The indoor smokehouses and pig roasters market is expected to witness steady growth from 2025 to 2035, due to rising demand for barbecue and smoked meat products, growing interest in cooking solutions on both home-based and commercial scales, and improving indoor smoking technology. The market is riding the rising culinary trend of slow-cooked and smoked meats, especially in restaurants, hotels, and home kitchens.

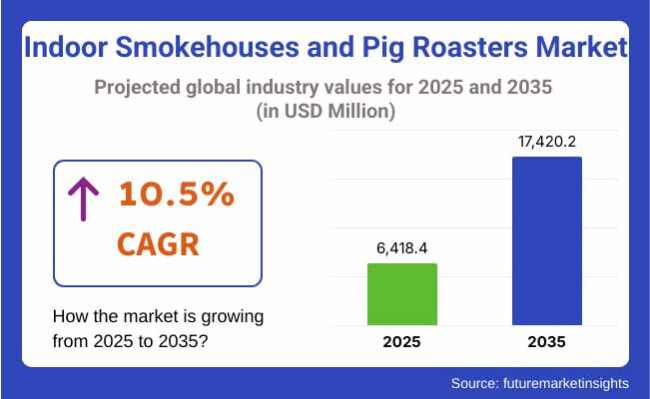

The market is expected to grow from USD 6,418.4 Million in 2025 to USD 17,420.2 Million by 2035 at a compounded annual growth rate (CAGR) of 10.5% during the forecast period. The incorporation of smart temperature control, advanced smoke filtration and energy-efficient heating elements is rendering indoor smokehouses and pig roasters, friendlier to work with and safer which will be adding to the growth of the market.

The indoor smokehouses and pig roasters market is segmented in three key regions, with North America leading mostly owing to the barbecue culture and home cooking that include the United States and Canada and the use of meat techniques in restaurant. Increase in the usage of indoor appliances having smart technology and increase in demand for compact, energy-efficient smokehouses have been fuelling the market growth.

Europe, accounts for a significant share of the market owing to the growing adoption of smoked and roasted meats in several countries including Germany, the UK, and France. Smoking and smoking equipment are gaining popularity in the hospitality sector, featuring in restaurants and catering also. As a result, the strict food safety regulation is boosting the use advanced smoke and air purification technology for indoor application.

The fastest market growth is anticipated in the Asia-Pacific region, driven by urbanization, increasing disposable incomes, and increasing interest in Western-style cooking in countries like China, Japan, South Korea, and Australia. With more and more consumers wanting appliances to aid in premium home cooking, the need for compact, high-efficiency indoor roasters is on the rise. Market growth is also being driven by factors such as the expansion of the food tourism and restaurant industry.

Challenge

Indoor Air Quality and Regulatory Compliance

Indoor smokehouses and pig roasters need to follow tight air ventilation and indoor air quality requirements, to be safely used in residential and commercial kitchens. The challenges include smoke emissions, grease build up and potential fire hazards. As safety measures and indoor airflow specifications become more stringent, manufacturers are placing increased emphasis on advanced filtration systems, catalytic converters, and automated temperature controls.

Opportunity

Smart Cooking Technology and Energy Efficiency

Major opportunity for market in rise of smart kitchen appliances as they are creating IoT-enabled smokehouses and pig roasters, letting users monitor temperature, smoke levels and cooking progress through smartphone apps. Moreover, energy-efficient heating elements and eco-friendly smoking methods are gaining popularity among environmentally conscious customers.

In addition, the a developing demand for compact, multi-functional indoor roasting solutions integrated with automated cleaning mechanisms and programmable settings is anticipated to fuel the market growth.

The indoor smokehouses and pig roasters market are going to witness an increased demand because of the home-based gourmet smoking and commercial BBQ expansion. Restaurants, catering services and butcher shops also took on large commercial pig roasters and smokehouses to diversify their menus.

Infrared heating, convection-based smoking systems, and digital temperature tracking became the norm for cooking efficiency. It has high equipment costs, requires ventilation and there is regulatory compliance. But smokeless technology, odour-reduction filters and fireproof designs came to the rescue.

Between 2025 and 2035 the market will transition to smart smokehouses with AI controlled temperature regulation, IoT connectivity, and automated cooking processes. Users will track and regulate smoking through smartphone applications, providing accuracy and uniformity. Sustainability will inspire innovation, with producers producing solar-powered and energy-efficient smokehouses.

Comparative to traditional food roasting methods, the adoption of charcoal-less, infrared, and induction-based food roasting technologies will reduce emissions and help consume less energy.

Commercial smokehouses will autonomously adjust cook weights to maximize food quality in real-time using AI-powered automation. The popularity of modular designs for smoking will increase since space-saving smoking devices will become more accessible in urban areas or within food trucks or small enterprises. Manufacturers will have new revenue streams in the form of subscription-based models for custom smoking blends, AI-driven recipes, and automated wood pellet replenishment.

Market Shifts: A Comparative Analysis (2020 to 2024 vs. 2025 to 2035)

| Market Shift | 2020 to 2024 |

|---|---|

| Technological Advancements | Digital temperature controls, infrared heating. |

| Home Cooking Trends | Rising interest in gourmet indoor smoking. |

| Commercial Expansion | Adoption of large-scale pig roasters in restaurants. |

| Sustainability Focus | Electric and smokeless technology adoption. |

| Customization & Smart Features | Convection-based smoking, manual adjustments. |

| Regulatory Compliance | Challenges with ventilation and fire safety. |

| Market Shift | 2025 to 2035 |

|---|---|

| Technological Advancements | AI-powered smart smokehouses with IoT and remote monitoring. |

| Home Cooking Trends | Expansion of AI-driven, fully automated smoking systems. |

| Commercial Expansion | AI-controlled roasters with automation and real-time analytics. |

| Sustainability Focus | Solar-powered, energy-efficient, and charcoal-free roasting. |

| Customization & Smart Features | Voice-activated commands, cloud-based recipe storage, and self-adjusting heat zones. |

| Regulatory Compliance | Enhanced smoke filtration, odor-neutralizing, and self-cleaning features. |

Growing consumer inclination toward barbecue cooking both at home and in commercial settings is likely to accelerate the demand in the USA Indoor smokehouses and pig roasters market. Due to the limited option of outdoor smoking in urban areas, smokers are preferring advanced indoor smokehouses for use throughout the year. In restaurants, the growing trend of smoked and slow-cooked meats is also contributing to market expansion.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 10.2% |

UK indoor smokehouses and pig roasters market is expected to grow at a steady pace due to expeditious movement of consumer consumers towards high graded smoked food items. Urban households and smaller commercial kitchens are increasingly looking for compact energy-efficient indoor smokehouses. Furthermore, markets are increasingly being moulded by the rise of electric & charcoal based models.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 10.4% |

The market for indoor smokehouses and pig roasters is growing in the European Union as consumers increasingly prefer artisanal smoked meats and cooking devices for home kitchens. Countries like Germany, France, and Italy are leading growth with a high preference for traditional meat preserving methods and modern cooking technologies. The demand for high-efficiency smoking solutions from the restaurant sector is also driving the growth of the market.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 10.6% |

The growing popularity of indoor smokehouses and pig roasters in Japan stems from the country's cultural focus on precision cooking and top-notch food preparation, which has fuelled steady growth in this market. Compact and high-tech smokehouses are hitting their stride with home cooks and small restaurant owners. High-quality electric models with precise temperature control are an influential condition impelling market volume expansion.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 10.3% |

South Korea is emerging as a key market for indoor smokehouses and pig roasters, driven by the rising trend of home-cooked barbecue and smoked meats. Increasing urbanization and the demand for space-efficient cooking solutions are encouraging the adoption of compact and portable smokehouses. Additionally, the growing popularity of premium smoked food products is influencing consumer purchases.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 10.5% |

| Category | Market Share (2025) |

|---|---|

| Indoor Smokehouses | 58.2% |

Indoor smokehouses are the market-leading choice, providing a controlled cooking environment for maximum flavour retention and consistency in smoked meats. Smokehouses are designed to regulate temperature and humidity at very specific levels for smoking meat, poultry, seafood and vegetables. The demand for home-cooked, restaurant-quality smoked foods is growing, making the adoption of indoor smokehouses for both residential and commercial premises an ideal solution.

Technological innovations, like automatic temperature control, digital timers, and Wi-Fi-enabled monitoring systems, also contribute to the rising popularity of indoor smokehouses. These elected features similar to such attainment of consistent results with minimal efforts, making an indoor smokehouse an attractive option for both amateur cooks and professional chefs. Plus, their sealed nature prevents smoke from escaping, so they can be used indoors without setting off smoke detectors or introducing smoke to the ventilation system.

More restaurants, delis and catering businesses are investing in indoor smokehouses to diversify their menus and improve food preparation efficiency. As a result of rising consumer demand for smoked specialties, such as ribs, brisket, and smoked cheeses, adoption of these appliances at restaurants and other food service locations has risen sharply. New manufacturers are coming up with products that incorporate multi-rack systems, adjustable smoke vents, energy-efficient heating elements, which are expected to accelerate the growth of the market.

| Power Source | Market Share (2025) |

|---|---|

| Electric | 46.5% |

Electric-powered smokehouses and pig roasters dominate the market on their ease of use, accurate temperature control, and low maintenance. These appliances provide a convenient cooking solution, as they do not require constant replenishing of the fuel, allowing both home cooks and commercial users to favour them. Electric smokehouses and roasters deliver the heat uniformly with no risk of over- or under-cooking.

Electric models are increasingly being chosen due to their efficiency of energy use and the fact that they can be used indoors, generating less smoke than their counterparts. Unlike traditional charcoal or propane and electric alternatives, electric smokehouses and roasters do not create an open flame and can safely be used in enclosed spaces like home kitchens, restaurants and food processing facilities. Programmable cooking cycles and digital thermostats are common on many models, which enable users to set and forget their cooking process with precision.

Electric smokehouses and roasters are becoming increasingly appealing to both health-conscious consumers and professional chefs looking to retain moisture without contributing to the carcinogens released by charcoal grilling. Added features like integrated wood chip compartments and adjustable smoke settings serve to further fine-tune the flavour, marrying convenience with authentic smoking methods. Urban dwellers looks for electric powered models as prepping a homemade meal with small impact of environmental footprint is adept to modern style of living.

The Indoor Smokehouses and Pig Roasters Market is flourishing owing to the growing proclivity of consumers to grilled or barbecued pork meat prepared at home, growing commercial demand in restaurants, and the speeding up of smoking and roasting technologies. With output temperatures regulation for extreme precision, energy efficiency, versatility, and user-specific designs among the highlights.

Demand for premium smoked meats is growing, automation is permeating cooking equipment, and compact, indoor-friendly designs are hitting retail. They comprise of manufacturers producing around smoking and roasting equipment for commercial-grade as well as home-use.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Alto-Shaam | 18-22% |

| Southern Pride | 14-18% |

| Town | 12-16% |

| Meadow Creek | 10-14% |

| Jade Range | 8-12% |

| Other Companies (combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| Alto-Shaam | In 2024, launched a high-capacity indoor smokehouse with precision-controlled heat and humidity settings. |

| Southern Pride | In 2025, introduced an energy-efficient pig roaster with improved fuel efficiency and even heat distribution. |

| Town | In 2024, expanded its commercial indoor roaster lineup with digital control systems for better precision. |

| Meadow Creek | In 2025, developed a compact, home-friendly smokehouse that offers restaurant-quality smoking at a consumer level. |

| Jade Range | In 2024, enhanced its professional-grade pig roasters with faster preheating and multi-level roasting capabilities. |

Key Company Insights

Alto-Shaam (18-22%)

Alto-Shaam leads the market with innovative indoor smokehouses that offer precision-controlled smoking and roasting for high-volume operations.

Southern Pride (14-18%)

Southern Pride specializes in energy-efficient pig roasters designed for both commercial kitchens and large-scale outdoor catering.

Town (12-16%)

Town manufactures high-performance indoor roasting systems with advanced temperature control for restaurant and professional use.

Meadow Creek (10-14%)

Meadow Creek focuses on consumer-friendly indoor smokehouses, providing professional-grade results in compact designs.

Jade Range (8-12%)

Jade Range enhances pig roasting efficiency with high-capacity, multi-level cooking solutions for commercial kitchens.

Other Key Players (30-40% Combined)

The overall market size for the Indoor Smokehouses and Pig Roasters Market was USD 6,418.4 Million in 2025.

The Indoor Smokehouses and Pig Roasters Market is expected to reach USD 17,420.2 Million in 2035.

The demand is driven by increasing consumer interest in home-based smoked and roasted meats, rising popularity of barbecue culture, growing adoption of advanced indoor cooking appliances, and expanding applications in restaurants and food service establishments.

The top 5 countries driving market growth are the USA, UK, Europe, Japan and South Korea.

The electric segment is expected to command a significant share over the assessment period.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Units) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Category, 2018 to 2033

Table 4: Global Market Volume (Units) Forecast by Category, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Power Source, 2018 to 2033

Table 6: Global Market Volume (Units) Forecast by Power Source, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by Material, 2018 to 2033

Table 8: Global Market Volume (Units) Forecast by Material, 2018 to 2033

Table 9: Global Market Value (US$ Million) Forecast by Distribution channel, 2018 to 2033

Table 10: Global Market Volume (Units) Forecast by Distribution channel, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 12: North America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Category, 2018 to 2033

Table 14: North America Market Volume (Units) Forecast by Category, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by Power Source, 2018 to 2033

Table 16: North America Market Volume (Units) Forecast by Power Source, 2018 to 2033

Table 17: North America Market Value (US$ Million) Forecast by Material, 2018 to 2033

Table 18: North America Market Volume (Units) Forecast by Material, 2018 to 2033

Table 19: North America Market Value (US$ Million) Forecast by Distribution channel, 2018 to 2033

Table 20: North America Market Volume (Units) Forecast by Distribution channel, 2018 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 22: Latin America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast by Category, 2018 to 2033

Table 24: Latin America Market Volume (Units) Forecast by Category, 2018 to 2033

Table 25: Latin America Market Value (US$ Million) Forecast by Power Source, 2018 to 2033

Table 26: Latin America Market Volume (Units) Forecast by Power Source, 2018 to 2033

Table 27: Latin America Market Value (US$ Million) Forecast by Material, 2018 to 2033

Table 28: Latin America Market Volume (Units) Forecast by Material, 2018 to 2033

Table 29: Latin America Market Value (US$ Million) Forecast by Distribution channel, 2018 to 2033

Table 30: Latin America Market Volume (Units) Forecast by Distribution channel, 2018 to 2033

Table 31: Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 32: Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 33: Europe Market Value (US$ Million) Forecast by Category, 2018 to 2033

Table 34: Europe Market Volume (Units) Forecast by Category, 2018 to 2033

Table 35: Europe Market Value (US$ Million) Forecast by Power Source, 2018 to 2033

Table 36: Europe Market Volume (Units) Forecast by Power Source, 2018 to 2033

Table 37: Europe Market Value (US$ Million) Forecast by Material, 2018 to 2033

Table 38: Europe Market Volume (Units) Forecast by Material, 2018 to 2033

Table 39: Europe Market Value (US$ Million) Forecast by Distribution channel, 2018 to 2033

Table 40: Europe Market Volume (Units) Forecast by Distribution channel, 2018 to 2033

Table 41: Asia Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 42: Asia Pacific Market Volume (Units) Forecast by Country, 2018 to 2033

Table 43: Asia Pacific Market Value (US$ Million) Forecast by Category, 2018 to 2033

Table 44: Asia Pacific Market Volume (Units) Forecast by Category, 2018 to 2033

Table 45: Asia Pacific Market Value (US$ Million) Forecast by Power Source, 2018 to 2033

Table 46: Asia Pacific Market Volume (Units) Forecast by Power Source, 2018 to 2033

Table 47: Asia Pacific Market Value (US$ Million) Forecast by Material, 2018 to 2033

Table 48: Asia Pacific Market Volume (Units) Forecast by Material, 2018 to 2033

Table 49: Asia Pacific Market Value (US$ Million) Forecast by Distribution channel, 2018 to 2033

Table 50: Asia Pacific Market Volume (Units) Forecast by Distribution channel, 2018 to 2033

Table 51: MEA Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 52: MEA Market Volume (Units) Forecast by Country, 2018 to 2033

Table 53: MEA Market Value (US$ Million) Forecast by Category, 2018 to 2033

Table 54: MEA Market Volume (Units) Forecast by Category, 2018 to 2033

Table 55: MEA Market Value (US$ Million) Forecast by Power Source, 2018 to 2033

Table 56: MEA Market Volume (Units) Forecast by Power Source, 2018 to 2033

Table 57: MEA Market Value (US$ Million) Forecast by Material, 2018 to 2033

Table 58: MEA Market Volume (Units) Forecast by Material, 2018 to 2033

Table 59: MEA Market Value (US$ Million) Forecast by Distribution channel, 2018 to 2033

Table 60: MEA Market Volume (Units) Forecast by Distribution channel, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Category, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Power Source, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Material, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Distribution channel, 2023 to 2033

Figure 5: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 6: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 7: Global Market Volume (Units) Analysis by Region, 2018 to 2033

Figure 8: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 9: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 10: Global Market Value (US$ Million) Analysis by Category, 2018 to 2033

Figure 11: Global Market Volume (Units) Analysis by Category, 2018 to 2033

Figure 12: Global Market Value Share (%) and BPS Analysis by Category, 2023 to 2033

Figure 13: Global Market Y-o-Y Growth (%) Projections by Category, 2023 to 2033

Figure 14: Global Market Value (US$ Million) Analysis by Power Source, 2018 to 2033

Figure 15: Global Market Volume (Units) Analysis by Power Source, 2018 to 2033

Figure 16: Global Market Value Share (%) and BPS Analysis by Power Source, 2023 to 2033

Figure 17: Global Market Y-o-Y Growth (%) Projections by Power Source, 2023 to 2033

Figure 18: Global Market Value (US$ Million) Analysis by Material, 2018 to 2033

Figure 19: Global Market Volume (Units) Analysis by Material, 2018 to 2033

Figure 20: Global Market Value Share (%) and BPS Analysis by Material, 2023 to 2033

Figure 21: Global Market Y-o-Y Growth (%) Projections by Material, 2023 to 2033

Figure 22: Global Market Value (US$ Million) Analysis by Distribution channel, 2018 to 2033

Figure 23: Global Market Volume (Units) Analysis by Distribution channel, 2018 to 2033

Figure 24: Global Market Value Share (%) and BPS Analysis by Distribution channel, 2023 to 2033

Figure 25: Global Market Y-o-Y Growth (%) Projections by Distribution channel, 2023 to 2033

Figure 26: Global Market Attractiveness by Category, 2023 to 2033

Figure 27: Global Market Attractiveness by Power Source, 2023 to 2033

Figure 28: Global Market Attractiveness by Material, 2023 to 2033

Figure 29: Global Market Attractiveness by Distribution channel, 2023 to 2033

Figure 30: Global Market Attractiveness by Region, 2023 to 2033

Figure 31: North America Market Value (US$ Million) by Category, 2023 to 2033

Figure 32: North America Market Value (US$ Million) by Power Source, 2023 to 2033

Figure 33: North America Market Value (US$ Million) by Material, 2023 to 2033

Figure 34: North America Market Value (US$ Million) by Distribution channel, 2023 to 2033

Figure 35: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 36: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 37: North America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 38: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 39: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 40: North America Market Value (US$ Million) Analysis by Category, 2018 to 2033

Figure 41: North America Market Volume (Units) Analysis by Category, 2018 to 2033

Figure 42: North America Market Value Share (%) and BPS Analysis by Category, 2023 to 2033

Figure 43: North America Market Y-o-Y Growth (%) Projections by Category, 2023 to 2033

Figure 44: North America Market Value (US$ Million) Analysis by Power Source, 2018 to 2033

Figure 45: North America Market Volume (Units) Analysis by Power Source, 2018 to 2033

Figure 46: North America Market Value Share (%) and BPS Analysis by Power Source, 2023 to 2033

Figure 47: North America Market Y-o-Y Growth (%) Projections by Power Source, 2023 to 2033

