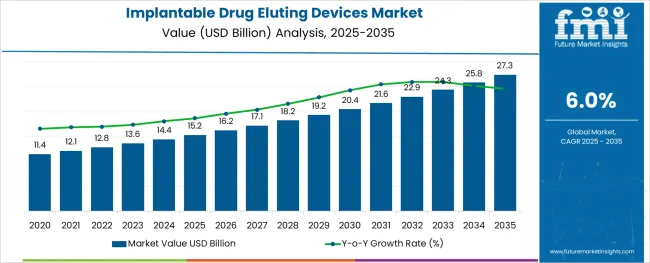

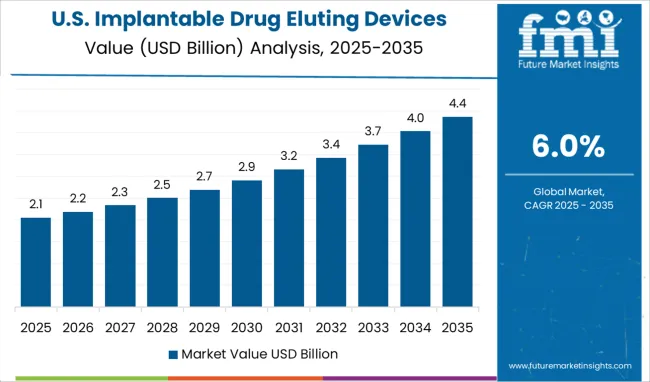

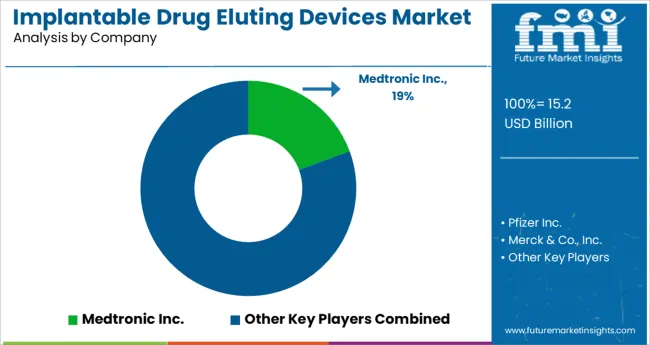

The Implantable Drug Eluting Devices Market is estimated to be valued at USD 15.2 billion in 2025 and is projected to reach USD 27.3 billion by 2035, registering a compound annual growth rate (CAGR) of 6.0% over the forecast period.

The implantable drug eluting devices market is evolving as healthcare providers emphasize targeted drug delivery and long-term therapeutic outcomes. Increased surgical interventions and chronic disease prevalence have created the need for devices that offer both structural support and localized drug release. Clinicians have widely accepted these solutions for improving patient recovery and reducing the frequency of repeat procedures.

Technological advances in polymer coatings and drug delivery mechanisms have elevated the performance of these devices in various medical specialties. Industry discussions have highlighted the growing focus on biocompatibility and controlled release kinetics to ensure patient safety.

