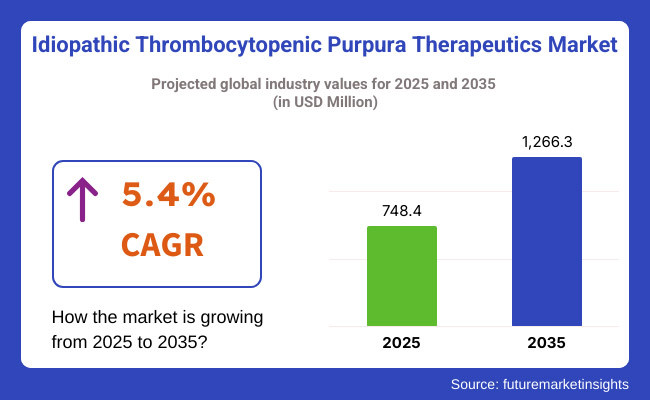

The idiopathic thrombocytopenic purpura therapeutics market is expected to reach USD 748.4 million by 2025 and is expected to steadily grow at a CAGR of 5.4% to reach USD 1,266.3 million by 2035. In 2024, cluster headache syndrome generated roughly USD 713.2 million in revenues.

The idiopathic thrombocytopenic purpura (ITP) therapeutics refers to the drugs used to treat ITP The disease happens when the immune system mistakenly attacks and destroys platelets, which are needed for blood to clot. Sales of ITP therapeutics are continuing to rise for several reasons.

But growing awareness and early diagnosis have an increasing number of patients getting treatment sooner. New initiatives available to treat patients, particularly targeted therapies such as TPO-RAs, enhanced patient outcomes and increased the market. A growing, aging population more susceptible to autoimmune diseases has also fueled demand.

Sales have also been driven by an increasing shift toward long-term management solutions over splenectomy. Their strength in the market has also been bolstered by regulatory approvals of newer therapies and continuing investigation into novel therapeutic mechanisms. The advent of better formulations and delivery devices (like subcutaneous injections) have improved patient adherence.

In addition, improved reimbursement policies and healthcare infrastructure across some regions have further enhanced treatment accessibility. With a growing number of treatment options, and the continued development of patient centered approaches to management, the utilization of ITP therapeutics is likely to remain on an upward curve.

The ITP therapeutics market is expected to grow significantly in the next few years due to increase in pharmacological options for treatment and increase in awareness of disease. In addition, the management of ITP has changed radically in recent years, with many therapies based on corticosteroid use no longer being as widely accepted as targeted, more-effective therapies.

The COVID-19 pandemic, which began in 2020, had an initial impact on the diagnosis and treatment of ITP, owing to the constraints of the healthcare system at that point. Soon thereafter, in the wake of the normalization of healthcare services, the demand for effective and accessible therapies grew - and the pandemic-related phenomena, namely social distancing, became a tool for patients.

The emergence of different therapies, as well as advancements in the formulation of intravenous immunoglobulin (IVIG) and an anti-D immunoglobulin, broadened treatment options for ITP patients, both acute and chronic. Moreover, the expansion of the market is aided by the regulatory approvals of newer biologics & non-immunosuppressive therapies.

Enhanced diagnostic capabilities increased early detection and treatment initiation and bolstered sales as well. Optimized reimbursement in a number of regions aided in accessibility to high-cost therapies, facilitating wider adoption. Demand was also supported by a growing geriatric population that is more prone to develop autoimmune conditions.

Additionally, the market dynamics transformed at a higher pace due to the rise of clinical research activities, and patient-centered treatment approaches. This, in addition to other factors, including limited competition and treatment pricing contributed to the year-on-year increase in ITP therapeutics sales from 2020 until 2024, with more advancements anticipated.

North America dominated the Idiopathic Thrombocytopenic Purpura (ITP) Therapeutics Industry due to the well-equipped healthcare infrastructure, higher incidents of early diagnosis and delivery of innovative therapies.

Healthcare professionals and patients are well informed about the area, which is very beneficial for timely intervention and effective management of the disease. Over the past couple of decades, there has been an exponential increase in the use of TPO-RAs, which have significant sustained efficacy and fewer complications than traditional corticosteroids.

Moreover, the emergence of robust reimbursement frameworks has rendered high-cost biologics more accessible, driving treatment adoption. Research and development initiatives continue to drive the development of new therapies, better treatment results, and greater numbers of treatment options.

The rising incidence of autoimmune disorders and an aging population keep driving demand. In addition, continuous innovation in this space is augmented by close partnerships between pharmaceutical firms and clinical AI-based solution companies.

The Europe account for the second-highest leading market of the total global Idiopathic thrombocytopenic purpura therapeutics market, Europe is powered by growing healthcare expenditure, benefitting reimbursement plans, and continued progress made in treatment modalities. The use of intravenous immunoglobulin (IVIG) and thrombopoietin receptor agonists has been widely adopted in the region, especially in patients where long-term corticosteroid use is challenged.

The approvals of more sophisticated biologics within the regulatory framework has allowed for greater access to these treatments, leading to better patient outcomes. Increasing efforts by governments and healthcare organizations to raise awareness of rare diseases have allowed for earlier diagnosis and intervention.

The broader EU clinical trial and research effort has encouraged innovation. An increasingly aging population that is prone to autoimmune diseases has also driven demand higher. Furthermore, the industry continues to flourish with the presence of major pharmaceutical producers and growing investment in the development of biopharmaceuticals.

The thetherapeutics evolving landscape for Idiopathic thrombocytopenic purpura the report when complete will help the reader to develop the understanding of it. The emerging countries in this region including China, Japan, India, etc. are putting special attention in this aspect & trying their best to increase the diagnosis rates with Government initiatives and better medical and diagnostic facilities.

Over the last two decades, the use of thrombopoietin receptor agonists and intravenous immunoglobulin therapies has increased, particularly in urban settings where healthcare services are more developed. In addition, expanded healthcare spending and widening insurance coverage have made innovative therapies more available.

Regional investments by pharmaceutical companies have introduced newer treatment options. An increasing prevalence of autoimmune disorders and an aging population have also driven demand. The growth of the industry represents the strengthening of a national capacity for clinical research and local production of medicines. Asia-Pacific is projected to enjoy continued growth in the years to come due to ongoing improvements in healthcare access.

Challenges

Side Effects and Long-term Dependency in Certain Therapies Creating Barrier in Market Growth

When it comes to the challenges, one of them is the regulatory approvals and compliance. Of course, the harsh approval processes for new therapies, particularly biologics and advanced treatment options also lead to procrastination in getting advanced solution for patients. This impacts the accessibility of new drugs and impedes progress in treatment choices.

A separate challenge is the high costs of treatment. Advanced therapies (thrombopoietin receptor agonists and intravenous immunoglobulin) are usually costly and have limited access due to higher expenses in areas with poorer insurance. "Widespread adoption is prevented by the affordability issue and forces many patients to rely on less effective or short-term treatment options.

Lack of awareness and late diagnosis are also hurdles. In many areas, there is not enough knowledge among healthcare workers and patients, so the disease is diagnosed late and not properly managed. When diseases progress, the complexity of treating them increases as well, resulting in higher treating costs.

Side effects and long-term reliance on certain therapies also pose another hurdle. Corticosteroids are often used as a first-line therapy, though they can have major long-term side effects and make long-term treatment challenging. Additionally, some patients may not respond well to available treatments, creating gaps in effective disease management.

Opportunities

Non-immunosuppressive Therapies and Personalized Treatment Strategies Creating Future Opportunities

One major opportunity is in personalized treatment strategies. As clinicians become more aware of how disease varies from one patient to another, this may offer an opportunity to develop treatments that enable clinicians to more precisely target an individual patient’s response to a therapy, minimizing side effects and potentially improving long-term control of disease.

This method improves the efficacy of treatment and enhances patient compliance, driving demand for specialization therapeutics. (Another emerging area includes non-immunosuppressive therapies.) Many current treatments like corticosteroids and immunoglobulins suppress the immune system, which can complicate long-term use. Recent advances in targeted therapies, driving platelet production while preserving immune functionality, are paving the way for safer and more durable treatments.

There are also options in alternative drug delivery methods in the industry. Inconvenience of Hospital Visits with Conventional Intravenous Treatments New subcutaneous and oral formulations are increasing accessibility and adherence, especially in areas for which hospital-based administration is less feasible.

From 2020 to 2024, The Idiopathic Thrombocytopenic Purpura (ITP) Therapeutics pipeline has seen the emergence of several investigational therapies for the management of ITP. Also during this time, an increased reliance on biologics was noted which offered more effective long-term disease control than conventional therapy.

Advancements in platelet-stimulating agents further improved treatment outcomes, effectively targeting refractory cases. Apart from it, the improved patient engagement with healthcare system aided due to post pandemic phase, thus having a more structured approach towards disease diagnostics and monitoring. This was complemented by supportive policy changes and the evolving clinical guidelines, allowing for a more standardized treatment landscape, where patients could receive a broader range of therapeutic options.

By 2025 to 2035 the field will witness transformative in-treatment modalities and disease-management strategies. Potential therapeutics such as gene and cell-based therapies may offer curative possibilities rather than symptom management.

Shifts in the Idiopathic Thrombocytopenic Purpura Therapeutics Market from 2020 to 2024 and Future Trends 2025 to 2035

| Category | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Institutionalization of regulations promoting safety and effectiveness of ITP therapies to guide standardization of treatment procedures and regulations on their usage. |

| Technological Advancements | Addition of TPO-RAs like eltrombopag and romiplostim offering secondary choice drugs for the management of those with resistance to corticosteroids. |

| Consumer Demand | Greater recognition and acceptance of ITP treatments, resulting in greater demand in health care facilities across the globe, especially for treating chronic conditions. |

| Market Growth Drivers | Growing incidence of ITP, improvement in therapeutic interventions, and a move towards cost-effective and effective treatment solutions. |

| Sustainability | Early initiatives towards green manufacturing processes and the creation of therapies with lower environmental footprints. |

| Supply Chain Dynamics | Reverence for specialized biologic component suppliers, with a move towards localizing production to counter supply chain interruption during international events. |

| Category | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Constant vigilance and possible tweaking of rules in ensuring equilibrium between the protection of the patient and scientific development, complemented by speedy review and approval for innovative medicines solving unsolved medical problems. |

| Technological Advancements | Emergence of new-generation therapies, such as combination therapies and customized medicine strategies, using artificial intelligence to customize therapy to a patient's profile. |

| Consumer Demand | Greater shift toward combined treatment strategies and patient-centered care due to better treatment strategies and the concern to reduce side effects and maximize quality of life. |

| Market Growth Drivers | Growing healthcare infrastructure in emerging economies, rising healthcare spending, and ongoing technological advancements improving treatment effectiveness and patient outcomes. |

| Sustainability | Implementation of green practices in drug production and distribution, such as the utilization of recyclable materials and energy-efficient operations, according to international environmental norms. |

| Supply Chain Dynamics | Augmentation of domestic manufacturing strength through technology upgrades and strategic alliances, resulting in diminished reliance on imports and enhanced supply chain stability. |

Market Outlook

The Therapeutics segment of the USA Idiopathic Thrombocytopenic Purpura (ITP) Industry segment is propelled by confidence in strong research and development initiatives that provide effective solutions via innovative products. The emergence of world-class biopharma companies, in part, has fast-tracked advent of targeted therapies that generally bring more efficacy with less toxicity.

Moreover, a well-established healthcare system together with high insurance coverage enables patients to access advanced biopharmacologic and novel therapeutic agents. The increasing implementation of telemedicine and digital health solutions has also enabled timely diagnosis and ongoing disease management, leading to improved treatment adherence. Advocacy groups have also launched more awareness campaigns to educate people about the treatment options available to them, which have contributed to increased treatment uptake.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 3.2% |

Market Outlook

ITP Therapeutic Landscape in Germany is Broadening Thanks to Evidence-based Medicine Focus and Stringent Healthcare Regulations Promoting Clinically Proven Therapies The countries have mandated reimbursement policies, which guarantee that patients obtain conventional and innovative therapies. Also, studies on immunotherapy research in Germany have resulted in new therapeutic protocols, opening up possibilities for curing the disease.

These conditions have been diagnosed promptly and have benefited from optimized treatments regimens thanks to the multitude of specialized hematology clinics and solid physician expertise. Continued investments in the biopharmaceutical space have bolstered domestic production, securing a continuous flow of both essential and innovative therapeutic agents.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| Germany | 3.0% |

Market Outlook

The ITP therapeutics industry is growing in India due to increasing disease awareness and a rising number of hematology specialists. The increased use of biosimilar has been instrumental in improving the affordability and availability of treatment options to a wider majority of the population. The efforts have improved the access to the diagnostic and therapeutic services for the patients through the strengthening of the health care infrastructure, especially in rural areas of the country.

Moreover, pharmaceutical companies are reducing the need for foreign biotechnology centers, by identifying alternative and less expensive ones within the country. Collaborative research endeavor’s between Indian institutes and global biopharmaceutical companies are also expediting the proliferation of advanced treatment modalities.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| India | 9.0% |

Market Outlook

China's ITP medical industry is thriving and the demand is growing because of the increase in healthcare expenditure and more government-led initiatives to help in treating rare diseases. The growth of the country’s pharmaceutical industry has allowed for the production of cost-friendly treatment alternatives at lower prices delivered to a wider patient base.

Fast-forwarding to the years 2023 and beyond, cell and gene editing and other therapies enable platelets, a main target for some anticancer drugs, to be amplified in numbers, resulting in better outcomes for patients. Moreover, a growing number of clinical trials in China facilitates the innovation of innovative therapeutic strategies specific to the genetic and demographic characteristics of local population.

Increased hospital infrastructure led by growing urbanization has also enabled the early diagnosis and better disease management. As more healthcare is spent on China, the volume of ITP therapeutics industry is expected to expand under the impetus of the government towards improving access to rare disease treatment.

Market Growth Drivers

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| China | 8.4% |

Market Outlook

Higher reimbursement options in Brazil are also becoming increasingly available because of the development of the country’s public healthcare system, with more sophisticated ITP therapeutic options being included in national reimbursement programs. Recent government policies designed to secure broadened access to rare disease therapeutics have led to improved access to ITP vital medications.

Moreover, hospital facility improvements as well as the growth of more specialized hematology centers have allowed for better disease treatment. Moreover, hospital infrastructures have also significantly improved and specialized centers for hematology have been established providing better management of the disease.

Furthermore, the development of new hospital facilities and the number of hematology centers specializing are now better suited to manage the disease. There have been increased investments in domestic pharmaceutical production, lowering dependence on imports, and ensuring a more stable continuous supply of essential therapeutics. The region also has witnessed a rise in the incidence of autoimmune disorders, which has spurred healthcare providers towards new therapeutic approaches, improving the treatment outcome.

Market Growth Drivers

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| Brazil | 2.8% |

Corticosteroids Lead as First-Line Therapy

Corticosteroids come first as a result of their well-established role as the primary first-line therapy in the Idiopathic Thrombocytopenic Purpura (ITP) treatment landscape. These drugs lead to a rapid increase in platelet count and are the first choice in the management of acute cases. Having been used clinically for decades, their efficacy is well established, and physicians are confident in prescribing them.