Figure 48: North America Market Value (US$ Million) Analysis by Material, 2018 to 2033

Figure 49: North America Market Volume (Units) Analysis by Material, 2018 to 2033

Figure 50: North America Market Value Share (%) and BPS Analysis by Material, 2023 to 2033

Figure 51: North America Market Y-o-Y Growth (%) Projections by Material, 2023 to 2033

Figure 52: North America Market Value (US$ Million) Analysis by Distribution channel, 2018 to 2033

Figure 53: North America Market Volume (Units) Analysis by Distribution channel, 2018 to 2033

Figure 54: North America Market Value Share (%) and BPS Analysis by Distribution channel, 2023 to 2033

Figure 55: North America Market Y-o-Y Growth (%) Projections by Distribution channel, 2023 to 2033

Figure 56: North America Market Attractiveness by Category, 2023 to 2033

Figure 57: North America Market Attractiveness by Power Source, 2023 to 2033

Figure 58: North America Market Attractiveness by Material, 2023 to 2033

Figure 59: North America Market Attractiveness by Distribution channel, 2023 to 2033

Figure 60: North America Market Attractiveness by Country, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) by Category, 2023 to 2033

Figure 62: Latin America Market Value (US$ Million) by Power Source, 2023 to 2033

Figure 63: Latin America Market Value (US$ Million) by Material, 2023 to 2033

Figure 64: Latin America Market Value (US$ Million) by Distribution channel, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 66: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 67: Latin America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 68: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 69: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 70: Latin America Market Value (US$ Million) Analysis by Category, 2018 to 2033

Figure 71: Latin America Market Volume (Units) Analysis by Category, 2018 to 2033

Figure 72: Latin America Market Value Share (%) and BPS Analysis by Category, 2023 to 2033

Figure 73: Latin America Market Y-o-Y Growth (%) Projections by Category, 2023 to 2033

Figure 74: Latin America Market Value (US$ Million) Analysis by Power Source, 2018 to 2033

Figure 75: Latin America Market Volume (Units) Analysis by Power Source, 2018 to 2033

Figure 76: Latin America Market Value Share (%) and BPS Analysis by Power Source, 2023 to 2033

Figure 77: Latin America Market Y-o-Y Growth (%) Projections by Power Source, 2023 to 2033

Figure 78: Latin America Market Value (US$ Million) Analysis by Material, 2018 to 2033

Figure 79: Latin America Market Volume (Units) Analysis by Material, 2018 to 2033

Figure 80: Latin America Market Value Share (%) and BPS Analysis by Material, 2023 to 2033

Figure 81: Latin America Market Y-o-Y Growth (%) Projections by Material, 2023 to 2033

Figure 82: Latin America Market Value (US$ Million) Analysis by Distribution channel, 2018 to 2033

Figure 83: Latin America Market Volume (Units) Analysis by Distribution channel, 2018 to 2033

Figure 84: Latin America Market Value Share (%) and BPS Analysis by Distribution channel, 2023 to 2033

Figure 85: Latin America Market Y-o-Y Growth (%) Projections by Distribution channel, 2023 to 2033

Figure 86: Latin America Market Attractiveness by Category, 2023 to 2033

Figure 87: Latin America Market Attractiveness by Power Source, 2023 to 2033

Figure 88: Latin America Market Attractiveness by Material, 2023 to 2033

Figure 89: Latin America Market Attractiveness by Distribution channel, 2023 to 2033

Figure 90: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 91: Europe Market Value (US$ Million) by Category, 2023 to 2033

Figure 92: Europe Market Value (US$ Million) by Power Source, 2023 to 2033

Figure 93: Europe Market Value (US$ Million) by Material, 2023 to 2033

Figure 94: Europe Market Value (US$ Million) by Distribution channel, 2023 to 2033

Figure 95: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 96: Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 97: Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 98: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 99: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 100: Europe Market Value (US$ Million) Analysis by Category, 2018 to 2033

Figure 101: Europe Market Volume (Units) Analysis by Category, 2018 to 2033

Figure 102: Europe Market Value Share (%) and BPS Analysis by Category, 2023 to 2033

Figure 103: Europe Market Y-o-Y Growth (%) Projections by Category, 2023 to 2033

Figure 104: Europe Market Value (US$ Million) Analysis by Power Source, 2018 to 2033

Figure 105: Europe Market Volume (Units) Analysis by Power Source, 2018 to 2033

Figure 106: Europe Market Value Share (%) and BPS Analysis by Power Source, 2023 to 2033

Figure 107: Europe Market Y-o-Y Growth (%) Projections by Power Source, 2023 to 2033

Figure 108: Europe Market Value (US$ Million) Analysis by Material, 2018 to 2033

Figure 109: Europe Market Volume (Units) Analysis by Material, 2018 to 2033

Figure 110: Europe Market Value Share (%) and BPS Analysis by Material, 2023 to 2033

Figure 111: Europe Market Y-o-Y Growth (%) Projections by Material, 2023 to 2033

Figure 112: Europe Market Value (US$ Million) Analysis by Distribution channel, 2018 to 2033

Figure 113: Europe Market Volume (Units) Analysis by Distribution channel, 2018 to 2033

Figure 114: Europe Market Value Share (%) and BPS Analysis by Distribution channel, 2023 to 2033

Figure 115: Europe Market Y-o-Y Growth (%) Projections by Distribution channel, 2023 to 2033

Figure 116: Europe Market Attractiveness by Category, 2023 to 2033

Figure 117: Europe Market Attractiveness by Power Source, 2023 to 2033

Figure 118: Europe Market Attractiveness by Material, 2023 to 2033

Figure 119: Europe Market Attractiveness by Distribution channel, 2023 to 2033

Figure 120: Europe Market Attractiveness by Country, 2023 to 2033

Figure 121: Asia Pacific Market Value (US$ Million) by Category, 2023 to 2033

Figure 122: Asia Pacific Market Value (US$ Million) by Power Source, 2023 to 2033

Figure 123: Asia Pacific Market Value (US$ Million) by Material, 2023 to 2033

Figure 124: Asia Pacific Market Value (US$ Million) by Distribution channel, 2023 to 2033

Figure 125: Asia Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 126: Asia Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 127: Asia Pacific Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 128: Asia Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 129: Asia Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 130: Asia Pacific Market Value (US$ Million) Analysis by Category, 2018 to 2033

Figure 131: Asia Pacific Market Volume (Units) Analysis by Category, 2018 to 2033

Figure 132: Asia Pacific Market Value Share (%) and BPS Analysis by Category, 2023 to 2033

Figure 133: Asia Pacific Market Y-o-Y Growth (%) Projections by Category, 2023 to 2033

Figure 134: Asia Pacific Market Value (US$ Million) Analysis by Power Source, 2018 to 2033

Figure 135: Asia Pacific Market Volume (Units) Analysis by Power Source, 2018 to 2033

Figure 136: Asia Pacific Market Value Share (%) and BPS Analysis by Power Source, 2023 to 2033

Figure 137: Asia Pacific Market Y-o-Y Growth (%) Projections by Power Source, 2023 to 2033

Figure 138: Asia Pacific Market Value (US$ Million) Analysis by Material, 2018 to 2033

Figure 139: Asia Pacific Market Volume (Units) Analysis by Material, 2018 to 2033

Figure 140: Asia Pacific Market Value Share (%) and BPS Analysis by Material, 2023 to 2033

Figure 141: Asia Pacific Market Y-o-Y Growth (%) Projections by Material, 2023 to 2033

Figure 142: Asia Pacific Market Value (US$ Million) Analysis by Distribution channel, 2018 to 2033

Figure 143: Asia Pacific Market Volume (Units) Analysis by Distribution channel, 2018 to 2033

Figure 144: Asia Pacific Market Value Share (%) and BPS Analysis by Distribution channel, 2023 to 2033

Figure 145: Asia Pacific Market Y-o-Y Growth (%) Projections by Distribution channel, 2023 to 2033

Figure 146: Asia Pacific Market Attractiveness by Category, 2023 to 2033

Figure 147: Asia Pacific Market Attractiveness by Power Source, 2023 to 2033

Figure 148: Asia Pacific Market Attractiveness by Material, 2023 to 2033

Figure 149: Asia Pacific Market Attractiveness by Distribution channel, 2023 to 2033

Figure 150: Asia Pacific Market Attractiveness by Country, 2023 to 2033

Figure 151: MEA Market Value (US$ Million) by Category, 2023 to 2033

Figure 152: MEA Market Value (US$ Million) by Power Source, 2023 to 2033

Figure 153: MEA Market Value (US$ Million) by Material, 2023 to 2033

Figure 154: MEA Market Value (US$ Million) by Distribution channel, 2023 to 2033

Figure 155: MEA Market Value (US$ Million) by Country, 2023 to 2033

Figure 156: MEA Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 157: MEA Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 158: MEA Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 159: MEA Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 160: MEA Market Value (US$ Million) Analysis by Category, 2018 to 2033

Figure 161: MEA Market Volume (Units) Analysis by Category, 2018 to 2033

Figure 162: MEA Market Value Share (%) and BPS Analysis by Category, 2023 to 2033

Figure 163: MEA Market Y-o-Y Growth (%) Projections by Category, 2023 to 2033

Figure 164: MEA Market Value (US$ Million) Analysis by Power Source, 2018 to 2033

Figure 165: MEA Market Volume (Units) Analysis by Power Source, 2018 to 2033

Figure 166: MEA Market Value Share (%) and BPS Analysis by Power Source, 2023 to 2033

Figure 167: MEA Market Y-o-Y Growth (%) Projections by Power Source, 2023 to 2033

Figure 168: MEA Market Value (US$ Million) Analysis by Material, 2018 to 2033

Figure 169: MEA Market Volume (Units) Analysis by Material, 2018 to 2033

Figure 170: MEA Market Value Share (%) and BPS Analysis by Material, 2023 to 2033

Figure 171: MEA Market Y-o-Y Growth (%) Projections by Material, 2023 to 2033

Figure 172: MEA Market Value (US$ Million) Analysis by Distribution channel, 2018 to 2033

Figure 173: MEA Market Volume (Units) Analysis by Distribution channel, 2018 to 2033

Figure 174: MEA Market Value Share (%) and BPS Analysis by Distribution channel, 2023 to 2033

Figure 175: MEA Market Y-o-Y Growth (%) Projections by Distribution channel, 2023 to 2033

Figure 176: MEA Market Attractiveness by Category, 2023 to 2033

Figure 177: MEA Market Attractiveness by Power Source, 2023 to 2033

Figure 178: MEA Market Attractiveness by Material, 2023 to 2033

Figure 179: MEA Market Attractiveness by Distribution channel, 2023 to 2033

Figure 180: MEA Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Indoor Rotary High Voltage Disconnect Switch Market Size and Share Forecast Outlook 2025 to 2035

Indoor Cable Assemblies Market Size and Share Forecast Outlook 2025 to 2035

Indoor Residential Switchgear Market Size and Share Forecast Outlook 2025 to 2035

Indoor Air Quality Monitor Market Size and Share Forecast Outlook 2025 to 2035

Indoor Location Market Size and Share Forecast Outlook 2025 to 2035

Indoor Space Heater Market Size and Share Forecast Outlook 2025 to 2035

Indoor Farming Market Analysis - Size, Share, and Forecast 2025 to 2035

A Detailed Global Analysis of Brand Share for the Indoor Farming Market

Smart Indoor Gardening System Market Size and Share Forecast Outlook 2025 to 2035

Family/Indoor Entertainment Centres Market Report – Forecast 2017-2027

Cat Condos & Indoor Houses Market Insights - Size & Trends 2025 to 2035

Pigment Hot Stamping Foil Market Size and Share Forecast Outlook 2025 to 2035

Pigmented Lesion Treatment Market Growth - Trends & Forecast 2025 to 2035

Market Share Breakdown of Pigment Hot Stamping Foil Manufacturers

Pigeon Pea Market Insights – Growth & Forecast 2025-2035

Pigging Valves Market

Apigenin Market Size and Share Forecast Outlook 2025 to 2035

Spigot End Cap Market Size and Share Forecast Outlook 2025 to 2035

Epiglottitis Treatment Market Size and Share Forecast Outlook 2025 to 2035

Feed Pigment Market Forecast and Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA