In 2025 the India protein A resins market is estimated to reach 44.2 million and will grow up to 85.3 million by 2035. This growth is highly attributed to the rapid growth in monoclonal antibody production in the world.

| Attributes | Values |

|---|---|

| Estimated India Market Size in 2025 | USD 44.2 Million |

| Projected India Value in 2035 | USD 85.3 Million |

| Value-based CAGR from 2025 to 2035 | 6.8% |

The India protein A resins market is expanding due to increasing demand for highly selective purification resins in the biopharmaceutical industry. Next-generation resins of recombinant protein A and improving chromatography methods are further enhanced efficiency in purification processes of the antibody. Further, the upsurge focus on personalized medicines and increasing output of monoclonal antibodies of cancer and auto-immune conditions are driving up the demand for the product.

Improvements in bioseparation technologies, particularly high-capacity and multi-cycle resins are enhancing process scale-up and also reducing production cost. Additionally, regulatory support for biopharmaceutical advancements and the expansion of manufacturing facilities are driving further adoption of protein A resins across multiple applications.

Explore FMI!

Book a free demo

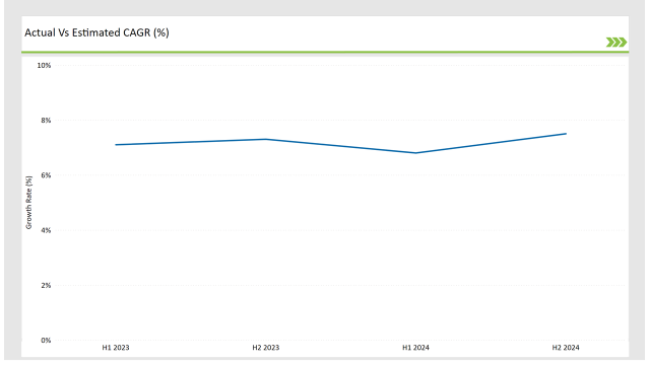

The table below highlights key shifts in the compound annual growth rate (CAGR) over six-month intervals for the base year (2024) and the current year (2025), providing insights into revenue realization trends.

| Year | 2024 |

|---|---|

| H1 Growth Rate (%) | 7.1 |

| H2 Growth Rate (%) | 7.3 |

| Year | 2025 |

|---|---|

| H1 Growth Rate (%) | 6.8 |

| H2 Growth Rate (%) | 7.5 |

The market has demonstrated steady growth, with an decline of 33 basis points in H1 2025 compared to H1 2024. H2 2025 is projected to grow by 15 basis points, driven by increasing adoption of recombinant protein A resins and innovations in bioseparation technologies. Rising investments in next-generatio n chromatography systems and automation in downstream processing are further fueling market expansion. The integration of AI-driven analytics for resin performance optimization is also enhancing process efficiency.

Additionally, growing collaborations between biotech firms and academic institutions are leading to advancements in protein purification methodologies, further strengthening the market outlook for protein A resins.

| Date | Development/M&A Activity & Details |

|---|---|

| 2025 | Expansion: The Pfizer company is aggressively growing its market position in the protein A resins market by entering new geography. |

| 2024 | Technological Advancements: The Becton, Dickinson and Company has introduced advanced innovations in protein A resins technology. |

| 2024 | Expansion: Cytiva company strengthen their presence by entering new markets, building robust distribution networks, and forming partnerships |

Emerging Biopharmaceutical Production and Demand

Gaining momentum in the country's pharmaceutical infrastructure and growing adoption of biopharmaceuticals is thus driving huge demand for protein A resins, which are necessary in the process of cleaning the antibodies before releasing them for use in biomanufacturing processes.

With the spate of recent developments in the field of biologic drug development, Indian manufacturers are investing highly-performing resins for their production of recombinant human antibody to reduce its production process as well as its yield value to further build this market.

Low cost and domestically made products are making the biggest share in Indian market of the resins related to protein A

Indian manufacturers are now investing in developing and manufacturing protein A resins in India. Compared to buying imported resins, manufacturers can be more cost-effective in this regard. The supply chain reliability and price competitiveness are better in the local scenario in the highly price-sensitive healthcare market of India. These cost-effective alternatives are finding popularity among international and Indian biopharmaceutical companies active in India.

Technological Advancements and Resin Customization

Increasing demand for high-quality biopharmaceutical products demands more innovative approaches in protein A resins. Indian companies have welcomed this new technological era and customized their protein A resins to increase binding capacity, stability, and durability. Recombinant protein A resins in resin engineering improve purification processes and increase efficiency while being more scalable. The customization of resins to meet specific therapeutic requirements is also contributing to the expansion of the protein A resins market in India.

Enhancing Biotechnology R&D

India has today taken its rightful place at the heart of the world's leadership in biotech research and development. Here are the core players in academic institutions, research labs, and biotech firms leading the way for innovation into bio manufacturing technologies. Biopharmaceuticals have taken centre stage for the country, focusing on R&D that fosters the production of new and better protein A resins for purification.

Research in India focuses on the efficiency and scalability of these resins, including advancement in their ligand structures and more sustainable resins. The current R&D programs are opening greater market opportunities with the increasing demands for customized resins for diversified applications in both research and the production of therapeutic antibodies.

Strong Export Potential

India is a prominent contributor to the internal protein A resin market; however, it is also turning out to be a supplier of the resin for the emerging markets of the Southeast Asia region, Africa, and Latin America. Exporting of protein A resins is making the country stronger as a hub for affordable biopharmaceuticals, while critical in mass production of monoclonal antibodies and other biologics.

The fact that India has been the most attractive hub for protein A resins to manufacture high-quality and cost-effective biopharmaceuticals in demand makes this country have encouraging support from the fast-growing sector of biotechnology.

Increasing Focus on Biosimilars

India is also among the largest players in the biosimilars market with domestic companies manufacturing monoclonal antibodies and biosimilars to human breast cancer The growing focus on advancing production of biosimilars which often require protein A resins for purification fuels demand for these resin.

As a consequence of the burgeoning proliferation of biosimilars due to cost-effectiveness and efficacy, Indian manufacturers are highly investing in protein-A resin as a means to meet the high demand for biosimilar production's high-quality purification processes.

Growing Adoption of Natural and Recombinant Protein A Resins

Natural protein A resins continue to be widely used for their high specificity in antibody purification. However, recombinant protein A resins are gaining traction due to their improved binding capacity and stability. By 2035, recombinant resins are expected to capture over 55% of the market share, driven by advancements in engineered ligands and enhanced resin durability.

Expanding Demand for Agarose-Based and Polymer-Based Matrices

Agarose-based matrices remain the most commonly used platform for protein A resins due to their superior binding efficiency and scalability. Glass or silica-based matrices are witnessing moderate growth, while organic polymer-based matrices are emerging as alternatives for enhanced purification efficiency and cost-effectiveness.

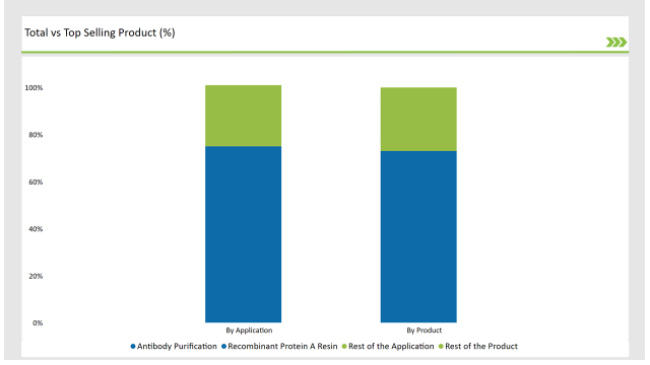

Increasing Application in Antibody Purification and Immunoprecipitation

The largest application area is in the purification of antibody, where a market share greater than 70% exists for protein A resins. High-performance resins are being translated to high-quality components through the boosting demand from the increasing demand for monoclonal antibody therapeutics. The advancement in precision medicine is presently stimulating more immunoprecipitation techniques primarily in research applications. These methodologies require highly selective purification methodologies.

Clinical research laboratories are increasingly using these resins for experimental and preclinical studies, and academic institutes are involved in innovation by developing new types of resins and researching applications.

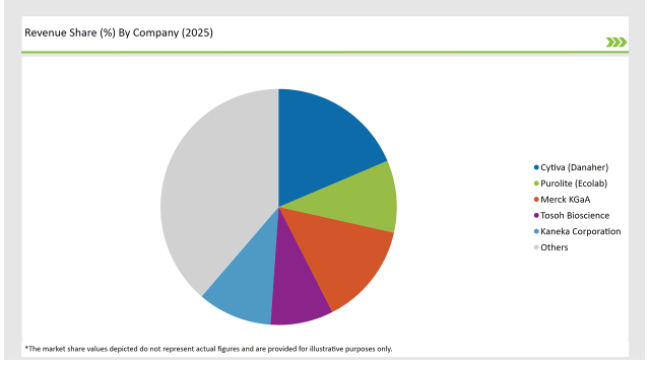

The Indian protein A resins market is moderately concentrated Smaller biotechnology firms and academic research institutions are also entering the market, focusing on developing cost-effective resin alternatives and advancing bio separation techniques. Increasing government and private sector investments in bioprocessing infrastructure are expected to support market expansion and innovation in protein purification solutions.

By 2025 to 2035 , the India Protein A resin market is expected to grow at a CAGR of 6.8%.

By 2035, the sales value of the India protein A resin industry is expected to reach is 85.3 million.

Key factors propelling the India protein A resin market include growing demand of biopharmaceutical, advancement in precision medicine, regulatory support, aging population, strong researchand development investment.

The key players operating in the global electrosurgery generators space include Medtronic Plc, Ackermann Instrument, B. Braun Melsungen AG, Symmetry Surgical Inc. (Aspen Surgical), Chengdu Mechan Electronic Technology Co., Ltd, Miconvey SURGICAL, Telea Electronic Engineering S.r.l., Olympus Corporation, Ethicon US, LLC (Johnson and Johnson Surgical Technologies) and others.

Epidemic Keratoconjunctivitis Treatment Market Overview – Growth, Trends & Forecast 2025 to 2035

Eosinophilia Therapeutics Market Insights – Trends & Forecast 2025 to 2035

Endometrial Ablation Market Analysis - Size, Share & Forecast 2025 to 2035

Endotracheal Tube Market - Growth & Demand Outlook 2025 to 2035

Encephalitis Treatment Market - Growth & Future Trends 2025 to 2035

Edward’s Syndrome Treatment Market – Growth & Future Prospects 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.