India market, in generic injectable are significantly expanding. With rate of 3.7%, the market will reach to USD 16.1 million in 2035 from USD 11.2 million in 2025.

| Attributes | Values |

|---|---|

| Estimated India Industry Size (2025) | USD 11.2 million |

| Projected India Value (2035) | USD 16.1 million |

| Growth Rate from (2025 to 2035) | 3.7% |

The rapidly growing health burden, especially because of CMEs and CDS conditions; increasing requirements of affordable drugs-must keep this country growing towards a superior position in injectable generics. Self-reliance in production according to governmental drive and facilitation policies are drawing India strongly as the low-cost leader internationally among injectables manufacturing countries.

The rising burden of oncology, cardiovascular diseases, diabetes, and infectious diseases has further accelerated the demand for affordable and accessible injectable drugs.

The Pradhan Mantri Bhartiya Janaushadhi Pariyojana and National List of Essential Medicines improve access to more affordable generic product options. Furthermore, the promoting bulk drug parks and incentives offered for the production-linked initiative schemes by the government are boosting injectables manufacturing on the domestic side.

Also, with the surge in demand arising from hospitals, specialty clinics, and retail pharmacies, the market is experiencing rapid growth in biosimilars, monoclonal antibodies, and insulin injectables. Other factors that enhance the availability of injectable medicines across urban and rural areas are the emergence of online pharmacies and telemedicine websites.

Explore FMI!

Book a free demo

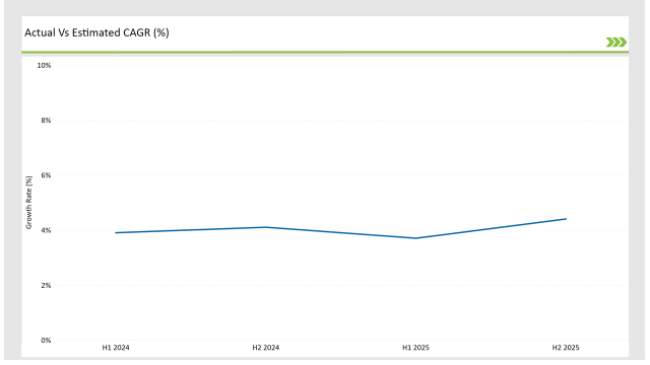

The table below offers a detailed comparative assessment of the changes in the compound annual growth rate (CAGR) over six months for the base year (2023) and the current year (2024) specifically for the India generic injectable market.

This semi-annual analysis highlights all the critical shifts of market dynamics as well as details the revenue realization pattern, thus more precisely providing to the stakeholders insight into the trajectory of growth within a year. In other words, H1 contains January to June, and the other half H2 contains July to December.

H1 signifies period from January to June, H2 Signifies period from July to December

The generic injectable sector for the India market is expected to rise at 3.9% growth rate in the first half of 2024, which will increase to 4.1% in the second half of the same year. In 2025, the growth rate is expected to slightly decline to 3.7% in H1 but is expected to rise to 4.4% in H2.

This pattern shows a decline of 23.0 basis points from the first half of 2023 to the first half of 2025, in the second half of 2024, it is lower by 22.0 basis points compared to the second half of 2024.

The nature of the India generic injectable market is cyclical, with periodic shifts in government regulations, healthcare reforms, and patient needs. The performance review will, on a six-monthly basis, help any business stay competitive and correct course in changing market dynamics.

| Date | Development/M&A Activity & Details |

|---|---|

| 2025 | Product Innovation: Dr. Reddy's Laboratories Ltd focus on long-acting injectables, nanoparticle-based formulations, and smart delivery systems for improved patient compliance. |

| 2024 | Acquisition: Key approvals for biosimilars and complex generics by the Sanofi S.A., expanding market opportunities. |

| 2024 | Expansion: Aurobindo Pharma Limited invest in large-scale production facilities and export capabilities, strengthening India’s position as a global leader in injectable drug supply. |

The Increasing demand for self-administration injectables

This is a growth trend towards injectable therapy performed at home as the use of prefilled syringes, auto-injectors, and long-acting formulations is going up. In this regard, such development cuts down on dependency on hospital visits for patients dealing with chronic issues like diabetes, hormonal disorders, and rheumatoid arthritis.

Government-Led Drug Pricing Regulations

India’s government-led healthcare affordability initiatives continue to play a crucial role in expanding generic injectable adoption. The Price Control Regulations under the Drug Price Control Order (DPCO) have made key injectables more accessible while ensuring market sustainability.

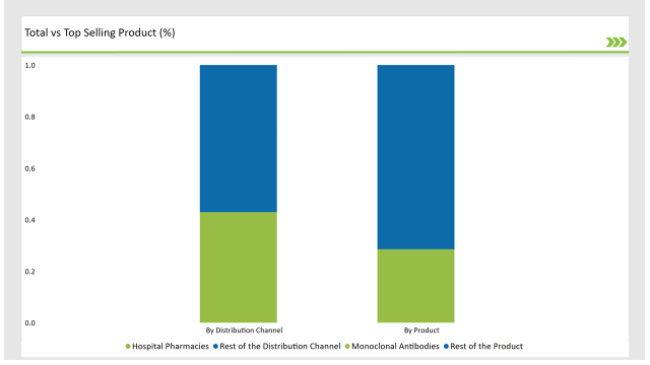

% share of Individual categories by Product Type and Distribution Channel in 2025

Monoclonal antibodies records significant surge in generic injectable market

Among product types, monoclonal antibodies (mAbs) hold the largest market share, primarily in oncology, immunology, and inflammatory diseases. Additionally, chemotherapy agents, peptide hormones, and insulin-based injectables have witnessed rising demand.

By distribution channel, hospital pharmacies dominate the market, as most injectables require administration by healthcare professionals in clinical settings. However, retail and online pharmacies are expanding their market share, particularly for insulin, pain management drugs, and hormonal therapies, as patients seek more convenient access to their medications.

Note: above chart is indicative in nature

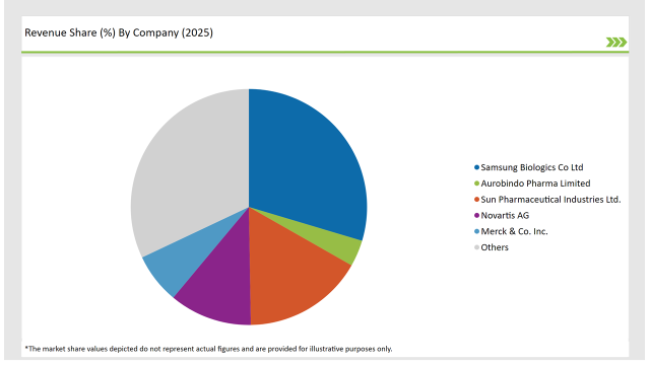

The injectables market in the India has always been quite competitive, with key focus areas including biosimilars, complex generics, and high-performance injectables for Tier 1 companies. These are driven by good R&D investment, advanced production capabilities, and regulatory expertise. They focus on efficient production technologies, hospital contracts, and retail pharmacy partnerships in an effort to strengthen their positions in the marketplace.

The market is expected to grow at a CAGR of 3.7% from 2025 to 2035.

Monoclonal antibodies are the leading products in the market.

Key players include Samsung Biologics Co Ltd, Aurobindo Pharma Limited , Sun Pharmaceutical, ndustries Ltd., Novartis AG, Merck & Co. Inc., Cipla Ltd, Pfizer Inc., Fresenius Kabi, Sanofi S.A, AstraZeneca Plc, Teva Pharmaceuticals., Mylan N.A, Baxter International, Dr. Reddy’s Laboratories Ltd.

The industry includes various product type such as monoclonal antibodies, immunoglobulin, cytokines, insulin, peptide hormones, blood factors, peptide antibiotics, vaccines, small molecule antibiotics, chemotherapy agents, and others.

The industry includes various molecule type such as small molecule, large molecule.

The industry includes various indications such as oncology, infectious diseases, diabetes, blood disorders, hormonal disorders, musculoskeletal disorders, CNS diseases, pain management, cardiovascular diseases

Available in route of administration like intravenous (IV), intramuscular (IM) and subcutaneous (SC)

The Prurigo Nodularis (PN) Treatment Market is segmented by product, and end user from 2025 to 2035

Warm Autoimmune Hemolytic Anemia (WAIHA) Treatment Market Analysis by Drug Class, Distribution Channel, and Region through 2035

Atrophic Vaginitis Treatment Market Analysis And Forecast by Diagnosis, Treatment, Therapy Type, Distribution Channel, and Region through 2035

Adrenal Crisis Management Market Analysis and Forecast, By Diagnosis Method, Treatment Method, Distribution Channel, and Region, through 2035

Birch Allergy Treatment Market Analysis by Drug Class, Route of Administration, Distribution Channel and Region: Forecast from 2025 to 2035

Cancer Vaccines Market Analysis by Technology, Treatment Method, Application and Region from 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.