The global Hydrolyzed Vegetable Protein (HVP) market is expected to remain moderately consolidated through 2025. Global players like Ajinomoto, Kerry Group, and ADM control nearly 60% of the total share of the market. They enjoy high market share because of strong R&D capabilities, effective supply chain systems, and large product portfolios in most regions.

Regional players like Roquette Frères in Europe and Angel Yeast in Asia share the remaining 30% market share, primarily due to their emphasis on regional preferences, clean-label products, and cheaper alternatives. Start-ups and niche players, such as Symega in India and PT Indesso Aroma in Indonesia, account for around 10% market share, which is with innovative applications including vegan and organic HVP products.

The top five players, namely Ajinomoto, Kerry Group, ADM, Sensient Technologies, and Givaudan, account for nearly 50% of the market share. This represents the fact that well-established global players are leading the market dynamics.

Explore FMI!

Book a free demo

| Global Market Share 2025 | Industry Share (%) |

|---|---|

| Top Multinationals (Ajinomoto, Kerry Group, ADM, Sensient, Givaudan) | 60% |

| Regional Leaders (Roquette Frères, Angel Yeast, CHS Inc.) | 30% |

| Startups & Niche Brands (Symega, PT Indesso Aroma, A. Constantino) | 10% |

The market is moderately consolidated, with significant contributions from regional leaders and niche brands.

The global plant-based protein market is dominated by the chunks segment, accounting for 38% of the overall market. Chunk-style plant-based proteins are the most in demand because they can closely replicate the texture and mouthfeel of meat products, hence a favorite for consumers looking for alternatives to meat.

The slice segment, at 25%, is also a considerable market share because plant-based protein products can easily be integrated into most recipes. The other product forms, mostly flakes and granules, account for the remaining 37% of the market share, which covers specific applications along with their processing requirements in the food industry as well as animal feed sectors.

The household sector accounts for 40% share of the market, which is the highest driver of the global plant-based protein market as consumers look to consume this protein at home with cooked food. The commercial segment, accounting for 25% of the market, is the use of plant-based proteins in foodservice establishments.

The remaining 35% is split between the food industry and the animal feed sector, where plant-based proteins are used as ingredients in processed food products and pet food/livestock feed.

Transformative contributions by key players marked the year in the HVP market. Multinationals used the time to expand production, develop clean-label innovations and sustainable efforts. Regional leaders offered adapted solutions according to local preferences. Start-ups came up with innovative vegan and allergen-free HVP products, while established companies such as Ajinomoto and Kerry Group fortified their global presence with collaborations and R&D investments.

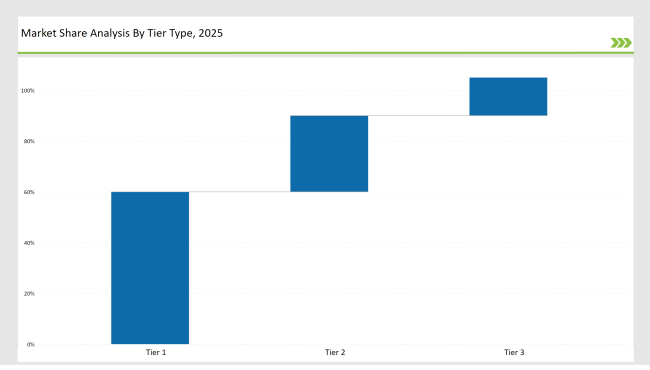

| By Tier Type | Tier 1 |

|---|---|

| Market Share (%) | 60% |

| Example of Key Players | Ajinomoto, Kerry Group, ADM |

| By Tier Type | Tier 2 |

|---|---|

| Market Share (%) | 30% |

| Example of Key Players | Roquette Frères, Sensient Technologies, Givaudan |

| By Tier Type | Tier 3 |

|---|---|

| Market Share (%) | 10% |

| Example of Key Players | Symega, PT Indesso Aroma, Angel Yeast, CHS Inc. |

| Brand | Key Focus |

|---|---|

| Ajinomoto | Expanded production of soy-based HVP in Asia to meet growing demand for instant noodles. |

| Kerry Group | Introduced clean-label HVP solutions for vegan products in Europe. |

| Givaudan | Focused on organic HVP for premium seasonings, targeting clean-label consumers globally. |

| ADM | Collaborated with snack manufacturers to develop high-protein HVP applications. |

| Sensient Technologies | Launched natural HVP flavors specifically designed for plant-based meats. |

| Roquette Frères | Enhanced wheat-based HVP production for European markets with improved shelf stability. |

| Angel Yeast | Increased focus on liquid HVP formulations for Asian seasoning markets. |

| Symega | Developed HVP solutions tailored for vegan cheese and sauces in the Indian market. |

| DSM | HVP promoted functional foods and dietary supplements in North America and Europe. |

| CHS Inc. | Expanded corn-based HVP production facilities in the USA to support growing snack demand. |

Consolidation is expected to persist in the plant-based protein sector, as more established players are likely to expand their product lines, distribution networks, and technological competencies by acquiring or partnering with small, innovative players. These strategic moves will create better positioned companies in a competitive setting and allow them to capitalize on increasing demand for plant-based protein solutions.

Personalized and customized plant-based protein products will be more in vogue, especially for catering to specific dietary needs, health goals, and lifestyle preferences of consumers. This includes personalized formulas, subscription models, direct-to-consumer channels, to name a few ways in which formulation recommendations and delivery can be achieved.

Harmonized standards and certifications would be set and regulated by regulatory bodies and industry associations across the globe to have quality, safety, and transparency in plant-based protein products, which would also help in enhancing consumer confidence to adopt plant-based proteins at the global level. Strengthening partnerships with the food service and the food processing industry would be quite necessary for extending reach and facilitating plant-based proteins across a lot more applications-ranging from restaurant menus to packaged foods.

Ajinomoto, Kerry Group, ADM, Sensient Technologies, and Givaudan dominate with a combined share of approximately 50% of the global HVP market.

North America leads with a 35% market share, driven by processed food consumption and major players like ADM and Sensient Technologies.

Sustainability initiatives such as renewable energy adoption and green packaging are reshaping industry, particularly in Europe, where eco-conscious consumption is a priority.

Startups contribute 10% of the market by offering innovative, vegan, and organic HVP products that cater to niche audiences in regions like India and Southeast Asia.

By creating region-specific HVP blends (e.g., soy-based for Asia, wheat-based for Europe) and aligning with local culinary preferences, manufacturers can boost their market share.

Vegan Bacon Market Growth - Plant-Based Protein Trends 2025 to 2035

Tapioca Market Trends - Starch Solutions & Global Demand 2025 to 2035

Chickpea Market Trends - Nutrition & Global Trade Insights 2025 to 2035

Botanical Supplements Market Growth - Herbal Wellness & Industry Demand 2025 to 2035

Vegetable Carbon Market Trends - Functional Uses & Industry Demand 2025 to 2035

Plant-Based Nuggets Market Insights - Growth & Innovation 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.