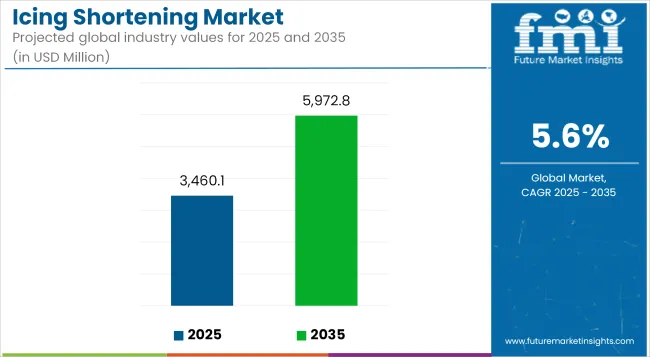

Driven by rising demand and innovation, the global icing shortening market is forecast to increase at a CAGR of 5.6% between 2025 and 2035, growing from USD 3,460.1 million to USD 5,972.8 million.

| Attributes | Description |

|---|---|

| Estimated Size (2025E) | USD 3,460.1 million |

| Projected Value (2035F) | USD 5,972.8 million |

| Value-based CAGR (2025 to 2035) | 5.6% |

The consistent application of icing shortening in bakery and confectionery industries has been shaping demand, especially among mass-market commercial bakers, quick-service restaurants, and industrial manufacturers seeking cost-effective fat systems with functional performance in frostings and whipped toppings.

A key force driving growth in the market has been the increasing consumer shift toward indulgent and aesthetically pleasing bakery goods, which has prompted commercial bakers to optimize frosting formulations. Shortenings offering creaming ability, plasticity, and aeration stability have been prioritized. Meanwhile, regulatory pushes against trans fats have steered innovation toward zero-trans and non-hydrogenated formulations, especially in North America and Europe.

Plant-based shortening alternatives have also made headway in response to rising vegan and clean-label preferences. However, volatility in palm oil pricing and sourcing constraints from sustainable suppliers have restrained steady margins for manufacturers. Additionally, bakery sector consolidation and cost-sensitive operations in emerging markets have forced regional players to offer formulation flexibility and price competitiveness.

Between 2025 and 2035, the icing shortening market is expected to be reshaped by continued demand for functional fats that can deliver shelf-stable aeration, heat tolerance, and emulsification across bakery products. Microencapsulation and fat-structuring technologies are anticipated to transform how icing shortenings behave in frozen or ambient bakery goods.

Clean-label and non-GMO trends will push formulators toward novel oil blends and enzymatic interesterification approaches. Market performance will remain strong in Asia-Pacific and Latin America, where industrial baking capacities are expanding and western-style desserts gain broader retail penetration. By 2035, all-purpose shortening will retain dominance due to its multifunctionality across icing and non-icing applications, while emulsified and specialty shortenings will likely gain share in premium segments.

The below table presents a comparative assessment of the variation in CAGR over six months for the base year (2024) and current year (2025) for the global icing shortening industry. This analysis reveals crucial shifts in performance and indicates revenue realization patterns, thus providing stakeholders with a better vision of the growth trajectory over the year. The first half of the year, or H1, spans from January to June. The second half, H2, includes the months from July to December.

| Particular | Value CAGR |

|---|---|

| H1 (2024 to 2034) | 5.0% |

| H2 (2024 to 2034) | 5.4% |

| H1 (2025 to 2035) | 5.3% |

| H2 (2025 to 2035) | 5.6% |

In the first half (H1) of the decade from 2024 to 2034, the business is predicted to surge at a CAGR of 5.0%, followed by a higher growth rate of 5.4% in the second half (H2) of the same decade. Moving into the subsequent period, from H1 2025 to H2 2035, the CAGR is projected to increase to 5.3% in the first half and remain high at 5.6% in the second half. In the first half (H1) the sector witnessed an increase of 30 BPS while in the second half (H2), the business witnessed an increase of 20 BPS.

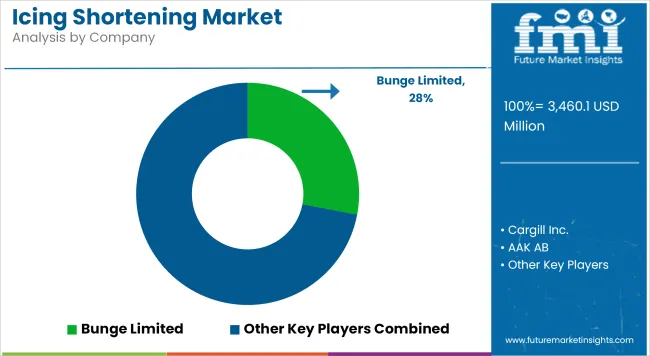

In Tier 1, one finds a limited group of global industry leaders with vast production capacities, advanced research capabilities for new techniques, and known multination distributors. For instance, Cargill, Inc. is a typical example of this tier with its broad range of specialized shortenings across industrial manufacturers to retail consumers.

It has dedicated innovation centres focused on the improvement of icing functionality and nutritional profile improvement. In this regard, Bunge Limited also uses its vertically integrated supply chain to ensure the quality of its premium icing shortenings.

Tier 2 comprises established specialists with significant but more regionally concentrated operations or more focused product portfolios. AAK AB has made its place by technical specialization in specifically optimized specialty lipid formulations for application in icing, while Wilmar International and Olenex have also secured a significant position in the market of these companies in their core regions through well-established distribution relationships and application-specific development support.

These mid-sized companies typically compete through specialized technical knowledge, customer service responsiveness, and ability to develop custom solutions for key accounts.

Tier 3 consists of those niche players playing within certain market segments or very specialized formulations targeting specific technical issues. Palsgaard A/S has created a position with emulsifier-based shortenings that are specially designed to perform transcendentally in difficult applications, while Par-Way Tryson Company has an almost exclusive focus on providing solutions for artisanal as well as small commercial bakeries.

ICL Food Specialties meets specific certification requirements through clean label formulations whereas Fuji Oil has built a presence through plant-based alternatives designed for specialty dietary needs.

Foodservice applications account for approximately 18.4% of the global icing shortening market in 2025. This segment is projected to expand steadily through 2035, driven by increased utilization in quick-service restaurants (QSRs), institutional bakeries, and frozen dessert chains. The growth is fueled by the rising need for consistent, high-aeration performance in whipped toppings, stable emulsification across temperature zones, and easy spreadability for high-volume applications.

In the foodservice sector, global brands like Dawn Foods and Rich Products Corporation have expanded their shortening portfolios to include non-hydrogenated and zero-trans fat variants that meet clean-label expectations and operational requirements in high-turnover kitchen environments.

These custom shortenings are optimized for functionality under automated piping and filling systems, critical for bakery commissaries and contract manufacturers supplying to QSR chains. Regulatory guidance from authorities such as the European Food Safety Authority (EFSA) and the USA FDA banning industrial trans fats has further catalyzed demand for reformulated shortenings compliant with regional food safety mandates .

As premium frozen bakery and patisserie formats grow within foodservice menus, shortening suppliers are increasingly investing in application-specific blends tailored to volume consistency, flavor neutrality, and re-whippability post-thaw, securing long-term supplier relationships with foodservice majors.

The frozen bakery segment contributes roughly 15.6% to the icing shortening market by value in 2025, and is poised for accelerated growth through 2035. Growth is driven by the increasing demand for ready-to-bake or thaw-and-serve frosted products across supermarket chains, club stores, and convenience channels. Shortenings that enable long shelf-life, freeze-thaw stability, and post-bake aeration retention are critical to this segment’s performance.

Market leaders such as Vandemoortele and Europastry have adopted advanced shortening systems that incorporate micro-aeration technologies, enzymatically structured fats, and high plasticity for frozen icing layers and fillings. These shortenings are engineered to preserve textural integrity and visual aesthetics, especially in frozen cakes, éclairs, and whipped dessert toppings. As freezing impairs air incorporation and texture, functional shortenings with superior crystallization behavior have become indispensable.

The segment has also benefitted from the premiumization trend in frozen goods, with increased usage of specialty and emulsified shortenings in artisanal-styled frozen bakery SKUs. Clean-label, RSPO-certified palm alternatives and coconut-oil-based blends are becoming standard for frozen dessert manufacturers targeting North American and European retailers concerned with sustainability and label transparency.

PHO Elimination and Trans-Fat Reduction

Shift: Health concerns and regulatory pressures have practically viewed the icing shortening market as Homo Consumer Expectations. There is little consideration for either zero trans-fat formulations as a baseline or as the premium against which everything else is measured. Such a radical shift will have meant major reformulation, maintained performance while eliminated these very ingredients, across the whole industry.

Strategic Response: Cargill processed their UltraPerform™ series through enzymatic interesterification technology for trans fat-free shortenings while still delivering plasticity and aeration characteristics of normal shortenings.

Bunge Limited set its ProFlex™ line as structured lipid technology that mimics functional characteristics of partially hydrogenated oils using only nonhydrogenated components. AAK AB has reformulated its entire icing shortening portfolio with fractionated palm and specialty vegetable oils to achieve zero trans content while also addressing expected workability among professional bakers.

Clean Label Simplification

Shift: Consumers are watching ingredient statements very closely and prefer products with familiar, minimally processed ingredients. The icing shortening market has cleaned up formulations to comply with consumer conscience by removing artificial additives, chemical modifiers, and industrial-sounding ingredients while still retaining those performance characteristics key for professional applications.

Strategic Response: Archer Daniels Midland launched its CleanFrost™ shortenings containing only oil, water, salt, and natural emulsifiers, directed at select bakeries that focus on artisanal production modes.

ICL Food Specialties created plant-based stabilizer systems that replace synthetic additives in their NatureCreme™ shortenings, achieving comparable stability with ingredients recognized by consumers. Palsgaard A/S reformulated its bakery shortening with naturally derived emulsifiers and the elimination of preservatives, classifying as clean label-worthy without sacrificing performance.

Plant-Based Transformation

Shift: Vegan and plant-based diets have surged causing a voracious demand for icing shortenings devoid of animal fat. Ethical reasons, with environmental concerns and the need to avoid allergens, accelerate the shift toward completely plant-derived formulations, which now extends beyond specialty bakeries into mainstream commercial producers in search of much wider market appeal.

Strategic Response: Fuji Oil has expanded their plant-based range with specialty shortenings specifically formulated for vegan buttercream applications, achieving texture and mouthfeel comparable to conventional dairy-based icings.

Wilmar International developed their VegeCream™ line using proprietary processing techniques that deliver the plasticity of animal shortenings with exclusively botanical ingredients. AAK AB developed plant-based shortenings with tailored melting curves that mimic the sensory experience of traditional buttercream while also satisfying vegan certification requirements.

Functional Performance Enhancement

Shift: Professional bakers and industrial manufacturers are demanding more icing shortenings with superior technical properties: heat stability and whipping performance, maintain texture during distribution and retail display. These functional properties began to differentiate the products once the industry addressed more basic formulation problems like removal of trans-fat.

Strategic Response: Cargill's premium shortenings, using StableWhip™ technology, gave increased incorporation of air for light icings that would hold their volume during mechanical processing. Olenex has developed a specialized crystal structuring in TropicalStable™ shortenings that works so oil does not migrate when temperatures rise, which is a common complaint for summer decorated cakes.

Par-Way Tryson has launched QuickSet™ shortenings that reduce preparation time for commercial bakeries while enhancing crust adhesion for difficult-to-ice cake formulations.

Artisanal and Craft Baking Support

Shift: The fast-growing artisanal bakery has called for shortenings that combine professional performance with a natural positioning. These special producers must compose products that support their quality narrative yet deliver consistency and reliability for their commercial success. This trend goes well with the other demands of commerce and consumers, thus affecting both sides.

Strategic Response: ArtisanSelect™, a vision established by Archer Daniels Midland offering small-batch shortenings made with sustainably sourced identity-preserved oils, targets enterprising independent bakeries with quality storytelling.

Palsgaard A/S gave training to allow individual oil blends to be selected by boutique bakeries for their shortenings, developing signature products exclusive to their establishments. AAK AB introduced heritage-inspired shortenings using their traditional processing methods which artisans can capitalize on in a variety of their marketing narratives.

Improvement in Nutritional Profile

Shift: In addition to trans-fat elimination, consumers now want positive nutritional attributes in all food ingredients, including icing shortenings. The market has responded with formulations offering improved fatty acid profiles, reduced levels of saturated fat, and functional health properties that add to the nutritional value, as opposed to those properties which merely subtract from it.

Strategic Response: Bunge Limited developed NutriPlus™ shortenings with optimized ratios of omega fatty acids created by custom blending of oils, thus providing options with better nutritional profiles than existing conventional formulations.

Wilmar International has advanced the more recent introduction of plant sterol-enriched shortenings that allow bakeries to make heart-health claims on finished products. Cargill instituted an innovation to provide reduced-saturated-fat shortenings using structured lipid technology that maintains all functionality, while improving nutritional scorecard metrics from the viewpoint of the commercial manufacturer.

The following table shows the estimated growth rates of the top five territories. These are set to exhibit high consumption through 2035.

| Countries | CAGR, 2025 to 2035 |

|---|---|

| USA | 4.3% |

| Germany | 4.7% |

| China | 6.4% |

| Japan | 5.1% |

| India | 6.8% |

USA icing shortening market growth is strongly driven by some combination of convenience demands and the development of premium products. Ready-to-use formats have gained wide acceptance among both home bakers and professional settings. Among manufacturers, Cargill developed stable emulsions that would give professional-quality results with minimum hassle in preparation.

The robust retail segment features a clear distinction between economy and premium level, with specialized shortenings for the advanced decorating techniques enjoying premium pricing among the hobbyist home bakers. Health reformulations have come to be accepted as the rule, with most manufacturers offering PHO-free alternatives that work as good as the other products in the now-outdated nutrition concern.

The big commercial bakery sector drives technical innovation, particularly relating to heat stability and whipping performance, as industrial producers search for improvements of efficiency in large-scale operations. Online sharing of elaborate cake decorating has prompted demand for shortenings that would lend support to intricate designs while extending display periods.

Germany's icing shortening market is designed to achieve this balance between high technical performance and clean-label ingredients. Strict regulatory standards have hastened the commercial timeline for the development of shortenings that satisfy functional needs as well as labeling requirements, with the likes of AAK AB developing formulations to the satisfaction of European food authorities with all-round professional performance.

Strong traditions of professional baking have nurtured demand for application-specific shortenings with precise technical properties for different icing types, with companies developing specialized products for distinctive German pastry styles. Sustainability efforts and consumer awareness have been worth investing in, since sourcing ingredients responsibly and eco-friendly processing has become a purchase motive, not just a marketing gimmick.

Growing acceptance of Western-style celebration cakes for birthdays, weddings, and other occasions has opened wider avenues for shortenings that can create decorative icings that maintain their appearance in variable climate conditions. Rapid urbanization and bakery chains have created huge industrial demand, with manufacturers such as Wilmar International developing formulations that are right for high-volume production environments.

The local product adaptation is catered specifically to regional preferences, with customized mouthfeel and sweetness levels molded to fit the Chinese consumer's expectations without simply importing western formulations. Huge expansions in bakery training programs and culinary education have created an increasingly sophisticated professional user base looking for advanced technical properties, with marketers for specialized shortenings for complex decorating techniques gaining a corresponding market.

The icing shortening international marketplace has a highly technical competitive landscape wherein rivals rarely use price as the determining factor: rather, technical differentiation and development for application-specific demands advance the contest. So, product performance is the greatest competitive vector, and thus manufacturers sink large sums into R&D for satisfyingly stable and workable shortenings looking good in applications when finished.

Competition in the icing shortening international market is not based on the regular raw formulation of icing shortenings but their provision, much synchronized with AAK AB and Cargill dynamics, of resorting to extensive modifications for specific applications.

Sustainability options are ever more becoming a competitive differentiator, as companies are trying to woo eco-friendly clients through responsible sourcing programs, carbon reduction schemes, and waste minimization initiatives. Clean label reformulation across the industry has gained speed, and manufacturers are in a race to produce the simplest ingredient statements without compromising on key functional properties.

The regional adaptation strategies of the competitors differ a lot, wherein, for example, Wilmar International customizes market-specific formulations to accommodate local tastes and climate change instead of offering a standardized global product. The manufacturers controlling their oil supply chains can gain leverage from vertical integration, whereby companies like Archer Daniels Midland use their direct access to raw materials for cost and quality considerations.

For instance

The global industry is estimated at a value of USD 3,460.1 million in 2025.

The market is projected to grow at a CAGR of 5.6% between 2025 and 2035.

Leading manufacturers include Cargill, Inc., Bunge Limited, Archer Daniels Midland Company, AAK AB, and Wilmar International, among others.

Manufacturers are developing formulations with simplified ingredient statements, removing artificial additives, using naturally derived emulsifiers, and obtaining clean label certifications.

Sustainability has become a significant competitive factor, with companies implementing responsible sourcing programs, carbon-neutral production initiatives, and transparent supply chains.

The elimination of PHOs has driven comprehensive reformulation throughout the industry, with manufacturers developing alternative technologies like enzymatic interesterification and specialized fractionation to maintain functionality without trans fats.

Explore Similar Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA