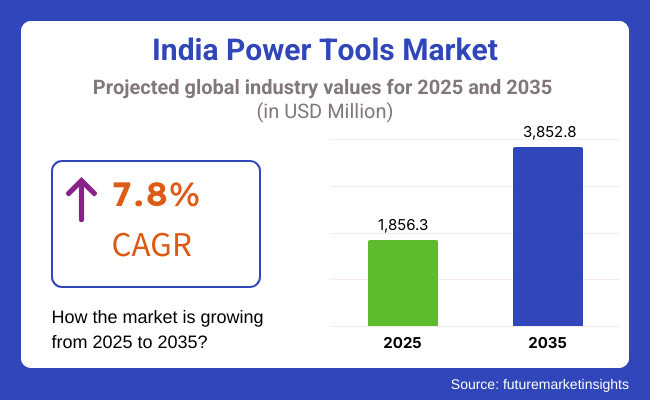

The India power tool market is set to experience significant growth between 2025 and 2035, driven by rapid industrialization, infrastructural development, and increasing automation in various sectors. The market, valued at USD 1,856.3 million in 2025, is expected to reach USD 3,852.8 million by 2035, expanding at a compound annual growth rate (CAGR) of 7.8% during the forecast period. Growing adoption of power tools in construction, automotive, and manufacturing industries, coupled with advancements in battery-powered tools, will be key growth drivers.

Increasing penetration of power tools in small and medium enterprises (SMEs), along with the growing trend of automation in industrial applications as a result of increasing adoption and investment in the solar & wind energy sector, is further projected to support the growth of the power tools market during the forecast period. Power tools with high performance-oriented specifications are in demand as India rapidly urbanizes and its real estate sector is on the upswing, resulting in growth in construction activities. Furthermore, the emergence of technological advancements such as smart tools and a brushless motor and the internet of things improves operational efficiency and safety, which is rapidly attracting an increasing number of consumers for these tools. With the introduction of e-commerce portals, reach to end-users has further been enhanced, leading to sales from professional users and the DIY user segment.

The demand for power tools in India is rising due to their efficiency, precision, and ability to reduce manual labour. The power tools market is becoming more popular because of the development and improvement of electronic devices. The construction sector is the leading consumer of the segment and is being boosted by government initiatives, such as the Smart Cities Mission and Pradhan Mantri Awas Yojana (PMAY) for urban development and housing projects. The automotive industry also uses power tools for assembly and maintenance, contributing to the rising demand for the market.

The rising penetration of DIY culture for home improvement and the growing usage of electric power tools across industries will drive the growth of the electric hand tools market. For over a decade, the international brand presence next to local manufacturers have led a no-rules competitive atmosphere resulting in innovative products at lower cost.

Explore FMI!

Book a free demo

Northern India, particularly Delhi NCR, Punjab, Haryana, and Uttar Pradesh, is witnessing significant growth in the power tool market due to rapid industrialization and infrastructure expansion. The booming construction sector due to urban development projects, metro rail expansion, and smart city projects are expected to propel the demand for power tools. Furthermore, the fast-growing manufacturing centers and automotive industry in regions such as Gurugram and Noida positively affect market growth. The trend of cordless power tools is growing, particularly in large-scale infrastructure projects that need quick mobility and efficient performance. With a sufficient number of domestic and international power tool manufacturers in the region, the competitive pricing and accessibility further fuel the penetration of professionals and small businesses within the market.

Maharashtra and Gujarat, forming part of western India, are vital contributors to the industrial and automotive sectors, impacting the power tool market projection in the region. Demand for precision power tools is significant in vehicle assembly and maintenance, as a high concentration of automobile manufacturers is located in and around Pune, Nashik, and Aurangabad. The availability of a strong manufacturing base inthe chemicals, engineering, and construction industry in the state of Gujarat is also anticipated to boost the market growth for power tools. The demand in the construction sector is further growing by ports, highway expansion, and metro rail project development. High-performance electric and battery-powered tools are increasing in demand as industrial automation and the establishment of huge multinational companies in Mumbai are growing. Western India is witnessing strong economic growth that is creating attractive opportunities for power tool manufacturers.

In Southern India, power tools markets are effectively growing in (Karnataka, Tamil Nadu, Andhra Pradesh, and Telangana) due to the self-projected industries in IT, electronics, and industry. Bengaluru, Chennai, and Hyderabad, which house big technology parks and major manufacturing units, require precision tools to operate. In addition, the demand for high-precision power tools is further driven by the growth of aerospace and defense manufacturing in this region. Further, in Chennai and Bengaluru, metro rail networks and smart city projects are and will facilitate the growth of the construction sector. The global power tool registrations, along with surging investments in the industrial infrastructure, are further boosting the regional market potential, owing to which Southern India is projected to register the highest growth for the forecasted timeline.

Most of Eastern India, comprising the states of West Bengal, Odisha, Bihar, and Jharkhand, has been gradually emerging with growth in the power tool markets, mainly supported by infrastructural development and industrial growth. On the other hand, in Kolkata, various construction and real-estate projects are getting popular with each passing day, resulting in a surge in the use of power tools in some of the most important urban centers. Odisha and Jharkhand are important markets for industrial power tools due to the high mineral resources and presence of steel manufacturing industries. New highway, bridge, and port projects are also driving higher demand in this region. Moreover, the lower adoption of sophisticated tools and the huge unclear conditions among small-scale market bases are still limited in the market. With various government initiatives intended to promote industrialization, power tools adoption is likely to increase in Eastern India.

Central India is growing at a steady rate in the power tools market due to high infrastructure growth and heavy industry support. Real estate and construction activities are booming in major cities like Indore and Bhopal, resulting in rising demand for power tools. As a steel and mining hub, Chhattisgarh needs heavy-duty industrial tools for extraction and processing operations. In addition, the growing demand for civil engineering applications is a result of government investments in road development and industrial corridors. Although the transition to power tools is not as fast as in other areas, growing urbanization and greater awareness of small businesses are anticipated to fuel future growth of the market in Central India.

High Initial Costs

One of the major challenges in the Indian power tool market is the high initial investment required for advanced power tools, particularly cordless and industrial-grade variants. Tools are expensive and its higher pricing (vs. traditional hand tools) makes it difficult for much of the subscription-based market to afford the premium tools, especially SMEs and individuals. The cost of use of lithium-ion batteries for cordless tools is also added on top of this. Although financing options and leasing models are introductory, affordability is still a major hurdle, particularly for price-sensitive consumers, which is the most common one. Manufacturers are working on launching affordable models and payment solutions, but massive adoption will require more awareness of financing options and wider access to them.

Skill Gap and Limited Workforce Training

Despite the increasing demand for power tools, a significant challenge lies in the shortage of skilled workers trained to handle advanced equipment. Many industries, especially particularly in small towns and rural areas, are still dependent on manual work because they do not know how to operate the power tools properly. These tools, if used improperly, can pose a safety risk, can result in accidents, and/or result in equipment damage, further leading to their hesitance to adopt it. Although a number of larger companies spend significantly on training their employees, there are no widely accepted efforts for skills development across the sector. To further this cause, there is a need for increased collaboration between manufacturers, vocational training institutes, and government programs to improve workforce competency and help ensure safer, more efficient use of power tools in all industries.

Technological Advancements in Power Tools

The rapid advancement of technology is creating significant growth opportunities in India's power tool market. The incorporation of brushless motors into cordless tools has enhanced working life with better efficiency, less maintenance, and longer running times with enhanced battery longevity, updated across multiple industries. Smart power tools with IoT functionality are also gaining traction; these tools can support wireless connectivity to facilitate real-time monitoring, predictive maintenance, and enhanced safety features. As precision does matter in industrial or construction tasks, such innovation is more effective in these domains. In addition, advances in lithium-ion battery technology are increasing the power and reliability of cordless power tools. As R&D is continuously being invested in by manufacturers, the advent of even more energy-saving, automated, and AI-integrated tools will aid in the further expansion and adoption of the market.

Government Initiatives and Local Manufacturing Growth

The "Make in India" initiative by the Indian government has helped power tools to be manufactured locally, making imports unnecessary and encouraging local production of power tools. The initiatives like industrialization, infrastructure, and MSME (Micro, Small & Medium Enterprises) development are encouraging in providing a conducive business environment for the power tool manufacturers. Other power tools initiatives by the government, such as Smart Cities Mission, Bharatmala Pariyojana, and Housing for All, are fuelling demand for power tools in construction and infrastructure development. Local manufacturing hubs in Gujarat, Maharashtra, and Tamil Nadu are facilitating supply chain efficiencies and lowering costs, too. The availability of favorable policies, tax incentives, and industrial automation investments to experience growth are anticipated to sustain the power tool market in India for the next decade.

The power tool market in India has witnessed significant growth from 2020 to 2024, driven by increasing infrastructure development in the country, expansion of the industrial sector, and a rise in do-it-yourself (DIY) culture among consumers. The urbanization across the developing and emerging markets, along with the growing adoption of automation in manufacturing and construction, has driven the industry of power tools. Government initiatives such as 'Make in India' and a push for local manufacturing have also been instrumental in doubling the market growth.

Looking ahead to the 2025 to 2035 period, the India power tool market is backed by advancements in battery technology, a trend towards cordless tools, and a growing demand for precision and efficacy in industrial applications. Manufacturers will be emphasizing energy efficiency as well as sustainability as they continue to develop eco-friendly power tools.

Comparative Market Analysis

| Market Shift | 2020 to 2024 |

|---|---|

| Regulatory Landscape | Standard safety regulations and import duties influenced the market. |

| Technological Advancements | Growth in brushless motor technology and integration of IoT in industrial tools. |

| Industry-Specific Demand | High demand from construction, automobile, and manufacturing sectors. |

| Sustainability & Circular Economy | Initial steps towards energy-efficient tools and recyclability of materials. |

| Production & Supply Chain | Imports from China and Europe; disruptions in logistics during COVID-19. |

| Market Growth Drivers | Increasing disposable income, urbanization, and government infrastructure projects. |

| Market Shift | 2025 to 2035 |

|---|---|

| Regulatory Landscape | Stricter safety norms, increased localization, and sustainability mandates. |

| Technological Advancements | Expansion of more AI-based power tools, better battery usage and smart connectivity. |

| Industry-Specific Demand | Increased adoption in renewable energy, aerospace, and precision engineering. |

| Sustainability & Circular Economy | Increased focus on sustainable production, biodegradable materials, and lower carbon footprints. |

| Production & Supply Chain | Strengthened domestic manufacturing, improved supply chain resilience, and localized production. |

| Market Growth Drivers | Emerging automation in manufacturing, Industry 4.0 trends, and a DIY culture among consumers. |

Uttar Pradesh's power tool sector is gradually expanding due to extensive infrastructure projects and increasing industrialization. The state witnessing a fast-paced urbanization backed by several smart city initiatives by various governments is also driving the demand for advanced power tools. In addition, the increase in real estate and road construction projects also drives the growth of the market. An increase in MSMEs and local manufacturing hubs is driving cost-effective and efficient tools. With India pushing for green energy, the use of electric and battery-powered tools is also seeing a rapid rise. Given these factors, Uttar Pradesh’s power tool market is expected to witness a CAGR of 8.2% from 2025 to 2035, slightly outperforming the national average.

| Country | CAGR (2025 to 2035) |

|---|---|

| Uttar Pradesh | 8.2% |

Maharashtra, as an industrial and financial hub, remains a key driver in India’s power tool market. With the state's leading manufacturing clusters, such as Mumbai, Pune, and Nashik, the demand for precision power tools is strong. The increasing automotive and construction industries and the growing infrastructure projects drive market growth. Moreover, the drive for industrial automation and smart manufacturing is driving high-tech cordless and pneumatic tool demand in Maharashtra. The growing focus on sustainability along with energy-efficient equipment is contributing for the market to grow even faster.With these favourable conditions, the power tool market in Maharashtra is anticipated to grow at a CAGR of 8.5% from 2025 to 2035.

| Country | CAGR (2025 to 2035) |

|---|---|

| Maharashtra | 8.5% |

Karnataka has a fast-growing power tool market because of its huge amount of IT and manufacturing industries. The state’s technology hub, Bengaluru, is witnessing the rising adoption of automated and smart devices in the precision engineering and electronics sector. The urban construction sector in places like Mysore and Hubballi is also growing vigorously, pushing demand for power tools. Government-sponsored industrial efforts make no mistake in accelerating the market, which involves consolidating MSME and industrial corridors. The electric and battery-driven machine sectors are projected to thrive due to increased interest in workplace effectiveness and equipment usage. With these developments, Karnataka’s power tool market is forecasted to grow at a CAGR of 8.0% from 2025 to 2035.

| Country | CAGR (2025 to 2035) |

|---|---|

| Karnataka | 8.0% |

West Bengal’s power tool market is expanding steadily, driven by increasing industrialization and urban development. Real estate and infrastructure projects are booming in Kolkata, the commercial capital of the state, leading to demand for high-end equipment. The growing logistics and warehousing industry, buoyed by the government's infrastructure-building projects, is also accelerating growth in the market. Furthermore, the increase in small-scale industries as well as local manufacturing units is generating a consistent demand for economical and long-lasting power tools. However, market growth is slightly moderated by price sensitivity among end users. Despite this, West Bengal’s power tool market is projected to grow at a CAGR of 7.6% from 2025 to 2035.

| Country | CAGR (2025 to 2035) |

|---|---|

| West Bengal | 7.6% |

In Madhya Pradesh, the demand for power tools is driven by rapid urbanization, increasing infrastructural developments, and government-driven industrial initiatives. The growth of smart cities and growing investments in roadways, railways, and real estate is further propelling the demand for power tools. The state has two solid manufacturing centres of Bhopal and Indore, and it's evolving manufacturing industry is additionally bolstering the requirement of efficient and superior tools. In addition, increasing focus on skills development and labour productivity in the state is leading to increasing adoption of modern power tools .With these factors contributing to a positive market outlook, Madhya Pradesh’s power tool market is expected to grow at a CAGR of 7.9% from 2025 to 2035.

| Country | CAGR (2025 to 2035) |

|---|---|

| Madhya Pradesh | 7.9% |

In the power tool market, drilling tools account for a large portion of the market due to their common use in construction, woodworking, and metalworking sectors. Their versatility in handling materials like concrete, metal, and wood makes them a preferred choice for professionals and DIY enthusiasts alike. Increasing infrastructure construction and urbanization in India have led to a rise in demand for drilling tools in both residential and commercial projects. As such, developments like cordless and brushless motor technology improve efficiency and durability, thus stimulating market adoption. For instance, Government schemes such as 'Make in India' is also driving manufacturing status domestically, in turn increasing the demand for high-performance drilling tools in industrial applications. Strong demand in regions such as Maharashtra and Karnataka due to the growing construction and industrial sectors.

Angle grinders are experiencing robust growth in India’s power tool market, driven by increasing applications in the metalworking, construction, and automotive industries. For professionals involved in fabrication and surface preparation tasks, their capability to cut, grind, and polish different materials is invaluable. The increasing investment in infrastructure and real estate sector in India is further driving the adoption of angle grinder for tile cutting, masonry work, and metal finishing. In addition, the advent of battery-operated and lightweight models is further improving ease of use and user ability for small contractors and individual users. Industrial activity is particularly high in states like Gujarat and Tamil Nadu, which have some of the most prominent metalworking and automobile manufacturing demand.

The construction sector is the largest consumer of power tools in India, accounting for a significant market share due to the rising infrastructure and real estate developments. The demand for reliable and high-powered tools like drilling machines, angle grinders, and circular saws is rapidly increasing with urbanization and government initiatives like the Smart Cities Mission. Power tools in construction improve productivity by allowing for speedy accuracy and eliminating physical labor. Moreover, the increasing shift towards cordless and ergonomic power tools is enhancing operational efficiency and safety on construction sites. In metro cities such as Delhi, Mumbai, and Bengaluru, demand is significant, with high-rise construction and commercial projects boosting the need for power tools as an indispensable element of construction in contemporary times.

Factors such as growth in the manufacturing sector and increasing focus on automation and precision engineering in India are the key contributors to the demand for power tools in the country. Power tools, including fastening tools, impact wrenches, and drills, are extensively used in industries ranging from automotive to aerospace to heavy machinery for assembly and maintenance operations. The drive for "Atmanirbhar Bharat" (self-reliant India) has promoted in-country manufacturing, which has been a booster of demand for high-performance tools. Furthermore, the use of power tools is growing in automated assembly lines for improved efficiency and precision. As electric vehicle (EV) manufacturing surges, along with the emergence of industrial hubs in states such as Maharashtra, Tamil Nadu, and Gujarat, the demand for power tools in production and maintenance processes remains at an all-time high.

The global power tool market is highly competitive, driven by technological advancements, increasing automation in industries, and a rising demand for cordless and battery-powered tools. An established group of multinational corporations dominates the market alongside growing players working on innovation and sustainability. The landscape of ITW (Innovative Technology Week) includes key players like Bosch, Stanley Black & Decker, Makita, Hilti, and Techtronic Industries , providing diversified offerings in the construction, automotive, and industrial applications.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Bosch | 15-20% |

| Stanley Black & Decker | 14-18% |

| Makita | 12-16% |

| Hilti | 8-12% |

| Techtronic Industries | 7-10% |

| Other Companies (combined) | 35-45% |

Key Company Offerings and Activities

| Company Name | Key Offerings/Activities |

|---|---|

| Bosch | Produces cordless, corded and smart IoT integrated tools for precision and performance in industrial and construction applications worldwide. |

| Stanley Black & Decker | They create professional and consumer power tools and are investing in lithium-ion batteries and a green future to improve performance and sustainability. |

| Makita | This time, a high-performance, lightweight, ergonomic lithium-ion battery tool, continuously innovation and strives to improve its durability and efficiency and battery life. |

| Hilti | The company focuses on power tools that are delivered in premium quality, designed for hard-wearing construction, and come with an intelligent digital fleet and tools. |

| Techtronic Industries | Manufactures Milwaukee and Ryobi tools, which focus on brews and brushless engine lithium-ion solutions for contractors, DIYers, and industrial users around the globe. |

Bosch

Bosch is a leader in the power tools market and offers state-of-the-art innovations and environment-friendly solutions. The company focuses on embedding IoT-enabled solutions that enable real-time diagnostics and predictive maintenance. AI-powered technology plays a key role in Bosch's vast and ambitious portfolio focused on the efficiency and precision of industrial and construction efforts. Specializing in biopsy and culture systems, as well as a range of other biomedical questions, QIAGEN offers building blocks for the development of customized molecular tools. Through acquisition and strategic partnerships, you can position yourself in professional and consumer markets that give you a competitive advantage and global reach.

Stanley Black & Decker

Stanley Black & Decker is a diversified global supplier of tools and storage as well as industrial and security products for both DIY and professional users. The company is redefining lithium-ion battery efficiency and longevity. Its sustainability agenda is both bold and ambitious, with a commitment to carbon neutrality and sustainable resources in the products it makes. Stanley Black & Decker targets contracts with financial institutions that finance developments and diversifying its product lines and acquisitions. It continues to be a hallmark of growth strategy with an eye on emerging markets and bolstering its distribution network. The company’s DeWalt brand is a leader in the high-performance segment, emphasizing durability and ergonomic design.

Makita

Makita is known for its lightweight, ergonomic designs and first-to-market brushless motor technology that increases power efficiency and durability. Recognized for leading the charge on cordless tools, all while still improving battery life and performance over time. Makita puts a lot of emphasis on product durability, so its tools work well for professional and industrial applications. With its expanding operations throughout Asia-Pacific and North America, the company has devoted resources to research and development to improve efficiency. Makita's focus on sustainability is evident in its commitment to energy-efficient battery technologies and reduced carbon footprints.

Hilti

Hilti makes high-performance power tools for commercial and industrial construction. Offer high-end solutions for demanding needs, guaranteeing functionality and lasting endurance. Hilti is accelerating digital solutions for tool fleet management, enabling customers to more efficiently track, manage, and maintain their equipment. Full-fledged global presence and extending its footprint in major markets via direct sales and rental models. With significant investments in research and development, Hilti focuses on making construction work more productive, safer, and more automated and has become a popular choice among construction professionals.

Techtronic Industries

Techtronic Industries is a significant player in the power tool market and is recognized for its Milwaukee and Ryobi brands. It has a significant share of the North American and Asia-Pacific markets and develops high-power, brushless motor-powered cordless tools under its brand. Techtronic features cutting-edge technology in battery technology, giving you a long run and quick charging. The company caters to both pro contractors and DIY users with its extensive product range. Techtronic is also focused on smart tools and automation to improve both user experience and productivity.

The India Power Tool market is projected to reach USD 1,856.3 million by the end of 2025.

The market is anticipated to grow at a CAGR of 7.8% over the forecast period.

By 2035, the Power Tool market is expected to reach USD 3,858.2 million.

The drilling tool segment is expected to dominate the market, due to high demand in construction, woodworking, and DIY projects. Their versatility, precision, and efficiency make them essential for professionals and homeowners alike.

Key players in the Power Tool market include Hitachi (Metabo), Festool, Husqvarna, Snap-on Tools, RIDGID.

In terms of products, the industry is divided into drilling tool, fastening tool, heat gun, angle grinder, chain saw, orbital sander, jigsaw, impact wrench, and circular saw.

In terms of application, the industry is segregated into manufacturing, MRO services, DIY, and construction.

The report covers key regions, including Northern India, Western India, southern India, Eastern India, North Eastern India.

Diaphragm Coupling Market Growth - Trends & Forecast 2025 to 2035

HID Ballast Market Growth - Trends & Forecast 2025 to 2035

Fluid Conveyance Systems Market Growth - Trends & Forecast 2025 to 2035

GCC Magnetic Separator Market Outlook – Growth, Trends & Forecast 2025-2035

United Kingdom Magnetic Separator Market Analysis – Size, Share & Forecast 2025-2035

Glass Door Merchandisers Market Growth - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.