World industrial air compressor market will grow more from 2025 to 2035 based on expanding applications of power-saving compressed air systems, expansion of manufacturing activities in all sectors, and ongoing advancement of infrastructure worldwide. Industrial air compressors are part of operations that vary from driving manufacturing equipment and air tools to delivering sustained pressure so that advanced industrial processes are properly serviced.

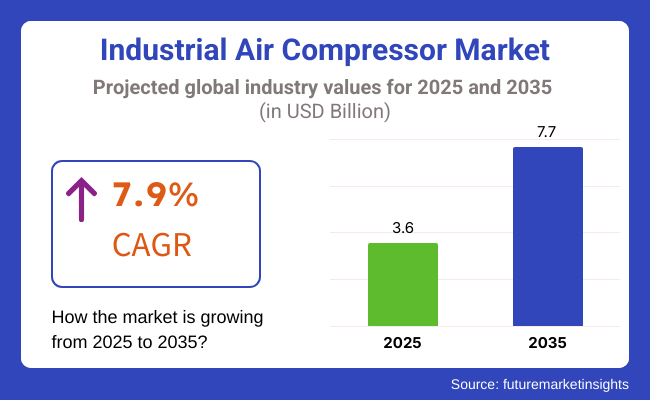

The pursuit of sustainability has also brought technology in the shape of variable-speed drive (VSD) and oil-free compressors, which have taken the market to record heights. It was approximately USD 3.6 Billion in 2025. It is projected to grow to USD 7.7 Billion by 2035 with a compound annual growth rate (CAGR) of 7.9%. This is all supported by real industrialization in the emerging economies, increasing energy needs, and increased demand for efficient and dependable compressed air solutions for industrial applications like automotive, food and beverage, and pharma.

Explore FMI!

Book a free demo

North America remains the North American technology center for industrial air compressors both in terms of energy efficiency and the environment. United States of America and Canadian, technology-intensive, very advanced industries propel the increasing volume-compression technology demand.

Access to large-scale manufacturers as well as favorable government policy supporting energy-compatible equipment has stimulated VSD and oil-free compressor investment. Furthermore, increasing activity in food processing, health care, and high-value manufacturing industries propel long-term industry growth in the market.

Europe is the dominant market for industrial air compressors due to the well-developed production industry, robust environmental regulation, and power-saving program. Germany, Italy, and France are among the industrial powerhouses of the developed world that must possess effective compressed air solutions.

The quest for energy to carbon-free energy and the utilization of alternative energy within the region has propelled low-emission, high-efficiency compressor technologies development and implementation. Business needs of high-performance energy-efficient air compressors continue to grow with mounting concerns on sustainability.

The most rapidly growing industrial air compressor market is Asia-Pacific because of a rising industrialization rate, new infrastructure projects, and increasing manufacturing operations in Japan, India, and China. Increased Asian automotive, electrical, and construction industries are prime drivers for the use of compressors.

Aside from this, greater focus on automation and intelligent manufacturing and higher energy cost have generated newer and energy-saving applications of compressors. Low-cost manufacturing bases and rising foreign direct investment (FDI) also enhance the opportunities for growth in the Asia-Pacific region.

Challenge

High Energy Consumption and Maintenance Costs

The physical wear and tear of compressor internal components like filters, setups and valves lead to regular maintenance, which gives rise to added downtimes and repair costs. Industry complexities are exacerbated by the need to comply with strict energy efficiency and emissions standards Adoption of ISO 8573 and DOE regulations.

To combat these problems companies need to invest in energy-efficient technologies for compressors, predictive maintenance driven by AI (artificial intelligence), and intelligent monitoring systems to reduce long-term costs and optimize efficiency.

Opportunity

Growth in Smart Manufacturing and Energy-Efficient Solutions

The burgeoning adoption of Industry 4.0, automation and energy-efficient systems opens a and opportunities for the Industrial Air Compressor Market. Growing industry demand for IoT-enabled, variable-speed drive (VSD) compressors, with real-time performance monitoring, is attributed to the ongoing transition to intelligent manufacturing.

AI-driven analytics, remote diagnostics, and digital twin technology are bringing improved system reliability, energy wastage reduction, and automation in multiple areas. Moreover, in a move towards oil-free and greener compressors caters to sustainability of industrial operations.

Smart energy optimization, cloud-integrated compressor monitoring and hybrid air compression systems will offer businesses a competitive edge as industries continue to evolve and innovate in the age of Industry 4.0.

The growing VSD technology for variable compressor efficiency, connected filtration systems, and cloud-based observation services helped companies innovate the compressors. But high operating costs, maintenance challenges, and regulatory pressures limited market growth. To solve these problems, industry stakeholders created AI-based diagnostics powered by low-energy air compression and consolidated predictive maintenance with reliability and performance improvements.

Looking ahead to 2025 to 2035 transformative shifts will be in automation, AI-powered performance optimization and eco-friendly compressor tech. Hydrogen powered and solar-amplified compressors will lead a renaissance in industrial energy efficiency. Finally, short-term innovations in self-learning compressor networks, automated fault detection, and compressed air energy storage (CAES) systems will further develop the compressor landscape.

The advantages of quieter, low-maintenance, and ultra-efficient compressors will continue to redefine the landscape of industrial air compression. Businesses implementing AI-powered efficiency monitoring, sustainable air-compression solutions that are environmentally friendly, and next-generation materials designed for durability will dominate industry growth.

Market Shifts: A Comparative Analysis (2020 to 2024 vs. 2025 to 2035)

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Compliance with ISO 8573, DOE energy standards, and air quality regulations |

| Technological Advancements | Growth in VSD compressors, smart diagnostics, and energy-efficient designs |

| Industry Adoption | Increased use in manufacturing, automotive, and construction |

| Supply Chain and Sourcing | Dependence on metal-based compressor components and lubricants |

| Market Competition | Dominance of traditional compressor manufacturers |

| Market Growth Drivers | Demand for industrial automation, manufacturing expansion, and construction growth |

| Sustainability and Energy Efficiency | Initial adoption of low-energy air compressors and improved filtration |

| Integration of Smart Monitoring | Limited real-time tracking and basic diagnostic monitoring |

| Advancements in Air Compression | Use of conventional rotary and reciprocating compressors |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Expansion of AI-driven compliance tracking, low-emission compressors, and sustainability-driven policies. |

| Technological Advancements | Widespread adoption of AI-powered fault detection, autonomous air compression systems, and hydrogen-powered compressors. |

| Industry Adoption | Expansion into renewable energy projects, smart factories, and digitalized industrial operations. |

| Supply Chain and Sourcing | Shift toward lightweight composite materials, oil-free compressor technology, and sustainable refrigerants. |

| Market Competition | Rise of automation-driven air compressor solutions, smart monitoring startups, and energy-efficient compressor innovations. |

| Market Growth Drivers | Increased investment in eco-friendly air compression, AI-driven monitoring, and self-regulating compressor networks. |

| Sustainability and Energy Efficiency | Large-scale deployment of carbon-neutral compressors, CAES systems, and AI-optimized energy consumption models. |

| Integration of Smart Monitoring | AI-enhanced predictive maintenance, real-time air quality monitoring, and cloud-integrated efficiency tracking. |

| Advancements in Air Compression | Development of autonomous, AI-assisted, and renewable-powered compressor systems with real-time adaptability. |

The growth of the food & beverage, pharmaceutical, and semiconductor industries where oil-free compressed air is a necessity also contributes to the growth of the market. The growth of smart factories and automation technologies is further driving the need for IoT-enabled high-performance air compressors.

Several initiatives from the government focused on establishing energy efficiency and sustainability, such as energy standards set by the DOE, are spurring the transition to advance and environmentally friendly air compression technologies.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 8.2% |

The UK air compressor market is expected to grow steadily, fuelled by the modernization of manufacturing, green energy initiatives, and growing industrial automation. Stringent government regulations on carbon will increase the adoption of energy-efficient air compression systems.

The low-maintenance and oil-free air compressors are being utilized by automotive, aerospace, and pharmaceuticals industries to meet safety and hygiene standards. Moreover, hydrogen energy development and the shift to environment-friendly manufacturing processes are propelling the demand for high-performance air compressors.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 7.8% |

Factors such as stringent environmental regulations, increased adoption of renewable energy, and rising industrial automation are contributing to the strong growth of the European industrial air compressor market. With leading economies such as Germany, France and Italy experiencing high demand for air compression solutions that are efficient and require low maintenance

Industrial Air compressor are known to be high energy consumers. EU-wide energy efficiency laws and regulations for CO2 reductions are leading industries to positioning themselves towards the energy efficiency landscape such as Variable Speed Drive (VSD) and oil-free air compressor. The fast-growing EV manufacturing and aerospace market is also driving demand..

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 8.0% |

Japan offers a sophisticated market for industrial air compressors due to its precision manufacturing, robotics, and energy-efficient technologies. Since the country’s semiconductor, automotive, and pharmaceutical industries have high quality and performance requirements, oil-free and energy-efficient air compressors are preferred.

Another sector that Japan leads is hydrogen energy and fuel cell production which, once again, relies heavily on air compression. Furthermore, government policies directing industries to use low-carbon industrial operations are prompting industries to adopt next-generation air compressors integrated with IoT-based performance monitoring.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 8.1% |

The South Korean Industrial Air Compressor Market has been rapidly rising aided by the increasing growth of the semiconductor, automotive, and electronics sectors. The nation is currently a world leader in electric vehicle battery production, where air compressors are critical to accurate and efficient manufacturing methods.

The investment in hydrogen energy and green industrial infrastructure in South Korea has also contributed to demand for high-efficiency compressed air systems. Furthermore, government incentives start manufacturing energy efficiency are playing an imperative role in promoting industries bestow smart air compressors with AI capabilities..

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 8.2% |

The industrial air compressor market include the short and medium to history alternating current drives, the pneumatic and industrial air compressor holding a predominating share in the industry's market, and the surge in demand in manufacturing, energy, and the process of sectors as industries are investing in industrial air compressor with increasing frequency for power, efficiency, and reliability to redundant times of production. Serving as these critical industrial components, which are integral in compressed air applications, including pneumatic systems, process automation, and large-scale energy generation, and thus essential for industrial automation, manufacturing, and heavy-duty applications.

Rotary industrial air compressors are among the most adopted air compression technologies due to their compact design, continuous-duty operation, and energy efficiency for a wide range of industrial applications. Whereas reciprocating air compressors use pistons to compress air in separate strokes, rotary compressors use a screw-based mechanism that allows for continuous compression.

Modern industries are adopting rotary air compressors supported with energy efficient air compression solutions such as low power consumption, less heating and optimized air output, mainly due to increasing energy delivery and consumption in industries. According to studies, rotary screw compressors are used in over 60% of industrial applications both for slice tools.

The proliferation of industrial automation and process-oriented manufacturing - with robotic assembly lines, precision machining and smart factory ecosystems - has bolstered market demand and assured increased penetration of rotary air compressors for pneumatic applications.

Additionally, the blend of AI-powered air compressor monitoring with functionalities like real time performance monitoring and predictive maintenance along with automated energy optimization is further propelling adoption, enabling greater reliability of the system and cost savings.

Product developments such as new oil-free rotary screw compressors, providing contamination-free compressed air for pharmaceutical and electronics manufacturing and food processing applications have boosted the market growth by complying with stringent regulations in various industries.

Moreover, the growing use of variable-speed drive (VSD) rotary air compressors with intelligent motor control and adaptive changes in air output has supported further market development, with better efficiency and adaptability across industrial operations.

However, due to high initial investment costs, increased demand for periodic lubrication, and performance restraints for ultra-high pressure applications, demand for rotary industrial air compressor segment is hindered despite its better energy efficiency, continuous duty operation low maintenance. However, new disruptive innovations in the areas of AI-driven compressor efficiency optimization, hybrid oil-free compression technology, and next-gen compact rotary designs are yielding improvements in efficiency, cost-effectiveness, and versatility, which promise to enable sustained market growth for rotary industrial air compressors.

Surging market penetration of centrifugal industrial air compressors in large-scale industrial processes, petrochemical processing, and high-volume compressed air systems, as industries escalate their capitulation toward high-capacity compression mechanisms for continuous and heavy-duty application. Centrifugal air compressors use a dynamic compression process (as opposed to rotary and reciprocating compressors) with high-speed impellers to produce continuous air pressure, offering minimal wear and tear.

As industries look for technology that can enhance high-demand operations, the demand for oil free, high-capacity air compression solution with large-scale compressed air generation for power plant, industrial gas processing and large-scale manufacturing systems has fuelled the demand for centrifugal air compressors. Centrifugal air compressors are used in more than 55% of all high-volume compressed air applications and are expected to be in high demand in this segment, as per the studies.

Increasing demand for centrifugal air compressor in large-scale infrastructure projects has been witnessed due to growing power generation and heavy engineering sectors including high-pressure gas handling, industrial cooling and turbine support systems across the globe.

The introduction of AI based condition monitoring, automatic flow optimization and compressor modelling using digital twin, have led to increased adoption across sectors with enhanced efficiency and predictive performance diagnostics.

Advancements in small, energy-efficient centrifugal air compressors with modular multi-stage designs & improved aerodynamic features are also fuelling market growth while providing better flexibility in energy-consuming industrial applications.

Furthermore, the implementation of hybrid centrifugal compressor technology, which comprises both centrifugal and axial flow designs, seeking to distribute optimal efficiency, has supported market expansion, valid to achieve optimal energy savings and low operating costs for the industrial facilities.

This energy-efficient compression technology benefits from high-capacity operation, oil-free compression, and long-term durability, but the industrial air segment faces hurdles in the form of high-capex per-facility build-out costs, demanding installation requirements, and operational constraints related to variable speed applications. Nonetheless, recent advances in AI-enabled centrifugal flow management, hybrid refrigeration solutions, and renewable high-velocity transmission methods are driving energy savings, enhanced scalability and cost efficiency, paving the way for ongoing growth for centrifugal industrial air compressors.

There are two primary market drivers behind the 500 to 2000 HP and 2000 to 5000 HP industrial air compressor segments, companies are integrating high-power air compression systems for large-scale operations, energy-intensive processes, as well as high-demand pneumatic applications.

The 500 to 2000 HP air compressor category has grown into one of the most demanding power segments, providing high-efficiency air compression solutions for classic medium to large scale production as well as processing and industrial automation facilities. Designed for the same range of industrial applications, 500 to 2000 HP air compressors provide versatility without the cost of a larger air compressor.

Mid-range industrial air compression, which find applications in precision machining, pneumatic tool operations and material handling systems, is witnessing increased adoption of 500 to 2000 HP air compressors as industries are more focused on optimized air supply and reduced operational costs.

Also, according to recent studies, more than 50% of medium-scale industrial plants use 500 - 2000 HP air compressor for production efficiency, creating strong demand for this segment.

Market demand has been bolstering the adoption of mid-range air compressors, presented by the proliferation of energy efficient production, compressor load balancing modules, AI integrated airflow supervision systems, and digital twin performances analytics.

While providing benefits like cost-efficiency, operational reliability, and flexibility for use in various industries, the 500 to 2000 HP air compressor range has limitations including restriction on ultra-high-pressure applications, maintenance requirements at regular intervals during which normal functioning is halted, and sound emissions that impact factory conditions. Nonetheless, evolving advancements in hybrid energy-efficient compressor drives along with AI-assisted load balancing, and integrated noise reduction technologies are adding value into its efficiency, adaptability, and flexibility of operation, paving ways for sustained growth in demand for 500 to 2000 HP air compressors.

The 2000 to 5000 HP air compressor solutions have been more popular in the market, specifically under heavy manufacturing, oil & gas processing and power generation, sectors where industries are willing to invest on large-scale and high-capacity air compression solutions for their operations. 2000 to 5000 HP units are high-pressure machines, very different from most mid-range air compressors.

End users are demanding high efficiency at the lowest operational cost, leading to the adoption of initiation components such as 2000 to 5000 HP air compressors for demand across mission-critical industrial applications requiring high volume airflow, including petrochemical plants, steel manufacturing, and power generation turbines.

Although offering high-volume airflow capabilities, proven industrial scalability, and long-term durability, the 2000 to 5000 HP air compressor segment faces obstacles including high energy consumption, a greater capital investment requirement, and operational intricacy under load-fluctuation conditions. But innovations in AI-powered efficiency management, modular high-pressure compressor designs, and next-generation hybrid turbine-compressor configurations are enhancing efficiency, sustainability and cost-effectiveness and ensuring continued growth for 2000 to 5000 HP air compressors.

The primary drivers for Industrial Air Compressor systems is the growing need for energy efficient compressed air solutions, the automation of manufacturing and improvements of technologies of oil-free and variable speed drive (VSD) industrial air compressing systems. To improve operational efficiency, reliability, and sustainability, companies are investing in AI-powered predictive maintenance, smart monitoring systems, and green compressor solutions. These include global heavy machinery manufacturers, specialized air compressor providers, and industrial automation firms, all contributing to innovation in rotary screw, centrifugal, reciprocating, and scroll air compressors.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Atlas Copco AB | 18-22% |

| Ingersoll Rand Inc. | 15-20% |

| Gardner Denver Holdings (Now part of Ingersoll Rand) | 12-16% |

| Kaeser Kompressoren SE | 8-12% |

| Hitachi Industrial Equipment Systems Co., Ltd. | 5-9% |

| Other Companies (combined) | 35-45% |

| Company Name | Key Offerings/Activities |

|---|---|

| Atlas Copco AB | Develops smart air compressor systems, variable speed drive (VSD) compressors, and AI-integrated remote monitoring solutions. |

| Ingersoll Rand Inc. | Specializes in high-efficiency industrial air compressors, oil-free systems, and compressed air automation solutions. |

| Gardner Denver Holdings (Now part of Ingersoll Rand) | Manufactures centrifugal, rotary screw, and reciprocating compressors with energy-efficient technologies. |

| Kaeser Kompressoren SE | Provides smart air system solutions, compressed air energy recovery, and precision control compressors. |

| Hitachi Industrial Equipment Systems Co., Ltd. | Offers next-generation air compressor solutions for industrial automation, integrating IoT and AI-based efficiency monitoring. |

Key Company Insights

Atlas Copco AB (18-22%)

Atlas Copco has a significant leadership position in the industrial air compressor space, including energy-efficient VSD air compressors, AI-driven predictive maintenance, and smart factory solutions.

Ingersoll Rand Inc. (15-20%)

Ingersoll Rand focuses on high-efficiency industrial air compressors to guarantee advanced compressed air control solutions and oil-free technology needed for critical applications.

Gardner Denver Holdings (12-16%)

Cost-effective centrifugal, rotary screw and reciprocating air compressor solutions with Gardner Denver.

Kaeser Kompressoren SE (8-12%)

Kaeser Kompressoren makes precision-engineered air compressors that include remote monitoring, energy recovery, and intelligent efficiency optimization.

Hitachi Industrial Equipment Systems (5-9%)

Hitachi produces industrial-grade air compressors with IoT-enabled performance and AI-driven efficiency improvements.

Other Key Players (35-45% Combined)

Many industrial equipment manufacturers and automation companies are leading next-generation air compressor designs: AI-powered compressed air controllers and energy-efficient air systems. These include:

The overall market size for Industrial Air Compressor Market was USD 3.6 Billion in 2025.

The Industrial Air Compressor Market is expected to reach USD 7.7 Billion in 2035.

The demand for the industrial air compressor market will grow due to increasing industrial automation, rising demand from manufacturing and oil & gas sectors, advancements in energy-efficient compressor technology, and expanding applications in construction, healthcare, and food & beverage industries.

The top 5 countries which drives the development of Industrial Air Compressor Market are USA, UK, Europe Union, Japan and South Korea.

Rotary and Centrifugal Industrial Air Compressors Drive Market to command significant share over the assessment period.

Diaphragm Coupling Market Growth - Trends & Forecast 2025 to 2035

HID Ballast Market Growth - Trends & Forecast 2025 to 2035

Glass Door Merchandisers Market Growth - Trends & Forecast 2025 to 2035

Hydrostatic Testing Market - Trends & Forecast 2025 to 2035

Rubber Extruder Market Growth - Trends & Forecast 2025 to 2035

Extrusion Equipment Market Growth - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.