The foley catheter market in India is estimated to be worth USD 83.0 million by 2025 and is projected to reach a value of USD 204.8 million by 2035, growing at a CAGR of 9.4% over the assessment period 2025 to 2035

| Attributes | Values |

|---|---|

| Estimated India Industry Size (2025) | USD 83.0 million |

| Projected India Value (2035) | USD 204.8 million |

| Value-based CAGR (2025 to 2035) | 9.4% |

The Foley catheter market in India is driven by rising prevalence of urological disorders, increase post-surgical stay in hospital facilities. The key players underscore affordability, infection prevention, and long-term usability in the service of various healthcare needs across India's large and growing population.

The Indian healthcare sector is evolving on the back of hospital development, improvement in diagnostic utilities, and orientation toward more patient-centric treatment.

In fact, urban hospitals represent a rising demand for Foley catheters with silicone-based material, antimicrobial coating, and hydrophilic properties due to increasing concern about infection control. Simultaneously, domestic players provide semi-urban and rural areas with appropriate cost-effective products to which the paying propensity is of essence.

Explore FMI!

Book a free demo

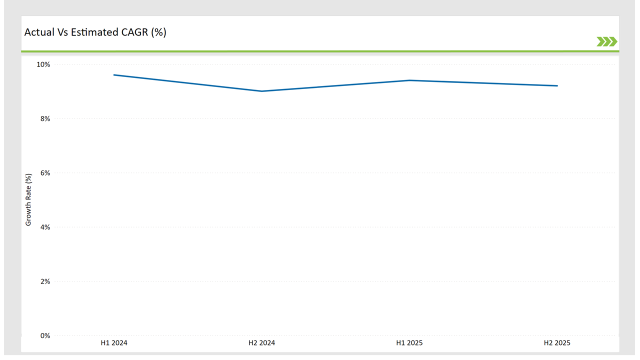

The table below offers a detailed comparative assessment of the changes in the compound annual growth rate (CAGR) over six months for the base year (2023) and the current year (2024) specifically for the India foley catheter market.

This semiannual analysis highlights all the critical shifts of market dynamics as well as details the revenue realization pattern, thus more precisely providing to the stakeholders insight into the trajectory of growth within a year. In other words, H1 contains January to June, and the other half H2 contains July to December.

H1 signifies period from January to June, H2 Signifies period from July to December

The foley catheter sector for the India market is expected to rise at 9.6% growth rate in the first half of 2023, which will increase to 10.0% in the second half of the same year. In 2024, the growth rate is expected to slightly decline to 9.4% in H1 but is expected to rise to 10.2% in H2.

This trend now reflects a decline of 5.0 basis points from the first half of 2023 to the first half of 2024, while in the second half of 2024, it has gone up by 26.0 basis points compared to the second half of 2023.

India's Foley catheter market is changing dynamically, driven by changes in regulatory updates, patient preference, and advancements in medical technology. Over the past few months, there has been a definite trend for the growing traction of silicone catheters, since they offer superior biocompatibility and extended wear time.

Additionally, with rising concerns related to HAIs, demand for antimicrobial Foley catheters has also surged to a heightened extent. The push for cost-effective solutions continues, with both multinational and domestic players striving toward affordable yet high-quality products.

| Date | Development/M&A Activity & Details |

|---|---|

| 2025 | Investment: B, Braun SE focuses on constant innovation and invests heavily in research and development. |

| 2024 | Launch of Biodegradable Foley Catheter: Coloplast Corp focuses on innovation-driven growth, expanding its global footprint in ostomy care, continence care, and wound & skin care markets. They prioritize patient-centric solutions and operational excellence to sustain their competitive advantage. |

| 2024 | Product Innovation: Medtronic’s strong focus on developing technologically advanced products aids them in staying ahead of the competition. |

Government Healthcare Initiatives and Infrastructure Expansion

The Indian infrastructure of healthcare with huge-government initiatives such as Ayushman Bharat, approximately millions get inexpensive access to health treatment.

Therefore, an increase in the number of hospitals, clinics, and diagnostic units has encouraged demand for basic accessories in medical catheters. Thus, investments into various sectors by the private sector have gone ahead and compelled market growth more efficiently.

Growing Awareness of Infection Control and Quality Medical Products

The infection control measures being focused on by more and more hospitals in India have therefore driven an increase in demand for antimicrobial-coated and hydrophilic Foley catheters. Growing awareness of CAUTIs encourages healthcare professionals to seek out improved catheter solutions that can help prevent infections and make their patients safer.

Besides, regulatory authorities are also motivating to increase the demand for high-quality medical devices that would improve the clinical outcome of patients.

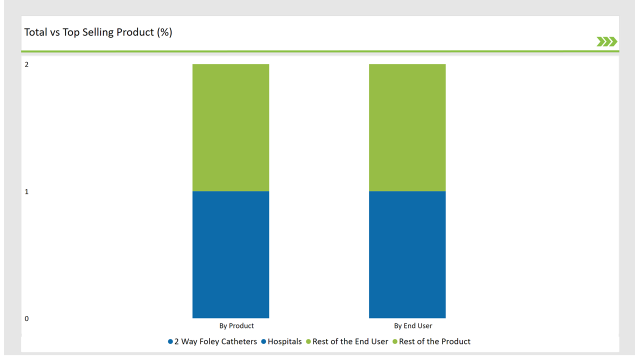

% share of Individual categories by Product Type and End User in 2025

2-way foley catheters records significant surge in India foley catheter market

The 2-Way type is the most consumed variety in the Indian market because of its relatively economical nature and easy availability; it is suitable for both short-term and long-term applications.

Foley catheters find their application in hospitals, home care, and nursing homes due to their simple yet effective design for urine drainage and ease of management. Besides, the cost-conscious nature of the Indian healthcare system makes 2-Way catheters a practical choice for both public and private healthcare facilities.

The hospital segment has remained the largest end-user segment in the Indian Foley catheter market due to the huge inflow of patients for surgeries, urological treatments, and post-operative care.

With more healthcare facilities being established across urban and semi-urban areas, hospitals have been driving demand for Foley catheters, especially infection-resistant variants. Moreover, government initiatives and private hospital chains are expanding their infrastructure, thereby bolstering the dominance of the hospital segment in the market.

Note: above chart is indicative in nature

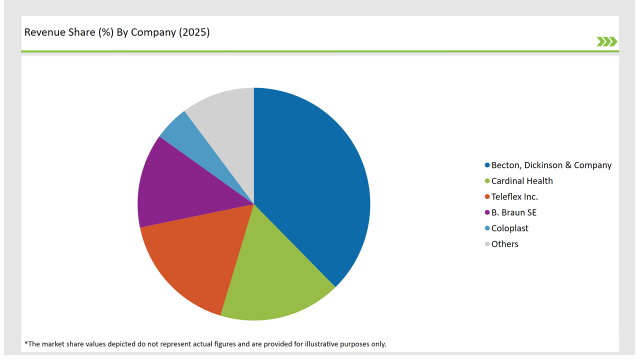

The competitive nature of India's Foley catheter market is very high, filled by global leaders as well as strong domestic players. Companies such as Becton, Dickinson & Company, Coloplast, and Medtronic have strategized introducing advanced technologies of catheters. Other low-cost players like Polymedicure, Advin Health Care, and Well Lead Medical Co. Ltd. in India make the most of affordability and accessibility.

The domestic players have successfully gained a strong foothold in the market by offering cost-effective catheter solutions relevant to the price-sensitive healthcare system of India.

Many companies are also expanding their production capacity and distribution networks to reach even the hospitals in rural and semi-urban areas. Meanwhile, global players are pushing technological advancement like antimicrobial coating and latex-free options to meet the growing demand for infection control in India's healthcare.

With the increasing government focus on healthcare infrastructure and medical device regulations, competition is foreseen to rise and, subsequently, drive more innovation and price competitiveness in the Foley catheter market in India.

By 2025, the India foley catheter units market is expected to grow at a CAGR of 9.4%.

By 2035, the sales value of the India foley catheter units industry is expected to reach India is USD 204.8 million.

Prominent players in the India foley catheter units manufacturing include Becton, Dickinson & Company, Cardinal Health, B. Braun SE, Coloplast, Medtronics, ConvaTec Group Plc, Teleflex Inc., Medline Industries, LP., Optimum Medical Limited, Polymedicure , AdvaCare Pharma, Well Lead Medical Co.,Ltd. and Advin Health Care.

The industry includes various product type such as 2-way foley catheter, 3-way foley catheter and 4-way foley catheter

The industry includes various materials such as latex foley catheter, silicone foley catheter and other materials.

The industry includes various indications such as urinary incontinence, urethral stricture, chronic obstruction, neurogenic bladder, enlarged prostate gland/bph, prostate cancer and other indications.

Available in end user like hospitals, long-term care facilities, ambulatory surgical centers.

Protein Diagnostics Market Share, Size and Forecast 2025 to 2035

CGRP Inhibitors Market Trends - Growth, Demand & Forecast 2025 to 2035

Indolent Systemic Mastocytosis treatment Market Insights: Size, Trends & Forecast 2025 to 2035

Intraoperative Fluorescence Imaging Market Report - Demand, Trends & Industry Forecast 2025 to 2035

Lung Cancer PCR Panel Market Trends, Growth, Demand & Forecast 2025 to 2035

Polymyxin Resistance Testing Market Trends – Innovations & Growth 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.