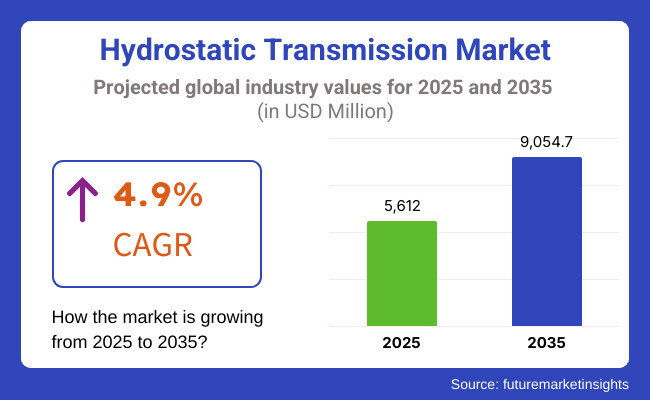

The Hydrostatic Transmission Market is projected to grow from USD 5,612.0 million in 2025 to USD 9,054.7 million by 2035, reflecting a CAGR of 4.9% over the forecast period. Increasing demand for efficient power transmission systems, growing applications in construction, agriculture, and industrial machinery, and advancements in hydraulic component technology are key drivers fueling market growth.

The rising mechanization of agriculture, expanding construction sector, and the integration of hydrostatic transmission systems in heavy-duty vehicles are further boosting market demand. Additionally, the shift toward electro-hydrostatic and hybrid transmission solutions is shaping the future of the industry.

The hydrostatic transmission market is expanding due to its high efficiency, precise control, and superior power transfer capabilities. These systems are widely used in heavy-duty construction machinery, agricultural tractors, industrial forklifts, and mining equipment, where variable speed control and high torque output are crucial.

In the agriculture sector, hydrostatic transmissions are gaining popularity in tractors, harvesters, and sprayers, as they provide seamless speed variation without the need for manual gear shifting. Apart from that, the construction equipment sector is the other major industrial consumer of these systems where they implement them in excavators, loaders, and bulldozers to boost productivity levels. On top of this, the surge in the embracing of automation as well as electric-hydraulic hybrid technologies is driving the path of innovation in authentic smart hydrostatic transmission systems.

The ascent witnessed by North America is due to steady market drivers exploding the power for automated and optimal-performing machines in agriculture and construction boilerplate. The USA and Canada, being the chief movers of Hydrostatic transmission systems, take advantage of the advanced manufacturing capacities and the respective development of infrastructure.

The construction equipment segment is fast onboard hydrostatic transmission technology for better fuel efficiency and operator control. On top of that, the agricultural mechanization initiatives in this area are encouraging farmers to buy high-precision units of hydrostatic transmission tractors and harvesters, which subsequently helps to augment the growth of the region's tractor market. Autonomous and smart machinery are the expected driving factors behind the increase in the demand for hydrostatic transmission solutions.

Europe is setting the pace in the race for technical timeshares, especially amid innovative electro-hydrostatic transmission solutions. Countries such as Germany, France, and Italy have dominating demand thanks to their strong agricultural and machinery sectors. Hybrid Hydrostatic Electric systems' usage is expediting, as it is aligned with the EU's objectives to decrease emissions and improve fuel efficiency.

The region's construction and mining industries are additionally investing in hi-tech hydrostatic gear to augment safety and cut down on energy consumption. Next-generation hydrostatic transmission technology is the key area of focus for European makers who embed sensor-based control systems along with digital monitoring features as a means to enhance productivity and reliability.

Asia-Pacific has cracked the top spot as the region with the fastest-growing hydrostatic transmissions market, fueled by catalytic growth of infrastructure and the industrial sector in China, India, and Japan. The booming construction and agricultural sectors in the region are stimulating the demand for hydrostatic equipment that enhances productivity and fuel efficiency.

The government-backed implementation of mechanized agriculture in farms in India and Southeast Asia has been the primary driver of the market's expansion. The simultaneous rise of hybrid and electric construction equipment in China and Japan, of whom are among the suppliers of the advanced hydrostatic transmission systems, has been increasing. The stage is set for the joining of smart hydraulic control systems and predictive maintenance technologies to crest the innovation and further growth.

In terms of market growth, Latin America is slowly but steadily progressing with the implementation of various projects in agriculture and mining. Brazil and Mexico are among the countries that are having their old construction and agriculture equipment replaced and demand in the market is therefore raised for state-of-the-art hydrostatic transmission systems.

The presence of mining industries in Chile and Peru with equipment running on hydrostatic technology is also transferring benefits through improved load-handling while operational efficiency is achieved. The hydros that are going to be deployed in the near future for load-sense control, feedback control on energy wasted, and cycle time reduction are proven to be of great interest.

Along these lines, machinery renunciation running on these systems is also observed in the loaders, excavators, and bulldozers. The challenge of economic instability is intertwined with government grants that are promoting agricultural mechanization and endorsing the use of ecological construction technologies, which are forecasted to support market bubble expansion.

The hydrostatic transmission market in the Middle East and Africa (MEA) is slowly but steadily growing, thanks to the construction, mining, and oil & gas sectors. The GCC cartel, with Saudi Arabia and the UAE as its main players, is experiencing an abundance of heavy duty hydrostatic transmission units due to numerous construction development programs.

Requiring hydrostatic machinery that can efficiently carry heavy loads and is durable enough to withstand operations in harsher environments are the mandates of the mining and oil extraction industries. Although mining mechanization and hydraulic handling solutions are some of the key points covered, the market mainly concentrates on agricultural machinery and smart solutions. The government automotive greenfield projects on smart trans and industrial automation deal also with the development of the area.

High Initial Costs and Maintenance Requirements

Hydrostatic transmission systems are pricier than their mechanical as well as electrical counterparts due to their superfluity of hydraulic working parts. Because of the lack of maintenance and defective hydraulic fluid management, the initial investment turns out to be a high hurdle to clear for small and medium enterprises within the agriculture, construction, and industrial sectors. Besides that, the management of fluid and running costs plus components changers affects the overall profit of the company.

Manufacturers, in an attempt to address these challenges, are designing cost-effective hydraulic systems, offering predictive maintenance solutions, and integrating digital diagnostics to reduce unplanned downtime and maximize performance, which in turn makes the systems more and more accessible and affordable.

Competition from Alternative Transmission Technologies

The thriving use of electric and hybrid powertrains in construction, agriculture, and industrial machinery stands as a challenge for the hydrostatic transmission systems. The rise of direct-drive and variable-speed electric powertrains has attracted a good deal of attention as they are more efficient with the energy and require less maintenance in comparison with other technologies.

Moreover, the electrification trend is the driver behind the development of hybrid hydrostatic systems that combine electronic control with hydraulic precision. Hydrostatic transmission providers are obliged to stay ahead of competition by the means of smart automation, energy recovery systems, and lightweight materials that come along with the benefits of better fuel efficiency and adaptability to the changing industrial applications.

Increasing Demand for Precision Agriculture and Smart Machinery

The intricacy connected with precise farming is a drive for the acquisition of hydrostatic transmission systems in tractors, harvesters, and irrigation equipment. There is a trend among farmers to use GPS-guided and automatically working farming solutions, which makes it necessary for them to receive more variable, high torque drive motors to increase control and save energy.

Enhanced hydrostatic systems are available with new technologies such as real-time load sensing, variable speed control, and hydraulic power-assisted steering, thereby making the farm operation productive and cost-effective. The growth at the IoT smart transmission systems and AI-based diagnostics is a real opportunity for the manufacturer to demonstrate the products in real-time monitoring and automatic adjustment cables that are used in agricultural machines.

Advancements in Electro-Hydrostatic Transmission Technology

The upsurge in the development of electro-hydrostatic transmission (EHT) systems is disrupting the market in an impressive way, by combining the advantages of hydraulic systems with the level of precision of electronic control. These new-generation transmission systems will be more energy efficient, have fewer carbon emissions, and will be fully automatable for the construction, agriculture, and industrial machinery fields.

With the arrival of digital control systems for energy monitoring, and the adaptation of transmission technology to variable load, the hydrostatic systems will become more intelligent and self-regulating. The hybrid and fully electric heavy-duty vehicles are finding market opportunities along the electro-hydrostatic segment which in turn help to improve fuel savings, decrease the environmental impact, and enhance the power transmission across various industry sectors.

The hydrostatic transmission market is a critical portion of the heavy machinery, construction equipment, agriculture, and industrial applications. This technological mechanism allows accurate speed control, generates high torque, and transmits power smoothly which is why it is vital for vehicles and equipment with variable-speed operations.

The market's expansion is propelled by the rising mechanization level in agriculture, the growing need for better-quality construction machines, and the innovations in hydraulic systems. The shift towards electro-hydraulic and energy-efficient systems is shaping the market, with producers focusing on smart hydrostatic transmissions that deliver improved performance while consuming lesser energy.

Comparative Market Analysis

| Market Shift | 2025 (Projected) |

|---|---|

| Regulatory Landscape | The emissions regulations are becoming stricter and this results in a higher demand for hydraulic systems that are energy-efficient. |

| Technological Advancements | The movement toward electronically-controlled hydrostatic transmissions illustrates the goal of greater efficiency. |

| Industry-Specific Demand | Construction, agriculture, and mining equipment are the fields being affected by high demand. |

| Sustainability & Circular Economy | Hydraulic systems are being promoted as the ones with fluid efficiency and leakage reduction capabilities. |

| Market Growth Drivers | The construction and agricultural sectors are gaining strength through increased activity and need for precision controls for machines. |

| Market Shift | 2035 (Forecasted) |

|---|---|

| Regulatory Landscape | Environmental Program impacts hydro and electric drives amid the shift for hybrid and electric hydrostatic systems. |

| Technological Advancements | Integration of IoT and AI algorithms makes preview maintenance more effective. |

| Industry-Specific Demand | Autonomous machinery, hybrid off-road vehicles, and smart industrial automation are the new frontier. |

| Sustainability & Circular Economy | Bio based fluids for hydraulic systems and energy-efficient hydrostatic solutions are the new direction for the company. |

| Market Growth Drivers | Improved efficiency is achieved through the development of electro-hydraulic transmissions and the introduction of smart industrial automation. |

The construction, agriculture, and industrial sectors are the main argument for positive growth of the hydrostatic transmission market in the USA. The main driver of the increase of high-performance hydraulic equipment in infrastructure projects and smart farming applications is the adoption of new technologies.

Furthermore, the rise in hydrostatic transmission applications in military and defense is a source of market addition. Additional market factors include the increasing replacement of manual controls with automated systems in material handling, thanks to hydrostatic systems that provide precise speed control and durability.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 4.4% |

The UK hydrostatic transmission market is on a steady rise owing to the rapid uptake of precision farming technology, the expansion of industrial automation, and the building of new infrastructure. As part of the efforts to increase productivity, the agriculture sector is purchasing hydrostatic transmission tractors and combines alongside other equipment.

Furthermore, the construction sector's preoccupation with fuel-efficient and reparable-less machines translates to the rise of the hydrostatic drive. The promotion of ecological and energy-efficient hydraulic solutions in factories and transport also helps in market growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 4.6% |

The hydrostatic transmission market of Europe is increasing with the help of technological improvements, agricultural and construction sectors are dominating the market, and strict energy efficiency laws. Conditionally, the European countries are allocating a huge amount of money to the development of hydrostatic drives for use in construction, industrial, and agricultural applications.

The emphasis on sustainable practices and the shift towards electro-hydrostatic solutions in manufacturing are other factors driving the growth of the market. Furthermore, the presence of major hydraulic equipment manufacturers such as those in Germany, France, and Italy has spurred innovations in compact and high-efficiency hydrostatic transmission.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union | 4.7% |

China’s hydrostatic transmission market is witnessing rapid growth due to rising demand for construction machinery, increasing industrial automation, and growth in agriculture mechanization. The Chinese government’s focus on infrastructure development is fueling demand for hydrostatic-driven excavators, loaders, and bulldozers.

Additionally, the expansion of smart agriculture is increasing the use of hydrostatic tractors for precision farming. The growing logistics and e-commerce sectors are also driving demand for hydrostatic forklifts and automated material handling systems.

| Country | CAGR (2025 to 2035) |

|---|---|

| China | 5.3% |

The increasing technological advances in industrial automation, the continuing strong demand for agricultural equipment, and the growth in compact construction machinery are the main drivers of the hydrostatic transmission market growth in Japan. Robotic and smart farming technologies are the main areas in which Japan excels, with the result that the need for hydrostatic tractors and automated harvesting systems also increases.

The growth of the electric and hybrid industrial vehicle segment also helps in the uptake of the electro-hydrostatic transmission systems. At the same time, Japan's concentration on the manufacturing of energy-efficient hydraulic components is another factor that drives the market up.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 4.6% |

Heavy-Duty (Above 100 HP) Segment Dominates Due to High Power Demand

High-performance needs in equipment manufacturing, construction, mining, and industrial applications are the major factors and forces driving heavy-duty hydrostatic transmission segment holding the maximum market share in the sector. Due to the high torque, exact control, and reinforced durability, they are suitable for bulldozers, excavators, and heavy-duty forestry machines, etc.

Some of the factors fueling the growth of heavy-duty machinery in the infra sector are the increasing infrastructure development, the growing mining activities, and the demand for powerful off-highway machinery. Both North America and Asia-Pacific are the key parties to the emerging hydrostatic transmission as they are continually investing in the huge-scale industrial and construction projects that require efficient and powerful hydrostatic transmission systems.

Medium-Duty (30-100 HP) Segment Expands with Versatile Applications

The medium-duty hydrostatic transmission segment is making considerable advancement, secured by its large employment in the agricultural tractors, material handling equipment, and industrial machinery sector. These types of systems offer better maneuverability, less fuel consumption, and fewer difficulties during operation; hence they are useful for mid-sized farm equipment, forklifts, and small excavators.

Agricultural mechanization and the growing need for logistics centers with energy-efficient material handling are the main drivers of this market advancement. The European and North American regions lead this segment, focusing on precision farming and advanced automation in industrial applications.

VDU - FCU Configuration Leads with Flexibility and Efficiency

The VDU - FCU (Variable Displacement Unit - Fixed Displacement Unit) system has the largest market share due to its excessive flexibility and efficiency. That configuration is applied widely in agriculture, construction, and forestry equipment, which provides precise speed control and power transmission.

Industries choose this configuration for better fuel economy, less wear and tear, and more adaptability to loads. The rising focus on hydraulic combustion and off-highway vehicle automation is boosting the VDU - FCU adoption, especially in North America and Europe.

VDU - VDU Systems Gain Traction in High-Precision Applications

VDU - VDU (Variable Displacement Unit - Variable Displacement Unit) systems emerge in the market because of their energy-efficient operation, technical advancement, and dimensionality. Continuous load variation in applications that require dynamic power adjustments makes them the optimal choice for hydraulic machinery and mining equipment.

This sector booms due to the growing demand for high-precision hydrostatic applications in the industries and in the mining field. Key manufacturers are investing in the smart hydrostatic systems added with electronic control modules so that they can either operate efficiently or can be subjected to real-time performance monitoring, especially in Europe and the Asia-Pacific region.

Agriculture Sector Leads with Rising Mechanization and Precision Farming

The agriculture segment is the market leader of the hydrostatic transmission which is somewhere sourced from the mechanization inclination and requirement for efficient tractors and harvesters. The hydrostatic transmissions can create smoother operations of variable speed control, lower the mechanical defects, and thus save fuel; these factors make this type of system perfect for changing conditions of the field.

The implementation of precision farming and automated machinery remains as two major drivers of the market growth at super-normal levels. By way of the Asia-Pacific and North America, these areas are responsible with their rising government incentives for farm remodeling and hydraulic tractors drive tractors and combines.

Construction Industry Drives Demand for High-Torque Applications

The construction sector is another key market driver, with hydrostatic transmissions widely used in excavators, loaders, and bulldozers. Such systems primarily drive torque seamlessly, besides discrete control, improved operational efficiency is also applicable in heavy construction and infrastructure.

Thanks to rapid urbanization, infrastructure giant projects in the growth stage mainly in Asia-Pacific and North America are corner-stone factors that create demand. Manufacturers, on the other hand, are engaging with electronically controlled and energy-efficient hydrostatic transmissions not only to carry out performance enhancements but also to reduce emissions thus, have to comply with stringent environmental rules in advanced economies.

The hydrostatic transmission market is a major part of the constructions, agriculture, materials handling, and industrial machine sectors. It is the best tool for power transfer through fluid mechanics. The preferential environmental conditions of hydrostatic transmissions arise from the smoothly operating, the speed that can be adjusted, and high torque capability making these vehicles indispensable in tractors, excavators, forklifts, and mining machines.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Eaton Corporation | 18-22% |

| Parker Hannifin Corporation | 15-19% |

| Danfoss A/S | 12-16% |

| Bosch Rexroth AG | 10-14% |

| Kawasaki Heavy Industries, Ltd. | 8-12% |

| Other Companies (combined) | 35-45% |

| Company Name | Key Offerings/Activities |

|---|---|

| Eaton Corporation | Specializes in heavy-duty hydrostatic transmissions for off-highway vehicles. |

| Parker Hannifin Corporation | Develops precision-engineered hydraulic drive systems for industrial and mobile applications. |

| Danfoss A/S | Focuses on energy-efficient hydrostatic transmissions for agriculture and construction. |

| Bosch Rexroth AG | Provides advanced electro-hydrostatic drive solutions for automation. |

| Kawasaki Heavy Industries, Ltd. | Manufactures high-performance hydrostatic transmission systems for heavy equipment. |

Key Company Insights

Eaton Corporation

Eaton is a global leader in hydraulic power transmission solutions, supplying heavy-duty hydrostatic transmissions for off-highway, construction, and industrial applications. The company’s products are known for high efficiency, durability, and load capacity, making them ideal for demanding environments.

Eaton has invested in intelligent hydrostatic drive technologies, incorporating electronic controls and automation for improved operational efficiency. Its commitment to sustainability and reduced energy consumption has led to innovations in low-emission hydraulic systems, reinforcing its leadership in the hydrostatic transmission market.

Parker Hannifin Corporation

Parker Hannifin is a major player in precision-engineered hydraulic drive systems, serving industrial, agricultural, and construction sectors. The company’s hydrostatic transmissions offer variable speed control, high torque output, and superior durability.

Parker is at the forefront of smart hydraulic solutions, integrating sensor-based monitoring and predictive maintenance capabilities into its transmission systems. Additionally, the company focuses on fuel-efficient and lightweight hydrostatic drives, catering to the increasing demand for sustainable power transmission solutions in off-highway machinery.

Danfoss A/S

Danfoss is a leading provider of energy-efficient hydrostatic transmissions, particularly for agriculture, forestry, and construction vehicles. The company emphasizes hydrostatic drive technology for precision control and fuel savings.

Danfoss is also developing electro-hydraulic and digital drive solutions, enabling better automation and connectivity in industrial vehicles. Its Plus+1® electronic control systems integrate seamlessly with hydrostatic transmissions, enhancing performance and reliability. With a strong presence in Europe and North America, Danfoss continues to expand its market share through innovation and strategic partnerships.

Bosch Rexroth AG

Bosch Rexroth specializes in high-performance electro-hydrostatic drive systems, catering to mobile machinery, mining, and automation industries. The company’s Hydrostatic Regenerative Braking Systems (HRB) are designed to improve energy efficiency and reduce fuel consumption, aligning with industry trends toward low-carbon solutions.

Bosch Rexroth’s expertise in IoT-enabled hydraulic systems enables real-time monitoring and predictive maintenance, ensuring longer equipment lifespans. With a strong R&D focus, the company continues to push the boundaries of hydrostatic drive technology, making it a preferred choice for OEMs.

Kawasaki Heavy Industries, Ltd. (8-12%)

Kawasaki is a key player in high-performance hydrostatic transmission systems, widely used in excavators, wheel loaders, and material handling equipment. The company’s hydrostatic drives offer smooth operation, high torque output, and exceptional durability, making them ideal for harsh working environments.

Kawasaki has been investing in next-generation hydraulic transmission technology, integrating electronic control units (ECUs) for improved efficiency and automation. Its strong presence in Asia-Pacific and partnerships with leading construction and agricultural machinery manufacturers bolster its competitive position in the market.

Other Key Players

The global Hydrostatic Transmission market is projected to reach USD 5,612.0 million by the end of 2025.

The market is anticipated to grow at a CAGR of 4.9% over the forecast period.

By 2035, the Hydrostatic Transmission market is expected to reach USD 9,054.7 million.

The heavy-duty hydrostatic transmission segment is expected to dominate due to its high efficiency, superior torque control, and increasing adoption in construction, agriculture, and mining equipment.

Key players in the market include Parker Hannifin Corporation, Eaton Corporation plc, Danfoss A/S, Bosch Rexroth AG, and Kawasaki Heavy Industries, Ltd.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Units) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Capacity, 2018 to 2033

Table 4: Global Market Volume (Units) Forecast by Capacity, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Operation Type, 2018 to 2033

Table 6: Global Market Volume (Units) Forecast by Operation Type, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 8: Global Market Volume (Units) Forecast by End User, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 10: North America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Capacity, 2018 to 2033

Table 12: North America Market Volume (Units) Forecast by Capacity, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Operation Type, 2018 to 2033

Table 14: North America Market Volume (Units) Forecast by Operation Type, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 16: North America Market Volume (Units) Forecast by End User, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 18: Latin America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 19: Latin America Market Value (US$ Million) Forecast by Capacity, 2018 to 2033

Table 20: Latin America Market Volume (Units) Forecast by Capacity, 2018 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by Operation Type, 2018 to 2033

Table 22: Latin America Market Volume (Units) Forecast by Operation Type, 2018 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 24: Latin America Market Volume (Units) Forecast by End User, 2018 to 2033

Table 25: Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 27: Europe Market Value (US$ Million) Forecast by Capacity, 2018 to 2033

Table 28: Europe Market Volume (Units) Forecast by Capacity, 2018 to 2033

Table 29: Europe Market Value (US$ Million) Forecast by Operation Type, 2018 to 2033

Table 30: Europe Market Volume (Units) Forecast by Operation Type, 2018 to 2033

Table 31: Europe Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 32: Europe Market Volume (Units) Forecast by End User, 2018 to 2033

Table 33: Asia Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 34: Asia Pacific Market Volume (Units) Forecast by Country, 2018 to 2033

Table 35: Asia Pacific Market Value (US$ Million) Forecast by Capacity, 2018 to 2033

Table 36: Asia Pacific Market Volume (Units) Forecast by Capacity, 2018 to 2033

Table 37: Asia Pacific Market Value (US$ Million) Forecast by Operation Type, 2018 to 2033

Table 38: Asia Pacific Market Volume (Units) Forecast by Operation Type, 2018 to 2033

Table 39: Asia Pacific Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 40: Asia Pacific Market Volume (Units) Forecast by End User, 2018 to 2033

Table 41: MEA Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 42: MEA Market Volume (Units) Forecast by Country, 2018 to 2033

Table 43: MEA Market Value (US$ Million) Forecast by Capacity, 2018 to 2033

Table 44: MEA Market Volume (Units) Forecast by Capacity, 2018 to 2033

Table 45: MEA Market Value (US$ Million) Forecast by Operation Type, 2018 to 2033

Table 46: MEA Market Volume (Units) Forecast by Operation Type, 2018 to 2033

Table 47: MEA Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 48: MEA Market Volume (Units) Forecast by End User, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Capacity, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Operation Type, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by End User, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 6: Global Market Volume (Units) Analysis by Region, 2018 to 2033

Figure 7: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 8: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 9: Global Market Value (US$ Million) Analysis by Capacity, 2018 to 2033

Figure 10: Global Market Volume (Units) Analysis by Capacity, 2018 to 2033

Figure 11: Global Market Value Share (%) and BPS Analysis by Capacity, 2023 to 2033

Figure 12: Global Market Y-o-Y Growth (%) Projections by Capacity, 2023 to 2033

Figure 13: Global Market Value (US$ Million) Analysis by Operation Type, 2018 to 2033

Figure 14: Global Market Volume (Units) Analysis by Operation Type, 2018 to 2033

Figure 15: Global Market Value Share (%) and BPS Analysis by Operation Type, 2023 to 2033

Figure 16: Global Market Y-o-Y Growth (%) Projections by Operation Type, 2023 to 2033

Figure 17: Global Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 18: Global Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 19: Global Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 20: Global Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 21: Global Market Attractiveness by Capacity, 2023 to 2033

Figure 22: Global Market Attractiveness by Operation Type, 2023 to 2033

Figure 23: Global Market Attractiveness by End User, 2023 to 2033

Figure 24: Global Market Attractiveness by Region, 2023 to 2033

Figure 25: North America Market Value (US$ Million) by Capacity, 2023 to 2033

Figure 26: North America Market Value (US$ Million) by Operation Type, 2023 to 2033

Figure 27: North America Market Value (US$ Million) by End User, 2023 to 2033

Figure 28: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 29: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 30: North America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 31: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 32: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 33: North America Market Value (US$ Million) Analysis by Capacity, 2018 to 2033

Figure 34: North America Market Volume (Units) Analysis by Capacity, 2018 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by Capacity, 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by Capacity, 2023 to 2033

Figure 37: North America Market Value (US$ Million) Analysis by Operation Type, 2018 to 2033

Figure 38: North America Market Volume (Units) Analysis by Operation Type, 2018 to 2033

Figure 39: North America Market Value Share (%) and BPS Analysis by Operation Type, 2023 to 2033

Figure 40: North America Market Y-o-Y Growth (%) Projections by Operation Type, 2023 to 2033

Figure 41: North America Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 42: North America Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 43: North America Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 44: North America Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 45: North America Market Attractiveness by Capacity, 2023 to 2033

Figure 46: North America Market Attractiveness by Operation Type, 2023 to 2033

Figure 47: North America Market Attractiveness by End User, 2023 to 2033

Figure 48: North America Market Attractiveness by Country, 2023 to 2033

Figure 49: Latin America Market Value (US$ Million) by Capacity, 2023 to 2033

Figure 50: Latin America Market Value (US$ Million) by Operation Type, 2023 to 2033

Figure 51: Latin America Market Value (US$ Million) by End User, 2023 to 2033

Figure 52: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 53: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 54: Latin America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 57: Latin America Market Value (US$ Million) Analysis by Capacity, 2018 to 2033

Figure 58: Latin America Market Volume (Units) Analysis by Capacity, 2018 to 2033

Figure 59: Latin America Market Value Share (%) and BPS Analysis by Capacity, 2023 to 2033

Figure 60: Latin America Market Y-o-Y Growth (%) Projections by Capacity, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) Analysis by Operation Type, 2018 to 2033

Figure 62: Latin America Market Volume (Units) Analysis by Operation Type, 2018 to 2033

Figure 63: Latin America Market Value Share (%) and BPS Analysis by Operation Type, 2023 to 2033

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by Operation Type, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 66: Latin America Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 67: Latin America Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 68: Latin America Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 69: Latin America Market Attractiveness by Capacity, 2023 to 2033

Figure 70: Latin America Market Attractiveness by Operation Type, 2023 to 2033

Figure 71: Latin America Market Attractiveness by End User, 2023 to 2033

Figure 72: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 73: Europe Market Value (US$ Million) by Capacity, 2023 to 2033

Figure 74: Europe Market Value (US$ Million) by Operation Type, 2023 to 2033

Figure 75: Europe Market Value (US$ Million) by End User, 2023 to 2033

Figure 76: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 77: Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 78: Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 79: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 80: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 81: Europe Market Value (US$ Million) Analysis by Capacity, 2018 to 2033

Figure 82: Europe Market Volume (Units) Analysis by Capacity, 2018 to 2033

Figure 83: Europe Market Value Share (%) and BPS Analysis by Capacity, 2023 to 2033

Figure 84: Europe Market Y-o-Y Growth (%) Projections by Capacity, 2023 to 2033

Figure 85: Europe Market Value (US$ Million) Analysis by Operation Type, 2018 to 2033

Figure 86: Europe Market Volume (Units) Analysis by Operation Type, 2018 to 2033

Figure 87: Europe Market Value Share (%) and BPS Analysis by Operation Type, 2023 to 2033

Figure 88: Europe Market Y-o-Y Growth (%) Projections by Operation Type, 2023 to 2033

Figure 89: Europe Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 90: Europe Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 91: Europe Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 92: Europe Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 93: Europe Market Attractiveness by Capacity, 2023 to 2033

Figure 94: Europe Market Attractiveness by Operation Type, 2023 to 2033

Figure 95: Europe Market Attractiveness by End User, 2023 to 2033

Figure 96: Europe Market Attractiveness by Country, 2023 to 2033

Figure 97: Asia Pacific Market Value (US$ Million) by Capacity, 2023 to 2033

Figure 98: Asia Pacific Market Value (US$ Million) by Operation Type, 2023 to 2033

Figure 99: Asia Pacific Market Value (US$ Million) by End User, 2023 to 2033

Figure 100: Asia Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 101: Asia Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 102: Asia Pacific Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 103: Asia Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 104: Asia Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 105: Asia Pacific Market Value (US$ Million) Analysis by Capacity, 2018 to 2033

Figure 106: Asia Pacific Market Volume (Units) Analysis by Capacity, 2018 to 2033

Figure 107: Asia Pacific Market Value Share (%) and BPS Analysis by Capacity, 2023 to 2033

Figure 108: Asia Pacific Market Y-o-Y Growth (%) Projections by Capacity, 2023 to 2033

Figure 109: Asia Pacific Market Value (US$ Million) Analysis by Operation Type, 2018 to 2033

Figure 110: Asia Pacific Market Volume (Units) Analysis by Operation Type, 2018 to 2033

Figure 111: Asia Pacific Market Value Share (%) and BPS Analysis by Operation Type, 2023 to 2033

Figure 112: Asia Pacific Market Y-o-Y Growth (%) Projections by Operation Type, 2023 to 2033

Figure 113: Asia Pacific Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 114: Asia Pacific Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 115: Asia Pacific Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 116: Asia Pacific Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 117: Asia Pacific Market Attractiveness by Capacity, 2023 to 2033

Figure 118: Asia Pacific Market Attractiveness by Operation Type, 2023 to 2033

Figure 119: Asia Pacific Market Attractiveness by End User, 2023 to 2033

Figure 120: Asia Pacific Market Attractiveness by Country, 2023 to 2033

Figure 121: MEA Market Value (US$ Million) by Capacity, 2023 to 2033

Figure 122: MEA Market Value (US$ Million) by Operation Type, 2023 to 2033

Figure 123: MEA Market Value (US$ Million) by End User, 2023 to 2033

Figure 124: MEA Market Value (US$ Million) by Country, 2023 to 2033

Figure 125: MEA Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 126: MEA Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 127: MEA Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 128: MEA Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 129: MEA Market Value (US$ Million) Analysis by Capacity, 2018 to 2033

Figure 130: MEA Market Volume (Units) Analysis by Capacity, 2018 to 2033

Figure 131: MEA Market Value Share (%) and BPS Analysis by Capacity, 2023 to 2033

Figure 132: MEA Market Y-o-Y Growth (%) Projections by Capacity, 2023 to 2033

Figure 133: MEA Market Value (US$ Million) Analysis by Operation Type, 2018 to 2033

Figure 134: MEA Market Volume (Units) Analysis by Operation Type, 2018 to 2033

Figure 135: MEA Market Value Share (%) and BPS Analysis by Operation Type, 2023 to 2033

Figure 136: MEA Market Y-o-Y Growth (%) Projections by Operation Type, 2023 to 2033

Figure 137: MEA Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 138: MEA Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 139: MEA Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 140: MEA Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 141: MEA Market Attractiveness by Capacity, 2023 to 2033

Figure 142: MEA Market Attractiveness by Operation Type, 2023 to 2033

Figure 143: MEA Market Attractiveness by End User, 2023 to 2033

Figure 144: MEA Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Hydrostatic Testing Market - Trends & Forecast 2025 to 2035

Automotive Hydrostatic Fan Drive System Market Size and Share Forecast Outlook 2025 to 2035

Transmission Overload Protectors Market Size and Share Forecast Outlook 2025 to 2035

Transmission Substation Market Size and Share Forecast Outlook 2025 to 2035

Transmission Oil Filters Market Size and Share Forecast Outlook 2025 to 2035

Transmission Components Market Size and Share Forecast Outlook 2025 to 2035

Transmission Towers Market Size and Share Forecast Outlook 2025 to 2035

Transmission & Distribution Electric Capacitor Market Size and Share Forecast Outlook 2025 to 2035

Transmission Fluids Market Trends & Demand 2025 to 2035

Transmission Sales Market Analysis & Forecast by Type, End Use Through 2035

Transmission Mounting Bracket Market

Transmission Oil Pump Market

Transmission Control Unit Market

EV Transmission System Market Growth – Trends & Forecast 2024-2034

HVDC Transmission System Market Size and Share Forecast Outlook 2025 to 2035

Power Transmission Component Market Size and Share Forecast Outlook 2025 to 2035

Power Transmission Lines and Towers Market Analysis & Forecast by Product, Conductor, Insulation, Voltage, Current, Application, and Region Through 2035

Power Transmission Gearbox Market Growth - Trends & Forecast 2025 to 2035

Power Transmission Cables Market

Manual Transmission Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA