The Immunoassay Market is estimated to be valued at USD 34.2 billion in 2025 and is projected to reach USD 55.6 billion by 2035, registering a compound annual growth rate (CAGR) of 5.0% over the forecast period.

The stainless steel valve tag market is expanding steadily as industrial sectors prioritize asset management, safety compliance, and equipment traceability. Increasing investments in infrastructure and process automation have heightened demand for robust and clear identification solutions capable of withstanding harsh environments.

The shift toward digital transformation in industries such as oil and gas, manufacturing, and utilities is encouraging the adoption of advanced tagging systems that support maintenance and audit operations. Growing awareness around regulatory compliance for equipment labeling and enhanced safety protocols is also influencing market expansion.

The rise of e-commerce platforms has facilitated easier procurement of valve tags, increasing accessibility for small to medium enterprises and broadening geographic reach. Material innovations and customization options continue to enhance product longevity and visibility, creating opportunities for market penetration across diverse industrial applications.

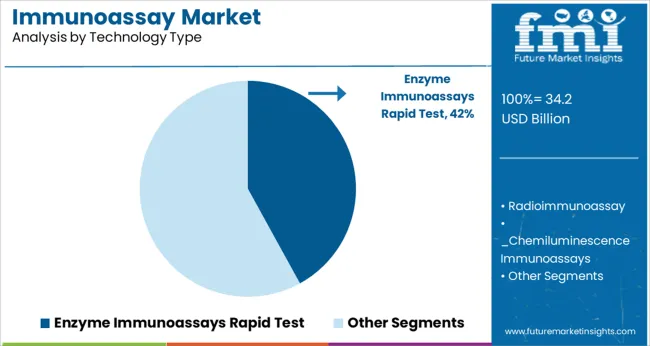

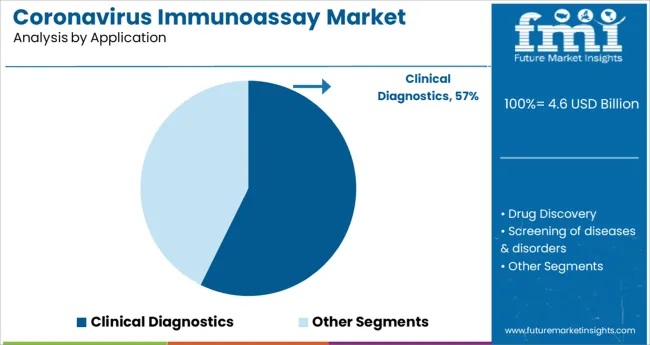

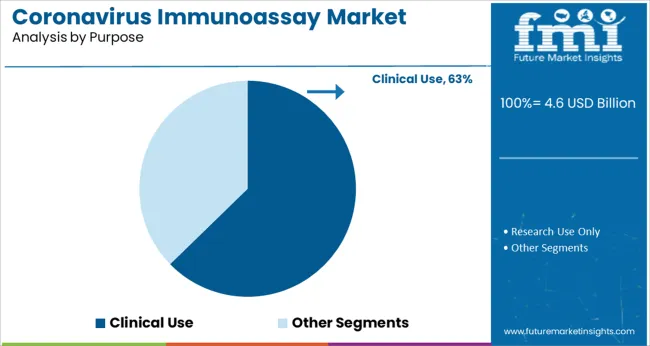

The market is segmented by Product Type, Technology Type, Application Area, and End-use and region. By Product Type, the market is divided into Reagents & Kits, Analyzers/Instruments, and Software & Services. In terms of Technology Type, the market is classified into Enzyme Immunoassays Rapid Test, Radioimmunoassay, and Others. Based on Application Area, the market is segmented into Infectious Disease Testing, Therapeutic Drug Monitoring, Oncology, Cardiology, Endocrinology, Autoimmune Diseases, and Other Applications. By End-use, the market is divided into Hospitals, Blood Banks, Clinical Laboratories, Pharmaceutical and Biotech Companies, and Academic Research Centers. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The market is segmented by Product Type, Technology Type, Application Area, and End-use and region. By Product Type, the market is divided into Reagents & Kits, Analyzers/Instruments, and Software & Services. In terms of Technology Type, the market is classified into Enzyme Immunoassays Rapid Test, Radioimmunoassay, and Others. Based on Application Area, the market is segmented into Infectious Disease Testing, Therapeutic Drug Monitoring, Oncology, Cardiology, Endocrinology, Autoimmune Diseases, and Other Applications. By End-use, the market is divided into Hospitals, Blood Banks, Clinical Laboratories, Pharmaceutical and Biotech Companies, and Academic Research Centers. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The less than 30 mm thickness segment is expected to hold 41.3% of the revenue share in 2025 within the thickness category. This segment’s leadership is supported by its suitability for a wide range of valve sizes and equipment types, providing sufficient durability while minimizing material costs.

The thinner tags offer flexibility in installation, especially in tight spaces and complex piping systems, making them preferable for industries where compactness is critical. Their compatibility with standard mounting hardware and ability to endure corrosion and wear have reinforced demand in sectors emphasizing both performance and cost efficiency.

This balance between robustness and adaptability has contributed to the segment’s dominant position.

Within the product type category, engraved valve tags are projected to command 57.8% of the market revenue share in 2025, marking them as the leading product form. The prominence of engraved tags is due to their superior legibility, permanence, and resistance to environmental degradation such as fading, scratching, and chemical exposure.

Engraving allows precise and customizable marking, meeting stringent industry standards for traceability and safety. The technique supports complex information including serial numbers, barcodes, and QR codes, enhancing integration with digital asset management systems.

Manufacturers’ emphasis on delivering long-lasting, tamper-proof tags that reduce maintenance costs has reinforced the adoption of engraved tags in heavy industries.

The online distribution channel is expected to generate 63.7% of market revenue in 2025, making it the most dominant sales route. The growth of e-commerce platforms has revolutionized procurement by offering convenience, broader product selections, and competitive pricing to end-users across industries.

Online channels enable buyers to access detailed product specifications, customization options, and customer reviews, simplifying purchase decisions. This has particularly benefited small and medium-sized enterprises lacking traditional supply chain networks.

Additionally, digital platforms have streamlined order fulfillment and reduced lead times, fostering faster adoption. Vendors are increasingly investing in online marketplaces and direct-to-customer websites to expand reach and improve customer engagement, reinforcing the online channel’s leadership in the stainless steel valve tag market.

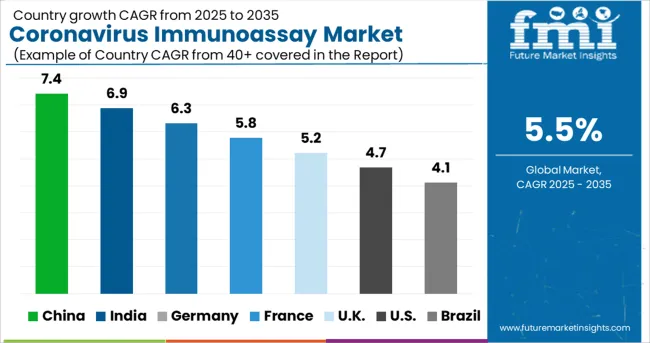

According to a global research report on immunoassay market, Asia-Pacific is the fastest growing region in the market. The higher CAGR is attributed to governments in China and India investing large sums of money in the advancement of the healthcare sector, including the construction of new hospitals and clinics as well as the redefining of diagnostic practises.

According to the immunoassay market demand analysis, the largest market share of 35% in 2025 is expected to hold the same position throughout the forecast period. The rising demand is attributed to an increase in cancer incidence and the ease of access to technologically advanced diagnostic techniques. Infectious disease outbreaks are becoming more common in the region.

The introduction of molecular kits, as well as an increase in the sales of reagents and kits, are also driving demand for immunoassay testing kits. This is due to the rise in infectious and chronic diseases, as well as the geriatric population, becoming infected as a result of them.

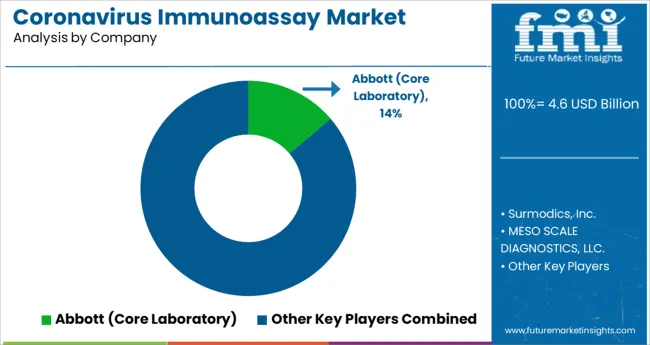

Abbott Laboratories focuses on chia technology and offers the Abbott prism, an automatic immunoassay analyzer. It is very effective for blood screening and produces useful results. Other benefits of these systems include cGMP compliance, error reduction due to the network's resistance to tampering, increased lab productivity, and reduced human involvement because the system handles routine details such as monitoring, processing, and documentation.

Siemens Healthineers announced on November 2024 that its SARS-CoV-2 IgG Antibody Test has demonstrated to evaluate neutralising antibodies and has received CE Marking.

Suzhou Hybiome Biomedical Engineering Co. Ltd. was acquired by bioMérieux in November 2020 for a majority stake. This acquisition is expected to boost the company's presence in the Chinese market.

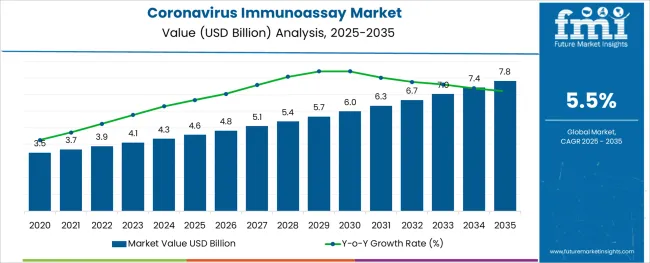

Global study on immunoassay market states that the dynamic shift from the last forecast period (2020 to 2024) to the current forecast period (2025 to 2035) is significant.

This fueled the market’s growth prospects and brought opportunities for the new medical and healthcare market players to come up with the latest technology and integrate it with immunoassay technology. The market is now growing at a slightly low CAGR but is expected to expand its market space due to the rising awareness and antibodies check-up post-vaccination.

With the environment changing and climate change-based diseases and viruses growing in the urban and rural areas, the demand for vaccines is on a rise. The immunoassay market survey explains that the tests of the effectiveness of these vaccines are conducted through immunoassays tests that include the strength of antibodies in the immune system, fueling the sales of immunoassay testing kits.

Immunoassay market analysis displays the higher growth prospects due to the higher awareness of the new viruses and diseases that demand for higher antibodies in the body. An immunoassay test gives you information about the antibodies present in the body for any specific virus or disease spread by it. Demand for immunoassay tests rises as the hospitals, clinics, and research and development centers established by the government are consuming the most from the market.

The latest technology integrates Artificial Intelligence and advanced healthcare and diagnostic technology. Also, regions like Asia Pacific includes India and China that are building their medical and healthcare infrastructure consume a huge chunk of immunoassay market.

The regulatory agencies in multiple nations restrict the sales of immunoassay instruments or limit their use of it in research and development centers or labs to prevent any misuse. Furthermore, the limitations associated with these instruments such as low antibody detection, false negative results, and other errors. Other than that, the high process of these immunoassay testing instruments is hindering the market’s growth.

The misinterpretation and the complex earlier immunoassay systems have made it hard for the end users to operate their systems in a good manner, hampering the demand for immunoassay testing kits.

Immunoassay Market:

| Attributes | Immunoassay Market |

|---|---|

| CAGR (2025 to 2035) | 5% |

| Market Value (2025) | USD 29.51 Billion |

| Growth Factor | The advent of Covid-19, new healthcare and diagnostics technology, and rising awareness around the application of immunoassay instruments and kits. |

| Future Opportunities | The market holds multiple opportunities for the new market players who come with the latest healthcare technologically driven products, government schemes in the healthcare innovation and startups also fuels the market growth. |

| Market Trends | The new kits that have higher detection capabilities and are logistic friendly are shaping the market trends for the immunoassay market. |

Blood Glucose Monitoring Devices Market:

| Attributes | Blood Glucose Monitoring Devices Market |

|---|---|

| CAGR (2025 to 2035) | 7.8% |

| Market Value (2025) | USD 12.61 Billion |

| Growth Factor | The geriatric population and the higher number of blood-related cases along with the higher health awareness globally are fuelling the demand for blood glucose monitoring devices. |

| Future Opportunities | Latest blood testing technology along with specific diabetes testing formats have created opportunities for the new markets to take interest and produce efficient, green and effective devices for the future. |

| Market Trends | The application of these devices in the United States has skyrocketed as the number of diabetic patients, especially youngsters are rising and setting up the growth trends for the market. |

By product, reagents and kits accounted for 60% share of total revenue generated of the immunoassay market globally and is anticipated to hold the highest share by 2035. As the climate change spreads its space in the world and gives birth to new infectious and autoimmune diseases like Covid-19, Monkeypox etc., the applications of reagents and kits have increased.

The approval and launch of novel immunoassayare likely to support the segment growth. Though the software and service segment hold the second position, owing to the cost-effective products, fueling the overall sales of immunoassay testing instrument.

Immunoassay market opportunities rise with the EIA/ELISA technology that is gaining traction in the market with its higher use in reducing the assay time for immunoelectrophoretic and immunodiffusion while providing accurate and quantitive results. This segment holds around 60% of the global market share. Other than that, rapid test technology is more useful in the infections caused by salmonella, campylobacter, Zika and Listeria.

By application, the infectious disease testing segment accounted for a 30% share of total revenue generated through the immunoassay market globally and is anticipated to hold the highest share by 2035. This growth is attributed to the high share can be attributed to the rise in the incidence of infectious diseases such as HIV, malaria, influenza, and the novel COVID-19.

Immunoassay market demand analysis defines that the largest market share of 35% in 2025 and is forecasted to hold the same position during the forecast period. The rising demand is attributed to increase in the incidence of cancer and the easy availability of technologically advanced diagnostic techniques. Furthermore, an increasing number of incidences of infectious diseases in the region, like HIV, Influenza, and Tuberculosis.

Also, the introduction of molecular kits and the increase in the sales of reagents and kits used are also fueling the demand for immunoassay testing kits. This happens due to the rising infectious and chronic diseases and the geriatric population getting infected through them.

Global market report on immunoassay records the Asia-Pacific region as the fastest growing region in the market. The higher CAGR is attributed to the governments in China and India investing huge amounts of capital in the advancement of the healthcare sector, building new hospitals and clinics while redefining its diagnostics practices. The covid-19 and its wave did hit the region adversely, fueling the sales of immunoassay testing kits in the region. Furthermore, the expected hike in the demand for immunoassay kits with the rapidly increasing geriatric population and chronic diseases amongst them. These are the outcomes of the inactive lifestyle amongst youngsters.

New market report on immunoassay defines the market space as a younger space where there is a space for innovation and technology. The defining factors key players have are the ability to deliver effective and accurate results while making the end product more logistics friendly and easy to use.

| Attribute | Details |

|---|---|

| CAGR (2025-2035) | 5.0% |

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2024 |

| Market Analysis | billion for Value and Million. Sq. M. for Volume |

| Key Regions Covered | North America; Latin America; Europe; East Asia; South Asia; and the Middle East & Africa |

| Key Countries Covered | USA, Brazil, Mexico, Germany, UK, China, India, Japan, Australia, and GCC Countries |

| Key Segments Covered | Product, Technology, Application, End-use and Region |

| Key Companies Profiled | Siemens Healthineers; BioMérieux SA; Abbott Laboratories; Danaher Corporation (Beckman Coulter); Quidel Corporation; Ortho Clinical Diagnostics; Sysmex Corporation; Bio-Rad Laboratories, Inc.; Becton, Dickinson and Company; F. Hoffmann-La Roche AG; Thermo Fisher Scientific, Inc |

| Report Coverage | Market Forecast, Company Share Analysis, Competition Intelligence, DROT Analysis, Market Dynamics and Challenges, and Strategic Growth Initiatives |

| Customization & Pricing | Available upon Request |

The global immunoassay market is estimated to be valued at USD 34.2 billion in 2025.

It is projected to reach USD 55.6 billion by 2035.

The market is expected to grow at a 5.0% CAGR between 2025 and 2035.

The key product types are reagents & kits, analyzers/instruments, _open-ended systems, _closed-ended systems and software & services.

enzyme immunoassays rapid test segment is expected to dominate with a 42.0% industry share in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Immunoassay CDMO Market Analysis – Size, Trends & Industry Outlook 2025-2035

Radioimmunoassay Market Growth - Trends & Forecast 2025 to 2035

The Neuro Immunoassay Market is segmented by product, and end user from 2025 to 2035

Animal Immunoassay Kits Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Mycology Immunoassays Testing Market Size and Share Forecast Outlook 2025 to 2035

Coronavirus Immunoassay Market Size and Share Forecast Outlook 2025 to 2035

Fluorescence Immunoassay Analyzers Market

Autoimmunity Immunoassay Market

Biomarker-based Immunoassays Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA