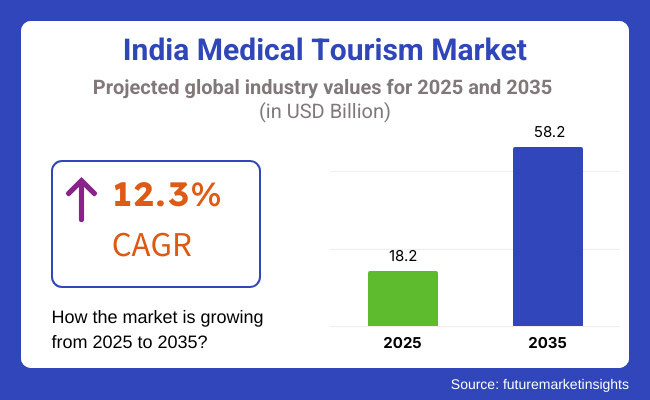

India's medical tourism industry is poised for substantial growth, with projections indicating an increase from an estimated USD 18.2 billion in 2025 to USD 58.2 billion by 2035, at a CAGR of 12.3% during the forecast period. This surge in growth is driven by India's reputation for high-quality healthcare services at a fraction of the cost compared to Western countries, along with the availability of cutting-edge technology and internationally trained medical professionals.

The demand for healthcare services such as cosmetic surgery, orthopedics, fertility treatments, and organ transplants is contributing significantly to the growth of India’s medical tourism market. In addition, the existence of internationally accredited hospitals and clinics in urban centers such as Delhi, Bangalore, and Mumbai is propelling India into a position of a top medical tourism destination globally. Low-cost medical interventions along with advanced technology and reduced waiting times relative to other areas are vital determinants driving the industry's growth.

Explore FMI!

Book a free demo

The following chart presents the projected CAGR for India’s medical tourism market, comparing growth patterns between 2024 and 2025.

CAGR Values for India Medical Tourism Industry (2024 to 2025)

It is projected that India’s medical tourism market will grow at a CAGR of 11.3% in the first half of 2024, with a slight increase to 11.8% in the second half. In 2025, the growth rate is expected to rise to 12%, driven by increasing demand for specialized surgeries, cosmetic procedures, and fertility treatments.

| Category | Details |

|---|---|

| Market Value | The Indian medical tourism industry is expected to generate USD 10.2 billion in 2024, capturing 25% of Asia’s medical tourism market. |

| Domestic Market Share | Domestic patients account for 45% of the market, with key destinations like Delhi, Bangalore, and Mumbai offering specialized treatments. |

| International Market Share | International patients make up 55%, with major source countries including the Middle East, Africa, the US, and Europe. They seek a wide range of services including orthopedic surgery, dental work, and cosmetic treatments. |

| Key Destinations | Popular destinations include Delhi’s Apollo Hospital for cancer treatments, Mumbai’s Nanavati Hospital for cardiac surgery, and Bangalore’s Sakra Premium Clinic for fertility treatments. |

| Economic Impact | The medical tourism sector generates billions annually, benefiting hospitals, clinics, and medical facilities such as Fortis Healthcare and Medanta. |

| Key Trends | Surge in the adoption of minimally invasive surgeries, rapid advancements in robotic surgery, and the rise of wellness tourism with Ayurvedic treatments. |

| Top Treatment Seasons | Winter and spring are peak seasons, especially for patients seeking cosmetic procedures, fertility treatments, and dental surgeries. |

India is fast emerging as one of the most popular medical tourism destinations, with Delhi, Mumbai, and Bangalore being the main hubs for quality healthcare. Global patients, particularly from the Middle East, Africa, and the US, are attracted by India's low cost, combined with high-tech medical equipment and professional healthcare professionals. Hospitals like Fortis Healthcare, Medanta, and the Apollo Group are leading the way in delivering high-quality treatments to propel India to a position of medical tourism leadership.

| Date | Development & Details |

|---|---|

| Jan 2025 | Launch of Robotic Surgery Unit: The Medanta Medicity Hospital in Gurgaon launched a state-of-the-art robotic surgery unit for advanced procedures in orthopedics and urology, attracting patients from the Middle East. |

| Dec 2024 | Fertility Treatment Expansion: Sakra Premium Clinic in Bangalore introduced an innovative package for IVF and fertility treatments, including egg freezing and surrogacy, drawing international patients from the US and Europe. |

| Nov 2024 | Opening of Advanced Cancer Treatment Center: The Apollo Hospital in Chennai opened a new center for cancer treatment, offering cutting-edge radiation therapy and immunotherapy for patients from Africa and Southeast Asia. |

| Oct 2024 | Ayurvedic Wellness Packages: Kerala Ayurvedic Resort launched exclusive wellness tourism packages, combining traditional Ayurvedic treatments with luxury accommodations, appealing to patients from Europe and North America seeking holistic health solutions. |

| Sept 2024 | Stem Cell Therapy Clinic Expansion: A leading stem cell clinic in Mumbai expanded its facilities, providing advanced treatments for orthopedic injuries, stroke rehabilitation, and chronic diseases, attracting international patients. |

Cosmetic Treatments Lead the Market

Cosmetic procedures will lead the way in India's medical tourism industry in 2025, holding around 30% of the entire market share. This is propelled by a rising demand worldwide for quality cosmetic surgery, such as rhinoplasty, facelift, liposuction, and dental implants. India's attraction is that it can provide these procedures at one-tenth of the price in Western nations while ensuring international levels of care. To this effect, medical tourists from the Middle East, Southeast Asia, and even the US are flocking to India for cosmetic enhancements.

Indian metropolises such as Mumbai, Delhi, and Hyderabad have become leading places for cosmetic surgeries. These metropolises are equipped with high-tech healthcare centers and surgeons who have been trained internationally, and therefore, these places are the first choice of people looking for specialized treatments. Mumbai, specifically, is very famous for specialized cosmetic clinics providing the latest services like facelifts, facial surgeries, and breast enhancements. Most of these clinics are headed by renowned surgeons from across the globe who provide a personal touch to every treatment, providing the best possible results.

One of the distinguishing features of India's cosmetic surgery medical tourism is that patients can mix their procedure with a vacation. Many medical tourists utilize the fact that they can enjoy India's rich cultural history, fast-paced cities, and natural landscapes while recovering from treatment. The combination of aesthetic improvement and tourism makes India an even more appealing choice for those who want to balance medical treatment with a recovery vacation.

In addition, India's well-established wellness industry, such as Ayurveda and heritage treatments, delivers a holistic rehabilitation experience to patients. This blend of low-cost, high-grade cosmetic procedures and cross-cultural experiences further establishes India as a global destination for health tourism, particularly in cosmetic surgery.

Independent Travelers Dominate the Market

By 2025, independent travelers will account for about 65% of all Indian medical tourists, reflecting a trend towards increasingly personalized and self-directed medical care experiences. This trend represents a rising patient preference for exercising direct control over the process of healthcare decision-making, from choosing the appropriate treatment and facility to handling the whole travel experience themselves. The presence of vast online resources has been instrumental in this revolution, enabling medical tourists to study hospitals, read reviews from patients, compare prices, and communicate directly with healthcare professionals prior to making a decision.

Growth of independent medical tourism in India is also supported by the availability of information that is on the rise. Now, patients have easy access to information regarding hospitals, their accreditations, the treatments being provided, and the success of procedures through widely established online networks. This ease of access to open information provides people with an opportunity to take more informed decisions and provides them with the strength to avoid middlemen like medical tourism companies. Most patients nowadays like to arrange their treatment, accommodation, and even excursions according to their personal liking and budget.

On top of this, India's open pricing systems and low-cost healthcare have made it even more appealing to independent medical travelers. The price for each procedure can be compared simply and easily across hospitals, guaranteeing high levels of care without the strain of high fees. The nature of this system permits patients to combine their treatment with vacation, being able to stay longer after a procedure to recover or even for tourist activities.

This transition towards independent travel is also made easy by the increased number of medical tourism platforms offering end-to-end solutions. Such platforms provide complete services, from assisting patients in selecting the appropriate clinics and doctors to arranging logistics such as visas and local travel, further allowing patients to gain control over their medical travel. This increasing sector is likely to continue propelling the Indian medical tourism sector forward in the next few years.

The India Medical Tourism Industry is highly competitive, with a blend of top-tier hospitals, specialized medical centers, and smaller boutique clinics offering niche treatments.

2025 Market Share of India Medical Tourism Players

Leading players with significant market shares include Fortis Healthcare, Medanta, and Apollo Hospitals, followed by a variety of regional hospitals and specialized clinics offering services like dental treatments, organ transplants, and cosmetic surgeries.

India's Medical Tourism Industry is expected to grow at a CAGR of 12.3% from 2025 to 2035.

The market is projected to reach USD 58.2 billion by 2035.

Key drivers include high-quality healthcare, affordability, availability of advanced medical procedures, and the growing influx of international patients seeking specialized treatments in India.

Key players include Fortis Healthcare, Medanta, Apollo Hospitals, and other prominent Indian hospitals offering world-class medical care and innovative treatments.

The industry is segmented into Cosmetic Treatment, Dental Treatment, Cardiovascular Treatment, Orthopedic Treatment, Infertility Treatment, Ophthalmic Treatment, and Other Treatments.

The market is analyzed by age groups (Less than 15 years, 15 - 25 years, 26 - 35 years, 36 - 45 years, 46 - 55 years, Over 55 years).

Segmentation includes Domestic and International tourists.

The industry includes Public Provider, Private Provider.

Independent Traveler, Tour Group, Package Traveler

The market is analyzed by gender (Men, Women) and age (Children).

The industry is segmented into Phone Booking, Online Booking, and In-person Booking.

Winning Strategies in Social Media and Destination Market Share Analysis: A Competitive Review

Winning Strategies in the Global Tourism Industry Loyalty Program Sector: A Competitive Review

Winning Strategies in the Global Animal Theme Parks Industry: A Competitive Review

Winning Strategies in the Global Winter Adventures Tourism Industry: A Competitive Review

Surrogacy Tourism Industry – Competitive Analysis and Market Share Outlook

China Destination Wedding Market Insights – Growth & Forecast 2025-2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.