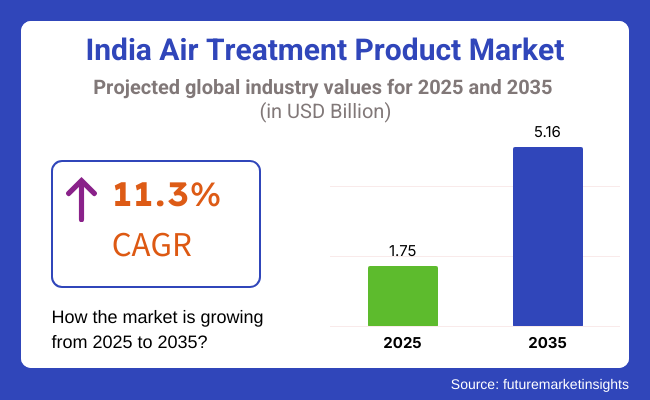

Market Overview The air treatment product industry in India is poised for significant growth from 2025 to 2035, driven by rising air pollution levels, increasing health awareness, and advancements in air purification technologies. The market is expected to expand from USD 1.75 billion in 2025 to USD 5.16 billion by 2035, registering a compound annual growth rate (CAGR) of approximately 11.3% during the forecast period.

Growing urbanization, industrialization, and the rise in respiratory illnesses have fueled the demand for air purifiers, humidifiers, dehumidifiers, and ventilation systems. Additionally, government initiatives promoting air quality management and sustainability are accelerating the adoption of advanced filtration and smart air treatment solutions. The integration of IoT, HEPA filtration, and eco-friendly technologies is further shaping market trends.

Explore FMI!

Book a free demo

North India, particularly cities like Delhi, NCR, and Chandigarh, is expected to dominate the air treatment product market due to extreme air pollution. The worsening AQI (Air Quality Index) in these regions has led to a surge in demand for household and commercial air purifiers.

Additionally, rising disposable income and increased awareness regarding respiratory health are driving market expansion. Government regulations on indoor air quality standards are further boosting product adoption.

South India, with cities like Bangalore, Chennai, and Hyderabad, is witnessing growing demand for air treatment solutions due to rising construction activities and increasing IT-sector expansion. The adoption of HVAC systems, dehumidifiers, and smart air purification solutions in commercial spaces is growing. Consumers in this region are more inclined toward energy-efficient and IoT-enabled air treatment products, driving technological innovations and product diversification.

Cities like Mumbai and Pune are experiencing increasing air pollution due to rapid urbanization and industrialization. The growing concerns over vehicular emissions and dust pollution drive residential and commercial demand for air purifiers. Additionally, luxury home automation trends fuel the demand for integrated HVAC and smart air treatment solutions in high-income households.

East India, including Kolkata and Bhubaneswar, is a developing market where rising industrialization and urban expansion propel demand. The focus on affordable air treatment products is increasing, and manufacturers are catering to this segment by offering cost-effective solutions with advanced filtration technologies.

High Product Costs and Low Awareness in Tier-2 and Tier-3 Cities One of the key challenges in India's air treatment product industry is the high cost of premium air purifiers and HVAC systems, making them less accessible to middle-income consumers.

While metro cities have witnessed strong adoption, tier-2, and tier-3 cities still lag due to low awareness about air pollution-related health risks and limited product penetration. Additionally, maintenance costs and lack of standardization in air quality regulations pose challenges for market expansion.

To address these challenges, companies focus on affordable product ranges, financing options, and awareness campaigns to educate consumers on the importance of air purification solutions.

Growth of Smart and Sustainable Air Treatment Solutions The rise of IoT-enabled air purifiers, energy-efficient HVAC systems, and AI-driven filtration technology presents a significant growth opportunity for the Indian market. Consumers are increasingly opting for eco-friendly and smart home-integrated air treatment products, leading to advancements in sustainable filtration technologies such as activated carbon, UV-C purification, and HEPA filters.

Additionally, increasing corporate investments in workplace air quality solutions and government-backed initiatives for clean indoor air programs will drive future market growth. E-commerce and online retail channels are pivotal in market penetration, offering customized solutions and expanding consumer reach.

As India's air treatment product industry evolves, brands prioritizing affordability, smart technology, and sustainability will lead the market.

| City | Delhi |

|---|---|

| Population (millions) | 32.2 |

| Estimated Per Capita Spending (USD) | 18.50 |

| City | Mumbai |

|---|---|

| Population (millions) | 21.6 |

| Estimated Per Capita Spending (USD) | 16.80 |

| City | Bengaluru |

|---|---|

| Population (millions) | 14.4 |

| Estimated Per Capita Spending (USD) | 14.30 |

| City | Chennai |

|---|---|

| Population (millions) | 11.5 |

| Estimated Per Capita Spending (USD) | 13.20 |

| City | Kolkata |

|---|---|

| Population (millions) | 15.1 |

| Estimated Per Capita Spending (USD) | 12.90 |

Delhi’s USD 595.70 Million air treatment market is fueled by severe air pollution, increasing respiratory issues, and government initiatives promoting air purifiers. Rising disposable income and heightened awareness are boosting sales of air purifiers, dehumidifiers, and humidifiers, with premium and smart-enabled products gaining popularity in urban households and offices.

Mumbai’s USD 362.88 Million market is driven by high humidity, rising urbanization, and growing health consciousness. Demand for dehumidifiers and advanced air purifiers is increasing due to mold-related issues and air quality concerns. Premium brands and IoT-enabled air treatment solutions are penetrating the market through e-commerce and retail expansions.

Bengaluru’s USD 205.92 Million air treatment industry is influenced by tech-savvy consumers, increasing pollution, and climate variations. Smart purifiers with AI-based air quality monitoring are seeing strong adoption. The city's expanding corporate sector and affluent residential communities drive demand for energy-efficient, premium air treatment systems.

High humidity levels, monsoonal variations, and increasing air pollution concerns primarily drive Chennai’s USD 151.80 Million market. Dehumidifiers, air purifiers, and cooling-based air treatment products are gaining traction. Rising awareness of airborne diseases and climate impact fuels demand for HEPA-filter-based and smart-enabled air solutions.

Kolkata’s USD 194.79 Million market benefits from rising industrial emissions, urban congestion, and growing health awareness. Consumers are shifting toward affordable, mid-range air purifiers due to increasing pollution and humidity concerns. Retail expansion, government awareness campaigns, and seasonal demand surges drive market growth in residential and commercial sectors.

India's air treatment product industry is experiencing robust growth, driven by rising pollution levels, increasing health awareness, and growing adoption of smart air purification solutions. A survey of 250 respondents across metropolitan and tier-1 cities, including Delhi, Mumbai, Bangalore, Chennai, and Hyderabad, highlights key consumer behavior trends.

69% of respondents prioritize air quality improvement and health benefits, with 72% in Delhi and Mumbai considering air purifiers essential due to high pollution levels. 58% of consumers in Bangalore and Chennai focus on energy-efficient and eco-friendly air treatment solutions. In comparison, 54% in Hyderabad and Pune prefer products with smart features such as app connectivity and real-time air quality monitoring.

Pricing sensitivity varies, with 65% of consumers in tier-1 cities willing to spend ₹15,000+ on premium air purifiers, while only 40% in tier-2 cities opt for high-end models. 55% of respondents nationwide expect air treatment products to balance affordability and long-term maintenance costs, making mid-range options a key driver.

E-commerce plays a major role in purchasing decisions, with 63% of respondents in metro cities preferring to buy air treatment products through Amazon, Flipkart, and brand websites. 50% of consumers in tier-1 and tier-2 towns still rely on offline retail stores, valuing in-person product demonstrations. 46% of respondents consider celebrity endorsements and expert recommendations as key purchase influences.

Sustainability is gaining importance, with 59% of respondents in the south (Bangalore, Chennai, Hyderabad) favoring eco-friendly and filterless air purifiers. 52% of buyers in Delhi and Mumbai seek compact, smart-enabled solutions suitable for urban apartments, while 48% in tier-2 cities prioritize multi-functional products, such as air purifiers with humidifiers or dehumidifiers.

Premium air treatment solutions (₹15,000+) see strong demand in metro cities, while affordable, energy-efficient models are preferred in tier-1 and tier-2 cities. E-commerce and digital marketing continue to grow, making influencer partnerships, interactive product demos, and smart technology integrations crucial for brands.

Local manufacturers have an opportunity to introduce cost-effective, high-performance solutions, while global players must emphasize smart connectivity, sustainability, and affordability to expand in the Indian market. India's air treatment product industry is evolving, with opportunities in smart home integration, eco-friendly innovations, and AI-driven air quality solutions.

| Market Shift | 2020 to 2024 |

|---|---|

| Technology & Product Innovation | Companies introduced HEPA and activated carbon filters in air purifiers. Smart air treatment devices with IoT connectivity and real-time air quality monitoring have gained popularity. |

| Sustainability & Energy Efficiency | Energy-efficient air purifiers and eco-friendly filters made from biodegradable materials gained traction. Solar-powered air purifiers were introduced for off-grid areas. |

| Market Expansion & Consumer Adoption | Rising pollution levels in urban centers drove demand for residential and commercial air purifiers. Increased awareness led to higher adoption of indoor air quality monitoring. |

| Regulatory & Compliance Standards | The government imposed stricter air quality regulations and promoted subsidies for energy-efficient air treatment solutions. Standards for indoor air quality monitoring were introduced. |

| Customization & Smart Features | Companies launched app-controlled air purifiers with personalized settings for allergy sufferers and asthmatics. Modular air treatment systems enabled customized solutions for various spaces. |

| Influencer & Social Media Marketing | Brands collaborated with health experts and environmental influencers to raise awareness about air pollution. Social media campaigns emphasized the importance of clean indoor air. |

| Consumer Trends & Behavior | Consumers prioritized air purifiers with multi-stage filtration and smart sensors. Demand for compact and aesthetically pleasing air treatment devices increased. |

| Market Shift | 2025 to 2035 |

|---|---|

| Technology & Product Innovation | AI-driven air purifiers provide adaptive filtration based on real-time pollution levels. Nano-filtration and photocatalytic oxidation technologies redefine air purification. |

| Sustainability & Energy Efficiency | Zero-emission air treatment systems become the industry standard. Self-cleaning and recyclable filters eliminate waste and reduce environmental impact. |

| Market Expansion & Consumer Adoption | With affordable and decentralized air treatment solutions, growth accelerates in tier-2 and tier-3 cities. AI-driven consumer education platforms enhance adoption rates. |

| Regulatory & Compliance Standards | Comprehensive air quality compliance regulations mandate real-time monitoring and reporting for businesses and households. Blockchain ensures transparency in product certification. |

| Customization & Smart Features | Hyper-personalized air treatment solutions based on AI-driven health data analytics become mainstream. Smart air treatment ecosystems integrate seamlessly with home automation. |

| Influencer & Social Media Marketing | Virtual influencers and AR-powered product trials revolutionize digital marketing. Metaverse-based air quality consultations engage consumers in immersive brand experiences. |

| Consumer Trends & Behavior | Consumers embrace biohacking-inspired air treatment solutions that integrate with wellness ecosystems. Demand rises for wearable air purification devices and AI-powered climate control. |

India’s air treatment product industry is experiencing strong growth, driven by rising concerns over air pollution, increasing health awareness, and a growing middle-class population. Consumers are increasingly investing in air purifiers, dehumidifiers, and ventilation systems to improve indoor air quality. Major players like Philips, Dyson, Honeywell, and Sharp dominate the market.

Market Growth Factors

| Category | CAGR (2025 to 2035) |

|---|---|

| Air Purifiers | 7.8% |

| Humidifiers & Dehumidifiers | 6.5% |

| Ventilation Systems | 6.9% |

Key Market Trends

The Indian air treatment product market is set for significant expansion over the next decade, with a strong push towards technological innovations, rising consumer awareness, and government-backed initiatives for air quality enhancement.

With increasing air pollution levels in metropolitan cities, consumers are actively investing in air purifiers for residential use. High-efficiency particulate air (HEPA) filters, activated carbon technology, and UV-based sterilization solutions are in high demand. Brands like Dyson, Philips, and Honeywell cater to health-conscious buyers seeking cleaner indoor air.

Smart air treatment products, including IoT-enabled purifiers, humidifiers, and dehumidifiers, witness growing adoption. Consumers prefer energy-efficient models with real-time air quality monitoring, app-based controls, and voice assistant compatibility. Leading players integrate AI-powered purification systems to optimize performance and enhance user experience.

Commercial establishments, including offices, hospitals, and hotels, increasingly invest in air treatment solutions to ensure clean indoor environments. Industrial sectors adopt large-scale filtration systems to comply with air quality regulations. The rising focus on employee well-being and productivity further accelerates demand for advanced air purification technologies.

Online platforms like Amazon, Flipkart, and Tata CLiQ contribute to market growth by offering a wide range of air treatment products. Exclusive brand collaborations, seasonal discounts, and subscription-based filter replacement services enhance customer engagement. Digital marketing campaigns and influencer promotions further drive awareness and sales in the Indian market.

India's air treatment products industry is experiencing significant growth, driven by increasing urbanization, rising awareness of indoor air quality, and escalating concerns over health issues related to air pollution. The market encompasses a range of products, including air purifiers, humidifiers, dehumidifiers, and air conditioners with advanced filtration systems.

Companies are focusing on product innovation, energy efficiency, and expanding distribution channels to cater to the diverse needs of Indian consumers. The industry is characterized by international and domestic players striving to enhance their market share through strategic initiatives.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Daikin Industries Ltd. | 15-20% |

| Panasonic Corporation | 12-16% |

| LG Electronics Inc. | 10-14% |

| Honeywell International Inc. | 8-12% |

| Blue Star Limited | 6-10% |

| Other Companies (combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| Daikin Industries Ltd. | Offers a range of air purifiers and air conditioners equipped with advanced filtration technologies. Focuses on energy-efficient products and has a strong distribution network across India. |

| Panasonic Corporation | Provides air treatment solutions, including air purifiers and humidifiers, with features like nanoe™ technology for improved air quality. Emphasizes innovation and user-friendly designs. |

| LG Electronics Inc. | Markets air purifiers and air conditioners with multi-stage filtration systems. Invests in smart technology integration and sleek designs to appeal to modern consumers. |

| Honeywell International Inc. | Offers air purifiers for residential and commercial spaces, focusing on high-efficiency particulate air (HEPA) filters. Leverages its global expertise to provide reliable air treatment solutions. |

| Blue Star Limited | Provides various air treatment products, including air purifiers and air conditioners with advanced purification features. Focuses on catering to the specific needs of the Indian market. |

Strategic Outlook of Key Companies

Daikin Industries Ltd. (15-20%)

Daikin leads the Indian air treatment market with a comprehensive range of air purifiers and air conditioners featuring advanced filtration technologies. The company emphasizes energy efficiency and has established a robust distribution network across urban and semi-urban areas in India. Daikin continues to innovate by introducing products tailored to the specific air quality challenges prevalent in various regions of the country.

Panasonic Corporation (12-16%)

Panasonic offers diverse air treatment solutions, including air purifiers and humidifiers equipped with proprietary nanoe™ technology that enhances air purification efficiency. The company focuses on user-friendly designs and has been expanding its presence in the Indian market through strategic partnerships and marketing initiatives aimed at health-conscious consumers.

LG Electronics Inc. (10-14%)

LG provides air purifiers and air conditioners with multi-stage filtration systems to remove many pollutants. The company invests in integrating smart technologies, allowing users to monitor and control air quality remotely. LG's sleek and modern designs appeal to urban consumers seeking functionality and aesthetics.

Honeywell International Inc. (8-12%)

Honeywell offers air purifiers suitable for residential and commercial applications, focusing on high-efficiency particulate air (HEPA) filters to capture fine particles. Leveraging its global expertise, Honeywell provides reliable air treatment solutions and has been actively involved in raising awareness about indoor air quality issues in India.

Blue Star Limited (6-10%)

Blue Star, a prominent Indian brand, provides various air treatment products, including air purifiers and air conditioners with advanced purification features. The company focuses on understanding and addressing the specific needs of the Indian market, offering products that cater to local preferences and environmental conditions.

Other Key Players (30-40% Combined)

Several other companies contribute to the growth of the air treatment products industry in India by focusing on niche segments, innovative technologies, and competitive pricing. Notable brands include:

These companies leverage their brand recognition and distribution networks to offer air treatment products that cater to various consumer needs and preferences. They employ online sales channels, customer education campaigns, and after-sales services to enhance their market positions.

India's air treatment products industry is poised for continued growth as consumers become increasingly aware of the health impacts of air pollution and seek solutions to improve indoor air quality. Companies focusing on innovation, energy efficiency, and effective distribution strategies will likely strengthen their market positions in this evolving landscape.

The Air Treatment Product industry in India is projected to witness a CAGR of 11.3% between 2025 and 2035.

The Air Treatment Product industry in India stood at USD 3,950 million in 2024.

The Air Treatment Product industry in India is anticipated to reach USD 5.16 billion by 2035 end.

Northern India is set to record the highest CAGR of 7.8% in the assessment period.

The key players operating in the Air Treatment Product industry in India include Dyson, Blueair, Philips, Panasonic, Honeywell, and others.

Coffea Arabica (Coffee) Seed Oil Market - Trends, Growth & Forecast 2025 to 2035

Dog Collars, Leashes & Harnesses Market Analysis by Dog Collars, Dog Leash, Dog Harness, Material Type, Distribution Channel and Region Through 2025 to 2035.

Cat Toys Market Analysis by Product Type, Material Type, Sales Channel, End-User, Application and Region Through 2035

Baby Swing Market Analysis by Seat Type, Sales Channel, End User, and Region, Forecast through 2035

Anti-Pollution Hair Care Market Analysis by Product Type, Packaging Type, and Region - Trends, Growth & Forecast 2025 to 2035

Electric Toothbrush Market by Product Type, Price, Head Movement, Sales Channel, and Region - Trends, Growth & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.