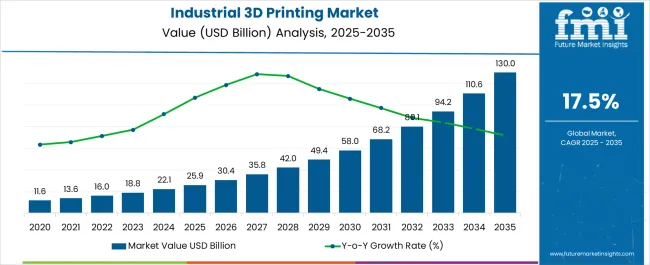

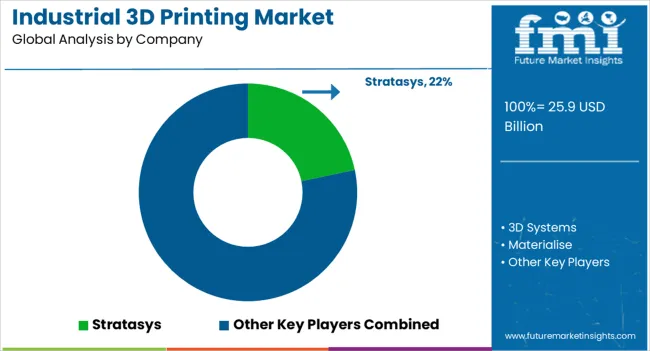

The Industrial 3D Printing Market is estimated to be valued at USD 25.9 billion in 2025 and is projected to reach USD 130.0 billion by 2035, registering a compound annual growth rate (CAGR) of 17.5% over the forecast period.

| Metric | Value |

|---|---|

| Industrial 3D Printing Market Estimated Value in (2025 E) | USD 25.9 billion |

| Industrial 3D Printing Market Forecast Value in (2035 F) | USD 130.0 billion |

| Forecast CAGR (2025 to 2035) | 17.5% |

The industrial 3D printing market is experiencing accelerated growth due to the increasing adoption of additive manufacturing technologies across automotive, aerospace, healthcare, and consumer goods industries. The ability to reduce production time, lower material wastage, and enable complex geometries has positioned industrial 3D printing as a critical component of modern manufacturing strategies.

Companies are investing in advanced printers, materials, and software integration to scale up production while ensuring precision and cost efficiency. Government initiatives promoting smart manufacturing and Industry 4.0 frameworks are further strengthening adoption.

The market outlook is positive, supported by the growing demand for customized solutions, supply chain resilience, and continuous advancements in printer capabilities, including higher speed, multi material processing, and automation integration.

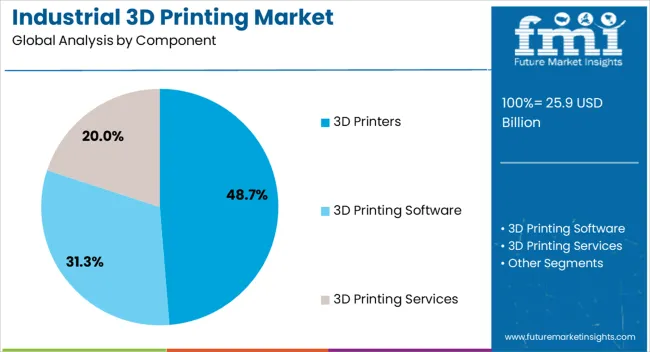

The 3D printers segment is projected to account for 48.70% of total revenue by 2025 within the component category, making it the dominant segment. Growth has been driven by rising demand for high performance printers capable of handling industrial scale applications.

Increasing investments in advanced printer models that offer greater precision, build size flexibility, and faster production speeds have further supported segment leadership. Manufacturers are focusing on integrating printers into large scale production lines to enable cost effective and on demand manufacturing.

These factors have reinforced the position of 3D printers as the cornerstone of the industrial 3D printing market.

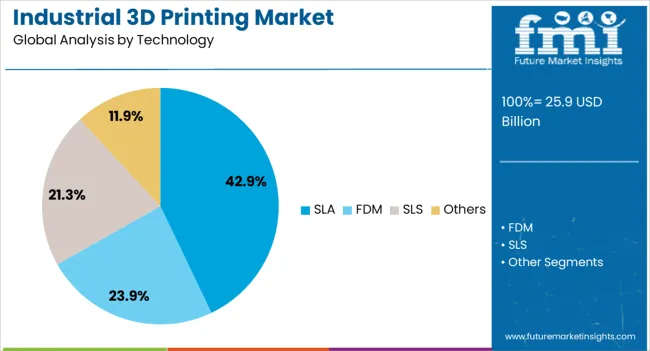

The SLA technology segment is expected to contribute 42.90% of total revenue by 2025 within the technology category, establishing it as the leading segment. Its dominance is attributed to superior surface finish, high dimensional accuracy, and versatility in material compatibility.

SLA has been widely deployed in industries that demand intricate detailing and high quality prototypes, including healthcare and automotive. The ability of SLA printers to produce complex geometries with minimal post processing has further enhanced adoption.

Continuous improvements in resin formulations and printer design are supporting broader applications, solidifying SLA’s position as the preferred industrial 3D printing technology.

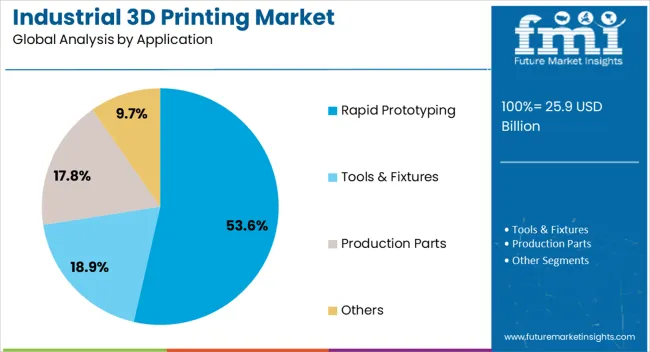

The rapid prototyping segment is projected to hold 53.60% of market revenue by 2025 under the application category, making it the most significant use case. Demand is being fueled by industries seeking faster product development cycles, reduced design iteration costs, and accelerated time to market.

The ability to quickly create functional prototypes for testing and validation has positioned rapid prototyping as a core driver of innovation. Its adoption has been further supported by advancements in printer speed, material diversity, and software integration that streamline prototyping workflows.

As companies prioritize agility and cost efficiency, rapid prototyping continues to dominate the industrial 3D printing application landscape.

As new and emerging players entering into the market, the 3D Printing Industry is proving divers in nature. New start-ups like ICON(USA), Spectroplast(Switzerland), Laser Melting Innovations(Germany), One Click Metal (Germany) are coming up with new promising technologies like silicone 3D printing, developing of low-cost Laser Powder Bed Fusion 3D printer, new 3D printing based on the electro photographic process.

Due to increase in number of new players and their new technologies in the market, the industrial 3D printing market has continued to grow and is now expanding and expect this number to grow considerably. It is thus fueling the healthy competition and pushing companies to focus more on innovation and development.

According to industry research, the global 3D printing market size is expected to reach nearly USD 49.4 billion by 2029, and it will be surging at a CAGR of about 25% in the next 5 years. The 3D printing becoming popular in healthcare because of its applications such as to create patient-specific body parts and organs using data from CT and MRI scans.

Also 3D-printing accurately replicated anatomical structures for treating aortic dissection and aortic aneurysm using CT scans of patients. Hence, looking into the growth, increasing application of 3D printing technology in healthcare is set to become a key driver.

The major challenge or restrain growth of the Industrial 3D Printing is high initial investment along with complex components, machinery, high level technology etc., and that’s why the manufacturing cost of 3D Printing is high. Also the challenge of the Industrial 3D Printing is, cost of raw materials for manufacturing of 3D printed industrial production parts and components.

The 60-70% material used for 3D printing is polymers and cost of polymers is high as compare to other materials, due to which the overall production cost increases. The cost of metal material for 3D Printing is about USD 500 per kg which is way more than the alternate products available in the market. Due to increase in production cost of the product 3D Printing industry’s growth is saturated.

The key vendors in the Industrial 3D Printing Market are identified based on their country of origin, different regions, developments, product diversification, and industry expertise. These vendors include-

These vendors are adopting various key strategies, to increase their customer base locally and globally. They are spending millions of dollars into product research & development to fulfill the requirements of their customers.

The companies involved in 3D Printing are carrying out different expansion strategies organic as well as inorganic for increasing their market share in the global Industrial 3D Printing Market.

Industry 4.0 has seen implementation and integration of new emerging technology like Big data, Model Simulation, Cloud Technology, Augmented Reality, 3D Printers/Additive Manufacturing, Artificial Intelligence, Autonomous Robots and Cyber security. Industry 4.0 introduce ‘Smart manufacturing’ in which physical systems expected to communicate with each other in Cloud Technology/virtual mode/ Internet of Things (IoT) though wireless web.

Today 3D printing technology is at a stage where companies are starting to realize tangible value for themselves and their customers using the technology. The old technology printers were slow as per the time concern but it can be the opportunity for 3D printers industry in coming days. 3D printers will be the great solution for mass production if key vendors find the solution over time constraints.

3D printing industry is spread over the region North America, Europe, Asia Pacific, and other regions. But North America, especially the USA, is at top in 3D printing industry as majority of key vendors like Stratasys and other vendors are based out of USA region.

These vendors creates opportunities for the new emerging players in the technologies like Fused Deposition Modelling (FDM) and Stereolithography (SLA). The use of 3D printing is increased in USA due to high demand form industrial sectors such as aerospace, automotive, medical devices, oil and gas sectors and others, for wide range of applications to create production parts, tools and prototypes.

As per the announcement by government across MEA region, it is expected that the construction of 25% of buildings in Dubai to be based on 3D printing technologies by 2035. The major driving factor to adopt 3D printing industry in MEA is construction, which is supposed to increase the demand for sustainable 3D printing technology market.

Dubai has adopted 3D printing technology by considering major factors like reduction in the labour costs, reduce time, increase in accuracy, customization of the products. UAE accounted for around 18% of the MEA 3D printing market in 2024 and is expected to hold nearly 22% of the market share by the year 2025. So UAE is expected to dominate in 3D Printing market in coming years, in the MEA region.

The global industrial 3D printing market is estimated to be valued at USD 25.9 billion in 2025.

The market size for the industrial 3D printing market is projected to reach USD 130.0 billion by 2035.

The industrial 3D printing market is expected to grow at a 17.5% CAGR between 2025 and 2035.

The key product types in industrial 3D printing market are 3D printers, 3D printing software and 3D printing services.

In terms of technology, sla segment to command 42.9% share in the industrial 3D printing market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

3D Printing Industry Analysis in Middle East Size and Share Forecast Outlook 2025 to 2035

3D Printing Ceramics Market Size and Share Forecast Outlook 2025 to 2035

3D Printing Metal Market Size and Share Forecast Outlook 2025 to 2035

3D Printing in Aerospace and Defense Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

3D Printing Market Size and Share Forecast Outlook 2025 to 2035

3D Printing in Automotive Market Size and Share Forecast Outlook 2025 to 2035

3D Printing In Construction Market Size and Share Forecast Outlook 2025 to 2035

3D Printing Dental Devices Market Growth - Trends & Forecast 2025 to 2035

3D Printing Photopolymers Market Trends, Analysis & Forecast by Material, Application and Region through 2035

3D Printing Materials Market Analysis by Material Type, Form, Application, and Region from 2025 to 2035

Market Positioning & Share in the 3D Printing Metal Industry

Evaluating 3D Printing Filament Market Share & Provider Insights

3D Bioprinting Market Analysis - Size, Share & Forecast 2025 to 2035

Dental 3D Printing Material Market Trends, Growth & Forecast by Material, Product, and Region through 2035

Ceramic 3D Printing Market Size and Share Forecast Outlook 2025 to 2035

Aerospace 3D Printing Materials Market Size and Share Forecast Outlook 2025 to 2035

Demand for 3D Printing Materials in Middle East Size and Share Forecast Outlook 2025 to 2035

Middle East 3D Printing Materials Market Trends 2022 to 2032

Fully Enclosed 3D Printing Smart Warehouse Market Size and Share Forecast Outlook 2025 to 2035

Hearing Devices 3D Printing Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA