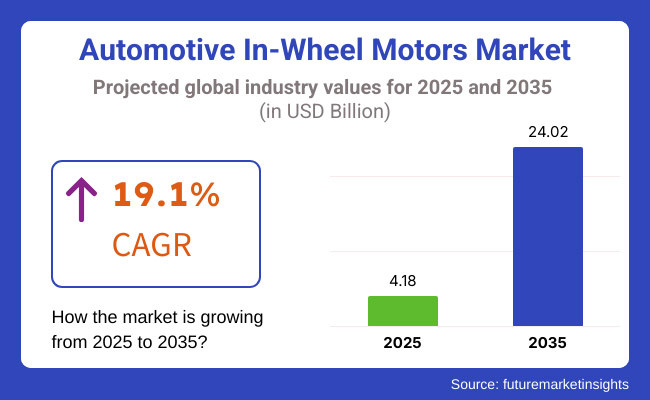

Through the 2025 to 2035 period, automotive in-wheel motors market is expected to provide widespread growth due to the increase of EV expected demand and high-power efficiency along with improved powertrain technology. The market was expected to grow from USD 4.18 Billion in 2025 to USD 24.02 Billion by 2035; from 2025 at a Compound Annual Growth Rate (CAGR) of 19.1% in the predicted period.

The clustered design of in-wheel motor technology combines electric propulsion with the wheels themselves, which eliminates the need for a traditional drivetrain, increasing vehicle efficiency, torque distribution, and interior space freedom. Hub motors have made their way into next-gen EVs, with automakers using the tech to make their vehicles accelerate faster, have better regenerative braking, and perfect their weight distribution.

The transition to autonomous driving vehicles, light weighting, and all-wheel-drive based on electric platforms also drives the need for high-performance in-wheel motors. Also, the development of solid-state batteries, AI-enabled traction control and modular architectures for EVs enable the use of in-wheel motor technology for passenger, commercial and performance vehicles.

Even with significant market potential, thermal management, cost efficiency, and mechanical durability are significant barriers. Nonetheless, new cooling technologies, high-torque density materials, and AI-based predictive maintenance systems are projected to propel the market ahead.

Explore FMI!

Book a free demo

North America is also an important market for the in-wheel motor, with the United States and Canada being pioneers in electric vehicle and drivetrain technology. Market growth is aided by the growing adoption of EVs, advanced autonomous-driving investment, and government incentives for sustainable transportation.

Several companies including Tesla, Rivian, and General Motors have devised integrated hub motors as a possible solution to enhance the EV range/performance/mobility modularity. Also, the USA Department of Energy (DOE) is supporting research on lightweight, high-efficiency electric propulsion systems, which will accelerate adoption even more.

Germany, France, and UK continue to be among the key contributors to the automotive in-wheel motor market in Europe through sustainable mobility and EV infrastructure development. Other mainstream automakers with all-electric vehicle platforms using in-wheel motor technology under development include BMW, Volkswagen, and Renault.

EU carbon neutrality goals and strict emissions controls push automakers to use smaller, higher-performance propulsion drives that enhance EV efficiency and reduce all-up weight. The growing demand for urban electric mobility solutions, such as small electric vehicles (EVs) and electric vans, is helping to drive innovation in diverse applications of in-wheel motors.

Asia-Pacific is the fastest-growing automotive in-wheel motors market, with China, Japan, South Korea, and India leading the way, as governments in these countries provide incentives and set aggressive EV production targets, and rapid urbanization drives adoption.

China, the world's biggest EV maker, is betting on motor tech to further drive performance gains in future generations of EVs. In addition, Japan and South Korea are at the forefront of integrated e-axle and in-wheel motor systems, with the likes of Nissan, Hyundai, and Toyota integrating hub motors into their prototype and concept vehicles.

Furthermore, the high demand for electric scooters, autonomous delivery vehicles, and urban micro-mobility solutions in the region is extending in-wheel motor applications beyond passenger EVs.

High Costs and Regulatory Complexities

The market is riding on the challenges provided associated with propelling production costs, administrative endorsements, and combination multifaceted nature. Automotive OEMs need to comply with strict ISO and UNECE standards for safety and performance, resulting in long development cycles and high costs.

Thermal Management and Durability Concerns

However, since in-wheel motors must fit in the tight space inside the wheel hub they must balance heat dissipation and durability. However, the absence of conventional cooling systems makes it difficult to maintain ideal motor efficiency and longevity at high speeds and off-road.

Growing Demand for Lightweight and Energy-Efficient Vehicles

As vehicles shift toward electrification and lightweight architectures, in-wheel motors bring energy efficiency, performance and reduced drivetrain complexity. Automakers will benefit from investing in advanced materials and power-dense motor designs as they will have a competitive advantage.

Advancements in Smart Mobility and Autonomous Vehicles

Highly integrated in-wheel motor systems will be needed to meet the demand of connected and autonomous mobility solutions. The in-wheel motors are the right choice for next gen autonomous electric cars due to their precision control, independent torque vectoring and modular scalability.

A gradual introduction of automotive in-wheel motors took place globally from the year 2020 to 2024 only in selected high-performance EVs, concept vehicles, and pilot projects. The direct-drive, hub-mounted electric propulsion was similar to that offered by automotive manufacturers and provided for higher efficiency and improved vehicle maneuverability.

While permanent magnet synchronous motors (PMSM), axial flux motors, and ultra-compact stators had a lot of industry-leading development focused on improving in-wheel performance, these designs could increase the weight of the wheel, making them inefficient. Automakers partnered more with tech providers, semiconductor companies, and battery makers to add smart inverters, regenerative braking, and wireless charging systems. But cost constraints, durability concerns, and lack of large-scale manufacturing capabilities meant that mass adoption was limited.

What the future holds: from 2025 to 2035: The in-wheel motors market will see rapid developments fueled by solid-state batteries, lighter composite materials, and AI-driven powertrain optimization. Next-generation modular EV platforms, AI-based torque vectoring, and 800V+ high voltage architectures will be the main driver for EV in-wheel motor technology.

Innovations such as self-healing coatings, advanced cooling solutions, and graphene-based motor windings will enhance both motor efficiency as well as reliability, solving some of the major durability challenges. In-wheel motor applications are likely to further expand with smart mobility solutions such as vehicle-to-everything (V2X) connectivity and sensor-integrated motor hubs in urban transport, last-mile delivery, and fleet electrification.

Sustainability is key to driving a reduction in rare earth dependency and the development of environmentally safe motor designs. To achieve global carbon neutrality objectives, manufacturers will develop recyclable motor components, low-emission production processes, and circular economy initiatives.

Market Shifts: A Comparative Analysis (2020 to 2024 vs. 2025 to 2035)

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | ISO and UNECE safety regulations influenced in-wheel motor adoption. |

| Technological Advancements | R&D focused on lightweight motor structures and enhanced power density. |

| Industry Applications | Adoption was limited to high-performance EVs and concept models. |

| Environmental Sustainability | Efforts to reduce drivetrain complexity and improve regenerative braking. |

| Market Growth Drivers | Demand for lightweight and space-saving electric propulsion solutions. |

| Production & Supply Chain Dynamics | Supply chain disruptions affected motor component sourcing and cost efficiency. |

| End-User Trends | Consumers showed interest in high-efficiency electric drivetrains and improved vehicle handling. |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Stricter efficiency and sustainability mandates reshape manufacturing and material selection. |

| Technological Advancements | AI-driven torque vectoring, graphene-based stators, and 800V+ ultra-fast charging redefine performance. |

| Industry Applications | Mass deployment in autonomous, commercial, and urban mobility EV segments. |

| Environmental Sustainability | Full-scale adoption of recyclable, energy-efficient, and low-carbon motor technologies. |

| Market Growth Drivers | Expansion of AI-integrated mobility, modular EV platforms, and zero-emission transport solutions. |

| Production & Supply Chain Dynamics | Localized production, sustainable material sourcing, and AI-driven inventory optimization improve market resilience. |

| End-User Trends | Growing preference for autonomous-ready, smart in-wheel motor systems with integrated safety analytics. |

The automotive HVAC ducts market in the USA is gradually expanding with growing consumer inclination towards advanced climate control systems in passenger and commercial vehicles. Ford, General Motors, Tesla and other major automakers are adding in lightweight and energy efficient duct materials to improve thermal management and reduce vehicle weight.

Government rules on emissions and fuel efficiency are inspiring HVAC duct designs that boost airflow efficiency while minimizing the energy needed to achieve it. Moreover, growing sales of electric and autonomous vehicles are surging the need for advanced HVAC solutions for optimized battery thermal management.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 20.3% |

UK automotive HVAC ducts market is growing significantly due to the well-established premium and electric vehicle segment manufacturers including Jaguar Land Rover and Aston Martin. The market is being driven by the growing transition to sustainable automotive components as well as lightweight HVAC duct material that are improving vehicle efficiency. Market demand is being further fueled by government policies promoting green vehicle technologies and investments in next-generation climate control systems. Moreover, Connected/ Autonomous vehicles technology are gaining traction on roads that provide a greater opportunity for integrating smart HVAC duct.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 18.5% |

Initiatives taken by domestic players such as Volkswagen, BMW, and Renault in Germany, France and Italy is facilitating the growth of the market in the mentioned European regions. A stronger emphasis on sustainable manufacturing and regulatory policies encouraging the transition of energy-efficient vehicles in the region will further augment the growth of advanced HVAC duct materials and designs. The HVAC size is shrinking to meet this demand, and with strict emissions regulations in place across Europe and production of electric vehicles on the rise, the demand for lightweight and thermally efficient HVAC ducts has skyrocketed. To add sponsor impact, the significant emergence of 3D-printed and bio-based duct materials is changing the market dynamic.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 19.4% |

The Japan automotive HVAC duct market is growing at a healthy rate, with surge in adoption of vehicular climate control systems and a strong demand for fuel-efficient vehicles. Toyota, Honda, and Nissan are using energy management optimized high-performance HVAC ducts. Hybrid and electric vehicles along with improvements in polymer-based and lightweight duct materials provide opportunities for this market to grow in the country. Furthermore, work on AI-based climate control systems would lead to new avenues for H-VAC duct optimization of autonomy vehicles.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 19.2% |

The growth rate of automotive HVAC ducts market in South Korea is also driven by Hyundai and Kia being at the forefront in the production of electric and hybrid vehicles. Smart climate control systems and AI-powered vehicle comfort solutions are the next HVAC duct technologies in line to make headlines as the world benefits from the advancements being made in these countries. The market growth is also a result of government policies promoting green mobility and eco-friendly vehicle systems. Moreover, genuine high-performance plastic and composite material solutions have been driving a transformation in lightweight, durability and thermal efficiency in HVAC ducts among automotive OEMs.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 19.1% |

The demand for axial flux motors and radial flux motors leads the automotive in-wheel motors market, due to a preference for high-performance, space-saving, energy-optimized in-wheel drive systems among automakers, electric vehicle (EV) manufacturers, and fleet operators. These motor arrangements are critical to increasing powertrain efficiency, facilitating acceleration, and minimizing mechanical complexity, making them paramount for battery electric vehicles (BEVs), plug-in hybrid electric vehicles (PHEVs), and hybrid electric vehicles (HEVs).

Axial Flux In-Wheel Motors Lead Market Demand as Automakers Focus on Lightweight, Compact, and High-Torque Solutions

Axial flux in-wheel motors are now considered a frontier in advanced electric propulsion, far improving the power density, size, and torque of traditional radial flux motors.Axial flux motors can be mounted directly inside vehicle wheels, creating a configuration that dispenses with the use of transmissions, drive shafts, and differentials, shattering the weight and space bottlenecks of conventional powertrain architectures.

This resulted in market adoption owing to various reasons, such as the rising demand for axial flux motors in high-performance electric vehicles, particularly luxury EVs, hypercars, and commercial fleet use, which have a common requirement of better traction and acceleration rate along with power density, energy efficiency, and all-wheel drive systems. Research shows that axial flux motors have nearly 30% higher power density than the conventional radial flux motors, which keeps the demand for this segment high.

Growing market demand for modular skateboard platforms, AI-based torque vectoring and smart motor-control systems has solidified the progressive adoption of next-generation electric vehicle architectures.

AI-powered energy management with algorithms for real-time torque distribution, predictive regenerative braking and adaptive power balancing has further enhanced adoption, providing improved driving dynamics and longer battery life.

Ultra-lightweight composite materials are underpinned by heat resistant carbon fiber rotor components, high-strength aluminum-alloy motor casings, and graphene-enhanced cooling systems, all of which are optimizing market growth by ensuring higher efficiency and thermal stability.

This has been further reinforced market expansion due to the capacity of in-wheel motor designs to be modular and scalable, customizable for different power outputs, plug-and-play integrated into different vehicle platforms through multi-wheel synchronization designs.

The best niche in the market for a scalable, and potentially mass-market electric motors, like the axial flux in-wheel motors which hold many advantages - such as a higher power density and efficiency, and fewer moving mechanical parts - are currently faced with challenges like needing to complex cooling solution designs and a high fabrication cost, as well as not being great candidates for something which has the infrastructure for mass production. That being said, new breakthroughs in AI-backed thermal regulation, blockchain-enabled supply chain transparency, and additive manufacturing-based precision-engineered axial flux components will ratchet down cost-effectiveness and production scalability while expanding global automotive market access, which will continue to buoy axial flux iWM penetration across automotive markets around the world.

Radial Flux In-Wheel Motors Expand as Automakers Prioritize Reliability, Cost-Efficiency, and Proven Performance in Electric Drivetrain Technologies

The radial flux in-wheel motor has been popular, particularly with mass-market EV manufacturers, fleet operators and hybrid vehicle designers, as the demand for affordable, rugged, and proven motor designs continues to grow. Radial flux, on the other hand, employs standard magnetic field orientation in its rotor and stator, which makes them simple to manufacture, integrate and maintain as compared to axial flux motors.

The growing demand tide towards radial flux motors for mass-market electric vehicles such as low-cost battery electric vehicles (BEVs), small electric city cars and last-mile delivery vans among others is driving up the adoption rate of in-wheel radial flux motor solutions, as OEMs look for cost-efficient and scalable propulsion technologies. According to studies, radial flux motors represent 60 % of the production volume of in-wheel motors worldwide, confirming their strong market penetration.

The newly available budgets friendly EV segments with affordable small EVs, shared mobility solutions and government-funded electric fleets programs, have further broadened the market demand, making them accessible to emerging automotive market segments.

The combination of sophisticated cooling and power management designs - air-cooled radial flux layouts, liquid-cooled hybrid motor designs, AI-enhanced powertrain efficiency gains - expands adoption, where higher thermal event assets can lead to increased temperature stability and significant energy savings.

High-efficiency motor control algorithms, including variable-frequency drive (VFD) optimization, automated torque synchronization, and self-learning drive pattern recognition are optimizing market growth by ensuring better adaptability under various driving conditions.

Cost-effective, scalable mass-volume motor production processes, with mass-manufacturable radial flux designs, next-gen coil winding methods, and AI-assisted quality validation systems, have further fueled market expansion by ensuring greater affordability to entry-level EV makers.

This radial flux in-wheel motor segment benefits from low cost, reliability, and existing supply chain infrastructure, but also suffers from lower power density, added weight compared to axial flux motors, and limits on high performance applications. But burgeoning advances such as AI-driven powertrain efficiency tuning, blockchain-based vehicle-to-grid (V2G) energy sharing networks, and next-gen, high-efficiency stator designs are enhancing the attributes of radial flux in-wheel motors at the performance, scalability and cost points at which radial flux continues to grow into automotive markets worldwide.

With in-wheel motor technology becoming differentially important for improving the energy efficiency, reducing the complexity of the drivetrain, and enabling all-wheel drive configurations, the BEV and the PHEV segments can be regarded as two large market drivers.

BEV Segment Leads Market Demand as Automakers Move Toward Fully Electric Vehicle Architectures

The BEV segment is now one of the largest end-user segments for in-wheel motor technology, enabling automakers to reduce mechanical complexity by eliminating transmission hardware and improve range via enhanced energy efficiency. BEVs differ from hybrid or ICE vehicles in that they are fully electric, so the effective integration of in-wheel motors is critical to their design and performance.

Such demand for BEVs, pertaining to the passenger and commercial vehicle segments, with zero-emission city cars, long-range electric sedan & high-performance electric SUVs, further compounds the adoption of the in-wheel motor technology, ensuring that the market is on a stabilizing tract.

However, although there are many advantages to being a pure BEV manufacturer (efficiency, simplicity of the powertrain, and ease of integration of vehicles), the BEV segment is also challenged by the high cost of batteries, limitations on charging infrastructure, an efficiency in energy consumption that varies depending on temperature, and more. Nonetheless, emerging innovations focusing on IT in the areas of AI-based battery management systems (BMS), blockchain-based EV grid connectivity, and next-generation solid-state batteries are seeking to enhance, their need for the in-wheel motors in BEVs to grow even more due to improved charging efficiencies, an overall reduction in cost, and better range optimization.

PHEV Segment Expands as Automakers Balance Electrification with Range-Extending Hybrid Powertrain Solutions

The PHEV segment has seen solid adoption in the market, in particular for automakers transitioning from ICE to electric powertrains, fleet operators searching for fuel-efficient solutions and burgeoning automotive markets evolving to hybrid vehicle regulations, with a growing appetite for extended-range electrification solutions. PHEVs, however, have a distinction from entirely electric vehicles in that they couple an internal combustion engine with an electric drivetrain, which gives an option of fuel efficiency with an extended range.

This adoption of in-wheel propulsion solutions, however, ensures better fuel economy and driving dynamics as well, all owing to the increasing demand for PHEVs with electric-assisted all-wheel drive, regenerative braking, and hybrid power distribution powered by AI.

Even with its benefits in fuel economy, long range for a hybrid, and a gradual transition to electrification, the PHEV segment battles with complicated powertrain integration, weight from using two sources, and a generalized regulation in which a hybrid is still classified as such, among other factors. Fortunately, new progress in areas like AI-powered hybrid drive control and blockchain-backed fuel efficiency tracking, coupled with cutting-edge lightweight hybrid chassis designs, are driving better overall performance, lower costs, and allowing the in-wheel motors segment for PHEVs to continue to grow and thrive.

The automotive in-wheel motors market is growing rapidly with the transition towards electric vehicles (EV), increase in demand for lightweight and energy-efficient drive trains, and continuous developments in direct-drive propulsion systems. Wheel hub motor tech provides better handling, propulsion response, and more effective regenerative braking, allowing for lighter, smaller chassis.

The best-performing motors coming out of the leading automotive and technology firms have a high torque density, multi-function cooling (the same system cools both the battery and electric motor), and AI-enhanced traction control. Integration of in-wheel motors in passenger cars, commercial fleets, and performance-level electric vehicles will only continue to pick up as the shift to autonomous and electric mobility solutions accelerates.

The global automotive in-wheel motors market CAGR stands at 19.3% from 2024 to 2032, with country-specific growth rates influenced by government EV incentives, advancements in battery technology, and automakers' transition to electric drivetrains.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Protean Electric (SAIC Motors) | 18-22% |

| Elaphe Propulsion Technologies | 12-16% |

| NTN Corporation | 10-14% |

| NSK Ltd. | 8-12% |

| Schaeffler AG | 5-9% |

| Other Companies (combined) | 35-45% |

Key Company Offerings & Activities

| Company Name | Key Offerings/Activities |

|---|---|

| Protean Electric (SAIC Motors) | Develops high-torque in-wheel motors with integrated power electronics and regenerative braking systems. |

| Elaphe Propulsion Technologies | Specializes in modular in-wheel motor platforms, improving scalability for EV manufacturers. |

| NTN Corporation | Produces hub-integrated motor solutions, ensuring optimized weight distribution and enhanced vehicle dynamics. |

| NSK Ltd. | Innovates compact in-wheel motor units with precision motion control for improved efficiency and traction. |

| Schaeffler AG | Focuses on electrified wheel drive solutions, integrating AI-driven torque vectoring for autonomous EVs. |

Protean Electric (SAIC Motors) (18-22%)

Elaphe Propulsion Technologies (12-16%)

NTN Corporation (10-14%)

NSK Ltd. (8-12%)

Schaeffler AG (5-9%)

Other Key Players (35-45% Combined)

Several emerging technology firms and automotive component manufacturers contribute to next-generation in-wheel motor innovations, focusing on power density, smart control systems, and scalability for mass production:

The overall market size for the Automotive In-Wheel Motors Market was USD 4.18 Billion in 2025.

The market is expected to reach USD 24.02 Billion in 2035.

The demand will be fueled by the rising adoption of electric vehicles (EVs), advancements in wheel motor technology, increasing focus on vehicle efficiency and weight reduction, and growing government initiatives promoting clean energy transportation.

The top five contributors are the USA, European Union, Japan, South Korea and UK.

Battery Electric Vehicles (BEVs) are anticipated to command a significant market share over the assessment period.

Sales of Used Bikes through Bike Marketplaces Market- Growth & Demand 2025 to 2035

Engine Tuner Market - Growth & Demand 2025 to 2035

Truck Bedliners Market Outlook- Trends & Forecast 2025 to 2035

Automotive Door Guards Market - Market Outlook 2025 to 2035

Automotive Connecting Rod Bearing Market -Trends & Forecast 2025 to 2035

Aircraft Strut Market - Market Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.