It is anticipated that the Insulated Gate Bipolar Transistor market will see substantial development between 2025 and 2035 due to growing deployment of efficient power electronics in end-user applications such as renewable energy systems, industrial motor drives, rail traction, electric vehicles, and smart grids among others.

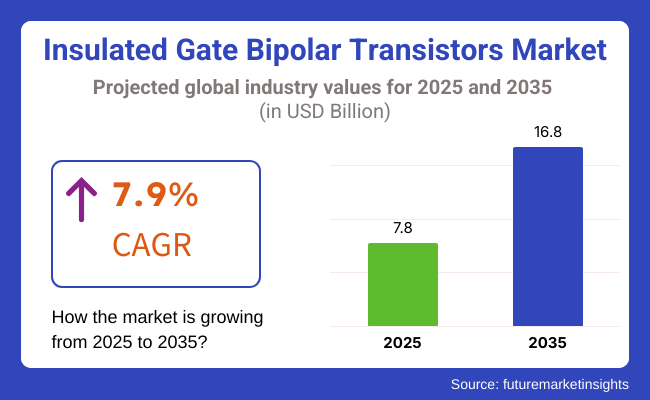

The need for even greater performance efficiencies in key areas will become a strong reason for the use of Insulated Gate Bipolar Triodes especially as businesses turn more towards energy savings and waste during power loss. Throughout future 10-years, the market is likely to achieve to an approximated worth of broadly USD 7.8 Billion 2025, up to USD 16.8 Billion 2035, and proceeding with a Compound Annual Growth Rate (CAGR) of 7.9% through the gauged period.

The integration of insulated gate bipolar transistors in solar inverters, wind turbines, and electric vehicle drivetrains will continue to be the strongest market driver as the industry focuses on renewables, sourcing more investments towards clean energy efforts.

Moreover, the growing adoption of high-voltage insulated gate bipolar transistors in industrial segments, which has HVDC transmissions, as well as in welding equipment and uninterruptible power supplies (UPS) are further supporting the market outlook.

Novel packaging designs and reverse conducting insulated gate bipolar transistors, for example, are some of the innovations that are enabling power density, thermal management and switching performance so manufacturers can meet the increasingly demanding performance and efficiency targets in a variety of applications.

Explore FMI!

Book a free demo

North America is a significant market for Insulated Gate Bipolar Transistors, with demand primarily driven by renewable energy adoption, industrial automation, and electric vehicle growth in the countries. In the United States and Canada, extensive deployment of clean energy technology solar and wind, specifically has surged, and one technology in particular, Insulated Gate Bipolar Transistor based inverters, will play a key role in increasing energy conversion efficiency and decreasing system losses.

Government incentives and increased battery technology continue to spur growth of the region's electric vehicle market. IGBTs are widely used in EV powertrains, charging stations and on-board chargers, which helps manufacturers increase both power density and thermal performance.

Growing smart grid infrastructure in North America continues to boost the demand for Insulated Gate Bipolar Transistors for HVDC transmission and grid-scale energy storage. Types of the insulation of gate bipolar transistors modules in industrial motor drives, robotics, and high performance welding systems are the figments of the factory automation growth and industrial modernization plans.

The market is a potentially attractive growth opportunity for companies investing in next-generation power electronics and energy-efficient solutions across North America.

With a strong focus on green energy policies, industrial electrification, and electric mobility Europe captures a large chunk of the global Insulated Gate Bipolar Transistors market. Countries such as Germany, France, the United Kingdom and Norway are deploying renewable energy projects and electric vehicle charging infrastructure on an aggressive scale, leading to a huge demand for Insulated Gate Bipolar Transistors modules in power inverters, chargers and energy management systems.

In terms of segments, the Insulated Gate Bipolar Transistors market in Germany is mainly attributable to the country’s industrial base, especially in manufacturing and automotive. In addition, due to high-speed transition of present day vehicles to electric and hybrid vehicles, the German OEMs are increasingly incorporating high performance Insulated Gate Bipolar Transistor (IGBT) technology in the electric vehicle powertrain in order to enable more efficiency, longer driving range and reduced overall energy consumption.

The adoption of Insulated Gate Bipolar Transistors in smart grid deployments, HVDC links, and industrial motor drives across the globe is predominantly motivated by the healthy regulatory framework in Europe, which aims to increase energy efficiency and lower carbon emissions. For example, both the European Green Deal and the associated climate neutrality strives for 2050 that will be incentivized by investments in energy-efficient technologies, including Insulated Gate Bipolar Transistors based power electronics.

Europe continues to be an important region for Insulated Gate Bipolar Transistors innovation and market development, driven by advances in Insulated Gate Bipolar Transistors packaging technologies, silicon carbide hybrid devices, and high-voltage applications.

Asia-Pacific Region as the conqueror of the global insulated gate bipolar transistors market during 2020 to 2024: Increase in urbanization and rise in industrialization coupled with an increasing energy demand in the emerging economy. Advanced insulated gate bipolar transistor (IGBT) based power electronics solutions can enable many manufacturing projects such as electric vehicle manufacturing, renewable energy projects and upgrading power infrastructure and countries like China, India, Japan, South Korea and few Southeast Asian countries are heavily investing in order to support the projects.

The transformation of India’s power sector, led by the rapid deployment of solar PV installations and the implementation of smart grid technologies, is also presenting big opportunities for the makers of Insulated Gate Bipolar Transistors. The “Make in India” initiative supports domestic manufacturing of power electronics components providing a further boost to the region's Insulated Gate Bipolar Transistors supply chain.

Insulated Gate Bipolar Transistors research and innovation efforts continue to be crucial leading players such as Japan and South Korea have achieved significant advanced research breakthroughs in high-efficiency modules and hybrid silicon-carbide Insulated Gate Bipolar Transistors & miniaturized power modules. As electric vehicles, robotics, and industrial automation proliferate across Asia-Pacific, next-generation Insulated Gate Bipolar Transistors for motor drives, HVACs, and charging infrastructure are poised for steep growth.

Challenge

Supply Chain Instability and High Production Costs

Challenges for IGBT Market are supply chain disruption, volatility in raw material prices, and high investments needed to establish advanced semiconductor fabrication units. IGBT semiconductors rely on key materials such as silicon and gallium nitride, which compete with significant market forces and geopolitical considerations.

And of course, production costs for IGBT solutions can be prohibitive due to the high purity requirements of the materials and the complexity of chip fabrication. The companies need to spend on ensuring enough of alternative raw materials, improving the production processes, and developing ever more efficient semiconductor manufacturing technologies in order to be less reliant on unduly rare edifice materials and lower production costs.

Opportunity

Rapid growth of renewable energy systems and electric vehicles (EVs) is creating several opportunities for the semiconductor (IGBT) Market. As a core component of power electronics, IGBTs are used in all kinds of energy conversion systems, including the ever more popular solar inverter, wind turbines, and battery-powered EV drivetrains.

The demand for high-performance IGBT solutions will further grow as governments around the globe adopt tougher carbon emission regulations and take initiatives to invest in electrification. This will give companies with high-efficiency, low-loss IGBT designs, next-generation wide-bandgap semiconductor materials and edge in the rapidly changing market.

The IGBT Market flourished from 2020 to 2024 due to the rising demand for electric mobility, grid modernization, and industrial automation. The greater integration of IGBTs in high-voltage applications, including electric railroad systems and smart grids, boosted power service efficiency and system reliability.

But supply chain disruptions, semiconductor shortages and trade restrictions have upended production schedules and driven up costs. Manufacturers reacted by investing in local semiconductor production plants, ramping up R&D into alternative new materials, and increasing IGBT module efficiency.

The 2025 to 2035 technology change point will involve a few key pieces, most notably an intense shift toward 150 mm (6 in) and 200 mm (8 in) IGBT wafers as well as increased use of silicon carbide and gallium nitride semiconductors to improve efficiency and switching speed.

In critical applications where performance and reliability are paramount, AI-driven power electronics and predictive maintenance systems will improve the performance and reliability of IGBT. Moreover, the adoption of energy-efficient industrial automation, high-speed rail electrification and solid-state transformer technologies will create additional revenue streams for IGBT manufacturers.

Market innovation and expansion will be led by companies that emphasize sustainability, power optimization, and improved thermal management in semiconductor designs.

Market Shifts: A Comparative Analysis (2020 to 2024 vs. 2025 to 2035)

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Increased government policies supporting electrification |

| Technological Advancements | Improvements in IGBT module efficiency and cooling systems |

| Industry Adoption | Expansion in electric vehicles, smart grids, and rail systems |

| Supply Chain and Sourcing | Semiconductor shortages impacting production |

| Market Competition | Established semiconductor manufacturers dominating key applications |

| Market Growth Drivers | Electrification trends, renewable energy expansion, and industrial automation |

| Sustainability and Energy Efficiency | Initial adoption of energy-efficient IGBT modules |

| Advanced Thermal Management | Challenges in heat dissipation for high-power applications |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Stricter emission reduction mandates driving widespread IGBT adoption. |

| Technological Advancements | Transition to wide-bandgap semiconductors (SiC & GaN) for superior performance. |

| Industry Adoption | Increased penetration in high-speed rail, solid-state transformers, and industrial automation. |

| Supply Chain and Sourcing | Regionalized supply chains and increased investment in local semiconductor fabrication. |

| Market Competition | Rise of new entrants focusing on AI-integrated power electronics and energy-efficient solutions. |

| Market Growth Drivers | Global decarbonisation goals, solid-state power electronics, and next-generation energy grids. |

| Sustainability and Energy Efficiency | Integration of AI-driven power management systems for optimal energy conservation. |

| Advanced Thermal Management | Development of next-gen cooling solutions and high-performance thermal interface materials. |

United States insulated gate bipolar transistors market is growing more rapidly due to the ever-increasing demand for electric vehicles, expanded use of renewable resources, and advancement in industrial automation technologies. The Department of Energy, urging the evolution of clever grids and high-voltage transmission systems, both major applications of insulated gate bipolar transistors, is stimulating progress.

Tesla, Ford, and General Motors, at the forefront of the booming EV sector, serve as a core driver due to insulated gate bipolar transistors being integral to vehicular power trains, charging ports, and battery oversight systems. Furthermore, amplified investments in solar and wind energy initiatives are fueling requirement for insulated gate bipolar transistors-built inverters and converters.

As a result of continuous technological refinement in power semiconductors and colossal government support for clean energies, the USA insulated gate bipolar transistors industry will increase step by step over the long term.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 8.2% |

UK markets for transistors with insulated gates and bipolar structures grow alongside Britain's mounting investments in the infrastructure vital for electric vehicles and intelligent electrical grids. Government plans to reach zero net carbon emissions compel businesses to embrace semiconductor technologies with higher efficiencies, such as transistors with insulated gates and bipolar structures applied in wind farms, batteries for energy storage, and networks distributing power.

The automotive sector, dominated by Jaguar Land Rover, faces a transformation toward vehicles running solely on electricity or combining electric motors with gas engines. This boosts demand for transistors with insulated gates and bipolar structures to control motors and invert alternating currents in cars. At the same time, pioneering British research into powerful semiconductors also propels the expanding market.

Provided authorities sustain sound encouragement for using green transports and renewable sources, requirements for transistors with insulated gates and bipolar structures in the UK will continue growing gradually in the coming years.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 7.7% |

European Union insulated gate bipolar transistors market is witnessing robust growth as a result of high standards of energy efficiency, increased EV production, and establishment of high-voltage DC power transmission infrastructure. Germany, France, and the Netherlands are among top countries to employ insulated gate bipolar transistors in the automotive, industrial automation, and power infrastructure industries.

Germany, which is a leading worldwide automotive motor vehicle producer, is investing heavily in electric automobile technology as well as power electronics, and Volkswagen, BMW, and Mercedes-Benz are moving toward insulated gate bipolar transistors-based battery management systems as well as inverters. Smart grids as well as energy storage systems are priority goals in France as well as Italy, thus steadily pushing the demand for insulated gate bipolar transistors power modules.

The EU move toward carbon-free status and development of renewable sources is driving the adoption of insulated gate bipolar transistors in solar and wind energy applications. Further, increased need for industrial automation and robotics is driving sustained market growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 8.0% |

European Union insulated gate bipolar transistor markets have robustly grown owing to escalating energy efficiency standards, swelling electric vehicle creations, and establishing high-voltage direct current power transmission infrastructures. Germany, France, the Netherlands, and Italy prominently employ insulated gate bipolar transistors in automotive, industrial automation, and power infrastructure industries.

Volkswagen, BMW, Mercedes-Benz, and Italy’s largest automakers progress toward adopting intricate insulated gate bipolar transistor-based battery management systems and sophisticated inverters for their fleets of electric vehicles. Meanwhile, Frances widespread smart grids and distributed energy storage systems are also primary targets for implementing cutting-edge insulated gate bipolar transistor power modules.

As the EU transitions toward being carbon-free and evolves to incorporate more renewable sources, insulated gate bipolar transistors are being adopted in increasingly complex solar and wind energy applications. Additionally, heightened requirements for advanced industrial automation and robotics across Germany and Italy are helping to drive the regions enduring market growth.

What's more, the steady rise of smart cities within the bloc has increased demand for efficient power transmission between nations, pushing the development of high capacity insulated gate bipolar transistor technologies suitable for interconnecting high-voltage direct current networks.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 7.8% |

The South Korean insulated gate bipolar transistors market is increasing with increasing electric vehicles, high industrial automation, and increasing semiconductor innovation. The nation has the best semiconductor giants such as Samsung and SK Hynix investing in the most advanced power electronic components such as high-efficiency insulated gate bipolar transistors modules.

Hyundai and Kia-dominated auto industry is among the key drivers, with insulated gate bipolar transistors being a major component of battery management systems and inverters. The increasing emphasis of the country on clean energy in solar and wind form is also driving demand for insulated gate bipolar transistors-based energy storage technology and grid interface.

South Korea's intelligent manufacturing industry, which is driven by government support for Industry and automation, is also creating growing demand for insulated gate bipolar transistors in motor drives, robot systems, and power conversion with high-conversion efficiency.

With ongoing improvement in technology and rising uses in automotive as well as industrial sectors, the South Korean insulated gate bipolar transistors market will keep growing steadily.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 7.9% |

The module and discrete segment accounts for a large share of the Insulated Gate Bipolar Transistor (IGBT) market as industries are rapidly moving toward energy-efficient power electronics to improve switches, help minimize power losses, and enhance the dependability of electrical systems.

These categories of IGBT form the backbone of categories where IGBTs are used in such as aerospace and defense, renewable energy, automotive, industrial automation, and consumer electronics for high-speed switching, thermal performance and enhanced power conversion efficiency.

IGBT (Insulated Gate Bipolar Transistor) modules are now among the most popular power semiconductor devices due to their advanced heat sink, ability to handle high voltages and devices integration for high power applications. In contrast, integrated power modules offer superior scalability, thermal performance, and component density, which will enable their greater adoption in high-power energy conversion systems.

The complex interplay between demand for energy-efficient solutions, accurate speed control, and longer motor life and the quest for optimum performance at lower operating costs by industrial manufacturers is the key driver facilitating high-power IGBT modules adoption in industrial motor drives.

The rising deployment of IGBT modules in EVs and HEVs, integrated with cutting-edge powertrain inverters and battery management systems, have contributed significantly to market growth, paving the way for newer transportation systems to ensure widespread adoption.

Further adoption from the inclusion of IGBT modules in renewable energy systems, such as solar inverters, wind turbines, and energy storage solutions, has enhanced power grid stability, which benefits conversion efficiency, powering reliability, and more.

Next-generation IGBT module architectures utilizing silicon carbide (SiC) and gallium nitride (GaN) semiconductor materials for reduced power dissipation and higher switching speed have further optimized and fostered market growth and confirmed broader accommodation in high-frequency power applications.

The growing use of IGBT modules in industrial automation and robotics with small size high power switching modules for precision control systems will further support market expansion ensuring an improved factory automation, energy-efficient manufacturing, and advance robotic motion control.

However, the heat dissipation constraints, complicated assembly processes and high turning cost is challenging for these devices even though they provide benefits of thermal efficiency, Scalability and high-power operation. New paradigm-shifting developments in AI-based thermal management, advanced cooling concepts and next evolutionary level product packaging for power modules will enhance efficiency, cost-effectiveness, and long-term reliability, creating a conducive market for IGBT modules in the future

The market for discrete IGBTs, is well established, with their strong market adoption across consumer electronics, power supplies, and compact motor control systems, as electronics fixture designers increasingly leverage discrete IGBT devices to realize very cost-effective benefits such as improved switching efficiency, energy savings, and component footprint reduction. Discrete IGBTs offer improved flexibility, lower cost, and better integration compared to designs that are module based, making them the preferred choice for low-to-medium power applications where adaptability is key.

The increasing popularity of home electronics with high-efficiency induction cooktops, air conditioner systems, smart inverters, and other appliances utilizing discrete IGBTs has boosted the adoption of compact and energy-efficient IGBT switches, as consumers continue to look for power-saving options in domestic applications. As a result of IGBT-based inverters in appliances efficiency increases by over 20%, guaranteeing lower energy consumption and prolonged product life.

The introduction of discrete IGBTs in UPS along with switched-mode power supply (SMPS) in data centers as well as telecommunication infrastructure possessing high-speed, low-loss switching configurations has further bolstered the market demand, enabling wide adoption in crucial power back-up and network protection frameworks.

With high voltage, low loss transistors facilitating the distribution of power on a mass scale easily, discrete used of IGBTs in LED lights drivers and smart grid applications has spread adoption since it guarantees effective energy management and grid stability for smart cities and IoT based infrastructure.

The evolution of hybrid IGBT-MOSFET power devices showing superior conduction properties and ultra-fast switching experience the expanding market growth which is ensuring wider utilization in automotive DC-DC converters, battery charging stations, and compact industrial inverters.

By integrating discrete IGBTs into medical devices and healthcare electronics with high-frequency power switching, including imaging equipment, laser systems, and diagnostic tools, the market growth is further driven, as they guarantee improved performance, safety, and precision in the field of medical technology.

In spite of their cost-effectiveness, flexibility, and smaller dimensions, discrete IGBTs have their disadvantages as well; IGBTs typically have less power handling capability, higher conduction losses, and their thermal management is more limited.

Nonetheless, advancements in AI-enabled energy efficiency, ultra-compact semiconductor materials, and integrated thermal dissipation solutions are enhancing operational efficiency, application scalability and performance reliability, paving the way for further growth of the discrete IGBT solutions market.

There are two main driving segments-high-power and medium power-as IGBT-based solutions vastly improve power conversion efficiency, voltage regulation, and energy loss in many electrical systems.

IGBTs with high-power have become one of the largest consumers of IGBT-based power electronics as energy producers, industrial operators, and transportation use high-voltage IGBTs to increase the stability of the electric grid, maximize renewable energy conversion, and improve rail traction systems. However, even though low-power semiconductor devices are good enough for smaller applications, the performance of high-power IGBTs will outperform them in high-load applications, in terms of conduction efficiency, switching losses, and voltage-handling capacity.

A surge in demand for high power IGBTs in the smart power grid and utility-scale energy systems (including grid-tied inverters, and High-Voltage Direct Current (HVDC) transmission solutions) have also contributed to the adoption of high power switching devices, with efficiency improvement and grid modernization high on the list for utilities.

Market demand driven by the growing adoption of high-power IGBTs in high-speed rail and electric locomotive drive systems including regenerative braking and power recovery, supports a further increase in market supply.

Current advantages including power efficiency, high-voltage handling and lower switching losses, many high-power IGBT applications suffer from serious disadvantages including complex cooling requirements, high thermal stress and reliability in rugged conditions. But with new advances such as AI-based fault prediction, next-gen heat dissipation tech, and modular power system designs, efficiency, reliability, and durability are increasing enough to keep high-power IGBT applications growing.

Low-power IGBTs have found their stride in consumer electronics, while high-power IGBTs thrive primarily in renewable energy conversion applications (solar inverters) and traction converters in electric developed as industries look to find alternative to silicon devices for efficient performance at medium-power levels. Compared to high power switching devices, medium power IGBTs offer better cost-to-performance ratio, easier thermal management, and better voltage regulation, which leads to a wide application in industrial and commercial applications.

Increasing adoption of medium-power IGBTs in fast-charging EV infrastructure with high-speed DC charging and battery protection systems to drive market demand to ensure enhanced adoption rate in the to-be-dominating electric mobility ecosystem.

Medium-power insulated gate bipolar transistor (IGBT) solutions become a prominent choice for critical applications given the need for power electronics to meet the demands of consumer applications in terms of efficiency, cost from an integration of hybrid technology and versatility.

But new advances in AI-based power analytics, wide-bandgap semiconductor integration strategies, and hybrid power converter designs, which offer better energy efficiency, heat management, and switching reliability, are keeping the market for medium-power IGBT applications healthy in the face of these threats.

Market Forecast Seasoned growing trade along changing in IGBT Products market thanks to the demand for personal computer-based, high-frequency operations in various applications like renewables, industrialization, and e-mobility. To achieve more efficiencies, improved switching, and thermal Performance, companies are working on high-power density silicon-based IGBTs, AI-assisted semiconductor-level design, and next-generation silicon carbide (SiC) and gallium nitride (GaN) substitutes.

It encompasses manufacturers of other global semiconductors and power electronics suppliers driving progress in IGBT modules, fast-switching IGBTs, and power-efficient semiconductors.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Infineon Technologies AG | 20-25% |

| Mitsubishi Electric Corporation | 15-20% |

| Fuji Electric Co., Ltd. | 10-14% |

| ON Semiconductor (onsemi) | 8-12% |

| STMicroelectronics | 5-9% |

| Other Companies (combined) | 40-50% |

| Company Name | Key Offerings/Activities |

|---|---|

| Infineon Technologies AG | Develops high-voltage IGBT modules, automotive IGBTs, and energy-efficient power switches for industrial applications. |

| Mitsubishi Electric Corporation | Specializes in fast-switching IGBTs, hybrid IGBT-SiC solutions, and high-performance IGBT modules for EVs and renewable energy. |

| Fuji Electric Co., Ltd. | Manufactures high-power IGBT devices for industrial motor drives, rail transportation, and energy infrastructure. |

| ON Semiconductor (onsemi) | Provides next-gen IGBT power modules for AI-driven automation, smart grids, and electric mobility. |

| STMicroelectronics | Offers compact, low-loss IGBT solutions for energy-efficient inverters, UPS systems, and consumer electronics. |

Key Company Insights

Infineon Technologies AG (20-25%)

The company is the leading player in the IGBT market and has high-efficiency IGBT modules for electric vehicles (EVs), industrial automation solutions, and smart engines that combine AI-powered semiconductor design and next-gen SiC-based power switches.

Mitsubishi Electric Corporation (15-20%)

Expertise in automotive grade IGBTs industrial power semiconductors, high-speed switching, low power loss, and higher thermal efficiency.

Fuji Electric Co., Ltd. (10-14%)

Fuji Electric manufactures highly reliable IGBT modules for traction (rail) systems, industrial motor control, power grid applications, and more, supporting long-term operational stability.

ON Semiconductor (onsemi) (8-12%)

ON Semiconductor’s leader in next-generation IGBT technology for renewable energy and high-voltage power conversion is becoming more of its AI-driven efficiency improvements.

STMicroelectronics (5-9%)

The IGBT solutions from STMicroelectronics excel in speed and energy efficiency combined with compact and cost-optimized semiconductor integration in various consumer and industrial power applications.

Other Key Players (40-50% Combined)

Many semiconductor and power electronics firms participate in the R&D of next-gen IGBTs, AI-optimized power efficiency, and SiC-based IGBTs. These include

The overall market size for Insulated Gate Bipolar Transistors (IGBT) Market was USD 7.8 Billion in 2025.

The Insulated Gate Bipolar Transistors (IGBT) Market expected to reach USD 16.8 Billion in 2035.

The demand for the Insulated Gate Bipolar Transistors (IGBT) Market will be driven by the rising demand for energy-efficient power electronic devices, growth in renewable energy sectors, electric vehicles, and industrial automation. Advancements in IGBT technology, along with the push for green energy, will further boost market growth.

The top 5 countries which drives the development of Insulated Gate Bipolar Transistors (IGBT) Market are USA, UK, Europe Union, Japan and South Korea.

Modules and Discrete IGBTs Drive Market to command significant share over the assessment period.

Diaphragm Coupling Market Growth - Trends & Forecast 2025 to 2035

HID Ballast Market Growth - Trends & Forecast 2025 to 2035

Fluid Conveyance Systems Market Growth - Trends & Forecast 2025 to 2035

GCC Magnetic Separator Market Outlook – Growth, Trends & Forecast 2025-2035

United Kingdom Magnetic Separator Market Analysis – Size, Share & Forecast 2025-2035

Glass Door Merchandisers Market Growth - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.