The India cell culture media bags market is expected to reach USD 35.7 million in 2025. Forecasts suggest the market will achieve a 5.6% compound annual growth rate (CAGR) and exceed USD 61.6 million in value by 2035.

| Attributes | Values |

|---|---|

| Estimated India Industry Size in 2025 | USD 35.7 million |

| Projected India Value in 2035 | USD 61.6 million |

| Value-based CAGR from 2025 to 2035 | 5.6% |

This particular market of cell culture media bags for the near term will grow significantly in India, facilitated by solid public health initiatives. India is one of the largest contributor in the expansion of the sector by 2025 in the European market. The market is expected to gain a steady CAGR of 5.6% till 2035, and the opportunity reflects a sustainable growth and investment future.

The demand in India for a cost-effective hub for manufacturing of biologics and vaccines in the form of scalable and efficient bioprocessing solutions such as cell culture media bags is based on the rationale that the country can deliver high-quality biologics at lower costs, forcing biopharmaceutical companies to adopt advanced cost-efficient technologies. Cell culture media bags are designed to be highly reliable and to provide scalable solution for large production, further boosting India's strong position in the global biopharmaceutical market.

Explore FMI!

Book a free demo

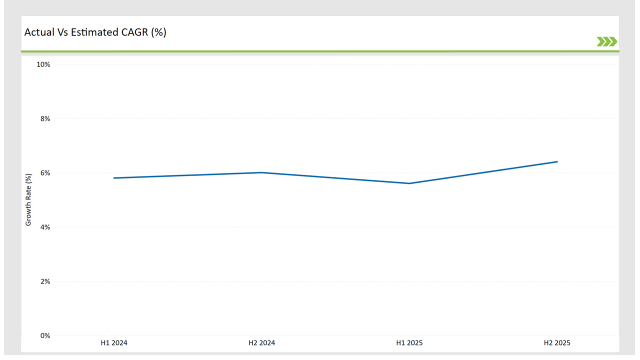

The table below offers a detailed comparative assessment of the changes in the compound annual growth rate (CAGR) over six months for the base year (2023) and the current year (2024) specifically for the India cell culture media bags market. This semi-annual analysis points out key changes in market dynamics and outlines revenue realization patterns, giving stakeholders a more precise understanding of the growth trajectory within the year. The H1 is the first half of the year which is from January to June, whereas H2 would represent the second half, from July to December.

H1 signifies period from January to June, H2 Signifies period from July to December

The cell culture media bags sector for the India market is expected to grow at a CAGR of 5.8% in the first half of 2023, which will increase to 6.0% in the second half of the same year. The growth rate is also expected to experience a slight reduction to 5.6% in H1 2024 but increase to 6.4% in H2 2024. That pattern assumes an increase of 17 basis points from H1 of 2023 to H1 of 2024 but, in H2 of 2024, is raised by 12 basis points compared to H2 of 2023.

These figures represent a dynamic and fast-changing India cell culture media bags market, largely influenced by growing demand for biologics, vaccines, India’s government is supporting the growth of the biotechnology sector, cost-effective manufacturing hub and others. This semestral breakup is crucial to businesses that chart their strategies, taking into consideration the growth trends and navigating market complexities.

| Date | Development/M&A Activity & Details |

|---|---|

| 2024 | Local Manufacturing Partnerships: Sartorius forms partnerships with local manufacturers to reduce production costs and enhance distribution efficiency. The company also invests in skill development programs to foster a deeper understanding of bioprocessing technologies within India’s growing biopharma sector. |

| 2024 | Cost-Effective Solutions & Government Collaboration: Thermo Fisher introduces affordable cell culture media bags tailored for India’s price-sensitive market. They collaborate with government-backed biotechnology initiatives to improve research infrastructure and make their products accessible to local biotech companies. |

| 2024 | Distribution Network Expansion & Technical Support: Pall strengthens its distribution network in India and offers localized customer support services. Their strategy includes providing technical expertise and affordable pricing, particularly for Indian biotech startups in the cell therapy and regenerative medicine fields. |

Cost-Effective Manufacturing Hub

This demand is further being fueled by the fact that India has emerged as a cost-effective manufacturing hub for biologics and vaccines, making scalable, efficient, and cost-effective bioprocessing solutions like cell culture media bags even more in demand.

Expanding Biotech Startups

The biotech startups that have been sprouting in India, especially regenerative medicine and stem cell research, are the reasons for a greater demand in reliable and efficient bioprocessing solutions.

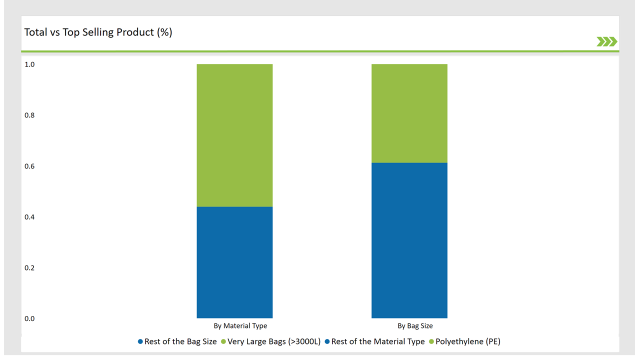

% share of Individual categories by Bag Size and Material Type in 2025

Very large bags (>3000L) records significant surge in India cell culture media bags market

Very Large Bags (>3000L) account for major sales due to the increasing demands of large-scale biopharmaceutical manufacturing, especially in the area of cell-based therapies, vaccines, and biologics. Very large bags enjoy fast growth a bigger volume have become necessary in the production of biologics and other treatments, companies need large capacity media bags with the capability to hold huge quantitates of cell culture media with the sterility level and prevention of contamination.

The Polyethylene (PE) segment is likely to witness considerable growth in the market, on account of material's cost-effectiveness, durability, and excellent barrier properties. PE is widely applied in the manufacturing of media bags as it can resist moisture and oxygen better and more other kinds of contaminants while keeping the sterility of the cell culture media intact.

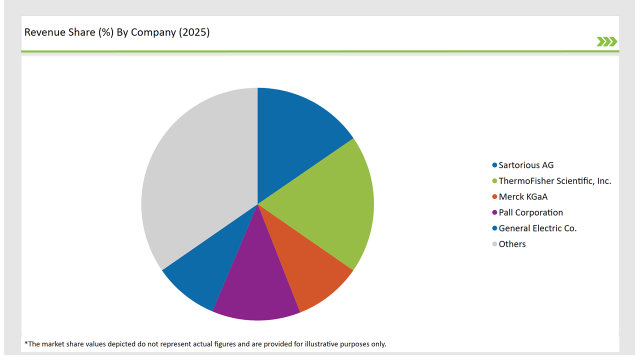

In the Indian market for cell culture media bags, concentration level can be considered moderately concentrated with key players dominating. Global leaders of the industry that are prominent have dominated the business through their advancement in product offers and distribution networks combined with continuous innovations in bioprocessing technologies from companies like Thermo Fisher Scientific, Sartorius AG, and Merck KGaA.

2025 Market share of India Cell Culture Media Bags suppliers

Note: above chart is indicative in nature

Some regional companies are available that meet the specific needs with cost-effective scalable solutions for this ever-growing biopharmaceuticals segment in India. It has an extremely competitive landscape through strategic alliances, partnerships, and mergers that help diversify the product portfolios of the companies, increase the market presence of the companies, and address increasing demand for cell culture media bags.

By 2025, the India cell culture media bags market is expected to grow at a CAGR of 5.6%.

By 2035, the sales value of the India cell culture media bags industry is expected to reach India is 61.6 million.

Key factors propelling the India cell culture media bags market include growing demand for biologics, vaccines, India’s government is supporting the growth of the biotechnology sector, cost-effective manufacturing hub and others, ensuring widespread adoption of high-quality cell culture media bags.

Prominent players in the India cell culture media bags manufacturing include Sartorious AG, Thermo Fisher Scientific, Inc., Merck KGaA, Pall Corporation, General Electric Co., Saint-Gobain Performance Plastics, Charter Medical, Avantor Fluid Handling LLC, Lonza and Entegris Inc. These companies are noted for their innovation, extensive product portfolios, and strategic market positioning.

The industry classifies bag sizes into very small bags (< 150 ml), small bags (151 - 500 ml), medium bags (501 ml - 1000L), large bags (1001L - 3000L), and very large bags (>3000L).

Regarding material types, the sector is categorized into polyethylene (PE), ethylene vinyl alcohol (EVOH), fluorinated ethylene propylene (FEP), polyolefin, and additional options.

Eyelid Scrub Market Analysis & Forecast by Product, Application and Region 2025 to 2035

Protein Diagnostics Market Share, Size and Forecast 2025 to 2035

CGRP Inhibitors Market Trends - Growth, Demand & Forecast 2025 to 2035

Indolent Systemic Mastocytosis treatment Market Insights: Size, Trends & Forecast 2025 to 2035

Intraoperative Fluorescence Imaging Market Report - Demand, Trends & Industry Forecast 2025 to 2035

Lung Cancer PCR Panel Market Trends, Growth, Demand & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.