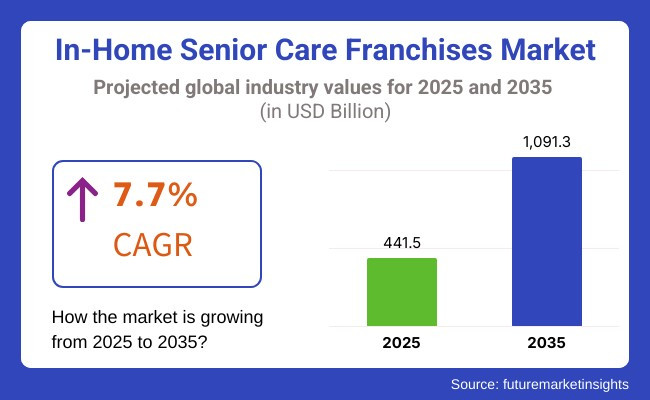

The in-home senior care franchises market is set to experience strong growth with the industry size at USD 441.5 billion in 2025, which will expand to USD 1091.3 billion by the year 2035. The industry is set to expand at a CAGR of 7.7% from 2025 to 2035, fueled by increasing population ages, increasing demand for home care, and enhanced healthcare services.

The primary driving force behind industry growth is the increasing aging population, particularly in developed countries, where life expectancy is increasing. Older individuals are opting for home care over institutionalized care with a preference for individualized, convenient, and cost-effective healthcare services.

Incidence of long-term ailments like dementia, arthritis, and cardiovascular diseases has raised the demand for long-term in-home medical and non-medical care. Increasing disposable incomes of baby boomers also validate industry growth since they are seeking high-end home care services. Despite strong demand, the company is crippled by factors like high overheads and shortage of labor. Recruitment of labor and retaining trained caregivers are ongoing problems as the work involves intensive training and commitment.

Regulatory compliance is also a hindrance in that aggressive licensing policies vary by different states. Moreover, affordability problems can discourage access by lower segments, thereby restricting industry expansion. Opportunities in the industry include telehealth and remote patient monitoring innovation, which ensures better delivery of healthcare in home settings. Scalability is offered by franchise models, which allow the service providers to expand rapidly across various geographies.

Strategic alliances with healthcare institutions and insurance companies can also simplify service access. In addition, the use of AI-driven support, smart home technology, and robotic caregiving solutions offers untapped potential for industry players. Some of the key industry trends that are influencing the industry are the increasing use of technology-based solutions, like AI-based virtual assistants and automated reminders for medication.

The shift to integrated and individualized care models, with a focus on emotional and mental wellbeing and physical health, is also impacting services being provided. As a result, in-home elderly care franchises are shifting to provide integrated, tech-enabled, and patient-centered solutions.

Explore FMI!

Book a free demo

The industry is experiencing a fast-paced growth fueled by a growing population of older adults and rising demand for home care compared to institutional settings. Family caregivers show the greatest demand, looking for trustworthy and tailored services to care for their elderly relatives. Dependability, reputation, and price are key factors in their buying decision.

Healthcare service providers are integrating senior care franchises into their networks to offer continuity of care, focusing on technology adoption for remote monitoring and telehealth capabilities. Insurance companies also understand the importance of in-home care in reducing the cost of hospitalization, hence they can be potential players for reimbursement models.

Future directions involve AI-enabled health tracking, customized care plans, and regulatory innovation guaranteeing standards of quality. While the need for aged care grows, franchise business models providing flexible, technology-enabled, and empathetic services will be the industry trend.

Between 2020 and 2024, the in-home senior care franchises industry grew at a fast rate due to the aging population, growing healthcare costs, and the aging in place demand. The COVID-19 pandemic served as a stimulus for demand for personalized in-home care services as families and seniors shunned long-term care nursing homes.

Others such as Home Instead, Visiting Angels, and Comfort Keepers established new businesses with telemedicine integration, Alzheimer's care, and post-hospital discharge. Subsidies from government programs and claims from long-term care insurance propelled industry expansion. Some of the constraints were shortages of caregivers, turn-over, and regulatory sophistication that impacted operations negatively.

Between 2025 and 2035, AI-driven care coordination, robot-supported caregiving, and smart home integration will transform the industry. AI-driven virtual assistants and predictive health monitoring will encourage senior autonomy and reduce the requirement for full-time caregivers. Wearable health sensors, IoT-based fall detection systems, and automated medication reminders will enable real-time health tracking.

Robotics will aid mobility support, household chores, and companionship. Franchises will utilize blockchain-secured patient data management to deliver confidentiality and effective information sharing between healthcare professionals. AI-powered workforce management software will streamline staffing, solving caregiver scarcity. By 2035, the in-home senior care franchise industry will be tech-savvy, extremely personalized, and integrated with AI, robotics, and smart health monitoring for optimal senior well-being.

Comparative Market Shift Analysis from 2020 to 2024 vs. 2025 to 2035

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Pandemic-induced demand, home-based care preference, and aging population. | Care coordination, robotics, and smart home health integration through AI. |

| Telehealth, dementia care programs, and post-hospital services. | Virtual assistants powered by AI, wearable health sensors, and automated medication management. |

| Shortages of caregivers, high turnover rates, and regulatory limitations. | Workforce automation, patient data cybersecurity, and affordability of sophisticated care solutions. |

| Growing franchises of personalized home care with government-backed initiatives. | AI-powered, robotics-based, and IoT-enabled care models for independent senior living. |

| Expansion of franchised home care networks with specialized senior needs. | Combining AI-powered monitoring, robotic care, and blockchain-enabled patient data protection. |

The in-home senior care franchises are developing at an unprecedented pace due to the increasing number of elderly people, the surge in the need for personalized treatment, and the shift to home care facilities as the first preference of services for most people over institutional care.

Franchises get an industry value from the practicality of previously used strategies, public trust in a well-known brand, and systemic programs of instruction that help new entrants to their industry; for this reason, they are highly demanded investment options. On the contrary, some uncertainties are likely to obstruct the growth of the industry and businesses if they are not well managed.

The primary issue is the lack of staff and high attrition rates. The number of qualified caregivers is on the rise, but it is still difficult to find and keep professionals with proper skills. Low salaries, burnout, and limited career prospects are the reasons behind the high turnover crisis which disrupts the continuity and quality of services.

Rising cost of performance and diverse payment protocols are another significant concern. In-home care services are usually financed through private payments, Medicaid reimbursements, or long-term care insurance. Transitions in governmental healthcare policies along with restructuring the way services are reimbursed can have a detrimental effect on the firm’s financial stability.

The franchise owners must implement different payment models, maximize the use of resources, and utilize technology to the fullest in order to lessen costs and streamline operations.

| Countries | CAGR (2025 to 2035) |

|---|---|

| USA | 8.2% |

| UK | 7.1% |

| France | 6.5% |

| Germany | 6.9% |

| Italy | 6.4% |

| South Korea | 7.5% |

| Japan | 5.8% |

| China | 9.1% |

| Australia | 6.7% |

| New Zealand | 6.2% |

The USA dominates the industry with a projected CAGR of 8.2% between 2025 and 2035. The rapidly expanding aging population, increased preference for home care over institutional care, and increase in healthcare infrastructure investment are key drivers of this strong growth. The Baby Boomer segment, which comprises a significant proportion of the aging population, is generating demand for personalized and technology-based home-based care solutions.

In addition, government programs like Medicare Advantage expansion and home care service reimbursement models drive industry growth further. A strong regulatory system, positive insurance coverage policies, and growing private equity interest in healthcare franchises bolster franchise operators. The lack of skilled caregivers is still an issue, resulting in increased wages and greater emphasis on caregiver training programs to ensure quality services.

The UK industry will grow at a CAGR of 7.1% from 2025 to 2035. An aging population, with more than 24% of the population expected to be over 65 years of age by 2035, is driving the industry. Increased pressure on the National Health Service (NHS) and moving towards individualized care budgets, where older individuals are given a choice to select their preferred caregiver, are the forces driving demand for home care.

Care Quality Commission (CQC) regulations guarantee high standards but also introduce additional operational complexities for franchise companies. UK home care franchises focus on specialist dementia care, companionship, and palliative care in accordance with the increased incidence of age-related diseases. The industry is also seeing the introduction of technology, including AI-powered monitoring systems and the integration of telehealth.

The French home elderly care industry is expected to achieve a CAGR of 6.5% between 2025 and 2035. The French government's home care policies, along with tax incentives for home care services, create a good opportunity for growth. France possesses a relatively higher life expectancy, and hence, the demand for long-term home care services is higher.

The Allocation Personnalisée d'Autonomie (APA) program gives monetary support to older people for home care, thus making it more accessible. Multilingual care services are the focus of French franchise companies in response to France's multi-ethnic composition. Caregiver shortages and adherence to strict labor laws, however, limit service growth. Robotic aid and remote monitoring solutions become more widely accepted, enabling providers to offer low-cost services without compromising quality.

Germany's home-based elderly care franchise industry will grow at a CAGR of 6.9% during 2025 to 2035. Germany's well-developed Pflegeversicherung (Long-term Care Insurance) system provides extensive coverage of home care services, fueling demand for franchise operators. The industry is dominated by a high percentage of elderly citizens, over 30% by 2035, fueling the demand for skilled caregivers.

Germany has witnessed heightened cross-border caregiving, with Eastern Europeans commuting to offer affordable services, affecting the pricing mechanism within the franchise sector. The government support for smart home retrofitting to ensure elderly independence has boosted the partnership between in-home caregiving personnel and IoT technology companies. The industry also faces the issue of human resources availability due to stringent labor laws and certification requirements by caregivers.

Italy's domestic elder care franchise industry is likely to increase at a CAGR of 6.4% during 2025 to 2035. Being one of the aging populations in Europe, with more than 35% of its residents aged above 65 years by 2035, demand for home care services is increasing. Family caregiving was the industry leader, but with the onset of urbanization and two-income families, professional care is on the rise.

Government subsidies and incentives for private home care agencies are driving the franchise ahead. However, labor costs are steep, and complex immigration regulations toward foreign caregivers are creating operating hurdles. Post-hospital rehabilitation and Alzheimer's care programs are seeing aggressive growth with specialized service offerings.

The senior care in-home franchise industry in South Korea is anticipated to post a CAGR of 7.5% during 2025 to 2035. With the population of the country growing rapidly in terms of its elderly population and having one of the world's fastest-growing aging populations, there is immense demand for professional home care. The government's Long-Term Care Insurance (LTCI) program guarantees financial support for home care services, enhancing accessibility.

Family care has been the societal norm in Korea, but with societal change and the rising number of elderly living alone, the demand for home care services has grown. Franchise organizations have been emphasizing the use of robotics and AI-based support, and South Korea is a leader in technology-supported home care services.

Japan's in-home elderly care industry is expected to expand at a CAGR of 5.8% between 2025 and 2035. Japan's population of more than 40% 65+ years by 2035 puts Japan at a stage of critical need for in-home care services. The government has invested heavily in caregiving infrastructure but remains concerned about caregiver shortages as a top priority.

AI-based caregiving robots and telehealth systems are more prevalent in Japan than in other nations and assist in mitigating labor shortages. The Kaigo insurance scheme subsidizes care at home, but regulatory impediments and institutional care preference hinder franchise expansion.

China's domestic senior care franchise industry will expand the most rapidly, at 9.1% CAGR during 2025 to 2035. China has a demographic transition as a result of the aging population issue, with an estimated 400 million aged citizens in 2035. China has eased its approach towards private sector entry into the old-age care industry, and thus, it is a profitable venture for franchise companies.

The growth in urbanization and nuclear families has diminished the caregiving provided by traditional families, further increasing the need for professional home care. China is also embracing smart home technologies, AI-based caregiving, and electronic health monitoring, establishing a new standard of elder care innovation.

Australia's franchise industry for in-home senior care will grow at a CAGR of 6.7% over 2025 to 2035. The government-led Aged Care Reforms are emphasizing home care over nursing homes, increasing the demand for franchised services. Commonwealth Home Support Programme (CHSP) and Home Care Packages (HCP) funding are making private home care more affordable.

The industry is seeing Indigenous aged care programs expanding to cater to the specific needs of Aboriginal and Torres Strait Islander communities. Labor shortages are, however, a top concern, inducing investment in carer education programs.

The in-home senior care franchising industry in New Zealand is anticipated to expand at a 6.2% CAGR from 2025 to 2035. Government attention is being focused on aging-in-place programs through home adjustment subsidies and caregiving support. The Pay Equity Settlement has increased remuneration for caregivers, enhancing the popularity of the profession.

However, franchise players are worried about labor shortages. The rural-urban caregiving disparity is still a widespread problem, with corporations investing in telehealth technology and mobile caregiving vehicles to extend their reach to far-flung regions.

The industry is expected to grow by 2025 as the population ages, and there is a greater desire for at-home care. The industry is bifurcated into two types: Skilled Nursing Care, dominated by a 42.3% market share, and Homemaker and Companion Services, which hold a 28.1% market share.

Specialized Care by Medicare plays a significant role, as Skilled Nursing Care is where most of the most critical and higher-valued in-home medical services are delivered-such as medication management, wound care, and rehabilitation following a hospital stay. These services are needed by seniors dealing with chronic illnesses or recovering from surgery, and they employ licensed nurses.

Top performers in this segment include leading franchises like Interim Healthcare and BrightStar Care. BrightStar Care maintains high clinical standards in all of North America as a joint commission accredited, leading home health care and medical staffing provider, recognized as the preferred home health agency for families when professional healthcare at home is a must. Likewise, Interim Healthcare offers various skilled nursing services, empowering seniors to receive personal medical care in the comfort of their own homes.

Homemaker and Companion Services, at 28.1% of the industry, is rapidly growing as many seniors wish to age in place- receiving help with activities of daily living, as opposed to seeking medical assistance. Such services include meal preparation, light housekeeping, transportation, and companionship that give critical emotional and physical support. Home Instead and Visiting Angels are the leaders in this category.

Home Instead specializes in dementia and Alzheimer’s care and trains its caregivers to manage cognitive decline. Watsonville is known for its flexible care plans, permitting families to select hourly or live-in services depending on their loved one’s needs. The need for these services, both medical and otherwise, has helped grow what now constitutes a little over 19% of franchises that cater to an industry of seniors that is increasingly diverse in terms of care.

The largest share of the industry in 2025 was the 66 to 75 years age group with 45.2%, with the next highest was the 55 to 65 years age group with 36.8%

Aged 66 to 75 Years: Due to the rising prevalence of chronic illnesses and mobility issues (both associated with aging), this group accounts for the largest share in the home healthcare industry, along with increased home care after hospitalization. Depending on their health conditions, this category of elderly may need a combination of Skilled Nursing Care and Homemaker and Companion Services.

Top franchises like BrightStar Care and Interim Healthcare supply this industry with high-level medical services that can include everything from wound care to physical therapy and chronic disease management. Home Instead and Visiting Angels have reduced the chances of seniors going to the hospital by providing non-medical support like meal prep and companionships.

It is also the largest industry segment between 55 and 65 years, accounting for 36.8% of the industry, which is increasing as early retirees and aging baby boomers seek assistance with preventive care and lifestyle support. While many in this group are still active, some need part-time home care services for age-related conditions, post-surgical recovery, or managing disability.

Franchises like Right at Home and Comfort Keepers have specially trained caregivers who provide customized, flexible, non-medical support to seniors to facilitate their independence. The industry is projected to grow as both age demographics require in-home care, increasing with longevity in life expectancy.

The in-home senior care franchise industry is increasingly influenced by the demand for customized personal care and skilled nursing care orphaned by an ever-increasing aged population and preference to age in place. The big names in the industry have branded themselves differently in terms of reputation, their offerings, caregiver training processes, and application of technology. The franchise model permits the attaining of greater scale with faster expansion across regions while ensuring consistency in delivering the service.

The competitive landscape defines a mixture of some established nationwide providers with emerging regional franchises. Larger franchises appear to use economies of scale, digital platforms for matching clients with caregivers, and good partnerships with healthcare organizations.

On the other hand, specialized providers are concentrating on niche services such as dementia care and post-hospitalization assistance. Also, the rising use of telehealth and remote patient monitoring has begun to change industry dynamics, which work in favor of franchises by enhancing their offering as well as client engagement.

Franchise owners place greater emphasis on improving caregiver recruitment and retention during labor shortages by investing in training, competitive salaries, and advancement opportunities. Furthermore, wellness programs, supportive transportation as well as companionship services are becoming major differentiators.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Home Instead | 20-24% |

| Visiting Angels | 15-19% |

| Comfort Keepers | 12-16% |

| Right at Home | 10-14% |

| Senior Helpers | 8-12% |

| Other Key Players | 15-20% |

| Company Name | Key Offerings & Market Focus |

|---|---|

| Home Instead | Comprehensive senior care services, strong caregiver training programs, and partnerships with healthcare providers. |

| Visiting Angels | Flexible, personalized in-home care with a focus on companion care and respite care for families. |

| Comfort Keepers | The holistic "Interactive caregiving" approach integrates physical, mental, and emotional well-being. |

| Right at Home | Specialized programs for dementia care, chronic condition management, and transitional care. |

| Senior Helpers | Leading provider of Alzheimer's and Parkinson’s disease care, leveraging proprietary care programs. |

Key Company Insights

Home Instead (20-24%)

Home Instead leads the industry with a strong nationwide presence and an extensive caregiver training program. Its partnerships with hospitals and senior living communities enhance care coordination and brand credibility.

Visiting Angels (15-19%)

Known for its flexible and affordable home care options, Visiting Angels focuses on personalized care plans and respite care services, catering to a broad client base.

Comfort Keepers (12-16%)

Comfort Keepers differentiates itself with its "Interactive Caregiving" philosophy, encouraging seniors to stay engaged in their daily activities for improved well-being.

Right at Home (10-14%)

Right at Home specializes in chronic disease management and transitional care programs, working closely with healthcare professionals to ensure continuity of care.

Senior Helpers (8-12%)

Senior Helpers is a leader in Alzheimer's and Parkinson’s care, offering proprietary training programs for caregivers and integrating technology for enhanced care monitoring.

Other Key Players (15-20% Combined)

The industry is expected to generate USD 441.5 billion in revenue by 2025.

The industry is projected to reach USD 1091.3 billion by 2035, growing at a CAGR of 7.7%.

Key players include Home Instead, Visiting Angels, Comfort Keepers, Right at Home, Senior Helpers, BrightStar Care, Griswold Home Care, Amada Senior Care, FirstLight Home Care, and Assisting Hands Home Care.

North America leads the market, followed by Europe, due to an aging population, rising healthcare costs, and a growing preference for home-based care solutions.

The market is expanding due to increasing life expectancy, a shift toward aging in place, advancements in telehealth and remote monitoring, and rising government initiatives supporting home healthcare.

By type, the market is segmented into skilled nursing care, homemaker and companion services, physical therapy, and medical social services.

By age group, the key segments include 55 to 65 years, 66 to 75 years, and others.

By region, the analysis includes North America, Latin America, Western Europe, Eastern Europe, Asia Pacific, Japan, and the Middle East & Africa.

E-Waste Management Market Growth - Trends & Forecast 2025 to 2035

Power Conditioning Services Market Trends - Growth & Forecast 2025 to 2035

Yacht Charter Market Analysis – Size, Share & Forecast 2025 to 2035

Examining Market Share Trends in Leadership Development Programs

Logistics Outsourcing Market Analysis – Growth & Forecast 2025-2035

Native Advertising Market Analysis – Trends & Forecast 2025-2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.