The convenience of home delivery system, especially through instant food delivery services help drive the growth of hyperlocal food delivery markets worldwide. A form of food delivery that caters to food delivery within a very small delivery radius (Usually a few KMs) as it is easier to deliver items from local/nearby operations, thus making delivery times relatively shorter, and logistics more efficient..

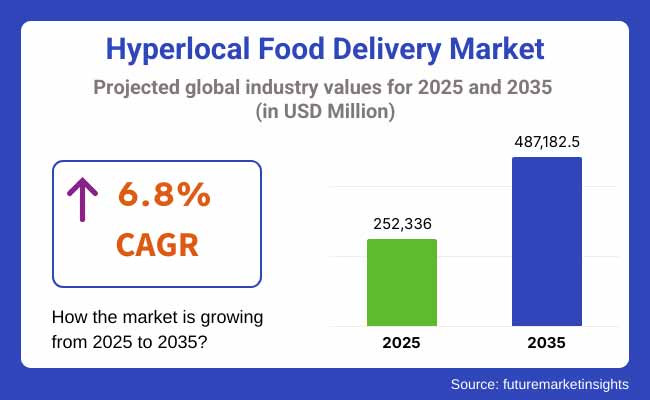

The market is anticipated to grow at approximately a 6.8% CAGR, reaching approximately USD 487,182.5 Million by 2035 and a value of USD 252,336 Million by the year 2025. A growing demand for food delivery services is fueled by the increasing number of smart devices, busy lifestyle habits, and user-friendliness of food delivery applications.

North America accounts for a sizeable hyperlocal food delivery market, owing to high levels of health awareness and a matured food delivery infrastructure. In the United States specifically, the growth has offered health-minded meal-delivery companies and restaurants selling nutritious takeout. The availability of various healthy cuisines and the convenience offered through online ordering is expected to fuel market growth in this region.

Steady growth in hyperlocal food delivery industry in the region, backed by strict food safety regulations and focus on balanced diet. The UK, Germany, and France are leading the way in the move toward healthy takeout meals as consumers make healthier food choices that complement their health and wellness. The boom in vegan and vegetarian takeout options also caters to the region’s varied dietary needs.

The Asia-Pacific region is estimated to witness the highest growth, driven by rapid urbanization, increasing disposable incomes, and growing awareness about healthy eating habits. In countries such as China, Japan and Australia, the trend is for health-oriented takeout, with food prepared in a health-conscious way but with a familiar cuisine. Technology is used to ease the demand for healthy takeout in this area via food delivery platforms.

Challenges

Logistics Complexity, Profitability Constraints, and Intense Competition

The penetration of School food delivery market is affected with complex nature of last mile logistics such as last mile transportation of high quality food which evolved a work around in densely populated metropolitan areas where requirements such as a significant difference in Delivery time in delivery operational efficiency, require minimization of delivery time in traffic patterns and optimizing delivery route complexity.Moreover, it is a hotly contested space, with local players, aggregator platforms, and direct-to-consumer brands all chasing for the pound of meat and incurring significant marketing and discounting spends.

Opportunities

Expansion of Cloud Kitchens, Integration of AI, and Focus on Fresh, Local Sourcing

The hyperlocal food delivery set is growing to sustainable demand because of increasing urban populaces, the acceptance of digitization and the requirement for speedy and agreeable tethers with fresh meal. The growth of cloud kitchens and virtual restaurants allows operators to scale quickly without the overhead of fixed dining rooms.

AI and machine learning for real-time order prediction, dynamic delivery routing, and personalized recommendations to enhance customer experience and operational efficiency. Plus, rising consumer demand for locally sourced, organic and seasonal ingredients is helping hyperlocal supply chains grow, which allows platforms to team up with neighborhood vendors, farmers and artisanal producers. Sustainable delivery models are also emerging as enablers of growth, along with loyalty programs and subscription-based deliveries.

The hyperlocal food delivery market saw explosive growth powered by the pandemic, which pushed consumer habits to shift towards immediately ordering food and having it delivered contactless. This era witnessed the increasing of homegrown delivery platforms, digital payment integration, and cloud kitchen expansion. But in the post-pandemic landscape, cost control and customer retention proved to be big challenges, leaving tons of players unable to scale sustainably.

Ultra-fast delivery models, drone-based delivery pilots, and AI-automated Kitchen systems from 2025 to 2035 Companies will be hyper-personalizing using consumer food preference data and investment will be growing in green delivery fleets, blockchain-based order tracking and zero-waste packaging solutions. In addition, integration within health and fitness applications could help platforms provide nutritional advice, calorie-tracking and meals tailored to one diet or another.

Market Shifts: A Comparative Analysis 2020 to 2024 vs. 2025 to 2035

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Focus on food safety, delivery hygiene, and local business licensing |

| Consumer Trends | Surge in contactless delivery, convenience-based meal purchases |

| Industry Adoption | Dominated by cloud kitchens, QSRs, and aggregator apps |

| Supply Chain and Sourcing | Centralized sourcing from restaurant kitchens |

| Market Competition | Led by global aggregators and local delivery startups |

| Market Growth Drivers | Driven by pandemic behavior shift, smartphone penetration, and convenience |

| Sustainability and Environmental Impact | Initial steps toward biodegradable packaging |

| Integration of Smart Technologies | Use of GPS tracking, mobile ordering apps, and real-time delivery updates |

| Advancements in Delivery Models | Standard 30-60 minute delivery windows, reliance on gig workers |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Stricter gig worker rights, eco-friendly delivery mandates, and traceability laws |

| Consumer Trends | Growth in health-focused, personalized food delivery and sustainability-conscious ordering |

| Industry Adoption | Expansion into direct-from-farm delivery, home chef platforms, and community-based food hubs |

| Supply Chain and Sourcing | Shift to hyperlocal ingredient sourcing, farmer partnerships, and AI-managed inventory |

| Market Competition | Entry of AI-native delivery platforms, health-tech integrated meal apps, and drone-based services |

| Market Growth Drivers | Accelerated by tech-enabled last-mile optimization, health integration, and sustainability initiatives |

| Sustainability and Environmental Impact | Broad adoption of zero-emission delivery, reusable containers, and carbon tracking tools |

| Integration of Smart Technologies | Expansion into AI demand prediction, drone delivery, and smart kitchen automation |

| Advancements in Delivery Models | Shift to 15-minute delivery zones, micro-fulfillment hubs, and autonomous delivery vehicles |

Unites States hyperlocal food delivery market is booming as a result of demand for high convenience, fast delivery of meals, as well as tech-driven logistics infrastructure. Innovation thrives on the rise of multi-brand cloud kitchens, AI-enabled customer targeting and subscription-based wellness meals. Companies are also investing in electric vehicle fleets and smart route planning software.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 6.9% |

In the UK, growth is being driven by growing urban density, demand for local sourcing and demand for plant-based meal options. Support for sustainable delivery models and clean-label foods from the government is aiding these hyperlocal services. Also, ghost kitchens in secondary markets are broadening coverage.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 6.7% |

The EU Market is determined by a tight regulatory compliance, focus on fair labor practices, consumer interest in organic, traceable food .Germany, France, and the Netherlands are taking this so seriously that they are putting money into drone-based pilots, electric delivery fleets, and blockchain-enabled supply chain systems. We also see the rise of platform cooperatives that support local producers.

| Country | CAGR (2025 to 2035) |

|---|---|

| EU | 6.8% |

Japan’s compact urban centers, aging demographics and tech-savvy consumers are driving growth of hyperlocal food delivery market AI-based nutrition tracking, smart vending delivery, and meal plans for seniors are pushing up demand. And autonomous delivery vehicles are being used in pilot programs.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 6.8% |

Hyper-personalization in Food Delivery South Korea is becoming a leader in hyper-personalized food delivery powered by tech integration, ultra-fast delivery networks, and wellness-focused consumers. Supporting growth are online marketplaces for home-cooked meal delivery, influencer-driven recipe delivery kits, and same-hour local produce delivery companies..

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 6.9% |

The salad segment and sandwiches & burger segments dominate the hyperlocal food delivery market as more people are opting for options that are quick, nutritional, and flavorful that suit modern lifestyles. These food categories cater to the increasing need for personalized, nutritious, and on-demand meals in both residential and commercial premises.

The hyperlocal food delivery landscape has seen a rise in the popularity of salads, a nutritious and healthy food option that is convenient for health-focused customers. Traditional fast food is all about heavy meals or ingredients, but salads come lighter and with varied items, which is in line with wellness and dietary personalization trends.

Growing demand for build-your-own salad bowls, with organic greens, plant-based proteins, and superfoods, has driven adoption. Research shows more than 60% of consumers will choose salad-based lunch or dinner deliveries because they are healthy and versatile.

The growth of salad-focused delivery chains and cloud kitchens with seasonal menus, gluten-free offerings, and macro-nutrient balanced bowls has fortified growth in the market by ensuring wider reach and menu diversity. The adoption has also accelerated with the introduction of AI-powered ordering platforms, real-time ingredient availability, diet-based customization and calorie tracking, which leads to better customer engagement and retention.

Eco-friendly/biodegradable salad packaging solutions which include compostable bowls, reusable containers, and sustainable cutlery are contributing to the growth of the market driven by ecologically sound consumer behavior. The salad segment has advantages in terms of nutrition, customization, and freshness, but there are challenges such as the limited shelf life, ingredient sourcing consistency, and price sensitivity. Solutions like AI-enhanced supply chain optimization, chef-assembled ingredient kits, and high ASD logistics are making the economics more feasible, foreshadowing further growth for salad-oriented hyperlocal food-delivery startups in the immediate future.

Sandwiches and burgers are very well adopted in the market as they are among the best market choices for working professionals, students, and families who prefer having quick bite meals and meals that can be catered to their own requirements. Hyperlocal delivery is unlike a traditional dine-in format, allowing for quicker access to freshly prepared sandwiches and gourmet-style burgers.

They followed above clouds-sevenaire foodies early in their journey down the road and to the top market adoption The growing demand for high-quality, chef-made sandwich and burger options, with global flavors, plant-based patties and premium toppings. Research shows more than 55% consumers in metropolitan regions order a continues supply of sandwiches or burgers through hyperlocal services for their lunch and dinner.

The market has been bolstered by the proliferation of gourmet fast-casual restaurants and delivery-only burger brands providing speed of preparation and guaranteed quality while seizing a loyal customer base. Adoption has also been accelerated by the advent of AI powered order tracking, smart kitchen automation and real-time delivery route optimization, all of which ensures hot, freshly prepared food reaches customers in under minutes.

The sandwiches and burgers segment, whilst advantageous in flavor diversity and convenience and portion control also faces its own set of challenges including high levels of competition, short delivery windows, and the need to standardize its menu across locations. But advances in robotic food preparation, AI-driven menu customization and ingredient sourcing automation are making scalability increasingly possible, and that's a sign that category is still growing.

Commoditized single store model and Store pick model are some of the fundamental business models driving hyperlocal food delivery scaling up, while this has made platforms and restaurants optimize their logistics as an strategy to enable quick and low price service to guarantee neighborhood market demand. This delivery type is considered fast as well as allows brands to manage the brand perception better.

This independence which can be seen as the same single store model to emerge in that hyperlocal food delivery market. This model provides full control over the quality of food, delivery time, and customer service that is not possible on aggregator platforms.

An increasing desire for swift, brand direct service that includes an in-house delivery fleet, proprietary apps and loyalty award programs has driven market adoption. In fact, recent reports indicate more than 60% of fast-casual restaurants today are investing in single store model operations to maintain customer loyalty and delivery consistency.

In addition, the growth of dedicated mobile applications for individual food businesses, with features such as contactless payment, real-time order tracking, and reminders to reorder from artificial intelligence (AI) has enhanced the market growth by providing a positive experience to the consumer.

All of this access, paired with cloud-based order management systems that bring inventory updates, delivery driver routing, and customer feedback analytics into the mix and have only further spurred adoption and the ability to fulfill orders for small to mid-sized restaurant operations.

Creating these localized delivery zones with geo-fenced marketing, hyper-personalized discounts, and data-driven menu planning have truly maximized market growth and competitive advantage in these tighter and tighter delivery radii.

The single store model, although benefiting from quality control, speed, and direct customer relationship, struggles with its reach, staffing and delivery resource allocation. But developments in AI-fueled scheduling, hyper-local delivery, last mile optimization, cheaper and scalable app infrastructure are creating possibilities for the growth of single store hyperlocal delivery businesses.

Another model is the store pick, also known as the delivery to customer model, where food aggregators and restaurant partners have trained the entire market for the app-centric customers who order from the local food chains and shops by enabling their delivery with third-party logistics providers. Store pick operations offer wide menu selection and logistics' flexibility, unlike single store model.

For example, the increase in demand for multi-brand delivery platforms, which offer curated menus, bundling discounts for different shops and the real-time stock of stores, is a key driver of market adoption. Almost 55% of all hyperlocal food orders are driven by store pick models, with most of urban centers such as downtown city areas having denser networks of vendors.

The growth of aggregator collaborations with independent restaurants, cafes, and specialty food sales outlets has positively impacted market expansion as it supports broader food access and diversity of the menu for consumers. Key advancements like AI-powered dispatch algorithms, dynamic pricing models, and live inventory syncing with stores and platforms have already accelerated this adoption, enabling timely deliveries and efficient order bundling.

By embracing hybrid dark store and store picking models, with back-of-store fulfillment zones and front-end service, markets optimized their growth, allowing small businesses to scale economically. The store pick model has its own set of shortcomings delivery delays, limited quality control and inconsistent standards around when and how food is packaged despite its advantages in terms of reach, scalability and menu variety.

Nonetheless, new solutions for real-time dispatching of stores, AI-based driver making assignments and unified packaging protocols are enhancing operational performance and driving continuing growth of store pick-based hyperlocal food delivery services.

Growing demand for instant and on-demand food delivery, increasing customer preference for local eating establishments as well as the growing trends of AI-powered delivery logistics have emerged as some of the factors analyzed in the hyperlocal food delivery market study. Market Drivers- urbanization, smartphone adoption and digital payment adoption

The competitive landscape is evolving with trends like sustainable packaging, subscription services, and real-time order tracking. Leading players in this arena emphasize AI-supported route optimization, hyper-personalized food recommendations, and collaborations with cloud kitchens. These include food delivery platforms, local restaurant aggregators, and companies building logistics solutions that are developing hyperlocal delivery ecosystems that are fast, accurate, and consumer-friendly.

Market Share Analysis by Key Players & Hyperlocal Food Delivery Providers

| Company Name | Estimated Market Share (%) |

|---|---|

| DoorDash, Inc. | 18-22% |

| Uber Technologies, Inc. (Uber Eats) | 14-18% |

| Zomato Ltd. | 12-16% |

| Deliveroo Plc | 8-12% |

| Swiggy | 6-10% |

| Other Hyperlocal Food Delivery Providers (combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| DoorDash, Inc. | Develops AI-powered logistics, real-time tracking, and last-mile delivery for local restaurants and grocery partners. |

| Uber Technologies, Inc. (Uber Eats) | Specializes in AI-enhanced food delivery networks, dynamic pricing, and integration with third-party restaurant systems. |

| Zomato Ltd. | Focuses on AI-driven restaurant discovery, hyper-personalized menu recommendations, and instant order fulfillment. |

| Deliveroo Plc | Provides AI-optimized delivery fleet management, smart batching, and hyperlocal order prediction algorithms. |

| Swiggy | Offers AI-assisted order prioritization, express delivery for hyperlocal restaurants, and integration with dark kitchens. |

Key Market Insights

DoorDash, Inc. (18-22%)

DoorDash leads in AI-powered logistics optimization, enabling real-time order tracking, hyperlocal route planning, and rapid fulfillment through its marketplace and white-label delivery networks.

Uber Technologies, Inc. (Uber Eats) (14-18%)

Uber Eats specializes in dynamic food delivery pricing, AI-enhanced courier assignment, and seamless integration with ride-hailing and restaurant POS systems.

Zomato Ltd. (12-16%)

Zomato focuses on AI-driven discovery and hyperlocal delivery precision, offering smart food recommendations and real-time restaurant syncing for speed and accuracy.

Deliveroo Plc (8-12%)

Deliveroo uses AI for order clustering, predictive time estimates, and customer preference modeling, improving local delivery efficiency and user experience.

Swiggy (6-10%)

Swiggy leverages AI for instant hyperlocal dispatching, dark kitchen integration, and customer loyalty programming through fast, reliable food delivery in urban centers.

Other Key Players (30-40% Combined)

Several food tech platforms, local restaurant aggregators, and AI-driven logistics startups contribute to hyperlocal food delivery innovation, last-mile efficiency, and customer engagement. Key contributors include:

The overall market size for the hyperlocal food delivery market was USD 252,336 Million in 2025.

The hyperlocal food delivery market is expected to reach USD 487,182.5 Million in 2035.

The demand for hyperlocal food delivery is rising due to increasing consumer preference for quick, on-demand meal services, growing smartphone and internet penetration, and the expansion of digital payment platforms. The shift in lifestyle toward convenience and time-saving solutions is further driving market growth.

The top 5 countries driving the development of the hyperlocal food delivery market are the USA, China, India, the UK, and Germany.

Single Store Model and Store Pick Model are expected to command a significant share over the assessment period.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Value (US$ Million) Forecast by Food Type, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Business Model, 2018 to 2033

Table 4: Global Market Value (US$ Million) Forecast by Delivery Type, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Payment Method, 2018 to 2033

Table 6: Global Market Value (US$ Million) Forecast by Purchaser Type, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by Subscription Type, 2018 to 2033

Table 8: Global Market Value (US$ Million) Forecast by Preferred Location, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 10: North America Market Value (US$ Million) Forecast by Food Type, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Business Model, 2018 to 2033

Table 12: North America Market Value (US$ Million) Forecast by Delivery Type, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Payment Method, 2018 to 2033

Table 14: North America Market Value (US$ Million) Forecast by Purchaser Type, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by Subscription Type, 2018 to 2033

Table 16: North America Market Value (US$ Million) Forecast by Preferred Location, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 18: Latin America Market Value (US$ Million) Forecast by Food Type, 2018 to 2033

Table 19: Latin America Market Value (US$ Million) Forecast by Business Model, 2018 to 2033

Table 20: Latin America Market Value (US$ Million) Forecast by Delivery Type, 2018 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by Payment Method, 2018 to 2033

Table 22: Latin America Market Value (US$ Million) Forecast by Purchaser Type, 2018 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast by Subscription Type, 2018 to 2033

Table 24: Latin America Market Value (US$ Million) Forecast by Preferred Location, 2018 to 2033

Table 25: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Western Europe Market Value (US$ Million) Forecast by Food Type, 2018 to 2033

Table 27: Western Europe Market Value (US$ Million) Forecast by Business Model, 2018 to 2033

Table 28: Western Europe Market Value (US$ Million) Forecast by Delivery Type, 2018 to 2033

Table 29: Western Europe Market Value (US$ Million) Forecast by Payment Method, 2018 to 2033

Table 30: Western Europe Market Value (US$ Million) Forecast by Purchaser Type, 2018 to 2033

Table 31: Western Europe Market Value (US$ Million) Forecast by Subscription Type, 2018 to 2033

Table 32: Western Europe Market Value (US$ Million) Forecast by Preferred Location, 2018 to 2033

Table 33: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 34: Eastern Europe Market Value (US$ Million) Forecast by Food Type, 2018 to 2033

Table 35: Eastern Europe Market Value (US$ Million) Forecast by Business Model, 2018 to 2033

Table 36: Eastern Europe Market Value (US$ Million) Forecast by Delivery Type, 2018 to 2033

Table 37: Eastern Europe Market Value (US$ Million) Forecast by Payment Method, 2018 to 2033

Table 38: Eastern Europe Market Value (US$ Million) Forecast by Purchaser Type, 2018 to 2033

Table 39: Eastern Europe Market Value (US$ Million) Forecast by Subscription Type, 2018 to 2033

Table 40: Eastern Europe Market Value (US$ Million) Forecast by Preferred Location, 2018 to 2033

Table 41: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 42: South Asia and Pacific Market Value (US$ Million) Forecast by Food Type, 2018 to 2033

Table 43: South Asia and Pacific Market Value (US$ Million) Forecast by Business Model, 2018 to 2033

Table 44: South Asia and Pacific Market Value (US$ Million) Forecast by Delivery Type, 2018 to 2033

Table 45: South Asia and Pacific Market Value (US$ Million) Forecast by Payment Method, 2018 to 2033

Table 46: South Asia and Pacific Market Value (US$ Million) Forecast by Purchaser Type, 2018 to 2033

Table 47: South Asia and Pacific Market Value (US$ Million) Forecast by Subscription Type, 2018 to 2033

Table 48: South Asia and Pacific Market Value (US$ Million) Forecast by Preferred Location, 2018 to 2033

Table 49: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 50: East Asia Market Value (US$ Million) Forecast by Food Type, 2018 to 2033

Table 51: East Asia Market Value (US$ Million) Forecast by Business Model, 2018 to 2033

Table 52: East Asia Market Value (US$ Million) Forecast by Delivery Type, 2018 to 2033

Table 53: East Asia Market Value (US$ Million) Forecast by Payment Method, 2018 to 2033

Table 54: East Asia Market Value (US$ Million) Forecast by Purchaser Type, 2018 to 2033

Table 55: East Asia Market Value (US$ Million) Forecast by Subscription Type, 2018 to 2033

Table 56: East Asia Market Value (US$ Million) Forecast by Preferred Location, 2018 to 2033

Table 57: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 58: Middle East and Africa Market Value (US$ Million) Forecast by Food Type, 2018 to 2033

Table 59: Middle East and Africa Market Value (US$ Million) Forecast by Business Model, 2018 to 2033

Table 60: Middle East and Africa Market Value (US$ Million) Forecast by Delivery Type, 2018 to 2033

Table 61: Middle East and Africa Market Value (US$ Million) Forecast by Payment Method, 2018 to 2033

Table 62: Middle East and Africa Market Value (US$ Million) Forecast by Purchaser Type, 2018 to 2033

Table 63: Middle East and Africa Market Value (US$ Million) Forecast by Subscription Type, 2018 to 2033

Table 64: Middle East and Africa Market Value (US$ Million) Forecast by Preferred Location, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Food Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Business Model, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Delivery Type, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Payment Method, 2023 to 2033

Figure 5: Global Market Value (US$ Million) by Purchaser Type, 2023 to 2033

Figure 6: Global Market Value (US$ Million) by Subscription Type, 2023 to 2033

Figure 7: Global Market Value (US$ Million) by Preferred Location, 2023 to 2033

Figure 8: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 9: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 10: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 11: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 12: Global Market Value (US$ Million) Analysis by Food Type, 2018 to 2033

Figure 13: Global Market Value Share (%) and BPS Analysis by Food Type, 2023 to 2033

Figure 14: Global Market Y-o-Y Growth (%) Projections by Food Type, 2023 to 2033

Figure 15: Global Market Value (US$ Million) Analysis by Business Model, 2018 to 2033

Figure 16: Global Market Value Share (%) and BPS Analysis by Business Model, 2023 to 2033

Figure 17: Global Market Y-o-Y Growth (%) Projections by Business Model, 2023 to 2033

Figure 18: Global Market Value (US$ Million) Analysis by Delivery Type, 2018 to 2033

Figure 19: Global Market Value Share (%) and BPS Analysis by Delivery Type, 2023 to 2033

Figure 20: Global Market Y-o-Y Growth (%) Projections by Delivery Type, 2023 to 2033

Figure 21: Global Market Value (US$ Million) Analysis by Payment Method, 2018 to 2033

Figure 22: Global Market Value Share (%) and BPS Analysis by Payment Method, 2023 to 2033

Figure 23: Global Market Y-o-Y Growth (%) Projections by Payment Method, 2023 to 2033

Figure 24: Global Market Value (US$ Million) Analysis by Purchaser Type, 2018 to 2033

Figure 25: Global Market Value Share (%) and BPS Analysis by Purchaser Type, 2023 to 2033

Figure 26: Global Market Y-o-Y Growth (%) Projections by Purchaser Type, 2023 to 2033

Figure 27: Global Market Value (US$ Million) Analysis by Subscription Type, 2018 to 2033

Figure 28: Global Market Value Share (%) and BPS Analysis by Subscription Type, 2023 to 2033

Figure 29: Global Market Y-o-Y Growth (%) Projections by Subscription Type, 2023 to 2033

Figure 30: Global Market Value (US$ Million) Analysis by Preferred Location, 2018 to 2033

Figure 31: Global Market Value Share (%) and BPS Analysis by Preferred Location, 2023 to 2033

Figure 32: Global Market Y-o-Y Growth (%) Projections by Preferred Location, 2023 to 2033

Figure 33: Global Market Attractiveness by Food Type, 2023 to 2033

Figure 34: Global Market Attractiveness by Business Model, 2023 to 2033

Figure 35: Global Market Attractiveness by Delivery Type, 2023 to 2033

Figure 36: Global Market Attractiveness by Payment Method, 2023 to 2033

Figure 37: Global Market Attractiveness by Purchaser Type, 2023 to 2033

Figure 38: Global Market Attractiveness by Subscription Type, 2023 to 2033

Figure 39: Global Market Attractiveness by Preferred Location, 2023 to 2033

Figure 40: Global Market Attractiveness by Region, 2023 to 2033

Figure 41: North America Market Value (US$ Million) by Food Type, 2023 to 2033

Figure 42: North America Market Value (US$ Million) by Business Model, 2023 to 2033

Figure 43: North America Market Value (US$ Million) by Delivery Type, 2023 to 2033

Figure 44: North America Market Value (US$ Million) by Payment Method, 2023 to 2033

Figure 45: North America Market Value (US$ Million) by Purchaser Type, 2023 to 2033

Figure 46: North America Market Value (US$ Million) by Subscription Type, 2023 to 2033

Figure 47: North America Market Value (US$ Million) by Preferred Location, 2023 to 2033

Figure 48: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 49: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 50: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 51: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 52: North America Market Value (US$ Million) Analysis by Food Type, 2018 to 2033

Figure 53: North America Market Value Share (%) and BPS Analysis by Food Type, 2023 to 2033

Figure 54: North America Market Y-o-Y Growth (%) Projections by Food Type, 2023 to 2033

Figure 55: North America Market Value (US$ Million) Analysis by Business Model, 2018 to 2033

Figure 56: North America Market Value Share (%) and BPS Analysis by Business Model, 2023 to 2033

Figure 57: North America Market Y-o-Y Growth (%) Projections by Business Model, 2023 to 2033

Figure 58: North America Market Value (US$ Million) Analysis by Delivery Type, 2018 to 2033

Figure 59: North America Market Value Share (%) and BPS Analysis by Delivery Type, 2023 to 2033

Figure 60: North America Market Y-o-Y Growth (%) Projections by Delivery Type, 2023 to 2033

Figure 61: North America Market Value (US$ Million) Analysis by Payment Method, 2018 to 2033

Figure 62: North America Market Value Share (%) and BPS Analysis by Payment Method, 2023 to 2033

Figure 63: North America Market Y-o-Y Growth (%) Projections by Payment Method, 2023 to 2033

Figure 64: North America Market Value (US$ Million) Analysis by Purchaser Type, 2018 to 2033

Figure 65: North America Market Value Share (%) and BPS Analysis by Purchaser Type, 2023 to 2033

Figure 66: North America Market Y-o-Y Growth (%) Projections by Purchaser Type, 2023 to 2033

Figure 67: North America Market Value (US$ Million) Analysis by Subscription Type, 2018 to 2033

Figure 68: North America Market Value Share (%) and BPS Analysis by Subscription Type, 2023 to 2033

Figure 69: North America Market Y-o-Y Growth (%) Projections by Subscription Type, 2023 to 2033

Figure 70: North America Market Value (US$ Million) Analysis by Preferred Location, 2018 to 2033

Figure 71: North America Market Value Share (%) and BPS Analysis by Preferred Location, 2023 to 2033

Figure 72: North America Market Y-o-Y Growth (%) Projections by Preferred Location, 2023 to 2033

Figure 73: North America Market Attractiveness by Food Type, 2023 to 2033

Figure 74: North America Market Attractiveness by Business Model, 2023 to 2033

Figure 75: North America Market Attractiveness by Delivery Type, 2023 to 2033

Figure 76: North America Market Attractiveness by Payment Method, 2023 to 2033

Figure 77: North America Market Attractiveness by Purchaser Type, 2023 to 2033

Figure 78: North America Market Attractiveness by Subscription Type, 2023 to 2033

Figure 79: North America Market Attractiveness by Preferred Location, 2023 to 2033

Figure 80: North America Market Attractiveness by Country, 2023 to 2033

Figure 81: Latin America Market Value (US$ Million) by Food Type, 2023 to 2033

Figure 82: Latin America Market Value (US$ Million) by Business Model, 2023 to 2033

Figure 83: Latin America Market Value (US$ Million) by Delivery Type, 2023 to 2033

Figure 84: Latin America Market Value (US$ Million) by Payment Method, 2023 to 2033

Figure 85: Latin America Market Value (US$ Million) by Purchaser Type, 2023 to 2033

Figure 86: Latin America Market Value (US$ Million) by Subscription Type, 2023 to 2033

Figure 87: Latin America Market Value (US$ Million) by Preferred Location, 2023 to 2033

Figure 88: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 89: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 90: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 91: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 92: Latin America Market Value (US$ Million) Analysis by Food Type, 2018 to 2033

Figure 93: Latin America Market Value Share (%) and BPS Analysis by Food Type, 2023 to 2033

Figure 94: Latin America Market Y-o-Y Growth (%) Projections by Food Type, 2023 to 2033

Figure 95: Latin America Market Value (US$ Million) Analysis by Business Model, 2018 to 2033

Figure 96: Latin America Market Value Share (%) and BPS Analysis by Business Model, 2023 to 2033

Figure 97: Latin America Market Y-o-Y Growth (%) Projections by Business Model, 2023 to 2033

Figure 98: Latin America Market Value (US$ Million) Analysis by Delivery Type, 2018 to 2033

Figure 99: Latin America Market Value Share (%) and BPS Analysis by Delivery Type, 2023 to 2033

Figure 100: Latin America Market Y-o-Y Growth (%) Projections by Delivery Type, 2023 to 2033

Figure 101: Latin America Market Value (US$ Million) Analysis by Payment Method, 2018 to 2033

Figure 102: Latin America Market Value Share (%) and BPS Analysis by Payment Method, 2023 to 2033

Figure 103: Latin America Market Y-o-Y Growth (%) Projections by Payment Method, 2023 to 2033

Figure 104: Latin America Market Value (US$ Million) Analysis by Purchaser Type, 2018 to 2033

Figure 105: Latin America Market Value Share (%) and BPS Analysis by Purchaser Type, 2023 to 2033

Figure 106: Latin America Market Y-o-Y Growth (%) Projections by Purchaser Type, 2023 to 2033

Figure 107: Latin America Market Value (US$ Million) Analysis by Subscription Type, 2018 to 2033

Figure 108: Latin America Market Value Share (%) and BPS Analysis by Subscription Type, 2023 to 2033

Figure 109: Latin America Market Y-o-Y Growth (%) Projections by Subscription Type, 2023 to 2033

Figure 110: Latin America Market Value (US$ Million) Analysis by Preferred Location, 2018 to 2033

Figure 111: Latin America Market Value Share (%) and BPS Analysis by Preferred Location, 2023 to 2033

Figure 112: Latin America Market Y-o-Y Growth (%) Projections by Preferred Location, 2023 to 2033

Figure 113: Latin America Market Attractiveness by Food Type, 2023 to 2033

Figure 114: Latin America Market Attractiveness by Business Model, 2023 to 2033

Figure 115: Latin America Market Attractiveness by Delivery Type, 2023 to 2033

Figure 116: Latin America Market Attractiveness by Payment Method, 2023 to 2033

Figure 117: Latin America Market Attractiveness by Purchaser Type, 2023 to 2033

Figure 118: Latin America Market Attractiveness by Subscription Type, 2023 to 2033

Figure 119: Latin America Market Attractiveness by Preferred Location, 2023 to 2033

Figure 120: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 121: Western Europe Market Value (US$ Million) by Food Type, 2023 to 2033

Figure 122: Western Europe Market Value (US$ Million) by Business Model, 2023 to 2033

Figure 123: Western Europe Market Value (US$ Million) by Delivery Type, 2023 to 2033

Figure 124: Western Europe Market Value (US$ Million) by Payment Method, 2023 to 2033

Figure 125: Western Europe Market Value (US$ Million) by Purchaser Type, 2023 to 2033

Figure 126: Western Europe Market Value (US$ Million) by Subscription Type, 2023 to 2033

Figure 127: Western Europe Market Value (US$ Million) by Preferred Location, 2023 to 2033

Figure 128: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 129: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 130: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 131: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 132: Western Europe Market Value (US$ Million) Analysis by Food Type, 2018 to 2033

Figure 133: Western Europe Market Value Share (%) and BPS Analysis by Food Type, 2023 to 2033

Figure 134: Western Europe Market Y-o-Y Growth (%) Projections by Food Type, 2023 to 2033

Figure 135: Western Europe Market Value (US$ Million) Analysis by Business Model, 2018 to 2033

Figure 136: Western Europe Market Value Share (%) and BPS Analysis by Business Model, 2023 to 2033

Figure 137: Western Europe Market Y-o-Y Growth (%) Projections by Business Model, 2023 to 2033

Figure 138: Western Europe Market Value (US$ Million) Analysis by Delivery Type, 2018 to 2033

Figure 139: Western Europe Market Value Share (%) and BPS Analysis by Delivery Type, 2023 to 2033

Figure 140: Western Europe Market Y-o-Y Growth (%) Projections by Delivery Type, 2023 to 2033

Figure 141: Western Europe Market Value (US$ Million) Analysis by Payment Method, 2018 to 2033

Figure 142: Western Europe Market Value Share (%) and BPS Analysis by Payment Method, 2023 to 2033

Figure 143: Western Europe Market Y-o-Y Growth (%) Projections by Payment Method, 2023 to 2033

Figure 144: Western Europe Market Value (US$ Million) Analysis by Purchaser Type, 2018 to 2033

Figure 145: Western Europe Market Value Share (%) and BPS Analysis by Purchaser Type, 2023 to 2033

Figure 146: Western Europe Market Y-o-Y Growth (%) Projections by Purchaser Type, 2023 to 2033

Figure 147: Western Europe Market Value (US$ Million) Analysis by Subscription Type, 2018 to 2033

Figure 148: Western Europe Market Value Share (%) and BPS Analysis by Subscription Type, 2023 to 2033

Figure 149: Western Europe Market Y-o-Y Growth (%) Projections by Subscription Type, 2023 to 2033

Figure 150: Western Europe Market Value (US$ Million) Analysis by Preferred Location, 2018 to 2033

Figure 151: Western Europe Market Value Share (%) and BPS Analysis by Preferred Location, 2023 to 2033

Figure 152: Western Europe Market Y-o-Y Growth (%) Projections by Preferred Location, 2023 to 2033

Figure 153: Western Europe Market Attractiveness by Food Type, 2023 to 2033

Figure 154: Western Europe Market Attractiveness by Business Model, 2023 to 2033

Figure 155: Western Europe Market Attractiveness by Delivery Type, 2023 to 2033

Figure 156: Western Europe Market Attractiveness by Payment Method, 2023 to 2033

Figure 157: Western Europe Market Attractiveness by Purchaser Type, 2023 to 2033

Figure 158: Western Europe Market Attractiveness by Subscription Type, 2023 to 2033

Figure 159: Western Europe Market Attractiveness by Preferred Location, 2023 to 2033

Figure 160: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 161: Eastern Europe Market Value (US$ Million) by Food Type, 2023 to 2033

Figure 162: Eastern Europe Market Value (US$ Million) by Business Model, 2023 to 2033

Figure 163: Eastern Europe Market Value (US$ Million) by Delivery Type, 2023 to 2033

Figure 164: Eastern Europe Market Value (US$ Million) by Payment Method, 2023 to 2033

Figure 165: Eastern Europe Market Value (US$ Million) by Purchaser Type, 2023 to 2033

Figure 166: Eastern Europe Market Value (US$ Million) by Subscription Type, 2023 to 2033

Figure 167: Eastern Europe Market Value (US$ Million) by Preferred Location, 2023 to 2033

Figure 168: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 169: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 170: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 171: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 172: Eastern Europe Market Value (US$ Million) Analysis by Food Type, 2018 to 2033

Figure 173: Eastern Europe Market Value Share (%) and BPS Analysis by Food Type, 2023 to 2033

Figure 174: Eastern Europe Market Y-o-Y Growth (%) Projections by Food Type, 2023 to 2033

Figure 175: Eastern Europe Market Value (US$ Million) Analysis by Business Model, 2018 to 2033

Figure 176: Eastern Europe Market Value Share (%) and BPS Analysis by Business Model, 2023 to 2033

Figure 177: Eastern Europe Market Y-o-Y Growth (%) Projections by Business Model, 2023 to 2033

Figure 178: Eastern Europe Market Value (US$ Million) Analysis by Delivery Type, 2018 to 2033

Figure 179: Eastern Europe Market Value Share (%) and BPS Analysis by Delivery Type, 2023 to 2033

Figure 180: Eastern Europe Market Y-o-Y Growth (%) Projections by Delivery Type, 2023 to 2033

Figure 181: Eastern Europe Market Value (US$ Million) Analysis by Payment Method, 2018 to 2033

Figure 182: Eastern Europe Market Value Share (%) and BPS Analysis by Payment Method, 2023 to 2033

Figure 183: Eastern Europe Market Y-o-Y Growth (%) Projections by Payment Method, 2023 to 2033

Figure 184: Eastern Europe Market Value (US$ Million) Analysis by Purchaser Type, 2018 to 2033

Figure 185: Eastern Europe Market Value Share (%) and BPS Analysis by Purchaser Type, 2023 to 2033

Figure 186: Eastern Europe Market Y-o-Y Growth (%) Projections by Purchaser Type, 2023 to 2033

Figure 187: Eastern Europe Market Value (US$ Million) Analysis by Subscription Type, 2018 to 2033

Figure 188: Eastern Europe Market Value Share (%) and BPS Analysis by Subscription Type, 2023 to 2033

Figure 189: Eastern Europe Market Y-o-Y Growth (%) Projections by Subscription Type, 2023 to 2033

Figure 190: Eastern Europe Market Value (US$ Million) Analysis by Preferred Location, 2018 to 2033

Figure 191: Eastern Europe Market Value Share (%) and BPS Analysis by Preferred Location, 2023 to 2033

Figure 192: Eastern Europe Market Y-o-Y Growth (%) Projections by Preferred Location, 2023 to 2033

Figure 193: Eastern Europe Market Attractiveness by Food Type, 2023 to 2033

Figure 194: Eastern Europe Market Attractiveness by Business Model, 2023 to 2033

Figure 195: Eastern Europe Market Attractiveness by Delivery Type, 2023 to 2033

Figure 196: Eastern Europe Market Attractiveness by Payment Method, 2023 to 2033

Figure 197: Eastern Europe Market Attractiveness by Purchaser Type, 2023 to 2033

Figure 198: Eastern Europe Market Attractiveness by Subscription Type, 2023 to 2033

Figure 199: Eastern Europe Market Attractiveness by Preferred Location, 2023 to 2033

Figure 200: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 201: South Asia and Pacific Market Value (US$ Million) by Food Type, 2023 to 2033

Figure 202: South Asia and Pacific Market Value (US$ Million) by Business Model, 2023 to 2033

Figure 203: South Asia and Pacific Market Value (US$ Million) by Delivery Type, 2023 to 2033

Figure 204: South Asia and Pacific Market Value (US$ Million) by Payment Method, 2023 to 2033

Figure 205: South Asia and Pacific Market Value (US$ Million) by Purchaser Type, 2023 to 2033

Figure 206: South Asia and Pacific Market Value (US$ Million) by Subscription Type, 2023 to 2033

Figure 207: South Asia and Pacific Market Value (US$ Million) by Preferred Location, 2023 to 2033

Figure 208: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 209: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 210: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 211: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 212: South Asia and Pacific Market Value (US$ Million) Analysis by Food Type, 2018 to 2033

Figure 213: South Asia and Pacific Market Value Share (%) and BPS Analysis by Food Type, 2023 to 2033

Figure 214: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Food Type, 2023 to 2033

Figure 215: South Asia and Pacific Market Value (US$ Million) Analysis by Business Model, 2018 to 2033

Figure 216: South Asia and Pacific Market Value Share (%) and BPS Analysis by Business Model, 2023 to 2033

Figure 217: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Business Model, 2023 to 2033

Figure 218: South Asia and Pacific Market Value (US$ Million) Analysis by Delivery Type, 2018 to 2033

Figure 219: South Asia and Pacific Market Value Share (%) and BPS Analysis by Delivery Type, 2023 to 2033

Figure 220: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Delivery Type, 2023 to 2033

Figure 221: South Asia and Pacific Market Value (US$ Million) Analysis by Payment Method, 2018 to 2033

Figure 222: South Asia and Pacific Market Value Share (%) and BPS Analysis by Payment Method, 2023 to 2033

Figure 223: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Payment Method, 2023 to 2033

Figure 224: South Asia and Pacific Market Value (US$ Million) Analysis by Purchaser Type, 2018 to 2033

Figure 225: South Asia and Pacific Market Value Share (%) and BPS Analysis by Purchaser Type, 2023 to 2033

Figure 226: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Purchaser Type, 2023 to 2033

Figure 227: South Asia and Pacific Market Value (US$ Million) Analysis by Subscription Type, 2018 to 2033

Figure 228: South Asia and Pacific Market Value Share (%) and BPS Analysis by Subscription Type, 2023 to 2033

Figure 229: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Subscription Type, 2023 to 2033

Figure 230: South Asia and Pacific Market Value (US$ Million) Analysis by Preferred Location, 2018 to 2033

Figure 231: South Asia and Pacific Market Value Share (%) and BPS Analysis by Preferred Location, 2023 to 2033

Figure 232: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Preferred Location, 2023 to 2033

Figure 233: South Asia and Pacific Market Attractiveness by Food Type, 2023 to 2033

Figure 234: South Asia and Pacific Market Attractiveness by Business Model, 2023 to 2033

Figure 235: South Asia and Pacific Market Attractiveness by Delivery Type, 2023 to 2033

Figure 236: South Asia and Pacific Market Attractiveness by Payment Method, 2023 to 2033

Figure 237: South Asia and Pacific Market Attractiveness by Purchaser Type, 2023 to 2033

Figure 238: South Asia and Pacific Market Attractiveness by Subscription Type, 2023 to 2033

Figure 239: South Asia and Pacific Market Attractiveness by Preferred Location, 2023 to 2033

Figure 240: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 241: East Asia Market Value (US$ Million) by Food Type, 2023 to 2033

Figure 242: East Asia Market Value (US$ Million) by Business Model, 2023 to 2033

Figure 243: East Asia Market Value (US$ Million) by Delivery Type, 2023 to 2033

Figure 244: East Asia Market Value (US$ Million) by Payment Method, 2023 to 2033

Figure 245: East Asia Market Value (US$ Million) by Purchaser Type, 2023 to 2033

Figure 246: East Asia Market Value (US$ Million) by Subscription Type, 2023 to 2033

Figure 247: East Asia Market Value (US$ Million) by Preferred Location, 2023 to 2033

Figure 248: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 249: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 250: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 251: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 252: East Asia Market Value (US$ Million) Analysis by Food Type, 2018 to 2033

Figure 253: East Asia Market Value Share (%) and BPS Analysis by Food Type, 2023 to 2033

Figure 254: East Asia Market Y-o-Y Growth (%) Projections by Food Type, 2023 to 2033

Figure 255: East Asia Market Value (US$ Million) Analysis by Business Model, 2018 to 2033

Figure 256: East Asia Market Value Share (%) and BPS Analysis by Business Model, 2023 to 2033

Figure 257: East Asia Market Y-o-Y Growth (%) Projections by Business Model, 2023 to 2033

Figure 258: East Asia Market Value (US$ Million) Analysis by Delivery Type, 2018 to 2033

Figure 259: East Asia Market Value Share (%) and BPS Analysis by Delivery Type, 2023 to 2033

Figure 260: East Asia Market Y-o-Y Growth (%) Projections by Delivery Type, 2023 to 2033

Figure 261: East Asia Market Value (US$ Million) Analysis by Payment Method, 2018 to 2033

Figure 262: East Asia Market Value Share (%) and BPS Analysis by Payment Method, 2023 to 2033

Figure 263: East Asia Market Y-o-Y Growth (%) Projections by Payment Method, 2023 to 2033

Figure 264: East Asia Market Value (US$ Million) Analysis by Purchaser Type, 2018 to 2033

Figure 265: East Asia Market Value Share (%) and BPS Analysis by Purchaser Type, 2023 to 2033

Figure 266: East Asia Market Y-o-Y Growth (%) Projections by Purchaser Type, 2023 to 2033

Figure 267: East Asia Market Value (US$ Million) Analysis by Subscription Type, 2018 to 2033

Figure 268: East Asia Market Value Share (%) and BPS Analysis by Subscription Type, 2023 to 2033

Figure 269: East Asia Market Y-o-Y Growth (%) Projections by Subscription Type, 2023 to 2033

Figure 270: East Asia Market Value (US$ Million) Analysis by Preferred Location, 2018 to 2033

Figure 271: East Asia Market Value Share (%) and BPS Analysis by Preferred Location, 2023 to 2033

Figure 272: East Asia Market Y-o-Y Growth (%) Projections by Preferred Location, 2023 to 2033

Figure 273: East Asia Market Attractiveness by Food Type, 2023 to 2033

Figure 274: East Asia Market Attractiveness by Business Model, 2023 to 2033

Figure 275: East Asia Market Attractiveness by Delivery Type, 2023 to 2033

Figure 276: East Asia Market Attractiveness by Payment Method, 2023 to 2033

Figure 277: East Asia Market Attractiveness by Purchaser Type, 2023 to 2033

Figure 278: East Asia Market Attractiveness by Subscription Type, 2023 to 2033

Figure 279: East Asia Market Attractiveness by Preferred Location, 2023 to 2033

Figure 280: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 281: Middle East and Africa Market Value (US$ Million) by Food Type, 2023 to 2033

Figure 282: Middle East and Africa Market Value (US$ Million) by Business Model, 2023 to 2033

Figure 283: Middle East and Africa Market Value (US$ Million) by Delivery Type, 2023 to 2033

Figure 284: Middle East and Africa Market Value (US$ Million) by Payment Method, 2023 to 2033

Figure 285: Middle East and Africa Market Value (US$ Million) by Purchaser Type, 2023 to 2033

Figure 286: Middle East and Africa Market Value (US$ Million) by Subscription Type, 2023 to 2033

Figure 287: Middle East and Africa Market Value (US$ Million) by Preferred Location, 2023 to 2033

Figure 288: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 289: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 290: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 291: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 292: Middle East and Africa Market Value (US$ Million) Analysis by Food Type, 2018 to 2033

Figure 293: Middle East and Africa Market Value Share (%) and BPS Analysis by Food Type, 2023 to 2033

Figure 294: Middle East and Africa Market Y-o-Y Growth (%) Projections by Food Type, 2023 to 2033

Figure 295: Middle East and Africa Market Value (US$ Million) Analysis by Business Model, 2018 to 2033

Figure 296: Middle East and Africa Market Value Share (%) and BPS Analysis by Business Model, 2023 to 2033

Figure 297: Middle East and Africa Market Y-o-Y Growth (%) Projections by Business Model, 2023 to 2033

Figure 298: Middle East and Africa Market Value (US$ Million) Analysis by Delivery Type, 2018 to 2033

Figure 299: Middle East and Africa Market Value Share (%) and BPS Analysis by Delivery Type, 2023 to 2033

Figure 300: Middle East and Africa Market Y-o-Y Growth (%) Projections by Delivery Type, 2023 to 2033

Figure 301: Middle East and Africa Market Value (US$ Million) Analysis by Payment Method, 2018 to 2033

Figure 302: Middle East and Africa Market Value Share (%) and BPS Analysis by Payment Method, 2023 to 2033

Figure 303: Middle East and Africa Market Y-o-Y Growth (%) Projections by Payment Method, 2023 to 2033

Figure 304: Middle East and Africa Market Value (US$ Million) Analysis by Purchaser Type, 2018 to 2033

Figure 305: Middle East and Africa Market Value Share (%) and BPS Analysis by Purchaser Type, 2023 to 2033

Figure 306: Middle East and Africa Market Y-o-Y Growth (%) Projections by Purchaser Type, 2023 to 2033

Figure 307: Middle East and Africa Market Value (US$ Million) Analysis by Subscription Type, 2018 to 2033

Figure 308: Middle East and Africa Market Value Share (%) and BPS Analysis by Subscription Type, 2023 to 2033

Figure 309: Middle East and Africa Market Y-o-Y Growth (%) Projections by Subscription Type, 2023 to 2033

Figure 310: Middle East and Africa Market Value (US$ Million) Analysis by Preferred Location, 2018 to 2033

Figure 311: Middle East and Africa Market Value Share (%) and BPS Analysis by Preferred Location, 2023 to 2033

Figure 312: Middle East and Africa Market Y-o-Y Growth (%) Projections by Preferred Location, 2023 to 2033

Figure 313: Middle East and Africa Market Attractiveness by Food Type, 2023 to 2033

Figure 314: Middle East and Africa Market Attractiveness by Business Model, 2023 to 2033

Figure 315: Middle East and Africa Market Attractiveness by Delivery Type, 2023 to 2033

Figure 316: Middle East and Africa Market Attractiveness by Payment Method, 2023 to 2033

Figure 317: Middle East and Africa Market Attractiveness by Purchaser Type, 2023 to 2033

Figure 318: Middle East and Africa Market Attractiveness by Subscription Type, 2023 to 2033

Figure 319: Middle East and Africa Market Attractiveness by Preferred Location, 2023 to 2033

Figure 320: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Hyperlocal Services Market Forecast and Outlook 2025 to 2035

Hyperlocal Delivery App Market Growth – Trends & Forecast 2024-2034

Hyperlocal Grocery Delivery Market Analysis by Food Type, Business Model, Purchaser Type, Delivery Type, End User, and Region Through 2035

Food & Beverage OEE Software Market Size and Share Forecast Outlook 2025 to 2035

Food Grade Crosslinked Polyvinylpolypyrrolidone (PVPP) Market Size and Share Forecast Outlook 2025 to 2035

Food Grade Cassia Gum Powder Market Size and Share Forecast Outlook 2025 to 2035

Food Grade Dry Film Lubricant Market Size and Share Forecast Outlook 2025 to 2035

Foodservice Equipment Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Food Basket Market Forecast and Outlook 2025 to 2035

Food Grade Tremella Polysaccharide Market Size and Share Forecast Outlook 2025 to 2035

Food Sorting Machine Market Size and Share Forecast Outlook 2025 to 2035

Foodservice Paper Bag Market Size and Share Forecast Outlook 2025 to 2035

Food Stabilizers Market Size and Share Forecast Outlook 2025 to 2035

Food Packaging Film Market Size and Share Forecast Outlook 2025 to 2035

Food Certification Market Size and Share Forecast Outlook 2025 to 2035

Food Tray Market Size and Share Forecast Outlook 2025 to 2035

Food & Beverage Industrial Disinfection and Cleaning Market Size and Share Forecast Outlook 2025 to 2035

Food Technology Market Size and Share Forecast Outlook 2025 to 2035

Food Tourism Sector Market Size and Share Forecast Outlook 2025 to 2035

Food Processing Boiler Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA