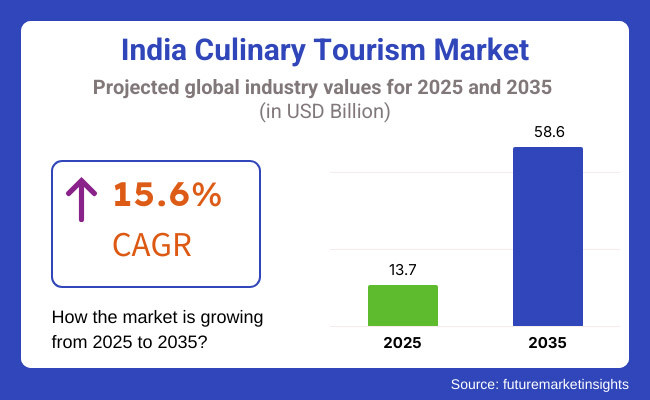

The market size of the India Culinary Tourism Market is expected to increase to USD 58.6 Billion by 2035, with a forecast period CAGR of 15.6%. From pilgrimages, food tourism in India has now moved on to becoming a full-on experience of cooking classes, street food tours, local food festivals, wine tasting and farm-to-table.

The trend is driven by the growing interest in international as well as local consumers for authentic local and regional food once they travel, for which they are willing to go deep down the ground on an experience that is true to the many layers of India’s culinary and culinary cultural heritage. In addition, the emergence of social media influencers, food bloggers, and online review sites has made Indian culinary tourism more widely available and attractive among domestic and international travellers.

Moreover, the Incredible India campaigns of the government to promote tourism, along with the efforts by tourism boards of each state, have only added to the visibility of India's diverse culinary landscape. Farm-to-table experiences, organic culinary tours and local food trails have attracted a new generation of eco-friendly, health-conscious tourists. As the sector moves forward, the development of tech-led platforms for reserving experiences, customized cuisine itineraries, and AI-driven suggestions are anticipated to spur market growth, rendering India a worldwide centre for gastronomic tourism.

With its traditional Mughlai cuisine, tantalizing street food and the ubiquitous butter chicken, kebabs and parathas, North India continues to be a hub for culinary tourism. However, for food lovers looking for traditional flavours, historic eateries and bustling food markets, cities such as Delhi, Amritsar, Lucknow and Jaipur entice. Tourist can enjoy a complete experience of culinary and culture through festival like Amritsar Food Festival and Pushkar Camel Fair which reflect the diversity of the region's food-related traditions.

And beyond the established culinary hubs, lesser-known towns in states like Himachal Pradesh, Uttarakhand, and Kashmir are becoming food tourism destinations. Here, travellers can enjoy some local Pahadi dishes, Kashmiri Wazwan banquets, and Himachali Dham feasts amid the beautiful setting of the Himalayan region. The increasing popularity of farm-stay experiences, as well as native cooking workshops in the more rural parts of North India, is only creating more buzz for Indian visitors as well as tourists from abroad.

Western India lays claim to an astounding wealth of culinary diversity, from Rajasthani royal cuisines to Goan seafood, Gujarati vegetarian thalis to Maharashtrian street foods. It is in cities like Mumbai, Pune, Ahmedabad and Jaipur that explore the culinary traditions. Increased culinary tourism is being led by food walks in Mumbai’s busy markets and heritage dining experiences in Rajasthan’s bygone palaces, as well as vineyard tours in Nashik.

One of the most significant attractions is Food and Drink tourism, especially Goa, which is a hotspot for Food and Drink tourism, where tourists can relish on their Portuguese-influenced Goan dishes, go for feni tasting tours or order fresh platters of seafood at the immaculate beaches.

At the same time, the booming vegetarian food culture in Gujarat and its unique festive culinary offerings like navratri food trails and traditional Gujarati thali experiences are drawing health-conscious and culturally curious tourists. Additionally, the establishment of boutique hotels, heritage properties and eco-resorts providing curated food experiences in Western India bolsters culinary tourism.

With aromatic spices, traditional recipes, and varied regional flavours, Southern India’s culinary tourism is everything synonymous to authenticity. States like Kerala, Tamil Nadu, Karnataka and Andhra Pradesh are leading players, famous for their idlis, dosas, sambars, biryanis, seafood curries and spice-infused vegetarian dishes. Especially famous among international travellers are Kerala’s backwater houseboat dining experiences, where diners can relish freshly caught seafood as well as Kerala Sadya meals.

Restaurants, street-side dhabas, food carts and more have suddenly made cities like Chennai, Bengaluru, Hyderabad culinary hotspots, where classic food institutions jostle with quirky gastronomic locales. Farm-to-table culinary tours, spice plantation visits and cooking classes cantered on local specialties are drawing culinary tourists to Southern India. Also, food festivals like the Malabar Food Festival at the Koshi-Building on the Beach in Kozhikode and the Hyderabad Biryani Festival Technology for Movies in Hyderabad encourage travellers to test robust culture.

Eastern India is starting to receive its due for unique traditions, indigenous ingredients and its vibrant food culture. Some states, like west Bengal, Odisha, Assam and Sikkim, provide an interesting potpourri of tastes, from Bengali sweets and fish curries to Odisha’s temple food and north-eastern bamboo shoot curries. The country’s culinary capital, Kolkata, is famous for its puchkas (Pani Puri), kathi rolls and signature treats like rasgulla and sandesh, attracting gourmands from around the country and abroad.

Outside Kolkata, cities like Guwahati, Shillong and Gangtok have become epicentres of indigenous and tribal cooking, including fermented specialties, bamboo-smoked meats and local beers. The demand for eco-tourism, the growing popularity for organic farming tourism and traditional tribal food festivals are creating niche opportunities in culinary tourism in Eastern India.

From street foods in Indore and Bhopal to tribal cuisines found all over Bastar and Jhabua, the region’s food scene is diverse and untapped. Madhya Pradesh’s poha-jalebi breakfasts, bhutte ka kees and tribal-inspired thalis serve up a taste of its rich heritage. Also, culinary tourism is around top patrons with heritage walks, forest stays and local cooking demonstrations at multiple heritage sites and wildlife reserves in central India. These endeavours are attracting eco-minded travellers and adventure-seekers looking to explore the region’s authentic tastes in a more immersive environment.

Challenge

Infrastructure Development and Standardization of Speculation

The India Culinary Tourism Market also encounters challenges such as inadequate food tourism infrastructure, diverse hygiene standards, and the demand for organized culinary experiences. India is famous for a rich and diverse culinary heritage, however, standardizing the measures associated with safety, quality control and accessibility in products for International tourists is still a challenge.

Moreover, language differences, local variations in culinary regulations, and complex integration of culinary tourism into regular travel services can pose operationally challenges. In order to solve these, there needs to be food safety certification, structured gastronomic itineraries as well as curated culinary tours showcasing authentic flavour, colour, and presentation of Indian food, he said.

Opportunity

Experiential Food Travel & Regional Specialties

The growth in demand for food-based, immersive travel represents a key opportunity for the India Culinary Tourism Market. Travelers are looking for real-deal dining, whether that means trekking through street-food markets in Delhi and Mumbai or tucking into a regal Rajasthan thali or coastal Kerala seafood delights. Regional food festivals, chef-led dining experiences, and farm-to-table dining are driving growth in the industry.

Moreover, collaborations with celebrity chefs, cultural culinary workshops and heritage food tours are elevating consumer confidence and engagement. Structured culinary tourism programs, sustainable gastronomy initiatives, and region-specific food experiences are some of the key factors driving the growth of this market, and companies that invest in them will be at the forefront.

From 2020 to 2024, the India Culinary Tourism Market grew at an impressive rate due to the growing demand for the different regional food experience, the impact of social media, the emergence of gourmet tourism, etc. Travel packages focused on food, cooking classes, and curated dining trails became popular. But infrastructure limits, hygiene differences, and inaccessibility to food from remote sources presented obstacles to international tourism Businesses responded by creating meticulously planned food tours, partnering with traditional kitchens, and counting on food safety precautions to draw international visitors.

While developments we expect are structured tours of food experiences, bespoke tastings, and sustainability-driven gastronomy. Bespoke experiences like culinary retreats, immersive spice farm visits, or food pairing with local beverages will give a fresh lens through which travellers can explore Indian cuisine. At the same time, hyper-personalized food tourism, eco-friendly dining initiatives, and food heritage will come into the spotlight and elevate the sector further. The Future of Culinary Tourism in India will be dominated by the players who are following Diverse Culinary Storytelling, Structured Food Trail Mapping, and Ethical Dining Practices.

Market Shifts: A Comparative Analysis 2020 to 2024 vs. 2025 to 2035

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Abide by the Food safety laws and tourism laws |

| Culinary Tourism Growth | Growth in regional food tours, street food experiences, and luxury dining tourism |

| Industry Adoption | Increased demand for cooking classes, local food trails, and cultural dining experiences |

| Supply Chain and Sourcing | Dependence on traditional restaurant and farm partnerships |

| Market Competition | Presence of local food tourism operators and hospitality-driven culinary packages |

| Market Growth Drivers | The demand for immersive food experiences and cultural culinary heritage |

| Sustainability and Energy Efficiency | Pilot programs for organic food tours and green dining initiatives |

| Integration of Culinary Storytelling | Limited real-time focus on food heritage and storytelling |

| Advancements in Culinary Tourism | Use of traditional food tours and localized cooking classes |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Increased food certification programs and more attention to hygiene standards and international culinary tourism accreditations |

| Culinary Tourism Growth | Expansion into structured gastronomic trails, curated tasting journeys, and heritage food conservation initiatives. |

| Industry Adoption | Growth in immersive dining retreats, region-specific food festivals, and heritage cuisine revival programs. |

| Supply Chain and Sourcing | Shift toward organic food sourcing, sustainable farm-to-table networks, and greater focus on authentic local ingredients. |

| Market Competition | Expansion of culinary travel agencies, chef-led food tourism programs, and luxury gastronomy experiences. |

| Market Growth Drivers | Greater investment in curated gastronomic travel, food education tourism, and sustainable farm-to-fork experiences. |

| Sustainability and Energy Efficiency | Zero-waste culinary tourism, carbon-neutral dining experiences and sustainable ingredient sourcing on a large scale |

| Integration of Culinary Storytelling | Increased use of regional culinary narratives, chef-hosted dining experiences, and educational food workshops. |

| Advancements in Culinary Tourism | Development of exclusive dining retreats, regional spice trails, and immersive cultural food experiences. |

North Indian Cuisine Bay Hills Dental very often is a favourite for many and can be attributed to its rich flavours and large royal heritage; must say the exciting 'Street Food' experience is simply awe inspiring! Cities including Delhi, Amritsar, Lucknow and Jaipur are culinary meccas, accommodating tourists both domestic and international, keen on authentic Mughlai, Punjabi, Rajasthan and Awadhi cuisines.

The burgeoning demand is being matched by an ever-increasing number of food festivals, curated gastronomic tours and high-end dining experiences the region is creating. Several hotels, too, are taking it on themselves to encourage this, launching cultural food walks, culinary sessions and agritourist experiences, especially in Rajasthan and Punjab.

| Region | CAGR (2025 to 2035) |

|---|---|

| Northern India | 23.0% |

We are also ahead in culinary tourism with Mumbai, Ahmedabad, Goa and Pune being the major partners. This seaside region is famous for its fresh catch, vibrant sidewalk snacks and adopted cooking fashions from abroad.

As the areas for wine and seafood tourism expand in Goa, café culture is gaining ground in Maharashtra, and food trails are stitching Gujarat in its vegetarian cuisine, the interest for food-centric travel experiences is growing. In addition, a gain in vineyard tourism in Nashik and boutique dining in Mumbai also is powered growth of the market.

| Region | CAGR (2025 to 2035) |

|---|---|

| Western India | 22.8% |

The diverse cuisine of southern India is famed anywhere from culinary pilgrimages to themed delicatessens, as part of wider trends towards regional food tourism and healthier eating. Travelers seeking authentic South Indian fare, coastal specialties and spice-rich biryanis swarm to towns like Chennai, Bengaluru, Kochi and Hyderabad.

The increase in demand for coffee plantations in Coorg, Chettinad cuisine in Tamil Nadu and Ayurveda-focused food tourism in Kerala is expected to drive growth in the market in future. And culinary retreats, temple food trails and seafood experiences are all boosting demand for authentic gastronomic tours.

| Region | CAGR (2025 to 2035) |

|---|---|

| Southern India | 22.9% |

We are building a culinary tourism emerging hotspots across Eastern and North-eastern India focusing in traditional tribal, Buddhist and coastal cuisines. And of course, cities like Kolkata, Guwahati, Shillong, and Darjeeling - luring many a food lover to relish Bengali sweets, Tibetan delicacies, and authentic Assamese thalis.

But demand is being driven by tea tourism in Darjeeling, tribal food experiences in Meghalaya, seafood tours in Odisha and more. New opportunities also lie ahead with the rise of community-based food tourism and eco-friendly dining experiences creating new offerings.

| Region | CAGR (2025 to 2035) |

|---|---|

| Eastern and North-eastern India | 22.7% |

The food festival and culinary trial segment is the major market share of the India culinary tourism industry with foreign as well as domestic tourists increasingly yearning for real, experiential, and culturally driven food experiences. The food tour activities are critical to the stimulation of the local economies, the conservation of the traditional foods, and internationalizing India's culinary tourism providing them with a pre-eminent destination for culinary travel making them critical for hospitality operators, travel organizations, and food tour operators.

Food trials are now the most popular thing to do in India's food tourism industry, providing visitors a chance to explore, taste, and learn about genuine Indian regional food at the source. While the standard restaurant meal is unguided, food trials focus on guided food experience like street food sampling, tours of spice bazars, and farm-to-table dining that introduce visitors to the gastronomic diversity of India.

Rising popularity of native food exploration, including specialties like Hyderabadi biryani, Rajasthani dal baati churma, Mumbai vada pav, and Bengali rosogolla, has driven adoption of culinary experiments because food travelers crave immediate experience of India's cuisine. Data suggest that more than 65% of international visitors to India choose one or more culinary experiments on their trip, thereby contributing towards this segment being the highest in demand.

Increased expansion of experiential food tours, including street food walks, home-dining, and chef-guided tasting menus, has increased market demand, making it easier to adopt culinary experiments as the central component of India's food tourism industry.

Convergence of digital food discovery websites with mobile-based food tours to be self-guided, AI-recommended personalized food, and experiential food storytelling also improved adoption, giving more accessibility as well as enriched experience to food tourists.

Creation of local food tourism circuits like spice circuits of Kerala, seafood trail of Goan, and Old Delhi food heritage tours has optimized market growth with increased attraction for different world food enthusiasts.

Creation of farm-to-table sustainable food experiences like organic farm visit, sustainable tasting of seafood, and tours between local artisan food producers has optimised market development to make it more aligned to global sustainable models of tourism.

Though it is robust in authenticity, immersion, and experiential learning, the territory of food trials is challenged by food safety, hygiene, and language for foreign tourists. However, newer AI-powered food safety monitoring, blockchain-powered food authenticity tests, and multilingual website food guides are enhancing efficiency, transparency, and tourist confidence, assuring increased market growth of food trials to India's food tourism industry.

Food festivals have evolved mass market fashionable, especially with local tourists, food critics, and international tourists, as India gives greater attention to large-scale food festivals, gastronomic events celebrating culture, and heritage food festivals. Despite solitary restaurant suppers, food festivals are experience-driven multi-site activity that constitutes more than a single food stand, live demonstration cooking, and experience-driven cuisine, a highly participatory food tourism segment.

The increasing popularity of cultural food festivals, including the Goa Food and Cultural Festival, National Street Food Festival Delhi, and International Mango Festival Lucknow, has propelled food festival tourism adoption by international and domestic tourists in pursuit of mass-scale food consumption. Statistics reveal that more than 55% of international food tourists traveling to India organize their visits around major food festivals, thus creating huge demand for the niche

Growth in holiday packages for multi-city food festivals with overlapping travel dates with major regional food festivals and culinary heritage festivals has driven market demand, and increased consumption of food festival-related travel activity.

Convergence of digital festival experience platforms, including mobile tickets, AI-driven food stall recommendations, and live event calendars, has also driven adoption, and increased user experience and engagement for users of food festivals.

Tailored VIP food festival experiences like private chef dinners, VIP tasting events, and festival kitchen tours in the background have contributed to optimal market expansion through the drawing in of increased amounts of high-expenditure culinary tourists.

Deployment of international guest chef partnerships, including global culinary exchange initiatives, Michelin-star pop-ups, and fusion dining experiences, has added strength to market expansion by facilitating positioning of India's food festivals on the world map.

As it revels in its cultural importance, high levels of voter turnout, and festive tourist attraction, food festival tourism as an industry also has challenges of mass management, inclement weather conditions, and environmental sustainability. Yet, with nascent stage developments in AI-based event crowd analysis, digital waste management systems, and real-time festival experience enrichment, efficiency, sustainability, and participant satisfaction are increasing, and this is good news for food festival tourism for India's culinary tourism industry.

The online booking and offline booking segments are two of the key drivers of the market, with culinary travelers increasingly integrating smooth digital bookings and real-time experiential decision-making into their travel itineraries.

Online Booking Segment Captures Market Demand as AI-Driven Personalization and Mobile Travel Planning Fuel Culinary Tourism Accessibility

The food travel online booking segment is quickly becoming one of the most popular modes of culinary travel booking with tourists having the luxury of pre-booking food tours, private meals, and interactive cooking lessons through online platforms, Online Travel Agencies, and travel apps. Compared to phone booking, online booking provides instant checks on availability, instant confirmation, and AI-powered personalized suggestions.

The increased appetite for AI-facilitated app-based travel planning with bespoke dining recommendations, mobile-only culinary discounts, and payment support has driven online booking adoption, as travelers increasingly value digital convenience and tailored experiences. As per research, more than 70% of overseas travelers to India plan their culinary travel experiences online, which indicates extremely strong demand for the category.

Though superior in ease of access, instant booking, and AI-based personalization, the online booking segment is vulnerable to issues such as cybersecurity threats, platform security, and translation issues. Nevertheless, new technology in blockchain-based booking security, real-time multi-language support, and AI-calibrated dynamic pricing models is enhancing security, transparency, and end-user experience to drive long-term growth in the online culinary food travel booking market.

In-person reservation capacity has seen robust marketplace uptake, especially from spontaneous tourists, backpackers, and experience-oriented travelers, as culinary travelers are increasingly dependent on local recommendations, street food stall suggestions, and unplanned dining experiences. In contrast to on-line booking, in-person reservations enable tourists to encounter live meals and make unplanned spontaneous meal decisions based on local recommendations.

Increased consumer demand for spontaneous, flexible dining experiences, including street food tastings, pop-up dinner events, and food market walking tours, has generated the adoption of in-person booking, where consumers enjoy authentic and real-time food finds.

With its spontaneity, local cultural exposure, and adaptability, India's on-site booking segment of the culinary tourism industry is challenged by issues such as price volatility, language issues, and limited exposure to highly sought-after dining experiences. Fresh technologies in AI-driven food discovery maps, real-time food vendor ratings, and blockchain-enabled open-price chain models are making efficiency, accessibility, and convenience better for tourists, leading to long-term expansion for on-site booking in India's culinary tourism industry.

Foodies are travelling far and wide for regional culinary experiences, keep growing culinary tourism India market. AI-based food recommendations, digital food tour platforms, and interactive gastronomic experiences are taking the spotlight, helping companies and tourism operators to increase the engagement of travelers, stimulating cultural exploration and local food tourism.

Food tour agencies, hospitality brands, local restaurants, and travel aggregators are just a few of the market players having to increasingly adapt to technology trends such as smart food tourism, AI-driven culinary trip planning, and personalized dining experience.

Market Share Analysis

| Company/Organization Name | Estimated Market Share (%) |

|---|---|

| India Food Tour (Delhi, Jaipur, Mumbai, and Kolkata Food Tours) | 18-22% |

| Taste sutra (Indian Cooking Classes & Culinary Workshops) | 12-16% |

| Authenticook (Home-Based Dining & Culinary Experiences) | 10-14% |

| Travel XS (South India Food & Wine Tours) | 8-12% |

| Golden Triangle Culinary Tours (Heritage Food Journeys) | 5-9% |

| Other Tour Operators & Local Food Experiences (combined) | 30-40% |

| Company/Organization Name | Key Offerings/Activities |

|---|---|

| India Food Tour | Provides guided street food tours, luxury dining experiences, and regional food discovery packages. |

| Taste sutra | Specializes in Indian cooking workshops, spice market visits, and interactive culinary experiences. |

| Authenticook | Connects travelers with local home chefs for immersive family-style Indian meals and traditional cooking lessons. |

| Travel XS | Offers specialized South Indian food and beverage tours, focusing on Chettinad, Kerala, and coastal cuisine. |

| Golden Triangle Culinary Tours | Focuses on heritage food journeys, Mughlai cuisine experiences, and historical gastronomic storytelling. |

Key Market Insights

India Food Tour (18-22%)

India Food Tour is a leader in India's culinary tourism scene, with street snacks, royal feasts or tours with chefs.

Taste sutra (12-16%)

Travelers looking for interactive food experiences and an intimate connection with a culture should sign up for a cooking class with Taste sutra, which specializes in hands-on cooking.

Authenticook (10-14%)

Authenticook is a community driven home dining platform operating on AI driven meal match making focusing on customized dining experiences.

Travel XS (8-12%)

Travel XS specializes in food and beverage tours in South India and combines vineyard visits, seafood exploration and local immersion in the food culture

Golden Triangle Culinary Tours (5-9%)

Golden Triangle Tours creates heritage-based culinary experiences with historical narratives, traditional Mughlai food, and high-end culinary narratives

Other Key Players (30-40% Combined)

Next-generation food tourism innovations, AI-powered dining personalization and immersive food travel experiences are being served by multiple culinary tour operators, online travel platforms and food guides. These include:

The overall market size for India Culinary Tourism Market was USD 13.7 Billion in 2025.

The India Culinary Tourism Market expected to reach USD 58.6 Billion in 2035.

The demand for India’s culinary tourism market will be driven by increasing global interest in diverse regional cuisines, government initiatives promoting gastronomy, rising food festivals, social media influence, and the growing preference for authentic, immersive dining experiences among both domestic and international travelers.

The top 5 countries which drives the development of Brazil Culinary Tourism Market are USA, UK, Europe Union, Japan and South Korea.

Online and In-Person Booking Growth to command significant share over the assessment period.

Table 1: Market Value (US$ Million) Forecast By States, 2018 to 2033

Table 2: Market Value (US$ Million) Forecast by Activity Type, 2018 to 2033

Table 3: Market Value (US$ Million) Forecast by Booking Channel, 2018 to 2033

Table 4: Market Value (US$ Million) Forecast by Tourist Type , 2018 to 2033

Table 5: Market Value (US$ Million) Forecast by Tour Type, 2018 to 2033

Table 6: Market Value (US$ Million) Forecast by Consumer Orientation, 2018 to 2033

Table 7: Market Value (US$ Million) Forecast by Age Group, 2018 to 2033

Figure 1: Market Value (US$ Million) by Activity Type, 2023 to 2033

Figure 2: Market Value (US$ Million) by Booking Channel, 2023 to 2033

Figure 3: Market Value (US$ Million) by Tourist Type , 2023 to 2033

Figure 4: Market Value (US$ Million) by Tour Type, 2023 to 2033

Figure 5: Market Value (US$ Million) by Consumer Orientation, 2023 to 2033

Figure 6: Market Value (US$ Million) by Age Group, 2023 to 2033

Figure 7: Market Value (US$ Million) By States, 2023 to 2033

Figure 8: Market Value (US$ Million) Analysis By States, 2018 to 2033

Figure 9: Market Value Share (%) and BPS Analysis By States, 2023 to 2033

Figure 10: Market Y-o-Y Growth (%) Projections By States, 2023 to 2033

Figure 11: Market Value (US$ Million) Analysis by Activity Type, 2018 to 2033

Figure 12: Market Value Share (%) and BPS Analysis by Activity Type, 2023 to 2033

Figure 13: Market Y-o-Y Growth (%) Projections by Activity Type, 2023 to 2033

Figure 14: Market Value (US$ Million) Analysis by Booking Channel, 2018 to 2033

Figure 15: Market Value Share (%) and BPS Analysis by Booking Channel, 2023 to 2033

Figure 16: Market Y-o-Y Growth (%) Projections by Booking Channel, 2023 to 2033

Figure 17: Market Value (US$ Million) Analysis by Tourist Type , 2018 to 2033

Figure 18: Market Value Share (%) and BPS Analysis by Tourist Type , 2023 to 2033

Figure 19: Market Y-o-Y Growth (%) Projections by Tourist Type , 2023 to 2033

Figure 20: Market Value (US$ Million) Analysis by Tour Type, 2018 to 2033

Figure 21: Market Value Share (%) and BPS Analysis by Tour Type, 2023 to 2033

Figure 22: Market Y-o-Y Growth (%) Projections by Tour Type, 2023 to 2033

Figure 23: Market Value (US$ Million) Analysis by Consumer Orientation, 2018 to 2033

Figure 24: Market Value Share (%) and BPS Analysis by Consumer Orientation, 2023 to 2033

Figure 25: Market Y-o-Y Growth (%) Projections by Consumer Orientation, 2023 to 2033

Figure 26: Market Value (US$ Million) Analysis by Age Group, 2018 to 2033

Figure 27: Market Value Share (%) and BPS Analysis by Age Group, 2023 to 2033

Figure 28: Market Y-o-Y Growth (%) Projections by Age Group, 2023 to 2033

Figure 29: Market Attractiveness by Activity Type, 2023 to 2033

Figure 30: Market Attractiveness by Booking Channel, 2023 to 2033

Figure 31: Market Attractiveness by Tourist Type , 2023 to 2033

Figure 32: Market Attractiveness by Tour Type, 2023 to 2033

Figure 33: Market Attractiveness by Consumer Orientation, 2023 to 2033

Figure 34: Market Attractiveness by Age Group, 2023 to 2033

Figure 35: Market Attractiveness By States, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

India Decorative Veneer Industry Size and Share Forecast Outlook 2025 to 2035

India Online Grocery Market Size and Share Forecast Outlook 2025 to 2035

India Electrical Testing Services Market Size and Share Forecast Outlook 2025 to 2035

India Ready-to-mix Food Market Size and Share Forecast Outlook 2025 to 2035

India Steel Drum & IBC Market Size and Share Forecast Outlook 2025 to 2035

India Lab Grown Diamond Jewelry Market Size and Share Forecast Outlook 2025 to 2035

India Colored Gemstones Market Size and Share Forecast Outlook 2025 to 2035

India Thyroid Function Test Market Insights - Trends, Demand & Growth 2025-2035

India Kaolin Market Analysis - Size, Share, and Forecast 2025 to 2035

India Outbound Meetings, Incentives to Europe Market Size and Share Forecast Outlook 2025 to 2035

India Hydrological and Meterological Equipment Market Size and Share Forecast Outlook 2025 to 2035

India Loyalty Program Market Analysis - Size, Share, and Forecast 2025 to 2035

India Injection Moulders Market – Demand and Growth Forecast 2025 to 2035

India Solar Panel Mounting Structure Market Analysis and Forecast for 2025 to 2035

India Residential Solar Inverter Market Growth – Trends & Forecast 2025 to 2035

India Power Metering Market Insights – Trends & Forecast 2025 to 2035

India Shape Memory Alloy Market Analysis by Material Type, Component Type, Application, End Use Industry, and Region Forecast Through 2025 to 2035

India Centrifugal Pumps Market Report – Trends, Demand & Outlook 2025-2035

Analyzing India Loyalty Program Market Share & Industry Leaders

India Yoga and Meditation Service Market Trends – Size, Share & Growth 2025-2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA