share Forecast Outlook 2025 to 2035

Industrial Cleaner Market Size and Share Forecast Outlook 2025 to 2035

Industrial Dust Treatment System Market Size and Share Forecast Outlook 2025 to 2035

Industrial Vertical Washing Tower Market Size and Share Forecast Outlook 2025 to 2035

Industrial Pepper Market Size and Share Forecast Outlook 2025 to 2035

Industrial Electronics Packaging Market Forecast and Outlook 2025 to 2035

Industrial Absorbent Market Forecast and Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA