The India axillary hyperhidrosis treatment sector will expand at a 10.1% CAGR, moving from USD 75.2 million in 2025 to USD 196.8 million in 2035, maintaining steady momentum.

| Attributes | Values |

|---|---|

| Estimated India Industry Size in 2025 | USD 75.2 million |

| Projected India Value in 2035 | USD 196.8 million |

| Value-based CAGR from 2025 to 2035 | 10.1% |

Increased awareness of this indication will further drive the sales of drugs across India, as more people will be seeking effective treatment. With awareness campaigns concerning hyperhidrosis in India's cities like Mumbai, Delhi, and Bengaluru increases, more patients are now opting for treatment rather than using the aforementioned antiperspirant.

Riemann A/S of Orkla has performed well in India with Perspirex. It offers a right solution for the personal needs of the Indian consumer who prefers treatments, easy to apply, and reasonably priced. Being an established name in the area, sales through high street retail ensures that it does have strength within the OTC category.

Similarly, GSK Plc. has established business in the Indian pharmaceutical space. Drysol is much more appropriately distributed through pharmacies and health networks, which opens avenues for further growing popularity due to the more aggressive form of the disease. The retail pharmacy network in India is the greatest facilitator for the growth of treatments of such nature.

Yet another key player targeting the Indian market through topical treatments is SweatStop International. More to come in its favor is strategic distribution channels across the urban and semi-urban territories. A product focusing on being skin-friendly and affordable suits the price-sensitive Indian market very well.

Changes in the healthcare infrastructure of the country and a burgeoning middle class speed up the market's growth. The growing middle class with more disposable income and the increase in diversified health-care options bring India into an emerging key market for axillary hyperhidrosis treatments.

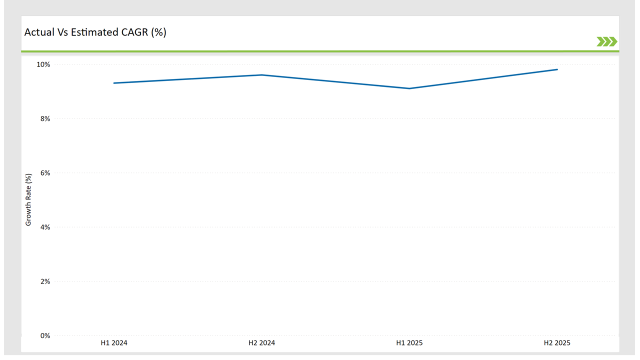

The table below offers a detailed comparative assessment of the changes in the compound annual growth rate (CAGR) over six months for the base year (2023) and the current year (2024) specifically for the India axillary hyperhidrosis treatment market. This semiannual analysis highlights all the critical shifts of market dynamics as well as details the revenue realization pattern, thus more precisely providing to the stakeholder’s insight into the trajectory of growth within a year. In other words, H1 contains January to June, and the other half H2 contains July to December.

H1 signifies period from January to June, H2 Signifies period from July to December

Axillary hyperhidrosis treatment market of the India is expected to grow at 9.7% CAGR for the first half of 2023, followed by an upgradation to 10.3% in the same year's second half. For 2024, the growth is forecasted to go a little down and reach 10.1% in H1 and is expected to rise to 10.8% in H2. This pattern presents a decline of -22.0 basis points from the first half of 2023 through to the first half of 2024, while being higher in the second half of 2024 than in the second half of 2023 by 24.0 basis points.

These figures are for a dynamic and fast-changing axillary hyperhidrosis market of the India, which is primarily affected by regulations, consumer trends, and improvements in axillary hyperhidrosis treatment. This semestral breakup becomes important for businesses as they plan their strategies, keeping in consideration these growth trends and going through the market complexities.

| Date | Development/M&A Activity & Details |

|---|---|

| 2025 | Awareness: Focus on increasing Orkla's Indian footprint by driving awareness around the condition of hyperhidrosis. Strengthen the product availability through the online and offline mode, targeting metropolitan city consumers as well as tier 2 and 3 towns. Educating the consumer, making them believe in the effective and safe medication of Perspirex, also its affordability and guarantee is the key aspect. Collaborations with local pharmacies and dermatologists help further strengthen its presence, targeting price-conscious but quality-seeking individuals across different demographics. |

| 2024 | Business Expansion: GlaxoSmithKline is focusing on expansion of business in India with key offering including Drysol. GSK is increasing the reach of the product through both traditional retail pharmacies as well as e-commerce websites. Here, the company has been localizing its marketing campaigns in order to emotionally resonate with Indian consumers, pursuing the concerns of excessive sweating and how Drysol works for moderate to severe conditions. The company further invests in educational programs among doctors and patients that increase its credence and induces adoption among the fast-growing middle class in cities. |

| 2024 | Personalized Product Development: Here, SweatStop International takes a very localized developmental approach in India, developing products for Indian skin types and for local conditions. There is a focus on the affordability of the products to increase this product's reach, while promoting use through targeted digital campaigns, especially through social media platforms. SweatStop also involves interaction with pharmacies and dermatology clinics to get a better visibility and consumer interface. The company is gaining ground in small cities by capturing the growing awareness of health-conscious people and putting itself as the most cost-effective solution to manage the condition of hyperhidrosis. |

Rising Disposable Income Among the Middle-Class and Awareness

Disposable income among middle-class people in India is one of the most relevant factors driving axillary hyperhidrosis treatment. This is because growing discretionary incomes empower more consumers with the ability to spend on items that improve their personal grooming, health, or both, such as too much sweating.

This change in consumer behavior creates a greater propensity for people to look for effective remedies, including antiperspirants available over-the-counter and prescription medicines. Along with this, other awareness campaigns about hyperhidrosis are also significantly educating consumers; and treatments are being increasingly adopted, mostly in urban cities.

Increase in Urbanization and Changing Lifestyles

High growth rates for the hyperhidrosis treatment market come from the country of India mainly due to high urbanization growth and changing lifestyle behaviors. More people being exposed to stress-related conditions or high temperatures increases the chances of hyperhidrosis.

Longer hours at work combined with increased social involvement in the city are compelling reasons for individuals to seek treatments to stop excessive sweating. This is pushing both men and women to explore medical and over-the-counter treatments, creating fertile market for brands catering to hyperhidrosis in urban centers across the country.

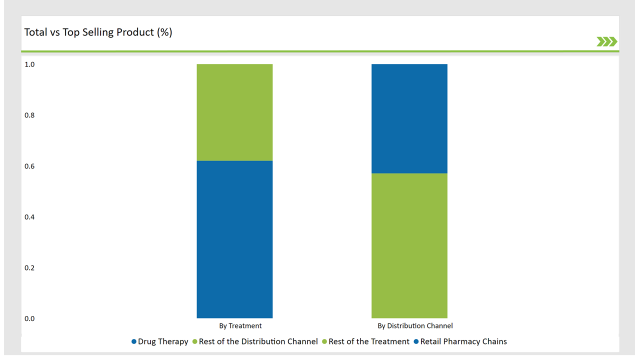

% share of Individual categories by Treatment and Distribution Channel in 2025

In India, drug therapy for axillary hyperhidrosis is on the rise as the medical landscape is changing in the country and dermatology clinics are opening up everywhere. Solutions like Botox are also gaining popularity as it is quick and effective with little time off work, a demand for urban professionals who have a very busy lifestyle. Medical tourism also contributes to this trend where patients are opting for treatments from specialized dermatologists. Drug therapy fits the emerging trend of clinical treatments that can visibly bring about change and are prescribed by doctors.

Hyperhidrosis treatment in India mainly distributes through retail pharmacy chains because of the reach of their services and affordable price. Main pharmacy chains, such as Apollo Pharmacy and Cipla, have built strong infrastructure across both urban and rural markets, hence products like antiperspirants can easily be purchased over the counter. The above-mentioned channels play a major role in delivering access to customers for both the primary and the advanced treatment options. With India preferring in-store shopping experiences, especially in smaller towns, pharmacy chains are catering to the demand for immediate, cost-effective solutions for hyperhidrosis.

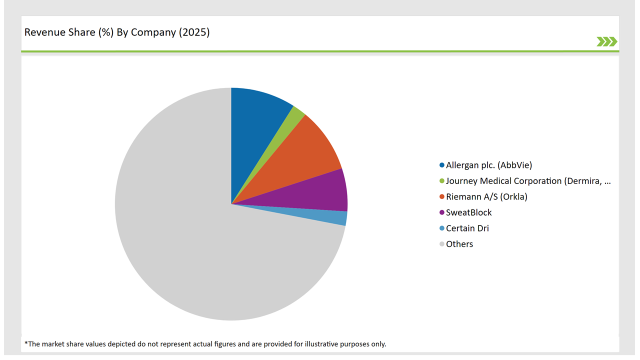

The axillary hyperhidrosis treatment market in India has a highly competitive landscape, and it is still evolving, though with considerable growth potential. While the market is largely fragmented, it is experiencing growing consolidation as leading players attempt to strengthen their hold.

Pharmaceutical companies like GlaxoSmithKline and Riemann A/S (Orkla) are gaining significant market share with over-the-counter treatments such as Drysol and Perspirex, which are very popular in urban regions. SweatStop International is gaining prominence, and one reason for this is the adaptation of treatments for local skin types and climates in India.

2025 Market share of India Axillary Hyperhidrosis Treatment suppliers

Note: above chart is indicative in nature

Local players that provide relatively low-cost solutions have also seen the market highly contribute to intense competition. Companies are looking for how they can easily reach the customer, not just in the city but also semi-urban towns, through pharmacy outlets and the online channel. In India, the retail pharmacy is crucial as they guarantee widespread reach for hyperhidrosis treatment.

International players are looking at India as a high-growth market, capitalizing on rising disposable incomes and awareness about personal grooming. However, the price sensitivity issue is a challenge, as consumers opt for cheaper solutions. Hence, competition will be more acute as global players expand their portfolios and local players refine their distribution strategies.

In terms of treatment, the industry is divided into- drug therapy, botulinum toxins, and medicated wipes.

In terms of end user, the industry is segregated into- hospitals, general physician’s clinics, retail pharmacy chains and online sales

By 2025, the India axillary hyperhidrosis treatment market is expected to grow at a CAGR of 10.1%.

By 2035, the sales value of the India axillary hyperhidrosis treatment industry is expected to reach India is USD 196.8 million.

Key factors propelling the India axillary hyperhidrosis treatment market include rising disposable income among the middle-class and awareness as well as increase in urbanization and changing lifestyles

Prominent players in the India axillary hyperhidrosis treatment manufacturing include Allergan plc. (AbbVie), Journey Medical Corporation (Dermira, Inc.), Riemann A/S (Orkla), SweatBlock, Certain Dri. among others These companies are noted for their innovation, extensive product portfolios, and strategic market positioning.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

India Online Grocery Market Size and Share Forecast Outlook 2025 to 2035

India Electrical Testing Services Market Size and Share Forecast Outlook 2025 to 2035

India Ready-to-mix Food Market Size and Share Forecast Outlook 2025 to 2035

India Steel Drum & IBC Market Size and Share Forecast Outlook 2025 to 2035

India Lab Grown Diamond Jewelry Market Size and Share Forecast Outlook 2025 to 2035

India Colored Gemstones Market Size and Share Forecast Outlook 2025 to 2035

India Thyroid Function Test Market Insights - Trends, Demand & Growth 2025-2035

India Decorative Veneer Industry - Size, Share, and Forecast 2025 to 2035

India Kaolin Market Analysis - Size, Share, and Forecast 2025 to 2035

India Outbound Meetings, Incentives to Europe Market Size and Share Forecast Outlook 2025 to 2035

India Hydrological and Meterological Equipment Market Size and Share Forecast Outlook 2025 to 2035

India Loyalty Program Market Analysis - Size, Share, and Forecast 2025 to 2035

India Injection Moulders Market – Demand and Growth Forecast 2025 to 2035

India Solar Panel Mounting Structure Market Analysis and Forecast for 2025 to 2035

India Residential Solar Inverter Market Growth – Trends & Forecast 2025 to 2035

India Power Metering Market Insights – Trends & Forecast 2025 to 2035

India Shape Memory Alloy Market Analysis by Material Type, Component Type, Application, End Use Industry, and Region Forecast Through 2025 to 2035

India Centrifugal Pumps Market Report – Trends, Demand & Outlook 2025-2035

Analyzing India Loyalty Program Market Share & Industry Leaders

India Safari Tourism Market Trends – Demand, Growth & Forecast 2025-2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA