The global hyperglycemia treatment market is projected to witness robust growth over the next decade, driven by the rising prevalence of diabetes and the growing number of patients experiencing hyperglycemia episodes. Hyperglycemia, or elevated blood glucose levels, requires prompt intervention to prevent serious complications.

This has spurred demand for advanced treatment options, including improved insulin delivery methods, combination therapies, and innovative glucose-lowering medications. With ongoing advancements in drug development, increasing access to healthcare services, and heightened awareness of diabetes management, the hyperglycemia treatment market is poised for significant expansion.

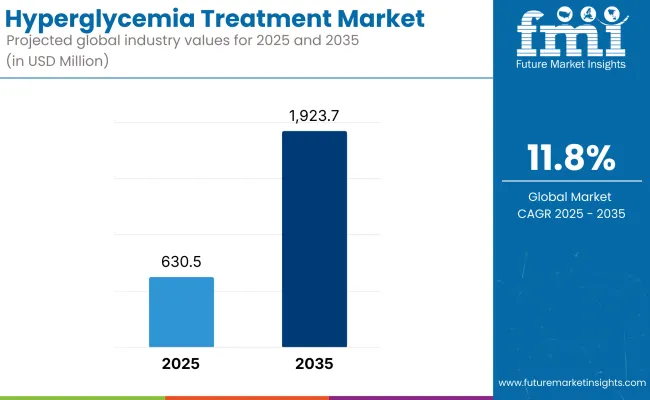

In 2025, the global hyperglycemia treatment market is estimated to be valued at approximately USD 630.5 Million. By 2035, it is projected to grow to around USD 1,923.7 Million, reflecting a compound annual growth rate (CAGR) of 11.8%.

North America is estimated to dominate the global hyperglycemia treatment market, due to the high prevalence of diabetes and adoption of advanced healthcare system with high investment in diabetes therapeutics R&D. The USA and Canada continue to play a critical role in resiliency of the continued rolling revolution in improved therapeutic approaches and state of the art blood glucose monitoring systems.

Europe is one of the flourishing markets due to large sections of diabetic population, good healthcare reimbursement policies & concentration on early detection and treatment of hyperglycemia. Germany, France and the United Kingdom come first in the number of prescribed new glucose-lowering agents and advanced insulin delivery technologies.

The APAC hyperglycemia treatment market is growing at the fastest pace owing to the increasing number of diabetic patients, increasing healthcare services, and growing awareness of control of blood glucose levels. Eager for more modern therapies, such as the government initiatives that have enhanced diabetes care in China, India and Japan.

Challenges

High Cost of Diabetes Medications, Side Effects, and Patient Compliance Issues

The market for hyperglycemic treatments is hindered by the increasing price of insulin therapy and diabetes medications. GLP-1 receptor agonists (semaglutide, liraglutide), SGLT-2 inhibitors (empagliflozin, dapagliflozin), and most of the new age hyperglycemia treatments are expensive and thus less accessible in low and middle-income regions.

Another hurdle is the adverse events associated with BG-lowering treatments, such as hypoglycemia, gastrointestinal discomfort, and weight gain or loss, which affect adherence to the treatment plan. Furthermore, as lifestyle adjustments, dietary restrictions and blood glucose monitoring are essential for the effective control of hyperglycemia, patient compliance to treatment represents another concern, since low adherence rates often arise from behavioral or sociodemographic aspects.

Opportunities

Growth in AI-Driven Diabetes Management, Personalized Medicine, and Smart Insulin Delivery Systems

Glucometers, including those equipped with AI-supported continuous glucose monitoring (CGM), like Dexcom G7 and Abbott's Freestyle Libre, are streamlining patient glucose management systems through precision, real-time tracking, and predictive glycemic control to drive patient outcomes.

Moreover, personalized medicine and genetic profiling are allowing for targeted hyperglycemia therapies that enhance drug effect and reduce adverse effects. The emergence of smart insulin pumps, AI-enhanced dosage algorithms, and non-invasive glucose monitoring technologies further advances diabetes management and patient comfort.

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Compliance with FDA, EMA, and WHO guidelines for diabetes treatments and insulin therapies. |

| Consumer Trends | Demand for oral antidiabetics, insulin pens, and continuous glucose monitoring devices. |

| Industry Adoption | High use of injectable insulin, GLP-1 receptor agonists, and SGLT-2 inhibitors. |

| Supply Chain and Sourcing | Dependence on insulin production, synthetic peptide formulations, and biosimilar drug development. |

| Market Competition | Dominated by pharmaceutical companies, digital health firms, and diabetes care device manufacturers. |

| Market Growth Drivers | Growth fueled by rising diabetes prevalence, increasing obesity rates, and demand for self-care diabetes management. |

| Sustainability and Environmental Impact | Moderate adoption of eco-friendly insulin packaging and low-carbon footprint pharma manufacturing. |

| Integration of Smart Technologies | Early adoption of IoT-connected insulin pumps, remote patient monitoring apps, and cloud-based diabetes management. |

| Advancements in Hyperglycemia Treatments | Development of once-weekly insulin injections, rapid-acting oral antidiabetic drugs, and improved CGM systems. |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Stricter AI-powered drug monitoring, digital health compliance regulations, and affordability-focused policies. |

| Consumer Trends | Growth in AI-driven diabetes coaching, smart insulin patches, and non-invasive glucose tracking solutions. |

| Industry Adoption | Expansion into personalized diabetes treatments, gene therapy-based glycemic control, and AI-assisted insulin dosing. |

| Supply Chain and Sourcing | Shift toward biotech-based insulin production, AI-optimized drug discovery, and blockchain-enabled pharma supply chains. |

| Market Competition | Entry of AI-driven diabetes startups, gene-editing firms for glucose regulation, and next-gen drug delivery innovators. |

| Market Growth Drivers | Accelerated by real-time AI-assisted glycemic control, wearable glucose monitors, and ultra-long-acting insulin innovations. |

| Sustainability and Environmental Impact | Large-scale shift toward biodegradable drug delivery systems, AI-optimized insulin recycling, and carbon-neutral diabetes care products. |

| Integration of Smart Technologies | Expansion into AI-powered glycemic forecasting, digital twin-based diabetes treatment simulations, and fully autonomous insulin dosing systems. |

| Advancements in Hyperglycemia Treatments | Evolution toward AI-customized diabetes therapies, next-gen beta cell regeneration treatments, and glucose-sensitive insulin delivery solutions. |

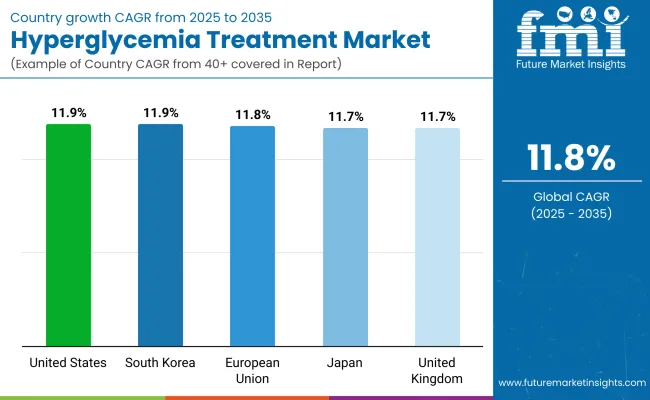

The USA hyperglycemia treatment market is growing rapidly as the prevalence of diabetes and metabolic disorders is on the rise along with the adoption rate of insulin therapies is also increasing, moreover, continuous glucose monitoring (CGM) technology is now an option for patients in many countries, and this is paving a way for the hyperglycemia treatment.

Market demand is also being driven by the increased provision of telemedicine and digital healthcare solutions for hyperglycemia management. Moreover, government programs supporting diabetes awareness and easy access to economical medicines are aiding the growth of the market.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 11.9% |

The UK hyperglycemia treatment market is driven by the growing prevalence of Type 2 diabetes, increasing uptake of oral antidiabetic medications, and developing uptake of insulin pumps and smart glucose monitors. Initiatives by the National Health Service (NHS) for early detection and improved glycemic control are also fueling market growth. Moreover, technological advancements in biosensor-based glucose monitoring systems are adrift in the market.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 11.7% |

Furthermore, diabetes prevalence is increasing all over Europe, along with government-supported diabetes management programs, there is steady growth in the hyperglycemia treatment market in the EU, driven by increasing demand of GLP-1 receptor agonists and SGLT-2 inhibitors and rising adoption of digital health technologies. Moreover, the EU's guidelines promoting the development of patient-friendly and minimally invasive glucose monitoring products is further propelling the growth of the industry.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 11.8% |

The hyperglycemia treatment market in Japan is growing moderately, owing to an ageing population, increasing number of diabetes-related complications, and increasing adoption of next-generation insulin delivery systems. Increasing penetration of personalized medicine and diabetic AI-powered care solutions is likely to drive the market growth. The other industry expansion is driven by government efforts to promote early intervention and lifestyle-based diabetes prevention programs.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 11.7% |

In South Korea, Factors such as the increasing adoption of wearable glucose monitors, closed-loop insulin delivery systems, and telemedicine platforms contribute to the growth of the market. Moreover, the growth of the industry is accelerating even more with government programs that supports diabetes prevention and early diagnosis.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 11.9% |

The hyperglycemia treatment market is showing tremendous growth with rising cases of diabetes, metabolic disorders and lifestyle-induced hyperglycemia. Awareness around early diagnosis, use of insulin therapy, and increasing adoption of personalized diabetes management solutions are driving the growth of effective, fast acting and long-term solutions for hyperglycemia in the market.

The market growth is also being driven by advancements in oral glucose-lowering medications, rapid-acting insulin formulations, and electrolyte management solutions. Based on the Treatment Type, the market is segmented Fluid Replacement, Electrolyte Replacement, Insulin Therapy, and Other Treatments.

Due to the fact that insulin is the first medication used to treat both acute and chronic hyperglycemia, mainly in diabetic patients, the Insulin Therapy segment holds a larger market share. Insulin therapy is an effective means of managing blood glucose levels, avoiding complications such as ketoacidosis, damage to organ systems, and increased risk for cardiovascular disease.

The rise in interest for precise insulin formulation is driven by the inevitable advancement of insulin delivery systems such as, smart insulin pens, continuous glucose monitoring (CGM)- integrated insulin pumps and ultra-rapid insulin formulations to meet the growing demand of precision-based insulin therapy among type 1 and insulin-dependent type 2 diabetes patients.

We are also seeing strong demand in Fluid Replacement, fundamentally in hospital and emergency settings where intravenous fluid therapy is needed to treat dehydration and severe hyperglycemia. Fluid replacement reestablishes hydration, restores blood volume, and prevents shock in patients with DKA or HHS.

As such, soaring cases of severe hyperglycemia-induced hospitalizations, greater accessibility to electrolyte-based intravenous solutions, and strategic allocation of emergency glucose therapy drive the demand for fluid replacement therapy in critical care and emergency medicine.

On the basis of route of administration, hyperglycemia treatment market is segmented into, oral glucose-lowering medications, electrolyte replacement solutions, and blood sugar stabilizers are predominantly used to mitigate hyperglycemia non-emergently. This combination creates convenience, cost-effectiveness and long-lasting adherence advantages for patients suffering from pre-diabetes, type 2 diabetes or postprandial hyperglycemia.

As the field develops new oral insulin formulations, sodium-glucose co-transporter-2 (SGLT2) inhibitors, and over-the-counter (OTC) glucose-(or hyperglycemia)-regulating supplements, manufacturers are taking measures to ensure fast-acting, bioavailable, and sustained-release oral therapies for managing elevated blood glucose levels.

Topical Administration is another growth area, especially in the sectors of transdermal insulin delivery, glucose-regulating skin patches and electrolyte-infused dermal treatments. They have enabled nanomaterial-based innovative solutions which offer good controls on these to achieve needle-free and pain-free glucose-tolerating ability improvement acting systems, which in turn leads to increased treatment compliance and efficacy.

Rising investments in the development of wearable insulin delivery systems, growing emphasis on non-invasive approaches for glucose management and use of nanotechnology-based transdermal drug formulations will further inform the prospects for topical hyperglycemia therapeutics in alternative diabetes care markets.

Increasing number of diabetes, obesity, and metabolic disorders globally by population have fueled the growth of hyperglycemia treatment market. Innovation in this space is primarily due to increased demand for advanced insulin therapies, AI-powered glucose monitoring systems, and the introduction of oral antidiabetic drugs, technological innovations related to CGM, personalized medicine and AI-based insulin dosing systems are influential on the market.

Businesses are working on planning for next-age insulin formations, AI-supported diabetes treatment, and combined medicine therapies to improve effectiveness, adherence, and glycemic control of patients.

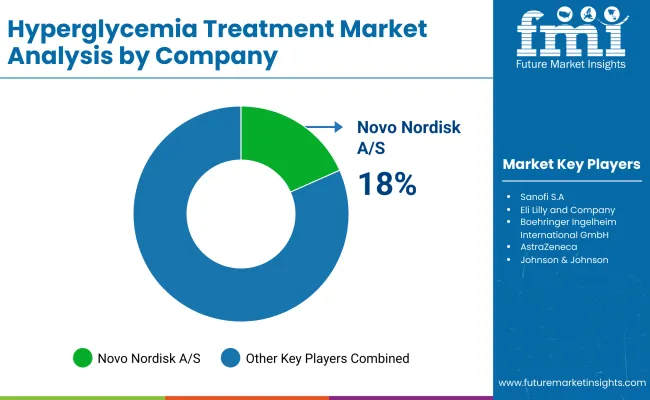

Market Share Analysis by Key Players & Hyperglycemia Treatment Manufacturers

| Company Name | Estimated Market Share (%) |

|---|---|

| Novo Nordisk A/S | 18-22% |

| Sanofi S.A. | 12-16% |

| Eli Lilly and Company | 10-14% |

| Merck & Co., Inc. | 8-12% |

| Boehringer Ingelheim International GmbH | 5-9% |

| Other Hyperglycemia Treatment Providers (combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| Novo Nordisk A/S | Develops AI-driven insulin delivery systems, ultra-long-acting insulin analogs, and GLP-1 receptor agonists for hyperglycemia control. |

| Sanofi S.A. | Specializes in AI-assisted basal insulin therapies, next-generation oral diabetes medications, and smart insulin pens. |

| Eli Lilly and Company | Provides fast-acting and combination insulin therapies, AI-powered diabetes tracking apps, and innovative peptide-based treatments. |

| Merck & Co., Inc. | Focuses on DPP-4 inhibitors, AI-enhanced personalized glucose control therapies, and metabolic disorder drug combinations. |

| Boehringer Ingelheim International GmbH | Offers SGLT2 inhibitors, AI-assisted type 2 diabetes management platforms, and cardio-protective hyperglycemia treatments. |

Key Market Insights

Novo Nordisk A/S (18-22%)

Novo Nordisk leads the hyperglycemia treatment market, offering AI-powered insulin dosing systems, GLP-1 receptor agonists, and smart insulin delivery solutions.

Sanofi S.A. (12-16%)

Sanofi specializes in long-acting basal insulin treatments, ensuring AI-driven personalized insulin dosing and next-generation diabetes management tools.

Eli Lilly and Company (10-14%)

Eli Lilly provides innovative insulin formulations, optimizing AI-assisted glucose control tracking and advanced peptide-based drug therapies.

Merck & Co., Inc. (8-12%)

Merck focuses on oral antidiabetic drugs, integrating AI-powered treatment algorithms and combination drug therapies for metabolic disorders.

Boehringer Ingelheim International GmbH (5-9%)

Boehringer Ingelheim develops cardio-metabolic diabetes treatments, ensuring AI-enhanced SGLT2 inhibitors and personalized hyperglycemia care.

Other Key Players (30-40% Combined)

Several pharmaceutical companies, biotech firms, and digital health platforms contribute to next-generation hyperglycemia treatment innovations, AI-powered glucose management, and advanced insulin therapies. These include:

The overall market size for the hyperglycemia treatment market was USD 630.5 Million in 2025.

The hyperglycemia treatment market is expected to reach USD 1,923.7 Million in 2035.

Growth is driven by the rising prevalence of diabetes, increasing awareness of blood sugar management, advancements in insulin and non-insulin therapies, and expanding access to diabetes care in emerging economies.

The top 5 countries driving the development of the hyperglycemia treatment market are the USA, China, Germany, India, and Japan.

Insulin Therapy and Oral Antidiabetic Medications are expected to command a significant share over the assessment period.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Value (US$ Million) Forecast by Treatment, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Mode of Administration, 2018 to 2033

Table 4: Global Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 5: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 6: North America Market Value (US$ Million) Forecast by Treatment, 2018 to 2033

Table 7: North America Market Value (US$ Million) Forecast by Mode of Administration, 2018 to 2033

Table 8: North America Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 9: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 10: Latin America Market Value (US$ Million) Forecast by Treatment, 2018 to 2033

Table 11: Latin America Market Value (US$ Million) Forecast by Mode of Administration, 2018 to 2033

Table 12: Latin America Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 13: Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 14: Europe Market Value (US$ Million) Forecast by Treatment, 2018 to 2033

Table 15: Europe Market Value (US$ Million) Forecast by Mode of Administration, 2018 to 2033

Table 16: Europe Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 17: South Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 18: South Asia Market Value (US$ Million) Forecast by Treatment, 2018 to 2033

Table 19: South Asia Market Value (US$ Million) Forecast by Mode of Administration, 2018 to 2033

Table 20: South Asia Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 21: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 22: East Asia Market Value (US$ Million) Forecast by Treatment, 2018 to 2033

Table 23: East Asia Market Value (US$ Million) Forecast by Mode of Administration, 2018 to 2033

Table 24: East Asia Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 25: Oceania Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Oceania Market Value (US$ Million) Forecast by Treatment, 2018 to 2033

Table 27: Oceania Market Value (US$ Million) Forecast by Mode of Administration, 2018 to 2033

Table 28: Oceania Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 29: MEA Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 30: MEA Market Value (US$ Million) Forecast by Treatment, 2018 to 2033

Table 31: MEA Market Value (US$ Million) Forecast by Mode of Administration, 2018 to 2033

Table 32: MEA Market Value (US$ Million) Forecast by End User, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Treatment, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Mode of Administration, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by End User, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 6: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 7: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 8: Global Market Value (US$ Million) Analysis by Treatment, 2018 to 2033

Figure 9: Global Market Value Share (%) and BPS Analysis by Treatment, 2023 to 2033

Figure 10: Global Market Y-o-Y Growth (%) Projections by Treatment, 2023 to 2033

Figure 11: Global Market Value (US$ Million) Analysis by Mode of Administration, 2018 to 2033

Figure 12: Global Market Value Share (%) and BPS Analysis by Mode of Administration, 2023 to 2033

Figure 13: Global Market Y-o-Y Growth (%) Projections by Mode of Administration, 2023 to 2033

Figure 14: Global Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 15: Global Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 16: Global Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 17: Global Market Attractiveness by Treatment, 2023 to 2033

Figure 18: Global Market Attractiveness by Mode of Administration, 2023 to 2033

Figure 19: Global Market Attractiveness by End User, 2023 to 2033

Figure 20: Global Market Attractiveness by Region, 2023 to 2033

Figure 21: North America Market Value (US$ Million) by Treatment, 2023 to 2033

Figure 22: North America Market Value (US$ Million) by Mode of Administration, 2023 to 2033

Figure 23: North America Market Value (US$ Million) by End User, 2023 to 2033

Figure 24: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 25: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 26: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 27: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 28: North America Market Value (US$ Million) Analysis by Treatment, 2018 to 2033

Figure 29: North America Market Value Share (%) and BPS Analysis by Treatment, 2023 to 2033

Figure 30: North America Market Y-o-Y Growth (%) Projections by Treatment, 2023 to 2033

Figure 31: North America Market Value (US$ Million) Analysis by Mode of Administration, 2018 to 2033

Figure 32: North America Market Value Share (%) and BPS Analysis by Mode of Administration, 2023 to 2033

Figure 33: North America Market Y-o-Y Growth (%) Projections by Mode of Administration, 2023 to 2033

Figure 34: North America Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 37: North America Market Attractiveness by Treatment, 2023 to 2033

Figure 38: North America Market Attractiveness by Mode of Administration, 2023 to 2033

Figure 39: North America Market Attractiveness by End User, 2023 to 2033

Figure 40: North America Market Attractiveness by Country, 2023 to 2033

Figure 41: Latin America Market Value (US$ Million) by Treatment, 2023 to 2033

Figure 42: Latin America Market Value (US$ Million) by Mode of Administration, 2023 to 2033

Figure 43: Latin America Market Value (US$ Million) by End User, 2023 to 2033

Figure 44: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 45: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 46: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 47: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 48: Latin America Market Value (US$ Million) Analysis by Treatment, 2018 to 2033

Figure 49: Latin America Market Value Share (%) and BPS Analysis by Treatment, 2023 to 2033

Figure 50: Latin America Market Y-o-Y Growth (%) Projections by Treatment, 2023 to 2033

Figure 51: Latin America Market Value (US$ Million) Analysis by Mode of Administration, 2018 to 2033

Figure 52: Latin America Market Value Share (%) and BPS Analysis by Mode of Administration, 2023 to 2033

Figure 53: Latin America Market Y-o-Y Growth (%) Projections by Mode of Administration, 2023 to 2033

Figure 54: Latin America Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 55: Latin America Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 57: Latin America Market Attractiveness by Treatment, 2023 to 2033

Figure 58: Latin America Market Attractiveness by Mode of Administration, 2023 to 2033

Figure 59: Latin America Market Attractiveness by End User, 2023 to 2033

Figure 60: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 61: Europe Market Value (US$ Million) by Treatment, 2023 to 2033

Figure 62: Europe Market Value (US$ Million) by Mode of Administration, 2023 to 2033

Figure 63: Europe Market Value (US$ Million) by End User, 2023 to 2033

Figure 64: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 65: Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 66: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 67: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 68: Europe Market Value (US$ Million) Analysis by Treatment, 2018 to 2033

Figure 69: Europe Market Value Share (%) and BPS Analysis by Treatment, 2023 to 2033

Figure 70: Europe Market Y-o-Y Growth (%) Projections by Treatment, 2023 to 2033

Figure 71: Europe Market Value (US$ Million) Analysis by Mode of Administration, 2018 to 2033

Figure 72: Europe Market Value Share (%) and BPS Analysis by Mode of Administration, 2023 to 2033

Figure 73: Europe Market Y-o-Y Growth (%) Projections by Mode of Administration, 2023 to 2033

Figure 74: Europe Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 75: Europe Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 76: Europe Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 77: Europe Market Attractiveness by Treatment, 2023 to 2033

Figure 78: Europe Market Attractiveness by Mode of Administration, 2023 to 2033

Figure 79: Europe Market Attractiveness by End User, 2023 to 2033

Figure 80: Europe Market Attractiveness by Country, 2023 to 2033

Figure 81: South Asia Market Value (US$ Million) by Treatment, 2023 to 2033

Figure 82: South Asia Market Value (US$ Million) by Mode of Administration, 2023 to 2033

Figure 83: South Asia Market Value (US$ Million) by End User, 2023 to 2033

Figure 84: South Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 85: South Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 86: South Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 87: South Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 88: South Asia Market Value (US$ Million) Analysis by Treatment, 2018 to 2033

Figure 89: South Asia Market Value Share (%) and BPS Analysis by Treatment, 2023 to 2033

Figure 90: South Asia Market Y-o-Y Growth (%) Projections by Treatment, 2023 to 2033

Figure 91: South Asia Market Value (US$ Million) Analysis by Mode of Administration, 2018 to 2033

Figure 92: South Asia Market Value Share (%) and BPS Analysis by Mode of Administration, 2023 to 2033

Figure 93: South Asia Market Y-o-Y Growth (%) Projections by Mode of Administration, 2023 to 2033

Figure 94: South Asia Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 95: South Asia Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 96: South Asia Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 97: South Asia Market Attractiveness by Treatment, 2023 to 2033

Figure 98: South Asia Market Attractiveness by Mode of Administration, 2023 to 2033

Figure 99: South Asia Market Attractiveness by End User, 2023 to 2033

Figure 100: South Asia Market Attractiveness by Country, 2023 to 2033

Figure 101: East Asia Market Value (US$ Million) by Treatment, 2023 to 2033

Figure 102: East Asia Market Value (US$ Million) by Mode of Administration, 2023 to 2033

Figure 103: East Asia Market Value (US$ Million) by End User, 2023 to 2033

Figure 104: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 105: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 106: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 107: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 108: East Asia Market Value (US$ Million) Analysis by Treatment, 2018 to 2033

Figure 109: East Asia Market Value Share (%) and BPS Analysis by Treatment, 2023 to 2033

Figure 110: East Asia Market Y-o-Y Growth (%) Projections by Treatment, 2023 to 2033

Figure 111: East Asia Market Value (US$ Million) Analysis by Mode of Administration, 2018 to 2033

Figure 112: East Asia Market Value Share (%) and BPS Analysis by Mode of Administration, 2023 to 2033

Figure 113: East Asia Market Y-o-Y Growth (%) Projections by Mode of Administration, 2023 to 2033

Figure 114: East Asia Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 115: East Asia Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 116: East Asia Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 117: East Asia Market Attractiveness by Treatment, 2023 to 2033

Figure 118: East Asia Market Attractiveness by Mode of Administration, 2023 to 2033

Figure 119: East Asia Market Attractiveness by End User, 2023 to 2033

Figure 120: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 121: Oceania Market Value (US$ Million) by Treatment, 2023 to 2033

Figure 122: Oceania Market Value (US$ Million) by Mode of Administration, 2023 to 2033

Figure 123: Oceania Market Value (US$ Million) by End User, 2023 to 2033

Figure 124: Oceania Market Value (US$ Million) by Country, 2023 to 2033

Figure 125: Oceania Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 126: Oceania Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 127: Oceania Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 128: Oceania Market Value (US$ Million) Analysis by Treatment, 2018 to 2033

Figure 129: Oceania Market Value Share (%) and BPS Analysis by Treatment, 2023 to 2033

Figure 130: Oceania Market Y-o-Y Growth (%) Projections by Treatment, 2023 to 2033

Figure 131: Oceania Market Value (US$ Million) Analysis by Mode of Administration, 2018 to 2033

Figure 132: Oceania Market Value Share (%) and BPS Analysis by Mode of Administration, 2023 to 2033

Figure 133: Oceania Market Y-o-Y Growth (%) Projections by Mode of Administration, 2023 to 2033

Figure 134: Oceania Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 135: Oceania Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 136: Oceania Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 137: Oceania Market Attractiveness by Treatment, 2023 to 2033

Figure 138: Oceania Market Attractiveness by Mode of Administration, 2023 to 2033

Figure 139: Oceania Market Attractiveness by End User, 2023 to 2033

Figure 140: Oceania Market Attractiveness by Country, 2023 to 2033

Figure 141: MEA Market Value (US$ Million) by Treatment, 2023 to 2033

Figure 142: MEA Market Value (US$ Million) by Mode of Administration, 2023 to 2033

Figure 143: MEA Market Value (US$ Million) by End User, 2023 to 2033

Figure 144: MEA Market Value (US$ Million) by Country, 2023 to 2033

Figure 145: MEA Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 146: MEA Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 147: MEA Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 148: MEA Market Value (US$ Million) Analysis by Treatment, 2018 to 2033

Figure 149: MEA Market Value Share (%) and BPS Analysis by Treatment, 2023 to 2033

Figure 150: MEA Market Y-o-Y Growth (%) Projections by Treatment, 2023 to 2033

Figure 151: MEA Market Value (US$ Million) Analysis by Mode of Administration, 2018 to 2033

Figure 152: MEA Market Value Share (%) and BPS Analysis by Mode of Administration, 2023 to 2033

Figure 153: MEA Market Y-o-Y Growth (%) Projections by Mode of Administration, 2023 to 2033

Figure 154: MEA Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 155: MEA Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 156: MEA Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 157: MEA Market Attractiveness by Treatment, 2023 to 2033

Figure 158: MEA Market Attractiveness by Mode of Administration, 2023 to 2033

Figure 159: MEA Market Attractiveness by End User, 2023 to 2033

Figure 160: MEA Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Treatment-Resistant Hypertension Management Market Size and Share Forecast Outlook 2025 to 2035

Treatment-Resistant Depression Treatment Market Size and Share Forecast Outlook 2025 to 2035

Treatment Pumps Market Insights Growth & Demand Forecast 2025 to 2035

Pretreatment Coatings Market Size and Share Forecast Outlook 2025 to 2035

Air Treatment Ozone Generator Market Size and Share Forecast Outlook 2025 to 2035

CNS Treatment and Therapy Market Insights - Trends & Growth Forecast 2025 to 2035

Seed Treatment Materials Market Size and Share Forecast Outlook 2025 to 2035

Acne Treatment Solutions Market Size and Share Forecast Outlook 2025 to 2035

Scar Treatment Market Overview - Growth & Demand Forecast 2025 to 2035

Soil Treatment Chemicals Market

Water Treatment System Market Size and Share Forecast Outlook 2025 to 2035

Water Treatment Chemical Market Size and Share Forecast Outlook 2025 to 2035

Algae Treatment Chemical Market Forecast and Outlook 2025 to 2035

Water Treatment Market Size and Share Forecast Outlook 2025 to 2035

Water Treatment Ozone Generator Market Size and Share Forecast Outlook 2025 to 2035

Water Treatment Equipment Market Size and Share Forecast Outlook 2025 to 2035

Burns Treatment Market Overview – Growth, Demand & Forecast 2025 to 2035

CRBSI Treatment Market Insights - Growth, Trends & Forecast 2025 to 2035

Water Treatment Polymers Market Growth & Demand 2025 to 2035

Asthma Treatment Market Forecast and Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA