The India loyalty program market is very rapidly growing as brands are investing in customer retention strategies to drive long-term engagement and revenue growth. With increasing digital adoption, spending by consumers, and competition across industries, companies are focusing on more sophisticated data-driven rewards programs to enhance customer relationships.

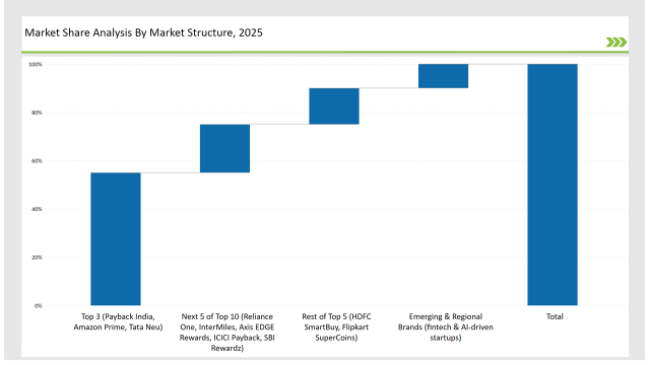

Advancements in AI, blockchain, and mobile-first solutions are further upscaling the sector. With major market share commanding brands including Payback India, Amazon Prime, and Tata Neu that have reached wider audiences and provide data-driven loyalty solutions, the market currently is held at 55%.

Regional brands and industry-specific programs account for 30%, while emerging fintech and AI-powered startups contribute the remaining 15%.

Explore FMI!

Book a free demo

| Market Segment | Industry Share (%) |

|---|---|

| Top 3 (Payback India, Amazon Prime, Tata Neu) | 55% |

| Rest of Top 5 (HDFC SmartBuy, Flipkart SuperCoins) | 15% |

| Next 5 of Top 10 (Reliance One, InterMiles, Axis EDGE Rewards, ICICI Payback, SBI Rewardz) | 20% |

| Emerging & Regional Brands (fintech & AI-driven startups) | 10% |

The India loyalty program market in 2025 is moderately concentrated, with the top players accounting for 50% to 60% of the total market share. Leading brands such as Payback India, Amazon Prime, and Tata Neu dominate the segment, while startup-driven digital loyalty platforms and retailer-specific programs add competitive diversity.

This market structure reflects strong brand influence while allowing space for data-driven personalization and innovative reward structures.

The India loyalty program operates through a channel that involves digital platforms and mobile applications, which comprise 60% of the market. App-based rewards and e-commerce integrations attract consumers.

Retail and offline programs form 25%, which emphasize point-based incentives and deals with particular partners. Co-branded credit card programs remain at 10% with reward-based advantages in spending. Direct corporate loyalty programs form 5%, providing both employee retention and business-to-business (B2B) incentives.

It has classified the loyalty program market in India into retail loyalty programs, travel and hospitality rewards, financial services loyalty, and subscription-based membership programs. Retail loyalty programs lead the market with 45% on account of wide-scale adoption in markets such as supermarkets, online marketplaces, and lifestyle brands.

Travel and hospitality rewards account for 25%, catering to frequent travelers and premium members. Financial services account for 20%, mainly through the use of reward-based credit cards and banking rewards. Subscription-based membership is at 10%, increasing with the growth of streaming services and premium shopping memberships.

2024 has been a transformative year for the India loyalty program market, which is marked by AI-driven personalization, digital rewards, and omnichannel engagement. Key players include:

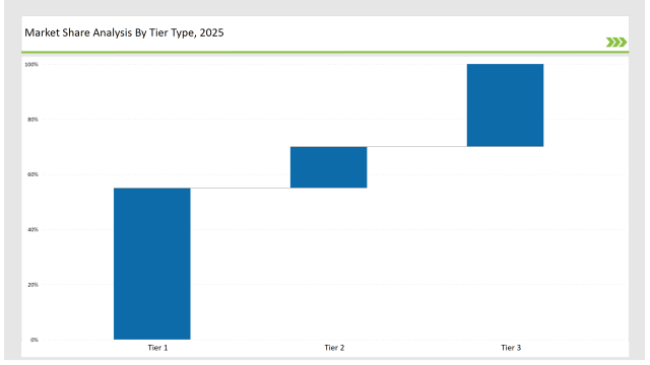

| Tier Type | Tier 1 |

|---|---|

| Example of Key Players | Payback India, Amazon Prime, Tata Neu |

| Market Share (%) | 55% |

| Tier Type | Tier 2 |

|---|---|

| Example of Key Players | HDFC SmartBuy, Flipkart SuperCoins |

| Market Share (%) | 15% |

| Tier Type | Tier 3 |

|---|---|

| Example of Key Players | Regional brands, fintech startups |

| Market Share (%) | 30% |

| Brand | Key Focus Areas |

|---|---|

| Payback India | Cross-category rewards & retail partnerships |

| Amazon Prime | Subscription-based loyalty with exclusive benefits |

| Tata Neu | Super-app loyalty integration across Tata brands |

| HDFC SmartBuy | Co-branded credit card cashback & travel rewards |

| Flipkart SuperCoins | Gamified loyalty experiences & tier-based benefits |

| Emerging Brands | AI-driven rewards & seamless multi-merchant point conversions |

India's loyalty program market will be one of sustained growth through data-driven personalization, fintech collaborations, and omnichannel customer engagement. Brands will focus on AI-powered predictive analytics, blockchain-backed reward security, and gamification to enhance customer retention. Consumer preferences are shifting, making loyalty programs more interactive, with immersive experiences and seamless digital integrations. Innovation, data-driven engagement, and ethical consumer incentives form the nucleus of India's future loyalty market.

Leading players such as Payback India, Amazon Prime, and Tata Neu collectively hold around 55% of the market.

Regional brands and industry-specific loyalty programs contribute approximately 30% of the market by offering customized rewards for local businesses.

Startups focusing on AI-based rewards, digital wallets, and blockchain-backed loyalty solutions hold about 10% of the market.

Private labels from retail and banking sectors hold around 5% of the market, focusing on co-branded credit card rewards and brand-specific incentives.

High for companies controlling 55%+, medium for 40-55%, and low for those under 30%.

Anti-Pollution Skin Care Market Trends - Growth & Forecast 2025 to 2035

Tissue Towel Market Analysis - Trends, Growth & Forecast 2025 to 2035

Korea Men’s Skincare Market Analysis - Size, Share & Trends 2025 to 2035

Japan Men’s Skincare Market Analysis - Size, Share & Trends 2025 to 2035

Japan Wall Décor Market Analysis by Base Material, End Use, Product Type, Sales Channel, and Region through 2025 to 2035

Korea Mobile Phone Accessory Market Analysis - Size, Share & Trends 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.