The India preclinical medical device testing services market will reach USD 74.1 million in 2025. The CAGR for this period is 8.1%. It will expand to reach a total value of USD 161.9 million by 2035.

| Attributes | Values |

|---|---|

| Estimated Industry Size 2025 | USD 74.1 million |

| Projected Value 2035 | USD 161.9 million |

| Value-based CAGR from 2025 to 2035 | 8.1% |

Rapidly growing healthcare infrastructure in India with the growing presence of private hospitals, growing expansion of multinational companies by inaugurating their research centers in the country, along with strong presence of diagnostic facilities that demands for advanced medical devices significantly attributes to the growth of the market. More importantly, companies operating within the medical device industry have moved to respond in growth by pegging their efforts on having products meet stringent regulatory standards laid down by national and international guidances-CDSCO. Moreover, India's growing focus on development of specialty devices for oncology, cardiology, and neurology treatments, significantly fuels demand for preclinical testing services.

Explore FMI!

Book a free demo

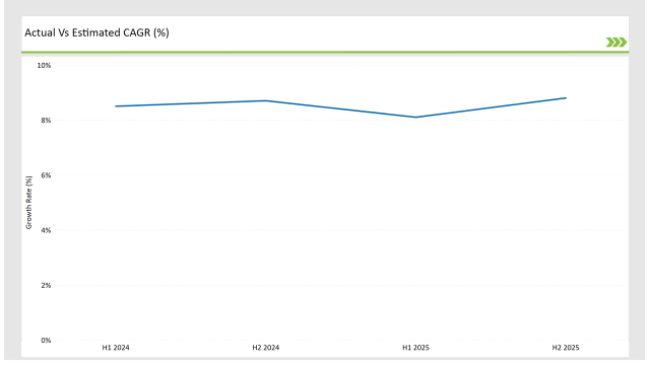

The table below offers a detailed comparative assessment of the changes in the compound annual growth rate (CAGR) over six months for the base year (2024) and the current year (2025) specifically for the India preclinical medical device testing services market.

The semi-annual analysis show significant changes in the dynamics of the market accurately demonstrates growth trajectory of the year. Here, H1 encompasses data for January to June, while H2 is from July to December.

H1 signifies period from January to June, H2 Signifies period from July to December

Preclinical medical device testing services is projected to grow at a CAGR of 8.5% during H1 2024 and further surge to an increment of 8.7% in the latter half of 2024. In 2024, the rate is projected to slightly lower down to 8.1% in H1 and increase up to 8.8% in H2. The market also witnessed decline of 33 basis points from the first half of 2024 to the first half of 2025 and an increase of 8 basis points in the second half of 2025 over the second half of 2024.

The foregoing figures describe the dynamics or changing nature in the India preclinical medical device testing services market impacted by factors, such as altered regulatory changes or innovations in several services provided by the service providers.

This semi-annual breakdown is critical for businesses planning their strategies to capitalize on the anticipated growth and navigate the complexities of the market.

| Date | Development/M&A Activity & Details |

|---|---|

| 2025 | Increase in Demand for Innovative Devices: Eurofins Scientific is focusing on growing demand for medical devices that has advanced capabilities for accurate diagnosis surges market growth |

| 2024 | Improving Healthcare Infrastructure: Pace Analytical Services LLC is focusing on growing investment in Private healthcare facilities increases demand for advanced diagnosis devices |

| 2024 | Growing Clinical Trials Ecosystem: Growing Clinical Trials ecosystem surges market growth in country for the company Porsolt. |

Increasing Demand for Innovative Devices anticipates the Growth of Market in the India

The driving factors responsible for growth within preclinical medical device testing services include rising demands from innovative medical devices within India. Devices, such as wearable health monitors, advanced diagnostic tools, and surgical robots, see more applications today due to advancements in technology and increased health-related needs.

These devices have complex designs involving new materials with advanced functionalities, hence requiring substantial testing to guarantee safety and effectiveness for regulatory standards. The preclinical test helps find out the potential risks, such as design flaws or functionality issues of the device, ahead of clinical trials.

This reduces the risks of costly recalls or failures after the product hits the market. With the increasing demand for such devices within India, it is no choice for the manufacturer other than to rely on specialized preclinical testing services to ensure these novel products are safe and reliable, which in turn drives the demand for these services within the country.

Growing Clinical Trial Ecosystem Anticipates its Market Growth in India

The growth of preclinical medical device testing services depends to a great extent on the well-set clinical trials ecosystem in India. With a large, diverse patient pool, India offers an attractive clinical trial destination for contract research organizations. Clinical trials can take place only after the devices are put through a series of preclinical tests under strict safety and efficacy standards laid down by regulatory bodies such as the Central Drugs Standard Control Organization.

These serve to identify potential risks, design flaws, and compliance issues that make such devices ready for human trials. A strong clinical trial infrastructure in the country therefore leads to increased demand for preclinical testing services while manufacturing companies look to accelerate product development in compliance with regulatory requirements. In this respect, such synergy is highly essential between preclinical testing and clinical trials if medical device industry growth has to keep its growth trajectory high in India.

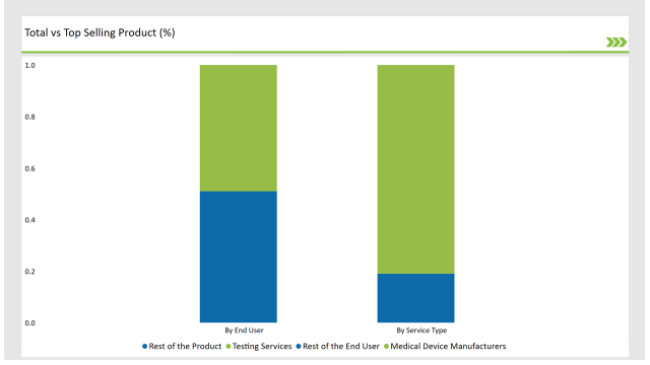

% share of Individual categories by Service Type and End User in 2025

The Critical Factor of Ensuring the Safety and Efficiency in Medical Device Aid Testing Services to dominate the Market

The CDSCO of India enforces a strict standard with an insistence on extensive preclinical testing to ascertain that the devices meet the bar for safety and efficacy, including regulatory requirements. Given the rapid rise in healthcare infrastructure in India, the demand for such sophisticated medical devices is constantly increasing, more so in cardiology, oncology, and neurology treatments.

The surge of digital health tools with AI-driven technologies further adds to the complexity. Advanced devices undergo extensive testing, while meeting both regulatory requirements at both the local and international levels, enables manufacturers to stay ahead in a dynamically changing regulatory environment.

Testing services in India help manufacturers assure standards of devices and speed up their time-to-market. It is this growing need for compliance and safety that drives significant demand in preclinical testing services from medical device developers across the country

Comprehensive Testing Required by Medical Device aid them to hold Dominant Position

The medical device industry in India dominates the preclinical medical device testing services market owing to the specialization of country in core part of designing, developing, and introducing new devices. Moreover, in India, the requirement for advanced medical technologies is at an all-time high, especially in cardiology, orthopedics, and digital health.

All such factors are bound to undergo a great amount of preclinical testing in order to be recognized as safe and efficient by the severe regulatory standards. As the medical device sector in India becomes increasingly successful, it increases demand for specialized testing services in device performance, early identification of risks, and speeding up the time to market.

The companies are highly reliant on preclinical testing services to ensure successful product development, regulatory approval, and faster market entry for continued growth in the industry of the medical device sector within India.

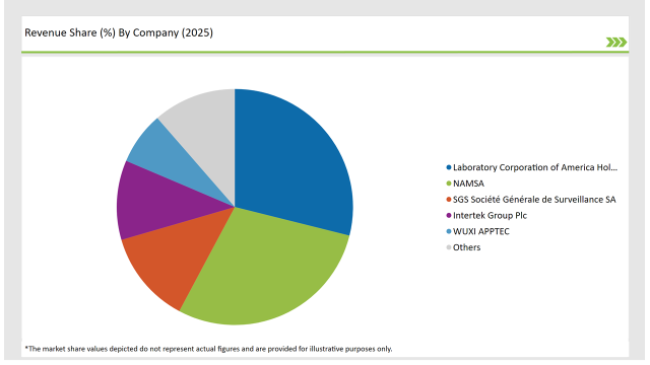

The India preclinical medical device testing services market is moderately fragmented, with a mix of multinational corporations and regional players contributing to a dynamic competitive environment. Companies like Laboratory Corporation of America Holdings, Charles River Laboratories, WUXI APPTEC and Sotera Health dominate the market by leveraging advanced technologies for streamlining their production process.

The competitive landscape of the India preclinical medical device testing services market features a blend of major multinational corporations and innovative regional companies.

2025 Market share of India Preclinical Medical Device Testing Services

Note: above chart is indicative in nature

By 2035, the India preclinical medical device testing services market is expected to grow at a CAGR of 8.1%.

By 2035, the sales value of the India preclinical medical device testing services industry is expected to reach USD 161.9 million.

Key factors that are attributing to the growth of the India preclinical medical device testing services market include improving healthcare facilities and growing advancements in medical technologies.

Prominent players in the India preclinical medical device testing services manufacturing include Laboratory Corporation of America® Holdings, NAMSA, SGS Société Générale de Surveillance SA., Intertek Group Plc, WUXI APPTEC, TÜV SÜD, Sotera Health, Eurofins Scientific, iuvo BioScience, llc, RQM+, Pace Analytical Services LLC, Pharmaron, Bioneeds India Pvt. Ltd., Porsolt, Gradient LLC and Goupe Icare.

The industry includes Testing Services (Biocompatibility Testing, Microbiological & Sterility Testing, Analytical chemistry {Material Characterization, Extractables and leachables, Storage and stability testing and Polymer Investigation}, Toxicology Testing { Cytotoxicity, Genotoxicity and Other Toxicology Testing}, Functional Testing, Electromagnetic Compatibility (EMC) Testing, Implantation Studies, Biological Safety Evaluation, Package Validation, Reusability Testing, Pyrogen Testing and Others, and Consulting Services (Device Designing/Engineering and Regulatory affairs Consulting).

In terms of device category, the industry is divided into Orthopedics, Cardiovascular, Respiratory, Diabetes, Dental, Neurology, Oncology, Ocular, Bariatrics, Wound Healing, General Health (Wearables), In Vitro Diagnostics, General Surgery, Drug Device Combination and Other Device Category.

The industry is divided into Class I, Class II and Class III.

The industry is classified by end user as medical device manufacturers, pharmaceutical and biotech companies, device design and engineering firms and academic and research institutions

The Prurigo Nodularis (PN) Treatment Market is segmented by product, and end user from 2025 to 2035

Warm Autoimmune Hemolytic Anemia (WAIHA) Treatment Market Analysis by Drug Class, Distribution Channel, and Region through 2035

Atrophic Vaginitis Treatment Market Analysis And Forecast by Diagnosis, Treatment, Therapy Type, Distribution Channel, and Region through 2035

Adrenal Crisis Management Market Analysis and Forecast, By Diagnosis Method, Treatment Method, Distribution Channel, and Region, through 2035

Birch Allergy Treatment Market Analysis by Drug Class, Route of Administration, Distribution Channel and Region: Forecast from 2025 to 2035

Cancer Vaccines Market Analysis by Technology, Treatment Method, Application and Region from 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.