Oral corticosteroids also emerged as the most cost-effective option when compared to more advanced biologic treatments with the assurance of its affordability in different healthcare settings. They come in oral and intravenous formulations, enabling flexible treatment to meet individual patient needs.

In addition, the well-characterized response to corticosteroids provides a rationale for their use as empirical therapy, before the use of second-line therapy. Although long-term use is limited by side effects, their rapid efficacy and suppression of declining platelet counts will ensure they are placed first choice in ITP treatment regimens, maintaining their dominant market share in therapeutic approaches.

Thrombopoietin Receptor Agonists Gain Preference for Chronic Management

Because of their ability to treat chronic and refractory thrombocytopenic patients, thrombopoietin receptor agonists (TPO-RA) are one of the largest segments of the ITP therapeutics market. In contrast, TPO-RA therapeutics increase platelet production and provide long-term benefits for disease control, while corticosteroids have been used primarily for short-term intervention.

These treatments are especially beneficial for patients who fail conventional therapy and decrease the likelihood of more invasive procedures (splenectomy). Their selective mechanism of action also spares broad immunosuppressive effects, resulting in a safer option for prolonged use.

TPO-RA are becoming more frequently prescribed to patients needing chronic platelet support, resulting in a gradual increase in the rate of their use. The introduction of various approved agents in this category has broadened the therapeutic options available, enabling individualized treatment selection. TPO-RA continues to cement its position in the ITP treatment landscape with greater awareness of long-term benefit and increased access to biologic treatment landscape.

Retail Pharmacies Drive Accessibility to ITP Medications

Retail pharmacies have the highest distribution share of all ITP therapeutics due to their accessibility, providing both prescription and specialty medications. They have an existing infrastructure which enables the ubiquitous availability of critical therapies like corticosteroids and oral thrombopoietin receptor agonists. Convenient access to refills reduces the need for patients to spend time going to the hospital for refills, hence improving compliance to treatment [9].

Also, most retail pharmacies have a pharmacist available to discuss with the patient on how to take their medications and what their side effects are. The insurance paradigm of reimbursement is favorable for retail pharmacy distribution of ITP given the channel that is preferred for outpatient management.

Coupled with the ongoing shift to home-based care and the self-administration of some of these drugs, it further cements the reliance on retail pharmacies. In an era of electronic prescriptions and home delivery services, these pharmacies further fill the gap between healthcare providers and patients, cementing their ever-prevalent role in ensuring uninterrupted access to ITP treatments.

Drug Stores Cater to Over-the-Counter and Prescription Needs

Drug stores retain a considerable share in the pharmaceutical distribution for ITP therapeutics named due to their accessibility in addition to the capability to handle prescription also as supportive medications. Most will turn to drug stores for corticosteroids and other adjunct therapies that help with ITP symptomatic management.

These facilities are critical in regions where specialized medical facilities might be scarce, allowing essential drugs to be available to a larger population. Similarly, there are drug stores which help patients who are looking to save money on their medications(since in most of the cases they have generic type of medications so if you want to go with the cheaper version of the medicine you can still very much have what you need on drug store).

The best drug stores integrate with telemedicine platforms, which means they can help fulfill a prescription without an in-person hospital visit. Their purpose in chronic disease treatment has increased because of more people wanting simple usage of important medications. Pharmacies remain a major distribution channel for ITP treatment delivery, by providing personalized services and expanding further into semi-urban and rural areas.

The competitive dynamics for Idiopathic Thrombocytopenic Purpura therapeutic companies are influenced by the presence of matured pharmaceutical firms and new entrants targeting innovative drugs. The market is observing rising investment in targeted therapies, biologics, and new-generation immunomodulators.

Firms are laying greater emphasis on research and development to improve the efficacy of drugs and minimize side effects, resulting in the launch of new drugs. Price pressures and regulatory sanctions have a direct impact on creating competition, with the expansion of patient access programs and strategic alliances driving market share penetration. Competition is likely to intensify even more in future with the increase in personalized medicine and biosimilar growth.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| GlaxoSmithKline | 28-29% |

| Amgen, Inc | 24-25% |

| Grifols S.A | 11-12% |

| CSL Behring | 9-10% |

| Other Companies (combined) | 21-22% |

| Company Name | Key Company Offerings and Activities |

|---|---|

| GlaxoSmithKline | GSK designs its immunomodulatory therapies to boost platelet production, with limited suppression of the immune system. Multi-Product Pipeline - investing in the expansion of treatment accessibility through global partnerships and regulatory approvals |

| Amgen, Inc | Amgen are the first and only thrombopoietin receptor agonists to address long-term platelet management in chronic patients. It focuses on next-generation biologics to advance patient care by reducing reliance on conventional therapeutics. |

| Grifols S.A | Grifols companies specialize in intravenous immunoglobulin therapies by leveraging expertise in plasma-derived products. Using plasma fractionation technology and expanding manufacturing capacity around the world, the company solidifies its position. |

| CSL Behring | The CSL Behring segment specializes in other rare disease treatments, including coagulation factor replacement therapies and immunoglobulin therapies. By continuously innovating in protein-based therapies, it will be well positioned to derive effective treatment options to difficult-to-manage cases. |

Key Company Insights

GlaxoSmithKline (28-29%)

GlaxoSmithKline's strategy for growth highlights its vaccine portfolio and specialty medicines segment. They invest in R&D aimed at innovation and satisfying unmet medical needs which are expected to strengthen the product pipeline, delivering sustainable growth.

Amgen, Inc (24-25%)

On its headquarters and some foreign acquisition and co-operation of biopharmaceutical pipeline. The company's strategy focuses on strengthening its position in oncology and other therapeutic areas, utilizing advanced technologies, and expanding its footprint globally.

Grifols S.A (11-12%)

Grifols plans to increase revenue and free cash flow by expanding its plasma collection capabilities and improving operations. As highlighted in the comprehensive strategic review, Group revenue is forecast to grow to €10 billion and EBITDA to €2.9 billion by 2029, underpinned by sustainable growth and value creation.

CSL Behring (9-10%)

CSL Behring's global strategy is to grow its end product portfolio through innovation and acquisitions. Relying on its global footprint and continued investment in research and development for rare and serious diseases to drive sustainable, global performance.

Other Key Players (21-22% Combined)

A number of other companies are major contributors to the idiopathic thrombocytopenic purpura therapeutics market through innovative technologies and increased distribution networks. They include:

With the demand for idiopathic thrombocytopenic purpura therapeutics procedures growing unabated, firms are focusing on expansion, accelerating research and development activities, regulatory clearances, and strategic partnerships to reinforce their market positions and enhance surgical outcomes.

Corticosteroids, Intravenous immunoglobulins, Anti-D immunoglobulin and Thrombopoietin receptor agonists (TPO-RA)

Retail pharmacies and Drug store

North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, Middle East & Africa

The overall market size for idiopathic thrombocytopenic purpura therapeutics market was USD 748.4 million in 2025.

The idiopathic thrombocytopenic purpura therapeutics market is expected to reach USD 1,266.3 million in 2035.

The development of novel monoclonal antibodies, improvements in corticosteroid treatment strategies, and rising research in immune-modulating therapies are enhancing market penetration the demand for idiopathic thrombocytopenic purpura therapeutics.

The top key players that drives the development of idiopathic thrombocytopenic purpura therapeutics market are GlaxoSmithKline, Amgen, Inc, Grifols S.A, CSL Behring and Baxter.

Corticosteroids is by treatment leading segment in idiopathic thrombocytopenic purpura therapeutics market is expected to command significant share over the assessment period.

Explore Similar Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA