The hyperinsulinemia hypoglycaemia treatment market is valued at USD 112.36 million in 2025. As per FMI's analysis, the industry will grow at a CAGR of 6% and reach USD 201.22 million by 2035.

The Hyperinsulinemia Hypoglycaemia treatment report is also a comprehensive analysis of all the key factors that influence industry growth and trends. The increasing prevalence of disorders related to hyperinsulinemia and the rising uptake of novel treatments drive this demand.

In 2024 stable development was witnessed in the global Hyperinsulinemia Hypoglycaemia treatment sector, due to development in diagnostic strategies and targeted therapies. After that date, however, pharmaceutical companies focused on improving these second-generation therapies, which included diazoxide formulations and novel GLP-1 receptor agonists with improved efficacy and fewer side effects. Notably, clinical trials for gene-based therapies, particularly for congenital hyperinsulinism, were also underway.

This rise is likely to be caused by ongoing research into metabolic disorders, the development of new treatments, and a growing number of patients who need long-term care for their illness.

Moreover, supportive government initiatives and investment in healthcare infrastructure will additionally help the industry grow. In such an event, the key biopharmaceutical and biotechnological companies are anticipated to boost their R&D activities to develop necessary treatment solutions with respect to the rising geriatric population and rising prevalence of diabetes in the upcoming decade.

Market Metrics

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 112.36 million |

| Industry Size (2035F) | USD 201.22 million |

| CAGR (2025 to 2035) | 6% |

Explore FMI!

Book a free demo

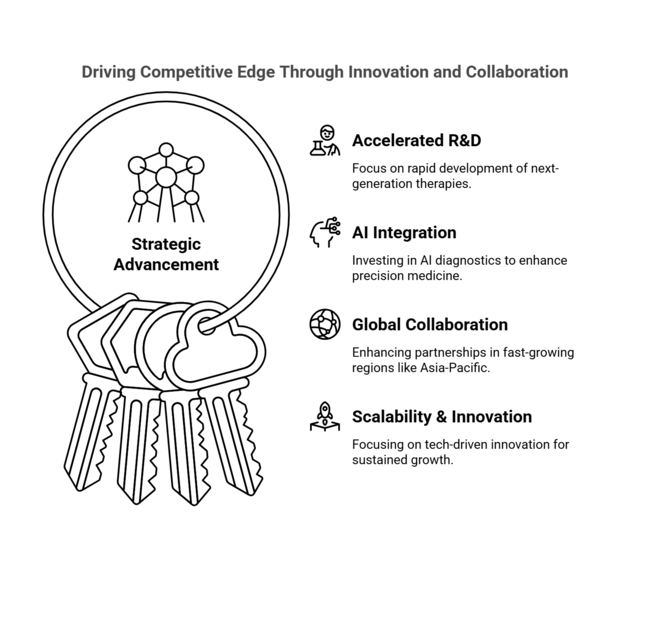

The sector for treating hyperinsulinemia and hypoglycemia is set on the path of sustained growth, fueled by innovative targeted therapies, rising rates of diagnosis, and investment in metabolic disorder research. Those who use traditional treatments that use old drugs will lose industry share to those who use new treatments like gene therapies and long-acting insulin regulators. Those who work in the pharmaceutical and biotech industries will gain the most. As personalized medicine and diagnostics powered by AI pick up speed, the industry will be dominated by the first companies to use them. This will lead to better patient outcomes and continued growth.

Invest Faster in Next-Gen Therapies

To stay ahead of treatment trends, biopharma and pharmaceutical companies need to allocate more resources towards the development of gene therapies, GLP-1 receptor agonists, and long-acting insulin regulators. To become the segment leader, expanding clinical trials and speeding up regulatory approval are important steps.

Use AI and digital health to drive precision diagnostics.

For better early detection and more personalized care, companies need to keep up with the trend of AI-based diagnostics and CGM technologies. Collaborating with health-tech companies and data analytics vendors can improve patient outcomes and refine treatment plans.

Expand Market Reach Through Strategic Partnerships

Companies can enter high-growth sectors like Asia-Pacific by strengthening their global distribution networks and forming partnerships with healthcare providers. Alternatively, they can acquire other companies. Investment in regional regulatory expertise and localized production can fuel scalability and provide a competitive edge.

| Risk | Probability & Impact |

|---|---|

| Regulatory Delays & Compliance Challenges | High Probability, High Impact |

| Slow Adoption of New Therapies | Medium Probability, High Impact |

| Industry Competition & Pricing Pressures | High Probability, Medium Impact |

1-Year Executive Watchlist

| Priority | Immediate Action |

|---|---|

| Advance Next- Gen Therapy Development | Accelerate clinical trials for GLP-1 receptor agonists and gene therapies |

| Enhance AI-Driven Diagnostics | Invest in AI-powered glucose monitoring and predictive analytics |

| Expand Industry Access & Partnerships | Strengthen distribution networks and initiate strategic alliances in high-growth regions |

To stay ahead, the company must accelerate R&D in next-generation therapies like gene-based treatments and long-acting insulin regulators, then fast-track regulatory approvals to maintain a competitive edge in the Hyperinsulinemia Hypoglycaemia treatment segment. The company could invest in AI-based diagnostics and digital health solutions to help find diseases earlier and improve patient outcomes even more.

This would make the company even more of a leader in precision medicine. To drive industry growth and increase revenue, stakeholders must enhance global collaboration, especially in fast-growing regions like Asia-Pacific. In parallel, the roadmap now must be focused on scalability, regulatory agility, and tech-driven innovation to extract sustained competitive advantage in a fast-changing environment.

Treatment Efficacy & Safety: 79% of stakeholders globally identified improving treatment efficacy and minimizing side effects as a critical priority.

Access & Affordability: 72% emphasized the need for cost-effective therapies to improve patient accessibility.

Regional Variance

High Variance

ROI Perspectives

70% of North American stakeholders determined precision medicine approaches to be “worth the investment,” whereas only 36% in Asia-Pacific supported widespread adoption due to budget constraints.

Consensus

GLP-1 receptor agonists were selected by 68% globally as the most promising treatment innovation.

Variance

Shared Challenges

85% cited rising R&D costs as a major hurdle in bringing affordable therapies to segment.

Regional Differences

Pharmaceutical Manufacturers

Healthcare Providers

End-Users (Patients & Clinics)

Alignment

72% of global pharmaceutical firms plan to invest in next-gen biologics and personalized treatment models.

Divergence

North America

66% cited FDA’s shifting guidelines on metabolic disorder drugs as a key regulatory hurdle.

Europe

78% saw EU’s evolving drug price control policies as a barrier to profitability.

Asia-Pacific

Only 35% felt regulations significantly impacted drug approvals, citing weaker enforcement mechanisms.

High Consensus

Efficacy, affordability, and R&D cost pressures remain universal concerns.

Key Variances

Strategic Insight

A one-size-fits-all industry strategy will not work. Regional adaptation is essential, with a focus on high-tech solutions in North America, sustainability in Europe, and affordability in Asia-Pacific to drive industry expansion.

| Country/Region | Policy & Regulatory Impact |

|---|---|

| United States (USA) | FDA Oversight & Drug Approval: Strict FDA regulations require extensive clinical trials for new hyperinsulinemia treatments. The Orphan Drug Act provides incentives for rare disease drug development. CMS reimbursement policies impact drug pricing and segment access. |

| European Union (EU) | EMA & EU Price Controls: The European Medicines Agency (EMA) enforces rigorous safety and efficacy standards. The EU’s Health Technology Assessment (HTA) influences pricing and reimbursement. Sustainability mandates (e.g., Green Pharma initiatives) encourage eco-friendly drug production. |

| United Kingdom (UK) | NICE & NHS Approval: The National Institute for Health and Care Excellence (NICE) evaluates cost-effectiveness before NHS approval. Post-Brexit regulatory divergence requires dual EMA and UK MHRA approvals for sector entry. |

| Canada | Health Canada Regulations: Requires adherence to the Notice of Compliance (NOC) for drug approval. The Pan-Canadian Pharmaceutical Alliance ( pCPA ) negotiates drug prices, impacting revenue potential. |

| Japan | PMDA & NHI Pricing Controls: The Pharmaceuticals and Medical Devices Agency (PMDA) enforces strict safety regulations. The National Health Insurance (NHI) system imposes price caps on hyperinsulinemia drugs, limiting premium pricing. |

| South Korea | MFDS & Reimbursement Barriers: The Ministry of Food and Drug Safety (MFDS) regulates drug approvals. Strict health insurance reimbursement policies limit access to high-cost therapies. K-Pharma initiatives promote local biotech innovation. |

| China | NMPA & Fast-Track Approvals: The National Medical Products Administration (NMPA) has fast-track pathways for critical metabolic disorder drugs. Volume-based procurement (VBP) policies push price reductions. |

| India | CDSCO & Price Controls: The Central Drugs Standard Control Organization (CDSCO) oversees approvals. National Pharmaceutical Pricing Authority (NPPA) price caps limit drug affordability but restrict high-margin opportunities. |

| Australia | TGA & PBS Pricing: The Therapeutic Goods Administration (TGA) mandates strict clinical validation. The Pharmaceutical Benefits Scheme (PBS) influences drug pricing and reimbursement decisions. |

The USA Hyperinsulinemia Hypoglycaemia treatment sector is projected to register a CAGR of 6.8% over the forecast period owing to strong R&D investments, and rising prevalence of related metabolic disorders and favorable regulation for novel therapies.

The FDA’s orphan drug and orphan biologics fast-track approval pathways significantly stimulate innovation in areas such as gene therapy and GLP-1 receptor agonists for the next generation of orphan drugs.

The USA also has higher healthcare spending and strong market penetration of insurance coveragewith Medicare and other private payers. Pricing pressure attributed to CMS reimbursement policies and the Inflation Reduction Act’s drug pricing negotiations may pose challenges for high-priced therapies.

The USA biotech ecosystem remains a dominant force globally, with companies concentrated in areas like AI-powered diagnostics, precision medicine, and continuous glucose monitoring (CGM) tech. The significant diagnosis rate and patient knowledge about the disease would likely lead to the early use of any advance treatment, which could contribute toward industry growth.

NICE (National Institute for Health and Care Excellence) guidelines where cost-effectiveness is mandatory before NHS (National Health Service) reimbursement approval, the UK sector is expected to grow at a CAGR of 5.5%. The sector is well-serviced by leading biotech academia and government-mediated life sciences funding, especially in London’s Golden Triangle (Oxford, Cambridge, and London).

Changes related to post-Brexit regulations have created a dual-approval dynamic with EMA and MHRA, slowing new drug introductions marginally. The widespread adoption of private healthcare and increasing penetration of telemedicine, however, bridge the gap. Through NHS AI initiatives, the UK is focused on leveraging data-driven healthcare and predictive analytics and remote monitoring.

With increasing rates of obesity and diabetes, the main precursors of hyperin-insulinemia, the demand for innovative therapies based on oral insulin and GLP-1 will increase in the coming years.

France's Hyperinsulinemia Hypoglycaemia treatment sector is growing at a CAGR of 5.3%, driven by stringent drug pricing regulations and strong universal healthcare. The French National Authority for Health (HAS), the main agency for drug approvals, often requires cost-benefit evaluations as a prelude to recommendations before drugs can be reimbursed. While this sows seeds of discord for high-cost therapies, government-backed biotech funding and a robust pharmaceutical manufacturing backbone will provide stability.

France is advancing in AI-powered metabolic disorder monitoring and digital therapeutics development. Industry expansion may progress at a slower pace due to longer regulatory approval timelines compared to Germany and the USA. Partnerships between French biotech companies and global pharmaceutical industry players will advance access to new-generation insulin treatments.

Germany is one of the leading countries in Europe in the Hyperinsulinemia Hypoglycaemia treatment sector, having growing CAGR of 6.2% owing to the high R&D spending, widespread government support for biotech innovation and a structured healthcare system. The Institute for Quality and Efficiency in Health Care (IQWiG) in Germany also mandates them for new substances.

Nonetheless, Germany’s rapid embrace of digital health solutions, including AI-powered diagnostics and CGM technology. Bayer and Boehringer Ingelheim are among the leading pharmaceutical firms, which ensures supply chain and manufacturing capability. Germany, on the other hand, is at the forefront of green pharma by focusing on sustainable drug production which could drive a dynamic shift for those prioritizing environmentally friendly companies.

The Italian Hyperinsulinemia Hypoglycaemia treatment sector is expected to grow at a 4.9% compound annual growth rate (CAGR), driven by an emphasis on cost-containment strategies measures set under the Italian Medicines Agency (AIFA) regulations and significant government control in a highly centralized health-care system. Pricing negotiation issues delay market entry for expensive therapeutics, particularly in the challenging landscape for premium biologics, given the declining cost of next-generation insulin therapies.

The increasing prevalence of diabetes and rising adoption of digital health care solutions is driving demand. Italy's emphasis on public-private collaboration in pharmaceutical R&D presents growth prospects for companies that use gene therapy and AI to assist with diagnostics.

The South Korea sector is expected to grow at 5.7% CAGR owing to high-tech healthcare infrastructure, encouragement from the government for digital health initiatives and an ever-increasing number of patients suffering from metabolic disorders. Drug development and approval processes by the Ministry of Food and Drug Safety (MFDS) have simplified, spurring the usage of biologics and digital therapeutics.

The South Korean biotech industry is thriving, with companies investing in AI-enabled diagnostics, nonstop blood glucose monitoring, and telehealth combined with other medical services. Heavy sector dependence on government price and reimbursement controls presents barriers for innovators. The growth potential of the sector is also driven by South Korea's advanced hospitals, particularly in Seoul, drive medical tourism.

The Japan sector is projected to grow at a CAGR of 5.0% during the forecast period, led by the growing older population and increasing prevalence of metabolic disorders. In Japan, the Pharmaceuticals and Medical Devices Agency (PMDA) has stringent regulations for approved drugs, which can lead to slower sector entry.

The Japanese National Health Insurance (NHI) system maintains strict controls on the price of drugs that can limit the revenue potential of high-cost therapies. Japan’s strength in robotics and digital health solutions is fast-tracking the adoption of diabetes-aware, AI-assisted insulin delivery systems.

Despite 'slow to adopt' gene therapy industry trends alongside underlying pressure from payor pricing sensitivity, there are growth opportunities for medical utilities in personalized medicine and digital therapeutics.

China's Hyperinsulinemia Hypoglycaemia treatment industry is expected to exhibit a CAGR of 7.2%, owing to increasing prevalence of diabetes, growing population of middle class, and government reforms in healthcare sector. China has established a fast-track approval route for metabolic disorder drugs. Volume-based procurement (VBP) as an example, citing China’s sector structure is similar to other emerging economies, where volume-driven procurement has reduced drug prices but created a high-volume, low-margin sector.

Chinese biotech companies are pouring capital into biosimilars, gene therapy, and AI-powered diagnostics. Rural healthcare will grow and telehealth platforms such as WeDoctor will be key industry drivers.

The sectorof Australia and New Zealand with an estimated growth of 5.8% CAGR due to advanced healthcare systems, high disposable income per capita and stringent laws that govern the medical device industry. Several steps must take place first, including approval and pricing negotiations with the Therapeutic Goods Administration (TGA) and the Pharmaceutical Benefits Scheme (PBS).

Australia’s biotechnology industry is growing, especially around AI-driven glucose monitoring and insulin automation. The use of telehealth is also on the rise, enhancing access to treatment for patients. Stringent regulatory barriers and the cost of R&D may prevent experimental therapies from gaining traction.

India sector is projected to grow at a CAGR of 6.5% due to increasing cases of diabetes and metabolic disorders, improving healthcare infrastructure, and other pharmaceutical initiatives by the government. India is now a key market for generic and biosimilar drugs, as the Central Drugs Standard Control Organization (CDSCO) has expedited the approval process for affordable hyperinsulinemia treatments.

Nonetheless, low insurance penetration and high out-of-pocket healthcare costs remain significant challenges. Key growth opportunities come from the country’s burgeoning medical tourism industry and growing adoption of digital health solutions.

This segment is expected to grow at a CAGR of 7.5% from 2025 to 2035.Many new biologics, gene therapies, and insulin analogs are in different stages of clinical investigation and are being considered as possible treatments for hyperinsulinemia and hypoglycemia. Biopharmaceutical giants are targeting extended-acting insulin preparations as well as agonists of the GLP-1 receptor to better stabilize metabolism.

Also, platforms for drug development that use artificial intelligence are speeding up the search for new molecular targets. It is expected that partnerships between research institutions and biotech companies will lead to new ideas. Also, regulatory bodies like the FDA and EMA are making it easier for medicines to be approved for rare metabolic disorders.

Insulin analogs, the primary treatment for long-term insulin dysregulation, continue to dominate the market, with the treatment segment projected to grow at a CAGR of 6.6%. Rapid, long, and ultra-long-actinginsulin analogues are being synthesized to fine-tune glycemic control versus the development of hypoglycemic events. The oral and SC routes constitute a primary share of the segment, of which SC insulin delivery remains a benchmark to manage hypoglycemia caused by hyperinsulinemia.

There is a rising demand for oral hypoglycemia drugs, especially for medication to stabilize blood sugar levels of non-acute patients in the long run. They have also been focusing on new segment trends, which have contributed to the development of non-invasive administration routes for peptides and proteins to enhance patient compliance and convenience.

Similar to treatment for other conditions, the distribution of Hyperinsulinemia Hypoglycaemia treatments is largely hospital-driven, especially since severe cases often necessitate emergency intervention, intensive care, and specialized endocrinology services.

During the forecast period (2025 to 2035), this segment is expected to grow at a CAGR of 6%.The main end-users for treating hyperinsulinemia and hypoglycemia are special clinics and hospitals. This is because they have access to more advanced treatments, care teams with members from different fields, and better patient monitoring.

Hospitals remain the primary treatment centers due to their ability to manage severe insulin dysregulation and hypoglycemia through emergency care and continuous glucose monitoring (CGM). People who have frequent hypoglycemia or metabolic problems after surgery need long-term glucose control programs, so rehabilitation centers are becoming more popular. Rehabilitation facilities target dietary management, physical therapy, and behavioral modification to supplement drug therapy.

Home glucose monitoring and digital therapies are changing the way patients are cared for as telehealth becomes more popular. Smart insulin delivery devices, wearable CGM devices, and mobile apps enable real-time tracking of glucose levels, reducing the need for hospitalization.

The segment of the for treating Hyperinsulinemia Hypoglycaemia identifies the key emerging players in the industry, their pricing strategy, expansion plans, introduction of innovative products, and presence in the global segment. Due to advanced therapies being costly, first-tier companies are embracing tiered pricing systems, patient assistance plans, and regionalized pricing to support affordability and capture industry share.

Strategic partnerships and acquisitions are also reshaping the competitive landscape. Major drug companies are teaming up with biotech firms and digital health startups to speed up the creation of new insulin analogs, somatostatin analogs, and gene-based therapies.

Market Share Analysis

Key Developments

The treatment options available are insulin analogs, diazoxide, somatostatin analogs, and glucagon therapy. New therapies like gene-based therapies and AI-driven insulin delivery systems are also under investigation.

The key growth drivers are the increasing prevalence of metabolic disorders, technological advancements in non-invasive drug delivery, enhanced clinical research activities, and increasing access to digital health solutions.

Technologies like continuous glucose monitoring (CGM), artificial intelligence-powered insulin pumps, intranasal glucagon, and wearable biosensors are revolutionizing disease management by enhancing real-time management and customized treatment regimens.

Hospitals and metabolic disorder specialty clinics continue to be main treatment sites based on their sophisticated diagnostic facilities, specialist endocrinologists, and availability of state-of-the-art therapies. But home care is increasing with telemedicine and remote monitoring technologies.

Western Europe and North America are the adopters in leader positions based on robust healthcare infrastructures, favorable regulatory approvals, and heavy investments in R&D. Asia-Pacific is growing high as a consequence of rising awareness, enhanced availability of treatments, and government-backed initiatives.

It is segmented into Pipeline Development Activities

It is segmented into Drug class, Route of administration, and Distribution channel

It is segmented into Hospitals and Clinics, Rehabilitation Centers, and Others

It is segmented into North America, Latin America, Europe, East Asia, South Asia, Oceania, and Middle East & Africa

The Intraoperative Radiation Therapy Systems Market Is Segmented by Disease Indication and End User from 2025 To 2035

The Soft Tissue Repair Market is segmented by Synthetic, Allograft, Xenograft and Alloplast from 2025 to 2035

At Home Heart Health Testing Market Analysis - Size & Industry Trends 2025 to 2035

Eyelid Scrub Market Analysis & Forecast by Product, Application and Region 2025 to 2035

Protein Diagnostics Market Share, Size and Forecast 2025 to 2035

Intraoperative Fluorescence Imaging Market Report - Demand, Trends & Industry Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.