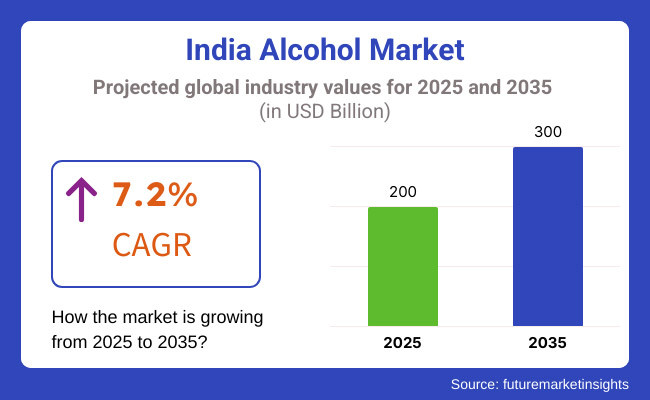

The demand for global India’s Alcohol Industry market is expected to be valued at USD 200.0 Billion in 2025, forecasted at a CAGR of 7.2% to have an estimated value of USD 300.0 Billion from 2025 to 2035. From 2020 to 2025 a CAGR of 6.8% was registered for the market.

Changing lifestyles and demographics have a big impact on Indias alcohol industry. Younger people who see drinking as a form of entertainment and social interaction are driving up demand for alcoholic beverages as the population becomes more youthful and urbanized.

Alcohol consumption among women has increased as a result of a change in cultural attitudes regarding alcohol consumption brought about by more women joining the workforce and becoming financially independent. With a greater acceptance of alcohol as a social norm this demographic shift is fuelling the expansion of the Indian alcohol industry.

The size and diversity of Indias alcohol industry are two of its distinguishing characteristics. It includes a broad variety of alcoholic drinks such as wine beer gin vodka rum whiskey and regionally specific indigenous mixtures. Every category serves different customer segments ranging from young urbanites embracing cutting-edge cocktail culture to discriminating connoisseurs looking for premium spirits. The industrys overall performance is improved by this.

The expansion of craft spirits and microbreweries along with the growing demand for premium and imported brands are anticipated to support the expansion of the Indian alcohol industry. Alcohol sales in the country will probably be boosted by the growing appeal of experiential drinking establishments that satisfy a range of customer tastes.

Explore FMI!

Book a free demo

Increase in Income is Driving the Market Growth

Alcohol sales in India are expected to soar in the upcoming years. First Indias middle class is becoming more affluent. Furthermore, people will purchase more alcohol as their wealth increases. People decide to try new alcoholic beverages as their disposable income rises. The second significant reason for Indias expanding alcohol market is the countrys citizens preference for a more affluent lifestyle.

As India becomes more urbanized its citizens choose to adopt a more cosmopolitan outlook and start drinking alcohol. Additionally, as more Indians move into cities the market is probably going to continue expanding. The rising disposable income of the middle class shifting lifestyles and growing urbanization are all expected to contribute to the steady growth of the Indian alcohol market in the years to come. In general, the market is expanding due to the rising demand for high-end global alcohol brands.

Demand for International Brands is Driving the Market Growth

The increasing demand for high-end global brands is another factor propelling the expansion of the Indian alcohol market. Indian consumers are more inclined to try out different kinds of alcohol and are also more willing to pay more for premium alcohol.

This is particularly true for younger consumers who are more susceptible to trend influence. Premium and foreign brands of alcohol are becoming increasingly popular among the wealthy population in India according to the alcohol market industry. The demand for these brands is being driven by rising disposable income and increased trend exposure.

During the period 2020-2024, the sales grew at a CAGR of 6.8%, and it is predicted to continue to grow at a CAGR of 7.2% during the forecast period of 2025 to 2035.

Growth in the alcohol sector is anticipated to be driven by rising disposable income and shifting consumer preferences toward upscale and upscale drinking experiences. India’s alcoholic beverage sales are expected to increase through 2035 due to the rising demand for flavored and premium vodka as well as the country’s growing cocktail culture and urbanization.

The increasing trend of premiumization is expected to give brands the chance to reach wealthy consumer groups and satisfy their changing preferences. The Indian liquor industry is being shaped by a number of important trends including craft spirits artisanal cocktails and experiential drinking establishments. These trends reflect a shift in drinking culture toward sophistication and individuality.

Tier 1 companies comprises industry leaders acquiring a 60% share in the global business market. These leaders are distinguished by their extensive product portfolio and high production capacity. These industry leaders stand out due to their broad geographic reach, in-depth knowledge of manufacturing and reconditioning across various formats and strong customer base. They offer a variety of services and manufacturing with the newest technology while adhering to legal requirements for the best quality.

Tier 2 companies comprises of mid-size players having a presence in some regions and highly influencing the local commerce and has a market share of 30%. These are distinguished by their robust global presence and solid business acumen. These industry participants may not have cutting-edge technology or a broad global reach but they do have good technology and guarantee regulatory compliance.

Tier 3 companies comprises mostly of small-scale businesses serving niche economies and serving at the local presence having a market share of 10%. Due to their notable focus on meeting local needs these businesses are categorized as belonging to the tier 3 share segment, they are minor players with a constrained geographic scope. As an unorganized ecosystem Tier 3 in this context refers to a sector that in contrast to its organized competitors, lacks extensive structure and formalization.

The following table shows the forecasted growth rates of the significant three geographies revenues. Maharashtra and Goa come under the exhibit of high consumption through 2035.

Known for its energetic cities like Pune and Mumbai Maharashtra holds a sizable portion of Indias alcohol market. The state has a culture of heavy alcohol use which is fueled by a large number of alcohol enthusiasts and quickly growing urban areas.

A wide range of alcoholic products are available in its booming industry which is backed by a strong network of distilleries breweries and liquor manufacturing facilities. Maharashtra successfully meets the various needs of alcohol consumers with its well-established network of bars restaurants liquor stores and hospitality facilities. This strengthens its standing as a major force in the Indian alcoholic beverage sector.

Due to its popularity as a travel destination with a thriving nightlife and lax alcohol laws Goas alcohol industry is expected to grow at a strong compound annual growth rate (CAGR). Goas beaches and lively atmosphere attract a large number of domestic and foreign tourists which fuels the demand for alcoholic beverages and supports the industry’s steady expansion. Reduced taxes and longer drinking hours are just two examples of Goas liberal alcohol policies that foster the sale and consumption of alcohol and support the growth of the sector.

The availability of a variety of bars clubs and beach shacks with a large assortment of alcoholic drinks enhances the allure and draws both residents and visitors. Residents can now spend more on leisure activities such as high-end and imported alcoholic and non alcoholic beverages thanks to their growing disposable income.

| Segment | Value Share (2025) |

|---|---|

| Beer (Product Type) | 45% |

More people particularly in urban areas are willing to pay more for premium spirits than other beverages as the nation’s disposable incomes continue to rise. Due to regional availability issues and cultural preferences wine and beer are still considered niche products in India when compared to spirits. just now.

| Segment | Value Share (2025) |

|---|---|

| Retail (Distribution Channel) | 70% |

Due to the expansion of modern retail supermarkets and hypermarkets dominate the Indian alcohol market in terms of distribution channels. 70% of the market in 2025 will be used for landscape. Beyond conventional liquor consumers today are looking for a variety of shopping experiences. stores attracting customers to air-conditioned hypermarkets that carry every product category in one location.

Supermarkets are in charge. first-rate shelf space to display alcohol and have knowledgeable employees to help with selections. thorough niche and category management. Locally specific assortments encourage impulsive buying.

The alcohol industry in India is marked by fierce competition and dynamic forces that are influenced by a number of variables such as consumer preferences industry dynamics and regulatory frameworks. Being one of the world’s biggest producers of alcoholic beverages India draws both domestic and foreign companies fighting for market share in a number of categories such as wine beer and spirits.

In order to obtain a competitive edge major player in India’s alcohol industry use tactics like product innovation pricing strategies distribution network expansion acquisitions mergers and marketing campaigns. The industry has a wide range of offerings and a sizable consumer base. For companies looking to succeed in India’s vibrant alcohol industry it is essential to comprehend the subtleties of this competitive landscape.

The market is expected to grow at a CAGR of 7.2% throughout the forecast period.

By 2035, the sales value is expected to be worth USD 300.0 Billion.

Rise in income is increasing demand for India’s Alcohol Industry.

Maharashtra is expected to dominate the Indian consumption.

Some of the key players in manufacturing include Carlsberg India Pvt. Ltd., Diageo PLC, Anheuser-Busch InBev. and more.

By product type, methods industry has been categorized into Beer, Spirits and Wine

By distribution channel, industry has been categorized into Retail, Specialty Liquor Stores, Online Platforms and Bar and Restaurants

Industry analysis has been carried out in zones like North India, South India, East India and West India

Vegan Bacon Market Growth - Plant-Based Protein Trends 2025 to 2035

Tapioca Market Trends - Starch Solutions & Global Demand 2025 to 2035

Chickpea Market Trends - Nutrition & Global Trade Insights 2025 to 2035

Botanical Supplements Market Growth - Herbal Wellness & Industry Demand 2025 to 2035

Vegetable Carbon Market Trends - Functional Uses & Industry Demand 2025 to 2035

Plant-Based Nuggets Market Insights - Growth & Innovation 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.