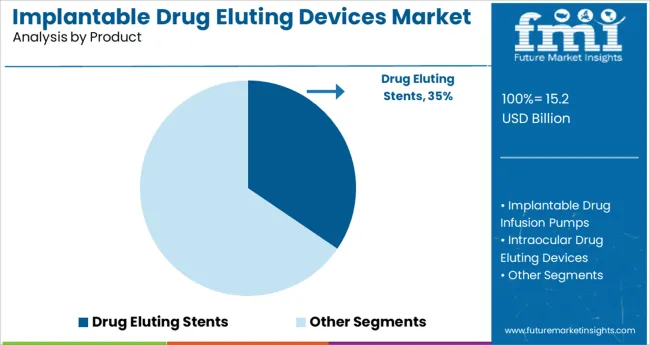

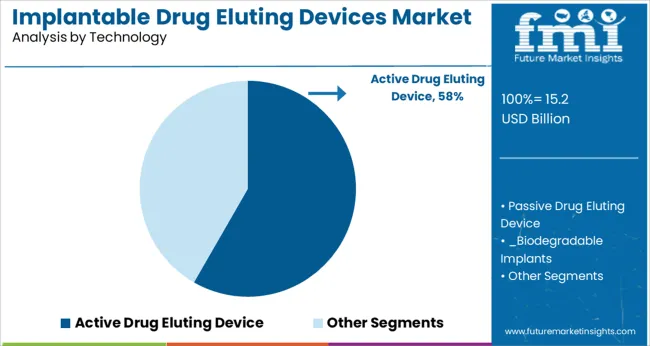

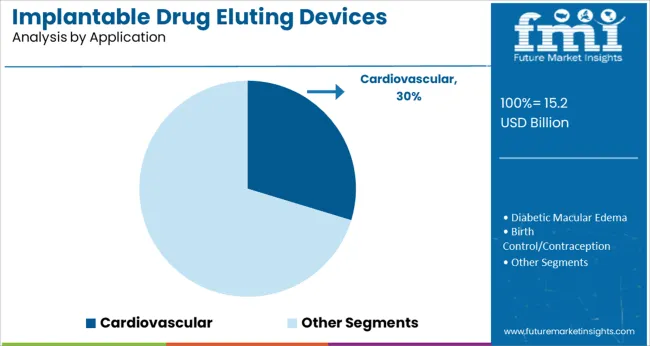

Moving forward, the market is expected to expand with the introduction of next-generation drug formulations and the broader application of these devices in minimally invasive surgeries. Segmental momentum is projected to be led by Drug Eluting Stents in product type, Active Drug Eluting Devices in technology, and Cardiovascular as the key application area.

The market is segmented by Product, Technology, Application, Implementation Type, and End User and region. By Product, the market is divided into Drug Eluting Stents, Implantable Drug Infusion Pumps, Intraocular Drug Eluting Devices, Contraceptive Drug Eluting Devices, Buprenorphine Implant, and Others. In terms of Technology, the market is classified into Active Drug Eluting Device and Passive Drug Eluting Device.

Based on Application, the market is segmented into Cardiovascular, Diabetic Macular Edema, Birth Control/Contraception, Opioid Addiction, Ophthalmology, Oncology, and Pain Management. By Implementation Type, the market is divided into Intravascular, Intravaginal, Intraocular, Intrathecal, Subcutaneous, and Intrauterine.

By End User, the market is segmented into Hospitals, Ambulatory Surgical Centers, Optical Care Centers, Cardiac Surgery Centers, Office Based Settings, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Drug Eluting Stents segment is anticipated to hold 34.5% of the implantable drug eluting devices market revenue in 2025, maintaining its lead in the product category. Growth in this segment has been supported by the clinical demand for devices that prevent restenosis while maintaining vascular patency. Cardiologists have adopted drug eluting stents as a standard intervention in the treatment of coronary artery disease due to their ability to deliver antiproliferative drugs directly to the arterial wall.

The dual function of mechanical support and therapeutic drug release has reinforced the clinical value of these devices. Moreover, advancements in stent design and drug-coating techniques have improved device safety and long-term outcomes.

As heart disease continues to remain a global health concern, the Drug Eluting Stents segment is expected to sustain steady demand in both established and emerging healthcare markets.

The Active Drug Eluting Device segment is projected to contribute 58.3% of the implantable drug eluting devices market revenue in 2025, holding its dominant position in the technology landscape. This segment’s growth has been attributed to the effectiveness of active drug release in enhancing local therapeutic action while minimizing systemic side effects.

Medical device engineers have focused on refining active delivery mechanisms that control the timing and concentration of drug release for specific clinical needs. Active drug eluting technologies have expanded their use beyond cardiovascular interventions into areas like oncology and orthopedics, where precise localized therapy is essential.

The ability to combine structural implants with programmable drug release has improved patient outcomes and expanded treatment options. As research continues to explore new drug-device combinations, the Active Drug Eluting Device segment is expected to remain at the forefront of implantable therapeutic solutions.

The Cardiovascular segment is estimated to represent 29.7% of the implantable drug eluting devices market revenue in 2025, maintaining its status as the largest application segment. This growth has been fueled by the global burden of cardiovascular diseases, which has driven the need for innovative treatment approaches.

Cardiologists have increasingly relied on drug eluting devices to reduce complications associated with coronary artery interventions and peripheral vascular procedures. Advances in interventional cardiology techniques have supported the wider adoption of these devices in both elective and emergency procedures.

Additionally, clinical studies have demonstrated improved patient recovery and reduced hospital readmissions when drug eluting technologies are used in cardiovascular care. As the global healthcare community continues to prioritize cardiovascular health, the Cardiovascular segment is expected to remain a key area for implantable drug eluting device applications.

| Particulars | Details |

|---|---|

| H1, 2024 | 6.03% |

| H1, 2025 Projected | 6.00% |

| H1, 2025 Outlook | 5.90% |

| BPS Change - H1, 2025 (O) - H1, 2025 (P) | (-) 10 ↓ |

| BPS Change - H1, 2025 (O) - H1, 2024 | (-) 13 ↓ |

According to Future Market Insights’ analysis, the global implantable drug eluting devices market will observe a diminished change in the Basis Point Share (BPS) by nearly 13 BPS in H1- 2025 (O) as compared with H1-2024. The attribute of non-biodegradable implants, which includes the requirement for surgical removal or the accumulation of polymer in the body after usage, has a negative impact on the total market.

Non-biodegradable implants are generally more traumatic to remove than they are to place. This is based on available clinical studies data. The comparative analysis and market growth rate of the global implantable drug eluting devices market as studied by Future Market Insights will show a negative BPS growth in the H1-2025 outlook as compared to H1-2025 projected period by 10 BPS. Furthermore, the manufacture of implants necessitates the use of huge amounts of organic solvent, which might affect drug stability and toxicity, as well as raise environmental problems.

On the contrary, numerous factors present several benefits to the overall implantable drug eluting devices market, including the adoption of compression as a manufacturing technique for implantable drugs, which refrains from the use of heat or solvents, making it a suitable method for the manufacture of implants containing heat or solvent sensitive compounds such proteins or peptides.

This is set to advance the manufacturing capacities of key producers within the global industry space.

The market value for Implantable Drug Eluting Devices holds nearly 5.8% of the overall USD 14.4.0 Billion Drug Delivery Devices market in 2024.

Implantable drug eluting devices provide numerous distinctive advantages which include the exceptional prospects of site-specificity, localization, and targeted drug delivery process.

The applications of implantable drug eluting devices are indispensable when considered under the scope of cardiology, ophthalmology, birth control, opioid addiction, pain management, diabetes management, contraception, as well as cancer therapy. The targeted drug delivery systems improve the efficacy of treatment (oncology and cardiology) and assist with the reduction of side effects by preventing damage to healthy tissue.

The implantable drug eluting devices are segmented into two main types: active drug eluting devices and passive drug eluting devices.

The technologies essentially incorporated in the active drug eluting devices are electromechanical and osmotic pressure gradients. Furthermore, the passive drug eluting devices are sub-segmented into 2 types which include biodegradable implants and non-biodegradable implants, wherein, the biodegradable implants are polyester amide and Polylactic glycolic acids devised and the non-biodegradable implantable devices are made using silicon, polyethylene-vinyl acetate, and thermoplastic polyurethane.

The non-biodegradable implants possess wide-ranging applications in diabetes, contraception, hormone regulation, pain management, cancer treatment, etc. Implantable drug delivery devices commonly comprise a drug reservoir enclosed by a polymer or a mixture of a drug-polymer.

The implant, when incorporated into the desired, localized area of the body, releases the drug at a pre-calculated rate whilst the polymer degrades.

The effective drug delivery system through implantable drug eluting devices is thus set to gain traction in terms of adoption over the forecast period, owing to the specificity of the target site and the rate of drug dissolution into the localized area of therapy.

The market is expected to expand at a considerable growth rate over the next seven years at a CAGR of close to 6.0%.

The implantable drug eluting devices is predicted to exhibit lucrative growth over the forecast period. This growth can be associated with the rising adoption of patient-controlled devices and increasing the incidence of peripheral and coronary artery diseases. Additionally, the key market players are displaying extensive focus on clinical trials of bio-reabsorbable stents and implantable drug infusion pumps.

Therefore, the growing adoption by patients and physicians, and rising demand for minimally invasive surgeries are set to offer growth opportunities to key market players in the development of novel implantable drug-eluting devices. Furthermore, the rising incidence of cardiovascular and chronic diseases over the globe is generating growth opportunities for the global implantable drug eluting devices market.

According to the WHO, cardiovascular diseases are one of the major causes of mortality globally.

Several research and clinical studies are currently taking place for the improvement of the functioning of existing drug eluting stents and devices. Research in this area is thus focused on the evaluation and development of novel and augmented drug eluting devices, which uphold notable clinical benefits and eliminate safety concerns regarding their long-term application. The innovative efforts in research on next-generation drug eluting devices are expected to further progress procedures such as endothelialization and rapid arterial healing.

These factors are thus comprehensively set to promote the growth of the implantable drug eluting devices market throughout the forecast period.

The factors associated with risks associated with the limited demand and value growth of the implantable drug eluting devices include the process of product recalls, which are indispensable for public health and safety as it leads to the voluntary action of manufacturers and distributors to carry out their responsibility that presents a risk of injury or defective or gross deception of products.

Additionally, pending approvals of products by regulatory bodies may hinder the growth of injunctions which can restrain the sale of products and may remarkably divert the attention of the management and technical personnel in the market. In the event of approval pending, the company's financial condition, business, and results of operations could be adversely affected. Moreover, several implantable drug eluting devices pose a problem in terms of patient adherence, terms of discomfort upon the implants being incorporated into them.

The ongoing biodegradation of the drug-eluting stents sometimes makes it difficult to maintain the accurate dose at the end of its lifetime. There is always a risk of device failure, which may result in another surgical involvement to correct the device.

Another factor of concern includes the fact that most implants possess an inadequate loading capacity owing to their small size. This gives way to some specific potent medicines for appropriate delivery by implantable devices.

The concerns arising from bodily reaction to a foreign substance also conceive a restrictive growth in the deployment of implants in lieu of its biocompatibility and safety. These factors collectively induce restraint in the growth of the implantable drug eluting devices market, however, augmented and personalized implant designing may prove to enhance the efficacy of the implanted drug delivery process.

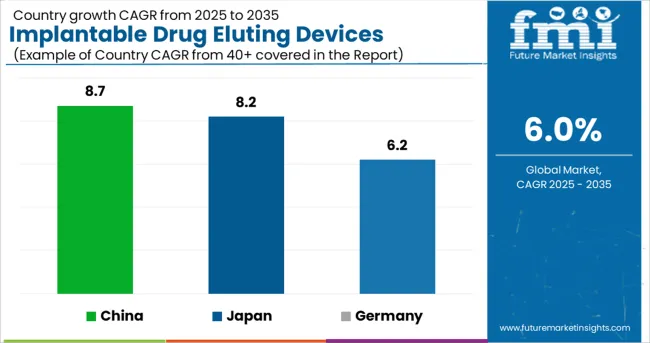

Germany is set to exhibit a CAGR of over 6.2% in the European implantable drug eluting devices market during the forecast period. The lucrative growth in the region is associated with the emergence of key and established players in the country, focusing on research and innovative methodologies for drug delivery and targeted site delivery systems.

China holds a 46.1% market revenue share in the East Asia market in 2024 and is projected to increase at a CAGR rate of 8.7% during the forecast period. The growth of the implantable drug eluting devices market in the country is attributed to the development of novel drug delivery technologies, such as an implantable nanogenerator, which can be adopted for precise drug delivery systems. Furthermore, increasing government funding for research and development activities is set to augment the China implantable drug eluting devices market over the forecast period.

In 2024, Japan held a 39.3% share in the East Asia implantable drug eluting devices market and is projected to expand at a CAGR of 8.2% from 2025 to 2035. The growth is associated with the rapid adoption of automated systems in the country, including models for site-specific and targeted drug delivery systems. These augmentations are cost-effective and reduce the error rate during clinical trials.

The USA dominates the North American region with a total market share of over 94.1% in 2024 and is projected to continue experiencing high growth throughout the forecast period.

The vast majority of shares gained by the USA in the implantable drug eluting devices market are owed to the factors associated with rising disease burden, increasing geriatric population, and the developing healthcare infrastructure which offers reimbursement opportunities for new procedures.

Contraceptive drug eluting devices project lucrative growth at a CAGR of 6.0% till the end of the forecast period, with a market share of around 39.8% in 2024. The growth is associated with the factor of increasing awareness in terms of female and reproductive health over the globe, and the efforts to minimize the mortality and morbidity rate associated with female reproductive health.

Passive drug eluting device technology holds a revenue share of 96.2% in 2024 and is projected to hold a share over the forecast period with the estimation being 96.6%. The segment holds the maximum revenue share due to the wide-ranging applications of passive drug eluting devices in the field of oncology, cardiology, pain management, contraception, etc.

Cardiovascular applications hold a revenue share of 45.1% in 2024 and are projected to hold a share over the forecast period with the estimation being 47.3%. The segment gains traction with the rising incidence of chronic diseases and the risks associated with infectious agents among the geriatric population.

Intravascular implantation type holds a revenue share of 44.1% in 2024 and is projected to hold a share over the forecast period with the estimation being 46.1%. The extensive ranging applications of the intravascular implants as well as the efficient patient adherence and outcomes have contributed to this method being implemented widely across several treatment indications.

Hospitals hold a revenue share of 61.9% in 2024 and are projected to hold a share over the forecast period with the estimation being 66.0%. The process of targeted drug delivery through implantable drug eluting devices requires the aid of skilled physicians with patient data for close monitoring in the event of implant rejection or other adverse events. Thus, the hospital segment accounts for a massive share of the implantable drug eluting devices market.

Corporate tie-ups amongst implantable drug eluting device manufacturers, acquisitions, expansion, product launches, agreements, and increasing clinical trials and research activities are the key strategies adopted by manufacturers to increase product sales in different geographies.

Similarly, recent developments related to companies operating in the implantable drug eluting devices market have been tracked by the team at Future Market Insights, which are available in the full report.

| Attribute | Details |

|---|---|

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2024 |

| Market Analysis | million for Value |

| Key Regions Covered | North America; Latin America; Europe; South Asia; East Asia; Oceania; and Middle East & Africa |

| Key Countries Covered | USA, Canada, Brazil, Mexico, Argentina, Germany, United Kingdom, France, Italy, Spain, Russia, China, Japan, South Korea, India, Thailand, Indonesia, Malaysia, Australia, New Zealand, GCC Countries, Northern Africa, South Africa, Turkey |

| Key Market Segments Covered | Product, Technology, Application, Implantation Type, End User, and Region |

| Key Companies Profiled | Pfizer Inc.; Medtronic Inc.; Merck & Co., In; Bayer AG; JOHNSON & JOHNSON; SurModics Inc.; AstraZeneca Plc.; Boston Scientific Corporation; Titan Pharmaceuticals, Inc.; BIOTRONIK, INC.; Abbott Laboratories; Allergan, Inc.; Bausch and Lomb, Inc.; Alimera Sciences; REVA Medical, Inc. |

| Pricing | Available upon Request |

The global implantable drug eluting devices market is estimated to be valued at USD 15.2 billion in 2025.

It is projected to reach USD 27.3 billion by 2035.

The market is expected to grow at a 6.0% CAGR between 2025 and 2035.

The key product types are drug eluting stents, implantable drug infusion pumps, intraocular drug eluting devices, contraceptive drug eluting devices, buprenorphine implant and others.

active drug eluting device segment is expected to dominate with a 58.3% industry share in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Implantable Tibial Neuromodulation Market Forecast and Outlook 2025 to 2035

Implantable Collamer Lens Market Size and Share Forecast Outlook 2025 to 2035

Implantable Defibrillator Market Size and Share Forecast Outlook 2025 to 2035

Implantable Infusion Pump Market Size and Share Forecast Outlook 2025 to 2035

Implantable Drug Infusion Pumps Market

Subcutaneous Implantable Defibrillator System Market Size and Share Forecast Outlook 2025 to 2035

Subcutaneous Implantable Defibrillator (S-ICD) Market is segmented by product, indication, and end user from 2025 to 2035

Drug Taste Masking Technologies Market Forecast and Outlook 2025 to 2035

Drug-Gene Interaction Panels Market Size and Share Forecast Outlook 2025 to 2035

Drug Testing Systems Market Size and Share Forecast Outlook 2025 to 2035

Drug Tester Market Size and Share Forecast Outlook 2025 to 2035

Drug Device Combination Products Market Size and Share Forecast Outlook 2025 to 2035

Drug Discovery Enzymes Market Size and Share Forecast Outlook 2025 to 2035

Drug Integrated Polymer Fibers Market Size and Share Forecast Outlook 2025 to 2035

Drug Discovery Outsourcing Market Size and Share Forecast Outlook 2025 to 2035

Drug Formulation Market Analysis - Size, Growth, & Forecast Outlook 2025 to 2035

Drug-Induced Dyskinesia Market Size and Share Forecast Outlook 2025 to 2035

Drug Free Depression Treatment Market Size and Share Forecast Outlook 2025 to 2035

Drug Delivery Technology Market is segmented by route of administration, and end user from 2025 to 2035

Drugs Glass Packaging Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA