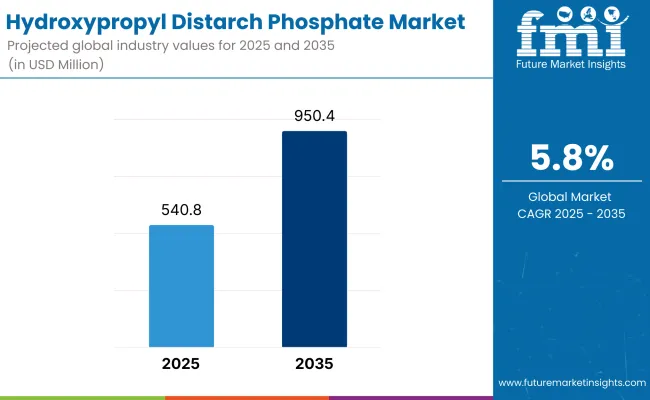

The global hydroxypropyl distarch phosphate (HDP) market is projected to grow from an estimated USD 540.8 million in 2025 to USD 950.4 million by 2035 at a CAGR of 5.8%. Increased applications in processed food, pharmaceuticals, and cosmetic formulations are expected to drive this growth trajectory.

HDP has been widely adopted in ready-to-eat meals, bakery fillings, and canned soups due to its superior freeze-thaw stability and ability to maintain viscosity under varying pH levels. As reported in Ingredion Incorporated’s 2024 Annual Sustainability and Innovation Review, a surge in customer demand for clean-label modified starches, including HDP, was observed across Southeast Asia. The company’s Senior Vice President for Asia-Pacific stated that “our customers are formulating for shelf-life resilience and texture uniformity using clean-label starches that meet regional regulatory preferences.”

In pharmaceutical applications, HDP is being utilized as a binder and disintegrant in oral solid dosage forms. It supports consistent disintegration while minimizing reactive interference with active pharmaceutical ingredients (APIs). Roquette Group, in its May 2025 executive address, confirmed the expansion of its pharma-grade starch facility in Lestrem, France. The CEO noted that “strategic expansion in high-purity starch production will allow Roquette to meet escalating demand from global excipient manufacturers.”

Cosmetic companies are incorporating HDP in emulsion creams and serums as a natural-texture enhancer. Amorepacific Corporation’s 2024 technical dossier on bio-based skincare ingredients indicated that HDP was chosen for its compatibility with vitamin C and fermented botanicals. This compatibility was essential for preserving product stability under light and oxygen exposure conditions. The company’s formulation director noted that “HDP allows our emulsions to retain clarity and softness without synthetic thickeners.”

Advancements in cross-linking and enzymatic hydrolysis have improved HDP production efficiency and purity. Research led by the University of Tokyo’s Institute of Food Science in late 2024 demonstrated that enzyme-treated HDP variants showed 18% higher stability during high-pressure processing. These findings have since been implemented by starch producers in Thailand and the Netherlands, resulting in a 22% increase in output capacity in Q1 2025.

Procurement teams are advised to prioritize suppliers with vertically integrated sourcing and in-house enzymatic treatment infrastructure to reduce supply risk. In response to raw material volatility, starch producers such as Agrana Beteiligungs-AG have diversified tapioca and maize sources across Brazil and Indonesia, as stated in their 2025 Agronomy Resilience Report. This strategic diversification is aimed at reducing exposure to weather-dependent starch commodities.

Thickener Applications Dominate Market Demand with Key Role in Texture and Viscosity Control

Hydroxypropyl distarch phosphate (HDP) is predominantly used in food, pharmaceutical, and cosmetic industries as a thickener where texture, mouthfeel, and viscosity have significant importance to product performance and consumer appeal. It is an excellent choice for the use in processed foods, sauces, dairy products, and soups, due to its modified starch derivative excellent heating, acid, and shear resistance.

Compared to conventional starches, HDP presents enhanced clarity, stability, and chill-thaw tolerance, thus being a more reliable and multifunctional ingredient for diagnosed foods and emulsified systems. In pharmaceutical suspensions and topical creams, HDP ensures a homogenous dispersement and flowability, which is crucial for dose consistency and user experience. As global demand for convenience foods and clean-label formulations rises, thickening applications will play an important role in the HDP development especially in emerging markets with processed food sector growth.

Emulsifier Segment Expands with Rising Use in Multiphase Systems and Personal Care Products

The emulsifier application of hydroxypropyl distarch phosphate is gaining popularity especially in cosmetics and personal care formulations, where it is used to desaturate oil-in-water emulsions and prolong product durability. HDP also serves as an emulsifier in food like mayonnaise, salad dressings, and non-dairy creamers, contributing to a smooth, lump-free texture and longer shelf life.

In the food sector, HDP acts as an emulsifier in mayonnaise, dressings, and non-dairy creamers, ensuring a smooth and lump-free texture while extending the shelf life. Rather than adding synthetic emulsifiers, HDP which is derived from nature and is compatible with conciseness-label formulations, provides a unique advantage, which is particularly appreciated by health-conscious consumers.

Elsewhere in the pharmaceutical field, the emulsifying properties of HDP enable active ingredient delivery systems that are stable, particularly for oral suspensions and topical formulations. Its ability to serve both as a mild thickener and an emulsifier in one system cuts down formulation complexity and fosters cost-effective production, thus it is an attractive choice for formulators in various sectors.

Food Industry Leads End-Use Demand with Clean-Label Functional Ingredients and Processed Product Growth

The food sector is the main consumer of hydroxypropyl distarch phosphate, which has the widest application in thickeners, stabilizers, and emulsifiers in processed and packaged foods. HDP is most extensively used in soups, sauces, puddings, salad dressings, baked products, and dairy products, due to its mouthfeel improvement, syneresis prevention (water separation), and the stability of the product for a longer period of time.

With the increased consumer choice of clean-label, gluten-free, and allergen-free ingredients, HDP is the clear choice as it is plant-based and has a well-established safety record. Approvals from organizations such as the FDA and EFSA further cement its status as a leading modified starch in the global food industry.

As food producers in areas like Asia-Pacific and Latin America target reformulations that are cost-effective, along with extending products' shelf life, the need for HDP in processes is anticipated to grow in a steady manner. Its reputation for quality during freeze-thaw cycles, acidic conditions, and retort processing makes it highly regarded for use in ready-to-eat meals and shelf-stable sauces, so global food trends toward convenient product lines gets aligned with it.

Cosmetics Industry Embraces HDP for Texture Enhancement and Natural Origin Appeal

The cosmetics sector has come to the forefront due to their dynamic emergence as a consumer of hydroxypropyl distarch phosphate driven by its action as a natural thickening agent, texture enhancer, and emulsifier in formulations. HDP is present in products like moisturizers, sunscreens, serums, and body lotions to make them feel smoother, non-greasy, enhance spreading ability, and preserve the quality of the product for longer periods of time.

Unlike synthetic polymer-derived and petroleum-derived thickeners, HDP gives biodegradability, skin-safety, and serves as a base for natural and organic claims, hence is quite appealing in the clean beauty movement. The low irritation potential and non-comedogenic profile is added value for the formulations which are suitable for sensitive skin and the multifunctionality of it helps to cut the number of ingredients which the cosmetic brands look for in the minimalist formulation trend.

As plants-based, ethical, and transparent personal care products are sought out by consumers the demand for HDP as a safe and sustainable multifunctional ingredient will increase in the cosmetics sector.

With a focus on food, North America still is the largest hydroxypropyl distarch phosphate market, reflecting its mainstream application in ready-to-eat foods, functional drinks, and clinical nutrition, which is aided by the ongoing high demand. The United States is a center for food innovation, wherein necessary brands with respect to the demand of people are adding HDP in sauces, soups, frozen foods, dairy desserts, and baby foods of improve stability and mouthfeel.

Besides this, HDP finds utilization in modified starches, which are taken up in nutraceutical tablets and capsules too therefore directly affecting HDP demand in the pharmaceutical space. Clarity of regulations and increased consumer interest in non-GMO and allergen-free elements are showing a rise in both mainstream and health-skewed product sectors utilization rates.

Europe's market responds to strict food safety regulations and increasing consumer disposition towards clean labels, plant-based, and low-fat products. Some countries such as Germany, France, UK, and the Netherlands are ones with a high demand of HDP in low-fat dairy, plant-based beverages, organic sauces, and frozen bakery items.

The European starch industry’s commitment to sustainable supply and traceability is another driving force for HDP adoption, particularly in premium, and organic food producers. The cosmetic industry uses HDP as a non-irritant, texture-enhancing additive in creams and lotions, which promotes its presence in the non-food area.

Asia-Pacific is the top market expanding region, with its leader China closely followed by India, Japan, and Southeast Asia countries, where the crimes of high-priced, shelf-stable, and processed foods are on the rise. The increase in per capita income, the commonality of busy lives, and the expansion of supermarkets and food delivery systems sister to each other to build a fertile field for the market of instant soups, noodle cups, frozen snacks, and dairy desserts. The options of HDP as a stabilizer are beneficial for all of these products.

HDP is gaining popularity as a binder and disintegrate in the manufacture of the pharmaceutical tablets and supplements, especially in the product line of generics and wellness markets in India and Southeast Asia.

The MEA (Middle eastern and African) market is gradually developing respecting the growth in long-shelf-life processed foods, ready-to-cook meal kits, and halal-certified functional ingredients. Jazzing these requirements up, countries like Saudi Arabia, UAE, Egypt, and South Africa also take the lead in HDP applications in dairy and bakery sectors provided by the increasing retail sector and changing food safety standards.

Pharmaceutical industries in the MEA are also checking out the more economical HDP option for dry’s syrups, suspensions and nutritional powders for geriatric populations among others.

Price Sensitivity and Supply Chain Disruptions

One of the fundamental challenges in the HDP market is price volatility of raw materials, particularly of corn and other sources of starch because of the fluctuation in raw material supply. Disputes regarding the corn crop yield impacts caused by climate change and geopolitical issues as well as price constraints have negative effects on plant-based products most HDP is from.

Supply chain bottlenecks in cross-border transactions, contributing higher lead times in the delivery of modified starches to consumers namely, food, and pharma companies. These difficulties have often resulted in such uncertainties among the small and medium-sized enterprises particularly the ones from developing countries with low cost margins.

Regulatory Complexity in Emerging Markets

The varying regional labeling norms, food additive codes, and excipient regulations can complicate it. In some emerging markets, the limited awareness and barriers of traditional legislation have a debilitating effect on the integration of HDP into product development.

Manufacturers need to spend on technical documentation, local validation trials, and regulatory support to address compliance issues and gain trust among buyers across regions where processed food ingredients are still being scrutinized.

Expanding Functional Food and Beverage Segment

The global shift in nutritional preferences towards clean labeled functional and fortified food and beverage products opens doors for HDP. The issue of excess sugar in many a product has forced brands to green the products, especially for the diabetic, and elderly consumers, and the gluten-sensitive, and weight-conscious.

In end products like protein or fiber-rich shakes, or lactose-free yogurts, or those that offer quick energy, HDP is the common ingredient enabling the making of clean-label formulations with better mouthfeel and a longer shelf life. With consumer focus on gut health and enhanced nutrient absorption, HDP's compatibility with fiber and protein composites is expected to increase over time.

Growth in Plant-Based and Vegan Formulations

The rise of plant-based diets globally and a simultaneous increase in vegan product launches have increased the demand for modified starches that do not contain any animal-derived additives during the span of time. HDP is the ideal ingredient and is found in plant-based meats, dairy alternatives, gravies, and desserts, formulations where emulsification and moisture retention are crucial.

| Market Shift | 2020 to 2024 |

|---|---|

| Main Functions | Extensively utilized in processed food, sauces, puddings, baby food, and pharma tablets. |

| Composition Options | Appreciated for their capability to remain intact at their high temperatures, acidities, and mechanical energy which in turn increases shelf life. |

| Environmental Consciousness & Clean Label Orientation | There is a considerable increase in the Popularity of non-GMO, gluten-free, and additive-free formulations. |

| Food & Beverage Aspects | Employed to develop mouth sensation, eliminate syneresis, and enhance freeze-thaw stability. |

| Drugs & Nutraceutical Accumulation | Utilized as a binder, disintegrant, and film former in both tablets and capsules. |

| Law & Policy | Data suggested by FDA, EFSA, and Codex regarding the use of said substances in food and pharmaceuticals. |

| Market Trend Enablers | Application is the measurement of the functional food, pharma, and texture enhancement increase size. |

| Market Shift | 2025 to 2035 |

|---|---|

| Main Functions | Progress in 3D-printing food, clean-label nutraceuticals, and AI-optimized pharma excipients. |

| Composition Options | They are designed for a specific viscosity, quick dispersion, and allergen-free performance. |

| Environmental Consciousness & Clean Label Orientation | Introduction of bioengineered HDP with transparent origins and enzymatic modification solutions. |

| Food & Beverage Aspects | They actively support plant-based, high-protein foods and low-glycemic foods with formulation and AI assistance. |

| Drugs & Nutraceutical Accumulation | They expand in controlled-release dosage forms and also provide excipients for personalized medicine. |

| Law & Policy | Incorporation in digital supply chains with certified cleanliness and labeling to guarantee compliance. |

| Market Trend Enablers | In a few years underneath, AI-personalized nutrition, bio functional ingredients, and green chemistry are expected to be drivers of future growth. |

The United States hydroxypropyl distarch phosphate (HDP) market is slowly developing with the support of processed food industry, clean label ingredient trend, and thickener applications in dairy, soups, and sauces. Modified starch is commonly used with hydroxypropyl distarch phosphate is due to its fabulous withstand to freeze-thaw, high temperatures as well as its ability to retain texture over shelf life.

Consumer interest in non-GMO and allergen-free additives is leading food manufacturers to use safe, FDA-Approved modified starch like HDP. In addition, it is growing in infant foods and nutritional drinks because of its good digestibility and neutral sensory impact.

| Country | CAGR (2025 to 2035) |

|---|---|

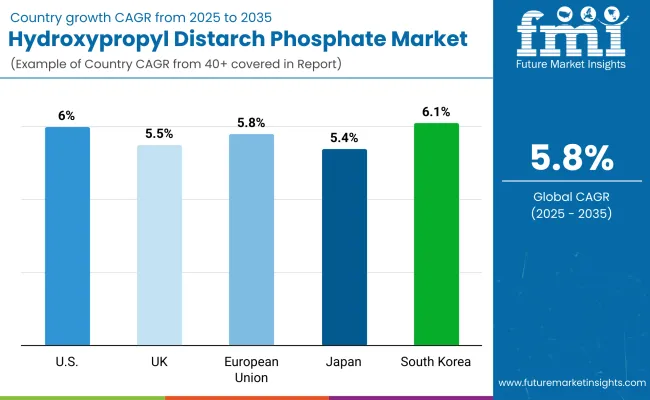

| United States | 6.0% |

The hydroxypropyl distract phosphate market in the United Kingdom is witnessing a moderate level of growth, which is made possible because of its application in meals, sauces, and clean-label food products. As HDP users become more and more ingredient-conscious, this serves as a natural replacement for synthetic thickeners and emulsifiers in vegan and plant-based food formulas.

Adapting to the compliance with European food safety regulations and in the quest of providing better shelf-stability through texture stability, HDP is becoming the first choice in the retail and foodservice sectors.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 5.5% |

The hydroxypropyl distarch phosphate market in the European Union is enjoying good growth, thanks to the stringent regulations on food additives, consumer preferences for clean-label products, and increasing sales of convenience and functional foods. For example, in Germany, France, and the Netherlands, proud adopters of HDP, you will find it in sauces, fillings, dairy desserts, and processed meats.

The EU's emphasis on a natural derivation, traceable ingredients, and clear declarations on GMOs aligns with the use of HDP as a safe, non-synthetic starch-based thickener and stabilizer. Besides gluten-free, it is also used in specialty diets.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union | 5.8% |

The hydroxypropyl distarch phosphate industry in Japan is solid with the help of its utilization in convenience food, instant noodles, and food service sauces. The food manufacturers in Japan rate the consistency, durability, and safety of foodstuffs high above all, consequently HDP is a regular choice for products that undergo repetition of conditions such as heating or cold-storage.

At the same time, HDP is being used in low-fat and reduced-calorie food formulations to create a rich texture without adding fat. The regulatory framework in Japan is such that it supports the inclusion of modified starches with proven safety profiles.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 5.4% |

South Korea is experiencing one of the most rapid growths in the hydroxypropyl distarch phosphate market, aided by the quick rise in convenience food, functional beverages, and Korean-style sauces. The shift of the local diet to one that includes more processed and packaged products is in the direction of HDP usage as it was initially created to solve texture problems in sauces like gochujang, kimbap, and noodle soups.

There are new uses of HDP in the cosmetics and personal care industry that have also been added to the scope of applications in food-grade thickeners like HDP in beauty supplements and oral care.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 6.1% |

The global hydroxypropyl distarch phosphate (HDP) market is witnessing steady expansion, driven by its broad utility as a modified starch with superior properties such as freeze-thaw stability, resistance to acid and shear. HDP is mainly used in food, beverages, pharmaceuticals, cosmetics, and paper production, in thickening, stabilizing, and emulsifying under harsh conditions.

The desire for clean-label ingredients, gluten-free products, and stability in processed food is driving manufacturers to prioritize the use of HDP compared to other starches and thickeners. While North America and Europe have the biggest share in consumption because of the regulatory approvals (e.g., E1442 as a food additive), the Asia Pacific demand is also amounting to a great deal as it lasts with instant soups, sauces, frozen meals, and dairy products.

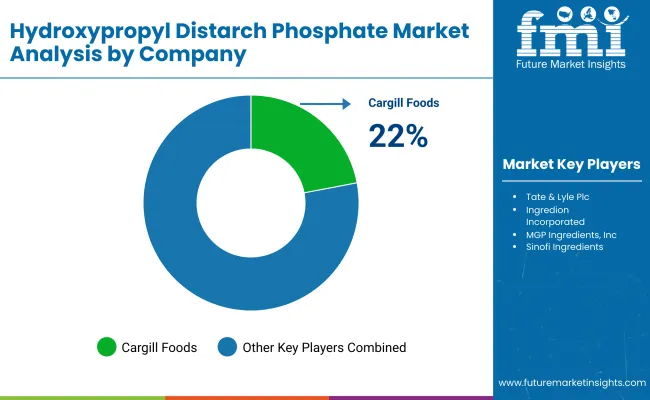

The market is fragmented and there are competing companies, with the top five players controlling 65-72% of the global market. These companies benefit from their global supply chains, technical support, and R&D investments to meet the needs of both large-scale industrial applications and specialty applications.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Cargill Foods | 22-25% |

| Tate & Lyle Plc | 20-25% |

| Ingredion Incorporated | 15-18% |

| MGP Ingredients, Inc. | 5-8% |

| Sinofi Ingredients | 3-6% |

| Company Name | Key Offerings/Activities |

|---|---|

| Cargill Foods | Offers HDP under its CTex and CEmTex brands, targeting processed foods, soups, gravies, and dairy systems with enhanced thermal and freeze-thaw stability. |

| Tate & Lyle Plc | Manufactures HDP starches under its Modified Starches and CLARIA® lines, focusing on clean-label thickening, emulsification, and stability in acidic foods. |

| Ingredion Incorporated | Supplies HDP under the ULTRA-TEX and N-CREAMER series, known for instant solubility, viscosity retention, and process resilience. |

| MGP Ingredients, Inc. | Produces HDP as part of its functional starch and ingredient systems used in snack foods, bakery fillings, and frozen meals. |

| Sinofi Ingredients | Offers cost-competitive food-grade HDP in the Asia-Pacific and Middle East markets, focusing on industrial bakery, sauces, and instant mixes. |

Key Company Insights

Cargill Foods

With its formidable product portfolio comprising brands such as CEmTex™, CTex™, and C*PolarTex™, Cargill is the HDP market leader. These products are distinguished by their high shear and thermal resistance, and they are available in both instant and cook-up systems.

Cargill's emphasis on formulation support, supply consistency, and regional manufacturing hubs propels it to serve clients in North America, Europe, and Asia. The company is venturing into clean-label HDP alternatives as a means to address the rising demand for non-GMO and label-friendly starches in the innovative and dairy-based products sector.

Tate & Lyle Plc

Tate & Lyle's hydroxypropyl distarch phosphate starches range is offered within its functional and clean-label modified starch lines while being used by the widest range of applications such as low-pH sauces, freeze-thaw-stable fillings, and ready meals. Their HDP-based solutions underline the qualities of the labeling being true, being safe, and the addition of an improved mouthfeel.

The company is enlarging its texturizer innovation centers and it is on a mission to have a sustainable production of such centers through techniques such as the use of a reduced amount of water and energy in the starch modification.

Ingredion Incorporated

Ingredion is a front-runner in innovative modified starch technologies and holds HDP formulations under the brands ULTRA-TEX™, N-CREAMER™, and NOVATION®. These starch types are used for thickening, emulsification, texture, excellent processing tolerance in beverages, dairy desserts, soups, and sauces.

Ingredion's strength in the market is due to its solution customization and clean-label positioning, while the tailored pilot starch development is facilitated through regional technical centers in various locations worldwide.

MGP Ingredients, Inc.

MGP Ingredients offers hydroxypropyl distarch phosphate as a component of its ingredient systems designed for high-moisture and heat-processed foods. These ingredient systems are the key components in applications like snack coatings, fillings, gravies, and meat analogues.

MGP is placing its emphasis on the hybrid starch-protein blend development to address a growing market for plant-based and gluten-free foods. Their asset base is an agile production capacity, as well as compliance with food safety regulations, particularly in the USA and Canada.

Sinofi Ingredients

Sinofi Ingredients is engaged mainly in price-sensitive markets in Asia, Africa, and the Middle East with the provision of standard-grade food starches, including hydroxypropyl distarch phosphate. The company has positioned itself as a bulk supplier for instant noodles, soups, seasonings, and ready-to-eat meals, utilizing the advantage of regional distribution networks and private-label collaborations.

The market is segmented into Halal and Vegan.

The industry is divided into Anticaking Agent, Emulsifier, Stabilizer, Thickener, and Binder.

The market includes Bakery & Confectionery, Dairy Products, Processed Foods, Beverages, and Nutritional Supplements.

The industry covers Food, Cosmetics, Pharmaceuticals, and Personal Care.

The report covers key regions, including North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia, and the Middle East & Africa (MEA).

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Tons) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Product Grade, 2018 to 2033

Table 4: Global Market Volume (Tons) Forecast by Product Grade, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 6: Global Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 8: Global Market Volume (Tons) Forecast by End Use, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 10: North America Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Product Grade, 2018 to 2033

Table 12: North America Market Volume (Tons) Forecast by Product Grade, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 14: North America Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 16: North America Market Volume (Tons) Forecast by End Use, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 18: Latin America Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 19: Latin America Market Value (US$ Million) Forecast by Product Grade, 2018 to 2033

Table 20: Latin America Market Volume (Tons) Forecast by Product Grade, 2018 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 22: Latin America Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 24: Latin America Market Volume (Tons) Forecast by End Use, 2018 to 2033

Table 25: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Western Europe Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 27: Western Europe Market Value (US$ Million) Forecast by Product Grade, 2018 to 2033

Table 28: Western Europe Market Volume (Tons) Forecast by Product Grade, 2018 to 2033

Table 29: Western Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 30: Western Europe Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 31: Western Europe Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 32: Western Europe Market Volume (Tons) Forecast by End Use, 2018 to 2033

Table 33: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 34: Eastern Europe Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 35: Eastern Europe Market Value (US$ Million) Forecast by Product Grade, 2018 to 2033

Table 36: Eastern Europe Market Volume (Tons) Forecast by Product Grade, 2018 to 2033

Table 37: Eastern Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 38: Eastern Europe Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 39: Eastern Europe Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 40: Eastern Europe Market Volume (Tons) Forecast by End Use, 2018 to 2033

Table 41: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 42: South Asia and Pacific Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 43: South Asia and Pacific Market Value (US$ Million) Forecast by Product Grade, 2018 to 2033

Table 44: South Asia and Pacific Market Volume (Tons) Forecast by Product Grade, 2018 to 2033

Table 45: South Asia and Pacific Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 46: South Asia and Pacific Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 47: South Asia and Pacific Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 48: South Asia and Pacific Market Volume (Tons) Forecast by End Use, 2018 to 2033

Table 49: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 50: East Asia Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 51: East Asia Market Value (US$ Million) Forecast by Product Grade, 2018 to 2033

Table 52: East Asia Market Volume (Tons) Forecast by Product Grade, 2018 to 2033

Table 53: East Asia Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 54: East Asia Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 55: East Asia Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 56: East Asia Market Volume (Tons) Forecast by End Use, 2018 to 2033

Table 57: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 58: Middle East and Africa Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 59: Middle East and Africa Market Value (US$ Million) Forecast by Product Grade, 2018 to 2033

Table 60: Middle East and Africa Market Volume (Tons) Forecast by Product Grade, 2018 to 2033

Table 61: Middle East and Africa Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 62: Middle East and Africa Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 63: Middle East and Africa Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 64: Middle East and Africa Market Volume (Tons) Forecast by End Use, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Product Grade, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Application, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by End Use, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 6: Global Market Volume (Tons) Analysis by Region, 2018 to 2033

Figure 7: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 8: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 9: Global Market Value (US$ Million) Analysis by Product Grade, 2018 to 2033

Figure 10: Global Market Volume (Tons) Analysis by Product Grade, 2018 to 2033

Figure 11: Global Market Value Share (%) and BPS Analysis by Product Grade, 2023 to 2033

Figure 12: Global Market Y-o-Y Growth (%) Projections by Product Grade, 2023 to 2033

Figure 13: Global Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 14: Global Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 15: Global Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 16: Global Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 17: Global Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 18: Global Market Volume (Tons) Analysis by End Use, 2018 to 2033

Figure 19: Global Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 20: Global Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 21: Global Market Attractiveness by Product Grade, 2023 to 2033

Figure 22: Global Market Attractiveness by Application, 2023 to 2033

Figure 23: Global Market Attractiveness by End Use, 2023 to 2033

Figure 24: Global Market Attractiveness by Region, 2023 to 2033

Figure 25: North America Market Value (US$ Million) by Product Grade, 2023 to 2033

Figure 26: North America Market Value (US$ Million) by Application, 2023 to 2033

Figure 27: North America Market Value (US$ Million) by End Use, 2023 to 2033

Figure 28: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 29: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 30: North America Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 31: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 32: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 33: North America Market Value (US$ Million) Analysis by Product Grade, 2018 to 2033

Figure 34: North America Market Volume (Tons) Analysis by Product Grade, 2018 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by Product Grade, 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by Product Grade, 2023 to 2033

Figure 37: North America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 38: North America Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 39: North America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 40: North America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 41: North America Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 42: North America Market Volume (Tons) Analysis by End Use, 2018 to 2033

Figure 43: North America Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 44: North America Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 45: North America Market Attractiveness by Product Grade, 2023 to 2033

Figure 46: North America Market Attractiveness by Application, 2023 to 2033

Figure 47: North America Market Attractiveness by End Use, 2023 to 2033

Figure 48: North America Market Attractiveness by Country, 2023 to 2033

Figure 49: Latin America Market Value (US$ Million) by Product Grade, 2023 to 2033

Figure 50: Latin America Market Value (US$ Million) by Application, 2023 to 2033

Figure 51: Latin America Market Value (US$ Million) by End Use, 2023 to 2033

Figure 52: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 53: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 54: Latin America Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 57: Latin America Market Value (US$ Million) Analysis by Product Grade, 2018 to 2033

Figure 58: Latin America Market Volume (Tons) Analysis by Product Grade, 2018 to 2033

Figure 59: Latin America Market Value Share (%) and BPS Analysis by Product Grade, 2023 to 2033

Figure 60: Latin America Market Y-o-Y Growth (%) Projections by Product Grade, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 62: Latin America Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 63: Latin America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 66: Latin America Market Volume (Tons) Analysis by End Use, 2018 to 2033

Figure 67: Latin America Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 68: Latin America Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 69: Latin America Market Attractiveness by Product Grade, 2023 to 2033

Figure 70: Latin America Market Attractiveness by Application, 2023 to 2033

Figure 71: Latin America Market Attractiveness by End Use, 2023 to 2033

Figure 72: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 73: Western Europe Market Value (US$ Million) by Product Grade, 2023 to 2033

Figure 74: Western Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 75: Western Europe Market Value (US$ Million) by End Use, 2023 to 2033

Figure 76: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 77: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 78: Western Europe Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 79: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 80: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 81: Western Europe Market Value (US$ Million) Analysis by Product Grade, 2018 to 2033

Figure 82: Western Europe Market Volume (Tons) Analysis by Product Grade, 2018 to 2033

Figure 83: Western Europe Market Value Share (%) and BPS Analysis by Product Grade, 2023 to 2033

Figure 84: Western Europe Market Y-o-Y Growth (%) Projections by Product Grade, 2023 to 2033

Figure 85: Western Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 86: Western Europe Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 87: Western Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 88: Western Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 89: Western Europe Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 90: Western Europe Market Volume (Tons) Analysis by End Use, 2018 to 2033

Figure 91: Western Europe Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 92: Western Europe Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 93: Western Europe Market Attractiveness by Product Grade, 2023 to 2033

Figure 94: Western Europe Market Attractiveness by Application, 2023 to 2033

Figure 95: Western Europe Market Attractiveness by End Use, 2023 to 2033

Figure 96: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 97: Eastern Europe Market Value (US$ Million) by Product Grade, 2023 to 2033

Figure 98: Eastern Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 99: Eastern Europe Market Value (US$ Million) by End Use, 2023 to 2033

Figure 100: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 101: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 102: Eastern Europe Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 103: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 104: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 105: Eastern Europe Market Value (US$ Million) Analysis by Product Grade, 2018 to 2033

Figure 106: Eastern Europe Market Volume (Tons) Analysis by Product Grade, 2018 to 2033

Figure 107: Eastern Europe Market Value Share (%) and BPS Analysis by Product Grade, 2023 to 2033

Figure 108: Eastern Europe Market Y-o-Y Growth (%) Projections by Product Grade, 2023 to 2033

Figure 109: Eastern Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 110: Eastern Europe Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 111: Eastern Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 112: Eastern Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 113: Eastern Europe Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 114: Eastern Europe Market Volume (Tons) Analysis by End Use, 2018 to 2033

Figure 115: Eastern Europe Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 116: Eastern Europe Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 117: Eastern Europe Market Attractiveness by Product Grade, 2023 to 2033

Figure 118: Eastern Europe Market Attractiveness by Application, 2023 to 2033

Figure 119: Eastern Europe Market Attractiveness by End Use, 2023 to 2033

Figure 120: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 121: South Asia and Pacific Market Value (US$ Million) by Product Grade, 2023 to 2033

Figure 122: South Asia and Pacific Market Value (US$ Million) by Application, 2023 to 2033

Figure 123: South Asia and Pacific Market Value (US$ Million) by End Use, 2023 to 2033

Figure 124: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 125: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 126: South Asia and Pacific Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 127: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 128: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 129: South Asia and Pacific Market Value (US$ Million) Analysis by Product Grade, 2018 to 2033

Figure 130: South Asia and Pacific Market Volume (Tons) Analysis by Product Grade, 2018 to 2033

Figure 131: South Asia and Pacific Market Value Share (%) and BPS Analysis by Product Grade, 2023 to 2033

Figure 132: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Product Grade, 2023 to 2033

Figure 133: South Asia and Pacific Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 134: South Asia and Pacific Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 135: South Asia and Pacific Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 136: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 137: South Asia and Pacific Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 138: South Asia and Pacific Market Volume (Tons) Analysis by End Use, 2018 to 2033

Figure 139: South Asia and Pacific Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 140: South Asia and Pacific Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 141: South Asia and Pacific Market Attractiveness by Product Grade, 2023 to 2033

Figure 142: South Asia and Pacific Market Attractiveness by Application, 2023 to 2033

Figure 143: South Asia and Pacific Market Attractiveness by End Use, 2023 to 2033

Figure 144: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 145: East Asia Market Value (US$ Million) by Product Grade, 2023 to 2033

Figure 146: East Asia Market Value (US$ Million) by Application, 2023 to 2033

Figure 147: East Asia Market Value (US$ Million) by End Use, 2023 to 2033

Figure 148: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 149: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 150: East Asia Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 151: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 152: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 153: East Asia Market Value (US$ Million) Analysis by Product Grade, 2018 to 2033

Figure 154: East Asia Market Volume (Tons) Analysis by Product Grade, 2018 to 2033

Figure 155: East Asia Market Value Share (%) and BPS Analysis by Product Grade, 2023 to 2033

Figure 156: East Asia Market Y-o-Y Growth (%) Projections by Product Grade, 2023 to 2033

Figure 157: East Asia Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 158: East Asia Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 159: East Asia Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 160: East Asia Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 161: East Asia Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 162: East Asia Market Volume (Tons) Analysis by End Use, 2018 to 2033

Figure 163: East Asia Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 164: East Asia Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 165: East Asia Market Attractiveness by Product Grade, 2023 to 2033

Figure 166: East Asia Market Attractiveness by Application, 2023 to 2033

Figure 167: East Asia Market Attractiveness by End Use, 2023 to 2033

Figure 168: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 169: Middle East and Africa Market Value (US$ Million) by Product Grade, 2023 to 2033

Figure 170: Middle East and Africa Market Value (US$ Million) by Application, 2023 to 2033

Figure 171: Middle East and Africa Market Value (US$ Million) by End Use, 2023 to 2033

Figure 172: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 173: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 174: Middle East and Africa Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 175: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 176: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 177: Middle East and Africa Market Value (US$ Million) Analysis by Product Grade, 2018 to 2033

Figure 178: Middle East and Africa Market Volume (Tons) Analysis by Product Grade, 2018 to 2033

Figure 179: Middle East and Africa Market Value Share (%) and BPS Analysis by Product Grade, 2023 to 2033

Figure 180: Middle East and Africa Market Y-o-Y Growth (%) Projections by Product Grade, 2023 to 2033

Figure 181: Middle East and Africa Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 182: Middle East and Africa Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 183: Middle East and Africa Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 184: Middle East and Africa Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 185: Middle East and Africa Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 186: Middle East and Africa Market Volume (Tons) Analysis by End Use, 2018 to 2033

Figure 187: Middle East and Africa Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 188: Middle East and Africa Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 189: Middle East and Africa Market Attractiveness by Product Grade, 2023 to 2033

Figure 190: Middle East and Africa Market Attractiveness by Application, 2023 to 2033

Figure 191: Middle East and Africa Market Attractiveness by End Use, 2023 to 2033

Figure 192: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

The global hydroxypropyl distarch phosphate market is projected to reach USD 540.8 million by the end of 2025.

The market is anticipated to grow at a CAGR of 5.8% from 2025 to 2035.

By 2035, the hydroxypropyl distarch phosphate market is expected to reach USD 950.4 million.

The thickener segment is expected to dominate due to the growing demand in food processing, sauces, soups, dairy, and bakery applications, where it improves texture, viscosity, and shelf life.

Key players in the market include Ingredion Incorporated, Cargill, Inc., Tate & Lyle PLC, Archer Daniels Midland Company, and Roquette Frères.

Explore Similar Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA