The sales of High Tibial Osteotomy (HTO) Plates in India is projected to grow from USD 24.3 million in 2025 to USD 55.0 million by 2035, exhibiting an 8.5% CAGR throughout the period.

| Attributes | Values |

|---|---|

| Estimated India Industry Size (2025) | USD 24.3 million |

| Projected India Value (2035) | USD 55.0 million |

| Value-based CAGR (2025 to 2035) | 8.5% |

The Indian market of HTO plates is expanding with a very prominent trajectory. More and more cases of acute sports injuries plus an increased geriatric population and better perception of sophisticated solutions in orthopedics have influenced this country largely to opt for surgeries with quicker recovery times and enhanced outcomes.

Additionally, rapid growth in healthcare infrastructure and improved access to specialty care, especially in tier-1 and tier-2 cities, is driving demand for orthopedic devices such as HTO plates. Further, with growing medical tourism in India, tremendous growth in patients coming for advanced orthopedic treatments further adds to the market potential.

Some of the major players include Johnson & Johnson, Zimmer Biomet, and Newclip Technics. The Indian market has several HTO plates that have been developed for different types of patients. Johnson & Johnson is a very old player in the Indian market and has been working on the cutting-edge orthopedic solutions, mainly focusing on the quality of products and outcomes of the patients.

Zimmer Biomet is increasingly making a penetration in the Indian market through advanced technologies and its robust distribution network. Newclip Technics is increasingly gaining prominence through specialized HTO plates. Newclip is increasingly getting attention as the healthcare system of India continues to change with respect to their demands for treatment.

Explore FMI!

Book a free demo

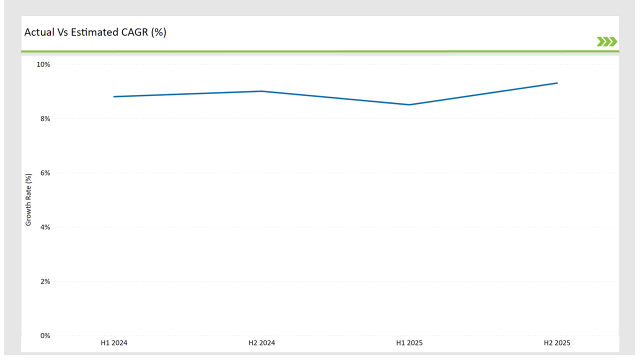

The table below offers a detailed comparative assessment of the changes in the compound annual growth rate (CAGR) over six months for the base year (2023) and the current year (2024) specifically for the India High Tibial Osteotomy (HTO) Plates market.

This semiannual analysis highlights all the critical shifts of market dynamics as well as details the revenue realization pattern, thus more precisely providing to the stakeholder’s insight into the trajectory of growth within a year. In other words, H1 contains January to June, and the other half H2 contains July to December.

H1 signifies period from January to June, H2 Signifies period from July to December

High Tibial Osteotomy (HTO) Plates market of the India is expected to grow at 8.8% CAGR for the first half of 2023, followed by an upgradation to 9.0% in the same year's second half. For 2024, the growth is forecasted to go a little down and reach 8.5% in H1 and is expected to rise to 9.3% in H2.

This pattern presents a decline of -25.0 basis points in the first half of 2023 through to the first half of 2024, whereas it is higher in the second half of 2024 by 28.0 basis points compared with the second half of 2023.

These figures are for a dynamic and fast-changing High Tibial Osteotomy (HTO) Plates market of the India, which is primarily affected by regulations, consumer trends, and improvements in high tibial osteotomy (HTO) plates. This semestral breakup becomes important for businesses as they plan their strategies, keeping in consideration these growth trends and going through the market complexities.

| Date | Development/M&A Activity & Details |

|---|---|

| 2024 | Technology Advancement: Johnson & Johnson's DePuy Synthes division launches VERASENSE™ Sensor-Assisted Technology in knee osteotomy procedures. Such technology will aid surgeons in knowing the real-time data for optimizing alignment and balance, thus promoting better patient outcome and fewer reoperations. In this regard, the company looks to integrate its advanced technology solutions to strengthen market position in the orthopedics market and further cater to an increasing demand of accurate and time-efficient surgical procedures in India. |

| 2024 | Strategic Collaboration: Zimmer Biomet engaged in strategic collaboration with a leader academic medical centre for research on osteotomy plate technologies. This strategic collaboration is focused on developing next-generation plates for osteotomy with better biomechanics and enhanced patient outcomes. Leveraging the output of Zimmer Biomet from academic researchers, it is focused on delivering highly innovative solutions catering to changing needs of orthopedic surgeons and continued market leadership in India. |

| 2024 | Market Expansion: With more demand for its orthopedic devices, the osteotomy plate included, it expanded its geographic distribution network for Smith & Nephew orthopedic technology into key growth markets in both Asia-Pacific regions and Latin American regions. For Smith & Nephew to expand its penetration of markets more effectively, meet unmet local medical needs while capitalizing on fast-growing economy opportunities, expansion into new economies is necessary as well as extending its global strength through partnerships established with local sources of distribution to capture growing demand in the India market. |

Rising Incidence of Knee Osteoarthritis Among the Population

The major demand drivers for HTO plates in India are its increasing aged population. As per 2021 census, the elderly population, i.e., people of the age group 60 plus, is expected to be growing rapidly and will rise beyond 300 million people by 2050.

Such increased demographics force an increase in knee ailments such as osteoarthritis among the elderly, which happens to become the largest cause of disability in the elderly populace. As the condition of knee joint degeneration increases, an increasing number of geriatric patients are opting for corrective surgeries such as HTO to delay the eventual TKR.

Surge in Health Insurance Penetration

The Indian health insurance landscape has been drastically changing within the last couple of years; people are becoming increasingly covered to access advanced surgeries like knee surgery. Government programs, such as Ayushman Bharat, along with private health insurance plans expanding, are increasing access for the patients to receive HTO surgery.

This increased accessibility to health insurance reduces the financial burden on the patient, whereby a patient is encouraged to opt for a more advanced and effective alternative, such as HTO, rather than waiting for the condition to worsen.

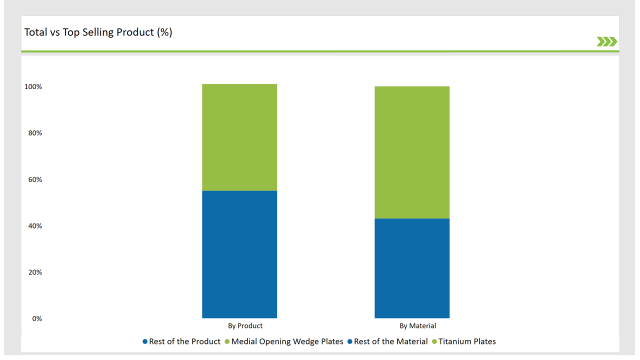

% share of Individual categories by Product Type and Material in 2025

Medial Opening Wedge Plates records significant surge in India High Tibial Osteotomy (HTO) Plates, By Product

The most commonly used plates in the Indian High Tibial Osteotomy (HTO) market are Medial Opening Wedge (MOW) plates as they correct common varus deformities seen in patients with osteoarthritis of the knee.

These plates are designed so that a precise and controlled alignment can be established through a wedge-shaped osteotomy of the tibia, leading to an enhancement in the distribution of load across the knee joint. This popularity can be explained because MOW plates provide better correction of knee malalignment without causing loss of natural range of motion of the joint.

Surgeons prefer them as they are proved to achieve reliable stable post-operative outcomes and, therefore, more and more increasingly recommended for the younger active patient who wants to delay the necessity of TKR. Advancement in surgical techniques and increased availability of these plates in India has made them the most widely used in the market.

Titanium plates have been dominating the Indian market because of their fantastic biomechanical properties, such as higher tensile strength, low corrosion rates, and biological compatibility. The area of tibia is one of the stress-prone areas that necessitate titanium during osteotomy procedures.

Surgeons prefer titanium plates because of better hardness, which would be less likely to cause some adverse reactions and infections, thus being the best for the long-term use in joint surgical procedures. The lightweight nature of titanium reduces the overall strain on the joint, which is one of the key benefits for the patients, mainly those with osteoarthritis.

The growth in the application of titanium in orthopedics, along with the improvement in manufacturing technologies, has increased the availability and cost-effectiveness of titanium, driving the market share of titanium plates in India further.

Note: above chart is indicative in nature

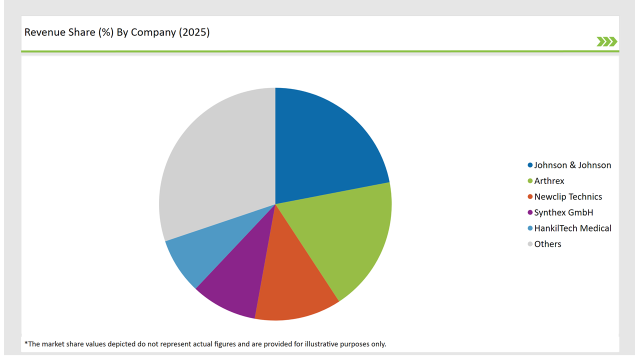

The concentration in the India market for High Tibial Osteotomy (HTO) plates is moderate, where a few global giants wield a considerable market share, although there is strong competition by regional and local players.

Such large manufacturers as Johnson & Johnson, Zimmer Biomet, and Newclip Technics exploit their long-established brands and latest surgical technologies to obtain top positions in the market. These companies also enjoy the robust healthcare infrastructure of India, which is becoming increasingly accessible, especially in tier-1 and tier-2 cities.

Local players, however, are finding niches by catering to the specific needs of Indian surgeons and patients. Companies like Jeil Medical Corporation have capitalized on regional expertise to provide affordable, high-quality implants that align with India's unique medical practices and cost considerations.

In addition, emphasis on minimally invasive surgery and patient-centric treatment solutions compels companies to continuously innovate. Price competition is fierce, with small players offering cheaper alternatives while keeping quality intact.

The strict regulatory standards of medical devices and pharmaceuticals in India ensure that the competition remains healthy, thus fueling market growth and stability for global and local firms alike.

By 2025, the India High Tibial Osteotomy (HTO) Plates market is expected to grow at a CAGR of 8.5%.

By 2035, the sales value of the India High Tibial Osteotomy (HTO) Plates industry is expected to reach is USD 55.0 million.

Key factors propelling the India High Tibial Osteotomy (HTO) Plates market include the strong demand for rising incidence of knee osteoarthritis among the population and surge in health insurance penetration.

The key players operating in the global high tibial osteotomy plates market include Johnson & Johnson, Synthex GmbH, Newclip Technics, Arthrex, Intrauma S.p.a., aap Implantate, Aplus Biotechnology, Astrolabe, Changzhou Zener Medtec, Corentec, DTM - Deva Tibbi Malzemeler, Groupe Lépine, HankilTech Medical, I.T.S., Intercus, Jeil Medical Corporation and Others.

In terms of product, the industry is divided into- Medial Opening Wedge Plates, Lateral Closing Wedge Plates, Biplanar Osteotomy Plates, Locking Compression Plates (LCPs), Contoured Plates and Spacer Plates.

In terms of material, the industry is segregated into- medial opening wedge plates, lateral closing wedge plates, biplanar osteotomy plates, locking compression plates (LCPs), contoured plates and spacer plates.

In terms of indication, the industry is segregated into- Knee Osteoarthritis, Knee Valgus/Varus Deformities, Sports Injuries and Trauma and Other Indications.

In terms of end user, the industry is segregated into- Hospitals, Ambulatory Surgical Centers and Independent Orthopedic Centers.

In Vitro Diagnostics Market Insights - Trends & Forecast 2025 to 2035

Stable Angina Management Market Analysis by Drug Class, Distribution Channel, and Region: Forecast for 2025 to 2035

Pet DNA Testing Market Analysis by Animal Type, Sample Type, Test Type, End User and Region: Forecast for 2025 to 2035

Panuveitis Treatment Market Analysis & Forecast by Drug Class, Route of Administration, Distribution Channel, and Region Through 2035

Phenylketonuria Therapeutics Market Analysis & Forecast by Drug Type, Route of Administration, Distribution Channel, and Region Through 2035

Dental Practice Management Software Market Growth, Demand & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.