The in-mold labels (IML) market is growing at a fast pace as producers are looking for long-lasting, economical, and environmentally friendly labeling options. IML technology embeds labels into plastic packaging at the time of molding, obliterating secondary labeling and adhesives. Companies are gravitating towards IML in order to maximize branding, improve recyclability, and simplify manufacturing processes.

Producers are investing in digital printing, high-barrier coatings, and automation to streamline the efficiency and quality of in-mold labeling. The market is moving toward lighter, higher-resolution, and sustainable labeling materials to keep pace with global sustainability initiatives and consumer demand.

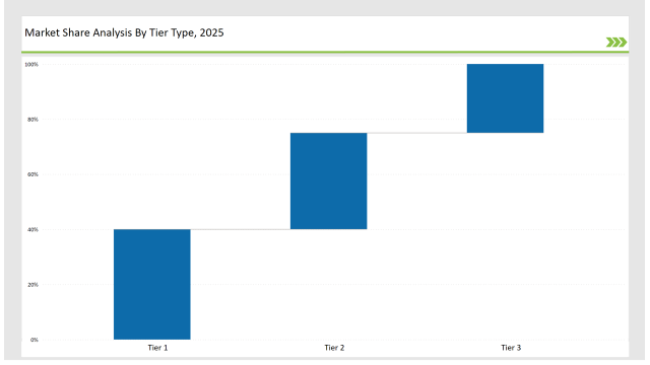

Tier 1 companies such as CCL Industries, Multi-Color Corporation, and Huhtamaki control 40% of the market owing to their high-quality printing expertise, robust relationships with global brands, and cutting-edge IML technology.

Tier 2 players like Coveris, Fort Dearborn, and Inland Packaging hold 35% of the market by providing affordable and specialized IML solutions for food, personal care, and household products.

Tier 3 consists of regional and niche players specializing in recyclable materials, digital IML printing, and unique label designs, holding 25% of the market. These companies focus on localized production, innovative designs, and eco-conscious printing techniques.

Explore FMI!

Book a free demo

Global Market Share by Key Players (2025)

| Category | Market Share (%) |

|---|---|

| Top 3 (CCL Industries, Multi-Color Corporation, Huhtamaki) | 19% |

| Rest of Top 5 (Coveris, Fort Dearborn) | 12% |

| Next 5 of Top 10 (Inland Packaging, Innovia Films, EVCO Plastics, Korsini, Yupo Corporation) | 9% |

The in-mold labels industry serves multiple sectors where high durability, cost-effectiveness, and sustainability are critical. Companies are developing advanced printing and labeling solutions to enhance product aesthetics and recyclability.

Manufacturers are optimizing IML production with high-performance printing, recyclable materials, and smart labeling innovations.

Sustainability and automation are redefining the in-mold labels industry. Companies are integrating AI-driven printing, bio-based inks, and precision molding techniques to enhance label quality and reduce production waste. They are developing recyclable IML films to replace traditional plastic labels. Manufacturers are investing in intelligent label tracking systems to improve supply chain transparency. Additionally, firms are incorporating augmented reality features into labels to create immersive consumer experiences.

Technology suppliers should focus on automation, sustainable printing solutions, and intelligent labeling technologies to support the evolving IML market. Partnering with FMCG brands and packaging manufacturers will accelerate adoption.

| Tier Type | Example of Key Players |

|---|---|

| Tier 1 | CCL Industries, Multi-Color Corporation, Huhtamaki |

| Tier 2 | Coveris, Fort Dearborn, Inland Packaging |

| Tier 3 | Innovia Films, EVCO Plastics, Korsini, Yupo Corporation |

Leading manufacturers are advancing IML technology with eco-friendly materials, AI-powered design solutions, and high-barrier labeling innovations.

| Manufacturer | Latest Developments |

|---|---|

| CCL Industries | Launched fully recyclable high-resolution IML in March 2024. |

| Multi-Color Corporation | Introduced compostable, bio-based IML for food applications in April 2024. |

| Huhtamaki | Expanded high-barrier IML solutions for dairy packaging in May 2024. |

| Coveris | Released moisture-resistant IML for household products in June 2024. |

| Fort Dearborn | Strengthened automated printing technology for IML production in July 2024. |

| Inland Packaging | Developed scratch-proof, high-gloss IML for personal care brands in August 2024. |

| Innovia Films | Pioneered ultra-thin, lightweight IML solutions in September 2024. |

The in-mold labels market is evolving as companies focus on sustainable materials, digital printing advancements, and smart labeling solutions.

The industry will continue integrating AI-driven printing, sustainable label coatings, and smart tracking technologies. Manufacturers will refine high-resolution printing techniques for sharper branding. Businesses will adopt bio-based polymers to improve recyclability. Companies will develop antimicrobial IML coatings for food safety applications. Digital watermarking will enhance product authentication and reduce counterfeiting. Additionally, firms will expand lightweight label designs to reduce material usage and improve efficiency.

Leading players include CCL Industries, Multi-Color Corporation, Huhtamaki, Coveris, Fort Dearborn, Inland Packaging, and Innovia Films.

The top 3 players collectively control 19% of the global market.

The market shows medium concentration, with top players holding 40%.

Key drivers include sustainability, automation, high-resolution printing, and smart labeling solutions.

Nitrogen Flushing Machine Market Analysis by Automatic and Semi-Automatic Through 2035

Pan Liner Market Analysis by Polyethylene (PE), Nylon, Polypropylene, Polyester, Polytetrafluoroethylene (PTFE) and Biodegradable Plastics Through 2035

Perfume Filling Machine Market Analysis by Automatic Perfume Filling Machines and Manual Perfume Filling Machines Through 2035

Molded Pulp Packaging Machines Market Analysis - Growth & Forecast 2025 to 2035

Packaging Tensioner Market Analysis - Growth & Forecast 2025 to 2035

Packaging Films Market Analysis by Product Type, Material Type and End Use Through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.