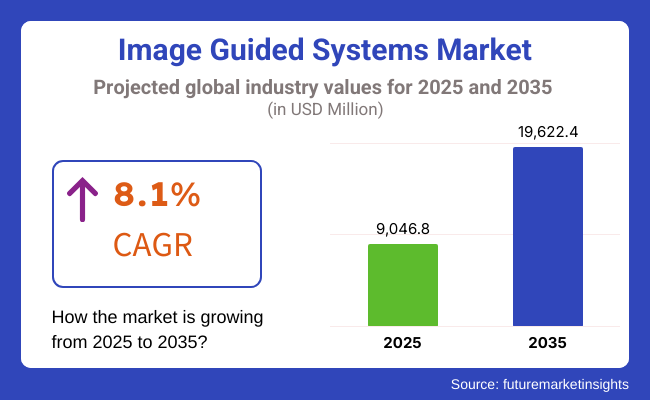

The global market for image guided systems is forecasted to attain USD 9,046.8 million by 2025, expanding at 8.1% CAGR to reach USD 19,622.4 million by 2035. In 2024, the revenue of this market was around USD 8,418.6 million.

Inclusion of real-time imaging such as CT, MRI, and ultrasound into procedures has transformed contemporary medicine by enhancing the precision of surgeries, reducing patients' trauma, and adding to clinical results in general. The imaging systems afford surgeons with real-time visualization by allowing for precise navigation through intricate procedures.

Due to all these reasons, image-guided systems have found their application in a variety of specialties that range from neurosurgery to orthopedics, cardiology, and even oncology, among many others, where accuracy is crucial to effective treatment.

Heightened incidences of chronic diseases like cancer, cardiovascular diseases, and neurological disorders give an even deeper sense to the fire burning inside health systems for development and deployment of sophisticated imaging-guided diagnostic and therapeutic applications as such systems would be in high demand.

However, many obstacles stand in the way of development in most cases. The procurement and operative maintenance of image-guided systems remains really expensive, while the regulatory guidelines about medical imaging devices are extremely tough.

Furthermore, special skill training becomes requisite, thus posing a bar to accept and adapt these systems. This leads to these technologies being inaccessible to health care providers, particularly in underprivileged developing nations.

However, in the present day, the market is projected for great growth in coming years due to sustained R&D efforts towards improvement in imaging accuracy, implementation of AI for aided decision-making, and availability of further cost-effective approaches. In line with growing interests in patient-centric approaches and minimally invasive approaches, the market is likely to witness huge demand in the next five or six years.

Advancements in imaging technology, such as higher resolution and faster processing speeds, enhanced the precision and effectiveness of these systems significantly contributed to the growth of the image guided systems market during 2020-2024. Various surgical techniques that are image guided are on the rise as further solutions to surgical applications with improved patient outcomes.

They give visualization of the operating field in pre-operative and post-operative planning to avoid critical structures of the brain. Image guided surgery helps to pinpoint the affected areas, such as tumors, and improve the patient's outcomes by reducing risks in relation to surgical errors while speeding up surgical procedures, reducing hospitalization, and shortening the time of recovery.

Recent advancements such as introduction of 3D ultrasound system provides three-dimensional images that allow clinicians to act intuitively to provide a better perspective of anatomical structures than using 2D images further anticipate the market growth. These images provide a clear view to accurately locate and remove the tumor, hence helping the surgeons preserve the body's functions after surgery.

Its high-quality navigational powers and accuracy are the reason behind its use in the most complex surgeries with various applications in tumor removal, neurosurgery, orthopedic surgery, urology, gastroenterology, and others.

Explore FMI!

Book a free demo

The developed healthcare infrastructure and rapid adoption of advanced imaging technology will boost the North American market significantly during the forecast period. Indeed, the region enjoys high R&D spending which acts as a trigger for innovations in both diagnosis and therapy imaging solutions.

The USA acts as a twin engine for the growth of the market due to the increase in the prevalence of chronic diseases, eg. cancers and cardiovascular diseases, requiring precision-based treatments. The high concentration of top players, the fierce patient-centricity focus, and other factors provide a luminescent height to the image-guided systems market’s growth.

Thus, factors like high purchasing, maintenance, and training costs could hinder growth in the market, notwithstanding the continued technological advances in this region.

The European market growth across the globe owes itself to rising awareness about state-of-the-art imaging technologies and an increasing demand for minimally invasive procedures that decrease trauma for patients. The major driving forces of the market, Germany, France, and the United Kingdom, are buoyed by solid healthcare infrastructure, fostering continuous innovation and the presence of leading medical device companies investing in imaging innovations.

Increasing acceptance of image-guided therapies in neurology, oncology, cardiology, and orthopedics is providing impetus for this development. The growth driver for the industries is the healthcare modernization policy. Economic uncertainties, along with the disparity in regulations adopted across European nations, may remain a cause of concern for the companies operating in these areas, with otherwise favorable general market trends.

Asia-Pacific region is also poised to experience the world's quickest growth in image-guided systems market attributed to improved health care infrastructure, high spending on healthcare, and raised awareness regarding improved health conditions for advanced imaging techniques.

Japan, India, and China are facing a swift rise in incidence rates of chronic diseases mainly attributable to ageing and changing lifestyles and hence driving precision-based diagnostic as well as therapy interventions. Further, the growth in the medical devices sector and the encouragement by government through support towards modernization in the healthcare sector help in adding momentum to market expansion.

Having players both foreign and domestic putting their investments into novel imaging products helps build a stronger regional market. Limited rural area awareness, variations in accessibility of healthcare services, and bureaucratic regulation may also inhibit market entry into specific areas.

Lack of Sufficient Training in the Use of Image Guided Surgical Systems

Image guided surgery devices are complex and highly specialized with surgical navigation systems and require skilled surgeons to perform surgeries accurately.

The lack of sufficient training in the use of image-guided surgical systems to surgeons is a major challenge, which hampers the growth of the IGS devices market.

The world is trying to scale up COVID testing and a major reason behind this is that there are not enough trained staff. SARS-CoV-2 relies on a staple laboratory method known as the reverse-transcription polymerase chain reaction, or RT-PCR, and it needs trained staff. Skilled personnel can help innovate and develop through research and development by creating new knowledge in the industry. Unfortunately, skilled personnel working on research and developmental work is in short supply.

Due to the lack of experience and training in image guided surgery, hospitals face a lack of surgeons and experts who can handle this advanced and precise treatment.

Development of Cost Effective & Innovative Products

Technological advances in image-guided surgery are likely to usher in a new age for surgery. Future progress must be geared towards speed, accuracy, ease, and creating low-cost instruments. The present navigation system implemented in image-guided surgeries tends to necessitate a complicated network of cables for it to be operational, requiring big space within an operating room and causing a mess in the operating area.

The evolution of smart sensors, which can substitute wire-based surgical navigation systems, will lead to wireless systems and improve the freedom of movement for surgeons and ease the process of conducting image guided surgeries. Existing image guided surgery devices are quite costly and hence limit adoption in small/mid-size hospitals.

Development for portable wireless systems and low cost-effective devices offers big opportunities for market players. Therefore, the evolution of low cost and innovative products is likely to offer interesting opportunities for current as well as new market participants in the market.

Advancing Image-Guidance Systems: Innovation, Accessibility, and Precision in Diagnostics:

The image-guidance systems are becoming piqued in their cusp with significant technological evolution and an increasing patient-centric imaging application. The recent most significant development is an advent of the combination imaging systems, including new modalities, such as PET-CT and PET-MRI combined together, which bring different diagnostic data and ameliorate better clinical decisions.

In addition, the portable systems are now developed to point-of-care imaging, thus broadening accessibility to advanced diagnostic techniques in any health care setting, even in a remote and underserved area.

The market also sees changing trends toward a backward incorporation of modern imaging technologies: intraoperative imaging, which allows real-time visualization and evaluation of surgery locations by the surgeon. Robotics are meant to revolutionize the image-guided processes by enhancing precision and control in procedures, reflective of the growing applications and advantages these technologies offer.

The using of artificial intelligence (AI) and machine-learning algorithms to improve image analysis and interpretation is one new trend in the image-guided systems market. Another trend is for AI to help identify patterns that lead to earlier and more accurate diagnoses of anomalies.

The rising interest in developing highly sophisticated imaging-guided minimally invasive procedures that reduce patient discomfort and recovery days is another trend. There is also a growing focus on personalized medicine, where image-guided systems are seen as a central component in patient-specific treatments. The introduction of augmented reality (AR) and virtual reality (VR) in image-guided procedure also becomes an important place in developing visualization for training and surgery using interactive visualization tools.

From 2020 to 2024, the market for image-guided systems grew at a robust pace on account of surging need for accuracy in surgeries, emerging trends in imaging technologies, and expanding incidence of minimally invasive surgery. Comprehensive adoption of intraoperative CT, MRI, ultrasound, and fluoroscopy optimized neurosurgery, orthopedic, and oncology accuracy during surgery.

Integrating artificial intelligence and augmented reality in navigation systems made real-time visualization and decision-making support better. However, high costs, bureaucratic obstacles, and specialized training needs stifled broader adoption, especially in the developing world.

Forward to 2025 to 2035, the market will be driven by AI-enabled imaging, the second generation of robotic-assisted surgery, and expansion of real-time 3D and 4D imaging capabilities. Regulatory environments will adapt to enable AI-powered image guidance and automated navigation systems. Greater adoption in outpatient and ambulatory care will fuel market growth. Sustainability efforts will result in the creation of energy-efficient imaging devices and environmentally friendly contrast agents. Supply chain resilience will also be enhanced by regionalized production and diversification of key imaging component suppliers.

| Category | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Stringent FDA and CE approvals for image-guided surgical systems; focus on radiation safety. |

| Technological Advancements | Development of AI-assisted imaging, real-time 3D orientation, and synergy with robotic-supported surgery |

| Consumer Demand | Growing application in neurosurgery, orthopedic operations, and minimal-access interventions. |

| Market Growth Drivers | Rising adoption of minimally invasive procedures, technological advancements, and growing aging population. |

| Sustainability | Initial steps toward energy-efficient imaging devices; high dependence on disposable contrast agents. |

| Supply Chain Dynamics | Dependence on specialized component manufacturers, occasional disruptions due to semiconductor shortages. |

| Category | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Regulatory adaptation for AI-assisted imaging, automated navigation systems, and standardization of 4D imaging protocols. |

| Technological Advancements | Real-time next-gen 4D imaging, augmented reality-enhanced visualization, and deep learning-assisted automated interpretation of images |

| Consumer Demand | Spreading adoption into ambulatory surgical centers and outpatients, driven by growth in demand for low-cost transportable imaging products |

| Market Growth Drivers | Increased integration of AI, robotic-assisted surgery, and precision medicine applications. |

| Sustainability | Development of eco-friendly contrast agents, sustainable imaging equipment, and lower energy consumption technologies. |

| Supply Chain Dynamics | Localization of manufacturing, supplier diversification, and increased automation in imaging system production. |

Market Outlook

The increasing rates of chronic disease incidences, including cancer and cardiovascular disability, are expected to create a very huge growth opportunity for the United States of image-guided systems markets across the forecast period.

Further propelling the demand for advanced imaging technologies is an increased demand for minimally invasive procedures. Technological improvements in the integration of AI and ML into imaging systems are increasing diagnosis accuracy and procedural efficiency. Nonetheless, the high costs associated with apparatus and stringent regulatory frameworks will inhibit market growth.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 7.5% |

Market Outlook

Germany's image-guided systems market is expanding, supported by a robust healthcare infrastructure and high priority placed on medical technology. Germany's focus on preventive therapy and early diagnosis of diseases drives the application of advanced imaging modalities.

Government grants and incentives for healthcare innovation also drive market growth. Regulatory control requirements and cost obstacles associated with advanced imaging devices can, however, limit market growth.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| Germany | 6.0% |

Market Outlook

India's image-guided systems market is expected to grow substantially, fueled by a high incidence of chronic diseases and an increasing elderly population. Increased healthcare facilities and healthcare spending fuel market growth. Government efforts to enhance access to healthcare and preventive care also aid market growth. Market growth could be affected by limited rural resources and inconsistency in healthcare quality.

Market Forecast Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| India | 8.6% |

Market Outlook

China's growing image-guided systems market is expected to push ahead on the grounds of economic growth, increasing healthcare investments, and rising burden from chronic diseases. While modernization of healthcare and growth in medical facilities are making advanced imaging technologies more accessible, the only factor to stand between many advanced imaging devices and their ideal place in the market is likely to be uneven access when it comes to healthcare. The market is also affected by a lack of awareness of this technology.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| China | 9.2% |

Market Outlook

Brazil's market for image-guided systems is on the growth path, thanks to enhanced healthcare infrastructure and the rising emphasis on preventive care. High incidence rates of chronic conditions create a demand for sophisticated imaging equipment. Public and private sector healthcare providers with image-guided offerings are covered in the market. Economic variations and regional disparity in access to healthcare could hamper market expansion.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| Brazil | 8.2% |

Devices will Dominate the Market Due to Constant Advancement in Imaging Technologies

The image-guidance equipment is the leading market segment as they are essential for real time imaging, precise surgery, and minimal interventions. These devices include CT, MRI, ultrasound, fluoroscopy and hybrid systems that improve the clinical accuracy during surgery procedures such as neurosurgery, orthopedic procedures and cardiology interventions.

We have recently witnessed vastly improved accuracy and result in surgery due to the adoption of high-precision robotic and AI-based imaging systems. Also, intraoperative imaging, 3D navigation, and mobile imaging equipment developments are also contributing to demand for these systems. The growing number of chronic conditions that need image-guided intervention, as well as increased healthcare spending on surgical facilities, is propelling this segment.

Software segment holds the second largest share in the market due to their essential role in enhancing surgical planning and real-time navigation

The software sector is fast-growing, and comes with a critical set of impediments as artificial intelligence (AI), machine learning, and augmented reality (AR) introduce innovations in image-guided surgery. It allows for the preoperative development of a plan, intraoperative navigation, and analysis of the procedure following surgery to enhance precision in intricate surgical procedures.

AI imaging software fuels real-time decision-making, automatic segmentation and 3D reconstruction that lowers surgical errors and improves workflow efficiency. The cloud-based imaging software, PACS, and augmented reality-guided navigation platforms are further strengthening market growth. Advanced imaging software continues to be further accelerated in hospitals and surgical centers globally by increasing demand for personalized surgery and precision medicine.

The Neurosurgery segment will dominate the market due to the growing number of neurosurgery worldwide

Image-guided systems are used in invasive procedures, and neurosurgery is one of the largest application segments in this domain as procedures performed on the brain and spinal cord require the greatest precision. Most of the intraoperative technologies utilized now (such as iMRI, CT-guided navigation and robot-assisted neurosurgery) are main-stream options with the ability to enhance operative precision and reduce complication rate.

Image-guided technologies have promoted better patient protection and optimal clinical outcomes in tumor resection, DBS, epilepsy surgery, and spinal surgery. Rising prevalence of neurological disorders such as brain tumors, Parkinson's, and spinal curvature, and increased application of minimal invasive neurosurgical interventions are fueling the demand for advanced imaging solutions.

Cardiac Surgery is another of the main segments due to increasing application of image-guided navigation in procedures in cardiology.

Not only will cardiac surgery be the second-largest sector of the image-guided system market, and growth will come from the increase of cardiovascular disease (CVD) cases and the increased need for less invasive procedures, but it will be growing at a very fast speed.

This is the technology that provided the most precision in developing this kind of surgery and its implementation, which includes among other things: CABG (Coronary Artery Bypass Grafting), replacement of aortic or mitral valves, and catheter-based procedures. For instance, fluoroscopy, intravascular ultrasound (IVUS), and 3D echo are high tech imaging devices that can help enhance the accuracy of the operation.

They bring an opportunity to correct the problems that might cause heavy casualties and they also decrease surgery duration, consequently reducing complications and recovery times. M&A Activities, and technological progressions leading to population geriatric years and high-risk of CVDs are factors that drive the cardiac surgery image guided segment to the top of the list all over the world.

The image-guided systems market is experiencing rapid growth due to increasing demand for precision in surgical procedures, advancements in imaging technology, and the rising prevalence of chronic diseases requiring minimally invasive treatments. Key players in the market are focusing on innovation, regulatory approvals, and strategic partnerships to strengthen their market presence.

The market is highly competitive, with medical device companies investing in next-generation image-guided solutions.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| GE Healthcare | 15.9% |

| Koninklijke Philips N.V. | 23.6% |

| Medtronic plc | 11.9% |

| Siemens Healthineers | 13.2% |

| Stryker | 10.2% |

| Other Companies (combined) | 25.1% |

| Company Name | Key Offerings and Activities |

|---|---|

| GE Healthcare | Focuses on advanced image-guided solutions, including AI-powered ultrasound, CT, and MRI systems to enhance surgical precision. |

| Koninklijke Philips N.V. | Innovates in real-time image-guided therapy, integrating AI and smart imaging technologies for minimally invasive procedures. |

| Medtronic | Develops cutting-edge image-guided navigation systems for neurosurgery, orthopedics, and cardiovascular interventions, improving procedural accuracy. |

| Siemens Healthineers | Expands its portfolio with high-resolution intraoperative imaging solutions, enhancing diagnostic and surgical workflows in multiple specialties. |

Key Company Insights

GE Healthcare (15.9%)

General Electric Healthcare company is a leader in cutting-edge imaging technology. It has technologies such as ultrasound, CT scans, and MRI that utilize artificial intelligence to help improve surgery and diagnosis accuracy.

Real-time imaging solution is being developed, enabling minimally invasive neurology, cardiology, and oncology surgeries. The company also finds areas where digital health can advance workflow efficiency and patient results. The company also seeks ways digital health can enhance workflow efficiency and patient outcomes.

Koninklijke Philips N.V. (23.6%)

Philips N.V. is well appreciated for its domain expertise in therapies that are guided by real-time image, employing AI and smart imaging technologies for the enhancement of minimally invasive procedures.

The range of products in this respect includes state-of-the-art interventional cardiology, oncology, and neurosurgical products that ensure competence for complex procedures. Philips is also in the pursuit of expanding digital imaging capabilities for clinical decision-making enhancement.

Medtronic plc (11.9%)

Medtronic has Innovatory image-guided navigation systems for neurosurgical, orthopedic, or cardiovascular procedures. The company’s surgical navigation platform reduces complications and recovery time by improving accuracy for complex procedures.

Medtronic has not obtained robotics and AI into its image-guided answer yet is including those innovations and just loosening them profound in its solution and directing a proceed up in precision-focused human services improvements.

Siemens Healthineers (13.2%)

Strongly positioned on the market of image-guided systems, Siemens Healthineers portfolios high-resolution intraoperative imaging technologies for the enhancement of diagnostic and surgical workflows. The company invests in AI-based image guidance solutions for real-time surgical assistance in oncology, neurology, and cardiology applications. Siemens Healthineers also aims to augment its hybrid operating room solutions for safer and more efficient clinics.

Beyond the leading companies, several other manufacturers contribute significantly to the market, enhancing product diversity and technological advancements. These include:

The global image guided systems industry is projected to witness CAGR of 8.1% between 2025 and 2035.

The global image guided systems market stood at USD 8,418.6 million in 2024.

The global image guided systems market is anticipated to reach USD 19,622.4 million by 2035 end.

China is expected to show a CAGR of 9.2% in the assessment period.

The key players operating in the global image guided systems industry are GE Healthcare, Koninklijke Philips N.V., Medtronic plc, Siemens Healthineers, Stryker, Smith & Nephew, Zimmer Biomet, Analogic Corporation, EndoMed Systems, Maxer Endoscopy and Others

Cold Relief Roll-On Market Analysis by Application, Distribution Channel, and Region through 2035

At-Home Micronutrient Testing Industry Share, Size, and Forecast 2025 to 2035

Bleeding Control Tablets Market Analysis - Growth, Applications & Outlook 2025 to 2035

Chloridometer Market Report Trends- Growth, Demand & Forecast 2025 to 2035

Coagulation Markers Market Trends - Growth, Demand & Forecast 2025 to 2035

Genomic Urine Testing Market Trends - Size, Share & Growth 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.