The India pharmaceutical intermediate market is expected to reach USD 2,781.1 million in 2025 and is projected reach a total value of USD 5,587.7 million by 2035. This represents a compound annual growth rate (CAGR) of 7.2% during the forecast period from 2025 to 2035.

| Attributes | Values |

|---|---|

| Estimated India Industry Size (2025) | USD 2,781.1 million |

| Projected Global Value (2035) | USD 5,587.7 million |

| Value-based CAGR (2025 to 2035) | 7.2% |

India can source almost every intermediate it needs for pharma manufacturing cheaper. This, together with cheap labor and generally well-developed infrastructures that supply basic input materials, further enables them to easily produce their intermediates at a much reduced cost, which would allow them to sell their end product at comparatively lower prices.

Thus, this cost advantage has triggered more domestic pharmaceuticals manufacturing and brought global exports of intermediates. So now, India becomes one of the major hubs of production of pharmaceutical intermediate products.

Explore FMI!

Book a free demo

The table below offers a detailed comparative assessment of the changes in the compound annual growth rate (CAGR) over six months for the base year (2024) and the current year (2025) specifically for the India pharmaceutical intermediate market.

This semi-annual analysis helps in identifying the vital dynamics of market shifts and categorizes the revenue realization patterns, thus giving better clarity to stakeholders about the overall growth pattern through the year. H1 includes January through June, while H2 includes July to December.

H1 signifies period from January to June, H2 Signifies period from July to December

Growth is likely to rise by 7.3% CAGR during H1-2024 in the India market of pharmaceutical intermediate. It may jump to 7.7% in the latter half of 2024. The growth rate is going to decline a bit to 7.2% in H1 and fall down to 8.0% in H2 in the calendar year of 2024.

Such a volatile and continuously changing stream of the industry of Indian pharmaceutical intermedicated products is heavily influenced by regulatory changes, consumer preferences, and innovations in complex intermediate. This semi-annual breakdown stands as a cornerstone for businesses to plan strategies that can take advantage of this opportunity as well as understand how markets change.

| Date | Development/M&A Activity & Details |

|---|---|

| 2025 | Strategic Expansion: Cambrex is emphasizing on making strategic expansion of their production capabilities in different geographic location of the globe |

| 2024 | Increase in Number of CMOs and CDMOs: Companies such as BASF and others, which are responsible for Increase in number of CDMOs in India, anticipate a significant growth of the market. |

| 2024 | International Conferences: Pharmaceutical intermediate manufacturers such as Aceto among others are focusing on participating in international conferences |

Increase in Domestic Demand of Pharmaceutical Intermediate Anticipates Market Growth in the Country

The competitive labor cost compared to developed nations greatly reduces production costs and makes it an attractive destination for both domestic and international pharmaceutical companies.

This makes the combination of low-cost labor, key raw materials, and proper infrastructure an added advantage to the pharmaceutical companies, as intermediates can be produced at lower costs, enabling the final products to become more competitively priced.

Thus, the cost advantage induced increased domestic manufacturing of pharmaceuticals, as well as global exports of intermediates, making India an important producer of pharmaceutical intermediates..

Rising investment towards Development of Biopharmaceutical and Biosimilars products Anticipate the Growth of the market in India

Supportive policies by the government, such as "Pharma Vision 2020" and incentives for the domestic manufacturing of pharmaceuticals, attract investment in the manufacturing of intermediates. Exports, especially to the USA and Europe, where India has traditionally been a strong exporter, also contribute to increasing demand for intermediates.

The emergence of CMOs in India has been another factor that has helped in cost-effective large-scale production of intermediates. Further, with increased investment in pharmaceutical R&D, new drug discoveries have been made and will be requiring advanced intermediates.

Besides, a better regulatory environment in India makes intermediates also qualitatively similar to international standards and hence more competitive internationally. These are all factors that keep the growth in the Indian market for pharmaceutical intermediates going ahead and place it as a vital player in the global supply chain of the pharmaceutical industry.

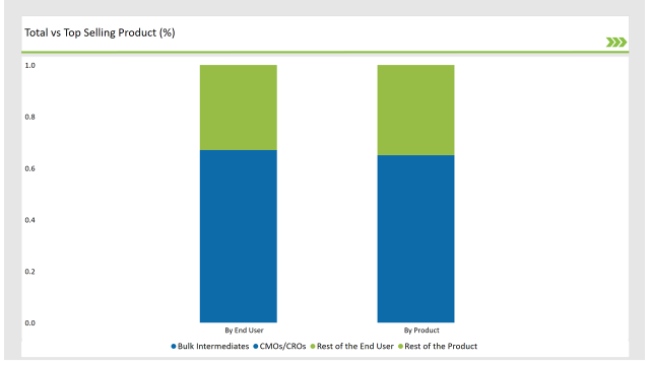

% share of Individual categories by Product Type and End User in 2025

Bulk drug intermediates records significant surge in the market owing to its growing adoption in manufacturing of dietary supplements

The growing trend of cost containment in the healthcare sector could be a prime reason for the dominance of bulk drug intermediates in India's pharmaceutical intermediate market.

Bulk intermediates provide an economy of scale approach to manufacture active pharmaceutical ingredients in large quantities; this is where controlling the drug price becomes easy, especially generics. Increasingly, biosimilars demand more of such bulk intermediates, as those drugs are mostly manufactured in mass production.

Furthermore, India's legal regime has adequately ensured that the quality of bulk intermediates is high, thereby becoming more appealing in domestic markets as well as global markets.

The incorporation of digital and automation technologies into bulk drug intermediates production enhances efficiency and scalability, supporting growth. Partnerships between pharmaceutical companies and CMOs focused on bulk intermediates help advance the reliability and flexibility required by supply chains for meeting global demand.

Emphasis on outsourcing their production facilities has aided CMOs to hold dominant position

The Indian pharmaceutical intermediate market is dominated by the contract manufacturing organizations, which account for approximately 66.6% of the share, due to several key factors: CMOs are highly cost-effective since companies can outsource the production instead of investing in expensive facilities; this is good, especially in a sensitive market like India.

Under this model, pharmaceutical firms can pay more attention to research and development. Besides, scalability and flexibility that CMOs offer are great for meeting the burgeoning demand for generics and biologics. A large pool of skilled labor force, cost advantages, and infrastructural development round up the support for the increased focus on contract manufacturing in India.

Indeed, the improved regulatory framework of the country also ascertains international quality standards and makes CMOs more attractive, both for domestic and global pharmaceutical companies. The Indian CMOs play a very important role in the growth of the pharmaceutical intermediate market, which is increasing demand for cost-effective production and efficient supply chains.

Note: above chart is indicative in nature

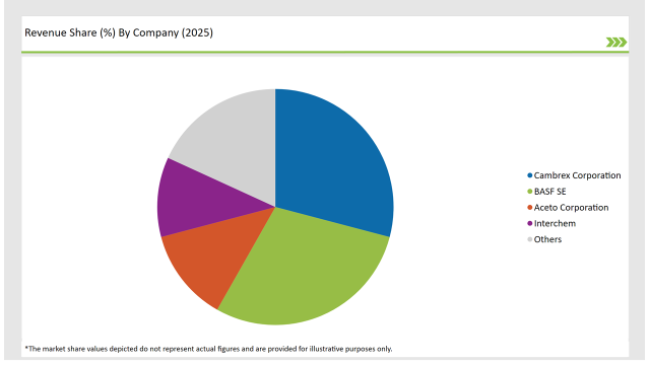

The India pharmaceutical intermediate market is moderately fragmented, with a mix of multinational corporations and regional players contributing to a dynamic competitive environment. Companies like Cambrex Corporation, BASF SE, Aceto Corporation, Interchem, Cambrex Corporation, Arkema Inc. dominate the market by leveraging advanced technologies for streamlining their production process.

The competitive landscape of the India pharmaceutical intermediate market features a blend of major multinational corporations and innovative regional companies.

By 2035, the India pharmaceutical intermediate market is expected to grow at a CAGR of 7.2%.

By 2035, the sales value of the India pharmaceutical intermediate industry is expected to reach USD 5,587.7 million.

Key factors propelling the India pharmaceutical intermediate market include the growing number of generic manufacturers in the country.

Prominent players in the India pharmaceutical intermediate manufacturing include BASF SE, Cambrex Corporation, Interchem, Arkema Inc, Pfizer, BMSetc, Midas Pharma GmbH, Chiracon GmbH, Codexis, Inc, A.R. Life Sciences Private Limited, Dishman Group and Dextra Laboratories Limited.

The industry includes chemical intermediates, bulk drug intermediates and custom intermediates.

Available in forms branded drug intermediates, and generic drug intermediates.

The industry is divided into analgesics, anti-inflammatory drugs, Cardiovascular Drugs, Anti-diabetic Drugs, Antimicrobial Drugs, Anti-cancer Drugs and others.

The industry is classified by end user as biotech and pharma companies, research laboratory and CMOs/CROs

The Prurigo Nodularis (PN) Treatment Market is segmented by product, and end user from 2025 to 2035

Warm Autoimmune Hemolytic Anemia (WAIHA) Treatment Market Analysis by Drug Class, Distribution Channel, and Region through 2035

Atrophic Vaginitis Treatment Market Analysis And Forecast by Diagnosis, Treatment, Therapy Type, Distribution Channel, and Region through 2035

Adrenal Crisis Management Market Analysis and Forecast, By Diagnosis Method, Treatment Method, Distribution Channel, and Region, through 2035

Birch Allergy Treatment Market Analysis by Drug Class, Route of Administration, Distribution Channel and Region: Forecast from 2025 to 2035

Cancer Vaccines Market Analysis by Technology, Treatment Method, Application and Region from 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.